Global Fluorspar Market

Market Size in USD Billion

CAGR :

%

USD

2.29 Billion

USD

3.25 Billion

2024

2032

USD

2.29 Billion

USD

3.25 Billion

2024

2032

| 2025 –2032 | |

| USD 2.29 Billion | |

| USD 3.25 Billion | |

|

|

|

|

Global Fluorspar Market Size

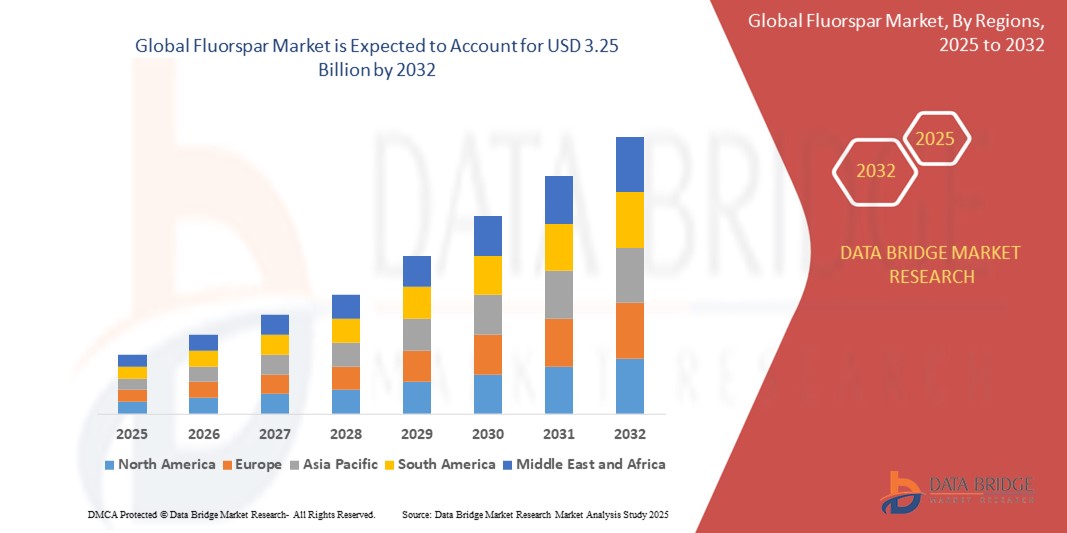

- The global fluorspar market size was valued at USD 2.29 billion in 2024 and is expected to reach USD 3.25 billion by 2032, at a CAGR of 4.46% during the forecast period

- The market growth is largely fueled by the rising demand for fluorspar across key industries such as steel, aluminum, and chemical manufacturing, driven by its critical role in metallurgical and hydrofluoric acid production. The increasing focus on infrastructure development and industrialization in emerging economies is significantly enhancing global consumption of fluorspar, particularly in steelmaking and cement production

- Furthermore, growing applications in the production of lithium-ion batteries, fluoropolymers, and refrigerants are establishing fluorspar as a vital industrial mineral in the transition toward clean energy and sustainable technologies. These converging factors are accelerating the uptake of Global Fluorspar solutions, thereby significantly boosting the industry's growth

Global Fluorspar Market Analysis

- Fluorspar, a critical mineral used in the production of hydrofluoric acid, aluminum, and as a flux in steelmaking, is increasingly vital across industrial and chemical manufacturing sectors due to its versatility and irreplaceable role in downstream applications

- The growing demand for fluorspar is primarily driven by its rising consumption in the production of fluoropolymers, refrigerants, aluminum smelting, and cement manufacturing, along with the shift toward environmentally friendly and energy-efficient alternatives in various industries

- Asia-Pacific dominated the global fluorspar Market with the largest revenue share of 40.01% in 2024, fueled by rapid industrialization, significant steel and aluminum output, and China’s position as the largest fluorspar producer and consumer globally. Regional demand is also supported by increasing use in refrigerants and fluorochemicals, particularly in China, India, and South Korea.

- North America is expected to be the fastest-growing region in the global fluorspar market during the forecast period due to renewed domestic mining efforts, rising demand for aluminum in automotive and aerospace, and growing focus on critical mineral supply chain security

- The Acidspar segment dominated the global fluorspar market with a market share of 62.4% in 2024, primarily due to its extensive use in the production of hydrofluoric acid, which serves as a precursor to a wide range of fluorochemicals used in refrigerants, aluminum smelting, and electronics manufacturing

Report Scope and Global Fluorspar Market Segmentation

|

Attributes |

Global Fluorspar Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Global Fluorspar Market Trends

“Rising Demand Driven by Industrial Automation and Sustainable Applications”

- A significant and accelerating trend in the global fluorspar market is the growing demand for fluorspar in industries embracing automation, clean technologies, and environmentally sustainable production processes

- Increasing use of acid-grade fluorspar in the production of hydrofluoric acid, which is essential for the manufacturing of fluoropolymers and refrigerants, is expanding rapidly in tandem with growth in electronics, automotive, and semiconductor industries.

