Global Fluorescent Pigment Market

Market Size in USD Million

CAGR :

%

USD

426.71 Million

USD

690.45 Million

2024

2032

USD

426.71 Million

USD

690.45 Million

2024

2032

| 2025 –2032 | |

| USD 426.71 Million | |

| USD 690.45 Million | |

|

|

|

|

Fluorescent Pigment Market Size

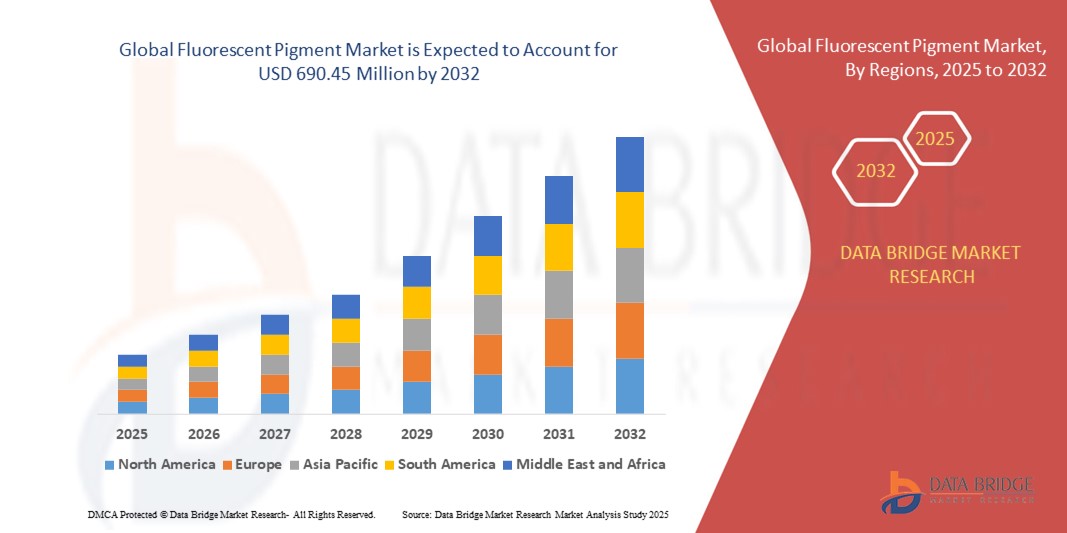

- The global fluorescent pigment market size was valued at USD 426.71 million in 2024 and is expected to reach USD 690.45 million by 2032, at a CAGR of 6.2% during the forecast period

- The market growth is primarily driven by increasing demand for vibrant and high-visibility colors in packaging, automotive coatings, and textiles, along with rising consumer preference for aesthetically appealing and functional products

- Growing awareness of safety and visibility applications, such as in road signs and personal protective equipment, is further boosting the demand for fluorescent pigments across various industries

Fluorescent Pigment Market Analysis

- The fluorescent pigment market is experiencing robust growth due to the rising adoption of fluorescent pigments in applications requiring high visibility, durability, and aesthetic appeal

- The demand for eco-friendly and sustainable fluorescent pigments is encouraging manufacturers to innovate with organic and low-VOC formulations to meet regulatory standards and consumer preferences

- North America dominated the fluorescent pigment market with the largest revenue share of 39.2% in 2024, driven by a well-established automotive and packaging industry and stringent safety regulations promoting high-visibility materials

- Asia-Pacific is expected to be the fastest-growing region during the forecast period, fueled by rapid industrialization, increasing demand for consumer goods, and growing textile and packaging industries in countries such as China, India, and Southeast Asian nations

- The organic segment dominated the largest market revenue share of 44.5% in 2024, driven by its vibrant color intensity, excellent dispersibility, and compatibility with a wide range of applications such as packaging, textiles, and cosmetics. Organic fluorescent pigments are widely preferred for their brighter hues and environmental compliance, making them particularly appealing in industries prioritizing aesthetics and safety

