Global Fluid Loss Additives Market

Market Size in USD Million

CAGR :

%

USD

370.52 Million

USD

480.42 Million

2024

2032

USD

370.52 Million

USD

480.42 Million

2024

2032

| 2025 –2032 | |

| USD 370.52 Million | |

| USD 480.42 Million | |

|

|

|

|

Fluid Loss Additives Market Size

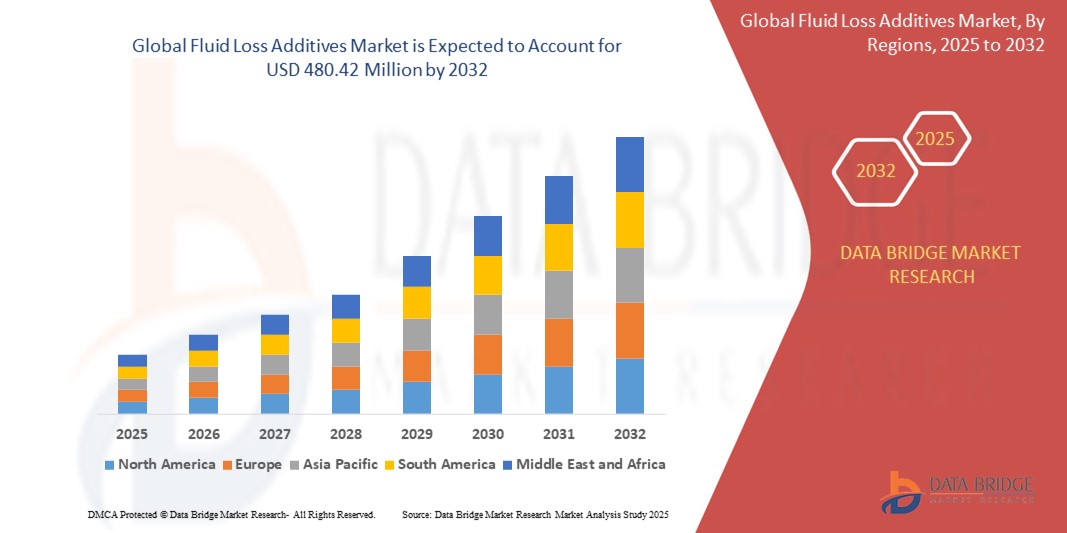

- The global fluid loss additives market size was valued at USD 370.52 million in 2024 and is expected to reach USD 480.42 million by 2032, at a CAGR of 3.30% during the forecast period

- The market growth is primarily driven by the increasing demand for efficient drilling fluids in oil & gas exploration and production, particularly in offshore and unconventional reserves, where fluid loss control is critical for operational efficiency

- In addition, the rising investments in energy infrastructure and deep-water drilling activities, especially in regions such as North America, the Middle East, and Asia-Pacific, are significantly contributing to the adoption of fluid loss additives across drilling operations

Fluid Loss Additives Market Analysis

- Fluid loss additives are essential components in drilling fluid systems, designed to minimize the loss of filtrate into permeable formations during drilling. They enhance wellbore stability, reduce formation damage, and support overall drilling efficiency—particularly in high-pressure, high-temperature (HPHT) environments

- The rising global focus on unconventional oil & gas exploration, such as shale gas, tight oil, and deepwater drilling, is a major driver of the market. These challenging drilling environments require high-performance fluid loss control additives, accelerating demand for both natural and synthetic polymer-based products

- North America dominates the global fluid loss additives market, holding a market share of approximately 38.4% in 2025. This is primarily due to the region's advanced drilling technologies, extensive shale gas operations, and significant offshore activity in the Gulf of Mexico. The U.S. remains the largest individual market, supported by leading oilfield service companies such as Halliburton, Schlumberger, and Baker Hughes that are continuously innovating additive solutions

- Asia-Pacific is expected to be the fastest-growing regional market, with a projected CAGR above 4.5% through 2032. This growth is fueled by increasing energy demand, large-scale upstream investments, and rising domestic drilling activity in countries such as China, India, and Indonesia. Government energy security initiatives are further encouraging local production, driving additive consumption

