Global Fluoropolymer In Healthcare Market

Market Size in USD Billion

CAGR :

%

USD

524.30 Billion

USD

864.46 Billion

2025

2033

USD

524.30 Billion

USD

864.46 Billion

2025

2033

| 2026 –2033 | |

| USD 524.30 Billion | |

| USD 864.46 Billion | |

|

|

|

|

Fluoropolymer in Healthcare Market Size

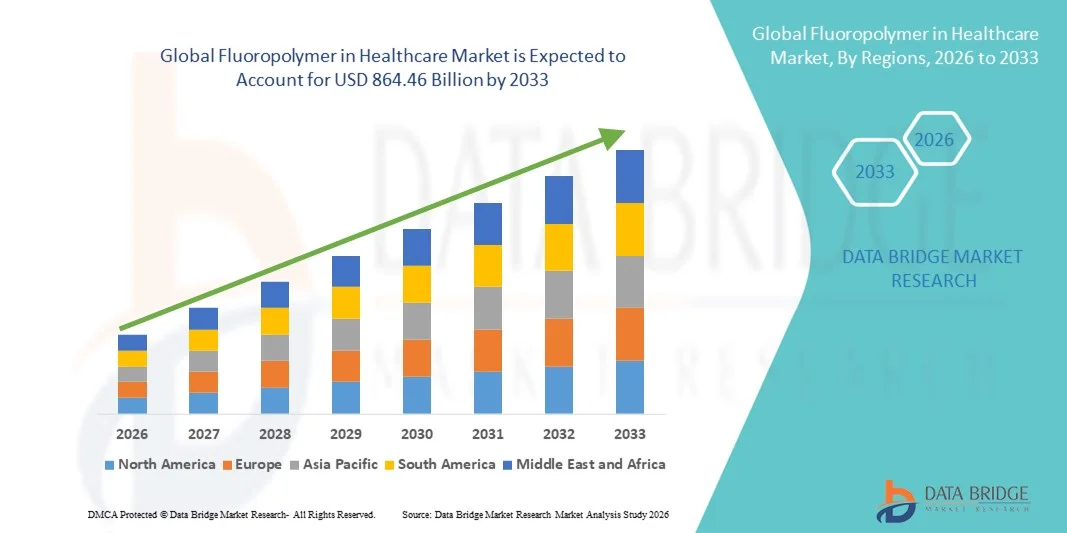

- The global fluoropolymer in healthcare market size was valued at USD 524.3 billion in 2025 and is expected to reach USD 864.46 billion by 2033, at a CAGR of 6.45% during the forecast period

- The market growth is largely fueled by increasing demand for high-performance materials in medical applications, driven by stringent hygiene standards, biocompatibility requirements, and the need for durable, chemical-resistant components

- Furthermore, rising adoption of minimally invasive procedures, advanced medical devices, and stringent regulatory compliance is accelerating the uptake of Fluoropolymer in Healthcare solutions, thereby significantly boosting the industry's growth

Fluoropolymer in Healthcare Market Analysis

- Fluoropolymers, known for their chemical resistance, thermal stability, and biocompatibility, are increasingly crucial in medical devices, pharmaceutical processing, and sterile packaging applications due to their reliability and performance under demanding conditions

- The escalating demand for fluoropolymers in healthcare is primarily fueled by the growth of advanced medical devices, increasing adoption of minimally invasive procedures, and rising need for sterile, high-performance materials in diagnostics, drug delivery, and implantable devices

- North America dominated the fluoropolymer in healthcare market with the largest revenue share of 38.55% in 2025, driven by high healthcare expenditure, advanced medical infrastructure, and strong R&D investments in healthcare materials, particularly in the U.S., where fluoropolymers are widely used in devices, tubing, and packaging applications

- Asia-Pacific is expected to be the fastest-growing region in the fluoropolymer in healthcare market during the forecast period, registering a CAGR supported by increasing medical device manufacturing, rising healthcare investments, and growing demand for advanced diagnostics and sterile packaging solutions in countries such as China and India

- The PTFE segment dominated the largest market revenue share of 36.8% in 2025, attributed to its excellent chemical resistance, high-temperature tolerance, and widespread adoption in medical tubing, seals, and packaging

Report Scope and Fluoropolymer in Healthcare Market Segmentation

|

Attributes |

Fluoropolymer in Healthcare Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Fluoropolymer in Healthcare Market Trends

Increasing Adoption of Fluoropolymers for Advanced Medical Applications

- The global Fluoropolymer in Healthcare market is witnessing strong growth as medical device manufacturers increasingly adopt fluoropolymers for their exceptional chemical resistance, biocompatibility, and thermal stability

- These properties make them ideal for applications such as tubing, catheters, surgical instruments, and implantable devices

