Global Food Deaerators For Beverages Application Market

Market Size in USD Billion

CAGR :

%

USD

1.58 Billion

USD

2.44 Billion

2025

2033

USD

1.58 Billion

USD

2.44 Billion

2025

2033

| 2026 –2033 | |

| USD 1.58 Billion | |

| USD 2.44 Billion | |

|

|

|

|

Global Food Deaerators for Beverages Application Market Size

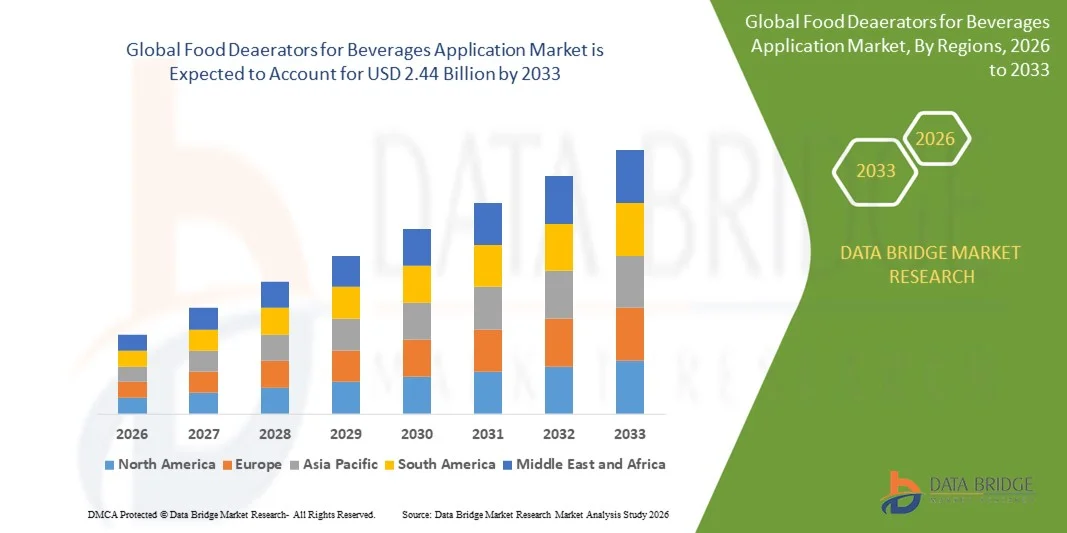

- The global Food Deaerators for Beverages Application Market size was valued at USD 1.58 billion in 2025 and is expected to reach USD 2.44 billion by 2033, at a CAGR of 5.60% during the forecast period.

- The market growth is primarily driven by increasing demand for high-quality, shelf-stable beverages, coupled with advancements in deaeration technologies that enhance flavor, texture, and preservation.

- Moreover, rising consumer preference for natural and preservative-free beverages is encouraging manufacturers to adopt efficient deaeration solutions, thereby boosting production efficiency and product quality. These factors collectively are fueling the widespread adoption of food deaerators across the beverage industry, significantly accelerating market expansion.

Global Food Deaerators for Beverages Application Market Analysis

- Food deaerators, used to remove dissolved gases from liquids in beverage production, are increasingly essential in modern beverage manufacturing processes due to their ability to enhance product stability, preserve flavor, and extend shelf life across both carbonated and non-carbonated drinks.

- The rising demand for food deaerators is primarily driven by growing consumer preference for high-quality, preservative-free beverages, coupled with advancements in deaeration technology that improve production efficiency and consistency.

- North America dominated the Global Food Deaerators for Beverages Application Market with the largest revenue share of 35.6% in 2025, supported by a strong beverage manufacturing industry, high adoption of advanced processing technologies, and the presence of leading market players investing in innovative deaeration solutions for both large-scale and craft beverage producers.

- Asia-Pacific is expected to be the fastest-growing region in the Global Food Deaerators for Beverages Application Market during the forecast period due to rising urbanization, growing disposable incomes, and increasing demand for packaged and processed beverages in emerging economies such as China and India.

- The spray deaerators segment dominated the market with the largest revenue share of 41.8% in 2025, driven by their high efficiency in removing dissolved oxygen from carbonated and non-carbonated beverages.

Report Scope and Global Food Deaerators for Beverages Application Market Segmentation

|

Attributes |

Food Deaerators for Beverages Application Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Global Food Deaerators for Beverages Application Market Trends

Enhanced Efficiency Through Automation and Smart Processing

- A significant and accelerating trend in the global Food Deaerators for Beverages Application Market is the growing integration of automated control systems and smart processing technologies, enabling precise removal of dissolved gases and optimization of beverage quality.

