Global Foam Mattress Market

Market Size in USD Billion

CAGR :

%

USD

44.46 Billion

USD

71.88 Billion

2024

2032

USD

44.46 Billion

USD

71.88 Billion

2024

2032

| 2025 –2032 | |

| USD 44.46 Billion | |

| USD 71.88 Billion | |

|

|

|

|

Global Foam Mattress Market Size

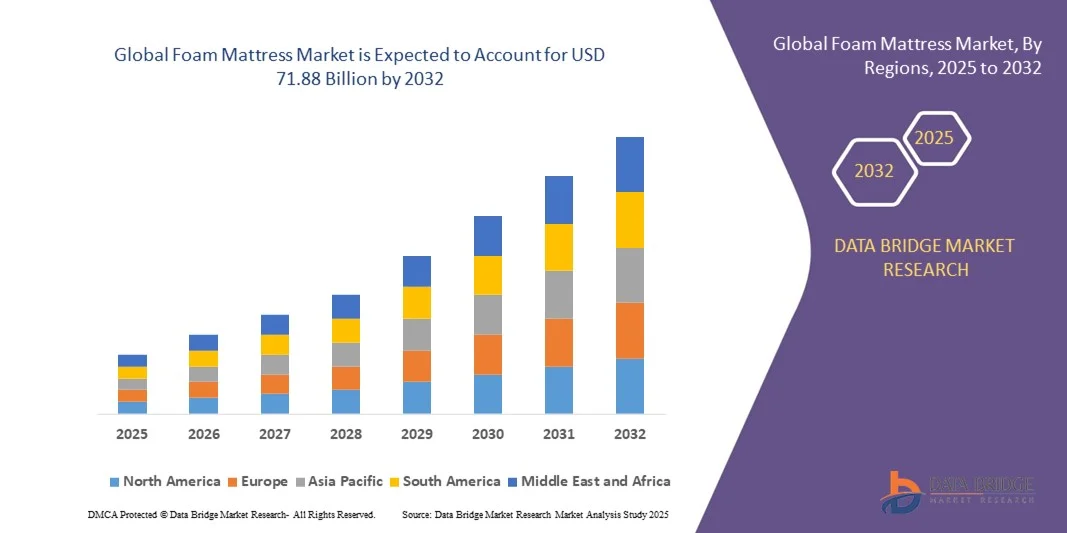

- The global Foam Mattress Market size was valued at USD 44.46 billion in 2024 and is projected to reach USD 71.88 billion by 2032, growing at a CAGR of 6.19% during the forecast period.

- The market growth is primarily driven by increasing consumer awareness of sleep health, advancements in memory foam and gel-infused technologies, and the rising demand for premium bedding products across residential and commercial sectors.

- Additionally, factors such as the expansion of the hospitality industry, e-commerce penetration, and the growing preference for customizable, durable, and eco-friendly mattresses are further accelerating market adoption, thereby propelling the overall industry's growth.

Global Foam Mattress Market Analysis

- Foam mattresses, designed using memory foam, latex, or polyurethane materials, are becoming essential components of modern sleep solutions in both residential and commercial applications due to their superior comfort, pressure relief, motion isolation, and compatibility with adjustable bed systems.

- The rising demand for foam mattresses is primarily fueled by growing consumer awareness regarding sleep quality, increasing prevalence of back and posture-related issues, and a growing preference for premium, customizable, and eco-friendly sleep products.

- North America dominated the Global Foam Mattress Market with the largest revenue share of 35.8% in 2024, driven by high consumer spending power, a mature bedding industry, and strong brand presence. The U.S. leads the market with robust sales across both online and offline channels, supported by technological innovations in cooling foam and sustainable materials introduced by leading manufacturers.

- Asia-Pacific is expected to be the fastest-growing region in the Global Foam Mattress Market during the forecast period due to rapid urbanization, expanding middle-class populations, and increasing adoption of Western lifestyle and sleep habits.

- The 10–30 cm segment dominated the market with the largest revenue share of 48.6% in 2024, attributed to its optimal balance between comfort, support, and affordability.

