Global Food Beverages Disinfection Market

Market Size in USD Million

CAGR :

%

USD

137.98 Million

USD

219.59 Million

2024

2032

USD

137.98 Million

USD

219.59 Million

2024

2032

| 2025 –2032 | |

| USD 137.98 Million | |

| USD 219.59 Million | |

|

|

|

|

Food and Beverages Disinfection Market Size

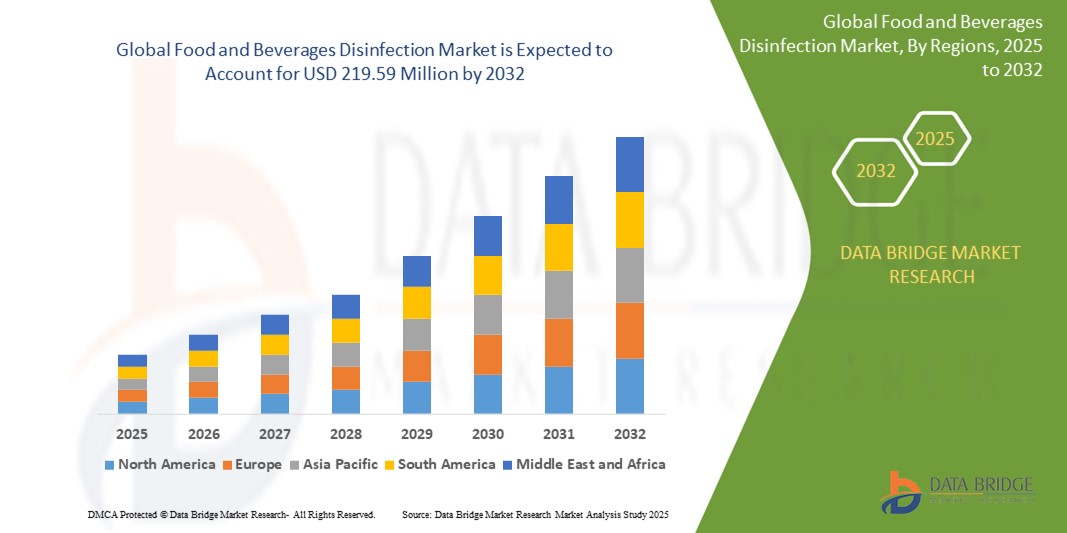

- The global food and beverages disinfection market size was valued at USD 137.98 million in 2024 and is expected to reach USD 219.59 million by 2032, at a CAGR of 5.98% during the forecast period

- The market growth is primarily driven by the increased need for food safety and hygiene, particularly in light of global health concerns and stricter regulatory mandates across food processing and packaging environments

- In addition, the rising demand for advanced disinfection solutions such as UV systems, chemical disinfectants, and ozone-based technologies is fostering innovation and encouraging widespread adoption across the food and beverage industry

Food and Beverages Disinfection Market Analysis

- Food and Beverages Disinfection refers to the process of eliminating or reducing harmful microorganisms on food contact surfaces, packaging areas, and food products, ensuring safe consumption and compliance with hygiene standards in the food and beverage industry

- The market is significantly driven by the rising awareness of food safety, stringent government regulations, and increasing foodborne illness outbreaks, pushing manufacturers to adopt more effective chemical and technology-based disinfection methods

- North America dominates the food and beverages disinfection market with the largest revenue share in 2024, supported by well-established food processing sectors, high regulatory compliance, and increased focus on maintaining hygiene across production and distribution chains

- Asia-Pacific is projected to be the fastest-growing region during the forecast period due to increasing urbanization, rising disposable incomes, and expansion of food processing industries, particularly in China, India, and Southeast Asia, where the demand for safe, packaged foods is rapidly increasing

- The chemical segment dominates the market in 2024 due to its widespread application, cost-effectiveness, and proven efficacy in eliminating a broad spectrum of pathogens

Report Scope and Food and Beverages Disinfection Market Segmentation

|

Attributes |

Food and Beverages Disinfection Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Food and Beverages Disinfection Market Trends