- For instance, in North America, hospitals are increasingly using PTFE and FEP-based catheters and tubing for cardiovascular and minimally invasive procedures, where chemical inertness and flexibility are critical for patient safety and procedural efficiency

- Fluoropolymers are being incorporated into drug delivery systems and infusion sets, enabling precise dosing, reduced drug interaction, and improved shelf life of sensitive pharmaceuticals

- In laboratory and diagnostic applications, fluoropolymer-coated equipment such as pipettes, sample containers, and microplates are helping reduce contamination risks and enhance accuracy in sample handling and testing processes

- The trend reflects the healthcare industry's increasing demand for high-performance polymeric solutions that improve patient outcomes, support complex procedures, and align with stringent sterilization and regulatory requirements

Fluoropolymer in Healthcare Market Dynamics

Driver

Growing Demand for High-Performance Medical Materials

- The rising prevalence of chronic diseases, minimally invasive surgeries, and outpatient procedures is fueling the demand for high-performance, reliable medical materials, including fluoropolymers

- Their unique properties allow manufacturers to produce lightweight, durable, and safe medical devices that meet evolving clinical needs

- For instance, hospitals in Europe are increasingly utilizing fluoropolymer-coated guidewires and catheters to enhance procedural precision, reduce patient trauma, and increase device lifespan, while Asia-Pacific markets are leveraging cost-effective fluoropolymer solutions for mass-produced diagnostic kits

- Growing awareness of patient safety, infection control, and device reliability is driving healthcare providers to prefer fluoropolymer-based disposables and surgical components over traditional materials

- Fluoropolymers’ resistance to high temperatures and chemical sterilants allows medical device manufacturers to comply with rigorous sterilization protocols without compromising material integrity, ensuring both compliance and efficiency

- The material’s versatility enables design flexibility, allowing medical device companies to develop innovative, minimally invasive, and patient-friendly devices, which is a key driver for market expansion

Restraint/Challenge

High Costs and Stringent Regulatory Compliance

- The Fluoropolymer in Healthcare market faces challenges due to the high cost of raw materials and the specialized manufacturing processes required for precision medical applications. These factors can limit adoption, particularly in price-sensitive regions and emerging markets

- For instance, manufacturers in developing countries often encounter budget constraints when sourcing high-grade PTFE or FEP for critical medical devices, which can slow product development and market penetration

- Stringent regulatory requirements imposed by authorities such as the FDA, ISO, and EU MDR add complexity to product approval processes, requiring extensive testing, documentation, and quality control

- Compliance with sterilization, biocompatibility, and chemical resistance standards is essential, and failure to meet these criteria can result in costly recalls or delayed product launches

- Fluctuations in raw material prices and the need for specialized engineering and processing expertise further increase production costs, creating challenges for small- and medium-sized enterprises aiming to scale operations

Fluoropolymer in Healthcare Market Scope

The market is segmented on the basis of product type, application, and end-use industry.

- By Product Type

On the basis of product type, the Fluoropolymer in Healthcare market is segmented into PTFE, FEP, PVDF, Fluoroelastomer, PVF, PFA, ETFE, and others. The PTFE segment dominated the largest market revenue share of 36.8% in 2025, attributed to its excellent chemical resistance, high-temperature tolerance, and widespread adoption in medical tubing, seals, and packaging. PTFE’s biocompatibility, low friction, and non-reactive nature make it ideal for critical healthcare applications such as catheters, implantable devices, and sterile packaging films. The established reputation of PTFE among medical device manufacturers, along with its compatibility with various sterilization processes, reinforces its dominance globally. Demand is particularly high in North America and Europe due to advanced healthcare infrastructure, regulatory compliance, and preference for long-lasting, reliable polymer solutions in hospitals and clinics.

The FEP segment is expected to witness the fastest CAGR of 8.2% from 2026 to 2033, driven by its flexibility, transparency, and superior dielectric properties. FEP is increasingly used in medical tubing, insulation for electrical components in healthcare devices, and protective coatings for surgical instruments. The growing adoption of minimally invasive procedures, rising production of medical devices, and the need for high-performance, lightweight polymers support FEP’s growth. Asia-Pacific, particularly China and India, is emerging as a key market for FEP due to increasing healthcare infrastructure investments and the expansion of medical device manufacturing.

- By Application

On the basis of application, the Fluoropolymer in Healthcare market is segmented into film, tube, sheet, pipe, membrane, sealant, roofing, additives, and others. The tube segment held the largest market revenue share of 34.5% in 2025, driven by the extensive use of fluoropolymer tubes in catheters, IV lines, and drug delivery systems. Tubes made of PTFE, FEP, and PVDF are favored for their chemical inertness, thermal stability, and biocompatibility, ensuring safe and reliable patient care. Hospitals, diagnostic centers, and medical device manufacturers prioritize fluoropolymer tubing for critical fluid transfer, implantable devices, and sterilizable applications. The segment’s dominance is especially evident in North America and Europe, where healthcare regulations and high adoption of advanced medical devices drive demand.

