Global Folding Furniture Market

Market Size in USD Billion

CAGR :

%

USD

10.76 Billion

USD

19.63 Billion

2024

2032

USD

10.76 Billion

USD

19.63 Billion

2024

2032

| 2025 –2032 | |

| USD 10.76 Billion | |

| USD 19.63 Billion | |

|

|

|

|

What is the Global Folding Furniture Market Size and Growth Rate?

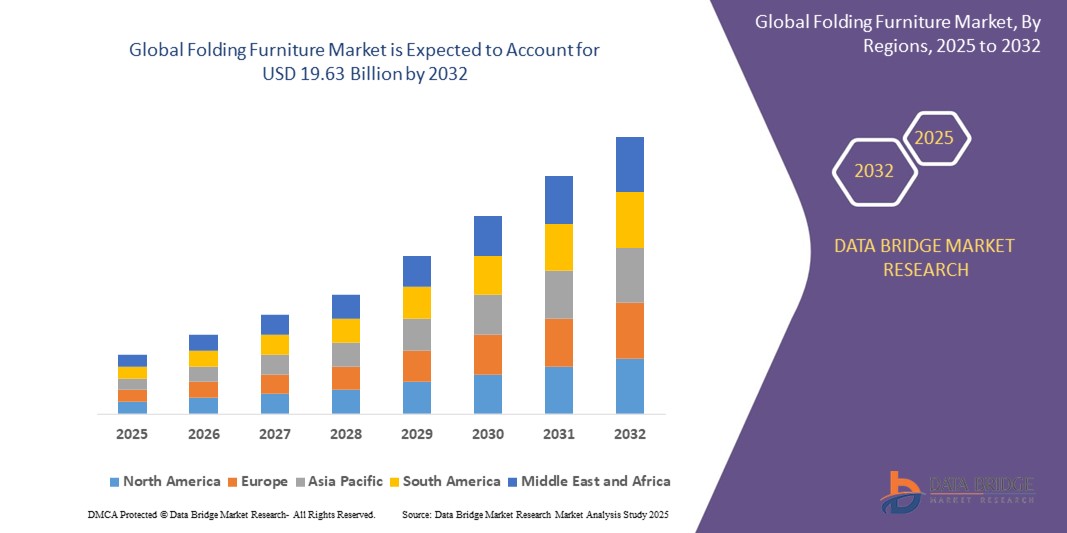

- The global folding furniture market size was valued at USD 10.76 billion in 2024 and is expected to reach USD 19.63 billion by 2032, at a CAGR of 7.80% during the forecast period

- The market is experiencing steady growth, one of the major drivers is the increasing trend of urbanization and the growing demand for space-saving furniture solutions, especially in small apartments and compact living spaces

- Folding furniture's versatility and convenience make it a favored option for consumers seeking to optimize space without sacrificing functionality. Another key driver is the rise in the number of dual-income households and the increasing focus on convenience and practicality in furniture choices

What are the Major Takeaways of Folding Furniture Market?

- The rising urbanization has significantly impacted living spaces, with more people residing in apartments and condos characterized by limited square footage. This shift has created a demand for furniture that maximizes space efficiency without compromising on functionality and comfort

- Folding furniture has become a practical solution, allowing items to be easily folded and stored when not in use, effectively maximizing space usage. Manufacturers are responding to this trend by designing innovative folding furniture that seamlessly blends style with functionality, catering to the needs of urban dwellers seeking versatile and space-saving solutions, driving the market growth

- Asia Pacific dominated the folding furniture market with the largest revenue share of 42.6% in 2024, driven by the rising demand for space-saving, multifunctional furniture, rapid urbanization, and increasing disposable incomes across emerging economies such as China, India, and Southeast Asian countries

- North America folding furniture market is poised to grow at the fastest CAGR of 19.4% from 2025 to 2032, driven by an increasing preference for flexible, portable furniture solutions that cater to modern living and remote work environments

- The Chairs segment dominated the folding furniture market with the largest revenue share of 41.5% in 2024, driven by the widespread use of folding chairs in residential, commercial, and event-based applications

Report Scope and Folding Furniture Market Segmentation

|

Attributes |

Folding Furniture Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Folding Furniture Market?

