Global Food Color Market

Market Size in USD Billion

CAGR :

%

USD

4.06 Billion

USD

6.85 Billion

2025

2033

USD

4.06 Billion

USD

6.85 Billion

2025

2033

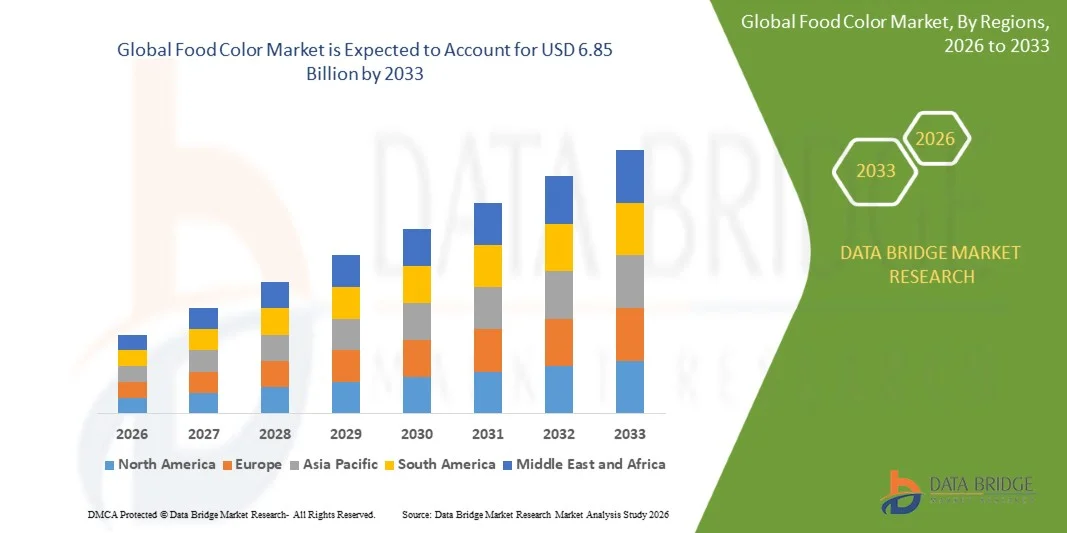

| 2026 –2033 | |

| USD 4.06 Billion | |

| USD 6.85 Billion | |

|

|

|

|

Food Color Market Size

- The global food color market size was valued at USD 4.06 billion in 2025 and is expected to reach USD 6.85 billion by 2033, at a CAGR of 6.75% during the forecast period

- The market growth is largely fueled by the rising consumer preference for natural, clean-label, and visually appealing food products, driving manufacturers to adopt innovative and stable food color solutions across food and beverage applications

- Furthermore, increasing regulatory focus on the safety and transparency of food additives is encouraging the use of natural and nature-identical colors, establishing them as essential ingredients in modern food formulation. These converging factors are accelerating the adoption of food color solutions, thereby significantly boosting the industry’s growth

Food Color Market Analysis

- Food colors, including natural, synthetic, and nature-identical options, are increasingly vital for enhancing the visual appeal, consumer acceptance, and overall quality perception of food and beverage products in both industrial and commercial settings

- The escalating demand for food colors is primarily fueled by growing health-consciousness among consumers, clean-label trends, and the need for vibrant, stable, and safe coloring solutions across bakery, confectionery, dairy, beverage, and pet food segments

- Europe dominated the food color market with a share of 32.5% in 2025, due to increasing demand for clean-label and natural colors, as well as stringent regulations on synthetic additives

- Asia-Pacific is expected to be the fastest growing region in the food color market during the forecast period due to increasing urbanization, rising disposable incomes, and growing demand for processed and packaged foods

- Powder segment dominated the market with a market share of 52.2% in 2025, due to its ease of handling, long shelf life, and cost-efficient transportation. Powdered colors allow precise dosing and are compatible with a wide range of food processes, ensuring consistent color output. Their stability under high temperatures and various processing conditions makes them ideal for industrial applications

Report Scope and Food Color Market Segmentation

|

Attributes |

Food Color Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Food Color Market Trends

“Rising Adoption of Natural and Clean‑Label Food Colors”

- A prominent trend in the food color market is the increasing shift toward natural and clean-label colors, driven by consumer preferences for healthier and safer food options. This trend is encouraging manufacturers to replace synthetic dyes with plant-derived and naturally sourced colorants to meet the rising demand for transparency and wellness-focused food products

