Global Flow Tank Market

Market Size in USD Billion

CAGR :

%

USD

6.63 Billion

USD

8.73 Billion

2024

2032

USD

6.63 Billion

USD

8.73 Billion

2024

2032

| 2025 –2032 | |

| USD 6.63 Billion | |

| USD 8.73 Billion | |

|

|

|

|

Flow Tank Market Size

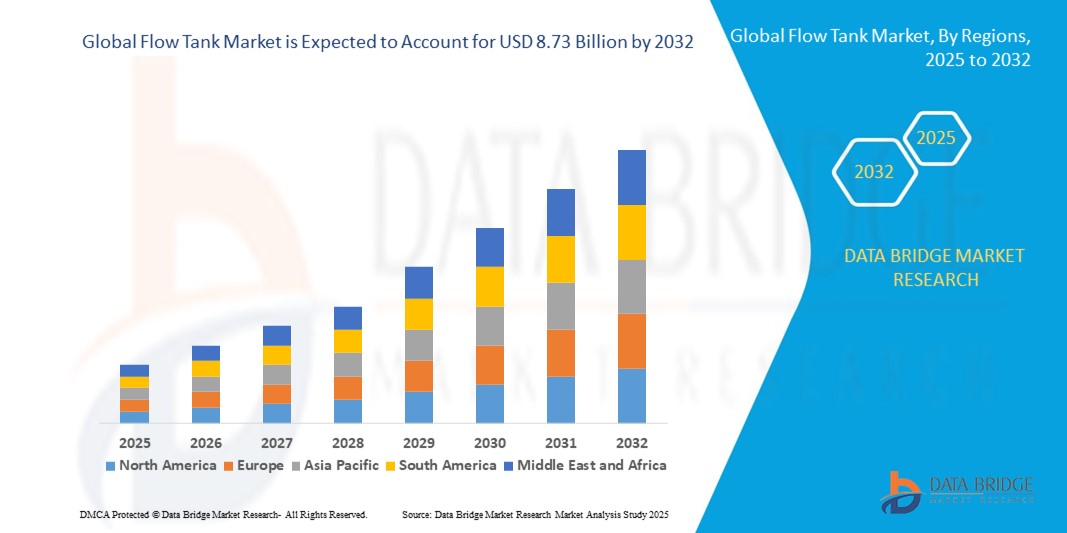

- The global flow tank market size was valued at USD 6.63 billion in 2024 and is expected to reach USD 8.73 billion by 2032, at a CAGR of 3.5% during the forecast period

- The market growth is largely fueled by increasing demand for reliable liquid storage solutions across industries such as chemicals, water treatment, oil and gas, and food and beverages, supported by advancements in tank design, corrosion resistance, and monitoring technologies that enhance safety and efficiency

- Furthermore, rising regulatory requirements for environmental protection and industrial safety are driving the adoption of flow tanks, as companies seek compliant, durable, and scalable storage systems to handle hazardous and non-hazardous materials, thereby significantly boosting the industry’s growth

Flow Tank Market Analysis

- Flow tanks are industrial storage systems designed to safely store and manage liquids such as water, chemicals, fuels, and wastewater, with applications spanning municipal, industrial, and commercial sectors. These tanks are available in aboveground and underground configurations, tailored for hazardous and non-hazardous materials, and are increasingly equipped with monitoring systems to ensure operational safety and compliance

- The escalating demand for flow tanks is primarily fueled by rapid industrialization, urban infrastructure expansion, and stricter environmental regulations worldwide, alongside the growing need for efficient, long-term storage solutions that minimize risks and optimize space utilization

- North America dominated the flow tank market with a share of 40.4% in 2024, due to increasing industrial infrastructure, stringent safety and environmental regulations, and growing demand for efficient liquid storage solutions

- Asia-Pacific is expected to be the fastest growing region in the flow tank market during the forecast period due to rapid industrialization, urbanization, and government initiatives promoting infrastructure development in countries such as China, Japan, and India