“Space Optimization with Smart, Modular Designs”

- A prominent and accelerating trend in the global folding furniture market is the evolution of space-saving, modular designs that cater to urban living and small-space environments. Consumers are increasingly seeking furniture that can transform or fold away to maximize usable space, especially in apartments, co-living spaces, and multifunctional rooms

- For instance, Resource Furniture offers wall beds, extendable tables, and folding desks that seamlessly combine functionality with aesthetic appeal, allowing rooms to serve multiple purposes without compromising comfort or design

- Innovations include compact foldable sofas, beds, and dining sets that integrate storage or convert into different configurations, making them highly adaptable for modern lifestyles. Materials such as lightweight alloys and durable polymers enhance mobility, while ergonomic engineering ensures ease of use

- The integration of folding mechanisms with minimalist, stylish aesthetics appeals to consumers valuing both form and function. Companies such as Expand Furniture focus on transforming spaces with folding tables and convertible furniture that adapt to changing needs throughout the day

- This trend reflects the growing demand for multifunctional, space-efficient furniture, especially in densely populated urban centers. As smart cities and compact housing projects expand, the popularity of folding furniture solutions is expected to grow significantly, reshaping the global furniture market landscape

What are the Key Drivers of Folding Furniture Market?

- The global rise in urbanization and shrinking living spaces is a primary driver of folding furniture demand, as consumers seek practical solutions for maximizing space utilization without sacrificing comfort or aesthetics

- For instance, IKEA has consistently introduced foldable chairs, drop-leaf tables, and multipurpose beds designed for compact homes, targeting urban dwellers and students living in small apartments

- The increasing preference for portable, lightweight, and easy-to-store furniture also drives the market, particularly for outdoor events, temporary setups, and travel purposes. Products such as Lifetime Products' folding tables and chairs are widely adopted for both residential and commercial use due to their durability and convenience

- In addition, the growing popularity of minimalist and multifunctional interior design trends, alongside the rising demand for flexible workspaces, supports the adoption of folding furniture for home offices and shared spaces

- Rising environmental consciousness further propels demand for sustainable, durable, and recyclable materials in folding furniture, prompting manufacturers to innovate with eco-friendly designs and processes

Which Factor is challenging the Growth of the Folding Furniture Market?

- Despite its advantages, the folding furniture market faces challenges related to durability, stability, and perceived quality compared to traditional fixed furniture. Consumers may associate folding mechanisms with structural weakness or short product lifespan, especially for heavily used items such as beds or workstations

- For instance, customer feedback in some regions highlights concerns over the long-term durability of low-cost folding furniture, which can suffer from material fatigue, hinge malfunctions, or stability issues under continuous use

- Furthermore, higher price points for premium, space-saving folding furniture solutions can limit accessibility for price-sensitive consumers, particularly in developing markets where traditional fixed furniture remains more affordable

- Overcoming these challenges will require manufacturers to focus on improving material quality, structural engineering, and affordability, along with clear consumer education on the functionality, reliability, and space benefits of modern folding furniture designs

- As brands such as Flexfurn and Nilkamal Furniture innovate with more durable and cost-effective solutions, the market is expected to gradually overcome these hurdles and expand into new residential and commercial applications

How is the Folding Furniture Market Segmented?

The market is segmented on the basis of product type, application, and distribution channel.

• By Product Type

On the basis of product type, the folding furniture market is segmented into Chairs, Tables, Beds, and Others. The Chairs segment dominated the Folding Furniture market with the largest revenue share of 41.5% in 2024, driven by the widespread use of folding chairs in residential, commercial, and event-based applications. Folding chairs offer portability, easy storage, and versatility, making them highly popular for indoor and outdoor use, particularly for events, temporary seating, and space-constrained environments. Their lightweight designs and affordability further enhance their appeal across both home and institutional markets.

The Beds segment is projected to witness the fastest CAGR from 2025 to 2032, fueled by the increasing demand for space-saving solutions in urban living spaces. Folding beds, including wall beds and sofa beds, offer multifunctionality and space optimization, making them ideal for apartments, guest rooms, and compact living setups. The trend toward modular, convertible furniture in smart homes also contributes to the growth of this segment.

• By Application

On the basis of application, the folding furniture market is segmented into Residential and Commercial. The Residential segment accounted for the largest market revenue share of 58.3% in 2024, attributed to rising urbanization, smaller living spaces, and the increasing adoption of multifunctional furniture for apartments and homes. Consumers seek folding furniture for its space-saving benefits, flexibility, and ease of storage, particularly in densely populated cities and regions with high real estate costs.

The Commercial segment is anticipated to witness the fastest growth rate from 2025 to 2032, driven by the growing need for portable, easy-to-set-up furniture in sectors such as hospitality, education, event management, and co-working spaces. Folding tables, chairs, and modular furniture provide practical solutions for flexible layouts, temporary setups, and efficient space management in commercial environments.