Report Scope and Fluorescent Pigment Market Segmentation

|

Attributes |

Fluorescent Pigment Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Fluorescent Pigment Market Trends

Growing Adoption of Fluorescent Pigments in Diverse Industrial Applications

- The global fluorescent pigment market is experiencing a notable trend toward expanding applications across industries such as packaging, textiles, cosmetics, automotive, and construction

- Advancements in pigment technology have led to brighter, more durable, and environmentally friendly formulations, meeting stricter safety and sustainability standards

- Demand is particularly increasing for organic fluorescent pigments due to their vibrant color range and safer chemical composition compared to certain inorganic variants

- For instance, several manufacturers are developing high-performance, weather-resistant pigments for automotive coatings and outdoor signage, ensuring long-lasting color vibrancy even in harsh environmental conditions

- In the packaging industry, fluorescent pigments are increasingly used for brand differentiation, product visibility, and security printing to deter counterfeiting

- The trend is also being supported by the growing use of phosphorescent and specialty pigments in personal care products and decorative applications, where unique visual effects are a key selling point

Fluorescent Pigment Market Dynamics

Driver

Rising Demand from Packaging and Automotive Sectors

- Increasing consumer preference for visually striking, high-impact product packaging is a major driver for the fluorescent pigment market

- In the automotive and transportation industry, these pigments are used in coatings and interiors to enhance aesthetics, safety markings, and visibility

- The booming e-commerce sector has boosted the need for attractive packaging, while stringent safety regulations in transport are encouraging the use of highly visible materials

- The versatility of fluorescent pigments in various forms—dayglow, phosphorescent, and specialty blends—is making them appealing across multiple sectors

- The strong demand in packaging and safety applications, while Asia-Pacific is emerging as the fastest-growing region due to rapid industrialization, rising consumer spending, and expanding manufacturing capabilities

Restraint/Challenge

High Production Costs and Regulatory Compliance

- The manufacturing of fluorescent pigments often involves specialized raw materials and processing techniques, leading to higher production costs compared to conventional pigments

- Compliance with stringent environmental and chemical safety regulations—especially in regions such as North America and Europe—adds to operational costs and limits the use of certain substances

- In some applications, concerns over chemical stability, lightfastness, and heat resistance may restrict broader adoption, particularly for outdoor or long-term uses

- Regulatory differences between countries regarding pigment formulation, safety testing, and permissible chemical content create challenges for global manufacturers

- These factors can hinder market penetration, particularly in cost-sensitive markets or in industries with strict compliance requirements

Fluorescent Pigment market Scope

The market is segmented on the basis of form, type, and end use.

- By Form

On the basis of form, the global fluorescent pigment market is segmented into organic and inorganic pigments. The organic segment dominated the largest market revenue share of 44.5% in 2024, driven by its vibrant color intensity, excellent dispersibility, and compatibility with a wide range of applications such as packaging, textiles, and cosmetics. Organic fluorescent pigments are widely preferred for their brighter hues and environmental compliance, making them particularly appealing in industries prioritizing aesthetics and safety. Their ability to achieve high chroma and strong daylight fluorescence has positioned them as the go-to option for premium branding and decorative applications.

The inorganic segment is expected to register the fastest growth rate from 2025 to 2032, owing to its superior durability, chemical resistance, and high thermal stability. These pigments are ideal for heavy-duty applications in automotive coatings, construction materials, and outdoor signage where long-term performance under harsh environmental conditions is critical. As industries seek longer-lasting and weather-resistant color solutions, advancements in inorganic pigment formulations are expanding their use in high-value, industrial-grade products.

- By Type

On the basis of type, the global fluorescent pigment market is categorized into dayglow, phosphorescent, and others. The dayglow segment accounted for the highest revenue share in 2024, supported by its extensive use in safety signage, promotional displays, and high-visibility applications. Dayglow pigments offer exceptional brightness under daylight and UV light, enhancing product visibility and consumer attention. Their adoption is further boosted by growing demand in advertising, fashion, and specialty printing industries where visual impact is a key differentiator.

