Global Food Blender And Mixer Equipment Market

Market Size in USD Billion

CAGR :

%

USD

8.52 Billion

USD

13.70 Billion

2021

2029

USD

8.52 Billion

USD

13.70 Billion

2021

2029

| 2022 –2029 | |

| USD 8.52 Billion | |

| USD 13.70 Billion | |

|

|

|

|

Food Blender and Mixer Equipment Market Analysis and Size

The factors such as the surging growth in food and beverages processing industry along with the advancement of new and improvised technology are the major factors fostering the growth of the food blender and mixer equipment market. In addition, the people's changing lifestyle and bust schedule are other important factors acting as food blender and mixer equipment market growth determinants. Moreover, the rising consumption of bakery and dairy food products in developing countries and the advanced production facilities with automated machineries and systems are estimated to accelerate the market's overall growth. On the other hand, the rising power and energy cost is supposed to hamper the market’s growth. Moreover, the high cost associated with the usage of machine and the rising need for a large amount of capital investment might hinder the overall growth of the market.

The increasing availability of funds from the government sector for small and medium sector enterprises will further generate various profitable opportunities for the food blender and mixer equipment market. However, the limited awareness of food blenders and their benefits in some underdeveloped regions might also pose a major challenge for the market growth rate as it disrupted the production and supply within the market.

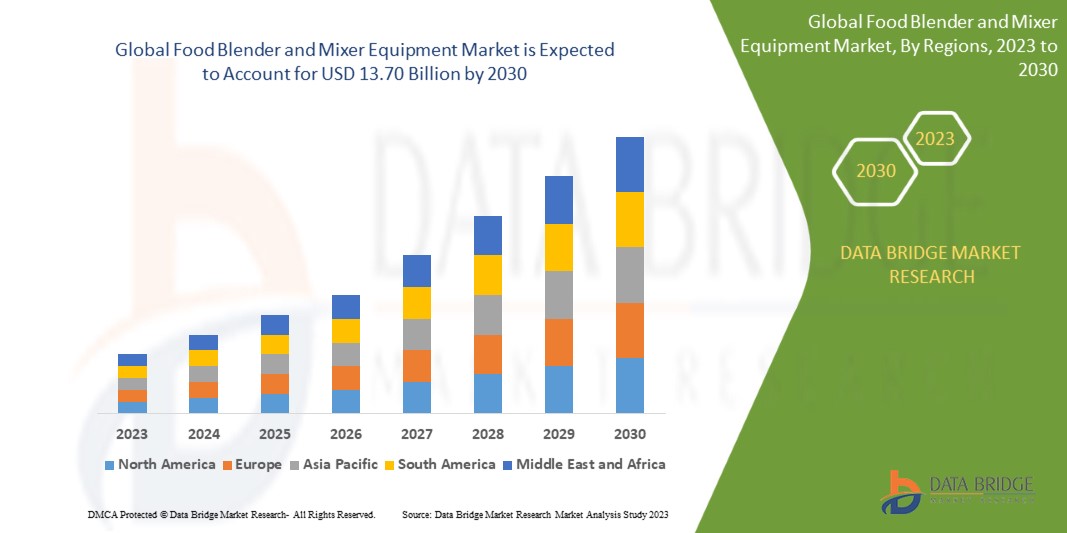

Data Bridge Market Research analyses that the food blender and mixer equipment market which was USD 8.52 billion in 2022, is likely to reach USD 13.70 billion by 2030, and is expected to undergo a CAGR of 6.12 % during the forecast period. This indicates the market value. "High Shear Mixer" dominates the type segment of the food blender and mixer equipment market due to them being widely used in food processing tasks like emulsification and particle size reduction, making them a key component of food production lines.

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand.

Report Scope and Market Segmentation

|

Report Metric |

Details |

|

Forecast Period |

2023 to 2030 |

|

Base Year |

2022 |

|

Historic Years |

2021(Customizable to 2015-2020) |

|

Quantitative Units |

Revenue in USD Billion, Volumes in Units, Pricing in USD |

|

Segments Covered |

By Type (High Shear Mixers, Shaft Mixers, Ribbon Blenders, Double Cone Blenders, Planetary Mixers, Screw Blenders and Mixers, Others), Mode of Operation (Automatic, Semi-automatic), Application (Bakery Products, Dairy Products, Beverages, Confectioneries, Other Applications), Technology (Batch, Continuous), Brand (Speedmix Dfml, Sanimix Mrma, GEA Unimix, Vitomix VX, Stein Promix, Innopro Paramix C, Contiflow, Carboflow, and Sypro B, Flex-Mix, Salomix, Tetra Almix, Albatch, Hoyer Promix, Alfast) |

|

Countries Covered |

U.S., Canada, Mexico, Germany, Sweden, Poland, Denmark, Italy, U.K., France, Spain, Netherlands, Belgium, Switzerland, Turkey, Russia, Rest of Europe, Japan, China, India, South Korea, New Zealand, Vietnam, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific, Brazil, Argentina, Rest of South America, UAE, Saudi Arabia, Oman, Qatar, Kuwait, South Africa, Rest of Middle East and Africa |

|

Market Players Covered |

GEA Group Aktiengesellschaft (Germany), Tetra Pak (Switzerland), Krones AG (Germany), SPX FLOW (United States), Sulzer Ltd (Switzerland), BühlerGroup (Switzerland), JBT (United States), KHS Group (Germany), Marel (Iceland), HOSOKAWA MICRON B.V., Hosokawa Micron Group (Netherlands), amixon GmbH (Germany), PRIMIX B.V. (Netherlands), Q-Pumps (Spain), Technosilos AP (Spain), ADMIX INC. (United States), Automated Process Equipment Corporation (United States), STK MAKINA (Turkey), Ross Process Equipment Pvt. Ltd. (India), J R Boone Ltd. (United Kingdom)

|

|

Market Opportunities |

|

Market Definition.