• By Distribution Channel

On the basis of distribution channel, the folding furniture market is segmented into Online and Offline channels. The Offline segment dominated the market with the largest revenue share of 64.7% in 2024, driven by the preference for physically inspecting furniture quality, durability, and mechanisms before purchase. Brick-and-mortar retail outlets, specialty furniture stores, and large-format home improvement centers continue to play a significant role in consumer buying decisions, especially for higher-value or customized folding furniture.

The Online segment is expected to register the fastest CAGR from 2025 to 2032, supported by the growing popularity of e-commerce platforms, greater product variety, and the convenience of home delivery. Online channels offer consumers easy access to reviews, competitive pricing, and a broader selection, driving increased adoption, particularly among younger, urban consumers comfortable with digital purchasing.

Which Region Holds the Largest Share of the Folding Furniture Market?

- Asia Pacific dominated the folding furniture market with the largest revenue share of 42.6% in 2024, driven by the rising demand for space-saving, multifunctional furniture, rapid urbanization, and increasing disposable incomes across emerging economies such as China, India, and Southeast Asian countries

- The region's booming real estate sector, coupled with the trend of compact living spaces, is significantly boosting the demand for folding chairs, tables, beds, and modular furniture solutions that offer flexibility and convenience

- Furthermore, strong manufacturing capabilities, affordable product availability, and growing consumer awareness regarding efficient space utilization are key factors positioning Asia Pacific as the global leader in Folding Furniture adoption across both residential and commercial applications

China Folding Furniture Market Insight

The China folding furniture market captured the largest revenue share in Asia Pacific in 2024, fueled by the country's expanding middle class, rapid urbanization, and the surge in smart city developments. As urban living spaces become more compact, folding furniture is gaining popularity for its practicality and adaptability. The presence of leading domestic manufacturers, combined with rising consumer preference for space-efficient home and office solutions, is further propelling market growth in China.

India Folding Furniture Market Insight

The India folding furniture market is anticipated to register the fastest CAGR within Asia Pacific during the forecast period, driven by increasing urban housing developments, the growing middle-class population, and heightened demand for affordable, space-saving furniture. The rising popularity of co-living spaces, hostels, and compact apartments, along with improving retail infrastructure and online availability of folding furniture, supports the country's market expansion.

Japan Folding Furniture Market Insight

The Japan folding furniture market continues to grow steadily, supported by the country's space-conscious living culture, high levels of urbanization, and advanced design preferences. Folding beds, modular seating, and compact tables are highly sought after, especially in metropolitan areas. In addition, Japan's emphasis on minimalistic, multifunctional interiors, along with its aging population's need for accessible and ergonomic furniture, fuels sustained demand for folding furniture solutions.

Which Region is the Fastest Growing Region in the Folding Furniture Market?

North America folding furniture market is poised to grow at the fastest CAGR of 19.4% from 2025 to 2032, driven by an increasing preference for flexible, portable furniture solutions that cater to modern living and remote work environments. Consumers across the U.S. and Canada are adopting folding furniture to optimize space in homes, offices, and outdoor settings. Growing demand for compact, easy-to-store furniture, coupled with the popularity of DIY setups and outdoor recreational activities, contributes to the market's rapid growth. Technological advancements, eco-friendly product offerings, and the expanding e-commerce sector are further enhancing folding furniture accessibility in North America.

U.S. Folding Furniture Market Insight

The U.S. folding furniture market captured the largest revenue share in North America in 2024, supported by high consumer spending power, the prevalence of small living spaces in urban areas, and the popularity of events, outdoor activities, and multifunctional home setups. The convenience, portability, and versatility of folding furniture continue to drive demand across both residential and commercial sectors.

Canada Folding Furniture Market Insight

The Canada folding furniture market is experiencing notable growth, fueled by rising urbanization, the increasing demand for temporary furniture solutions for events, and the adoption of compact, space-saving furniture for modern homes. The expanding hospitality sector and emphasis on sustainable, recyclable furniture materials are also contributing to market expansion in the country.

Which are the Top Companies in folding furniture Market?

The folding furniture industry is primarily led by well-established companies, including:

- ASHCOMM LLC (U.S.)

- Inter Ikea Systems B.V. (Netherlands)

- Flexsteel Industries, Inc. (U.S.)

- Meco Corporation (U.S.)

- Haworth Inc. (U.S.)

- Resource Furniture (U.S.)

- Murphy Wall Beds Hardware Inc. (U.S.)

- Leggett & Platt, Incorporated (U.S.)