- Aboveground storage tanks segment dominated the market with a market share of 58.9% in 2024, due to its ease of installation, accessibility for maintenance, and lower upfront construction costs compared to underground tanks. Aboveground tanks are often preferred in industries requiring frequent inspections or rapid deployment, such as chemical processing, water treatment, and petroleum storage. Their visible placement allows for quicker leak detection and operational monitoring, enhancing safety and operational efficiency. Moreover, ASTs offer flexible scalability, making them suitable for both large-scale industrial applications and mid-sized commercial setups, which continues to support their strong adoption across regions

Report Scope and Flow Tank Market Segmentation

|

Attributes |

Flow Tank Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Flow Tank Market Trends

Increasing Demand for Oil and Gas Exploration

- The flow tank market is experiencing robust growth due to heightened oil and gas exploration activities worldwide. Flow tanks are critical for managing fluids, separating phases, and ensuring safety and operational efficiency at drilling and extraction sites

- For instance, Halliburton supplies advanced flow tank solutions tailored for offshore and unconventional oil and gas fields, enabling precise monitoring and control of multiphase flows for improved well performance and safety

- The trend toward digitization and real-time data acquisition in oil and gas is fostering adoption of smart flow tanks with integrated sensors and analytics capabilities for process optimization and predictive maintenance

- In addition, rising investments in remote oil fields and challenging geographies are accelerating demand for modular and portable flow tank systems that support flexible deployment and rapid field operations

- Enhanced environmental and safety standards in exploration make compliance-focused flow tank solutions essential for risk reduction and regulatory approval

- Ongoing innovations in corrosion resistance and tank material engineering are boosting product lifespan and reliability in demanding exploration and production settings

Flow Tank Market Dynamics

Driver

Expansion of Industrial Infrastructure

- Global expansion of industrial and energy infrastructure is a major driver for flow tank market growth. New facilities across energy, chemicals, water treatment, and manufacturing require robust flow tanks for processing, storage, and distribution

- For instance, Pentair provides customized flow tanks for process industries ranging from petrochemicals to municipal water, supporting the construction of large-scale plants with tailored liquid management capabilities

- Rapid industrialization in emerging markets is stimulating demand for flow tanks as foundational components of new factories, refineries, and utilities. Rising investments in power generation, including renewables and thermal plants, necessitate specialized flow tanks for cooling, fuel processing, and waste management needs

- In addition, growth in food and beverage, pharmaceutical, and biotechnology production intensifies the market for sanitary and corrosion-resistant flow tank designs aligned with strict process standards

- Industrial modernization and automation initiatives are driving adoption of highly engineered tanks with remote monitoring, advanced controls, and scalable performance. Urban development and infrastructure upgrades worldwide require effective flow management systems, further supporting sustained flow tank demand across sectors

Restraint/Challenge

Regulatory Compliance Challenges

- Complex regulatory frameworks surrounding design, installation, safety, and environmental impacts create significant challenges for flow tank manufacturers and users. Compliance demands raise costs and lengthen approval timelines

- For instance, Flowserve and other global suppliers frequently navigate evolving API, ASME, and environmental standards, necessitating expensive engineering modifications and rigorous documentation for project approval

- Stringent environmental protection laws can delay deployment or force redesigns, impacting efficiency and inflating costs for customers in sensitive locations. In addition, failure to meet regulatory standards can lead to fines, license revocation, or forced shutdowns, posing financial and reputational risks for operators

- Regional differences in codes and enforcement complicate multi-country deployments and supply chain logistics, limiting scale and increasing compliance efforts

- The need for specialized personnel and ongoing training to maintain compliance further elevates operational complexity and costs for both manufacturers and plant operators

Flow Tank Market Scope

The market is segmented on the basis of type and product.

- By Type

On the basis of type, the flow tank market is segmented into aboveground storage tanks (ASTs) and underground storage tanks (USTs). The aboveground storage tank segment dominated the largest market revenue share of 58.9% in 2024, driven by its ease of installation, accessibility for maintenance, and lower upfront construction costs compared to underground tanks. Aboveground tanks are often preferred in industries requiring frequent inspections or rapid deployment, such as chemical processing, water treatment, and petroleum storage. Their visible placement allows for quicker leak detection and operational monitoring, enhancing safety and operational efficiency. Moreover, ASTs offer flexible scalability, making them suitable for both large-scale industrial applications and mid-sized commercial setups, which continues to support their strong adoption across regions.