- For instance, Givaudan and Chr. Hansen have introduced a range of natural color solutions sourced from fruits, vegetables, and spices that cater to clean-label requirements. These offerings help food and beverage manufacturers enhance product appeal while complying with consumer expectations for natural ingredients

- The adoption of natural food colors is rising across beverages, confectionery, and dairy products, where visual appeal significantly influences purchasing decisions. This is positioning natural colorants as key differentiators for brands seeking to improve shelf presence and consumer perception

- Manufacturers are increasingly leveraging advanced extraction and stabilization technologies to maintain color intensity and consistency in processed foods. This trend is driving innovation in formulation techniques to ensure natural colors withstand heat, pH changes, and storage conditions without compromising quality

- Retailers and foodservice operators are actively promoting products made with natural colors to attract health-conscious consumers. This is boosting the market for naturally derived food colorants and reinforcing the overall preference for clean-label ingredients

- The market is witnessing growing collaboration between ingredient suppliers and food manufacturers to develop customized natural color solutions that match specific product applications. This rising focus on tailored solutions is enhancing product differentiation and supporting long-term adoption of natural colors

Food Color Market Dynamics

Driver

“Growing Consumer Demand for Visually Appealing and Safe Food Products”

- The rising expectation for aesthetically attractive and safe food products is fueling the demand for food colorants that enhance visual appeal without compromising health. Consumers are increasingly scrutinizing ingredient labels, favoring products with natural and safe color sources

- For instance, Sensient Technologies offers natural and functional color solutions that improve visual appeal in confectionery, beverages, and bakery products. These solutions enable brands to deliver visually engaging products while adhering to safety standards and clean-label requirements

- Food manufacturers are investing in R&D to create vibrant color profiles using natural sources, enhancing the sensory experience and marketability of their products. This trend is motivating companies to reformulate products to replace synthetic dyes with approved natural alternatives

- The expansion of premium and health-focused food segments is driving the preference for safe and visually appealing products, where color plays a critical role in consumer acceptance. This is prompting broader adoption of natural colorants across various product categories

- Increasing global awareness of food safety regulations and nutritional transparency is intensifying the demand for clean-label and natural colorants. Manufacturers are responding by sourcing colors that align with both safety norms and aesthetic requirements, strengthening the market growth

Restraint/Challenge

“Stringent Regulatory Compliance and High Production Costs”

- The food color market faces challenges from complex regulatory frameworks that vary across regions, requiring extensive testing and approval processes for both synthetic and natural colorants. Compliance with such regulations increases development timelines and operational costs

- For instance, companies such as Kerry Group must ensure their color solutions meet FDA, EFSA, and other regional food safety standards before commercialization. These compliance requirements necessitate rigorous documentation, testing, and validation, adding to production complexity

- High costs associated with sourcing natural raw materials and maintaining consistency in color quality pose financial challenges for manufacturers. Seasonal availability and extraction inefficiencies further exacerbate production expenses and supply chain management

- Manufacturers must invest in advanced processing technologies to stabilize natural colors against heat, light, and pH variations, adding to capital expenditure. These technical requirements influence overall product pricing and limit cost flexibility for market players

- The market continues to face pressure to balance innovation, quality, and cost-effectiveness while adhering to regulatory mandates. Overcoming these challenges is essential for sustaining growth and meeting evolving consumer expectations for safe and appealing food products

Food Color Market Scope

The market is segmented on the basis of type, application, form, and solubility.

• By Type

On the basis of type, the food color market is segmented into natural, synthetic, and nature-identical. The synthetic segment dominated the market with the largest market revenue share in 2025, driven by its consistent coloring properties, cost-effectiveness, and long shelf life. Manufacturers often prefer synthetic food colors due to their ability to provide uniform intensity and stability across various food matrices. The demand is further strengthened by the scalability of synthetic colors, which supports large-scale industrial production and reduces dependency on seasonal raw materials. Their versatility in diverse food applications also contributes to their continued preference in commercial food manufacturing.

The natural segment is anticipated to witness the fastest growth rate from 2026 to 2033, fueled by increasing consumer demand for clean-label and health-conscious food products. Natural colors offer perceived health benefits and are favored in products targeting organic and premium segments. Companies such as Chr. Hansen are expanding their natural color portfolio to cater to this growing preference, enhancing product transparency and label appeal. The rising regulatory scrutiny on synthetic additives further encourages the shift toward natural alternatives.

