Global Fluid Transfer System Market

Market Size in USD Billion

CAGR :

%

USD

25.52 Billion

USD

40.74 Billion

2024

2032

USD

25.52 Billion

USD

40.74 Billion

2024

2032

| 2025 –2032 | |

| USD 25.52 Billion | |

| USD 40.74 Billion | |

|

|

|

|

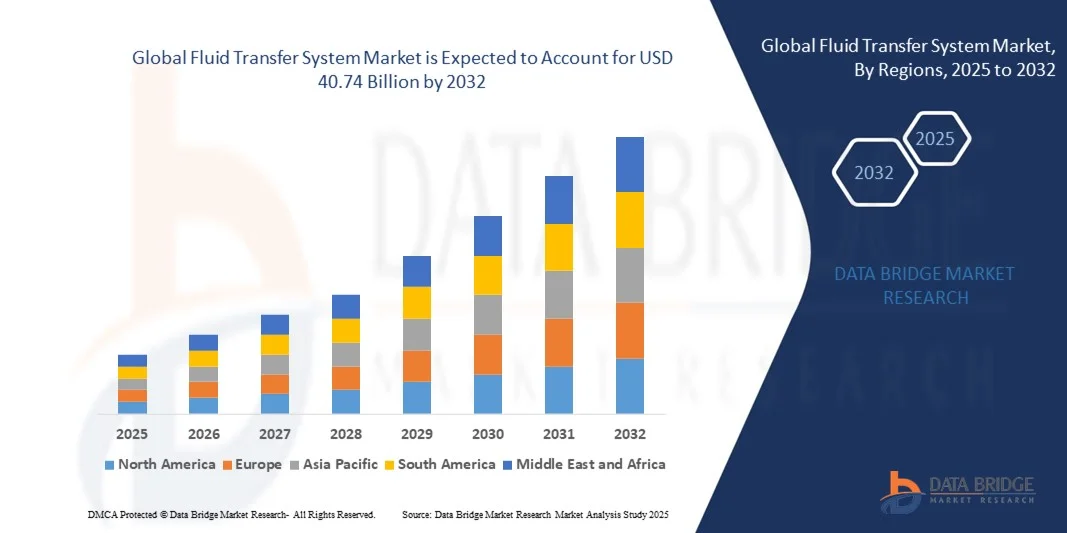

What is the Global Fluid Transfer System Market Size and Growth Rate?

- The global fluid transfer system market size was valued at USD 25.52 billion in 2024 and is expected to reach USD 40.74 billion by 2032, at a CAGR of 6.16% during the forecast period

- Growth in the production of passenger vehicles especially in the emerging economies, shifting and improving economic conditions of certain economies around the globe and increased focus of the manufacturers on innovative automotive air conditioning systems and on the adoption of durable and lightweight vehicle materials are the major factors attributable to the growth of fluid transfer system market

What are the Major Takeaways of Fluid Transfer System Market?

- Growth in the demand for the adoption of SCRs in diesel engines has resulted in growth in the market value. Growth and expansion of automotive industry especially in the developing economies coupled with surge in the application of recyclable or reusable metals will also create lucrative growth opportunities for the market

- Increasing emissions and fuel efficiency regulations imposed by the government will also foster the market growth. Increased focus of the manufacturers on innovating with the technology will further carve the way for the growth of market

- Asia-Pacific dominated the fluid transfer system market with the largest revenue share of 42.3% in 2024, driven by rapid urbanization, expanding automotive and industrial sectors, and increasing adoption of advanced vehicle technologies

- The North America fluid transfer system market is poised to grow at the fastest CAGR of 8.36% during 2025 to 2032, driven by rising vehicle electrification, advanced industrial automation, and adoption of hybrid and off-highway vehicles

- The Fuel Lines segment dominated the market with the largest revenue share of 38.5% in 2024, driven by the high demand for fuel efficiency, safety compliance, and precision fluid delivery across passenger and commercial vehicles

Report Scope and Fluid Transfer System Market Segmentation

|

Attributes |

Fluid Transfer System Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Fluid Transfer System Market?

