Global Fluid Pressure Sensors Market

Market Size in USD Billion

CAGR :

%

USD

16.85 Billion

USD

29.18 Billion

2024

2032

USD

16.85 Billion

USD

29.18 Billion

2024

2032

| 2025 –2032 | |

| USD 16.85 Billion | |

| USD 29.18 Billion | |

|

|

|

|

What is the Global Fluid Pressure Sensors Market Size and Growth Rate?

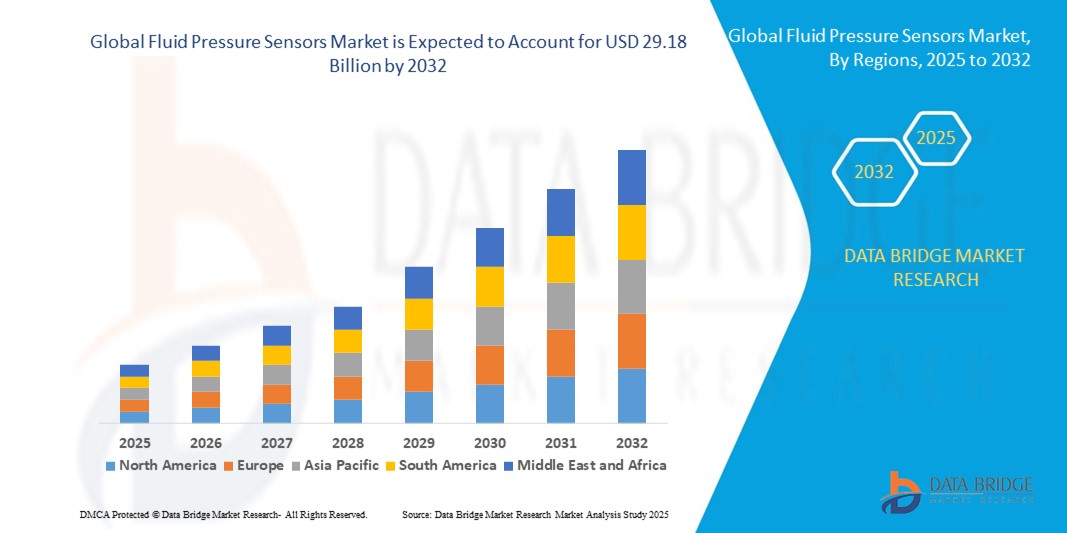

- The global fluid pressure sensors market size was valued at USD 16.85 billion in 2024 and is expected to reach USD 29.18 billion by 2032, at a CAGR of 7.10% during the forecast period

- The global fluid pressure sensors market encompasses sensors designed to detect pressure variations in liquids and gases. These sensors find application in diverse industries, including manufacturing, automotive, aerospace and defense, medical, and oil and gas

- Fluid pressure sensors are crucial for monitoring and controlling various processes, ensuring safety, and optimizing efficiency. The market involves stakeholders such as sensor manufacturers, distributors, and system integrators

What are the Major Takeaways of Fluid Pressure Sensors Market?

- The escalating demand for safety and efficiency stands as a key driver for the global fluid pressure sensors market. In industries ranging from automotive to aerospace, fluid pressure sensors play a critical role in ensuring operational safety by accurately monitoring pressure levels in various systems and components

- Moreover, as businesses focus on enhancing operational efficiency and minimizing downtime, the adoption of fluid pressure sensors facilitates real-time monitoring and proactive maintenance, thereby optimizing performance and reducing costs

- With safety and efficiency remaining paramount concerns across industries, the demand for fluid pressure sensors is poised to witness significant growth, propelling market expansion in the coming years

- North America dominated the fluid pressure sensors market with the largest revenue share of 36.14% in 2024, supported by strong industrial automation demand, expanding automotive applications, and the rapid adoption of IoT-enabled monitoring solutions

- Asia-Pacific fluid pressure sensors market is forecast to grow at the fastest CAGR of 5.28% between 2025 and 2032, driven by rising industrialization, expanding automotive production, and strong government support for smart manufacturing and infrastructure development

- The piezoresistive segment dominated the fluid pressure sensors market with the largest market revenue share of 38.6% in 2024, driven by its high sensitivity, low cost, and extensive use in automotive and industrial applications

Report Scope and Fluid Pressure Sensors Market Segmentation

|

Attributes |

Fluid Pressure Sensors Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Fluid Pressure Sensors Market?

