Global Food Container And Kitchen Appliances Market

Market Size in USD Billion

CAGR :

%

USD

54.44 Billion

USD

114.18 Billion

2024

2032

USD

54.44 Billion

USD

114.18 Billion

2024

2032

| 2025 –2032 | |

| USD 54.44 Billion | |

| USD 114.18 Billion | |

|

|

|

|

Food Container and Kitchen Appliances Market Size

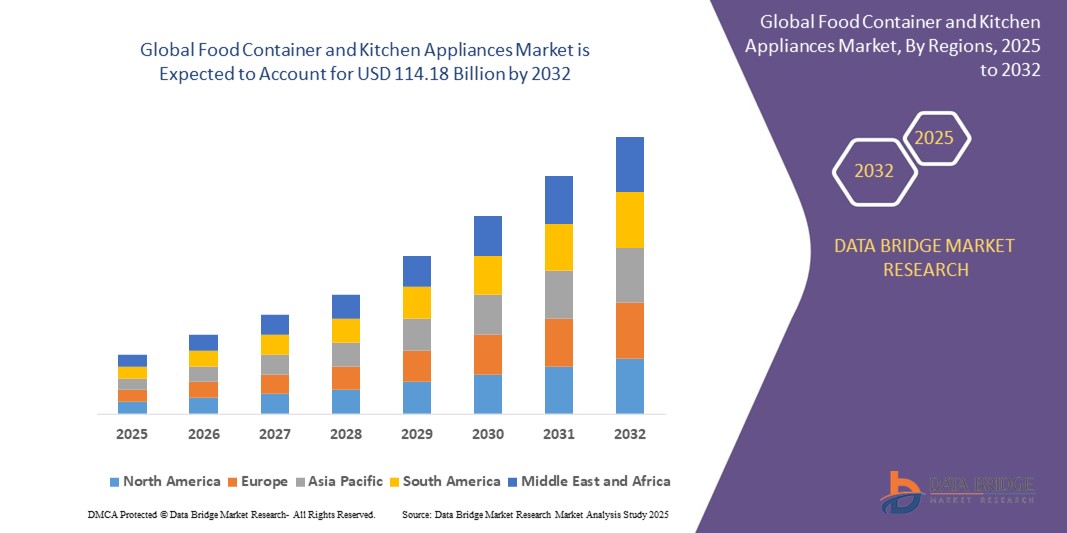

- The global food container and kitchen appliances market size was valued at USD 54.44 billion in 2024 and is expected to reach USD 114.18 billion by 2032, at a CAGR of 9.7% during the forecast period

- The market growth is driven by increasing consumer demand for convenient, sustainable, and innovative kitchen solutions, fueled by rising urbanization, changing lifestyles, and advancements in smart kitchen technologies

- The growing preference for eco-friendly and durable food storage solutions, coupled with the rising popularity of smart kitchen appliances, is positioning this market as a key segment in the FMCG industry, significantly boosting its growth

Food Container and Kitchen Appliances Market Analysis

- Food containers and kitchen appliances, encompassing cookware, storage solutions, and smart appliances, are critical components of modern households and commercial kitchens, offering enhanced convenience, sustainability, and integration with smart home ecosystems

- The escalating demand is primarily driven by increasing consumer focus on food safety, sustainability, and time-saving kitchen solutions, alongside the growing adoption of smart appliances with IoT and AI capabilities

- North America dominated the food container and kitchen appliances market with the largest revenue share of 38.5% in 2024, driven by high consumer spending, early adoption of smart kitchen technologies, and a strong presence of key industry players

- Asia-Pacific is expected to be the fastest-growing region during the forecast period due to rapid urbanization, rising disposable incomes, and increasing demand for convenient and sustainable kitchen solutions

- The Food Containers segment dominated the largest market revenue share of 34.8% in 2024, driven by the critical need for packaging in the growing processed and convenience food industries, alongside rising consumer awareness for food safety and hygiene

Report Scope and Food Container and Kitchen Appliances Market Segmentation

|

Attributes |

Food Container and Kitchen Appliances Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Food Container and Kitchen Appliances Market Trends

“Increasing Integration of Sustainable Materials and Smart Technologies”

- The global food container and kitchen appliances market is experiencing a notable trend toward the integration of sustainable materials and smart technologies

- Manufacturers are increasingly using eco-friendly materials such as biodegradable plastics, glass, and recycled metals to meet consumer demand for sustainable products

- Smart kitchen appliances, such as connected refrigerators and app-controlled cookware, are gaining traction, enabling remote monitoring, recipe suggestions, and energy efficiency

- For instance, companies are developing smart food containers with sensors to monitor freshness and alert users to expiration dates, enhancing food safety and reducing waste

- This trend is making food containers and kitchen appliances more appealing to environmentally conscious consumers and tech-savvy households

- Data analytics is also being utilized to optimize supply chains and improve product designs based on consumer usage patterns

Food Container and Kitchen Appliances Market Dynamics

Driver

“Rising Demand for Convenient and Sustainable Food Storage Solutions”

- The growing consumer preference for convenient, ready-to-eat meals and meal prepping is a key driver for the global food container and kitchen appliances market

