Global Fmcg Packaging Market

Market Size in USD Billion

CAGR :

%

USD

886.00 Billion

USD

1,269.66 Billion

2025

2033

USD

886.00 Billion

USD

1,269.66 Billion

2025

2033

| 2026 –2033 | |

| USD 886.00 Billion | |

| USD 1,269.66 Billion | |

|

|

|

|

FMCG Packaging Market Size

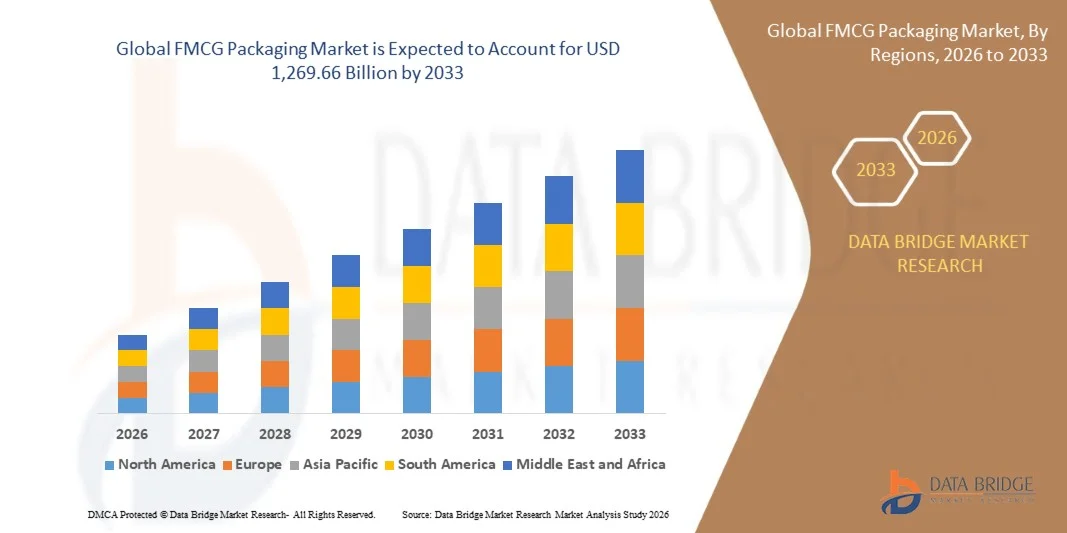

- The global FMCG packaging market size was valued at USD 886.00 billion in 2025 and is expected to reach USD 1,269.66 billion by 2033, at a CAGR of 4.60% during the forecast period

- The market growth is largely fuelled by rising consumption of packaged food, beverages, personal care, and household products driven by urban lifestyles and convenience demand

- Increasing focus on product safety, shelf life extension, and branding differentiation is supporting sustained demand for advanced packaging solutions

FMCG Packaging Market Analysis

- The market is experiencing steady growth due to continuous innovation in packaging designs, materials, and technologies aimed at improving functionality and consumer appeal

- Strong competition among FMCG brands is increasing the importance of attractive, lightweight, and cost-efficient packaging solutions

- North America dominated the FMCG packaging market with the largest revenue share in 2025, driven by high consumption of packaged food, beverages, and personal care products, along with strong brand presence and advanced packaging technologies

- Asia-Pacific region is expected to witness the highest growth rate in the global FMCG packaging market, driven by increasing population, rising middle-class income, and expanding FMCG consumption. Growth in manufacturing capacity, urban lifestyles, and demand for cost-effective and sustainable packaging solutions continue to propel regional market expansion

- The Plastic segment held the largest market revenue share in 2025 driven by its lightweight nature, cost-effectiveness, and versatility across multiple FMCG applications. Plastic packaging offers durability, barrier protection, and design flexibility, making it widely used in food, beverage, and personal care products

Report Scope and FMCG Packaging Market Segmentation

|

Attributes |

FMCG Packaging Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

FMCG Packaging Market Trends

“Rising Focus On Sustainable, Smart, And Consumer-Centric Packaging”