• By Application

On the basis of application, the food color market is segmented into food products and beverages. The food products segment held the largest market revenue share in 2025 due to its extensive use in bakery items, confectionery, dairy, and processed foods. Food manufacturers prioritize vibrant and stable colors to enhance visual appeal and consumer acceptance, which directly impacts purchase decisions. The segment’s dominance is supported by innovations in multi-functional colors that improve both aesthetics and sensory perception.

The beverages segment is expected to witness the fastest CAGR from 2026 to 2033, driven by growing demand in soft drinks, juices, and functional beverages. Companies such as Sensient Colors are introducing natural and clean-label color solutions for beverages to cater to health-conscious consumers. Beverage applications benefit from liquid and water-soluble colors that blend easily, ensuring consistency and stability in final products. The expansion of the functional drinks market, including energy and fortified drinks, further supports this growth trend.

• By Form

On the basis of form, the food color market is segmented into liquid, powder, and emulsion. The powder segment dominated the market with the largest revenue share of 52.2% in 2025, due to its ease of handling, long shelf life, and cost-efficient transportation. Powdered colors allow precise dosing and are compatible with a wide range of food processes, ensuring consistent color output. Their stability under high temperatures and various processing conditions makes them ideal for industrial applications.

The liquid segment is anticipated to witness the fastest growth from 2026 to 2033, fueled by increasing use in beverages, sauces, and ready-to-eat products. Liquid colors offer superior solubility, uniform dispersion, and rapid mixing, which enhances production efficiency. Companies such as DDW Food Colors are innovating in water-soluble and oil-dispersible liquid colors to meet diverse manufacturing requirements. The convenience of integration with automated production lines also drives adoption in high-volume food processing.

• By Solubility

On the basis of solubility, the food color market is segmented into water-soluble and oil-soluble. The water-soluble segment held the largest revenue share in 2025, driven by its extensive use in beverages, dairy, and other aqueous food products. Water-soluble colors are preferred due to their ease of incorporation, uniform color distribution, and compatibility with liquid food systems. Their widespread availability and cost-effectiveness make them a staple choice for large-scale food and beverage production.

The oil-soluble segment is expected to witness the fastest growth rate from 2026 to 2033, fueled by the rising production of bakery items, confectionery, and fat-based foods. Oil-soluble colors ensure stable coloration in oils, fats, and chocolate, which is critical for maintaining product appearance and consumer appeal. Companies such as Kerry Group are expanding their oil-dispersible color offerings to cater to these specialized applications. The growing demand for premium bakery and chocolate products further accelerates the adoption of oil-soluble colors.

Food Color Market Regional Analysis

- Europe dominated the food color market with the largest revenue share of 32.5% in 2025, driven by increasing demand for clean-label and natural colors, as well as stringent regulations on synthetic additives

- Consumers in the region are highly focused on product safety, health benefits, and transparency, favoring natural and nature-identical colors in food and beverages

- This widespread adoption is further supported by high disposable incomes, sophisticated food manufacturing infrastructure, and strong demand for visually appealing products, establishing food colors as a critical component across the food industry

Germany Food Color Market Insight

The Germany food color market captured the largest share in Europe, driven by stringent food safety regulations and increasing adoption of natural and clean-label ingredients. German manufacturers are investing in high-quality, stable food colors for bakery, dairy, and beverage applications to enhance product appeal. The country’s strong focus on sustainability and innovation promotes the adoption of advanced coloring solutions. Consumer demand for visually appealing, safe, and premium food products is fostering growth across the market.

U.K. Food Color Market Insight

The U.K. food color market is expected to expand at a noteworthy CAGR during the forecast period, fueled by consumer inclination toward natural and nature-identical colors. Rising awareness of health, clean-label products, and regulatory compliance is encouraging manufacturers to adopt safer coloring alternatives. The U.K.’s strong retail and e-commerce infrastructure, along with demand for innovative, visually attractive food and beverage products, supports market growth. Companies are increasingly focusing on customized color solutions to cater to bakery, confectionery, and beverage segments.