The phosphorescent segment is anticipated to grow at the fastest CAGR from 2025 to 2032, propelled by innovations in glow-in-the-dark materials and increased adoption in emergency signage, night-time safety gear, and novelty products. Phosphorescent pigments store light energy and emit it over extended periods, making them highly valuable for applications requiring visibility in low-light or power outage conditions. Emerging uses in consumer electronics, interior design, and sustainable urban lighting further contribute to their rapid market expansion.

- By End Use

On the basis of end use, the global fluorescent pigment market is segmented into packaging, automotive & transportation, building & construction, textiles, personal care & cosmetics, and others. The packaging segment held the largest revenue share in 2024, attributed to the growing emphasis on product differentiation, brand visibility, and anti-counterfeiting measures. Fluorescent pigments are increasingly used in labels, inks, and decorative packaging to attract consumer attention and ensure authenticity verification. Rising demand for vibrant and sustainable packaging solutions, particularly in food & beverage and consumer goods, is driving this segment’s dominance.

The automotive & transportation segment is projected to grow at the fastest rate from 2025 to 2032, fueled by the rising use of high-visibility pigments in vehicle coatings, safety markings, and decorative trims. Enhanced road safety regulations, combined with growing interest in custom automotive finishes, are encouraging manufacturers to incorporate fluorescent pigments for both functional and aesthetic purposes. In addition, developments in weather-resistant and UV-stable pigment technologies are enabling broader adoption in exterior automotive applications.

Fluorescent Pigment Market Regional Analysis

- North America dominated the fluorescent pigment market with the largest revenue share of 39.2% in 2024, driven by a well-established automotive and packaging industry and stringent safety regulations promoting high-visibility materials

- Consumers prioritize fluorescent pigments for their ability to enhance visibility, provide UV-reactive aesthetics, and meet safety standards, particularly in regions with stringent regulatory requirements

- Growth is supported by advancements in pigment technology, including eco-friendly and non-toxic formulations, alongside rising adoption in both industrial and consumer applications

U.S. Fluorescent Pigment Market Insight

The U.S. fluorescent pigment market captured the largest revenue share of 76.4% in 2024 within North America, fueled by strong demand in safety signage, packaging, and automotive coatings. Growing consumer awareness of visibility and aesthetic benefits, coupled with regulatory emphasis on safety standards, drives market expansion. The integration of fluorescent pigments in both OEM and aftermarket applications creates a diverse product ecosystem.

Europe Fluorescent Pigment Market Insight

The Europe fluorescent pigment market is expected to witness significant growth, supported by regulatory focus on sustainability and safety. Consumers demand pigments that offer vibrant colors and UV stability while meeting environmental standards. Growth is notable in both industrial applications and consumer goods, with countries such as Germany and France showing high adoption due to environmental concerns and advanced manufacturing capabilities.

U.K. Fluorescent Pigment Market Insight

The U.K. market for fluorescent pigments is expected to witness rapid growth, driven by demand for vibrant aesthetics and enhanced visibility in textiles, packaging, and safety applications. Increased awareness of UV-reactive properties and sustainability encourages adoption. Evolving regulations balancing aesthetic appeal with safety compliance further influence consumer preferences.

Germany Fluorescent Pigment Market Insight

Germany is expected to witness rapid growth in the fluorescent pigment market, attributed to its advanced manufacturing sector and focus on eco-friendly and high-performance pigments. German consumers prefer pigments that offer bright, durable colors and contribute to sustainability goals. The integration of these pigments in premium coatings, textiles, and automotive applications supports sustained market growth.