• The growing emphasis on sustainability and environmental responsibility is significantly shaping the FMCG packaging market, as brands increasingly adopt recyclable, biodegradable, and lightweight materials. FMCG companies are prioritizing packaging solutions that reduce environmental impact while maintaining product safety, shelf life, and visual appeal. This trend is driving innovation across food, beverage, personal care, and household product packaging, encouraging the development of eco-friendly materials and designs

• Increasing demand for convenience-oriented and ready-to-use products is accelerating the adoption of advanced FMCG packaging formats such as flexible packaging, resealable packs, and portion-controlled designs. These solutions enhance ease of use, portability, and storage efficiency, aligning with fast-paced urban lifestyles. As a result, manufacturers are investing in packaging innovations that balance functionality, cost efficiency, and consumer convenience

• Technological advancements, including smart and intelligent packaging solutions, are gaining traction as brands seek better product tracking, freshness monitoring, and consumer engagement. Features such as QR codes, RFID tags, and tamper-evident designs are improving supply chain transparency and brand trust. These innovations are also supporting data-driven marketing and enhancing the overall consumer experience

• For instance, in 2024, Unilever in the U.K. and Nestlé in Switzerland expanded the use of recyclable and smart packaging across food and personal care product lines. These initiatives aimed to reduce plastic waste and improve traceability while strengthening brand sustainability credentials. The products were distributed through both retail and e-commerce channels, enhancing market reach and consumer engagement

• While sustainability and innovation are driving growth, continued market expansion depends on cost-effective material sourcing, scalability of new packaging technologies, and regulatory compliance. FMCG packaging manufacturers are focusing on improving production efficiency, material performance, and collaboration across the value chain to meet evolving market demands

FMCG Packaging Market Dynamics

Driver

“Growing Demand For Sustainable And Innovative Packaging Solutions”

• Rising consumer awareness regarding environmental impact is a key driver for the FMCG packaging market, prompting brands to transition from traditional packaging to sustainable alternatives. FMCG companies are increasingly investing in recyclable, compostable, and reusable packaging to meet regulatory requirements and align with consumer expectations. This shift is also encouraging innovation in bio-based and paper-based packaging materials

• Expanding consumption of packaged food, beverages, personal care, and household products is supporting sustained demand for efficient and protective packaging solutions. FMCG packaging plays a critical role in ensuring product safety, shelf life, and brand differentiation, driving continuous investment in advanced packaging technologies. Growth in e-commerce further reinforces the need for durable and lightweight packaging formats

• Manufacturers are actively promoting sustainable packaging initiatives through branding, certifications, and transparent communication. These efforts are supported by collaborations between FMCG brands, packaging suppliers, and recycling organizations to improve material recovery and reduce waste. Such strategies strengthen brand reputation and foster long-term consumer loyalty

• For instance, in 2023, Procter & Gamble in the U.S. and Coca-Cola in the U.S. increased the use of recyclable and reduced-plastic packaging across multiple product categories. These initiatives were driven by sustainability commitments and rising consumer demand for eco-friendly packaging, supporting brand differentiation and repeat purchases

• Despite strong demand drivers, continued growth depends on innovation in materials, optimization of production costs, and the ability to scale sustainable packaging solutions globally. Investment in R&D, supply chain integration, and circular economy models remains critical for maintaining competitiveness

Restraint/Challenge

“High Cost And Recycling Infrastructure Limitations”

• The higher cost of sustainable and advanced packaging materials compared to conventional options remains a major challenge for the FMCG packaging market. Bio-based, recyclable, and smart packaging solutions often involve higher raw material and processing costs, limiting adoption among cost-sensitive FMCG manufacturers. Price volatility of raw materials further impacts profitability

• Inadequate recycling and waste management infrastructure, particularly in developing regions, restricts the effectiveness of sustainable packaging initiatives. Limited collection, sorting, and recycling capabilities reduce the actual environmental benefits of recyclable packaging, discouraging large-scale implementation. This challenge also affects regulatory compliance and brand sustainability targets

• Supply chain complexities and material availability pose additional challenges, as FMCG packaging manufacturers must source certified, high-quality materials while ensuring consistent supply. Logistical constraints and dependence on specialized suppliers can increase lead times and operational costs, impacting production efficiency

• For instance, in 2024, FMCG brands operating in markets such as Brazil and Indonesia reported challenges in scaling recyclable packaging due to limited recycling infrastructure and higher material costs. Companies such as local beverage and personal care brands faced difficulties in maintaining cost competitiveness while meeting sustainability goals

• Addressing these challenges will require investment in recycling infrastructure, cost optimization, and collaboration between governments, FMCG brands, and packaging manufacturers. Strengthening circular economy initiatives, improving consumer awareness, and advancing material innovation will be essential to unlock long-term growth in the global FMCG packaging market

FMCG Packaging Market Scope

The market is segmented on the basis of material, product type, and end-use industry.