North America Food Color Market Insight

The North America food color market is anticipated to grow steadily, driven by the demand for vibrant and safe colors across processed foods and beverages. U.S. and Canadian consumers are increasingly opting for natural and nature-identical colors, influenced by health-conscious trends and clean-label preferences. Innovations in color formulations, including water-soluble and oil-soluble variants, are enhancing adoption across food processing industries. The region’s technologically advanced food manufacturing sector supports large-scale integration of high-quality food colors.

Asia-Pacific Food Color Market Insight

The Asia-Pacific food color market is poised to grow at the fastest CAGR during the forecast period, driven by increasing urbanization, rising disposable incomes, and growing demand for processed and packaged foods. Countries such as China, India, and Japan are witnessing significant adoption of both synthetic and natural colors in bakery, confectionery, and beverage industries. Government regulations promoting food safety, coupled with expanding food processing infrastructure, are encouraging the use of standardized coloring solutions. The region’s dynamic market and evolving consumer preferences are propelling the demand for innovative and stable food colors.

China Food Color Market Insight

The China food color market accounted for the largest revenue share in Asia Pacific in 2025, attributed to the expanding middle-class population, rapid urbanization, and high consumption of processed foods and beverages. Both natural and synthetic colors are widely adopted across bakery, confectionery, and beverage products. Domestic manufacturers are investing in research and development to enhance color stability, safety, and versatility. The growing preference for premium and visually appealing products further supports market expansion.

Japan Food Color Market Insight

The Japan food color market is gaining traction due to the country’s high demand for safe, clean-label, and visually appealing food products. Consumers prefer natural and nature-identical colors, especially in confectionery, beverages, and processed foods. Technologically advanced manufacturing facilities and strict regulatory frameworks support consistent quality and stability of food colors. In addition, innovations in liquid, powder, and emulsion forms are enabling versatile application across food and beverage categories, fostering market growth.

Food Color Market Share

The food color industry is primarily led by well-established companies, including:

- DSM (Netherlands)

- BASF SE (Germany)

- ADM (U.S.)

- Cargill, Incorporated (U.S.)

- Roquette Frères (France)

- Sensient Technologies Corporation (U.S.)

- Chr. Hansen Natural Colors A/S (Denmark)

- NATUREX SA (France)

- Vinayak Ingredients India Pvt Ltd. (India)

- Kolorjet Chemicals Pvt Ltd. (India)

- Rung International (India)

- Denim Colourchem (P) Limited (India)

- Alliance Organics LLP (India)

- International Flavors & Fragrances Inc. (U.S.)

- Kerry Group (Ireland)

- Givaudan (Switzerland)

- DDW The Color House (U.S.)

- Kalsec Inc. (U.S.)

- sunfoodtech (India)

Latest Developments in Global Food Color Market

- In October 2025, ROHA Group, an India‑based food color solutions manufacturer, completed the acquisition of Tebracc, a Brazil‑based natural color producer specializing in annatto extraction and sustainable pigments. This strategic move strengthens ROHA’s global natural colors capabilities and enhances supply chain resilience, enabling broader penetration across food, beverage, nutraceutical, and pet food segments with high‑quality natural color offerings

- In November 2025, PepsiCo announced plans to reformulate several of its flagship snack and beverage products by replacing artificial dyes with natural color alternatives, beginning with reformulated versions of popular brands later this year. This initiative underscores a major shift by a global food leader toward clean‑label ingredients, which is expected to drive increased demand and adoption of natural color solutions across the industry

- In July 2025, GNT Group introduced EXBERRY Shade Vivid Orange, a new clean‑label paprika‑derived natural color that delivers a bold orange hue suitable for use in confectionery, dairy, bakery, and plant‑based meat applications. This product expansion enhances the versatility of natural food colors and supports manufacturers in meeting rising consumer expectations for vibrant, label‑friendly ingredients across diverse food categories

- In April 2023, Sensient Colors, a division of Sensient Technologies, developed Vertafine, a new natural green color for pet foods that enables pet food manufacturers to address growing consumer demand for natural colors. With bright green shades and cost‑effective performance under high‑heat processing conditions, this solution expands application options in an increasingly health‑conscious pet food market

- In December 2022, Givaudan acquired DDW, a U.S.‑based natural color company, to broaden its food color portfolio and collaborate on creating engaging, multi‑sensory food experiences. This acquisition enhances Givaudan’s capabilities in natural pigment development and positions the company to better serve global food and beverage customers seeking innovative, appealing color solutions

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Food Color Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Food Color Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Food Color Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.