Global Fluorobenzene Market

Market Size in USD Million

CAGR :

%

USD

266.63 Million

USD

370.55 Million

2024

2032

USD

266.63 Million

USD

370.55 Million

2024

2032

| 2025 –2032 | |

| USD 266.63 Million | |

| USD 370.55 Million | |

|

|

|

|

Fluorobenzene Market Size

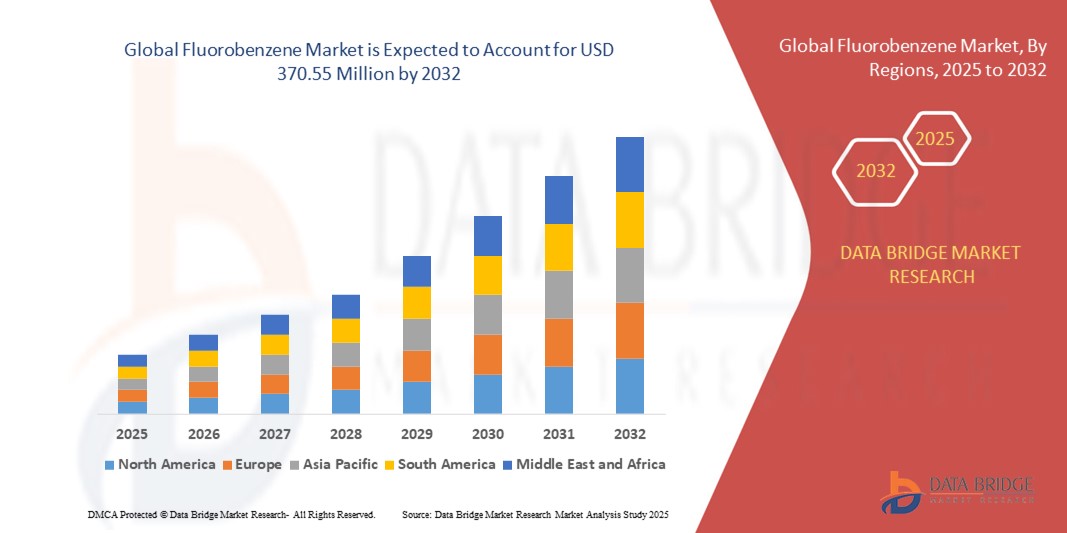

- The global fluorobenzene market size was valued at USD 266.63 million in 2024 and is expected to reach USD 370.55 million by 2032, at a CAGR of 4.2% during the forecast period

- The market growth is largely fueled by the increasing demand for fluorinated intermediates in pharmaceutical and agrochemical synthesis, driven by rising global healthcare needs and expanding agricultural production

- Furthermore, the shift toward high-purity and specialty chemicals, combined with strong demand from drug manufacturers and agrochemical producers, is reinforcing the importance of fluorobenzene as a core building block. These converging factors are accelerating the compound’s usage across sectors, significantly boosting the industry's growth

Fluorobenzene Market Analysis

- Fluorobenzene is an aromatic compound widely used as an intermediate in the production of pharmaceuticals, agrochemicals, dyes, and specialty polymers. Its chemical structure enables the introduction of fluorine atoms into larger molecules, enhancing stability, bioavailability, and efficacy

- The increasing utilization of fluorobenzene is primarily driven by the growing demand for fluorinated drugs and crop protection agents, rapid expansion of generic drug manufacturing, and rising investments in specialty chemical production across emerging economies

- Asia-Pacific dominated the fluorobenzene market with a share of 35.5% in 2024, due to expanding pharmaceutical manufacturing, increasing demand for fluorinated agrochemicals, and a strong presence of chemical production hubs

- North America is expected to be the fastest growing region in the fluorobenzene market during the forecast period due to robust demand for fluorinated chemicals in pharmaceuticals, agrochemicals, and polymers

- 99% to 99.9% segment dominated the market with a market share of 61.9% in 2024, due to its broad applicability in standard chemical synthesis and industrial processes. This purity level is widely used in large-scale manufacturing where ultra-high precision is not critical, such as in dyes, industrial reagents, and some agrochemical formulations. Cost-efficiency and ease of production further bolster its preference among manufacturers targeting volume-based applications

Report Scope and Fluorobenzene Market Segmentation

|

Attributes |

Fluorobenzene Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Fluorobenzene Market Trends

Growing Demand for High-Purity Fluorobenzene in Pharma Synthesis

- The fluorobenzene market is expanding rapidly due to increasing applications in pharmaceutical synthesis where high-purity fluorobenzene serves as a key intermediate in the development of active pharmaceutical ingredients (APIs) and advanced drug compounds

- For instance, companies such as SDFuer, LIANCHANG, and XLH Chemical supply high-grade fluorobenzene tailored for oncology and cardiovascular drug manufacturing, aiding in improving drug efficacy, stability, and bioavailability

- Advances in synthesis technologies, including greener catalytic processes and improved purification methods, are enabling production of ultra-pure fluorobenzene that meets stringent pharma-grade specifications with reduced environmental impact

- Demand for fluorobenzene in agrochemical synthesis is also growing, supporting production of high-performance herbicides and insecticides that improve crop yields and agricultural sustainability