- The oil-based drilling fluids segment is projected to lead the market with a market share of around 41.2% in 2025, due to their superior thermal stability and effectiveness in extreme drilling environments. Oil-based compatible fluid loss additives such as modified lignite, asphalt derivatives, and synthetic polymers are extensively used in offshore and HPHT wells

Report Scope and Fluid Loss Additives Market Segmentation

|

Attributes |

Fluid Loss Additives Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework |

Fluid Loss Additives Market Trends

“Shift Toward Sustainable Drilling and Performance-Optimized Formulations”

- A significant emerging trend in the fluid loss additives market is the growing emphasis on sustainable drilling practices and the development of eco-friendly fluid systems. Regulatory pressure and ESG commitments are driving the adoption of biodegradable, non-toxic additives compatible with water-based drilling fluids (WBDFs), especially in offshore and environmentally sensitive regions

- In February 2024, Solvay introduced a plant-derived fluid loss additive with enhanced filter cake quality and thermal resistance, designed for offshore drilling in the North Sea. The additive complies with both REACH and OSPAR regulations, reducing ecological impact without compromising performance

- Another key development is the increasing use of high-performance synthetic polymers and nanocomposites to address operational challenges in high-pressure, high-temperature (HPHT) wells. These next-gen additives maintain rheological stability at extreme depths and support efficient drilling in technically demanding environments

- For example, in June 2024, Halliburton launched a nano-engineered fluid loss control agent specifically designed for ultra-deepwater wells. The product improves filtration control under HPHT conditions and reduces the need for multiple additive components, lowering overall mud costs

- The localization of additive manufacturing is also gaining momentum as companies seek to mitigate supply chain disruptions and reduce lead times. In 2023, Newpark Resources opened a new production facility in Texas for custom fluid loss additives tailored to North American shale plays, emphasizing faster delivery and regional customization

- Furthermore, collaborative R&D and digital simulation are helping operators model additive behavior under real-world drilling scenarios. In late 2023, Schlumberger partnered with a consortium of drilling contractors to develop AI-based fluid models that optimize fluid loss control strategies across varying well profiles, improving success rates in challenging geologies

- These trends indicate a broader transformation toward sustainable, intelligent, and performance-optimized drilling fluids, where fluid loss additives play a critical role in balancing operational efficiency, regulatory compliance, and environmental responsibility

Fluid Loss Additives Market Dynamics

Driver

“Rising Demand from Unconventional Drilling and Environmental Compliance”

- The increasing exploration and production of unconventional hydrocarbon resources such as shale gas, tight oil, and deepwater reserves is a primary driver fueling demand for advanced fluid loss additives. These additives are critical for maintaining wellbore stability and minimizing formation damage in complex drilling environments

- For instance, in March 2024, a major North American oilfield services company expanded its portfolio of fluid loss additives specifically designed for shale drilling in the Permian Basin, supporting operators’ needs for high-temperature and high-pressure (HTHP) performance

- The growing emphasis on environmental sustainability is also accelerating the adoption of biodegradable and low-toxicity fluid loss additives, particularly in water-based drilling fluids. Regulations such as the U.S. EPA’s and EU REACH standards are pushing operators to switch to eco-friendly additives, driving market growth globally

- Rapid upstream investment in emerging markets such as Asia-Pacific, Latin America, and the Middle East is boosting demand. Countries such as India, Brazil, and Saudi Arabia are increasing drilling activities, raising consumption of fluid loss additives tailored for region-specific geology and regulatory frameworks

- Technological advancements in drilling fluid formulations, including nanomaterial-enhanced additives and multifunctional polymer blends, are improving fluid loss control efficiency and operational cost savings. Companies such as Halliburton and Schlumberger are pioneering these innovations to cater to evolving drilling challenges

- Overall, the combination of expanding unconventional drilling, regulatory focus on environmental impact, and technological progress continues to drive strong demand for fluid loss additives worldwide

Restraint/Challenge

“Raw Material Price Volatility and Regulatory Complexities”

