Global Fluid Power Equipment Market

Market Size in USD Billion

CAGR :

%

USD

47.69 Billion

USD

75.55 Billion

2024

2032

USD

47.69 Billion

USD

75.55 Billion

2024

2032

| 2025 –2032 | |

| USD 47.69 Billion | |

| USD 75.55 Billion | |

|

|

|

|

Fluid Power Equipment Market Size

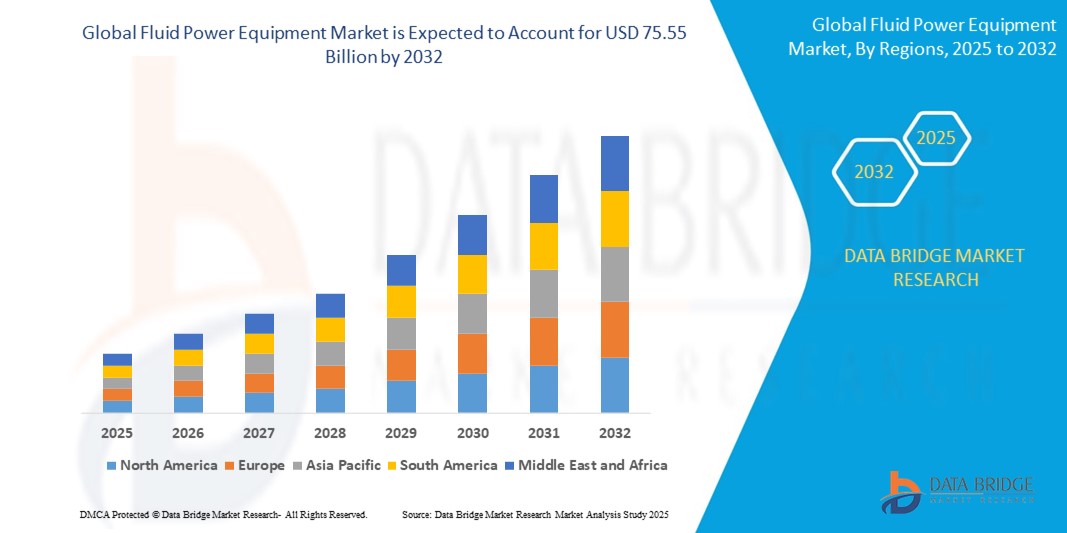

- The global fluid power equipment market size was valued at USD 47.69 billion in 2024 and is expected to reach USD 75.55 billion by 2032, at a CAGR of 5.92% during the forecast period

- The market growth is largely fueled by the rising demand for automation and energy-efficient solutions across key industries such as construction, automotive, and oil & gas, where hydraulic and pneumatic systems play a vital role in delivering high-performance and precision

- Furthermore, ongoing technological advancements in electro-hydraulics, smart sensors, and IoT-integrated fluid power systems are driving efficiency, real-time monitoring, and predictive maintenance, thereby significantly enhancing operational productivity and boosting the industry's growth

Fluid Power Equipment Market Analysis

- Fluid power equipment, comprising hydraulic and pneumatic systems, is a critical enabler of motion control and power transmission across a wide range of industrial applications, offering high force output, reliability, and adaptability in environments requiring precision and durability

- The escalating demand for fluid power equipment is primarily driven by expanding industrial automation, infrastructure development, and the need for energy-efficient, high-performance machinery in sectors such as construction, manufacturing, and oil & gas

- North America dominated the fluid power equipment market with a share of 31.5% in 2024, due to extensive industrial infrastructure, demand from construction and automotive sectors, and the early adoption of hydraulic and pneumatic systems.

- Asia-Pacific is expected to be the fastest growing region in the fluid power equipment market during the forecast period due to rapid industrialization, infrastructure development, and expanding manufacturing capabilities in China, India, and Southeast Asia.

