Global Food Blenders And Mixers Market

Market Size in USD Billion

CAGR :

%

USD

9.71 Billion

USD

15.27 Billion

2025

2033

USD

9.71 Billion

USD

15.27 Billion

2025

2033

| 2026 –2033 | |

| USD 9.71 Billion | |

| USD 15.27 Billion | |

|

|

|

|

Food Blenders and Mixers Market Size

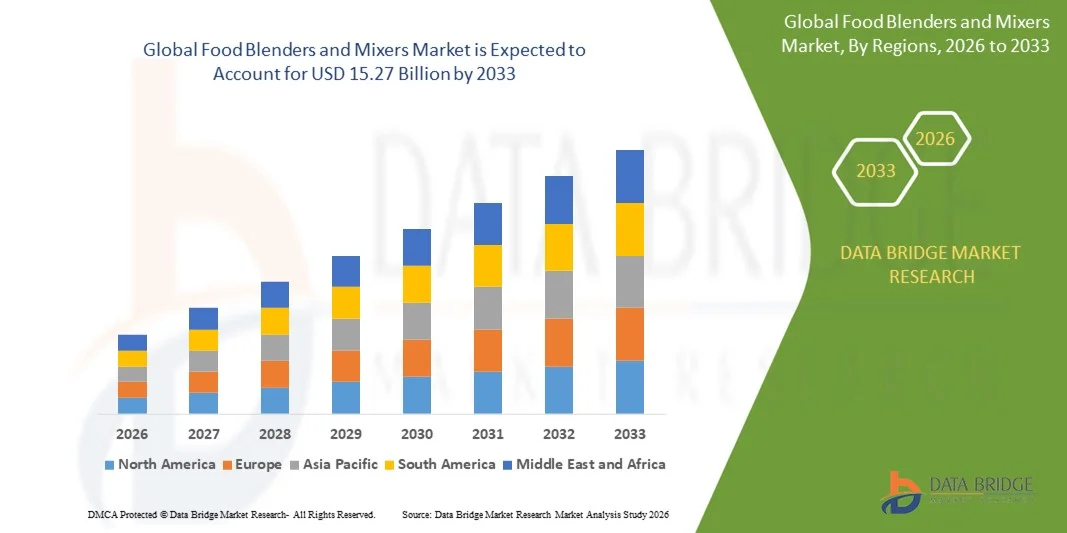

- The global food blenders and mixers market size was valued at USD 9.71 billion in 2025 and is expected to reach USD 15.27 billion by 2033, at a CAGR of 5.82% during the forecast period

- The market growth of food blenders and mixers is largely driven by the increasing demand for processed and convenience foods, rising urbanization, and growing adoption of automated and high-efficiency kitchen equipment in both residential and commercial settings

- Furthermore, rising consumer preference for multifunctional, durable, and energy-efficient blending and mixing solutions is establishing advanced blenders and mixers as essential appliances in modern kitchens and food processing facilities. These converging factors are accelerating the adoption of innovative food processing equipment, thereby significantly boosting the industry’s growth

Food Blenders and Mixers Market Analysis

- Food blenders and mixers, offering precise and uniform mixing, grinding, and blending capabilities, are becoming indispensable in residential, commercial, and industrial food preparation settings due to their ability to enhance productivity, consistency, and product quality

- The escalating demand for food blenders and mixers is primarily fueled by the growth of the packaged and ready-to-eat food sector, increasing focus on health and nutrition, and the rising trend of smart and connected kitchen appliances that provide convenience and efficiency in daily food preparation

- Asia-Pacific dominated the food blenders and mixers market with a share of 35% in 2025, due to the strong expansion of the food processing industry, rising disposable incomes, and growing demand for packaged and ready-to-eat products

- North America is expected to be the fastest growing region in the food blenders and mixers market during the forecast period due to rising demand for processed and convenience foods, technological innovation, and a well-established food manufacturing infrastructure