“Increasing Adoption of Non-Thermal Disinfection Technologies”

- A significant and accelerating trend in the global food and beverages disinfection market is the increasing adoption of non-thermal disinfection technologies as alternatives to traditional heat-based methods. This shift is driven by the need to preserve the quality, nutritional value, and organoleptic properties of food and beverages while ensuring effective microbial inactivation

- Companies are focusing on implementing technologies such as Ultraviolet (UV) irradiation, ozone treatment, pulsed electric fields (PEF), and high-pressure processing (HPP). For instance, UV-C light is increasingly used for surface disinfection of packaging materials and even liquids, while ozone is effective for water treatment and disinfection of processing environments

- Non-thermal disinfection methods offer several advantages, including lower energy consumption, reduced impact on product quality, and the ability to treat heat-sensitive food and beverage products. This allows manufacturers to meet stringent safety standards while maintaining the desired characteristics of their products

- The trend towards minimal processing and the growing consumer demand for natural and fresh-like food and beverages are further driving the adoption of non-thermal disinfection technologies that can ensure safety without the need for harsh chemical treatments or high temperatures

- Consequently, research and development efforts are focusing on optimizing the efficiency and scalability of these non-thermal methods for various applications within the food and beverage industry, including the water treatment, raw materials, processing equipment, and packaging

- The demand for innovative non-thermal disinfection solutions is growing rapidly as the food and beverage industry seeks more effective, sustainable, and quality-preserving methods to ensure product safety and meet evolving consumer preferences

Food and Beverages Disinfection Market Dynamics

Driver

“Rising Concerns over Foodborne Illnesses and Stringent Regulations”

- The increasing global concerns over the prevalence of foodborne illnesses and the implementation of more stringent food safety regulations by governing bodies worldwide are significant drivers for the heightened demand for effective Food and Beverages Disinfection solutions

- For instance, outbreaks of foodborne diseases can lead to significant public health issues, economic losses, and damage to brand reputation, making the prevention of contamination a top priority for food and beverage manufacturers. Regulatory agencies are responding with stricter standards for hygiene and disinfection throughout the food supply chain

- As consumer awareness about food safety increases, there is a growing expectation for food and beverage products to be free from harmful microorganisms. This consumer demand, coupled with the potential consequences of contamination, compels manufacturers to invest in robust disinfection processes to ensure product safety and maintain consumer trust

- Furthermore, the globalization of the food supply chain has increased the risk of contamination spreading across borders, necessitating the adoption of effective disinfection practices at all stages of production, processing, and distribution to meet both domestic and international safety standards

- The implementation of Hazard Analysis and Critical Control Points (HACCP) and similar food safety management systems, which require thorough disinfection protocols, is also contributing significantly to the growth of the food and beverages disinfection market

Restraint/Challenge

“Potential Impact on Organoleptic Properties and Product Quality”

- A notable challenge in the food and beverages disinfection market is the potential for certain disinfection methods to negatively impact the organoleptic properties (such as taste, smell, color, and texture) and overall quality of the food and beverage products being treated

- For instance, while effective for microbial inactivation, high concentrations of certain chemical disinfectants can leave undesirable residues or alter the flavor profiles of beverages. Similarly, some irradiation methods, if not carefully controlled, can affect the texture or color of certain food items

- Ensuring that the chosen disinfection method is effective in eliminating pathogens without compromising the sensory attributes and market appeal of the final product is a critical concern for food and beverage manufacturers. This requires careful selection of disinfection technologies, optimization of treatment parameters, and thorough testing of product quality

- Moreover, consumer perception plays a role, as some consumers may have concerns about the use of certain disinfection methods, even if scientifically proven to be safe and effective. This necessitates transparency and clear communication from manufacturers about the disinfection processes used

- Balancing the need for effective disinfection to ensure food safety with the desire to maintain the natural taste, appearance, and nutritional value of food and beverages remains a key challenge that the industry must address through ongoing research and development of gentle yet effective disinfection technologies

Food and Beverages Disinfection Market Scope

The market is segmented on the basis of type, product type, application area, and end-use.