- For instance, advanced deaerators from GEA and SPX Flow feature automated control panels that monitor oxygen levels and adjust processing parameters in real time, ensuring consistent flavor and extended shelf life. Similarly, Alfa Laval’s deaeration systems incorporate smart sensors to optimize gas removal for different beverage types, reducing wastage and improving efficiency.

- Automation in deaerators allows features such as real-time monitoring of dissolved oxygen, predictive maintenance alerts, and optimized flow rates for varying beverage formulations. Some systems, like the JBT Avapure deaerators, can adjust processing based on continuous feedback, ensuring beverages meet stringent quality standards while minimizing energy consumption.

- The seamless integration of deaerators with broader production line management systems facilitates centralized control over multiple stages of beverage production. Through a single interface, manufacturers can manage deaeration alongside mixing, carbonation, and pasteurization processes, creating a unified and highly efficient production workflow.

- This trend towards more intelligent, automated, and interconnected deaeration solutions is fundamentally reshaping expectations for beverage quality and manufacturing efficiency. Consequently, companies such as SPX Flow and GEA are developing smart deaeration systems with AI-enabled predictive maintenance, process optimization, and real-time quality monitoring.

- The demand for food deaerators with advanced automation and smart processing capabilities is growing rapidly across both large-scale and craft beverage manufacturers, as the industry increasingly prioritizes product quality, operational efficiency, and cost-effective production.

Global Food Deaerators for Beverages Application Market Dynamics

Driver

Growing Need Due to Rising Demand for High-Quality and Preservative-Free Beverages

- The increasing consumer preference for high-quality, preservative-free, and shelf-stable beverages, coupled with the growing demand for efficient and consistent beverage production, is a significant driver for the heightened adoption of food deaerators.

- For instance, in 2025, GEA Group introduced advanced deaeration systems equipped with real-time oxygen monitoring and automation features, allowing beverage manufacturers to maintain consistent quality while reducing waste. Such innovations by key players are expected to drive market growth during the forecast period.

- As manufacturers strive to meet stringent quality and regulatory standards, food deaerators offer advanced capabilities such as precise gas removal, improved flavor retention, and extended shelf life, providing a critical upgrade over traditional or manual deaeration methods.

- Furthermore, the rising adoption of automated and integrated beverage production lines is making food deaerators an essential component of modern manufacturing systems, enabling seamless integration with mixing, carbonation, and pasteurization processes.

- The operational efficiency, reduced oxygen-related spoilage, and improved product consistency offered by food deaerators are key factors propelling their adoption across both large-scale and craft beverage producers. Increasing awareness of the benefits of advanced deaeration technology further supports market growth.

Restraint/Challenge

High Initial Investment and Maintenance Complexity

- The relatively high initial cost of advanced food deaeration systems poses a significant challenge to broader market penetration, particularly for small-scale beverage producers or startups.

- For instance, premium deaerators with automated controls, real-time monitoring, and AI-enabled process optimization can require substantial capital investment, which may deter price-sensitive manufacturers from adoption.

- Additionally, complex maintenance requirements, need for skilled operators, and periodic calibration of sensors and control systems can increase operational costs and present barriers to smaller or resource-constrained producers.

- While more compact and cost-effective deaerators are entering the market, premium systems with advanced features such as integrated automation, predictive maintenance, or multi-beverage compatibility still come at a higher price point.

- Overcoming these challenges through the development of more affordable, user-friendly systems, operator training programs, and scalable solutions suitable for both small and large producers will be vital for sustained market growth.

Global Food Deaerators for Beverages Application Market Scope

Food deaerators for beverages application market is segmented on the basis of type, end use and function.

- By Type

On the basis of type, the food deaerators for beverages market is segmented into spray deaerators, tray deaerators, and cold water deaerators. The spray deaerators segment dominated the market with the largest revenue share of 41.8% in 2025, driven by their high efficiency in removing dissolved oxygen from carbonated and non-carbonated beverages. Spray deaerators are widely adopted due to their ability to ensure uniform deaeration, improve product shelf life, and maintain beverage flavor stability. Their compact design and compatibility with automated production lines further enhance their preference among manufacturers.

Tray deaerators are expected to witness the fastest CAGR from 2026 to 2033, fueled by rising adoption in small to medium-scale beverage facilities. They offer operational flexibility, easier maintenance, and suitability for specialty beverages such as craft juices and artisanal drinks, supporting manufacturers in maintaining consistent quality while minimizing oxygen-related spoilage.