- Hydraulic segment dominated the fluid power equipment market with a market share of 50.5% in 2024, due to its high power density and superior control capabilities across heavy-duty applications. Industries such as construction, mining, and agriculture rely heavily on hydraulic systems for their ability to generate high force and operate under extreme conditions. Their durability and efficiency in powering large machinery and vehicles make hydraulics the backbone of heavy industrial operations

Report Scope and Fluid Power Equipment Market Segmentation

|

Attributes |

Fluid Power Equipment Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Fluid Power Equipment Market Trends

“Rising Construction and Infrastructure Activities”

- A significant and accelerating trend in the global fluid power equipment market is the rising demand driven by expanding construction and infrastructure activities, which require robust, reliable hydraulic and pneumatic systems for heavy machinery and automation

- For instance, companies such as Parker Hannifin and Eaton supply advanced hydraulic pumps and valves widely used in construction equipment such as excavators and cranes, enabling efficient and precise motion control essential for large-scale projects

- The surge in infrastructure development, including roads, bridges, and commercial buildings, is fueling increased deployment of fluid power components that deliver high power density and durability in demanding environments

- In addition, manufacturers are innovating with smart fluid power technologies featuring integrated sensors and IoT capabilities, allowing real-time monitoring and predictive maintenance to reduce downtime on critical construction equipment

- This growing trend of leveraging fluid power solutions in construction is reshaping industry standards for performance and reliability, prompting key players such as Bosch Rexroth to develop intelligent hydraulic systems optimized for heavy-duty applications

- The demand for fluid power equipment tailored to the construction and infrastructure sector is expected to rise rapidly, supported by government investments and the modernization of construction fleets worldwide

Fluid Power Equipment Market Dynamics

Driver

“Increasing Technological Advancements”

- The increasing pace of technological advancements in fluid power systems, including the integration of IoT and smart sensors, is a significant driver for the growing demand for fluid power equipment

- For instance, in 2024, Bosch Rexroth introduced advanced IoT-enabled hydraulic valves that provide real-time performance monitoring and predictive maintenance capabilities, enhancing operational efficiency across industries. Such innovations by leading companies are expected to accelerate market growth during the forecast period

- As industries prioritize automation and efficiency, fluid power equipment now offers smarter control, energy optimization, and reduced downtime through enhanced diagnostics and connectivity features

- Furthermore, the rising adoption of Industry 4.0 and smart manufacturing practices is driving demand for intelligent fluid power solutions that seamlessly integrate with digital platforms and analytics tools

- The capability to monitor system health remotely, optimize performance, and schedule maintenance proactively are key factors propelling the adoption of technologically advanced fluid power equipment in sectors such as construction, automotive, and oil & gas

Restraint/Challenge

“Competition from Electric Systems”

- Competition from electric systems, such as fully electric actuators and servo drives, poses a significant challenge to the fluid power equipment market, as these alternatives offer higher energy efficiency, precision, and easier integration with digital controls

- For instance, companies such as Moog and Parker Hannifin are expanding their electric actuator portfolios, which are increasingly preferred in applications demanding quieter operation and lower maintenance compared to traditional hydraulic or pneumatic systems

- The shift towards electrification is driven by industries aiming to reduce energy consumption and comply with stricter environmental regulations, putting pressure on fluid power manufacturers to innovate or risk losing market share

- In addition, the initial higher cost and complexity of some electric systems can be a barrier, but their long-term benefits in efficiency and flexibility often outweigh these concerns, especially in sectors such as automotive and semiconductor manufacturing

- Overcoming this challenge requires fluid power companies, such as Eaton and Bosch Rexroth, to develop hybrid solutions and smart fluid power technologies that combine the strengths of hydraulics and electrics, ensuring competitiveness in a rapidly evolving market

Fluid Power Equipment Market Scope

The market is segmented on the basis of type, component, and application.

- By Type

On the basis of type, the fluid power equipment market is segmented into hydraulic and pneumatic. The hydraulic segment is further sub-segmented into hydraulic pumps, hydraulic motors, hydraulic valves, hydraulic cylinders, hydraulic transmission, hydraulic filters, and hydraulic accumulators. The pneumatic is sub-segmented into pneumatic pumps, pneumatic valves, pneumatic actuators, pneumatic filter regulator lubricators (FRLs), pneumatic fittings, and others. The hydraulic segment dominated the market with the largest market revenue share of 50.5% in 2024, attributed to its high power density and superior control capabilities across heavy-duty applications. Industries such as construction, mining, and agriculture rely heavily on hydraulic systems for their ability to generate high force and operate under extreme conditions. Their durability and efficiency in powering large machinery and vehicles make hydraulics the backbone of heavy industrial operations.