Adoption of Smart and Connected Sensor Technologies

- A major trend in the global fluid pressure sensors market is the rapid integration of sensors with IoT platforms, AI-driven analytics, and cloud-based monitoring systems, enhancing precision and real-time decision-making in industrial and automotive applications

- For example, Bosch Sensortec GmbH offers MEMS-based pressure sensors that integrate with IoT systems, enabling predictive maintenance and improved operational efficiency. Similarly, Honeywell International Inc. has introduced digital pressure sensors compatible with industrial automation networks

- AI integration allows fluid pressure sensors to detect anomalies, optimize performance, and provide predictive alerts, reducing downtime in manufacturing and transportation industries. In addition, cloud connectivity enables remote monitoring and diagnostics, improving user convenience

- These advancements are increasingly aligning with Industry 4.0 initiatives, offering centralized platforms where pressure sensors function alongside temperature, flow, and vibration sensors, creating a unified smart monitoring ecosystem

- This evolution toward intelligent, connected, and predictive sensing technologies is redefining industrial efficiency, safety, and performance benchmarks

- As a result, companies such as Siemens AG and Emerson Electric Co. are actively developing IoT-enabled Fluid Pressure Sensors to meet the rising demand for smart factory and smart mobility solutions worldwide

What are the Key Drivers of Fluid Pressure Sensors Market?

- The growing demand for automotive safety systems, industrial automation, and smart healthcare devices is a key driver of fluid pressure sensors market growth

- For instance, in February 2024, NXP Semiconductors announced advancements in automotive pressure sensor solutions that support electric vehicles and autonomous driving safety features. Such developments are expected to fuel market expansion during the forecast period

- Rising safety regulations in the automotive industry, such as the integration of tire pressure monitoring systems (TPMS), are accelerating adoption. Similarly, in industrial settings, pressure sensors are critical for leak detection, flow monitoring, and predictive maintenance

- The surge in connected medical devices, particularly in respiratory monitoring and blood pressure management, is further boosting demand for miniature and high-accuracy Fluid Pressure Sensors

- Moreover, the global shift toward smart manufacturing, coupled with the adoption of Industry 4.0 frameworks, positions fluid pressure sensors as vital components for real-time monitoring and operational optimization

Which Factor is Challenging the Growth of the Fluid Pressure Sensors Market?

- Calibration complexity, high cost, and cybersecurity concerns related to connected sensors present notable challenges for market growth

- For instance, high-profile cases of IoT device vulnerabilities have heightened concerns about data security in industrial and automotive applications, slowing adoption in sensitive sectors

- Pressure sensors also face challenges in harsh environments, such as extreme temperatures and corrosive conditions, where durability and long-term stability remain critical. In addition, advanced MEMS and digital sensors often involve higher production costs, limiting adoption in price-sensitive markets

- Leading companies such as Texas Instruments and STMicroelectronics are addressing these issues by developing cost-effective, durable, and encrypted sensor solutions to enhance performance and reliability

- While affordability and security improvements are gradually emerging, widespread adoption will require stronger cybersecurity measures, cost optimization, and improved consumer awareness of sensor benefits

- Overcoming these obstacles will be essential to sustain long-term market penetration across automotive, industrial, and healthcare sectors

How is the Fluid Pressure Sensors Market Segmented?

The market is segmented on the basis of sensor type, fluid type, application, technology, and end-user.

- By Sensor Type

On the basis of sensor type, the fluid pressure sensors market is segmented into piezoresistive, capacitive, electromagnetic, resonant, and optical. The piezoresistive segment dominated the fluid pressure sensors market with the largest market revenue share of 38.6% in 2024, driven by its high sensitivity, low cost, and extensive use in automotive and industrial applications. Piezoresistive sensors are widely adopted for their robustness, miniaturization capability, and compatibility with silicon-based manufacturing.

The optical segment is anticipated to witness the fastest growth rate of 19.4% from 2025 to 2032, fueled by rising demand in healthcare, aerospace, and oil & gas industries, where precision and immunity to electromagnetic interference are critical.