The film segment is projected to witness the fastest CAGR of 7.9% from 2026 to 2033, owing to its applications in sterile packaging, protective barriers, and flexible medical devices. Fluoropolymer films offer excellent barrier properties against gases, moisture, and chemicals, making them essential for pharmaceuticals and medical packaging. Growth is fueled by rising healthcare expenditure, increasing demand for long shelf-life packaging, and the expansion of hospitals and clinics across Asia-Pacific and Latin America. Manufacturers are also innovating with multi-layer and biodegradable fluoropolymer films to enhance performance and sustainability, further boosting market adoption.

- By End-Use Industry

On the basis of end-use industry, the Fluoropolymer in Healthcare market is segmented into transportation equipment, electrical & electronics, construction, industrial equipment, and others. The electrical & electronics segment dominated the market with a revenue share of 39.2% in 2025, primarily due to the increasing integration of fluoropolymers in medical electronics, diagnostic instruments, and monitoring devices. Fluoropolymers’ high dielectric strength, thermal stability, and chemical resistance make them essential for wires, connectors, and insulation in medical equipment. The demand is strongest in North America and Europe, supported by advanced healthcare infrastructure, innovation in medical devices, and stringent safety standards.

The industrial equipment segment is expected to witness the fastest CAGR of 8.0% from 2026 to 2033, driven by rising adoption of fluoropolymers in sterilizable medical machinery, pumps, valves, and fluid handling systems. High-performance polymers are increasingly used in automated drug delivery systems, laboratory equipment, and hospital-grade machinery due to their durability, chemical inertness, and resistance to extreme temperatures. Growth is especially pronounced in Asia-Pacific, where expanding healthcare infrastructure and manufacturing hubs are creating strong demand for industrial-grade fluoropolymer components.

Fluoropolymer in Healthcare Market Regional Analysis

- North America dominated the fluoropolymer in healthcare market with the largest revenue share of 38.55% in 2025, driven by high healthcare expenditure, advanced medical infrastructure, and strong R&D investments in healthcare materials

- The region benefits from the presence of major medical device manufacturers that rely on fluoropolymers for tubing, seals, films, and sterile packaging. Hospitals and clinics prioritize high-performance polymer solutions due to their chemical resistance, biocompatibility, and durability, particularly in critical care and diagnostic applications. Regulatory compliance, stringent quality standards, and technologically advanced healthcare systems further reinforce the adoption of fluoropolymers

- The market is also fueled by increasing production of minimally invasive surgical devices, wearable healthcare electronics, and advanced drug delivery systems, where fluoropolymers ensure safety and reliability. The U.S. remains the largest contributor within the region, supported by extensive R&D, innovations in medical device packaging, and the integration of fluoropolymers in high-precision equipment

U.S. Fluoropolymer in Healthcare Market Insight

The U.S. fluoropolymer in healthcare market captured the largest revenue share in North America in 2025, reflecting the rapid adoption of advanced polymer materials in medical devices, tubing, and sterile packaging. Demand is driven by increasing healthcare expenditure, high patient care standards, and the widespread adoption of minimally invasive procedures. Fluoropolymers are extensively used in catheters, IV systems, diagnostic instruments, and drug delivery solutions due to their chemical inertness, thermal stability, and biocompatibility. Rising investments in healthcare infrastructure, continuous innovations, and a strong focus on product safety and regulatory compliance further boost market growth. The U.S. also leads in research and development for next-generation fluoropolymer materials, enabling enhanced device performance, reduced contamination risks, and extended shelf-life of medical products.

Europe Fluoropolymer in Healthcare Market Insight

The Europe fluoropolymer in healthcare market is projected to expand at a substantial CAGR during the forecast period, driven by the growing need for high-quality medical devices and sterile packaging solutions. Increased urbanization, rising healthcare awareness, and stringent regulations on medical materials are fostering adoption. European hospitals and clinics emphasize safe, reliable, and long-lasting polymers for critical applications in diagnostic, surgical, and drug delivery equipment. The market is experiencing significant growth in countries such as Germany, France, and Italy, supported by advanced manufacturing capabilities and a focus on innovation in healthcare technologies. Fluoropolymers are being integrated into new constructions, medical facilities, and device upgrades, promoting adoption in both clinical and industrial healthcare applications.

U.K. Fluoropolymer in Healthcare Market Insight

The U.K. fluoropolymer in healthcare market is expected to grow at a noteworthy CAGR over the forecast period, driven by rising adoption of advanced medical materials and a focus on patient safety. Hospitals and private clinics are increasingly using fluoropolymers in tubing, packaging, and medical device components due to their chemical resistance and durability. The trend toward home healthcare and minimally invasive procedures is further supporting growth. Additionally, stringent regulations and safety standards encourage healthcare providers to opt for high-performance polymers, while the U.K.’s strong healthcare infrastructure and e-commerce distribution channels facilitate access to innovative fluoropolymer-based solutions.