• By Type

On the basis of type, the food and beverages disinfection market is segmented into chemical and technology. The chemical segment is projected to dominate the market in 2024 due to its widespread application, cost-effectiveness, and proven efficacy in eliminating a broad spectrum of pathogens. Chlorine compounds, hydrogen peroxide, and peracetic acid are commonly used chemicals that offer rapid disinfection in both food and beverage facilities.

The technology segment is expected to grow at the fastest CAGR from 2025 to 2032, driven by the rising demand for non-chemical disinfection methods such as ultraviolet (UV) systems and ozone oxidation systems. These methods provide residue-free and eco-friendly alternatives, appealing to sustainability-conscious manufacturers and regulatory bodies.

• By Product Type

On the basis of product type, the market is segmented into chlorine compounds, hydrogen peroxide and peroxyacid (PAA), carboxylic acid, ultraviolet (UV) systems, and ozone oxidation systems. In 2024, chlorine compounds hold the largest market share due to their affordability, effectiveness, and established usage across various disinfection applications.

The hydrogen peroxide and PAA segment is expected to witness notable growth due to its biodegradability, low toxicity, and effectiveness across a wide microbial spectrum. In addition, UV systems and ozone oxidation systems are gaining traction for their advanced, non-chemical disinfection capabilities that align with clean-label and eco-friendly processing trends.

• By Application

On the basis of application, the market is segmented into area food packaging, food processing area, and food surface. The food processing area segment dominates the market in 2024 due to the critical need for contamination control in manufacturing environments. Effective disinfection in this segment ensures compliance with food safety standards and prolongs product shelf life.

The food surface disinfection segment is anticipated to grow at the fastest rate throughout 2032, driven by increased attention toward contact point sanitation, especially post-pandemic. The area food packaging segment also shows consistent demand due to the importance of sterile packaging environments in extending product safety and consumer trust.

• By End-Use

On the basis of end-use, the market is segmented into the food industry and beverage industry. The food industry segment holds the largest market revenue share in 2024, driven by growing global consumption of ready-to-eat meals, dairy, meat, and poultry products where hygiene and microbial control are paramount.

The beverage industry segment is projected to register the fastest CAGR from 2025 to 2032, owing to the rising demand for shelf-stable juices, dairy-based drinks, and functional beverages. These products require cleanroom-level hygiene and advanced disinfection techniques to maintain quality, safety, and compliance with health regulations.

Food and Beverages Disinfection Market Regional Analysis

- North America dominates the food and beverages disinfection market with the largest revenue share in 2024, driven by stringent food safety regulations and advanced disinfection technologies

- Consumers (food and beverage manufacturers and processors) in the region highly value the convenience, advanced disinfection features, and seamless integration offered by food and beverages disinfection in their production processes

- This widespread adoption is further supported by a strong focus on hygiene, a technologically advanced food industry, and the growing preference for contamination-free products, establishing food and beverages disinfection as a favored solution for both large and small-scale operations

U.S. Food and Beverages Disinfection Market Insight

The U.S. food and beverages disinfection market captured a significant revenue share within North America in 2024, fueled by the swift implementation of robust food safety protocols and increasing concerns about foodborne illnesses. Manufacturers are increasingly prioritizing the enhancement of product safety through effective disinfection methods. The growing preference for advanced disinfection technologies, combined with rising concerns about food safety, further propels the food and beverages disinfection industry. The market is expected to continue growing, driven by these factors.

Europe Food and Beverages Disinfection Market Insight

The European food and beverages disinfection market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by stringent regulatory frameworks and the escalating need for effective contamination control in the food supply chain. The increase in demand for organic products, coupled with innovation in non-toxic disinfection solutions, is fostering the adoption of food and beverages disinfection. European consumers and regulatory bodies prioritize food safety, leading to significant growth across various segments of the food and beverage industry.