Automation and Smart Integration for Operational Efficiency

- A major and accelerating trend in the global fluid transfer system market is the integration of advanced automation technologies and IoT-enabled smart monitoring systems. This allows operators to optimize fluid flow, reduce downtime, and enhance overall operational efficiency

- For instance, several modern fluid transfer systems are equipped with predictive analytics and IoT-enabled sensors that monitor pressure, temperature, and flow rates in real-time, allowing operators to identify leaks, blockages, or maintenance needs instantly

- AI-powered systems further enhance performance by analyzing historical data to predict anomalies, optimize pump operations, and improve energy efficiency. These smart features reduce human intervention and minimize operational errors

- The integration of fluid transfer systems with digital dashboards and industrial automation platforms enables centralized control, seamless monitoring, and automated reporting, improving decision-making and process transparency

- This trend toward intelligent, automated, and interconnected fluid management is transforming industry standards, with leading companies developing AI-enabled solutions to ensure precise, energy-efficient, and reliable fluid transfer operations across multiple sectors

- Demand for smart, automated fluid transfer solutions is increasing across industrial, automotive, and chemical sectors as companies prioritize operational efficiency, cost savings, and safety compliance

What are the Key Drivers of Fluid Transfer System Market?

- The rising demand for industrial automation and efficient fluid handling solutions is a primary driver for the Fluid Transfer System market, as companies aim to reduce operational downtime and enhance productivity

- For instance, in January 2025, Gates Corporation (U.S.) launched an advanced high-pressure fluid transfer line designed to support automated manufacturing processes, which is expected to drive market adoption

- The need for precision in fluid delivery, consistent quality control, and real-time monitoring in chemical, automotive, and HVAC applications is fueling demand for advanced fluid transfer solutions

- Furthermore, environmental regulations and the need to minimize leakage, spillage, and energy waste are encouraging the adoption of high-efficiency fluid transfer systems

- The trend toward smart manufacturing and Industry 4.0 is also supporting market growth, with companies integrating IoT and predictive maintenance features, enabling remote monitoring, real-time alerts, and automated control

Which Factor is Challenging the Growth of the Fluid Transfer System Market?

- High upfront costs and the complexity of implementing smart, automated fluid transfer systems pose a key challenge, particularly for SMEs or cost-sensitive industries

- Compatibility issues with existing industrial infrastructure and equipment can slow adoption, requiring companies to invest in retrofitting or complete system upgrades

- Cybersecurity vulnerabilities in IoT-enabled fluid transfer systems present risks of operational disruption or data breaches, making enterprises cautious in adopting fully connected solutions

- Companies such as TI Fluid Systems and Kongsberg Automotive emphasize secure protocols and regular software updates to address security concerns, but awareness and trust among end-users remain a barrier

- Overcoming these challenges through cost optimization, robust cybersecurity measures, and easier integration with legacy systems will be critical to sustaining long-term market growth

How is the Fluid Transfer System Market Segmented?

The global fluid transfer system market is segmented on the basis of type, material, vehicle type, electric and hybrid vehicles and off-highway vehicles.

- By Type

On the basis of type, the fluid transfer system market is segmented into Air Suspension Lines, Fuel Lines, Brake Lines, AC Lines, Diesel Particulate Filter (DPF) Lines, Selective Catalytic Reduction (SCR) Lines, Transmission Oil Cooling Lines, and Turbo Coolant Lines. The Fuel Lines segment dominated the market with the largest revenue share of 38.5% in 2024, driven by the high demand for fuel efficiency, safety compliance, and precision fluid delivery across passenger and commercial vehicles. Fuel lines are widely adopted due to their critical role in engine performance and emission control, and their compatibility with various automotive platforms ensures steady demand.

The Air Suspension Lines segment is anticipated to witness the fastest CAGR of 20.4% from 2025 to 2032, fueled by increasing adoption of air suspension technology in luxury and commercial vehicles, offering enhanced ride comfort, vehicle stability, and improved load management. Advanced materials and automation in manufacturing are further accelerating growth in this segment.

- By Material

On the basis of material, the fluid transfer system market is segmented into Nylon, Stainless Steel, Aluminium, Steel, Rubber, and Other. The Stainless Steel segment dominated the market with the largest revenue share of 36.7% in 2024, owing to its corrosion resistance, durability, and ability to withstand high pressure and temperature conditions in automotive and industrial applications. Stainless steel fluid transfer lines are widely preferred in critical systems such as fuel, brake, and SCR lines for their reliability and long service life.

