Global Fluoroalkyl Based Coatings Market

Market Size in USD Billion

CAGR :

%

USD

1.37 Billion

USD

2.50 Billion

2024

2032

USD

1.37 Billion

USD

2.50 Billion

2024

2032

| 2025 –2032 | |

| USD 1.37 Billion | |

| USD 2.50 Billion | |

|

|

|

|

Fluoroalkyl-based Coatings Market Size

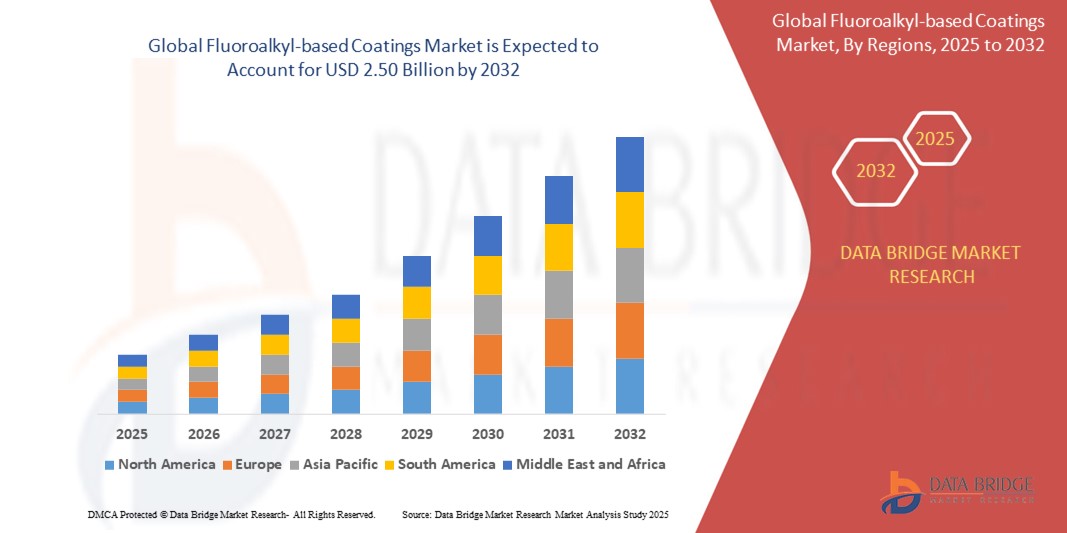

- The global fluoroalkyl-based coatings market size was valued at USD 1.37 billion in 2024 and is expected to reach USD 2.50 billion by 2032, at a CAGR of 7.8% during the forecast period

- The market growth is largely fuelled by the increasing demand for durable, non-stick, and chemical-resistant coatings across industries such as automotive, construction, and electronics

- Advancements in coating technologies and the rising adoption of fluorinated polymers in surface treatments are accelerating the market expansion, particularly in harsh weather and chemical exposure environments

Fluoroalkyl-based Coatings Market Analysis

- The market is witnessing significant demand from the automotive and electronics sectors, where resistance to moisture, abrasion, and chemicals is critical

- Environmental regulations promoting sustainable and low-VOC coatings are pushing innovation towards safer, short-chain fluorinated alternatives

- North America dominated the fluoroalkyl-based coatings market with the largest revenue share in 2024, driven by stringent environmental regulations, growing demand for high-performance coatings, and advancements in surface treatment technologies

- Asia-Pacific region is expected to witness the highest growth rate in the global fluoroalkyl-based coatings market, driven by rapid industrialization, increased demand for durable coatings in automotive and electronics sectors, and expanding manufacturing capabilities across China, Japan, and India

- The short-chain fluoroalkyl coatings segment held the largest market revenue share in 2024, driven by increased regulatory pressure against long-chain PFAS and the need for safer alternatives. These coatings offer similar performance in terms of repellency and durability while aligning with stricter environmental standards. Industries are shifting towards short-chain solutions due to their reduced bioaccumulation potential and evolving safety profiles

Report Scope and Fluoroalkyl-based Coatings Market Segmentation

|

Attributes |

Fluoroalkyl-based Coatings Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

• Rising Demand for Anti-Fingerprint and Non-Stick Coatings in Electronics and Automotive • Expanding Use in Solar Panels and Green Buildings for Durability and Weather Resistance |

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Fluoroalkyl-based Coatings Market Trends

“Rising Shift Toward Short-Chain Fluoroalkyl Alternatives Due to Regulatory Pressure”

- Global environmental regulations are pushing manufacturers away from long-chain PFCs such as PFOA and PFOS due to their bioaccumulative and toxic nature

- There is growing adoption of short-chain fluoroalkyl compounds that offer similar protective performance with lower ecological impact

- Companies are investing in R&D to create coatings that are compliant with international standards without compromising functionality

- Consumer awareness and regulatory oversight are influencing procurement in sectors such as automotive, electronics, and food processing