Report Scope and Global Foam Mattress Market Segmentation

|

Attributes |

Foam Mattress Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Global Foam Mattress Market Trends

Enhanced Comfort and Personalization Through Smart Technology Integration

- A significant and accelerating trend in the global Foam Mattress Market is the deepening integration of smart technologies such as artificial intelligence (AI), IoT sensors, and sleep-tracking systems. This convergence is transforming traditional mattresses into intelligent sleep solutions that monitor, analyze, and optimize users’ sleep quality for enhanced comfort and health benefits.

- For instance, Sleep Number’s 360® Smart Bed automatically adjusts firmness and support levels based on users’ body movements, while Emma Motion uses built-in sensors and AI algorithms to adapt its foam structure in real-time for ideal spinal alignment and pressure relief.

- AI integration in foam mattresses enables advanced features such as personalized sleep recommendations, temperature regulation, and automatic posture adjustment. Some models also connect with mobile apps to deliver detailed sleep analytics, helping users improve their rest patterns and overall well-being.

- The seamless integration of smart foam mattresses with digital ecosystems—including Google Fit, Apple Health, and Amazon Alexa—allows users to control sleep settings, room temperature, and lighting through a single platform or voice commands, promoting a fully connected and automated bedroom environment.

- This shift toward intelligent, data-driven, and responsive sleep systems is reshaping consumer expectations in the mattress industry. Leading companies such as Sleep Number, Eight Sleep, and Emma – The Sleep Company are pioneering innovations that combine comfort with smart functionality, catering to the growing demand for technology-enhanced sleep solutions.

- The demand for AI-integrated and app-connected foam mattresses is rapidly increasing across residential and hospitality sectors, as consumers prioritize personalized comfort, health insights, and integrated smart home experiences.

Global Foam Mattress Market Dynamics

Driver

Growing Demand Driven by Health Awareness and Lifestyle Upgrades

- The increasing awareness of the importance of sleep health, coupled with rising disposable incomes and evolving lifestyle preferences, is a significant driver for the heightened demand for foam mattresses. Consumers are increasingly prioritizing high-quality sleep products that offer comfort, pressure relief, and long-term durability.

- For instance, in March 2024, Tempur Sealy International, Inc. announced advancements in its adaptive cooling and pressure-relief foam technologies, aiming to enhance personalized comfort and sleep quality. Such innovations by key manufacturers are expected to drive the global foam mattress industry growth over the forecast period.

- As consumers become more conscious of sleep-related health issues—such as back pain, insomnia, and posture problems—foam mattresses are being favored for their superior support, body-contouring capabilities, and hypoallergenic properties, offering a substantial upgrade over traditional spring mattresses.

- Furthermore, the growing popularity of luxury bedding products and smart bedroom ecosystems is making foam mattresses an essential component of modern home environments, often integrated with adjustable bases, sleep-tracking devices, and smart home systems.

- The convenience of online mattress purchasing, customization options (firmness, size, material), and direct-to-consumer business models are key factors propelling foam mattress adoption across both residential and hospitality sectors. Additionally, the expansion of e-commerce platforms and the trend toward bed-in-a-box solutions further contribute to market growth.

Restraint/Challenge

Environmental Concerns and High Product Costs

- Environmental concerns associated with the use of synthetic foams and non-biodegradable materials pose a significant challenge to broader foam mattress adoption. As awareness about sustainability grows, consumers are becoming cautious about products that rely heavily on petroleum-based polyurethane and non-recyclable components.

- For instance, reports highlighting the environmental impact of foam waste and the use of volatile organic compounds (VOCs) in manufacturing have made some consumers hesitant to purchase non-eco-friendly mattresses.

- Addressing these sustainability challenges through eco-conscious production, bio-based foam materials, and recyclable packaging is crucial for maintaining consumer trust. Companies such as Emma – The Sleep Company and Sheela Foam Ltd. are increasingly emphasizing their use of certified eco-friendly materials and green manufacturing processes to attract environmentally conscious buyers.