Asia-Pacific Fluorescent Pigment Market Insight

The Asia-Pacific region is expected to witness the fastest growth rate, driven by rapid industrialization and rising demand for vibrant colors in textiles, automotive, and packaging applications in countries such as China, India, and Japan. Increasing awareness of safety, aesthetics, and sustainability boosts demand. Government initiatives promoting eco-friendly materials further encourage the adoption of advanced fluorescent pigments.

Japan Fluorescent Pigment Market Insight

Japan’s fluorescent pigment market is expected to witness rapid growth due to strong consumer preference for high-quality, technologically advanced pigments that enhance visibility and aesthetics. The presence of major manufacturers and integration of fluorescent pigments in OEM products accelerate market penetration. Rising interest in aftermarket customization also contributes to growth.

China Fluorescent Pigment Market Insight

China holds the largest share of the Asia-Pacific fluorescent pigment market, propelled by rapid urbanization, increasing industrial output, and growing demand for vibrant and UV-reactive colorants. The country’s expanding manufacturing sector and focus on innovative applications support the adoption of advanced fluorescent pigments. Competitive pricing and strong domestic production capabilities enhance market accessibility.

Fluorescent Pigment Market Share

The fluorescent pigment industry is primarily led by well-established companies, including:

- Day-Glo Color Corp., (U.S.)

- Dane Color UK Ltd., (UK)

- China Wanlong Chemical Co., Ltd., (China)

- Brilliant Group Inc., (U.S.)

- Radiant Color NV, (Belgium)

- RPM International Inc., (U.S.)

- Ferro Corporation, (U.S.)

- Suzhou Ruihong Electronic Chemical Co., Ltd., (China)

- Merck KGaA, (Germany)

- Spectra Colors Corporation, (U.S.)

- Umicore, (Belgium)

- Yipin Pigments, Inc., (U.S.)

- Toyo Ink Group, (Japan)

- Eckart GmbH, (Germany)

- Dynasty Chemicals (Ningbo) Co., Ltd., (China)

- Cathay Industries, (U.S.)

- Arsons Chemicals, (U.S.)

- Willing New Materials Technology Co., Ltd., (China)

- China Glaze Co. Ltd., (China)

- Vicome Corp, (U.S.)

What are the Recent Developments in Global Fluorescent Pigment Market?

- In September 2024, Sun Chemical Corporation announced an expansion of its fluorescent pigment production capacity in the Asia-Pacific region, a strategic move aimed at meeting the rising demand from industries such as automotive, textiles, and security printing. This initiative supports Sun Chemical’s commitment to delivering high-performance color solutions and strengthening its supply capabilities across key markets. By enhancing regional production, the company aims to reduce lead times, improve customer responsiveness, and support innovation in applications requiring vibrant, durable, and specialized pigments

- In March 2024, the CHT Group launched BEZAFLUOR FF, a new range of fluorescent pigments specifically developed for textile printing. These pigments are water-based, formaldehyde-free, and APEO-free, making them environmentally friendly and safe for human contact. With exceptional contact fastness, BEZAFLUOR FF meets the stringent requirements for STANDARD 100 by OEKO-TEX®, Class 1 certification, even at high application levels. The pigments also offer excellent heat stability, migration resistance, and storability, making them ideal for continuous, screen, and transfer printing. This launch underscores CHT’s commitment to sustainable innovation in textile chemistry

- In March 2023, DayGlo Color Corp. launched Elara Luxe™, a groundbreaking line of fluorescent pigments tailored for the cosmetics and personal care industry. Comprising seven vivid, plant-based pigments made from natural rice protein, Elara Luxe aligns with the rising demand for clean beauty products that are free from microplastics and harmful ingredients. These pigments are biodegradable, non-GMO, and certified vegan, kosher, and halal, making them suitable for a wide range of formulations including makeup, soaps, nail polish, and temporary hair color. Elara Luxe redefines cosmetic colorants by merging intense vibrancy with sustainable innovation

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Fluorescent Pigment Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Fluorescent Pigment Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Fluorescent Pigment Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.