Global Fluorescent Protein Related Assay Kits Market

Market Size in USD Million

CAGR :

%

USD

831.86 Million

USD

1,312.91 Million

2024

2032

USD

831.86 Million

USD

1,312.91 Million

2024

2032

| 2025 –2032 | |

| USD 831.86 Million | |

| USD 1,312.91 Million | |

|

|

|

|

Fluorescent Protein-Related Assay Kits Market Size

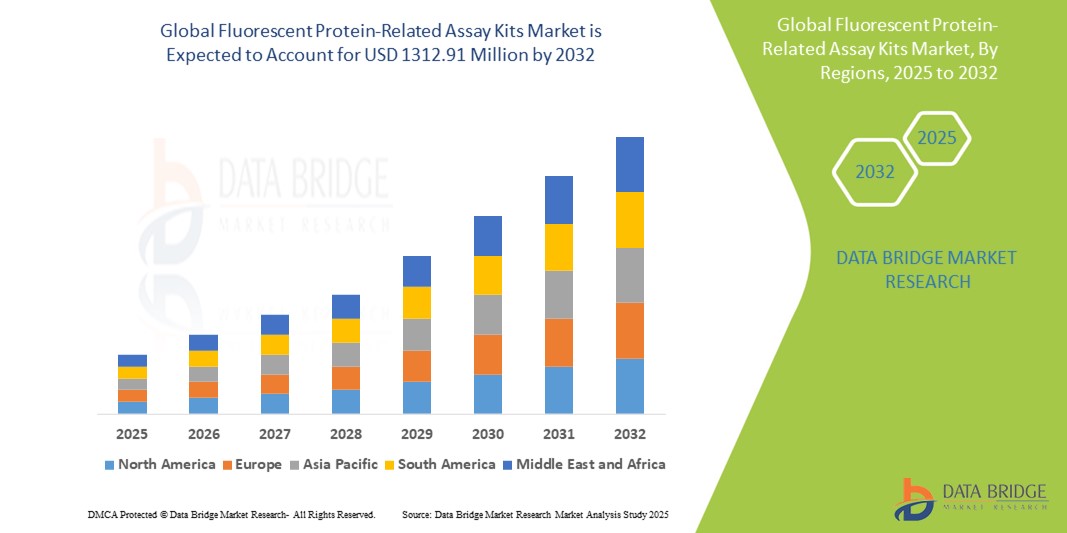

- The global fluorescent protein-related assay kits market size was valued at USD 831.86 Million in 2024 and is expected to reach USD 1,312.91 Million by 2032, at a CAGR of 5.87% during the forecast period

- The market growth is largely fueled by the increasing adoption of fluorescent-based techniques in cell biology, molecular diagnostics, and drug discovery, along with technological advancements in imaging systems and detection platforms. These developments have led to broader applications of fluorescent protein-related assay kits in research and clinical diagnostics, driving significant market expansion across academic, pharmaceutical, and biotechnology sectors

- Furthermore, rising demand for sensitive, high-throughput, and real-time analytical tools is establishing fluorescent protein-based assay kits as the preferred choice for protein-protein interaction studies, gene expression analysis, and live-cell imaging. These converging factors are accelerating the uptake of Fluorescent Protein-Related Assay Kits solutions, thereby significantly boosting the industry’s growth across global research institutions and commercial laboratories

Fluorescent Protein-Related Assay Kits Market Analysis

- Fluorescent Protein-Related Assay Kits, offering high-sensitivity detection of protein expression, cellular activity, and gene regulation, are increasingly vital components of modern molecular biology and biomedical research due to their enhanced real-time tracking, non-invasive capabilities, and compatibility with live-cell imaging and high-throughput screening systems

- The escalating demand for these kits is primarily fueled by the widespread adoption of fluorescence-based detection technologies, growing research in oncology and neuroscience, and a rising preference for non-radioactive, cost-effective, and scalable assay methods for both in vitro and in vivo applications

- North America dominated the fluorescent protein-related assay kits market with the largest revenue share of 38.4% in 2024, characterized by high R&D investment, strong academic and pharmaceutical research infrastructure, and the presence of major industry players such as Thermo Fisher Scientific, Bio-Rad, and PerkinElmer