- A significant challenge in the fluid loss additives market is the price volatility of key raw materials, such as specialty polymers, cellulose derivatives, and synthetic chemicals derived from petrochemicals. Fluctuations in crude oil and natural gas prices directly affect the production costs and pricing stability of fluid loss additives

- For instance, between 2022 and 2024, geopolitical tensions and supply-demand imbalances caused erratic crude oil pricing, impacting the cost structure of drilling fluid additives and squeezing profit margins for manufacturers

- Another major restraint is the complex regulatory landscape governing chemical additives used in drilling fluids. Increasingly stringent environmental regulations in regions such as Europe, North America, and parts of Asia mandate rigorous testing, disclosure, and restrictions on chemical compositions, limiting formulation flexibility

- The limited integration of recycled or bio-based feedstocks into fluid loss additive production also poses challenges. Despite growing interest in sustainable drilling fluids, technical and performance barriers restrict widespread adoption of recycled materials without compromising effectiveness

- In addition, the capital-intensive nature of developing high-performance additives—especially those tailored for harsh drilling conditions (HPHT, deepwater)—creates high entry barriers for new players and limits market expansion in developing economies

- Addressing these restraints will require innovations in feedstock diversification, eco-friendly additive formulations, and regulatory harmonization to ensure resilient and sustainable market growth globally

Fluid Loss Additives Market Scope

The market is segmented on the basis of type, application, fluid type, material type, and product type.

• By Type

On the basis of type, the Fluid Loss Additives market is segmented into Synthetically Modified, Natural Additives, Synthetic Additives, and Natural Additives. The Synthetically Modified segment dominates the largest market revenue share in 2025, driven by its enhanced filtration control properties and thermal stability, which make it ideal for demanding downhole environments, particularly in high-pressure, high-temperature (HPHT) wells. Operators prefer synthetically modified additives for their consistent performance and compatibility with a wide range of drilling fluids and cementing systems. The market also sees steady demand for these additives due to their tailored molecular structure and superior formation sealing capabilities in both onshore and offshore wells

The Natural Additives segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by increasing regulatory pressure and industry shift toward eco-friendly, biodegradable solutions. These additives—often derived from plant-based or cellulose materials—are gaining traction in water-based fluid systems used in environmentally sensitive zones, offering sustainable performance without compromising fluid integrity

• By Application

On the basis of application, the Fluid Loss Additives market is segmented into Drilling Fluid and Cement Slurry. The Drilling Fluid segment held the largest market revenue share in 2025, driven by the critical role fluid loss additives play in maintaining wellbore stability, reducing differential sticking, and preventing formation damage during drilling operations. These additives are widely utilized across vertical, horizontal, and directional drilling, supporting diverse geologies and reservoir conditions

The Cement Slurry segment is expected to witness the fastest CAGR from 2025 to 2032, as fluid loss control is essential in primary cementing to ensure proper zonal isolation, minimize gas migration, and improve cement integrity. The demand is especially prominent in offshore and deepwater operations, where cementing performance directly impacts well safety and longevity

• By Fluid Types

On the basis of fluid type, the Fluid Loss Additives market is segmented into Water-Based Fluids, Oil-Based Fluids, and Synthetic-Based Fluids. The Water-Based Fluids segment dominates the largest market share in 2025, owing to their lower environmental impact, cost efficiency, and compatibility with a wide range of fluid loss control materials such as cellulose derivatives and natural polymers. Water-based systems are extensively used in both conventional and unconventional drilling projects globally

The Synthetic-Based Fluids segment is anticipated to exhibit the fastest growth from 2025 to 2032, supported by their high lubricity, thermal stability, and environmental compliance in sensitive drilling environments. These systems, often used in high-angle and extended reach wells, demand specialized fluid loss additives that maintain performance under extreme conditions

• By Material Type

On the basis of material type, the Fluid Loss Additives market is segmented into Bentonite, Barite, Polyanionic Cellulose (PAC), Polyacrylamide (PAM), Calcium Carbonate, Hydroxyethyl Cellulose (HEC), Latex, and Others. The Polyanionic Cellulose (PAC) segment leads the market in terms of revenue in 2025, due to its excellent fluid loss control performance, salt tolerance, and thermal stability across both water-based and synthetic drilling fluids. It is widely used in shale drilling and offshore wells where wellbore protection is critical