- Food containers and kitchen appliances enhance convenience by offering features such as airtight seals, microwave-safe designs, and stackable storage solutions

- Government initiatives promoting sustainable packaging, particularly in regions such as Europe, are encouraging the adoption of eco-friendly materials in food containers

- The expansion of e-commerce and online grocery platforms, supported by improved logistics, is driving demand for durable and efficient packaging solutions for food delivery

- Manufacturers are increasingly incorporating smart features into kitchen appliances, such as Wi-Fi connectivity and voice control, to meet consumer expectations for modern, connected homes

Restraint/Challenge

“High Costs of Sustainable Materials and Data Privacy Concerns”

- The high cost of transitioning to sustainable materials, such as biodegradable plastics or high-quality glass, can be a significant barrier, particularly for manufacturers in cost-sensitive markets

- Integrating smart technologies into kitchen appliances and food containers increases production costs, which may deter adoption in emerging markets

- Data privacy concerns are a major challenge, as smart appliances collect and transmit user data, raising risks of breaches or misuse, especially with varying data protection regulations across regions

- The fragmented regulatory landscape for sustainable packaging and smart device compliance across countries complicates operations for global manufacturers

- These factors may limit market growth in regions with high cost sensitivity or stringent data privacy awareness

Food Container and Kitchen Appliances market Scope

The market is segmented on the basis of product type, material, and distribution channel.

- By Product Type

On the basis of product type, the Global Food Container and Kitchen Appliances Market is segmented into cookware, kitchen appliances, food containers, serveware, and baby/kids. The Food Containers segment dominated the largest market revenue share of 34.8% in 2024, driven by the critical need for packaging in the growing processed and convenience food industries, alongside rising consumer awareness for food safety and hygiene.

The Kitchen Appliances segment is expected to witness robust growth from 2025 to 2032. This growth is driven by increasing disposable incomes, urbanization, and the rising adoption of smart and energy-efficient kitchen appliances. The demand for modern and multi-functional appliances that offer convenience and enhanced cooking experiences is a key driver.

- By Material

On the basis of material, the Global Food Container and Kitchen Appliances Market is segmented into rigid packaging, flexible packaging, paperboard, metal, glass, and others. The Rigid Packaging segment is expected to hold the largest market revenue share, primarily due to its widespread use for durability, protection, and preservation of food products across various applications, including dairy, beverages, and ready-to-eat meals.

The Rigid Packaging segment is also anticipated to witness the fastest growth rate from 2025 to 2032, driven by continuous innovations in material science offering enhanced barrier properties and sustainability features, alongside increasing demand for longer shelf life and improved product safety.

- By Distribution Channel

On the basis of distribution channel, the Global Food Container and Kitchen Appliances Market is segmented into store-based retailers and e-commerce. The Store-Based Retailers segment is expected to hold the largest market revenue share, attributed to consumers' preference for physical inspection of products, immediate purchase, and personalized assistance, especially for larger kitchen appliances.

The E-commerce segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by the rising trend of online shopping, increased internet penetration, convenient home delivery options, and the wide array of products available on digital platforms, making it easier for consumers to compare and purchase.

Food Container and Kitchen Appliances Market Regional Analysis

- North America dominated the food container and kitchen appliances market with the largest revenue share of 38.5% in 2024, driven by high consumer spending, early adoption of smart kitchen technologies, and a strong presence of key industry players

- Consumers prioritize food containers and kitchen appliances for enhancing food storage, reducing waste, and improving meal preparation efficiency, particularly in regions with diverse culinary preferences

- Growth is supported by advancements in material technology, such as eco-friendly and smart appliances, alongside rising adoption in both household and commercial segments

U.S. Food Container and Kitchen Appliances Market Insight

The U.S. food container and kitchen appliances market captured the largest revenue share of 83.2% in 2024 within North America, fueled by strong demand for innovative kitchen solutions and growing consumer awareness of food safety and sustainability benefits. The trend towards smart home integration and increasing regulations promoting eco-friendly materials further boost market expansion. Manufacturers’ growing incorporation of advanced appliances and containers complements aftermarket sales, creating a diverse product ecosystem.

Europe Food Container and Kitchen Appliances Market Insight

The Europe food container and kitchen appliances market is expected to witness significant growth, supported by regulatory emphasis on sustainability and food safety. Consumers seek products that enhance food preservation and streamline cooking processes. The growth is prominent in both new household purchases and commercial applications, with countries such as Germany and France showing significant uptake due to rising environmental concerns and urban lifestyles.

U.K. Food Container and Kitchen Appliances Market Insight

The U.K. market for food containers and kitchen appliances is expected to witness rapid growth, driven by demand for convenient meal preparation and food storage solutions in urban and suburban settings. Increased interest in kitchen aesthetics and rising awareness of sustainable materials encourage adoption. Evolving regulations on plastic use influence consumer choices, balancing functionality with compliance.

Germany Food Container and Kitchen Appliances Market Insight

Germany is expected to witness rapid growth in the food container and kitchen appliances market, attributed to its advanced manufacturing sector and high consumer focus on convenience and energy efficiency. German consumers prefer technologically advanced appliances and eco-friendly containers that reduce waste and enhance food safety. The integration of these products in premium households and commercial settings supports sustained market growth.