• By Material

On the basis of material, the global FMCG packaging market is segmented into Plastic, Paper & Paperboard, Metal, Glass, and Others. The Plastic segment held the largest market revenue share in 2025 driven by its lightweight nature, cost-effectiveness, and versatility across multiple FMCG applications. Plastic packaging offers durability, barrier protection, and design flexibility, making it widely used in food, beverage, and personal care products.

The Paper & Paperboard segment is expected to witness the fastest growth rate from 2026 to 2033 due to rising environmental concerns and increasing adoption of recyclable and biodegradable packaging solutions. Growing regulatory pressure and consumer preference for sustainable materials are accelerating the shift toward paper-based packaging across FMCG brands.

• By Product Type

On the basis of product type, the FMCG packaging market is segmented into Bags & Pouches, Clamshells, Bottles & Jars, Boxes & Cartons, Cans, Sachets & Stick Packs, Film & Laminates, and Others. Bags & Pouches accounted for a significant market share in 2025 owing to their lightweight design, convenience, and suitability for flexible packaging applications. These formats are widely used in food, beverage, and personal care products due to ease of handling and cost efficiency.

Sachets & Stick Packs is expected to witness the fastest growth rate from 2026 to 2033, driven by increasing demand for single-use, affordable, and portion-controlled packaging. Their popularity is rising in emerging markets where low unit pricing and convenience play a critical role in consumer purchasing decisions.

• By End-use Industry

On the basis of end-use industry, the market is segmented into Food, Beverage, Personal Care & Cosmetic, Home Care, Tobacco, Pharmaceutical, and Others. The Food segment dominated the market revenue share in 2025 due to high consumption of packaged and processed food products and the need for packaging that ensures freshness, safety, and extended shelf life.

The Personal Care & Cosmetic segment is anticipated to grow at a rapid pace from 2026 to 2033, supported by increasing demand for premium, aesthetically appealing, and sustainable packaging solutions. Rising beauty awareness and brand differentiation strategies are further driving packaging innovation within this segment.

FMCG Packaging Market Regional Analysis

• North America dominated the FMCG packaging market with the largest revenue share in 2025, driven by high consumption of packaged food, beverages, and personal care products, along with strong brand presence and advanced packaging technologies

• Consumers in the region place high value on convenience, product safety, and sustainable packaging, encouraging the adoption of recyclable, lightweight, and smart packaging solutions

• This dominance is further supported by high disposable incomes, well-established retail and e-commerce infrastructure, and continuous innovation in packaging materials and designs, strengthening demand across food, beverage, and home care segments

U.S. FMCG Packaging Market Insight

The U.S. FMCG packaging market captured the largest revenue share within North America in 2025, supported by strong demand for packaged and ready-to-consume products. Manufacturers are increasingly focusing on sustainable, functional, and visually appealing packaging to enhance brand differentiation. The rapid growth of e-commerce, private-label brands, and smart packaging technologies continues to drive market expansion across food, personal care, and household products.

Europe FMCG Packaging Market Insight

The Europe FMCG packaging market is expected to witness the fastest growth rate from 2026 to 2033, primarily driven by stringent environmental regulations and strong emphasis on sustainability. Rising adoption of recyclable, biodegradable, and reusable packaging materials is accelerating market growth. Increasing urbanization and demand for convenient packaging solutions across food and beverage sectors further support expansion.