- Sauder Woodworking Co. (U.S.)

- The Bedder Way Co. (U.S.)

- La-Z-Boy Incorporated (U.S.)

- Flexfurn (Belgium)

- Nilkamal Furniture (India)

- HARDWARE, INC. (U.S.)

- Gopak (U.K.)

- Twin Cities Closet Company (U.S.)

- Dorel Industries (Canada)

- Hussey Seating Company (U.S.)

- Expand Furniture Inc. (Canada)

- Lifetime Products (U.S.)

What are the Recent Developments in Global Folding Furniture Market?

- In May 2025, Dorel Home integrated its residential furniture operations under the Cosco division, strengthening its strategic focus on the folding furniture segment. This consolidation is expected to streamline operations and reinforce Dorel's market position in space-saving furniture solutions

- In May 2025, MityLite announced that its entire line of folding furniture products has successfully retained GREENGUARD certification, ensuring low VOC emissions and compliance with strict indoor air quality standards. This achievement highlights the company's ongoing commitment to health-conscious and sustainable furniture manufacturing

- In September 2024, Ashley Furniture Industries revealed its plan to invest USD 80 million to expand its manufacturing facilities in Lee County, Mississippi, to enhance production capabilities. This expansion reflects Ashley's intention to meet the growing demand for innovative folding furniture products in the North American market

- In November 2023, ITALICA launched the Phoenix Folding Chair, recognized as India's first fully plastic folding chair made with durable, high-quality materials. This product introduction represents a milestone in India’s furniture market by combining portability, strength, and sustainability for various residential and commercial applications

- In May 2023, Meco Corporation committed USD 27.8 million to expand its headquarters in Greeneville, Tennessee, enhancing its production facilities. This investment underlines the company's dedication to increasing output to meet rising consumer demand for portable, space-saving furniture solutions

- In April 2022, Dorel Home, part of Dorel Industries Inc., reopened its renovated 9th-floor showroom in the C&D Building at High Point Market, showcasing an expanded portfolio of folding furniture and licensed product lines. This initiative reflects the company’s aim to enhance product visibility and attract new buyers in the furniture industry

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL FOLDING FURNITURE MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL FOLDING FURNITURE MARKET SIZE

2.3 VENDOR POSITIONING GRID

2.4 MARKETS COVERED

2.5 GEOGRAPHIC SCOPE

2.6 YEARS CONSIDERED FOR THE STUDY

2.7 RESEARCH METHODOLOGY

2.8 TECHNOLOGY LIFE LINE CURVE

2.9 MULTIVARIATE MODELLING

2.1 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.11 DBMR MARKET POSITION GRID