- The electronics and semiconductor industries are adopting fluorobenzene for manufacturing specialty chemicals used in liquid crystal displays (LCDs), semiconductors, and battery materials, reflecting diversification of end-use sectors

- Regulatory emphasis on sustainable chemical manufacturing and increasing use of eco-friendly solvents are steering the market towards innovation in fluorobenzene production processes that minimize hazardous emissions and waste

Fluorobenzene Market Dynamics

Driver

Growing Electronics and Semiconductor Industry

- The rise of advanced electronics and semiconductor manufacturing is fueling demand for fluorobenzene as a critical intermediate in producing materials such as polymers, circuit boards, and specialty coatings essential for device performance

- For instance, leading chemical suppliers such as Mitsui Chemicals and HAL Advanced Chemicals provide purified fluorobenzene to meet the rigorous quality standards required for electronics applications, including LCD screens and microelectronics

- Expansion of consumer electronics, 5G infrastructure, electric vehicles, and renewable energy technologies globally amplifies requirements for high-purity fluorobenzene and related specialty chemicals

- The growth of Asia-Pacific countries as global manufacturing hubs for electronics and semiconductors further drives regional fluorobenzene demand and associated supply chain developments

- Collaborative R&D between chemical manufacturers and electronics firms enables formulation of custom fluorobenzene derivatives that improve thermal and electrical properties of semiconductor components

Restraint/Challenge

Competition from Other Chemicals and Solvents

- Fluorobenzene faces intense competition from alternative aromatic and fluorinated solvents as industries seek cost-effective, scalable, and sometimes less environmentally stringent options for synthesis and manufacturing processes

- For instance, solvents such as chlorobenzene, bromobenzene, and fluorinated ethers can substitute fluorobenzene in certain applications due to lower cost or established supply chains, challenging market share growth for fluorobenzene suppliers

- The high purity requirements and complex manufacturing methods for fluorobenzene result in elevated production costs, limiting price competitiveness in broader chemical markets

- Stringent environmental regulations around the production and handling of fluorinated compounds add compliance costs and operational complexities for producers and users alike

- Market penetration in emerging sectors can be slowed by technical barriers where alternative solvents demonstrate comparable performance, necessitating ongoing innovation and customer education

Fluorobenzene Market Scope

The market is segmented on the basis of purity and application.

- By Purity

On the basis of purity, the fluorobenzene market is segmented into 99% to 99.9% and greater than 99.9%. The 99% to 99.9% segment dominated the largest market revenue share of 61.9% in 2024, primarily due to its broad applicability in standard chemical synthesis and industrial processes. This purity level is widely used in large-scale manufacturing where ultra-high precision is not critical, such as in dyes, industrial reagents, and some agrochemical formulations. Cost-efficiency and ease of production further bolster its preference among manufacturers targeting volume-based applications.

The greater than 99.9% segment is projected to register the fastest growth rate from 2025 to 2032, fueled by increasing demand from high-purity applications in pharmaceuticals and specialty polymers. This level of purity is crucial in drug development and fine chemical synthesis, where any impurity can compromise the efficacy or safety of the final product. Growing regulatory stringency and the rising need for reliable high-performance materials are driving demand for ultra-pure fluorobenzene across advanced sectors.

- By Application

On the basis of application, the fluorobenzene market is segmented into pharmaceutical intermediates, agrochemicals, solvents, polymer production, industrial chemicals, reagents, dyes, and others. The pharmaceutical intermediates segment held the largest market revenue share in 2024, owing to the extensive use of fluorobenzene in the synthesis of active pharmaceutical ingredients and other key intermediates. Its ability to serve as a fluorine source in drug molecules enhances bioavailability and metabolic stability, making it indispensable in modern pharmaceutical chemistry.

The polymer production segment is expected to witness the fastest CAGR from 2025 to 2032, driven by the growing use of fluorinated polymers in automotive, electronics, and aerospace applications. Fluorobenzene plays a vital role in introducing fluorine functionality during polymer synthesis, improving chemical resistance, thermal stability, and dielectric properties. As industries increasingly shift toward advanced, high-performance materials, demand for fluorobenzene in polymer applications is poised for strong acceleration.

Fluorobenzene Market Regional Analysis

- Asia-Pacific dominated the fluorobenzene market with the largest revenue share of 35.5% in 2024, driven by expanding pharmaceutical manufacturing, increasing demand for fluorinated agrochemicals, and a strong presence of chemical production hubs

- The region’s cost-effective manufacturing landscape, rising investments in specialty chemical production, and growing exports of fluorinated intermediates are accelerating market expansion

- The availability of skilled labor, favorable government policies, and rapid industrialization across developing economies are contributing to increased consumption of fluorobenzene in both pharmaceutical and industrial sectors

China Fluorobenzene Market Insight

China held the largest share in the Asia-Pacific fluorobenzene market in 2024, owing to its status as a global leader in chemical manufacturing and active pharmaceutical ingredients (API) production. The country's strong industrial base, favorable government policies supporting chemical sector expansion, and extensive export capabilities for fluorinated compounds are major growth drivers. Demand is also bolstered by ongoing investments in specialty and fine chemicals for both domestic and international markets.