- Technological advancements in aluminum production, especially in electric vehicles (EVs) and aerospace, are bolstering the use of fluorspar as a flux to lower melting temperatures and improve metal yield efficiency

- Industry players are increasingly leveraging digital supply chain platforms and automated quality control systems in fluorspar mining and processing to enhance output consistency, reduce emissions, and meet global environmental standards

- The transition toward low-global-warming refrigerants and green fluorochemicals in compliance with global agreements such as the Kigali Amendment is fueling demand for high-purity fluorspar in refrigerant production

- Countries such as China, Mexico, South Africa, and Vietnam are investing in advanced processing technologies and sustainable mining practices, contributing to a more resilient and environmentally conscious fluorspar supply chain

Global Fluorspar Market Dynamics

Driver

“Growing Demand Driven by Industrialization and Clean Energy Transition”

- The increasing industrialization in emerging economies and the global transition toward cleaner energy solutions are major drivers for the rising demand in the global fluorspar market. Fluorspar is an essential raw material in the production of hydrofluoric acid, aluminum, steel, and lithium-ion batteries—key elements supporting industrial development and the shift to sustainable technologies

- For instance, in May 2024, Masan High-Tech Materials (Vietnam) announced a capacity expansion in its fluorspar operations to cater to the rising demand for electric vehicle batteries and high-performance materials. Such initiatives by major players are expected to accelerate the fluorspar industry’s growth during the forecast period

- As countries aim to reduce carbon emissions and invest in electric vehicles and renewable energy, fluorspar becomes a crucial feedstock in the battery and aluminum value chains. Its role in enabling lightweight metal production and chemical processing creates a strong growth opportunity

- Furthermore, increasing steel consumption across infrastructure, automotive, and construction sectors is also fueling fluorspar demand, as it is widely used as a flux to remove impurities and improve the melting process

- The growing number of applications, including use in fluoropolymers, refrigerants, and pharmaceuticals, coupled with government support for mining and critical mineral security, are strengthening the fluorspar market outlook across regions such as Asia-Pacific, Africa, and Latin America

Restraint/Challenge

“Environmental Regulations and Supply Concentration Risks”

- Strict environmental regulations regarding mining and processing of fluorspar can restrict market expansion, especially in developed nations. The extraction and handling of fluorspar may generate waste and emissions that must comply with hazardous waste and fluorine compound handling standards, raising operational costs

- In addition, the global fluorspar market faces risks associated with supply concentration. A significant portion of the world's fluorspar production is concentrated in China, making the market vulnerable to trade restrictions, export controls, and geopolitical tensions

- For instance, in early 2024, China imposed tighter environmental checks on mining operations, leading to reduced fluorspar output, which caused short-term price volatility globally

- To mitigate these risks, countries are investing in domestic mining projects and recycling fluorine compounds. However, setting up new mines involves high capital investment, regulatory hurdles, and long lead times

- The dependency on a few countries for raw materials can pose long-term challenges unless diversified sourcing and strategic reserves are developed. Strengthening supply chain transparency and encouraging alternative fluorine sources or recycling technologies will be essential for market stability and growth

Global Fluorspar Market Scope

The market is segmented on the basis of product type, variety, form, and application.

• By Product Type

On the basis of product type, the global fluorspar market is segmented into acidspar, metspar, ceramic grade, optical grade, and lapidary grade. The Acidspar segment dominated the largest market revenue share of 62.4% in 2024, primarily due to its extensive use in the production of hydrofluoric acid, which serves as a precursor to a wide range of fluorochemicals used in refrigerants, aluminum smelting, and electronics manufacturing.

The ceramic grade segment is anticipated to witness the fastest growth rate of 18.9% from 2025 to 2032, fueled by rising demand for specialty ceramics and glass across various industries including optics, consumer goods, and chemical processing equipment.

• By Variety

On the basis of variety, the global fluorspar market is segmented into Antozonite, Blue John, Chlorophane, Yttrocerite, Yttrofluorite, and Others. The Antozonite segment held the largest revenue share of 50% in 2024 due to its relatively high concentration of fluorine and commercial availability.