2.12 MARKET APPLICATION COVERAGE GRID

2.13 DBMR MARKET CHALLENGE MATRIX

2.14 IMPORT AND EXPORT DATA

2.15 SECONDARY SOURCES

2.16 GLOBAL FOLDING FURNITURE MARKET: RESEARCH SNAPSHOT

2.17 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

5.1 CONSUMER BUYING BEHAVIOUR

5.2 FACTORS AFFECTING BUYING DECISION

5.3 PRODUCT ADOPTION SCENARIO

5.4 PORTER’S FIVE FORCES

5.5 REGULATION COVERAGE

5.6 RAW MATERIAL SOURCING ANALYSIS

5.7 IMPORT EXPORT SCENARIO

6 PRODUCTION CAPACITY OUTLOOK

7 PRICING ANALYSIS

8 BRAND OUTLOOK

8.1 BRAND COMPARATIVE ANALYSIS

8.2 PRODUCT VS BRAND OVERVIEW

9 IMPACT OF ECONOMIC SLOWDOWN

9.1 IMPACT ON PRICES

9.2 IMPACT ON SUPPLY CHAIN

9.3 IMPACT ON SHIPMENT

9.4 IMPACT ON DEMAND

9.5 IMPACT ON STRATEGIC DECISIONS

10 SUPPLY CHAIN ANALYSIS

10.1 OVERVIEW

10.2 LOGISTIC COST SCENARIO

10.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

11 GLOBAL FOLDING FURNITURE MARKET, BY PRODUCT, 2022-2031 (USD MILLION) (MILLION UNITS)

11.1 OVERVIEW

11.2 FOLDING SOFA

11.2.1 FOLDING SOFA, BY TYPE

11.2.1.1. CONVERTIBLE FOLDING SOFAS

11.2.1.2. FUTONS

11.2.1.3. SECTIONAL FOLDING SOFAS

11.2.1.4. LOVESEATS

11.2.1.5. OTHERS

11.2.2 FOLDING SOFA, BY STYLE

11.2.2.1. MODERN

11.2.2.2. CONTEMPORARY

11.2.2.3. TRADITIONAL

11.2.3 FOLDING SOFA, BY SIZE

11.2.3.1. SINGLE-SEATER

11.2.3.2. TWO-SEATER

11.2.3.3. THREE-SEATER

11.2.3.4. L-SHAPED

11.2.3.5. CUSTOM SIZES

11.2.3.6. OTHERS

11.3 FOLDING BED

11.3.1 FOLDING BED, BY TYPE

11.3.1.1. ROLLAWAY FOLDING BEDS

11.3.1.2. CABINET FOLDING BEDS (MURPHY BEDS)

11.3.1.3. SOFA BEDS

11.3.1.4. CONVERTIBLE FOLDING BEDS

11.3.1.5. OTTOMAN BEDS

11.3.1.6. OTHERS

11.3.2 FOLDING BED, BY SIZE

11.3.2.1. SINGLE

11.3.2.2. TWIN

11.3.2.3. FULL/DOUBLE

11.3.2.4. QUEEN

11.3.2.5. KING

11.3.2.6. OTHERS (IF ANY)

11.3.3 FOLDING BED, BY STYLE

11.3.3.1. MODERN

11.3.3.2. CONTEMPORARY

11.3.3.3. TRADITIONAL

11.4 FOLDING TABLES

11.4.1 FOLDING TABLES, BY TYPE

11.4.1.1. GENERAL USE TABLES

11.4.1.2. CARD TABLE

11.4.1.3. BANQUET TABLE

11.4.1.4. IRONING BOARD

11.4.1.5. DINNER TABLES

11.4.1.6. PESONAL TABLES

11.4.1.7. WALLPAPER TABLES

11.4.1.8. OTHERS

11.4.2 FOLDING TABLES, BY HEIGHT

11.4.2.1. FIXED HEIGHT

11.4.2.2. ADJUSTABLE HEIGHT

11.4.3 FOLDING TABLES, BY SHAPE

11.4.3.1. ROUND & OVAL

11.4.3.2. RECTANGULAR & SQUARE

11.4.3.3. QUARTER ROUND

11.4.3.4. SERPENTINE

11.4.4 FOLDING TABLES, BY LEG TYPE

11.4.4.1. PEDESTAL LEGS

11.4.4.2. WISHBONE LEGS

11.4.4.3. ROMAN LEGS

11.4.4.4. LADDER LEGS

11.4.5 FOLDING TABLES, BY STYLE

11.4.5.1. MODERN

11.4.5.2. CONTEMPORARY

11.4.5.3. TRADITIONAL

11.5 FOLDING CHAIRS

11.5.1 FOLDING CHAIRS, BY TYPE

11.5.1.1. STANDARD FOLDING CHAIRS

11.5.1.2. LOUNGE CHAIRS

11.5.1.3. CHAIR OTTOMANS

11.5.1.4. PADDED FOLDING CHAIRS

11.5.1.5. DIRECTORS CHAIRS

11.5.1.6. DECK CHAIRS

11.5.1.7. LAWN CHAIRS

11.5.1.8. CAMPING CHAIRS

11.5.1.9. OTHERS

11.5.2 FOLDING CHAIRS, BY STYLE

11.5.2.1. MODERN

11.5.2.2. CONTEMPORARY

11.5.2.3. TRADITIONAL

11.5.3 FOLDING CHAIRS, BY USAGE

11.5.3.1. INDOOR FOLDING CHAIRS

11.5.3.2. OUTDOOR FOLDING CHAIRS