- Automatic segment dominated the market with a market share of 62.6% in 2025, due to rising trend of automation in food manufacturing for enhanced precision and reduced labor dependency. Automatic blenders and mixers are equipped with programmable control systems that optimize mixing parameters, ensuring repeatability and product uniformity. Their deployment is expanding across large food production plants aiming to minimize human error and improve hygiene standards. The increasing integration of sensors and smart control interfaces further strengthens the growth of this segment

Report Scope and Food Blenders and Mixers Market Segmentation

|

Attributes |

Food Blenders and Mixers Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Food Blenders and Mixers Market Trends

Rising Adoption of Multifunctional and Smart Kitchen Appliances

- The food blenders and mixers market is evolving rapidly with growing consumer interest in multifunctional and smart kitchen appliances that combine convenience, connectivity, and performance. These appliances often integrate IoT features such as app control, voice assistant compatibility, and smart sensors that adjust blending speed and duration based on ingredients, enhancing user experience and culinary precision. The trend is driven by increasing urbanization, busy lifestyles, and a growing preference for home-cooked, health-conscious meals prepared efficiently

- For instance, Philips and Ninja are leading in the smart blender segment by offering app-enabled blenders that provide recipe guidance, automated blending cycles, and remote troubleshooting. These smart appliances support meal prepping through programmable features and voice assistant integration, making them highly appealing to tech-savvy users and health-oriented consumers

- Consumers appreciate multifunctional designs, whereby a single device can perform blending, chopping, mixing, and even heating tasks, reducing the need for multiple kitchen gadgets. This versatility saves kitchen space, cuts down on cleanup time, and meets growing demand for energy-efficient and time-saving appliances

- As smart home ecosystems continue to expand, interconnectivity between kitchen appliances, smartphones, and voice assistants such as Alexa and Google Assistant is becoming standard. This enhances customer convenience and promotes seamless user control over meal preparation processes

- Energy efficiency and sustainability remain key focus areas for manufacturers introducing advanced motors and eco-conscious materials. These developments align with consumer preferences for products that combine technology with environmental responsibility, further accelerating market growth

- Overall, the market for food blenders and mixers is moving toward intelligent, multifunctional solutions that cater to evolving culinary habits and digital lifestyles. The convergence of automation, connectivity, and user personalization is reshaping how consumers perceive and utilize these appliances

Food Blenders and Mixers Market Dynamics

Driver

Growing Demand for Processed and Convenience Foods

- Rising urban populations and changing dietary habits have led to increased consumption of processed, ready-to-eat, and convenience foods. This shift drives demand for advanced blenders and mixers that can efficiently process a variety of ingredients for homemade sauces, smoothies, purees, and mixes with minimal effort and time

- For instance, Hamilton Beach and Breville have tailored their product lines to meet consumer needs for rapid food processing capabilities, emphasizing motor power, blade design, and ease of cleaning. These features support the preparation of fresh, customized convenience foods, catering to busy lifestyles and health-conscious consumers

- The increasing trend of meal prepping and functional foods consumption encourages the use of high-performance blending and mixing machines that enable users to maintain nutritional quality while streamlining kitchen workflows

- Consumers increasingly seek appliances that support diverse diets such as vegan, gluten-free, or allergen-free products, expanding the usage scenarios for food blenders and mixers in household and professional kitchens

- The expanding demand for homemade, nutritious convenience foods underlines the rising popularity of blenders and mixers as essential kitchen tools, positioning the market for sustained growth fueled by evolving food trends and consumer preferences

Restraint/Challenge

High Initial Cost of Advanced Blenders and Mixers

- The rising cost of advanced multifunctional and smart blenders and mixers remains a significant barrier to broader adoption, especially in price-sensitive markets. Enhanced features such as AI integration, digital controls, and IoT connectivity generally increase appliance prices, limiting appeal among budget-conscious consumers

- For instance, high-end brands such as Vitamix and Blendtec, which offer highly programmable and durable blenders, face challenges in expanding market penetration despite strong brand equity due to premium pricing. This restricts access to advanced technology to primarily affluent and professional segments