The Chlorophane segment is expected to exhibit the fastest CAGR 10% over the forecast period due to its unique thermoluminescent and fluorescent properties, which are gaining attention in specialized optics and academic research.

• By Form

On the basis of form, the Global Fluorspar market is segmented into powder, lump, and filter cake. The lump form accounted for the largest revenue share of 48.3% in 2024, driven by its prevalent use in metallurgical applications, especially in steel and aluminum production where it acts as a flux to lower melting points and remove impurities.

The powder form is projected to grow at the fastest CAGR from 2025 to 2032, attributed to its increasing use in chemical applications such as the production of hydrofluoric acid, where fine particle size enhances reaction efficiency.

• By Application

On the basis of application, the global fluorspar market is segmented into aluminum production, steel production, hydrofluoric acid, concrete additives, and lithium-ion battery. The hydrofluoric acid segment captured the largest market revenue share of 39.7% in 2024, driven by the vital role of fluorspar-derived acids in fluorocarbon, fluoropolymer, and chemical industries.

The lithium-ion battery segment is expected to register the highest CAGR of 21.4% from 2025 to 2032, owing to the rapid growth in electric vehicles and energy storage systems, where fluorspar-based materials enhance battery stability and performance.

Global Fluorspar Market Regional Analysis

- North America is the fastest growing global fluorspar market with the largest revenue share of 21.0% in 2024, driven by increasing demand from the aluminum and steel production sectors, coupled with advancements in hydrofluoric acid manufacturing

- The region's well-established industrial base, particularly in the U.S. and Canada, and growing investment in electric vehicles and renewable energy technologies are key contributors to this growth

- The U.S. accounted for 17.0% of the global fluorspar market in 2024, driven by robust growth in hydrofluoric acid applications, which are essential for refrigerants, aluminum production, and pharmaceutical manufacturing

U.S. Global Fluorspar Market Insight

The U.S. fluorspar market accounted for 17.0% of the global fluorspar market in 2024, driven by robust growth in hydrofluoric acid applications, which are essential for refrigerants, aluminum production, and pharmaceutical manufacturing. Domestic initiatives to reduce dependence on Chinese supply, coupled with the strategic importance of fluorspar as a critical mineral, are fostering investments in domestic mining and processing. Moreover, advancements in battery and semiconductor manufacturing further reinforce the growing consumption of high-purity fluorspar.

Europe Global Fluorspar Market Insight

The Europe fluorspar market held a 19.0% revenue share in 2024, fueled by environmental regulations promoting cleaner steel and aluminum production. Europe’s commitment to decarbonization and circular economy strategies is increasing the demand for fluorspar in applications such as fluoropolymers, lithium-ion batteries, and specialty chemicals. Rising investments in electric mobility and energy-efficient construction are also fostering market growth across Germany, the U.K., and France.

U.K. Global Fluorspar Market Insight

The U.K. fluorspar market accounted for 5.3% of the European fluorspar market in 2024 and is anticipated to grow at a noteworthy CAGR during the forecast period, supported by expanding use in the pharmaceutical and metallurgical sectors. The country’s strong R&D landscape and government support for innovation in advanced materials and critical mineral security are accelerating the uptake of fluorspar across various industries.

Germany Global Fluorspar Market Insight

The Germany fluorspar market held 7.4% of the global fluorspar market share in 2024, propelled by the nation’s advanced manufacturing capabilities and rising demand for high-quality fluorspar in automotive, chemical, and electronics industries. With a focus on sustainable resource use and recycling, German companies are investing in cleaner production technologies where fluorspar is used as a critical input.

Asia-Pacific Global Fluorspar Market Insight

The Asia-Pacific fluorspar market dominated the global market with a 40.01% share in 2024, driven by massive infrastructure development, rapid urbanization, and expanding chemical production in economies such as China, India, and Japan.

Japan Global Fluorspar Market Insight

The Japan fluorspar market accounted for 6.1% of the Asia-Pacific fluorspar market in 2024. The market is gaining momentum due to the country’s technological advancement, strong electronics and automotive sectors, and push toward clean manufacturing processes. Japan’s emphasis on self-sufficiency and sustainable raw material sourcing is driving innovation in fluorspar recycling and efficiency optimization.

China Global Fluorspar Market Insight

The China fluorspar market held the largest share of 45.6% within the Asia-Pacific fluorspar market in 2024, driven by its dominant role in global fluorspar mining and processing. With over half of the world’s fluorspar reserves and output, China leads in supplying raw and refined products for hydrofluoric acid, refrigerants, and aluminum production.

Global Fluorspar Market Share

The global fluorspar industry is primarily led by well-established companies, including:

- Tertiary Minerals (U.K.)