The underground storage tank segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by increasing urbanization and the growing need for space-efficient storage solutions in densely populated areas. USTs provide a discreet and secure option for storing liquids, reducing environmental and safety risks associated with spills and contamination. Advancements in corrosion-resistant materials and leak detection technologies are further driving adoption, particularly in fuel stations, municipal water storage, and industrial facilities. The combination of regulatory incentives and the need for long-term, durable storage solutions is expected to accelerate the growth of USTs over the forecast period.

- By Product

On the basis of product, the flow tank market is segmented into hazardous and non-hazardous tanks. The non-hazardous tank segment held the largest market revenue share in 2024, driven by widespread industrial and municipal applications where safe handling of water, wastewater, and other non-toxic liquids is required. Non-hazardous tanks are favored due to their lower compliance burden, ease of installation, and versatility across sectors including agriculture, food processing, and water treatment. Their cost-effectiveness and minimal safety risks make them the default choice for large-scale storage, contributing to consistent demand across both developed and emerging markets.

The hazardous tank segment is expected to witness the fastest CAGR from 2025 to 2032, propelled by stringent environmental and safety regulations, particularly in the chemical, petrochemical, and pharmaceutical industries. These tanks are specifically designed to store flammable, toxic, or corrosive liquids, incorporating features such as double walls, leak detection systems, and pressure relief mechanisms to ensure safe storage and transport. Rising awareness regarding industrial safety, combined with the expansion of hazardous material-intensive industries, is driving investments in specialized tank infrastructure, thereby accelerating the adoption of hazardous flow tanks globally.

Flow Tank Market Regional Analysis

- North America dominated the flow tank market with the largest revenue share of 40.4% in 2024, driven by increasing industrial infrastructure, stringent safety and environmental regulations, and growing demand for efficient liquid storage solutions

- Companies and municipalities in the region prioritize aboveground and non-hazardous storage solutions for their ease of installation, low maintenance requirements, and operational safety

- This widespread adoption is further supported by advanced technological capabilities, strong regulatory compliance frameworks, and rising investments in industrial, chemical, and municipal projects, establishing flow tanks as essential infrastructure for liquid storage and management

U.S. Flow Tank Market Insight

The U.S. flow tank market captured the largest revenue share in North America in 2024, fueled by rising industrialization, expansion of the oil & gas, water treatment, and chemical sectors, and increasing adoption of aboveground storage tanks. The preference for efficient, durable, and easily maintainable storage solutions is driving growth across both commercial and municipal applications. Moreover, federal and state-level environmental and safety regulations, combined with the demand for leak-proof and corrosion-resistant tanks, are significantly contributing to market expansion.

Europe Flow Tank Market Insight

The Europe flow tank market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by strict environmental and safety regulations and the rising need for sustainable storage solutions. The adoption of both aboveground and underground tanks is being promoted by urbanization and industrial modernization. European consumers and industries are increasingly focusing on operational efficiency, safety compliance, and environmentally responsible storage practices, fostering consistent demand across chemical, water treatment, and industrial applications.

U.K. Flow Tank Market Insight

The U.K. flow tank market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by the expansion of industrial infrastructure, heightened environmental awareness, and the increasing need for safe and reliable liquid storage solutions. The country’s emphasis on sustainability, coupled with the adoption of modern tank technologies such as corrosion-resistant materials and leak detection systems, is expected to continue to drive market growth across industrial, commercial, and municipal sectors.

Germany Flow Tank Market Insight

The Germany flow tank market is expected to expand at a considerable CAGR during the forecast period, fueled by a focus on environmental safety, industrial efficiency, and technological advancements. Germany’s well-developed industrial and municipal infrastructure encourages the adoption of both hazardous and non-hazardous storage solutions. Integration of advanced monitoring and maintenance systems, combined with strong compliance to EU regulations, supports market growth, particularly in chemical processing, water treatment, and energy sectors.