- Additionally, the high initial cost of premium foam mattresses compared to conventional options can deter price-sensitive consumers, especially in developing regions. While affordable alternatives are emerging through online retailers, high-end models featuring gel-infused foam, cooling layers, or smart sensors continue to carry a premium price tag.

- Although prices are gradually becoming more competitive, the perceived premium nature of foam technology can still limit mass-market penetration. Overcoming these challenges through sustainable innovation, transparent marketing, and cost-efficient production methods will be vital for the sustained growth of the global foam mattress market.

Global Foam Mattress Market Scope

The foam mattress market is segmented on the basis of product depth, type, material, size, application and sales channel.

- By Product Depth

On the basis of product depth, the Global Foam Mattress Market is segmented into Below 10 cm, 10–30 cm, and Above 30 cm. The 10–30 cm segment dominated the market with the largest revenue share of 48.6% in 2024, attributed to its optimal balance between comfort, support, and affordability. Mattresses in this range cater to both household and hospitality needs, offering sufficient cushioning for most body types while maintaining portability and cost-effectiveness.

The Above 30 cm segment is expected to witness the fastest CAGR from 2025 to 2032, fueled by rising consumer preference for premium, multi-layered, and luxury foam mattresses that deliver enhanced support, deep comfort, and superior motion isolation. The growing popularity of high-end bedding products in developed economies and luxury hotels further contributes to this segment’s rapid expansion.

- By Type

on the basis of type, the market is segmented into Traditional, Air Cool, and Gel foam mattresses. The Traditional segment held the largest market revenue share of 44.3% in 2024, owing to its affordability, widespread availability, and consistent performance in offering comfort and support. These mattresses remain popular among budget-conscious consumers and in emerging markets.

The Gel segment is anticipated to witness the fastest CAGR during 2025–2032, driven by its superior cooling properties and enhanced breathability. Gel-infused mattresses effectively dissipate heat, making them ideal for warm climates and individuals seeking temperature-regulated sleep. Increased innovation in gel-based foam and the demand for luxurious, temperature-neutral sleeping surfaces are propelling the segment’s growth globally.

- By Material

On the basis of material, the market is divided into Polyurethane, Memory Foam, Hybrid, Innerspring, and Latex. The Memory Foam segment dominated the market with the largest revenue share of 41.8% in 2024, driven by its superior pressure-relieving properties, body-contouring comfort, and hypoallergenic features. Memory foam’s ability to adapt to different sleep positions has made it a leading choice for consumers seeking orthopedic and restorative sleep solutions.

The Hybrid segment is projected to record the fastest CAGR from 2025 to 2032, as it combines the responsiveness of innersprings with the contouring comfort of foam layers, offering a balanced sleep experience. Growing demand for mattresses that deliver both support and cooling comfort is boosting the adoption of hybrid variants.

- By Size

On the basis of size, The market is categorized into Twin or Single Size, Twin XL, Full or Double, Queen, King, and Others. The Queen-size segment accounted for the largest market revenue share of 36.9% in 2024, as it strikes the ideal balance between space efficiency and sleeping comfort, making it the most popular choice for households worldwide. It caters to both single sleepers and couples, fitting well in standard-sized bedrooms.

The King-size segment is anticipated to grow at the fastest CAGR during 2025–2032, driven by rising demand for larger, more luxurious sleeping spaces, particularly in North America, Europe, and premium hospitality settings. Increasing consumer focus on comfort and spacious sleeping arrangements continues to drive growth in this segment.

- By Application

On the basis of application, the Global Foam Mattress Market is segmented into Household and Commercial. The Household segment dominated the market with a revenue share of 72.4% in 2024, supported by rising consumer awareness of sleep health, home furnishing upgrades, and growing adoption of online mattress purchasing.

The availability of customized and bed-in-a-box solutions has further accelerated demand. The Commercial segment, encompassing hotels, hospitals, and serviced apartments, is projected to witness the fastest CAGR from 2025 to 2032, owing to increasing hospitality investments, healthcare infrastructure growth, and rising demand for durable, easy-to-maintain foam mattresses in high-traffic environments.