- For instance, 3M has phased out PFOA-containing products in favor of short-chain, environmentally safer alternatives to meet U.S. EPA guidelines

Fluoroalkyl-based Coatings Market Dynamics

Driver

“Growing Demand for Advanced Protective Coatings in Harsh Environments”

- Increased use in industries such as aerospace, automotive, and construction is driving demand for coatings with strong chemical, weather, and UV resistance

- Fluoroalkyl-based coatings offer non-stick, hydrophobic, and oleophobic properties, making them ideal for surfaces that require minimal maintenance

- These coatings extend the lifespan of equipment and infrastructure, reducing repair costs and improving operational efficiency

- There is rising demand for protective solutions in electronics to guard against moisture and contamination

- For instance, In the electronics sector, companies such as Apple use specialized coatings to protect internal components of devices from liquid damage

Restraint/Challenge

“Environmental Concerns and Regulatory Hurdles Regarding Fluorinated Compounds”

- Long-chain fluorinated substances are facing global bans and restrictions due to their persistence and potential health risks

- Compliance with evolving regulatory frameworks is increasing costs for manufacturers in terms of reformulation and testing

- Public perception of “forever chemicals” is creating reputational risks and driving preference for eco-friendly coatings

- Companies are facing tighter chemical disclosure requirements, especially in North America and Europe

- For instance, The European Chemicals Agency (ECHA) has added PFHxA and related substances to its restriction proposal list, pushing manufacturers to find alternatives

Fluoroalkyl-based Coatings Market Scope

The fluoroalkyl-based coatings market is segmented into three notable segments based on product type, application, and end-use industry.

• By Product Type

On the basis of product type, the fluoroalkyl-based coatings market is segmented into long‑chain fluoroalkyl coatings, short‑chain fluoroalkyl coatings, fluoroalkyl methacrylate copolymer coatings, fluoroalkyl silane coatings, fluoroalkyl polyester coatings, fluoroalkyl polyurethane coatings, and others. The short-chain fluoroalkyl coatings segment held the largest market revenue share in 2024, driven by increased regulatory pressure against long-chain PFAS and the need for safer alternatives. These coatings offer similar performance in terms of repellency and durability while aligning with stricter environmental standards. Industries are shifting towards short-chain solutions due to their reduced bioaccumulation potential and evolving safety profiles.

The fluoroalkyl polyurethane coatings segment is expected to witness the fastest growth rate from 2025 to 2032, propelled by their rising usage in high-performance applications. These coatings combine flexibility, abrasion resistance, and excellent hydrophobicity, making them ideal for use in sectors such as automotive, electronics, and industrial manufacturing.

• By Application

On the basis of application, the fluoroalkyl-based coatings market is segmented into stain‑resistant coatings, water & oil repellent coatings, anti‑fouling coatings, non‑stick coatings, corrosion‑resistant coatings, electronic coatings, and others. The water & oil repellent coatings segment dominated the market in 2024, fueled by demand from textiles, electronics, and packaging sectors. Their ability to maintain surface cleanliness and prevent fluid penetration makes them crucial in maintaining product longevity and performance.

The anti-fouling coatings segment is expected to witness the fastest growth rate from 2025 to 2032, primarily driven by growing adoption in marine and industrial applications. These coatings significantly reduce the accumulation of unwanted materials on surfaces, thereby improving efficiency and reducing maintenance costs.

• By End-Use Industry

On the basis of end-use industry, the market is segmented into automotive & transportation, building & construction, electronics & semiconductors, textiles & apparel, aerospace & defense, consumer goods, industrial equipment, marine, and others. The electronics & semiconductors segment held the highest revenue share in 2024 due to the critical role these coatings play in moisture and chemical resistance for sensitive electronic components.

The aerospace & defense segment is expected to witness the fastest growth rate from 2025 to 2032, driven by the industry's emphasis on performance reliability, weight reduction, and durability in extreme environments. The specialized properties of fluoroalkyl-based coatings—such as low surface energy and thermal stability—are gaining traction in aircraft surface treatments and defense-grade equipment.

Fluoroalkyl-based Coatings Market Regional Analysis

• North America dominated the fluoroalkyl-based coatings market with the largest revenue share in 2024, driven by stringent environmental regulations, growing demand for high-performance coatings, and advancements in surface treatment technologies

• The region benefits from strong research and development infrastructure and early adoption of sustainable coating solutions across industries such as automotive, aerospace, and construction

• Increased regulatory scrutiny regarding PFAS and a shift toward short-chain alternatives are also pushing manufacturers to innovate, further accelerating regional market penetration

U.S. Fluoroalkyl-based Coatings Market Insight

The U.S. fluoroalkyl-based coatings market held the highest share within North America in 2024, supported by rising demand in electronics, industrial equipment, and defense sectors. The country’s proactive stance on environmental safety has encouraged the development of PFAS-free coating alternatives. Leading players are investing heavily in new product development, catering to both functional and regulatory needs. Furthermore, the growth in the electronics and semiconductor sector is boosting demand for anti-fouling and non-stick coatings.