- By Fluid Type

On the basis of fluid type, the fluid pressure sensors market is segmented into liquid and gas. The liquid segment held the largest market revenue share in 2024 at 55.2%, driven by the growing demand for hydraulic monitoring in automotive systems, industrial equipment, and oil & gas pipelines. Liquid-compatible pressure sensors are essential for maintaining safety, efficiency, and performance in fluid-powered systems.

The gas segment is expected to grow at the fastest CAGR from 2025 to 2032, boosted by applications in HVAC systems, environmental monitoring, and aerospace propulsion systems.

- By Application

On the basis of application, the fluid pressure sensors market is segmented into automotive, industrial, healthcare, consumer electronics, aerospace and defense, oil and gas, and others. The automotive segment accounted for the largest market revenue share of 31.7% in 2024, driven by increasing use of pressure sensors in fuel systems, tire pressure monitoring systems (TPMS), and engine management. Stricter government regulations on vehicle safety and emissions further propel demand.

The healthcare segment is expected to witness the fastest CAGR from 2025 to 2032 due to rising applications in medical devices such as ventilators, infusion pumps, and patient monitoring systems.

- By Technology

On the basis of technology, the fluid pressure sensors market is segmented into analog and digital. The analog segment held the largest market revenue share in 2024 at 60.8%, owing to its extensive deployment in legacy systems, low cost, and ease of integration in basic pressure monitoring devices.

The digital segment, however, is projected to grow at the fastest CAGR from 2025 to 2032, supported by the shift towards IoT-enabled smart devices, higher accuracy, and integration with data analytics platforms.

- By End-User

On the basis of end-user, the fluid pressure sensors market is segmented into OEM and aftermarket. The OEM segment dominated the market with a 68.5% revenue share in 2024, driven by large-scale sensor integration in newly manufactured automobiles, industrial machinery, and healthcare equipment.

The aftermarket segment is projected to grow rapidly during 2025–2032, fueled by the replacement demand in automotive, industrial, and oil & gas equipment to maintain efficiency and safety.

Which Region Holds the Largest Share of the Fluid Pressure Sensors Market?

- North America dominated the fluid pressure sensors market with the largest revenue share of 36.14% in 2024, supported by strong industrial automation demand, expanding automotive applications, and the rapid adoption of IoT-enabled monitoring solutions

- The region benefits from a technologically advanced infrastructure and well-established industries that rely heavily on accurate pressure monitoring for safety, efficiency, and regulatory compliance

- High investments in smart manufacturing, coupled with the increasing use of pressure sensors in oil & gas, aerospace, and healthcare, further solidify North America’s leadership in the market

U.S. Fluid Pressure Sensors Market Insight

U.S. fluid pressure sensors dominated the market revenue share in 2024 within North America, fueled by the strong presence of automotive manufacturers, healthcare device providers, and industrial automation companies. Growing demand for high-performance sensors in EVs, HVAC systems, and medical devices is driving expansion. The integration of MEMS-based sensors, paired with advances in miniaturization and wireless connectivity, further accelerates growth. Government initiatives supporting industrial safety and emission monitoring also reinforce the U.S. market’s dominance.

Europe Fluid Pressure Sensors Market Insight

Europe fluid pressure sensors market is expected to register substantial growth throughout the forecast period, driven by stringent environmental regulations and the rising adoption of Industry 4.0 technologies. European industries, particularly automotive and energy, are integrating advanced pressure sensors for enhanced efficiency and sustainability. Increasing adoption in residential HVAC systems and smart building projects also fuels demand. Growth is evident across both Western and Eastern Europe, with emphasis on high-reliability, eco-friendly sensor solutions.

U.K. Fluid Pressure Sensors Market Insight

U.K. fluid pressure sensors market is projected to grow at a noteworthy CAGR during the forecast period, driven by advancements in smart infrastructure and automotive engineering. The rising focus on sustainable energy solutions, such as hydrogen and renewable energy systems, supports the demand for precision fluid pressure measurement. Furthermore, the U.K.’s strong healthcare sector and adoption of connected medical devices enhance market opportunities, positioning the country as a significant growth pocket within Europe.

Germany Fluid Pressure Sensors Market Insight

Germany fluid pressure sensors market is set to expand at a considerable CAGR during the forecast period, supported by its robust automotive manufacturing base and leadership in industrial engineering. The country’s push toward energy efficiency, coupled with its adoption of digital industrial technologies, is propelling sensor demand across industries. Pressure sensors integrated with smart control systems are gaining prominence, particularly in automotive, HVAC, and renewable energy projects, reinforcing Germany’s key role in the European market.

