Global Fluorescent Lighting Market

Market Size in USD Billion

CAGR :

%

USD

8.73 Billion

USD

19.99 Billion

2024

2032

USD

8.73 Billion

USD

19.99 Billion

2024

2032

| 2025 –2032 | |

| USD 8.73 Billion | |

| USD 19.99 Billion | |

|

|

|

|

Fluorescent Lighting Market Size

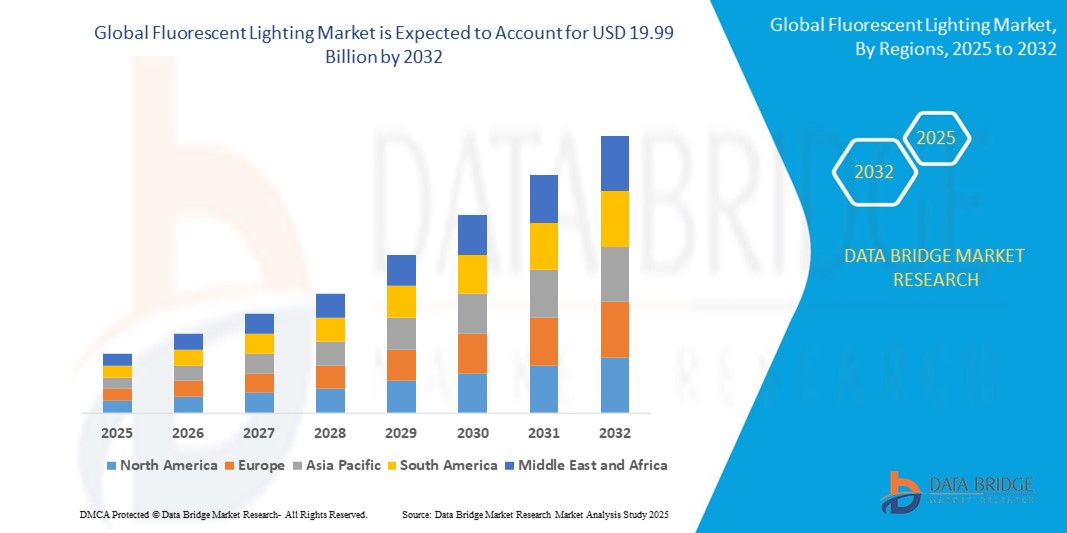

- The global fluorescent lighting market size was valued at USD 8.73 billion in 2024 and is expected to reach USD 19.99 billion by 2032, at a CAGR of 10.91% during the forecast period

- The market growth is largely influenced by the widespread adoption of fluorescent lamps in commercial and industrial settings due to their energy efficiency and long lifespan compared to incandescent bulbs

- Furthermore, the ongoing demand for cost-effective and reliable lighting solutions, particularly in developing economies, continues to bolster the fluorescent lighting sector, despite the gradual shift towards LED technologies

Fluorescent Lighting Market Analysis

- Fluorescent lighting, characterized by its energy efficiency and bright, diffused illumination, has long been a staple in various applications, from large commercial spaces to residential settings. These lamps offer a significant improvement in energy consumption over traditional incandescent bulbs, contributing to lower electricity costs and reduced environmental impact

- The sustained demand for fluorescent lighting is primarily driven by its established infrastructure, lower upfront costs compared to some advanced lighting systems, and its suitability for large-scale illumination needs, especially in regions with budget constraints or existing compatible fixtures

- Asia-Pacific dominates the fluorescent lighting market with the largest revenue share of 35.5% in 2024, driven by robust manufacturing capabilities, extensive industrial and commercial development, and a large consumer base that continues to utilize fluorescent technology

- North America is expected to be the fastest-growing region in the fluorescent lighting market during the forecast period, primarily due to ongoing retrofit projects in commercial and institutional buildings replacing older, less efficient lighting systems, and a continued demand for cost-effective lighting solutions in certain segments

- The linear fluorescent lamp segment dominates the fluorescent lighting market with a market share of 56% in 2024, driven by its widespread use in commercial, industrial, and institutional applications due to its high lumen output, energy efficiency, and suitability for general area illumination

Report Scope and Fluorescent Lighting Market Segmentation

|

Attributes |

Fluorescent Lighting Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Fluorescent Lighting Market Trends

“Cost-Effectiveness Driving Sustained Demand”