- Asia-Pacific is expected to be the fastest-growing region in the fluorescent protein-related assay kits market during the forecast period, with a projected CAGR of 9.3%, which is attributed to expanding biotechnology sectors in China, India, and South Korea, rising academic research funding, and increasing demand for diagnostic tools and translational research solutions

- The kits segment dominated the fluorescent protein-related assay kits market with the largest market revenue share of 58.7% in 2024, driven by their comprehensive nature, ease of use, and ready-to-use format. Kits provide researchers with all necessary reagents and protocols, streamlining experimental workflows for applications such as gene expression analysis, protein interaction studies, and cell tracking, thus saving time and reducing variability

Report Scope and Fluorescent Protein-Related Assay Kits Market Segmentation

|

Attributes |

Fluorescent Protein-Related Assay Kits Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Fluorescent Protein-Related Assay Kits Market Trends

“Enhanced Convenience Through AI and Automation in Assay Analysis”

- A significant and accelerating trend in the global fluorescent protein-related assay Kits market is the integration of artificial intelligence (AI) and automated imaging systems within laboratory workflows. This fusion of technologies is significantly enhancing data accuracy, efficiency, and interpretation in protein expression, localization, and quantification

- For instance, modern high-content screening platforms that incorporate fluorescent protein assay kits are now powered by AI algorithms that can automatically detect and quantify fluorescence intensity, cellular morphology changes, and protein-protein interactions across thousands of samples in real time. This reduces manual variability and accelerates drug discovery pipelines

- AI-enhanced assay platforms also utilize machine learning to recognize cellular patterns and generate predictive models for disease progression and therapeutic response. This is especially valuable in oncology, where fluorescent protein-based imaging helps track cancer cell behavior over time

- Voice-controlled automation, while less prevalent in wet lab environments, is emerging through voice-activated digital lab assistants that help scientists access protocols, schedule assays, and retrieve results hands-free—especially useful in BSL labs or sterile environments. Integration with platforms such as Amazon Alexa and Google Assistant is being explored in smart labs to facilitate verbal commands for equipment control or assay status updates

- AI-driven software in live-cell imaging systems, such as those used with GFP (Green Fluorescent Protein) and RFP (Red Fluorescent Protein) assays, can now perform real-time kinetic analyses, optimizing experiment parameters on the fly to capture critical biological events with minimal user intervention

- This seamless integration of AI with fluorescence-based assay kits and imaging is facilitating centralized control over data collection, analysis, and storage, making experimental processes more intuitive and reproducible. Cloud-based platforms further enable remote access and collaboration, creating a more intelligent and connected research ecosystem

- The trend toward more intelligent, automated, and interoperable assay platforms is reshaping user expectations in biomedical research. Consequently, companies such as Thermo Fisher Scientific, Bio-Rad, and PerkinElmer are heavily investing in AI-integrated assay platforms that offer streamlined data analysis, enhanced reproducibility, and reduced time to insight

- The demand for fluorescent protein-related assay kits with advanced automation and smart data analysis features is growing rapidly across biotech, pharma, and academic labs, as researchers increasingly prioritize convenience, efficiency, and scientific accuracy in high-throughput settings

Fluorescent Protein-Related Assay Kits Market Dynamics

Driver

“Growing Demand Due to Advancements in Life Sciences Research and Personalized Medicine””

- The increasing prevalence of chronic and infectious diseases, combined with the rapid growth of life sciences and biotechnology research, is significantly driving demand for fluorescent protein-related assay kits. These kits are crucial in applications such as protein expression studies, cell signaling, gene expression monitoring, and cancer research

- For instance, in April 2024, Thermo Fisher Scientific announced enhancements to its fluorescence-based assay portfolio by integrating AI-driven imaging analysis with its Invitrogen kits. These innovations aim to improve accuracy in single-cell analysis, highlighting the critical role of fluorescence assays in advancing personalized medicine and precision diagnostics

- As research institutions and biopharma companies increasingly seek real-time, high-throughput, and non-invasive tools, fluorescent protein-based assays provide a robust platform for visualizing complex cellular processes and identifying molecular targets, thereby accelerating drug discovery and disease pathway analysis

- Furthermore, the expanding usage of fluorescent proteins such as GFP, RFP, and mCherry in live-cell imaging and CRISPR validation workflows is making these kits an indispensable tool in academic and translational research settings. Their compatibility with automated liquid handling systems and high-content screening platforms further supports growth