U.K. FMCG Packaging Market Insight

The U.K. FMCG packaging market is expected to witness strong growth from 2026 to 2033, driven by increasing consumer awareness regarding plastic reduction and sustainability. Demand for paper-based, recyclable, and lightweight packaging is rising across food, beverage, and personal care products. The country’s advanced retail and e-commerce ecosystem further supports innovation in packaging formats and materials.

Germany FMCG Packaging Market Insight

The Germany FMCG packaging market is expected to witness strong growth from 2026 to 2033, supported by strong regulatory frameworks and high awareness of eco-friendly packaging solutions. Germany’s focus on innovation, recycling infrastructure, and sustainable manufacturing practices promotes the adoption of advanced and circular packaging systems. Demand is particularly strong in food, beverage, and pharmaceutical packaging applications.

Asia-Pacific FMCG Packaging Market Insight

The Asia-Pacific FMCG packaging market is expected to witness the fastest growth rate from 2026 to 2033, driven by rapid urbanization, rising disposable incomes, and expanding middle-class populations. Growing consumption of packaged food, beverages, and personal care products is accelerating demand for flexible and cost-effective packaging solutions. The region’s role as a major manufacturing hub further enhances market accessibility and scalability.

Japan FMCG Packaging Market Insight

The Japan FMCG packaging market is expected to witness strong growth from 2026 to 2033 due to high demand for premium, convenient, and technologically advanced packaging solutions. Japanese consumers prioritize product quality, hygiene, and innovative packaging designs. The increasing use of smart and functional packaging, along with strong demand from food and beverage sectors, continues to support market growth.

China FMCG Packaging Market Insight

The China FMCG packaging market accounted for the largest revenue share in Asia Pacific in 2025, driven by rapid urbanization, a growing middle-class population, and high consumption of packaged goods. Strong domestic manufacturing capabilities and the expansion of retail and e-commerce channels are fueling packaging demand. Government initiatives supporting sustainable packaging and the growth of smart cities further contribute to long-term market expansion.

FMCG Packaging Market Share

The FMCG Packaging industry is primarily led by well-established companies, including:

- Amcor (Switzerland)

- Berry Global Inc. (U.S.)

- WestRock Company (U.S.)

- Sealed Air Corporation (U.S.)

- Sonoco Products Company (U.S.)

- Ball Corporation (U.S.)

- Mondi Plc (U.K.)

- Huhtamaki Oyj (Finland)

- Ardagh Group S.A. (Luxembourg)

- DS Smith (U.K.)

- Nampak Ltd. (South Africa)

- Berry Astrapak (South Africa)

- Constantia Flexibles (Austria)

- Stora Enso Oyj (Finland)

- Graham Packaging Company (U.S.)

- Toyo Seikan Group Holdings Ltd. (Japan)

Latest Developments in Global FMCG Packaging Market

- In September 2023, Mondi, product launch, introduced the first paper-based packaging for dry rice in the U.K. in collaboration with Veetee. The solution uses Mondi’s recyclable FunctionalBarrier Paper to replace conventional plastic packs. This development enhances recyclability while ensuring product protection and durability. It supports the shift toward sustainable food packaging and is expected to accelerate the adoption of paper-based alternatives in the FMCG sector.

- In October 2022, Sidel, product innovation, launched the 1SKIN bottle designed for sensitive beverages. The label-less PET bottle is fully recyclable and reduces material usage. This innovation helps lower carbon footprint and supports circular economy goals. The launch strengthens sustainable packaging adoption in the beverage industry and encourages lightweight packaging trends

- In April 2022, Amcor, portfolio expansion, introduced sustainable high-shield laminates for pharmaceutical packaging applications. The solutions include stick packs, sachets, and strip packs made from paper-based and polyolefin-based materials. These innovations maintain high barrier protection while improving sustainability. The development supports regulatory compliance and drives demand for eco-friendly pharmaceutical packaging

- In October 2021, AR Packaging, product launch, unveiled a fully recyclable fiber-based tray for high-barrier food packaging. Made from sustainably sourced carton board with thin mono barrier films, the tray reduces plastic usage while extending shelf life. This solution addresses demand for sustainable chilled food and ready-meal packaging. It reinforces the shift toward fiber-based alternatives in food packaging markets

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Fmcg Packaging Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Fmcg Packaging Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Fmcg Packaging Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.