- A significant trend in the global fluorescent lighting market is its sustained demand in specific niche applications and its continued appeal as a cost-effective lighting solution, particularly in developing and price-sensitive markets

- For instance, in large industrial warehouses, certain commercial office spaces, and educational institutions, where extensive illumination is required, the established infrastructure for fluorescent lighting and the lower per-unit cost of bulbs make them a practical choice

- Furthermore, in regions with less developed economies, the accessibility and affordability of fluorescent lighting products contribute to their ongoing adoption. Local manufacturers and distributors often find it more viable to produce and supply fluorescent lamps due to lower manufacturing complexities and established supply chains

- This trend highlights that while LED technology offers superior energy efficiency and longevity, fluorescent lighting continues to serve a vital role for users prioritizing immediate cost savings and proven reliability in specific operational contexts

- The market is also seeing a trend of incremental improvements in fluorescent technology, focusing on better energy efficiency and longer lifespans for existing form factors, rather than revolutionary innovations

- The demand for fluorescent lighting in these specific segments, driven by cost-effectiveness and established infrastructure, is expected to remain steady

Fluorescent Lighting Market Dynamics

Driver

“Rising Demand for Energy-Efficient and Sustainable Lighting”

- Growing global awareness of energy conservation and the need to reduce carbon emissions is a major driver for the fluorescent lighting market

- Fluorescent lights are known for their energy efficiency compared to traditional incandescent bulbs, making them a preferred choice for various applications

- Governments and organizations worldwide are implementing initiatives and regulations that promote the adoption of energy-efficient lighting solutions, further boosting the market

- The cost-effectiveness of fluorescent lighting, both in terms of initial purchase and operational costs, contributes to its sustained demand, particularly in commercial and industrial settings

- The continued industrialization and urbanization in developing economies also fuel the demand for lighting solutions that offer a balance of efficiency and affordability

Restraint/Challenge

“Competition from LED Technology and Environmental Concerns”

- The most significant challenge facing the fluorescent lighting market is the accelerating adoption of LED (Light Emitting Diode) technology, which offers superior energy efficiency, longer lifespan, and greater design flexibility

- For instance, government regulations and energy efficiency mandates in many developed countries are actively promoting the phase-out of less efficient lighting technologies, including fluorescent lamps, in favor of LEDs

- Additionally, environmental concerns related to mercury content in fluorescent lamps pose a significant restraint. While the amount of mercury is small, it necessitates special disposal procedures, which can be inconvenient and costly, such as mercury-free LED alternatives

- The rapid advancements in LED technology have also led to a significant drop in LED prices, narrowing the cost gap with fluorescent lamps and making the transition to LEDs more economically viable

- Overcoming these challenges requires the fluorescent lighting industry to focus on niche applications where its cost-effectiveness remains a strong advantage, or to innovate with hybrid solutions that combine aspects of both technologies

Fluorescent Lighting Market Scope

The market is segmented on the basis of type, installation, and application.

- By Type

On the basis of type, the fluorescent Lighting market is segmented into market is segmented into Compact Fluorescent Lamp (CFL), Linear Fluorescent Lamp (LFL), and Cold Cathode Fluorescent Lamp (CCFL). The linear fluorescent lamp segment dominates with the largest market revenue share of 56% in 2024, driven by its established reputation for energy efficiency, high lumen output, and suitability for broad area illumination in commercial and industrial settings. Businesses and institutions often prioritize linear fluorescent lamps for their proven performance and the straightforward replacement into existing fixtures. The market also sees strong demand for linear fluorescent types due to their compatibility with various ballast systems and the availability of diverse wattages enhancing lighting flexibility.

The compact fluorescent lamp (CFL) segment is anticipated to witness the fastest growth rate of 5.6% from 2025 to 2032, fueled by increasing adoption in residential and smaller commercial sectors. CFLs offer significant energy savings and a longer lifespan compared to traditional incandescent bulbs, making them a cost-effective upgrade for consumers. Their compact size and compatibility with standard screw-in sockets also contribute to their growing popularity in modern lighting applications.