- Orbia (Mexico)

- Masan Group (Vietnam)

- Zhejiang Wuyi Shenlong Floatation Co. Ltd. (China)

- DuPont (U.S.)

- Minchem Impex India Private Limited (India)

- Mongolian Copper Corporation (Mongolia)

- Kenya Fluorspar Company Ltd. (Kenya)

- MINERSA GROUP (Spain)

- Seaforth Mineral & Ore Co. (U.S.)

- BASF SE (Germany)

- Puremin (Mexico)

- China Kings Resources Group Co., Ltd. (China)

Latest Developments in Global Global Fluorspar Market

- In November 2021, Silatronix, specializing in organosilicon electrolytes, was acquired by Koura, a leading fluoroproducts and technology company within the Orbia network. Koura, a major global fluorspar producer, aims to enhance its energy storage capabilities through this acquisition, aligning with its holistic energy materials strategy

- In December 2020, Ares Strategic Mining, a Canadian company with a fluorspar mine in the U.S., announced technical advancements facilitated by its manufacturing partner, Mujim Group. Mujim Group developed an innovative process enabling the production of fluorspar lumps from previously unusable materials at Ares' Utah site, expanding its product range and optimizing production efficiency

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL FLUORSPAR MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL FLUORSPAR MARKET SIZE

2.3 VENDOR POSITIONING GRID

2.4 MARKETS COVERED

2.5 GEOGRAPHIC SCOPE

2.6 YEARS CONSIDERED FOR THE STUDY

2.7 RESEARCH METHODOLOGY

2.8 TECHNOLOGY LIFE LINE CURVE

2.9 MULTIVARIATE MODELLING

2.1 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.11 DBMR MARKET POSITION GRID

2.12 MARKET APPLICATION COVERAGE GRID

2.13 DBMR MARKET CHALLENGE MATRIX

2.14 IMPORT AND EXPORT DATA

2.15 SECONDARY SOURCES

2.16 GLOBAL FLUORSPAR MARKET : RESEARCH SNAPSHOT

2.17 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

5.1 RAW MATERIAL COVERAGE

5.2 PRODUCTION CONSUMPTION ANALYSIS

5.3 IMPORT EXPORT SCENARIO

5.4 TECHNOLOGICAL ADVANCEMENT BY MANUFACTURERS

5.5 PORTER’S FIVE FORCES

5.6 VENDOR SELECTION CRITERIA

5.7 PESTEL ANALYSIS

5.8 REGULATION COVERAGE

6 SUPPLY CHAIN ANALYSIS

6.1 OVERVIEW

6.2 LOGISTIC COST SCENARIO

6.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

7 CLIMATE CHANGE SCENARIO

7.1 ENVIRONMENTAL CONCERNS

7.2 INDUSTRY RESPONSE

7.3 GOVERNMENT’S ROLE

7.4 ANALYST RECOMMENDATIONS

8 GLOBAL FLUORSPAR MARKET, BY TYPE, 2022-2031 (USD MILLION) (KILO TONS)

(VALUE, VOLUME AND ASP FOR EACH SEGMENT WILL BE PROVIDED)