The food blender and mixer equipment are basically the appliances that are used to mix, grind, and blend food products in both commercial and domestic settings. The mixer basically prepares foods that require mixing and beating, while a blender on the other hand is used to combine food and other ingredients, resulting in a thick consistency that is consistent and smooth.

Food Blender and Mixer Equipment market dynamics

Drivers

- Changing Lifestyles and Dietary Preferences

The market benefits from evolving consumer lifestyles and dietary choices. As more people adopt healthier eating habits, demand for food blenders and mixers grows to prepare smoothies, health shakes, and nutritious meals conveniently.

- Foodservice Industry Growth

The burgeoning foodservice industry, including restaurants, cafes, and catering businesses, is a significant driver. These establishments rely on industrial-grade blenders and mixers for efficient food preparation, which fuels market expansion.

Opportunity

- Technological Advancements

There's an opportunity for manufacturers to develop more advanced and versatile blender and mixer equipment, incorporating features like precision control, automation, and safety enhancements to meet the evolving demands of both consumers and professional chefs.

Restraints/Challenges

Cost and Price Sensitivity

The cost of high-quality commercial-grade blender and mixer equipment can be a barrier for smaller foodservice businesses and budget-conscious consumers. Market players must address pricing concerns while maintaining quality.

Regulatory Compliance and Safety Standards

Adherence to stringent food safety regulations and certifications can be a challenge for manufacturers, adding to the cost and complexity of producing these appliances. Compliance with these standards is vital to ensure the safety of food processing equipment.

This food blender and mixer equipment market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the Food Blender and Mixer Equipment market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Global Food Blender and Mixer Equipment Market Scope

The food blender and mixer equipment market is segmented on the basis of type, mode of operation, application, technology and brand. The growth amongst these segments will help you analyse meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Type

- High Shear Mixers

- Shaft Mixers

- Ribbon Blenders

- Double Cone Blenders

- Planetary Mixers

- Screw Blenders

- Others

Operation

- Automatic

- Semi-automatic

Operations

- Semi-Automatic

- Automatic

Application

- Bakery Products

- Dairy Products

- Beverages

- Confectioneries

- Others

Technology

- Batch

- Continuous

Brand

- SpeedMix DFML

- SaniMix MRMA

- GEA UniMix

- VitoMix VX

- Stein ProMix

- InnoPro ParaMix C

- ContiFlow

- CarboFlow

- Sypro B

- Flex-Mix

- SaloMix

- Tetra AlMix

- AlBatch

- Hoyer ProMix

- AlFast

Food Blender and Mixer Equipment Market Regional Analysis/Insights

The food blender and mixer equipment market is analysed and market size insights and trends are provided by country, type, mode of operation, application, technology and brand as referenced above.

The countries covered in the food blender and mixer equipment market report are U.S., Canada, Mexico in North America, Germany, Sweden, Poland, Denmark, Italy, U.K., France, Spain, Netherlands, Belgium, Switzerland, Turkey, Russia, rest of Europe in Europe, Japan, China, India, South Korea, New Zealand, Vietnam, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, rest of Asia-Pacific (APAC) in Asia-Pacific (APAC), Brazil, Argentina, rest of South America as a part of South America, UAE, Saudi Arabia, Oman, Qatar, Kuwait, South Africa, rest of Middle East and Africa(MEA) as a part of Middle East and Africa (MEA).

Europe region is expected to dominate the food blender and mixer equipment market and will continue to flourish its trend of dominance during the forecast period owing to the increasing consumption of food products such as snacks, bakery and others within the region. Asia-Pacific, on the other hand is expected to show growth due to growing demand of food products in the region.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Rising Demand for Convenience and Time-Saving Kitchen Appliances

The food blender and mixer equipment market also provides you with detailed market analysis for every country growth in expenditure for capital equipment, installed base of different kind of products for Food Blender and Mixer Equipment market, impact of technology using life line curves and changes in regulatory scenarios and their impact on the Food Blender and Mixer Equipment market. The data is available for historic period 2010-2020.

Competitive Landscape and Food Blender and Mixer Equipment Market Share Analysis

The food blender and mixer equipment market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies focus related to Food Blender and Mixer Equipment market.

Some of the major players operating in the Food Blender and Mixer Equipment market are:

- GEA Group Aktiengesellschaft (Germany)

- Tetra Pak (Switzerland)

- Krones AG (Germany)

- SPX FLOW (United States)

- Sulzer Ltd (Switzerland)

- BühlerGroup (Switzerland)

- JBT (U.S.)

- KHS Group (Germany)

- Marel (Iceland)

- HOSOKAWA MICRON B.V., Hosokawa Micron Group (Netherlands)

- amixon GmbH (Germany)

- PRIMIX B.V. (Netherlands)

- Q-Pumps (Spain)

- Technosilos AP (Spain)

- ADMIX INC. (U.S.)

- Automated Process Equipment Corporation (U.S.)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Food Blender And Mixer Equipment Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Food Blender And Mixer Equipment Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Food Blender And Mixer Equipment Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.