11.5.3.3. EVENT/PARTY FOLDING CHAIRS

11.5.3.4. CAMPING/HIKING FOLDING CHAIRS

11.5.3.5. OTHERS

11.5.4 FOLDING CHAIRS, BY SIZE

11.5.4.1. ADULT-SIZED

11.5.4.2. CHILDREN'S-SIZED

11.6 FOLDING RECLINERS

11.6.1 FOLDING RECLINERS, BY TYPE

11.6.1.1. STANDARD FOLDING RECLINERS

11.6.1.2. ZERO GRAVITY RECLINERS

11.6.2 FOLDING RECLINERS, BY SIZE

11.6.2.1. SINGLE

11.6.2.2. OVERSIZED

11.6.3 FOLDING RECLINERS, BY STYLE

11.6.3.1. MODERN

11.6.3.2. CONTEMPORARY

11.6.3.3. TRADITIONAL

11.7 FOLDING CUPBOARDS & CABINETS

11.7.1 FOLDING CUPBOARDS & CABINETS, BY STYLE

11.7.1.1. MODERN

11.7.1.2. CONTEMPORARY

11.7.1.3. TRADITIONAL

11.8 FOLDING DESKS

11.8.1 FOLDING DESKS, BY TYPE

11.8.1.1. WALL-MOUNTED FOLDING DESKS

11.8.1.2. PORTABLE FOLDING DESKS

11.8.1.3. FOLDING LAPTOP DESKS

11.8.1.4. STANDING FOLDING DESKS

11.8.1.5. OTHERS

11.8.2 FOLDING DESKS, BY STYLE

11.8.2.1. MODERN

11.8.2.2. CONTEMPORARY

11.8.2.3. TRADITIONAL

11.9 FOLDING BENCHES

11.9.1 FOLDING BENCHES, BY STYLE

11.9.1.1. MODERN

11.9.1.2. CONTEMPORARY

11.9.1.3. TRADITIONAL

11.1 OTHERS

12 GLOBAL FOLDING FURNITURE MARKET, BY MATERIAL, 2022-2031 (USD MILLION)

12.1 OVERVIEW

12.2 WOOD

12.2.1 SOLID WOOD

12.2.2 PLYWOOD

12.2.3 VENEER

12.2.4 PARTICLE BOARD

12.2.5 OTHERS

12.3 PLASTIC

12.4 METAL

12.4.1 STEEL

12.4.2 ALUMINUM

12.4.3 OTHERS

12.5 GLASS

12.6 LEATHER

12.7 FABRIC

12.8 OTHERS

13 GLOBAL FOLDING FURNITURE MARKET, BY STYLE, 2022-2031 (USD MILLION)

13.1 OVERVIEW

13.2 MODERN

13.3 CONTEMPORARY

13.4 TRADITIONAL

14 GLOBAL FOLDING FURNITURE MARKET, BY PRICE RANGE, 2022-2031 (USD MILLION)

14.1 OVERVIEW

14.2 ECONOMY RANGE

14.3 PREMIUM RANGE

15 GLOBAL FOLDING FURNITURE MARKET, BY CUSTOMIZATION, 2022-2031 (USD MILLION)

15.1 OVERVIEW

15.2 STANDARD

15.3 CUSTOMIZED

16 GLOBAL FOLDING FURNITURE MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

16.1 OVERVIEW

16.2 INDOOR

16.2.1 BEDROOMS

16.2.2 KITCHEN

16.2.3 LIVING ROOMS

16.2.4 COMMON AREAS

16.2.5 OTHERS

16.3 OUTDOOR

16.3.1 BALCONY

16.3.2 PATIOS

16.3.3 DECKS

16.3.4 GARDENS

16.3.5 COMMON AREAS

16.3.6 OTHERS

17 GLOBAL FOLDING FURNITURE MARKET, BY END-USE, 2022-2031 (USD MILLION)

17.1 OVERVIEW

17.2 RESIDENTIAL

17.3 COMMERCIAL

17.3.1 COMMERCIAL, BY END USE

17.3.1.1. OFFICES

17.3.1.2. HOSPITALS

17.3.1.3. RESTAURANTS & CAFES

17.3.1.4. STADIUMS

17.3.1.5. SHOPPING CENTERS

17.3.1.6. GYM & FITNESS CENTERS

17.3.1.7. CONFERENCE HALLS

17.3.1.8. OTHERS

17.4 INSTITUTIONAL

17.4.1 INSTITUTIONAL, BY END USE

17.4.1.1. SCHOOLS

17.4.1.2. UNIVERSITIES

17.4.1.3. LIBRARIES

17.4.1.4. OTHERS

17.5 OTHERS

18 GLOBAL FOLDING FURNITURE MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

18.1 OVERVIEW

18.2 ONLINE

18.2.1 COMPANY OWNED WEBSITES

18.2.2 THIRD PARTY WEBSITES

18.3 OFFLINE

18.3.1 SUPER MARKETS / HYPERMARKETS

18.3.2 SPECIALTY STORES

18.3.3 HOME CENTERS

18.3.4 CONVENIENCE STORES

18.3.5 OTHERS

19 GLOBAL FOLDING FURNITURE MARKET, BY GEOGRAPHY, 2022-2031 (USD MILLION) (MILLION UNITS)

Global FOLDING FURNITURE market, (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