- Maintenance costs for smart appliances, firmware updates, and the need for occasional technical support can add to the total cost of ownership. These expenses may discourage consumers unfamiliar with digital kitchen solutions or those concerned about long-term durability

- The price disparity between basic manual mixers and sophisticated smart blenders creates a segmented market, where many consumers prefer traditional products for everyday use to avoid higher upfront costs

- Addressing cost-related challenges through product line diversification, offering entry-level smart models, financing options, and educating consumers about long-term value will be vital for market expansion. As production scales and technological adoption increases, prices are anticipated to decrease, making advanced blenders and mixers more accessible in the coming years

Food Blenders and Mixers Market Scope

The market is segmented on the basis of technology, mode of operation, application, and type.

- By Technology

On the basis of technology, the food blenders and mixers market is segmented into batch and continuous. The batch segment dominated the market with the largest revenue share in 2025, primarily due to its flexibility in handling a wide range of formulations and ingredient variations. Batch blenders and mixers are widely used in food processing plants where customization and quality control are key, such as in bakery and confectionery production. Their ability to maintain consistent quality in smaller production runs makes them highly suitable for specialized and premium food manufacturers. In addition, their ease of cleaning and maintenance further supports their dominance across multiple food processing categories.

The continuous segment is expected to witness the fastest growth rate from 2026 to 2033, driven by increasing industrial demand for automation, efficiency, and higher throughput. Continuous systems enable uniform mixing with minimal downtime and are highly preferred in large-scale beverage and dairy production lines. The growing adoption of Industry 4.0 technologies and the focus on operational efficiency have accelerated the integration of continuous mixers into automated food manufacturing systems. Their ability to reduce waste and ensure consistent product quality across extended runs contributes to their rapid expansion in industrial food processing facilities.

- By Mode of Operation

On the basis of mode of operation, the market is segmented into automatic and semi-automatic. The automatic segment dominated the market with the largest share of 62.6% in 2025, attributed to the rising trend of automation in food manufacturing for enhanced precision and reduced labor dependency. Automatic blenders and mixers are equipped with programmable control systems that optimize mixing parameters, ensuring repeatability and product uniformity. Their deployment is expanding across large food production plants aiming to minimize human error and improve hygiene standards. The increasing integration of sensors and smart control interfaces further strengthens the growth of this segment.

The semi-automatic segment is projected to record the fastest growth from 2026 to 2033, supported by demand from small and medium-scale enterprises seeking cost-effective yet efficient processing solutions. Semi-automatic mixers provide operational flexibility and are easier to maintain compared to fully automated systems, making them suitable for niche and local food producers. These systems allow controlled manual intervention, ensuring adaptability for diverse product types and formulations. Their affordability and simpler operational structure are driving their growing adoption in emerging markets where automation investments are gradually evolving.

- By Application

Based on application, the market is categorized into beverages, dairy products, bakery products, meat, poultry, fish and seafood, confectionery, and other applications. The beverages segment held the largest market revenue share in 2025, supported by high demand for efficient mixing technologies in the production of juices, smoothies, and functional drinks. Beverage manufacturers prioritize high-speed blending systems to ensure consistent texture and flavor, especially for products with emulsified or powdered ingredients. The growing consumer shift toward health-oriented beverages has further increased the need for precision mixing to maintain nutrient integrity and quality.

The bakery products segment is anticipated to grow at the fastest rate from 2026 to 2033, driven by rising consumption of baked goods and innovations in dough preparation and aeration technologies. Mixers designed for bakery applications focus on achieving ideal texture and volume, enhancing product consistency across batches. The integration of smart temperature and speed controls in modern bakery mixers supports efficient ingredient blending, even in high-capacity operations. Expanding bakery retail chains and the growing popularity of artisanal bakery items worldwide are key factors propelling this segment’s rapid growth.