The Nylon segment is expected to witness the fastest CAGR of 19.8% from 2025 to 2032, driven by lightweight properties, flexibility, and cost-effectiveness. Nylon is increasingly used in air suspension, AC, and coolant systems, aligning with the automotive industry’s shift toward fuel efficiency, weight reduction, and high-performance polymer solutions.

- By Vehicle Type

On the basis of vehicle type, the fluid transfer system market is segmented into Passenger Car, Light Commercial Vehicle, Truck, and Bus. The Passenger Car segment dominated the market with the largest revenue share of 41.2% in 2024, driven by the continuous growth in passenger vehicle production, rising adoption of advanced automotive technologies, and stringent emission standards requiring precise fluid transfer systems. Passenger vehicles integrate multiple fluid transfer lines such as fuel, AC, and brake lines, boosting demand for high-quality systems.

The Light Commercial Vehicle segment is anticipated to witness the fastest CAGR of 18.6% from 2025 to 2032, owing to the increasing need for logistics, e-commerce delivery, and small-scale transportation solutions. LCVs require durable, lightweight, and efficient fluid transfer lines for engines, transmission, and exhaust after-treatment systems, supporting the segment’s rapid growth.

- By Electric and Hybrid Vehicles

On the basis of electric and hybrid vehicles, the fluid transfer system market is segmented into Battery Electric Vehicle (BEV), Hybrid Electric Vehicle (HEV), and Plug-In Hybrid Electric Vehicle (PHEV). The BEV segment dominated the market with the largest revenue share of 44.5% in 2024, driven by the rapid adoption of battery electric vehicles globally, increased government incentives, and growing environmental awareness. BEVs rely heavily on cooling lines, thermal management systems, and high-pressure fluid systems to maintain battery efficiency and performance.

The HEV segment is expected to witness the fastest CAGR of 22.1% from 2025 to 2032, due to the increasing focus on hybrid powertrains as a transitional technology in regions with developing EV infrastructure. HEVs require complex integration of fuel, coolant, and thermal fluid systems, propelling growth in fluid transfer solutions.

- By Off-Highway Vehicles

On the basis of off-highway vehicles, the fluid transfer system market is segmented into Agriculture Tractors, Construction Equipment, and Mining Equipment. The Construction Equipment segment dominated the market with the largest revenue share of 39.3% in 2024, owing to high demand for hydraulic lines, fuel systems, and cooling lines in earth-moving and heavy machinery. Construction equipment requires robust, high-pressure fluid systems to ensure operational safety, efficiency, and durability under harsh conditions.

The Agriculture Tractors segment is projected to witness the fastest CAGR of 20.7% from 2025 to 2032, driven by modernization in agricultural machinery, increasing adoption of precision farming, and automation in irrigation and harvesting equipment. Lightweight and corrosion-resistant fluid lines are increasingly used in tractors to improve efficiency, productivity, and sustainability in farming operations.

Which Region Holds the Largest Share of the Fluid Transfer System Market?

- Asia-Pacific dominated the fluid transfer system market with the largest revenue share of 42.3% in 2024, driven by rapid urbanization, expanding automotive and industrial sectors, and increasing adoption of advanced vehicle technologies

- Consumers and manufacturers in the region highly value efficiency, durability, and integration of fluid transfer systems across vehicles, off-highway machinery, and hybrid/electric platforms

- This widespread adoption is further supported by government initiatives promoting industrial automation, smart manufacturing, and vehicle electrification, establishing Fluid Transfer Systems as a critical component in APAC’s growing automotive and industrial landscape

China Fluid Transfer System Market Insight

The China fluid transfer system market captured the largest revenue share of 35% in 2024 within APAC, fueled by the country’s booming automotive production, rising disposable income, and increased adoption of electric and hybrid vehicles. The expansion of infrastructure projects and growth in off-highway vehicle segments further propels the demand for high-performance fluid transfer systems. Strong domestic manufacturing capabilities and availability of cost-effective solutions also drive widespread adoption in passenger vehicles, commercial fleets, and industrial machinery.