- The demand is also supported by the growing adoption of personalized healthcare, where these assay kits enable the identification of biomarker expression profiles, response prediction, and therapeutic monitoring, particularly in oncology and immunology. The increasing use of these kits in clinical trial settings is expected to sustain robust market expansion

Restraint/Challenge

“Technical Complexity and High Cost of Advanced Imaging Systems”

- Despite their critical role in biomedical research, fluorescent protein-related assay kits often require advanced imaging and analysis systems such as confocal microscopes, flow cytometers, or high-content screening platforms, which can be expensive and technically demanding to operate. This creates barriers for smaller research labs or institutions with limited infrastructure or funding.

- For instance, high-resolution fluorescent imaging systems often cost several hundred thousand dollars and require trained personnel, which limits the accessibility of these technologies in developing regions or early-stage laboratories. The need for fluorophore-specific filters, lasers, and calibration tools adds to the cost and complexity

- In addition, concerns regarding photobleaching, cytotoxicity of fluorescent dyes, and signal overlap in multiplex assays may compromise the accuracy of results or necessitate repeat testing, increasing both time and resource investment. These technical constraints can reduce workflow efficiency and hinder broader usage in high-throughput environments.

- Moreover, the cost of premium assay kits—especially those that offer multiplex capabilities, genetically encoded reporters, or real-time kinetic monitoring—can be a limiting factor for cost-sensitive end users, particularly in academia or government-funded research centers.

- Overcoming these challenges will require manufacturers to focus on cost-effective product development, simplified protocols, cloud-based image analysis tools, and user-friendly instrumentation. Market players such as Bio-Rad and PerkinElmer are actively working to lower barriers through integrated, plug-and-play assay platforms that reduce hands-on time and streamline analysis

Fluorescent Protein-Related Assay Kits Market Scope

The market is segmented on the basis of product, type, application, end user and technique.

•By Product

On the basis of product, the fluorescent protein-related assay kits market is segmented into reagents, kits, instruments, and accessories. The kits segment dominated the market with the largest revenue share of 58.7% in 2024, driven by their extensive use in various fluorescence-based biological experiments. These include essential dyes, buffers, and labeling agents used in gene expression analysis, protein tracking, and live-cell imaging.

The reagents segment is anticipated to witness the fastest CAGR of 9.6% from 2025 to 2032, owing to their convenience, consistency, and ready-to-use format, which help reduce experimental variability and save time in both academic and commercial research labs.

• By Type

On the basis of type, the market is segmented into green fluorescent protein, red fluorescent protein, yellow fluorescent protein, cyan fluorescent protein, and other fluorescent proteins. The green fluorescent protein segment held the largest market share of 42.5% in 2024, attributed to its historical significance, wide application in gene expression studies, and high photostability.

The red fluorescent protein (RFP) segment is expected to witness the fastest CAGR of 9.8% during 2025–2032, owing to its superior tissue penetration, low phototoxicity, and suitability for in vivo imaging and multicolor labeling applications.

• By Application

On the basis of application, the fluorescent protein market is segmented into immunology, cell biology, molecular biology, developmental biology, and microbiology. The cell biology segment accounted for the largest market share of 35.4% in 2024, driven by the vital role of fluorescent proteins in studying cellular processes such as cell division, migration, and intracellular signaling pathways.

The molecular biology segment is projected to grow at the fastest CAGR of 10.2% from 2025 to 2032, fueled by rising demand for fluorescent-tagged assays in gene editing technologies (such as, CRISPR-Cas9) and protein-DNA interaction studies.

• By End User

On the basis of end user, the market is segmented into biotechnology & pharmaceutical companies, academic & research institutes, contract research organizations (CROs), clinical laboratories, hospitals, and others. The academic & research institutes segment dominated the market with the largest share of 41.3% in 2024, supported by significant government and private funding for life science research and the widespread use of fluorescent proteins in foundational and translational research.

The contract research organizations (CROs) segment is expected to witness the fastest CAGR of 10.5% from 2025 to 2032, driven by increased outsourcing of drug discovery and assay validation by pharmaceutical and biotech firms seeking to streamline R&D operations.