19.1 NORTH AMERICA

19.1.1 U.S.

19.1.2 CANADA

19.1.3 MEXICO

19.2 EUROPE

19.2.1 GERMANY

19.2.2 U.K.

19.2.3 ITALY

19.2.4 FRANCE

19.2.5 SPAIN

19.2.6 RUSSIA

19.2.7 SWITZERLAND

19.2.8 TURKEY

19.2.9 BELGIUM

19.2.10 NETHERLANDS

19.2.11 LUXEMBURG

19.2.12 REST OF EUROPE

19.3 ASIA-PACIFIC

19.3.1 JAPAN

19.3.2 CHINA

19.3.3 SOUTH KOREA

19.3.4 INDIA

19.3.5 SINGAPORE

19.3.6 THAILAND

19.3.7 INDONESIA

19.3.8 MALAYSIA

19.3.9 PHILIPPINES

19.3.10 AUSTRALIA

19.3.11 NEW ZEALAND

19.3.12 REST OF ASIA-PACIFIC

19.4 SOUTH AMERICA

19.4.1 BRAZIL

19.4.2 ARGENTINA

19.4.3 REST OF SOUTH AMERICA

19.5 MIDDLE EAST AND AFRICA

19.5.1 SOUTH AFRICA

19.5.2 EGYPT

19.5.3 SAUDI ARABIA

19.5.4 UNITED ARAB EMIRATES

19.5.5 ISRAEL

19.5.6 REST OF MIDDLE EAST AND AFRICA

20 GLOBAL FOLDING FURNITURE MARKET, COMPANY LANDSCAPE

20.1 COMPANY SHARE ANALYSIS: GLOBAL

20.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

20.3 COMPANY SHARE ANALYSIS: EUROPE

20.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

20.5 MERGERS AND ACQUISITIONS

20.6 NEW PRODUCT DEVELOPMENT AND APPROVALS

20.7 EXPANSIONS

20.8 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

21 SWOT AND DATA BRIDGE MARKET RESEARCH ANALYSIS

22 GLOBAL FOLDING FURNITURE MARKET- COMPANY PROFILE

22.1 MECO CORPORATION

22.1.1 COMPANY SNAPSHOT

22.1.2 REVENUE ANALYSIS

22.1.3 GEOGRAPHIC PRESENCE

22.1.4 PRODUCT PORTFOLIO

22.1.5 RECENT UPDATES

22.2 HAWORTH INTERNATIONAL, LTD.

22.2.1 COMPANY SNAPSHOT

22.2.2 REVENUE ANALYSIS

22.2.3 GEOGRAPHIC PRESENCE

22.2.4 PRODUCT PORTFOLIO

22.2.5 RECENT UPDATES

22.3 IKEA

22.3.1 COMPANY SNAPSHOT

22.3.2 REVENUE ANALYSIS

22.3.3 GEOGRAPHIC PRESENCE

22.3.4 PRODUCT PORTFOLIO

22.3.5 RECENT UPDATES

22.4 LEGGETT & PLATT INC (PANGEO CABLE INDUSTRIES LTD)

22.4.1 COMPANY SNAPSHOT

22.4.2 REVENUE ANALYSIS

22.4.3 GEOGRAPHIC PRESENCE

22.4.4 PRODUCT PORTFOLIO

22.4.5 RECENT UPDATES

22.5 RESOURCE FURNITURE

22.5.1 COMPANY SNAPSHOT

22.5.2 REVENUE ANALYSIS

22.5.3 GEOGRAPHIC PRESENCE

22.5.4 PRODUCT PORTFOLIO

22.5.5 RECENT UPDATES

22.6 SAUDER WOODWORKING CO.

22.6.1 COMPANY SNAPSHOT

22.6.2 REVENUE ANALYSIS

22.6.3 GEOGRAPHIC PRESENCE

22.6.4 PRODUCT PORTFOLIO

22.6.5 RECENT UPDATES

22.7 FLEXFURN LTD,

22.7.1 COMPANY SNAPSHOT

22.7.2 REVENUE ANALYSIS

22.7.3 GEOGRAPHIC PRESENCE

22.7.4 PRODUCT PORTFOLIO

22.7.5 RECENT UPDATES

22.8 GOPAK

22.8.1 COMPANY SNAPSHOT

22.8.2 REVENUE ANALYSIS

22.8.3 GEOGRAPHIC PRESENCE

22.8.4 PRODUCT PORTFOLIO

22.8.5 RECENT UPDATES

22.9 IMPACT CANOPIES USA

22.9.1 COMPANY SNAPSHOT