U.K. Food and Beverages Disinfection Market Insight

The U.K. food and beverages disinfection market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by the escalating focus on hygiene standards and a desire for heightened food safety and quality. In addition, concerns regarding contamination and the spread of foodborne illnesses are encouraging both large-scale food processors and smaller businesses to adopt effective disinfection solutions. The UK’s strong regulatory environment, alongside its focus on consumer safety, is expected to continue to stimulate market growth.

Germany Food and Beverages Disinfection Market Insight

The German food and beverages disinfection market is expected to see some shifts during the forecast period, with a focus on specific types of disinfection services. There's an increasing demand for technologically advanced and eco-friendly disinfection solutions within the food and beverage sector. The well-developed food processing infrastructure, combined with an emphasis on hygiene and safety, promotes the adoption of effective food and beverages disinfection methods.

Asia-Pacific Food and Beverages Disinfection Market Insight

The Asia-Pacific food and beverages disinfection market is poised to grow at a rapid pace in 2024, driven by increasing food processing activities, a rising population demanding packaged food, and growing awareness about food safety in countries such as China, Japan, and India. The region's expanding food and beverage industry, supported by development in industrialization and advances in technology, is driving the adoption of food and beverages disinfection methods.

China Food and Beverages Disinfection Market Insight

The China food and beverages disinfection market accounted for a significant market revenue share in Asia Pacific in 2024, attributed to the country's large food and beverage processing industry, increasing urbanization leading to a higher consumption of packaged food, and high rates of industrial adoption of disinfection technologies. China stands as one of the largest markets for food and beverage production, and effective disinfection measures are becoming increasingly important for ensuring food safety and quality across various stages of the supply chain.

Food and Beverages Disinfection Market Share

The Food and Beverages Disinfection industry is primarily led by well-established companies, including:

- Evonik Industries AG (Germany)

- Neogen Chemicals Limited (India)

- SUEZ (France)

- Solvay (Belgium)

- FINK TEC GmbH (Germany)

- Advanced UV Inc. (U.S.)

- Halma plc (U.K.)

- Entaco (U.K.)

- Trojan Technologies Group ULC (Canada)

- Stepan Company (U.S.)

- TOSHIBA CORPORATION (Japan)

- Xylem (U.S.)

- Evoqua Water Technologies LLC (U.S.)

- UV-Guard Australia PTY Ltd. (Australia)

Latest Developments in Global Food and Beverages Disinfection Market

- In May 2023, Nuvonic, a global provider of UV technology solutions and a part of the Halma Group, officially launched as the first company to offer an integrated portfolio of UV-based disinfection solutions for water, surfaces, and air. The launch consolidates the expertise of Aquionics, Berson, Hanovia, and Orca, aiming to enhance contamination protection in various food and beverage processes. This move strengthens Nuvonic’s market presence in the hygiene and safety segment

- In January 2021, Neogen Corporation acquired Megazyme Ltd. (Ireland), a key provider of analytical solutions to the food and beverage industries. This strategic acquisition expands Neogen’s geographical footprint and enhances its capability to deliver advanced testing products across Ireland. The deal reinforces Neogen’s product offerings in international markets

- In November 2020, Ecolab introduced Exelerate TUFSOIL, a ready-to-use gel cleaner and degreaser designed for food and protein manufacturers. This innovative product is formulated to remove tough, burnt-on residues from fryers, ovens, racks, dryers, and similar environments, significantly improving cleaning efficiency. The launch expands Ecolab’s specialized cleaning solutions portfolio for the food processing sector

- In May 2020, Ecolab completed the acquisition of CID Lines N.V. (Belgium), a global specialist in livestock biosecurity and hygiene solutions. The acquisition marked the formation of a new animal health division, aiming to strengthen hygiene solutions in the food industry. This initiative supports Ecolab’s growth strategy in the European market

- In May 2020, the Kersia Group acquired Holchem, a Manchester-based leader in food hygiene and safety solutions in the U.K. The acquisition positions Kersia as a dominant player in the U.K. food hygiene industry and the second-largest in Europe. This move accelerates Kersia’s market expansion across Europe

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Food Beverages Disinfection Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Food Beverages Disinfection Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Food Beverages Disinfection Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.