The pneumatic segment is anticipated to witness the fastest CAGR from 2025 to 2032, driven by increasing adoption in manufacturing, food processing, and packaging sectors. Pneumatic systems are lightweight, clean, and cost-effective, making them ideal for applications requiring quick, repetitive motion with minimal contamination risk. Their growing use in automated production lines and assembly applications underscores the shift toward compact and maintenance-friendly solutions.

- By Component

On the basis of component, the fluid power equipment market is segmented into pumps, motors, valves, cylinders, steel tube and compression fittings, accumulators, and accessories. The pumps segment held the largest market revenue share in 2024, driven by their central role in transmitting fluid energy across both hydraulic and pneumatic systems. A surge in industrial automation and expansion of mobile equipment applications further propel pump demand across sectors such as construction and oil & gas.

The cylinders segment is expected to witness the fastest CAGR from 2025 to 2032, owing to their critical role in delivering linear motion and force. Their application in robotics, automated manufacturing lines, and mobile machinery is expanding due to the increasing need for precise movement and control. Compact and energy-efficient cylinder designs also support adoption across industries seeking productivity and space optimization.

- By Application

On the basis of application, the fluid power equipment market is segmented into construction, automotive, oil and gas, food processing, packaging, semiconductor, and others. The construction segment accounted for the largest market revenue share in 2024, driven by extensive use of hydraulic systems in equipment such as excavators, loaders, and cranes. Rapid urbanization, infrastructure development, and rising investments in public works have boosted demand for fluid-powered machinery essential for earthmoving and lifting tasks.

The semiconductor segment is expected to witness the fastest CAGR from 2025 to 2032, supported by the growing need for precision fluid control in chip fabrication and cleanroom processes. Pneumatic systems are particularly favored for their contamination-free operation, compact size, and responsiveness in handling delicate operations. The increasing miniaturization and complexity of semiconductor devices further amplify the role of fluid power in ensuring accuracy and process stability.

Fluid Power Equipment Market Regional Analysis

- North America dominated the fluid power equipment market with the largest revenue share of 31.5% in 2024, driven by extensive industrial infrastructure, demand from construction and automotive sectors, and the early adoption of hydraulic and pneumatic systems

- Industries in the region emphasize efficiency, automation, and rugged machinery, all of which align with the strengths of fluid power technologies

- A mature manufacturing base, high capital investment in heavy machinery, and the adoption of advanced motion control systems further contribute to North America’s leadership in the global fluid power landscape

U.S. Fluid Power Equipment Market Insight

U.S. fluid power equipment market captured the largest revenue share in 2024 within North America, propelled by growing investments in infrastructure projects, energy exploration, and automation in manufacturing. Hydraulic systems are extensively used in agriculture, aerospace, and defense, while pneumatics dominate assembly lines and packaging operations. The presence of key market players, along with continuous technological advancements in electro-hydraulics and smart pneumatics, further strengthens the U.S. market position.

Europe Fluid Power Equipment Market Insight

The Europe fluid power equipment market is projected to witness significant growth over the forecast period, fueled by strong demand from automotive, food processing, and renewable energy sectors. The region’s regulatory push towards energy-efficient systems is encouraging the adoption of more sophisticated fluid power components with improved sustainability. Increasing focus on automation and robotics across industries is also accelerating the demand for compact and high-performance hydraulic and pneumatic solutions.

U.K. Fluid Power Equipment Market Insight

The U.K. fluid power equipment market is expected to grow steadily due to modernization across manufacturing and food processing sectors. Increased investments in factory automation, coupled with the replacement of aging hydraulic systems, are driving demand. The emphasis on sustainable and compact systems aligns with the U.K.’s broader industrial decarbonization efforts, encouraging the adoption of electric-hydraulic hybrid solutions and smart pneumatic technologies.