- By Sales Channel

On the basis of Sales Channel, The market is segmented by sales channel into Direct and Distributor. The Distributor segment held the largest market share of 57.8% in 2024, driven by the extensive reach of retail stores, showrooms, and online marketplaces offering multiple brands and price points. Distributors remain vital in emerging economies where consumers prefer physical inspection before purchase.

The Direct segment is expected to witness the fastest CAGR from 2025 to 2032, fueled by the expansion of direct-to-consumer (D2C) brands such as Casper, Emma, and Sleepwell, which offer convenience, cost savings, and customization through online platforms. The growing trust in e-commerce and simplified delivery models continues to boost this segment’s growth.

Global Foam Mattress Market Regional Analysis

- North America dominated the Global Foam Mattress Market with the largest revenue share of 35.8% in 2024, driven by the rising emphasis on sleep health, increasing consumer spending on premium bedding products, and the growing popularity of direct-to-consumer mattress brands.

- Consumers in the region highly value comfort, durability, and advanced features such as cooling technology, memory foam adaptability, and pressure-relief properties. The demand is further fueled by heightened awareness of posture support and overall wellness benefits associated with high-quality foam mattresses.

- This widespread adoption is supported by high disposable incomes, a strong online retail presence, and the technological innovation introduced by leading players such as Tempur Sealy, Casper, and Purple Innovation, establishing foam mattresses as a preferred choice for both residential and hospitality applications across the U.S. and Canada.

U.S. Foam Mattress Market Insight

The U.S. foam mattress market captured the largest revenue share of 42% in 2024 within North America, driven by rising consumer awareness about sleep quality, comfort, and wellness. Increasing adoption of memory foam, gel-infused, and hybrid mattresses, combined with the popularity of bed-in-a-box brands and direct-to-consumer sales models, is fueling market growth. The growing trend of home remodeling, coupled with higher disposable incomes, encourages consumers to invest in premium foam mattresses. Additionally, rising e-commerce penetration and easy access to online reviews further support adoption across both urban and suburban regions.

Europe Foam Mattress Market Insight

The European foam mattress market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by increasing demand for ergonomic sleep solutions and advanced cooling technologies. High standards for product quality and safety regulations in countries such as Germany, France, and Italy are encouraging innovation in mattress design. Urbanization, rising disposable income, and growing awareness of sleep health are promoting adoption across residential and hospitality sectors. Eco-friendly and recyclable foam mattresses are also gaining traction due to environmental concerns among European consumers.

U.K. Foam Mattress Market Insight

The U.K. foam mattress market is anticipated to grow at a noteworthy CAGR, fueled by the rising trend of home comfort upgrades and increased awareness of sleep health. Consumers are increasingly seeking mattresses that provide pressure relief, support, and cooling properties. The availability of premium and affordable options through robust e-commerce and retail infrastructure supports wide adoption. Additionally, growing demand from rental properties, urban households, and boutique hotels is driving growth, while the convenience of direct-to-consumer deliveries strengthens market penetration.

Germany Foam Mattress Market Insight

The Germany foam mattress market is expected to expand at a considerable CAGR, driven by rising consumer focus on ergonomics, comfort, and long-term durability. Germany’s well-developed retail and online distribution channels, along with its high disposable income, support the purchase of premium foam mattresses. Consumers increasingly prefer hybrid and memory foam variants for better sleep quality. Growing investments in eco-friendly and recyclable foam mattresses, coupled with rising awareness about orthopedic and posture-improving solutions, are further propelling market growth in both residential and commercial segments.

Asia-Pacific Foam Mattress Market Insight

The Asia-Pacific foam mattress market is poised to grow at the fastest CAGR of 22% during 2025–2032, driven by rapid urbanization, rising disposable incomes, and increasing awareness of sleep wellness. Countries such as China, Japan, and India are witnessing rising demand for memory foam, gel, and hybrid mattresses due to the growing middle-class population and premium lifestyle adoption. Government initiatives promoting housing and digital retail platforms are improving accessibility. Additionally, APAC’s emergence as a manufacturing hub for foam mattress components is enhancing affordability and availability, further accelerating regional growth.