- By Type

On the basis of type, the food blenders and mixers market is segmented into high shear mixer, shaft mixer, screw mixer and blender, double cone blender, ribbon blender, planetary mixer, and other types. The ribbon blender segment dominated the market in 2025, driven by its versatility and suitability for both dry and wet ingredient mixing. Ribbon blenders are preferred in large-scale food processing facilities due to their ability to handle bulk materials with uniform blending efficiency. Their energy efficiency, low maintenance requirements, and suitability for a wide range of food formulations make them a top choice across multiple food industry applications.

The high shear mixer segment is projected to register the fastest growth rate from 2026 to 2033, supported by increasing demand for precise emulsification and dispersion in complex food formulations. High shear mixers are widely used in dairy, sauces, and beverage applications where achieving a uniform and stable mixture is critical. Their advanced rotor-stator design allows for superior particle size reduction and consistent product texture. The rising focus on product innovation and high-performance processing technologies in the food industry is expected to further boost the adoption of high shear mixers in the coming years.

Food Blenders and Mixers Market Regional Analysis

- Asia-Pacific dominated the food blenders and mixers market with the largest revenue share of over 35% in 2025, driven by the strong expansion of the food processing industry, rising disposable incomes, and growing demand for packaged and ready-to-eat products

- The region’s rapid urbanization, increasing investments in modern food manufacturing facilities, and government initiatives supporting food sector innovation are further strengthening market growth

- China is the fastest-growing country in the region, supported by large-scale food exports, advanced production technologies, and continuous infrastructure development in the processing industry

China Food Blenders and Mixers Market Insight

China held the largest share in the Asia-Pacific food blenders and mixers market in 2025, owing to its robust food manufacturing base and expanding production of dairy, bakery, and beverage products. The country’s emphasis on automation, large-scale production facilities, and continuous technological adoption are driving strong demand for high-capacity blenders and mixers. Rising domestic consumption of processed foods and increasing exports of packaged products further strengthen China’s market position. Government support for food safety and industrial modernization also plays a key role in market growth.

India Food Blenders and Mixers Market Insight

India is witnessing the fastest growth in the Asia-Pacific region, fueled by the expansion of the food processing industry and growing investments in modern manufacturing infrastructure. Rapid urbanization, rising disposable incomes, and changing dietary habits are stimulating demand for bakery, beverage, and dairy products, thereby increasing the need for advanced mixing technologies. The government’s “Make in India” initiative and focus on developing agro-processing clusters are further promoting equipment adoption. Local and multinational manufacturers are expanding their footprints to meet growing consumer demand for processed and convenience foods.

Europe Food Blenders and Mixers Market Insight

The Europe food blenders and mixers market is expanding steadily, supported by stringent food safety regulations, technological innovation, and the rising adoption of energy-efficient and automated equipment. The region emphasizes high product quality, consistency, and sustainability, leading to strong demand for precision mixing solutions in bakery, dairy, and confectionery production. The increasing focus on premium and organic food products is encouraging manufacturers to invest in advanced blending systems that maintain product integrity and texture.

Germany Food Blenders and Mixers Market Insight

Germany’s market is driven by its strong engineering expertise, advanced automation capabilities, and leadership in food machinery manufacturing. The country’s focus on precision, hygiene, and efficiency has positioned it as a key hub for high-performance blending technologies. Growing demand from bakery and dairy sectors, combined with the presence of global mixer manufacturers, continues to support growth. Investments in smart factories and integration of IoT-based systems are also enhancing production efficiency and quality control.

U.K. Food Blenders and Mixers Market Insight

The U.K. market is supported by a mature food processing industry, increasing investments in automation, and rising consumer preference for premium, ready-to-eat, and health-oriented food products. Post-Brexit initiatives aimed at strengthening domestic food manufacturing and supply chain resilience are fostering demand for efficient blending solutions. Ongoing advancements in sustainable equipment design and the adoption of smart manufacturing technologies are further boosting market growth in the country.