22.9.2 REVENUE ANALYSIS

22.9.3 GEOGRAPHIC PRESENCE

22.9.4 PRODUCT PORTFOLIO

22.9.5 RECENT UPDATES

22.1 KESTELL FURNITURE LLC

22.10.1 COMPANY SNAPSHOT

22.10.2 REVENUE ANALYSIS

22.10.3 GEOGRAPHIC PRESENCE

22.10.4 PRODUCT PORTFOLIO

22.10.5 RECENT UPDATES

22.11 CORRELL INC.

22.11.1 COMPANY SNAPSHOT

22.11.2 REVENUE ANALYSIS

22.11.3 GEOGRAPHIC PRESENCE

22.11.4 PRODUCT PORTFOLIO

22.11.5 RECENT UPDATES

22.12 INTERMETAL

22.12.1 COMPANY SNAPSHOT

22.12.2 REVENUE ANALYSIS

22.12.3 GEOGRAPHIC PRESENCE

22.12.4 PRODUCT PORTFOLIO

22.12.5 RECENT UPDATES

22.13 SICO INCORPORATED

22.13.1 COMPANY SNAPSHOT

22.13.2 REVENUE ANALYSIS

22.13.3 GEOGRAPHIC PRESENCE

22.13.4 PRODUCT PORTFOLIO

22.13.5 RECENT UPDATES

22.14 SAMSONITE INTERNATIONAL S.A.

22.14.1 COMPANY SNAPSHOT

22.14.2 REVENUE ANALYSIS

22.14.3 GEOGRAPHIC PRESENCE

22.14.4 PRODUCT PORTFOLIO

22.14.5 RECENT UPDATES

22.15 MITYLITE

22.15.1 COMPANY SNAPSHOT

22.15.2 REVENUE ANALYSIS

22.15.3 GEOGRAPHIC PRESENCE

22.15.4 PRODUCT PORTFOLIO

22.15.5 RECENT UPDATES

22.16 FLEXIFORM

22.16.1 COMPANY SNAPSHOT

22.16.2 REVENUE ANALYSIS

22.16.3 GEOGRAPHIC PRESENCE

22.16.4 PRODUCT PORTFOLIO

22.16.5 RECENT UPDATES

22.17 MAYWOOD FURNITURE CORP (DESAUSSURE EQUIPMENT)

22.17.1 COMPANY SNAPSHOT

22.17.2 REVENUE ANALYSIS

22.17.3 GEOGRAPHIC PRESENCE

22.17.4 PRODUCT PORTFOLIO

22.17.5 RECENT UPDATES

22.18 KUSUMAFURNITURE

22.18.1 COMPANY SNAPSHOT

22.18.2 REVENUE ANALYSIS

22.18.3 GEOGRAPHIC PRESENCE

22.18.4 PRODUCT PORTFOLIO

22.18.5 RECENT UPDATES

22.19 NILKAMAL LIMITED

22.19.1 COMPANY SNAPSHOT

22.19.2 REVENUE ANALYSIS

22.19.3 GEOGRAPHIC PRESENCE

22.19.4 PRODUCT PORTFOLIO

22.19.5 RECENT UPDATES

22.2 HUSSEY SEATING COMPANY

22.20.1 COMPANY SNAPSHOT

22.20.2 REVENUE ANALYSIS

22.20.3 GEOGRAPHIC PRESENCE

22.20.4 PRODUCT PORTFOLIO

22.20.5 RECENT UPDATES

22.21 LIFETIME PRODUCTS

22.21.1 COMPANY SNAPSHOT

22.21.2 REVENUE ANALYSIS

22.21.3 GEOGRAPHIC PRESENCE

22.21.4 PRODUCT PORTFOLIO

22.21.5 RECENT UPDATES

22.22 ASHLEY FURNITURE INDUSTRIES

22.22.1 COMPANY SNAPSHOT

22.22.2 REVENUE ANALYSIS

22.22.3 GEOGRAPHIC PRESENCE

22.22.4 PRODUCT PORTFOLIO

22.22.5 RECENT UPDATES

NOTE: THE COMPANIES PROFILED IS NOT EXHAUSTIVE LIST AND IS AS PER OUR PREVIOUS CLIENT REQUIREMENT. WE PROFILE MORE THAN 100 COMPANIES IN OUR STUDY AND HENCE THE LIST OF COMPANIES CAN BE MODIFIED OR REPLACED ON REQUEST

23 RELATED REPORTS

24 QUESTIONNAIRE

25 CONCLUSION

26 ABOUT DATA BRIDGE MARKET RESEARCH

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.