Which Region is the Fastest Growing Region in the Fluid Pressure Sensors Market?

Asia-Pacific fluid pressure sensors market is forecast to grow at the fastest CAGR of 5.28% between 2025 and 2032, driven by rising industrialization, expanding automotive production, and strong government support for smart manufacturing and infrastructure development. Increasing consumer adoption of smart home appliances and IoT-enabled devices further accelerates market penetration. The region’s role as a global manufacturing hub for sensor technologies enhances both affordability and accessibility across diverse applications.

Japan Fluid Pressure Sensors Market Insight

Japan fluid pressure sensors market is witnessing strong growth, driven by the country’s focus on high-precision manufacturing, automation, and healthcare innovation. The adoption of MEMS-based and miniaturized sensors is increasing, particularly in medical devices, automotive systems, and robotics. Japan’s aging population also contributes to the demand for advanced medical monitoring devices using pressure sensors, while its strong electronics sector drives integration with IoT and smart home ecosystems.

China Fluid Pressure Sensors Market Insight

China fluid pressure sensors market accounted for the largest revenue share in Asia-Pacific in 2024, attributed to rapid urbanization, large-scale industrial production, and increasing consumer demand for connected devices. The automotive and consumer electronics sectors remain the primary drivers, supported by strong domestic manufacturers and government initiatives promoting smart city development. Affordable pricing and mass-scale production further strengthen China’s position as a global leader in fluid pressure sensor consumption and manufacturing.

Which are the Top Companies in Fluid Pressure Sensors Market?

The fluid pressure sensors industry is primarily led by well-established companies, including:

- Honeywell International Inc. (U.S.)

- TE Connectivity (Switzerland)

- Siemens AG (Germany)

- Bosch Sensortec GmbH (Germany)

- Emerson Electric Co. (U.S.)

- Pepperl+Fuchs (Germany)

- Schneider Electric SE (France)

- Yokogawa Electric Corporation (Japan)

- Omron Corporation (Japan)

- NXP Semiconductors N.V. (Netherlands)

- STMicroelectronics International NV (Switzerland)

- Texas Instruments Incorporated (U.S.)

- Analog Devices, Inc. (U.S.)

- Baumer Group (Switzerland)

- Burkhardt Grob Holding AG (Switzerland)

- Keller AG für Druckmesstechnik (Switzerland)

- DRUCK GmbH (Germany)

- Pendergast Instruments Ltd. (U.K.)

What are the Recent Developments in Global Fluid Pressure Sensors Market?

- In January 2024, Melexis launched the MLX90830, a MEMS pressure sensor with Triphibian technology designed for gas and liquid media measurements ranging from 2 to 70 bar with exceptional accuracy. This innovation enhanced integration into electric vehicle thermal management systems, improving efficiency and supporting extended driving ranges. This advancement strengthens Melexis’ position in the EV sensor market

- In June 2023, STMicroelectronics unveiled the world’s first MEMS water/liquid-proof absolute pressure sensor under a 10-year longevity program tailored for the industrial market. With its robust environmental resilience, high accuracy, and wide temperature range, the sensor proved ideal for gas and water metering, weather stations, and smart appliances. This launch highlights STMicroelectronics’ commitment to driving digital transformation in industrial IoT applications

- In September 2022, Digi-Key Electronics of the U.S. collaborated with Schneider Electric to elevate customer service standards and broaden access to high-quality electronic components and automation solutions across multiple industries. This partnership enhanced customer experience and strengthened supply chain accessibility for global clients

- In May 2022, ABB expanded its KPM KC7 microwave consistency transmitter range by introducing a larger flow sensor suitable for pipelines up to 16 inches in diameter. This development improved ABB’s capabilities in process optimization for industrial fluid management

- In May 2021, Sick launched its LBR SickWave and LFR SickWave radar-based sensing solutions, designed for non-contact monitoring of liquids and complex objects in real time. With a detection range of up to 120 meters, the bulk solid level sensor provided high versatility in industrial environments. This innovation reinforced Sick’s leadership in advanced radar sensing technologies

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Fluid Pressure Sensors Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Fluid Pressure Sensors Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Fluid Pressure Sensors Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.