India Fluorobenzene Market Insight

India is witnessing the fastest growth in the Asia-Pacific region, fueled by a rapidly growing pharmaceutical sector, increasing generic drug production, and rising investments in specialty chemical infrastructure. The "Make in India" initiative, along with a shift toward self-reliance in pharmaceutical intermediates, is strengthening the demand for fluorobenzene. In addition, a surge in agrochemical exports and expanding R&D capabilities in fine chemicals are contributing to robust market expansion.

Europe Fluorobenzene Market Insight

The Europe fluorobenzene market is expanding steadily, supported by stringent regulatory frameworks, high demand for high-purity fluorinated intermediates, and growing investments in sustainable and specialty chemical production. The region places strong emphasis on quality, environmental compliance, and advanced formulations, particularly in pharmaceuticals and high-performance materials. The increasing use of fluorinated compounds in custom synthesis is further enhancing market growth.

Germany Fluorobenzene Market Insight

Germany’s fluorobenzene market is driven by its leadership in high-precision pharmaceutical manufacturing, strong chemical industry heritage, and export-oriented production model. The country has well-established R&D networks and partnerships between academic institutions and chemical manufacturers, fostering continuous innovation in fluorinated intermediates. Demand is particularly strong for use in fine chemicals, polymers, and pharmaceutical ingredients.

U.K. Fluorobenzene Market Insight

The U.K. market is supported by a mature life sciences industry, growing efforts to localize pharmaceutical and chemical supply chains post-Brexit, and increased demand for specialty reagents and intermediates. With rising focus on R&D, academic-industry collaboration, and investments in lab-scale synthesis and production of niche fluorinated compounds, the U.K. continues to play a significant role in high-value chemical markets.

North America Fluorobenzene Market Insight

North America is projected to grow at the fastest CAGR from 2025 to 2032, driven by robust demand for fluorinated chemicals in pharmaceuticals, agrochemicals, and polymers. A strong focus on drug discovery, advancements in material science, and growing reliance on high-purity intermediates are boosting demand. In addition, rising reshoring of chemical manufacturing and increasing collaboration between pharma and specialty chemical companies are supporting market expansion.

U.S. Fluorobenzene Market Insight

The U.S. accounted for the largest share in the North America market in 2024, underpinned by its expansive pharmaceutical industry, strong R&D infrastructure, and significant investment in specialty chemical production. The country’s focus on innovation, regulatory compliance, and sustainability is encouraging the use of high-purity fluorinated compounds in drug synthesis and advanced material development. Presence of key players and a mature distribution network further solidify the U.S.'s leading position in the region.

Fluorobenzene Market Share

The fluorobenzene industry is primarily led by well-established companies, including:

- Azelis Group (Belgium)

- Kishida Chemical Co., Ltd. (Japan)

- KANTO KAGAKU (Japan)

- CHEMOS GmbH & Co. KG (Germany)

- Xiangshui Xinlianhe Chemical Co., Ltd. (China)

- Shandong Fore Co., Ltd. (China)

- Nacalai Tesque Inc. (Japan)

- Fuxin Hongchang Chemical Co., Ltd. (China)

- Hridaan Pharma Chem (India)

- Regal Remedies Limited (India)

- Tokyo Chemical Industry Co., Ltd. (Japan)

- Muby Chemicals (India)

- Haihang Industry (China)

- Molekula Group (U.K.)

- A. B. ENTERPRISES (India)

Latest Developments in Global Fluorobenzene Market

- In March 2023, AGC announced the expansion of its fluorochemical production capacity at the Chiba plant in Japan, reflecting rising global demand for high-performance fluorinated compounds. This strategic move underscores the company's intent to strengthen its position in the fluorobenzene and broader fluorochemical market by enhancing supply capabilities and supporting the growing needs of the electronics, pharmaceuticals, and chemical sectors

- In 2022, Tata Steel completed the acquisition of Neelachal Ispat Nigam Ltd. (NINL), gaining access to 1.1 million tonnes per annum of long-steel production capacity and approximately 100 million tonnes of iron ore reserves. This acquisition significantly strengthens Tata Steel’s raw material security and production capabilities, bolstering its position in the long-steel market and enhancing its ability to meet infrastructure and construction sector demands in India

- In 2022, FMC India launched Corprima, a novel insecticide formulated for tomato and okra crops. This product introduction expands FMC's agrochemical portfolio and supports the Indian agricultural sector by offering extended pest control duration, improving crop yield, and delivering higher economic returns to farmers. The launch reinforces FMC's market presence in India’s growing crop protection segment

- In 2022, Novo Nordisk introduced Oral Semaglutide in the Indian market, a groundbreaking oral anti-diabetic medication designed for the treatment of type 2 diabetes. This launch represents a major advancement in diabetes care by providing an effective oral alternative to injectables, improving patient adherence and accessibility. It also strengthens Novo Nordisk’s footprint in India’s rapidly expanding pharmaceutical and diabetes treatment market

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Fluorobenzene Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Fluorobenzene Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Fluorobenzene Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.