Japan Foam Mattress Market Insight

The Japan foam mattress market is gaining momentum due to high urban population density, an aging population, and an emphasis on comfort and convenience in home living. Consumers are increasingly adopting memory foam and gel-infused mattresses for enhanced support and temperature regulation. Integration with smart bedroom solutions, such as adjustable bed frames and sleep monitoring devices, is also driving adoption. The focus on ergonomics, health, and space-efficient furniture supports growth in both residential and hospitality segments.

China Foam Mattress Market Insight

The China foam mattress market accounted for the largest market revenue share in Asia-Pacific in 2024, fueled by the expanding middle class, rapid urbanization, and high adoption of home improvement products. Memory foam and hybrid mattresses are gaining popularity in residential, commercial, and rental properties. The push toward modern housing developments, growing e-commerce penetration, and availability of affordable local and international brands are key factors propelling market growth. Increased consumer awareness regarding sleep quality and wellness further strengthens demand across urban and semi-urban regions.

Global Foam Mattress Market Share

The Foam Mattress industry is primarily led by well-established companies, including:

• Tempur Sealy International, Inc. (U.S.)

• Serta Simmons Bedding, LLC (U.S.)

• Sleep Number Corporation (U.S.)

• Casper Sleep Inc. (U.S.)

• Emma – The Sleep Company (Germany)

• Kingsdown, Inc. (U.S.)

• Purple Innovation, Inc. (U.S.)

• Boll & Branch LLC (U.S.)

• Eve Sleep PLC (U.K.)

• IKEA (Sweden)

• Silentnight Group Limited (U.K.)

• Simmons Bedding Company (U.S.)

• Spring Air International (U.S.)

• Kurlon Enterprises Ltd. (India)

• Sheela Foam Ltd. (India)

• Sleepwell Industries Co., Ltd. (Japan)

• Recticel NV (Belgium)

• BASF SE (Germany)

• Duroflex Pvt. Ltd. (India)

• Southerland Sleep (U.S.)

What are the Recent Developments in Global Foam Mattress Market?

- In April 2023, Tempur Sealy International, a global leader in sleep solutions, launched a strategic initiative in South Africa to introduce its premium memory foam mattresses, aimed at improving sleep quality for both residential and hospitality sectors. This initiative demonstrates the company’s commitment to delivering innovative, high-comfort bedding solutions tailored to local consumer preferences, leveraging its global expertise to strengthen its presence in the rapidly growing Global Foam Mattress Market.

- In March 2023, Haven Sleep Inc., a U.S.-based startup focused on ergonomic bedding solutions, introduced its PowerGel mattress series, specifically designed for healthcare and hospitality applications. The new line offers enhanced pressure relief and temperature regulation, highlighting Haven Sleep’s dedication to advancing comfort and wellness through cutting-edge foam mattress technologies.

- In March 2023, Sleep Number Corporation successfully launched its Smart Bed Project in Bengaluru, India, aimed at integrating smart sleep tracking technology with foam mattresses to enhance personalized sleep experiences. This initiative underscores the growing significance of connected sleep solutions in improving health and wellness, contributing to the development of smarter bedroom environments.

- In February 2023, Casper Sleep, a leading direct-to-consumer mattress brand, announced a strategic partnership with the Asia-Pacific Bedding Association to create a marketplace for eco-friendly foam mattresses. This collaboration is designed to promote sustainable sleep solutions and expand accessibility for consumers, highlighting Casper’s commitment to innovation and operational excellence in the bedding industry.

- In January 2023, Purple Innovation, a leading foam mattress manufacturer, unveiled its Purple Hybrid Premier Mattress at the International Home + Housewares Show 2023. This advanced product features hyper-elastic polymer technology and targeted pressure relief zones, offering enhanced comfort and support. The launch reflects Purple’s dedication to integrating innovative materials and design into its products, ensuring superior sleep quality for consumers worldwide.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.