Germany Fluoropolymer in Healthcare Market Insight

The Germany fluoropolymer in healthcare market is projected to expand at a considerable CAGR, supported by rising awareness of digital and medical safety, demand for eco-conscious materials, and advanced healthcare infrastructure. German hospitals and medical device manufacturers favor fluoropolymers for their reliability in critical care, diagnostics, and surgical applications. The integration of fluoropolymers into medical equipment and sterile packaging ensures compliance with stringent regulatory standards. Germany’s emphasis on sustainability and innovation, combined with its technological expertise, positions it as a key contributor to the European fluoropolymer market.

Asia-Pacific Fluoropolymer in Healthcare Market Insight

The Asia-Pacific fluoropolymer in healthcare market is expected to be the fastest-growing region during the forecast period, supported by increasing medical device manufacturing, rising healthcare investments, and growing demand for advanced diagnostics and sterile packaging solutions in countries such as China, India, and Japan. Rising urbanization, government healthcare initiatives, and expanding hospitals and clinics are driving the adoption of high-performance fluoropolymer materials. APAC is emerging as a manufacturing hub for cost-effective polymer solutions, making fluoropolymers more accessible to a wider healthcare base. Growth is further fueled by the rising demand for minimally invasive surgical devices, IV systems, and diagnostic instruments, with a projected CAGR of 7.8% from 2026 to 2033.

Japan Fluoropolymer in Healthcare Market Insight

The Japan fluoropolymer in healthcare market is gaining momentum due to the country’s advanced healthcare infrastructure, high-tech adoption, and increasing demand for convenient, safe, and reliable medical solutions. Hospitals, clinics, and medical device manufacturers are increasingly using fluoropolymers in tubing, films, and packaging for diagnostics, drug delivery, and surgical applications. The market benefits from Japan’s emphasis on innovation, aging population requiring safer medical solutions, and integration of fluoropolymers into connected healthcare devices.

China Fluoropolymer in Healthcare Market Insight

China fluoropolymer in healthcare market accounted for the largest market revenue share in the Asia-Pacific region in 2025, driven by rapid urbanization, growing middle-class population, and high adoption of medical devices and advanced healthcare materials. Fluoropolymers are widely used in tubing, films, and sterile packaging across hospitals, clinics, and medical device manufacturing facilities. The country’s push towards smart hospitals and medical device production, along with increasing healthcare expenditure and government initiatives promoting advanced materials, is propelling market growth. Affordable and locally manufactured fluoropolymer solutions are expanding adoption across commercial and residential healthcare applications, positioning China as a leading market in APAC.

Fluoropolymer in Healthcare Market Share

The Fluoropolymer in Healthcare industry is primarily led by well-established companies, including:

- 3M Company (U.S.)

- Honeywell International Inc. (U.S.)

- Saint-Gobain (France)

- Daikin Industries Ltd. (Japan)

- Parker Hannifin Corporation (U.S.)

- Solvay SA (Belgium)

- Kureha Corporation (Japan)

- Arkema Group (France)

- Gore & Associates (U.S.)

- Fluoropolymer Technologies (U.S.)

- Shin-Etsu Chemical Co., Ltd. (Japan)

- Toray Industries, Inc. (Japan)

- DuPont de Nemours, Inc. (U.S.)

- Hutchinson (France)

Latest Developments in Global Fluoropolymer in Healthcare Market

- In May 2023, Biotech Fluidics AB introduced a new line of traceable, certified fluoropolymer flexible tubing designed for use in regulated medical and life sciences environments, compliant with ISO 10993, USP Class VI, and FDA Title 21 standards — enhancing precision and traceability for critical fluidic applications

- In December 2023, Avient Corporation (formerly PolyOne) introduced new fluoropolymer‑based material formulations specifically engineered for medical device applications, offering enhanced biocompatibility and chemical resistance to meet evolving healthcare industry needs

- In January 2024, Solvay announced an initiative to produce nearly all of its fluoropolymers without fluorosurfactants by 2026, aiming to enhance environmental sustainability while maintaining performance characteristics critical in healthcare applications

- In June 2024, fluoropolymer demand in healthcare was highlighted for strong growth due to rising use in advanced medical devices, disposables, and pharmaceuticals, driven by medical tubing and hospital disposables as key end uses

- In March 2025, industry reports noted expansion of fluoropolymer applications in minimally invasive surgical tools and drug delivery systems as hospitals and healthcare providers increasingly adopt materials with high chemical resistance and biocompatibility to support advanced care solutions

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.