- By Installation

On the basis of installation, the fluorescent lighting market is segmented into retrofit and new installation. The retrofit segment held the largest market revenue share in 2023, driven by the widespread need to upgrade existing lighting infrastructure in older buildings and facilities to more energy-efficient solutions without requiring a complete overhaul. Property owners often prioritize fluorescent retrofits for their perceived ease of implementation and the straightforward replacement of older, less efficient lamps. The market also sees strong demand for retrofit installations due to increasing energy efficiency regulations and the availability of various compatible fluorescent products that can be easily integrated into existing systems

The new installation segment is expected to witness the fastest CAGR from 2025 to 2032, fueled by increasing construction activities in developing economies and the continued demand for cost-effective lighting solutions in new commercial and industrial projects. While LED adoption is growing in new builds, fluorescent lighting remains a viable and budget-friendly option for large-scale deployments where initial investment is a key consideration.

- By Application

On the basis of application, the fluorescent lighting market is segmented into general lighting, commercial lighting, residential lighting, industrial lighting, outdoor lighting, medical lighting, surgical and treatment lighting, general/mounted lighting, and others. The commercial lighting segment accounted for the largest market revenue share in 2023, driven by the extensive use of fluorescent lamps in offices, retail spaces, educational institutions, and healthcare facilities. These environments require uniform, high-quality illumination over large areas, which fluorescent lamps efficiently provide. The segment's dominance is also supported by the established infrastructure and the cost-effectiveness of fluorescent solutions for large-scale commercial applications.

The industrial lighting segment is expected to witness the fastest CAGR from 2025 to 2032, fueled by continued demand for robust, cost-effective, and reliable lighting solutions in factories, warehouses, and manufacturing plants. Industrial settings often prioritize durability and efficiency for demanding environments, and fluorescent lamps offer a proven solution with sufficient brightness and a long operational life, making them a favored choice for new installations and upgrades.

Fluorescent Lighting Market Regional Analysis

- Asia-Pacific dominates the fluorescent lighting market with the largest revenue share of 35.5% in 2024, driven by robust manufacturing capabilities, extensive industrial and commercial development, and a large consumer base that continues to utilize fluorescent technology due to its cost-effectiveness

- North America is expected to be the fastest-growing region in the fluorescent lighting market during the forecast period from 2025 to 2032.

- This growth is primarily due to ongoing retrofit projects in commercial and institutional buildings that are replacing older, less efficient lighting systems with more modern fluorescent options before a full transition to LEDs.

U.S. Fluorescent Lighting Market Insight

The U.S. fluorescent lighting market captured a significant revenue share within North America in 2024, primarily driven by the vast installed base of fluorescent lighting systems in commercial, industrial, and institutional buildings. While there's a growing trend towards LED adoption, the demand for cost-effective fluorescent replacements and upgrades in existing infrastructure continues to be robust. Strict energy efficiency regulations also encourage retrofitting older, less efficient fluorescent systems with newer, more efficient fluorescent technologies. The availability of diverse fluorescent products catering to various commercial and industrial applications further supports market stability.

Europe Fluorescent Lighting Market Insight

The European fluorescent lighting market is projected to expand at a steady CAGR throughout the forecast period, primarily driven by ongoing efforts to upgrade existing lighting infrastructure in commercial and public buildings, and the continued demand for energy-efficient lighting solutions. While European countries are actively transitioning towards LEDs, the need for economical and compliant lighting in a large installed base of fluorescent fixtures ensures sustained demand for fluorescent replacements. Regulatory support for circular economy principles, which encourages extending the lifespan of existing lighting assets, also contributes to the market's stability.

U.K. Fluorescent Lighting Market Insight

The U.K. fluorescent lighting market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by the substantial installed base of fluorescent lighting in commercial and public sectors requiring maintenance and upgrades. Concerns around immediate replacement costs for a full LED overhaul, coupled with the availability of more energy-efficient fluorescent options, encourage businesses to opt for fluorescent solutions. The U.K.'s focus on sustainable infrastructure and the gradual phase-out of less efficient lighting technologies also create opportunities for compliant fluorescent replacements.

Germany Fluorescent Lighting Market Insight

The German fluorescent lighting market is expected to expand at a considerable CAGR during the forecast period, fueled by the country's strong industrial base and the high number of commercial and public buildings that rely on fluorescent lighting. Germany's emphasis on energy efficiency and precise lighting control in its industrial and commercial sectors, where fluorescent lamps offer reliable and robust solutions, contributes to sustained demand. The availability of high-quality fluorescent products and a well-established distribution network further support the market in Germany.