Asia-Pacific Food Container and Kitchen Appliances Market Insight

The Asia-Pacific region is expected to witness the fastest growth rate, driven by expanding consumer markets and rising disposable incomes in countries such as China, India, and Japan. Increasing awareness of food safety, convenience, and kitchen aesthetics is boosting demand. Government initiatives promoting energy efficiency and sustainable materials further encourage the use of advanced food containers and kitchen appliances.

Japan Food Container and Kitchen Appliances Market Insight

Japan’s food container and kitchen appliances market is expected to witness rapid growth due to strong consumer preference for high-quality, technologically advanced products that enhance cooking efficiency and food preservation. The presence of major manufacturers and integration of smart appliances in households accelerate market penetration. Rising interest in aftermarket customization also contributes to growth.

China Food Container and Kitchen Appliances Market Insight

China holds the largest share of the Asia-Pacific food container and kitchen appliances market, propelled by rapid urbanization, rising household numbers, and increasing demand for convenient and sustainable kitchen solutions. The country’s growing middle class and focus on modern lifestyles support the adoption of advanced products. Strong domestic manufacturing capabilities and competitive pricing enhance market accessibility.

Food Container and Kitchen Appliances Market Share

The food container and kitchen appliances industry is primarily led by well-established companies, including:

- LG Electronics (South Korea)

- SAMSUNG (South Korea)

- Koninklijke Philips N.V. (Netherlands)

- AB Electrolux (Sweden)

- Whirlpool (U.S.)

- BALL CORPORATION (U.S.)

- Greif (U.S.)

- Evergreen Packaging LLC (U.S.)

- Crown (U.S.)

- Havells India Ltd. (India)

- Pactiv LLC (U.S.)

- Berry Global Inc. (U.S.)

- Amcor plc (Switzerland)

- PLASTIPAK HOLDINGS, INC. (U.S.)

- Plus Pack AS (Denmark)

- Lacerta Group, Inc. (U.S.)

- Ampak Inc. (Canada)

- Novolex (U.S.)

- O-I Glass, Inc. (U.S.)

What are the Recent Developments in Global Food Container and Kitchen Appliances Market?

- In July 2025, Huhtamaki, a global leader in sustainable food packaging, launched a new line of compostable ice cream cups designed for both home and industrial composting, as well as recyclability. Made from certified paperboard with a bio-based barrier coating, the cups contain less than 10% plastic and mark a shift from fossil-based to bio-based materials. This innovation reflects Huhtamaki’s commitment to reducing environmental impact while maintaining product quality and performance. The launch expands its ice cream packaging portfolio and aligns with growing consumer and industry demand for eco-friendly food containers

- In March 2025, Samsung Electronics Co., Ltd. revealed plans to debut its first Air to Water Heat Pump lineup for North American homes at CES 2025. The system includes Slim Fit EHS ClimateHub indoor units—available in Mono and Hydro variants—and the EHS Mono R32 HT Quiet outdoor unit, engineered for ultra-low noise and high efficiency. Featuring AI Home integration, these units offer intuitive control, energy monitoring, and compatibility with SmartThings-connected devices. This launch marks Samsung’s strategic entry into the North American heating market, delivering compact, high-performance solutions tailored for modern households

- In July 2024, BSH Hausgeräte GmbH, Europe’s leading home appliance manufacturer, inaugurated its first refrigeration factory in Monterrey, Mexico, marking a strategic milestone in its North American expansion. The facility, located in Nuevo León, produces French Door Bottom Mount refrigerators under the Bosch and Thermador brands, tailored to meet the preferences of U.S. and Canadian consumers. Designed for scalability, the plant features state-of-the-art production technologies, carbon-neutral operations, and photovoltaic energy systems. With an investment of €220 million, BSH aims to create 1,500 skilled jobs, reinforcing its commitment to innovation and sustainability in the premium appliance segment

- In May 2024, Thermomix® introduced the Thermomix® Sensor, a smart thermometer designed to elevate precision cooking beyond the TM6 mixing bowl. Equipped with dual sensors, it measures both core food temperature (up to 212°F) and ambient oven temperature (up to 527°F), making it ideal for baking, grilling, and roasting. The Sensor connects via Bluetooth® to the TM6 and the Cooking Center mobile app, enabling real-time monitoring and guided cooking. This innovation ensures perfect doneness for cakes, bread, meat, and fish—turning guesswork into guaranteed results for home chefs

- In February 2023, Electrolux expanded its footprint in India by launching a premium range of built-in kitchen appliances, including microwaves, ovens, hobs, cooker hoods, dishwashers, and a fully automatic coffee machine. The lineup features the UltimateTaste and UltimateCare series, designed with Scandinavian aesthetics and smart functionality. Key highlights include Eco programs for water and energy conservation, pre-set meal settings, and steam-cooking modes that preserve nutrients and flavor. With options such as Airfry, SenseFry, and Hob2Hood automation, Electrolux aims to simplify sustainable cooking and elevate the home chef experience in modern Indian kitchens

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.