North America Food Blenders and Mixers Market Insight

North America is projected to grow at the fastest CAGR from 2026 to 2033, driven by rising demand for processed and convenience foods, technological innovation, and a well-established food manufacturing infrastructure. The region’s strong focus on automation, energy efficiency, and product consistency is fueling the adoption of modern blenders and mixers. Increasing investment in food innovation centers and growing demand for clean-label and plant-based products are contributing to market growth.

U.S. Food Blenders and Mixers Market Insight

The U.S. accounted for the largest share in the North American market in 2025, supported by advanced production technologies, a highly developed food industry, and increasing adoption of automated mixing systems. The country’s focus on process optimization, hygiene, and innovation in food formulations is driving equipment upgrades. Strong presence of major manufacturers, extensive R&D investments, and growing consumer demand for high-quality packaged foods continue to strengthen the U.S. market position.

Food Blenders and Mixers Market Share

The food blenders and mixers industry is primarily led by well-established companies, including:

- GEA Group Aktiengesellschaft (Germany)

- Tetra Pak International SA (Switzerland)

- SPX FLOW (U.S.)

- ALFA LAVAL (Sweden)

- Marel (Iceland)

- Krones AG (Germany)

- Sulzer Ltd (Switzerland)

- Bühler AG (Switzerland)

- JBT (U.S.)

- KHS Group (Germany)

- Hosokawa Micron Group (Japan)

- amixon GmbH (Germany)

- PRIMIX B.V. (Netherlands)

- Q-Pumps (U.K.)

- Technosilos AP (France)

- ADMIX INC. (U.S.)

- Automated Process Equipment Corporation (U.S.)

- STK MAKINA (Turkey)

- Ross Process Equipment Pvt. Ltd (India)

- J R Boone Ltd. (U.K.)

Latest Developments in Global Food Blenders and Mixers Market

- In June 2024, Philips introduced a new line of eco-friendly blenders designed to meet the rising consumer demand for sustainable and energy-efficient appliances. This launch emphasizes the company’s commitment to environmental responsibility and aligns with global sustainability goals. The move is expected to strengthen Philips’ market position among environmentally conscious consumers while encouraging other manufacturers to integrate eco-friendly designs and materials into their product portfolios

- In May 2024, Alfa Laval completed the acquisition of a mixing-technology company to enhance its product portfolio and expand its footprint in the global food mixing equipment market. This acquisition allows Alfa Laval to integrate advanced mixing technologies into its existing offerings, catering to a broader range of industrial and food processing applications. The move is projected to boost the company’s competitiveness and enable it to deliver more comprehensive, high-efficiency solutions to food manufacturers worldwide

- In April 2024, KitchenAid launched a new range of energy-efficient mixers aimed at reducing power consumption and improving operational efficiency in both residential and commercial kitchens. This product innovation reflects the company’s focus on sustainability and performance optimization, addressing the increasing demand for durable, eco-conscious appliances. The launch is expected to enhance KitchenAid’s market presence and set a benchmark for sustainable equipment manufacturing within the food blenders and mixers industry

- In March 2024, Vitamix unveiled a high-performance smart blender integrated with IoT technology to provide enhanced connectivity and user control. The innovation enables remote operation and real-time performance monitoring, catering to the growing trend of smart kitchen ecosystems. This development is anticipated to expand Vitamix’s market reach among tech-savvy consumers while accelerating the adoption of intelligent blending solutions in both household and commercial segments

- In October 2023, Stovekraft launched the “Pigeon Nutri Mixer 900,” a multifunctional appliance combining blending, grinding, and juicing capabilities into a single system. This launch addresses the rising consumer preference for space-saving, versatile kitchen equipment. By offering an affordable, all-in-one solution, Stovekraft has reinforced its position in the competitive Indian market and tapped into the growing demand for multifunctional appliances among urban households

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Food Blenders And Mixers Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Food Blenders And Mixers Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Food Blenders And Mixers Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.