Germany Fluid Power Equipment Market Insight

The Germany fluid power equipment market is anticipated to expand robustly owing to its advanced engineering sector and leadership in industrial automation. German manufacturers are increasingly integrating fluid power systems with digital controls and IoT platforms for improved efficiency and monitoring. As a hub for high-precision machinery and automotive innovation, Germany continues to favor modular and energy-optimized fluid power solutions.

Asia-Pacific Fluid Power Equipment Market Insight

Asia-Pacific fluid power equipment market is set to grow at the fastest CAGR from 2025 to 2032, driven by rapid industrialization, infrastructure development, and expanding manufacturing capabilities in China, India, and Southeast Asia. The increasing deployment of construction machinery, coupled with growing investments in renewable energy and transportation, supports high demand for hydraulic and pneumatic equipment. Government-backed smart manufacturing initiatives are also boosting regional growth.

Japan Fluid Power Equipment Market Insight

Japan fluid power equipment market is expanding steadily, supported by automation in electronics, semiconductor, and automotive sectors. Japan's emphasis on precision, efficiency, and compact machinery makes it a key market for advanced pneumatic systems and miniaturized hydraulics. With aging infrastructure and labor shortages, Japanese industries are turning to automation and robotics—areas where fluid power plays a critical role.

China Fluid Power Equipment Market Insight

China fluid power equipment market accounted for the largest revenue share in Asia-Pacific in 2024, driven by large-scale infrastructure projects, industrial modernization, and a dominant construction equipment sector. China is both a leading consumer and manufacturer of hydraulic and pneumatic components. Favorable government policies, export-oriented manufacturing, and high domestic demand make it a key driver of regional and global market growth.

Fluid Power Equipment Market Share

The fluid power equipment industry is primarily led by well-established companies, including:

- Bosch Rexroth Corporation (Germany)

- Eaton (Ireland)

- Parker Hannifin Corp (U.S.)

- Kawasaki Heavy Industries, Ltd. (Japan)

- Fluid-Power Equipment Inc (U.S.)

- Sparrows Offshore Group Limited (U.K.)

- Fluid Systems, Inc. (U.S.)

- HYDAC (India)

- HAWE Hydraulik SE (Germany)

- Moog Inc. (U.S.)

- Bucher Hydraulics GmbH (Germany)

- DAIKIN INDUSTRIES, Ltd. (Japan)

- CASAPPA S.p.A. (Italy)

- Applied Industrial Technologies (U.S.)

- CIRCOR International (U.S.)

- Crane Co. (U.S.)

- Flowserve Corporation (U.S.)

- Graco Inc. (U.S.)

- Christian Bürkert GmbH & Co. KG (Germany)

- Dover Corporation (U.S.)

What are the Recent Developments in Global Fluid Power Equipment Market?

- In December 2021, Danfoss launched a multi-axis steering system aimed at enhancing maneuverability and productivity for farm and construction equipment OEMs. This technology, driven by a software-based electro-hydraulic valve, enables independent control of front and rear axles from the vehicle's cab, facilitating tighter turns and high-visibility crabbing. Initially deployed in European vineyard tractors and EU construction and material handling equipment, the system promises improved operational efficiency in confined spaces

- In May 2021, Bosch Rexroth launched the Hägglunds Atom hydraulic motor, a fast and power-dense alternative to the existing Hägglunds CAb. This motor offers increased revolutions per minute and enhanced power within a compact footprint, making it suitable for mobile, marine, and recycling applications. The Hägglunds Atom's superior performance in a smaller size presents a promising solution for industries requiring high power density and efficiency

- In December 2020, Parker Hannifin lunched the PCH Network Portal, designed to facilitate global factory automation within the company. This portal enables communication with various industrial controllers in the automation sector and supports multiple Industrial Ethernet communication protocols. With capabilities to integrate seamlessly into existing automation infrastructures, the PCH Network Portal offers enhanced connectivity and interoperability for streamlined manufacturing operations

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Fluid Power Equipment Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Fluid Power Equipment Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Fluid Power Equipment Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.