Europe Fluoroalkyl-based Coatings Market Insight

The Europe fluoroalkyl-based coatings market is expected to witness the fastest growth rate from 2025 to 2032, bolstered by strict environmental and safety regulations across the region. European manufacturers are rapidly transitioning to low-VOC and PFAS-free coatings, particularly in the construction and textile industries. In addition, EU legislation pushing for the replacement of long-chain fluorochemicals is reshaping product offerings, while innovation in textile repellents and protective coatings is further driving market adoption.

U.K. Fluoroalkyl-based Coatings Market Insight

The U.K. market is expected to witness the fastest growth rate from 2025 to 2032, driven by increasing industrial demand for corrosion-resistant and water-repellent coatings. As part of the country's broader green industrial strategy, there is a strong push for sustainable materials in manufacturing. The U.K.'s flourishing aerospace, electronics, and marine industries present ample opportunities for the use of fluoroalkyl coatings, especially those compliant with REACH and upcoming PFAS regulations.

Germany Fluoroalkyl-based Coatings Market Insight

The Germany’s fluoroalkyl-based coatings market is expected to witness the fastest growth rate from 2025 to 2032, supported by a robust manufacturing base and a national focus on sustainability. The country's leadership in automotive and industrial machinery production necessitates durable and resistant coating solutions. In addition, increased research collaboration between academia and industry is fostering the development of next-generation coatings that balance performance with environmental responsibility.

Asia-Pacific Fluoroalkyl-based Coatings Market Insight

The Asia-Pacific fluoroalkyl-based coatings market is expected to witness the fastest growth rate from 2025 to 2032, led by rapid industrialization, urbanization, and rising manufacturing output in nations such as China, India, and Japan. The growth in electronics, textiles, and automotive industries is significantly boosting demand for high-performance surface coatings. The availability of cost-effective raw materials and increasing awareness of advanced coatings are expanding product usage across various sectors.

Japan Fluoroalkyl-based Coatings Market Insight

The Japan’s market is expected to witness the fastest growth rate from 2025 to 2032, driven by strong demand in electronics, automotive, and marine applications. The country’s emphasis on innovation and environmental compliance has led to a growing preference for short-chain and PFAS-free fluoroalkyl-based coatings. Domestic manufacturers are actively engaging in R&D to ensure performance coatings that meet both regulatory and industrial standards.

China Fluoroalkyl-based Coatings Market Insight

The China led the Asia-Pacific market in terms of revenue in 2024, underpinned by its expansive industrial base and growing demand for coatings in construction, consumer goods, and automotive sectors. Government initiatives promoting sustainable manufacturing and technological upgrades are boosting the adoption of advanced coating formulations. China is also home to numerous domestic players offering cost-effective and tailored solutions, positioning the country as a key exporter and end user of fluoroalkyl-based coatings.

Fluoroalkyl-based Coatings Market Share

The Fluoroalkyl-based Coatings industry is primarily led by well-established companies, including:

- 3M (U.S.)

- The Chemours Company (U.S.)

- AGC Inc. (Japan)

- Daikin Industries, Ltd. (Japan)

- PPG Industries, Inc. (U.S.)

- Heraeus Holding GmbH (Germany)

- Solvay S.A. (Belgium)

- BASF SE (Germany)

- Akzo Nobel N.V. (Netherlands)

- W. L. Gore & Associates, Inc. (U.S.)

Latest Developments in Global Fluoroalkyl-based Coatings Market

- In March 2024, Archroma launched Cartaseal OGB F10, a water-based and recyclable oil and grease barrier coating. Designed to replace fluorochemicals and polyethylene in packaging and paper applications, it meets FDA and BfR compliance standards. This development promotes sustainability in food and non-food packaging, contributing to the shift toward eco-friendly alternatives in the market.

- In July 2024, NOF Metal Coatings announced the launch of its PFAS-free PLUS topcoat series. The new coatings aim to meet global OEM standards with enhanced tribological properties, silver aesthetics, and fluorescent readability. This initiative supports the transition away from PTFE-based coatings, aligning with upcoming European PFAS restrictions and reinforcing market demand for safer coating solutions.

- In September 2022, AGC Incorporated, in collaboration with Kobe University, developed a patented photo-on-demand method to produce fluoroalkyl carbonates. This innovation provides a safer, environmentally friendly alternative to toxic chemicals such as phosgene, with applications in pharmaceuticals and chemical manufacturing, potentially reshaping synthetic pathways in the market.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Fluoroalkyl Based Coatings Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Fluoroalkyl Based Coatings Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Fluoroalkyl Based Coatings Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.