Japan Fluid Transfer System Market Insight

The Japan fluid transfer system market is witnessing steady growth due to high technological adoption, a focus on vehicle safety, and stringent emission regulations. Japanese consumers and manufacturers prioritize reliability, precision, and eco-friendly solutions in fluid transfer systems. The country’s emphasis on electric and hybrid vehicles, as well as advanced industrial machinery, is encouraging investments in high-performance fluid transfer lines. In addition, Japan’s aging population is increasing demand for user-friendly, low-maintenance fluid systems across commercial and residential vehicles.

India Fluid Transfer System Market Insight

The India fluid transfer system market is expanding rapidly, driven by urbanization, rising middle-class income, and increasing vehicle sales across passenger, commercial, and off-highway segments. Government initiatives supporting electric vehicles, infrastructure development, and smart manufacturing are fostering adoption of advanced fluid transfer systems. Lightweight and durable lines, such as nylon and stainless steel, are increasingly integrated into both conventional and hybrid vehicles. The growing automotive supply chain network and domestic production capabilities enhance the accessibility and affordability of fluid transfer systems across the region.

Which Region is the Fastest Growing Region in the Fluid Transfer System Market?

The North America fluid transfer system market is poised to grow at the fastest CAGR of 8.36% during 2025 to 2032, driven by rising vehicle electrification, advanced industrial automation, and adoption of hybrid and off-highway vehicles. The region’s strong focus on safety, fuel efficiency, and emission standards is encouraging manufacturers to implement technologically advanced fluid transfer systems.

U.S. Fluid Transfer System Market Insight

The U.S. fluid transfer system market is gaining significant momentum due to high adoption of electric and hybrid vehicles, growing industrial machinery production, and emphasis on vehicle safety and emissions compliance. Advanced manufacturing technologies, government incentives for electrification, and the increasing demand for reliable and lightweight fluid transfer lines are driving growth. Furthermore, rising awareness of efficiency and performance in passenger and commercial vehicles is pushing manufacturers to integrate innovative fluid transfer solutions, expanding market penetration.

Canada Fluid Transfer System Market Insight

The Canada fluid transfer system market is expanding steadily, supported by infrastructure development, adoption of hybrid and electric vehicles, and modernization of industrial machinery. Canadian manufacturers and consumers prioritize durability, reliability, and energy-efficient solutions. Increasing government support for emissions reduction and green mobility, combined with technological advancements in fluid transfer systems, is accelerating adoption across passenger vehicles, trucks, and off-highway machinery.

Which are the Top Companies in Fluid Transfer System Market?

The fluid transfer system industry is primarily led by well-established companies, including:

- Cooper Standard (U.S.)

- Kongsberg Automotive (Norway)

- ContiTech AG (Germany)

- AKWEL (France)

- TI Fluid Systems (U.K.)

- Mgi Coutier (France)

- Lander Holdings (U.S.)

- HUTCHINSON (France)

- Castello Italia (Italy)

- Gates Corporation (U.S.)

- PIRTEK (Australia)

- AGS Company (U.S.)

- Graco Inc. (U.S.)

- BALCRANK CORPORATION, INC. (U.S.)

- Sanoh Industrial Co., Ltd (Japan)

- Yamada America, Inc. (U.S.)

- Kros Otomotiv Sanayi ve Tic. A.S (Turkey)

- PARKER HANNIFIN CORP (U.S.)

What are the Recent Developments in Global Fluid Transfer System Market?

- In June 2025, Cooper Standard (US) was honored with the 2024 Ford Supplier of the Year award by Ford Motor Company (US), recognizing the company’s exceptional quality, innovation, and contribution to Ford’s supply chain excellence, highlighting its leadership in the fluid transfer system industry

- In June 2025, Parker Hannifin Corp (US) announced the acquisition of Curtis Instruments, Inc. (US) to strengthen its capabilities in electric and hybrid vehicle systems, expanding its product portfolio and reinforcing its competitive position in advanced mobility solutions

- In April 2025, Continental AG (Germany) unveiled plans for a new production line for hydrogen hoses at its Korbach facility, aiming to support the growing demand for hydrogen-powered vehicles and promote sustainable mobility solutions

- In April 2025, Nichirin (Japan) completed the acquisition of ATCO Products (US), expanding its footprint in the North American heavy-duty vehicle market and enhancing its ability to serve global customers with advanced fluid transfer solutions

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.