• By Technique

On the basis of technique, the market is segmented into flow cytometry, fluorescence microscopy, spectrofluorometry, and others. The fluorescence microscopy segment held the largest market share of 39.6% in 2024, as it remains a cornerstone technique for live-cell imaging, fixed tissue analysis, and studying intracellular protein localization.

The flow cytometry segment is projected to grow at the fastest CAGR of 9.9% during 2025–2032, driven by its high-throughput capabilities, the ability to quantify protein expression at the single-cell level, and its expanding use in immunology, oncology, and AI-integrated phenotypic screening.

Fluorescent Protein-Related Assay Kits Market Regional Analysis

- North America dominated the fluorescent protein-related assay kits market with the largest revenue share 38.4% in 2024, driven by substantial investments in pharmaceutical R&D, robust academic research funding, and the strong presence of leading biotechnology and diagnostic firms

- Researchers and pharmaceutical companies in the region highly value the sensitivity, specificity, and real-time visualization capabilities offered by fluorescent protein-related assay kits for applications in drug discovery, disease diagnostics, and fundamental biological research

- This widespread adoption is further supported by high research expenditures, a technologically advanced scientific community, and the growing preference for high-throughput screening and live-cell imaging techniques, establishing fluorescent protein-related assay kits as favored tools for both academic institutions and biopharmaceutical companies

U.S. Fluorescent Protein-Related Assay Kits Market Insight

The U.S. fluorescent protein-related assay kits market captured the largest revenue share of 55.3% in 2024. This is fueled by substantial investments in pharmaceutical and biotechnology R&D, as well as robust funding for life sciences research. Researchers are increasingly prioritizing enhanced biological understanding and drug discovery through highly sensitive and precise fluorescent protein-based assays. The growing preference for advanced laboratory setups, coupled with strong demand for high-throughput screening technologies and real-time cellular analysis, further propels the Fluorescent Protein-Related Assay Kits industry. Moreover, the increasing integration of cutting-edge imaging techniques and bioinformatics platforms significantly contributes to market expansion.

Europe Fluorescent Protein-Related Assay Kits Market Insight

The Europe fluorescent protein-related assay kits market is projected to expand at a substantial CAGR of 6.3% from 2025 to 2032. Europe captured a notable 30.5% share of the global ELISpot and Fluorospot assay market in 2024. This growth is primarily driven by increasing investments in academic and clinical research, coupled with a strong emphasis on disease diagnostics and biopharmaceutical development. The continuous advancements in molecular biology techniques, along with the demand for advanced tools in personalized medicine, are fostering the adoption of these kits. European researchers are also drawn to the high sensitivity, specificity, and efficiency these kits offer in complex biological analyses. The region is experiencing significant growth across research institutes, pharmaceutical companies, and diagnostic laboratories, with fluorescent protein assays being incorporated into various research and clinical applications.

U.K. Fluorescent Protein-Related Assay Kits Market Insight

The U.K. fluorescent protein-related assay kits market is anticipated to grow at a noteworthy CAGR from 2024 to 2032. This growth is driven by escalating investment in proteomics and life sciences research. In addition, the increasing focus on understanding complex biological pathways and developing novel therapeutics is encouraging both academic institutions and biotechnology firms to utilize advanced fluorescent protein-related assays. The U.K.’s embrace of cutting-edge research methodologies, alongside its robust scientific infrastructure and government funding for R&D, is expected to continue to stimulate market growth.

Germany Fluorescent Protein-Related Assay Kits Market Insight

The Germany fluorescent protein-related assay kits market is expected to expand at a considerable CAGR during the forecast period. This growth is fueled by increasing awareness of the importance of digital molecular analysis and the demand for technologically advanced, precise, and efficient research solutions. Germany’s well-developed research infrastructure, combined with its emphasis on innovation and high-quality scientific output, promotes the adoption of fluorescent protein-related assay kits, particularly in pharmaceutical R&D and academic research. The integration of these assays with automated laboratory systems is also becoming increasingly prevalent, with a strong preference for robust, reliable, and high-throughput solutions aligning with local scientific expectations.