The Latex segment is projected to grow at the fastest rate from 2025 to 2032, favored for its superior sealing properties and flexible film-forming capability in cementing fluids. Latex-based additives enhance bonding between cement and formation, reduce micro-annulus formation, and are increasingly used in challenging cementing applications

• By Product Type

On the basis of product type, the Fluid Loss Additives market is segmented into Water-Soluble and Water-Insoluble. The Water-Soluble segment accounted for the largest market share in 2025, driven by its widespread use in water-based drilling fluids and ease of dispersion, which allows for quick action and effective permeability plugging. These additives are preferred for their environmental safety and operational simplicity in both land and offshore operations

The Water-Insoluble segment is expected to witness the fastest CAGR from 2025 to 2032, due to increasing application in oil-based and synthetic-based fluid systems. These additives, such as asphaltic materials and synthetic polymers, offer excellent sealing in permeable formations and maintain structural integrity under high-temperature conditions

Fluid Loss Additives Market Regional Analysis

- North America dominates the global Fluid Loss Additives market, accounting for the largest revenue share of 38.04% in 2025, driven by a robust oil and gas exploration sector in the U.S. and Canada, particularly across shale formations such as the Permian Basin, Bakken, and Marcellus. The region benefits from advanced drilling technologies, established energy infrastructure, and strong demand for high-performance additives that ensure wellbore integrity and filtration control during complex drilling operations

- In addition, significant investments in unconventional resource development and enhanced oil recovery (EOR) projects are driving fluid demand, along with the adoption of environmentally compliant and high-efficiency additives. Key players such as Halliburton, Schlumberger, and Newpark Resources are innovating customized fluid loss control systems to meet evolving regulatory requirements and maximize drilling efficiency across offshore and onshore assets

- The regional market also benefits from a favorable regulatory framework that supports domestic energy production and R&D in advanced drilling fluids. Ongoing advancements in low-toxicity, biodegradable fluid loss additives, coupled with digitalization of drilling operations, further enhance market prospects by aligning with both ESG objectives and productivity targets set by major operators across North America

U.S. Fluid Loss Additives Market Insight

The U.S. Fluid Loss Additives market holds the largest share in North America in 2025, driven by its mature oil & gas exploration industry, advanced drilling technologies, and increasing shale gas production. High demand for performance-optimized additives in horizontal and directional drilling is encouraging the development of customized polymer and latex-based fluid loss control agents. In addition, regulatory emphasis on environmental safety is pushing U.S. companies to innovate biodegradable and low-toxicity formulations for water-based drilling fluids, enhancing domestic market leadership and export capabilities

Asia-Pacific Fluid Loss Additives Market Insight

The China Fluid Loss Additives market is expected to dominate the Asia-Pacific region, fueled by the country’s massive drilling activity, strong domestic production of drilling fluids, and growing demand for oil and gas to support industrial growth. Fluid loss additives are widely used in both onshore and offshore operations, with Chinese manufacturers investing in high-efficiency polymer-based additives and developing cost-effective solutions to meet regional and global demand. Government-led energy initiatives and expanding shale development further support long-term market expansion

Japan Fluid Loss Additives Market Insight

The Japan Fluid Loss Additives market is growing steadily due to the country’s precision-focused drilling practices and high demand for advanced wellbore stability solutions. Japanese firms emphasize technological innovation in fluid formulation, using synthetically modified polymers and PAC variants to ensure reliable filtration control in geothermal and offshore wells. The nation’s commitment to low-impact drilling operations and environmental sustainability is also increasing the use of water-soluble and biodegradable additives in energy projects

China Fluid Loss Additives Market Insight

The China Fluid Loss Additives market leads in the Asia-Pacific region, driven by the country’s expansive oil & gas sector, investment in domestic energy security, and development of deep and ultra-deep wells. Local manufacturers are enhancing product lines with polymeric and natural additives, tailored for use in challenging geological conditions. In addition, the emphasis on clean energy transition is spurring interest in eco-friendly formulations and integration of fluid loss additives into geothermal and CCS (carbon capture and storage) drilling operations