8.1 OVERVIEW

8.2 METSPAR

8.2.1 ASP (USD)

8.2.2 MARKET VALUE (USD MILLION)

8.2.3 MARKET VOLUME (KILO TONS)

8.3 ACIDSPAR

8.3.1 ASP (USD)

8.3.2 MARKET VALUE (USD MILLION)

8.3.3 MARKET VOLUME (KILO TONS)

9 GLOBAL FLUORSPAR MARKET, BY GRADE, 2022-2031 (USD MILLION)

9.1 OVERVIEW

9.2 ACID GRADE

9.3 CERAMIC GRADE

9.4 METALLURGICAL GRADE

9.5 OPTICAL GRADE

9.6 LAPIDARY GRADE

10 GLOBAL FLUORSPAR MARKET, BY COLORS, 2022-2031 (USD MILLION)

10.1 OVERVIEW

10.2 CLEAR FLUORITE

10.3 BLUE FLUORITE

10.4 GREEN FLUORITE

10.5 PURPLE FLUORITE

10.6 YELLOW FLUORITE

10.7 RAINBOW FLUORITE

11 GLOBAL FLUORSPAR MARKET, BY FORMS, 2022-2031 (USD MILLION)

11.1 OVERVIEW

11.2 POWDER

11.3 LUMP ORE

11.4 BRIQUETTES

12 GLOBAL FLUORSPAR MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

12.1 OVERVIEW

12.2 ALUMINUM

12.3 GASOLINE

12.4 INSULATING FOAMS

12.5 REFRIGERANTS

12.6 STEEL

12.7 URANIUM FUEL

12.8 CLEAR FLUORITE

12.9 CEMENT

12.1 GLASS FIBER

12.11 OTHERS

13 GLOBAL FLUORSPAR MARKET, BY GEOGRAPHY, 2022-2031 (USD MILLION) (KILO TONS)

GLOBAL FLUORSPAR MARKET, (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

13.1 NORTH AMERICA

13.1.1 U.S.

13.1.2 CANADA

13.1.3 MEXICO

13.2 EUROPE

13.2.1 GERMANY

13.2.2 U.K.

13.2.3 ITALY

13.2.4 FRANCE

13.2.5 SPAIN

13.2.6 SWITZERLAND

13.2.7 RUSSIA

13.2.8 TURKEY

13.2.9 BELGIUM

13.2.10 NETHERLANDS

13.2.11 REST OF EUROPE

13.3 ASIA-PACIFIC

13.3.1 JAPAN

13.3.2 CHINA

13.3.3 SOUTH KOREA

13.3.4 INDIA

13.3.5 SINGAPORE

13.3.6 THAILAND

13.3.7 INDONESIA

13.3.8 MALAYSIA

13.3.9 PHILIPPINES

13.3.10 AUSTRALIA AND NEW ZEALAND

13.3.11 REST OF ASIA-PACIFIC

13.4 SOUTH AMERICA

13.4.1 BRAZIL

13.4.2 ARGENTINA

13.4.3 REST OF SOUTH AMERICA

13.5 MIDDLE EAST AND AFRICA

13.5.1 SOUTH AFRICA

13.5.2 EGYPT

13.5.3 SAUDI ARABIA

13.5.4 UNITED ARAB EMIRATES

13.5.5 ISRAEL

13.5.6 REST OF MIDDLE EAST AND AMERICA

14 GLOBAL FLUORSPAR MARKET, COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: GLOBAL

14.1.1 COMPANY SHARE ANALYSIS: NORTH AMERICA COMPANY SHARE ANALYSIS: EUROPE COMPANY SHARE ANALYSIS: ASIA-PACIFIC MERGERS AND ACQUISITIONS NEW PRODUCT DEVELOPMENT AND APPROVALS EXPANSIONS PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS GLOBAL FLUORSPAR MARKET – DBMR AND SWOT ANALYSIS GLOBAL FLUORSPAR MARKET – COMPANY PROFILES KOURA COMPANY SNAPSHOT PRODUCT PORTFOLIO REVENUE ANALYSIS RECENT UPDATES MASAN GROUP COMPANY SNAPSHOT PRODUCT PORTFOLIO REVENUE ANALYSIS RECENT UPDATES FLUORSID COMPANY SNAPSHOT PRODUCT PORTFOLIO REVENUE ANALYSIS RECENT UPDATES

14.2 MINCHEM IMPEX

14.2.1 COMPANY SNAPSHOT

14.2.2 PRODUCT PORTFOLIO

14.2.3 REVENUE ANALYSIS

14.2.4 RECENT UPDATES

14.3 MONGOLROSTSVETMET LLC

14.3.1 COMPANY SNAPSHOT

14.3.2 PRODUCT PORTFOLIO

14.3.3 REVENUE ANALYSIS

14.3.4 RECENT UPDATES

14.4 KENYA FLUORSPAR COMPANY LTD.

14.4.1 COMPANY SNAPSHOT

14.4.2 PRODUCT PORTFOLIO

14.4.3 REVENUE ANALYSIS

14.4.4 RECENT UPDATES

14.5 MINERSA GROUP

14.5.1 COMPANY SNAPSHOT

14.5.2 PRODUCT PORTFOLIO

14.5.3 REVENUE ANALYSIS

14.5.4 RECENT UPDATES

14.6 CHINA KINGS RESOURCES GROUP CO.,LTD.

14.6.1 COMPANY SNAPSHOT

14.6.2 PRODUCT PORTFOLIO

14.6.3 REVENUE ANALYSIS

14.6.4 RECENT UPDATES

14.7 SR GROUP

14.7.1 COMPANY SNAPSHOT

14.7.2 PRODUCT PORTFOLIO

14.7.3 REVENUE ANALYSIS

14.7.4 RECENT UPDATES

15 CONCLUSION

16 QUESTIONNAIRE

17 RELATED REPORTS

18 ABOUT DATA BRIDGE MARKET RESEARCH

Global Fluorspar Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Fluorspar Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Fluorspar Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.