Asia-Pacific Fluorescent Protein-Related Assay Kits Market Insight

The Asia-Pacific fluorescent protein-related assay kits market is poised to grow at the fastest CAGR of 9.3% from 2025 to 2032. This is driven by increasing investments in life sciences R&D, rising disposable incomes contributing to better healthcare funding, and rapid technological advancements in countries such as China, Japan, and India. The region's growing inclination towards advanced biotechnology research, supported by government initiatives promoting digitalization in healthcare and life sciences, is driving the adoption of these assay kits. Furthermore, as APAC emerges as a manufacturing hub for life science reagents and systems, the affordability and accessibility of fluorescent protein-related assay kits are expanding to a wider research and diagnostic base.

China Fluorescent Protein-Related Assay Kits Market Insight

The China fluorescent protein-related assay Kits market accounted for the largest market revenue share in Asia Pacific in 2024. This is attributed to the country's expanding investment in R&D, rapid growth in the biotechnology sector, and high rates of technological adoption in scientific research. China stands as one of the largest markets for life science tools, and fluorescent protein assays are becoming increasingly popular in academic, pharmaceutical, and diagnostic laboratories. The push towards strengthening domestic biopharmaceutical capabilities and the availability of increasingly affordable and high-quality fluorescent protein-related assay options, alongside strong domestic manufacturers, are key factors propelling the market in China.

India Fluorescent Protein-Related Assay Kits Market Insight

The India fluorescent protein-related assay kits market is anticipated to grow at a promising CAGR of 7.6% from 2025 to 2032. This growth is driven by significant improvements in healthcare infrastructure, increasing government and private funding for life sciences research, and the burgeoning pharmaceutical and biotechnology industries. The rising prevalence of chronic diseases and infectious diseases is propelling the demand for advanced diagnostic and research tools, including fluorescent protein-related assay kits. Moreover, the increasing focus on proteomics and genomics research, coupled with a growing number of Contract Research Organizations (CROs) and academic collaborations, is contributing to the market's expansion in India.

Fluorescent Protein-Related Assay Kits Market Share

The fluorescent protein-related assay kits industry is primarily led by well-established companies, including:

- Thermo Fisher Scientific Inc. (U.S.)

- BD (U.S.)

- Merck KGaA (Germany)

- PerkinElmer (U.S.)

- Lonza (Switzerland)

- Abcam Limited (U.K.)

- Assay Biotech (U.S.)

- RayBiotech, Inc. (U.S.)

- Cell Biolabs, Inc. (U.S.)

- Amgen Inc. (U.S.)

- Abbott (U.S.)

- F. Hoffmann-La Roche Ltd (Switzerland)

- Danaher Corporation (U.S.)

- Promega Corporation (U.S.)

- Bio-Rad Laboratories, Inc. (U.S.)

- R&D Systems, Inc. (U.S.)

- GE HealthCare (U.K.)

- Bruker (U.S.)

Latest Developments in Global Fluorescent Protein-Related Assay Kits Market

- In April 2024, Thermo Fisher Scientific Inc. launched an upgraded series of Invitrogen fluorescence-based protein quantification kits, integrating AI-powered image analysis to support high-throughput screening and live-cell imaging. This development is aimed at advancing drug discovery and protein expression analysis in both academic and pharmaceutical labs

- In March 2024, Merck KGaA (Germany) announced a strategic partnership with several European research institutes to develop next-generation fluorescent protein tags with improved photostability and lower cytotoxicity. These innovations are expected to enhance real-time tracking of cellular processes in developmental biology and cancer research

- In March 2024, Bio-Rad Laboratories, Inc. introduced its FluoroStar Multiplex Protein Assay Kits, capable of detecting multiple fluorescent proteins simultaneously in a single well. Designed for use with advanced plate readers, the kits streamline protein expression analysis and are particularly useful in multiplex cytokine profiling and gene expression workflows

- In February 2024, Abcam plc unveiled its latest line of cell imaging kits that use red and cyan fluorescent proteins for precise visualization of cellular compartments. These kits are optimized for high-resolution fluorescence microscopy and are ideal for neuroscience and immunology research applications

- In January 2024, PerkinElmer Inc. expanded its Opera Phenix High-Content Screening System compatibility with new assay kits based on green and yellow fluorescent proteins. These assay kits support phenotypic screening, toxicity profiling, and real-time kinetic studies, helping researchers gain deeper insights into disease mechanisms

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.