Europe Fluid Loss Additives Market Insight

The Europe Fluid Loss Additives market is projected to grow steadily, supported by rising energy exploration in the North Sea, Eastern Europe, and emerging geothermal hotspots. Strict environmental regulations such as REACH are encouraging the use of low-toxicity, biodegradable fluid loss control agents in both drilling fluids and cementing slurries. Countries such as Germany, France, and Norway are leading innovation in sustainable drilling solutions, partnering with service providers to introduce advanced polymer and cellulose-based additives aligned with circular economy goals

U.K. Fluid Loss Additives Market Insight

The U.K. Fluid Loss Additives market is gaining traction, fueled by increased offshore drilling activities in the North Sea and ongoing investments in low-carbon energy development. The demand for high-efficiency, environmentally compliant fluid loss additives is rising as operators seek to minimize formation damage and enhance zonal isolation. Government-backed initiatives promoting energy independence and cleaner drilling practices are driving the adoption of water-based and synthetic-compatible additives across the oil & gas and geothermal sectors

Germany Fluid Loss Additives Market Insight

The Germany Fluid Loss Additives market is expanding steadily, supported by strong demand from its oilfield service sector and precision-driven drilling operations. German companies are focusing on high-purity, engineered additives such as PAC, PAM, and latex-based variants to improve performance in HPHT wells and deep geothermal projects. The growing adoption of green drilling fluids and compliance with EU sustainability standards are driving innovation in synthetic and natural additive solutions that combine technical performance with environmental responsibility

Fluid Loss Additives Market Share

The fluid loss additives industry is primarily led by well-established companies, including:

- Halliburton (U.S.)

- Schlumberger Limited (U.S.)

- Newpark Resources Inc. (U.S.)

- Solvay (Belgium)

- BASF SE (Germany)

- Clariant (Switzerland)

- Global Drilling Fluid and Chemicals Limited (U.K.)

- Tytan Organics (India)

- Kemira (Finland)

- Sepcor, Inc. (U.S.)

- Aubin Group (U.K.)

- Nouryon (Netherlands)

- Drilling Fluids And Chemicals Limited (India)

Latest Developments in Global Fluid Loss Additives Market

- In May 2024, TAQA unveiled Threlix, an advanced drilling technology designed to reduce downtime and increase productivity for oil and gas operators. Threlix addresses drilling dysfunctions, such as vibration and torsional oscillations, commonly associated with Rotary Steerable Systems (RSS). By mitigating stick-slip and inconsistent torque, Threlix enhances drilling reliability and cost-effectiveness, preventing equipment damage

- In September 2023, Halliburton Company introduced BaraFLC Nano-I, a nanocomposite suspension designed to enhance wellbore stability. This innovative sealant works with Halliburton’s conventional and high-performance water-based fluid systems, creating tighter, more secure seals to reduce fluid loss into formations. By utilizing nanoparticles, BaraFLC Nano-I prevents pore pressure transmission caused by interactions between filtrate and reactive shale formations, reinforcing wellbore integrity and extending drilling efficiency

- In August 2023, Italmatch Chemicals Group expanded its fluid loss additive portfolio with the introduction of Aubin CFL-600L, a cement additive designed to eliminate fluid loss in oilfield applications. This marks the first cement additive launched under the Aubin brand since Italmatch’s acquisition of Aubin in 2022. The additive enhances water adsorption on cement surfaces, preventing water loss and ensuring reliable hydration for well construction

- In November 2022, NanoMalaysia Bhd introduced Synergy 10AS Nano, a fluid loss additive designed for drilling applications in the oil and gas sector. This graphene-infused additive, developed under the National Graphene Action Plan (NGAP) 2020, enhances sealing properties and reduces fluid loss, improving well integrity and operational efficiency. Synergy 10AS Nano meets Petronas Technical Standards and performs well under high-pressure, high-temperature (HPHT) conditions

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Fluid Loss Additives Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Fluid Loss Additives Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Fluid Loss Additives Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.