Asia-Pacific Flow Tank Market Insight

The Asia-Pacific flow tank market is poised to grow at the fastest CAGR during the forecast period of 2025 to 2032, driven by rapid industrialization, urbanization, and government initiatives promoting infrastructure development in countries such as China, Japan, and India. The region’s growing industrial base and expanding municipal water and wastewater projects are driving demand for both aboveground and underground tanks. Technological advancements and cost-effective manufacturing in APAC are making flow tanks more accessible, fueling adoption across a wide range of industries.

Japan Flow Tank Market Insight

The Japan flow tank market is gaining momentum due to rapid urbanization, a focus on industrial efficiency, and demand for safe and durable storage solutions. The Japanese market emphasizes high-quality materials and advanced monitoring systems, driving adoption in both industrial and municipal sectors. Integration with automated systems for maintenance and safety compliance further supports growth in aboveground and underground tank applications.

China Flow Tank Market Insight

The China flow tank market accounted for the largest revenue share in Asia-Pacific in 2024, driven by rapid industrial expansion, urban infrastructure projects, and high demand for safe, scalable liquid storage solutions. China’s focus on smart city initiatives and modern industrial facilities is boosting the adoption of both hazardous and non-hazardous tanks. Domestic manufacturers offering cost-effective and technologically advanced tanks, coupled with government support for infrastructure development, are key factors propelling the market in China.

Flow Tank Market Share

The flow tank industry is primarily led by well-established companies, including:

- TOYO KANETSU K.K (Japan)

- Ishii Iron Works Co., Ltd (Japan)

- Pfaudler MEKRO Sp. Z O.O (Poland)

- CST Industries, Inc (U.S.)

- McDermott (U.S.)

- PERMIANLIDE (U.S.)

- HIGHLAND TANK & MANUFACTURING COMPANY, INC (U.S.)

- FOX TANK COMPANY (U.S.)

- F WARREN GROUP INC (U.S.)

- SUPERIOR TANK CO., INC (U.S.)

Latest Developments in Global Flow Tank Market

- In January 2025, SPX FLOW announced a collaboration with Siemens to showcase cutting-edge digital twin technology at the MxD (Manufacturing x Digital) center in Chicago. This partnership is expected to accelerate innovation in fluid management by enabling advanced simulation, predictive maintenance, and efficiency improvements across industries such as food and beverage, chemicals, and batteries. The integration of digital twin capabilities strengthens SPX FLOW’s market positioning in next-generation fluid technology solutions, offering customers enhanced reliability and process optimization

- In November 2024, Tezalon introduced its groundbreaking Modular TFF Benchtop System, marking a significant advancement in modular filtration solutions. This product launch enhances flexibility for laboratory and small-scale bioprocessing operations by providing a scalable and efficient platform for testing and pilot projects. The innovation positions Tezalon as a competitive player in modular fluid management technologies, expanding its footprint in pharmaceutical and biotech applications where demand for compact, customizable systems is growing

- In June 2023, KROHNE completed the launch of the BM26A series of Magnetic Level Indicators (MLI) with the introduction of the BM26A-8000. Designed to replace the previous generation, the BM26A series addresses evolving industry needs for accurate level measurement in demanding environments. This development reinforces KROHNE’s market leadership in precision instrumentation while supporting customers in industries such as oil & gas, chemicals, and water treatment with enhanced safety, compliance, and measurement reliability

- In March 2023, China-based ATO Flow Meter expanded its portfolio with the launch of two advanced products: a magnetic flow meter and an ultrasonic flow meter. These innovations strengthen ATO’s global position in flow measurement technology by offering versatile solutions suitable for liquids, gases, and steam applications. The new devices meet growing industrial demands for accurate and customizable flow monitoring, enabling ATO to penetrate diverse industries worldwide and address the rising need for tailored, high-performance measurement solutions

- In July 2021, CST Industries, Inc. announced a strategic partnership with Adams Brothers Inc., a process equipment manufacturer, to extend its market coverage across the eastern U.S., including Virginia and North Carolina. This collaboration enhanced CST’s regional presence by leveraging Adams Brothers’ established network and expertise, improving customer access to CST’s tank and storage solutions. The expansion underscores CST’s focus on strengthening distribution channels and maintaining competitive positioning in the U.S. storage tank market

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Flow Tank Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Flow Tank Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Flow Tank Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.