Asia-Pacific Fluorescent Lighting Market Insight

The Asia-Pacific fluorescent lighting market is poised to grow at the fastest CAGR of over 12% in 2024, driven by increasing urbanization, rapid industrialization, and the ongoing demand for cost-effective lighting solutions in developing economies such as China and India. The region's extensive manufacturing capabilities for fluorescent lamps and the lower upfront cost of fluorescent installations compared to LEDs make them a popular choice for new constructions and large-scale infrastructure projects. Furthermore, a large existing installed base of fluorescent lighting continues to drive demand for replacements and maintenance.

Japan Fluorescent Lighting Market Insight

The Japan fluorescent lighting market is gaining momentum due to the country's high standards for quality, efficiency, and the significant installed base of fluorescent lighting in its commercial and industrial sectors. While Japan is at the forefront of LED innovation, the precise lighting requirements in certain specialized applications, combined with the cost-effectiveness of maintaining existing fluorescent systems, ensure continued demand. The market also sees opportunities in the replacement cycle for older fluorescent fixtures and in regions where full LED conversion is not yet economically viable.

China Fluorescent Lighting Market Insight

The China fluorescent lighting market accounted for the largest market revenue share in Asia-Pacific in 2024, attributed to the country's massive industrial and commercial growth, extensive construction activities, and the strong preference for cost-effective lighting solutions. China remains a major manufacturing hub for fluorescent lamps, ensuring their widespread availability and competitive pricing. The sheer scale of new installations and the vast installed base of fluorescent lighting in factories, offices, and public infrastructure continue to drive significant demand for both initial deployment and replacements.

Fluorescent Lighting Market Share

The fluorescent lighting industry is primarily led by well-established companies, including

- Signify Holding (Netherlands)

- Fagerhult Group AB (Sweden)

- OSRAM GmbH (Germany)

- Zumtobel Group (Austria)

- LEDVANCE GmbH (Germany)

- Altman Lighting (US)

- Astute Lighting Ltd (UK)

- Dextra Group (UK)

- Enarlux (Spain)

- Halla, a.s (Czechia)

- Hubbell Incorporated (US)

- Ideal Industries, Inc (US)

- Reggiani Spa Illuminazione (Italy)

- Sylvania (US)

- TRILUX Lighting Ltd (India)

Latest Developments in Global Fluorescent Lighting Market

- In January 2025, Philips Lighting unveiled its next-generation Linear Fluorescent Lamp (LFL) series, featuring enhanced ballast technology that boosts energy efficiency by up to 20% for commercial applications. This innovation aligns with global sustainability regulations and supports large-scale retrofitting projects across North America and Europe. By improving efficiency and reducing environmental impact, Philips Lighting continues to advance sustainable lighting solutions for businesses

- In November 2024, Osram collaborated with a leading smart home platform to integrate its smart Compact Fluorescent Lamps (CFLs) into IoT ecosystems. This integration enables voice control and energy monitoring, enhancing convenience for residential users. Targeting tech-savvy consumers in the Asia-Pacific region, the product aims to strengthen market penetration in urban areas. By leveraging IoT technology, Osram enhances energy efficiency and smart home automation, catering to modern consumer demands

- In April 2023, Philips Lighting introduced a new range of low-mercury Linear Fluorescent Lamps (LFLs) designed for commercial applications. These lamps prioritize sustainability and adhere to global environmental standards, supporting energy-efficient lighting solutions. The launch aligns with industry efforts to reduce mercury usage while maintaining high-performance illumination for businesses. By enhancing efficiency and compliance, Philips Lighting continues to lead in sustainable lighting innovations

- In March 2023, Osram launched a smart Compact Fluorescent Lamp (CFL) designed for residential and small business use, integrating seamlessly with IoT platforms. This innovation enhances energy monitoring and control, allowing users to optimize consumption and improve efficiency. By leveraging smart technology, Osram strengthens its position in the connected lighting market, catering to modern automation needs

- In February 2023, GE Lighting collaborated with a major U.S. retailer to provide energy-efficient fluorescent lamps for store retrofitting, enhancing its presence in commercial spaces. This initiative aims to improve lighting efficiency, reduce energy consumption, and support sustainability efforts in retail environments. By integrating advanced lighting solutions, GE Lighting strengthens its market position while helping businesses transition to eco-friendly alternatives

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Fluorescent Lighting Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Fluorescent Lighting Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Fluorescent Lighting Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.