- By End Use

On the basis of end use, the market is segmented into fruit juices, dairy, alcoholic beverages, sports drinks, and non-carbonated artificial beverages. The fruit juice segment dominated the market with a revenue share of 38.5% in 2025, owing to the high sensitivity of natural juices to oxygen exposure, which can affect color, taste, and nutritional value. Beverage manufacturers rely heavily on deaeration systems to extend shelf life and maintain product freshness.

The sports drinks segment is expected to witness the fastest CAGR from 2026 to 2033 due to the growing global demand for functional beverages, energy drinks, and ready-to-drink hydration products. The need for longer storage life, consistent flavor, and oxygen-free formulations in sports drinks is driving the adoption of advanced deaerators in both large-scale and emerging production facilities worldwide.

- By Function

On the basis of function, the market is segmented into oxygen removal, water heating, aroma and flavor retention, and others. The oxygen removal segment dominated the market with a revenue share of 45.2% in 2025, as removing dissolved oxygen is critical for preventing oxidation, microbial growth, and flavor degradation in beverages. Manufacturers prioritize oxygen removal to ensure product stability, safety, and extended shelf life.

The aroma and flavor retention segment is expected to witness the fastest CAGR from 2026 to 2033, driven by increasing consumer preference for fresh-tasting, high-quality beverages. Advanced deaeration technologies that preserve volatile compounds, natural aromas, and flavor profiles are becoming essential in fruit juices, dairy-based drinks, and craft beverages, fueling investments in specialized deaerators that maintain both product quality and sensory appeal.

Global Food Deaerators for Beverages Application Market Regional Analysis

- North America dominated the Global Food Deaerators for Beverages Application Market with the largest revenue share of 35.6% in 2025, driven by the well-established beverage industry, advanced manufacturing infrastructure, and high adoption of modern processing technologies.

- Beverage manufacturers in the region prioritize high-quality, oxygen-free products to maintain flavor, extend shelf life, and ensure consistent quality across carbonated and non-carbonated drinks.

- This widespread adoption is further supported by the presence of major equipment manufacturers, high investment in automation, and stringent quality standards, establishing food deaerators as a critical solution in beverage production for both large-scale and craft beverage facilities.

U.S. Food Deaerators Market Insight

The U.S. food deaerators market captured the largest revenue share of 81% in 2025 within North America, driven by the country’s advanced beverage processing infrastructure and strong demand for high-quality, oxygen-free beverages. Manufacturers increasingly adopt deaeration systems to enhance flavor stability, extend product shelf life, and comply with stringent food safety standards. The rapid growth of ready-to-drink beverages, premium juices, functional drinks, and dairy-based formulations further fuels demand. Additionally, the widespread integration of automated processing lines and rising investment in modern filling and packaging systems continue to support the expansion of deaerator installations across large-scale beverage plants and craft processing facilities.

Europe Food Deaerators Market Insight

The Europe food deaerators market is projected to expand at a substantial CAGR throughout the forecast period, driven by strict quality and safety regulations as well as increasing demand for premium, natural, and clean-label beverages. Urbanization and increasing consumption of processed beverages are promoting the adoption of advanced deaeration technologies. European beverage producers emphasize consistency, flavor retention, and oxygen-free formulations, making deaerators vital across juice, dairy, beer, and sports drink applications. The region is experiencing rising installations in both new processing facilities and modernization projects, especially in Northern and Western Europe where automation adoption is high.

U.K. Food Deaerators Market Insight

The U.K. food deaerators market is anticipated to grow at a noteworthy CAGR during the forecast period, supported by the rising demand for premium fruit juices, fortified beverages, and dairy-based drinks. Growing awareness of oxygen-related spoilage and quality degradation is encouraging beverage manufacturers to adopt reliable deaeration systems. Additionally, the U.K.’s expanding craft beverage industry—including artisanal juices, kombucha, and low-alcohol drinks—is strengthening the need for efficient oxygen removal technologies. Strong technological infrastructure and a shift toward high-efficiency processing equipment are expected to further drive market expansion.

Germany Food Deaerators Market Insight

The Germany food deaerators market is expected to expand at a considerable CAGR, fueled by the country’s emphasis on precision engineering, high beverage quality standards, and demand for technologically advanced processing solutions. German manufacturers prioritize sustainable production, driving interest in energy-efficient deaerators integrated with heat recovery and automated controls. The country’s strong beer, dairy, and juice industries increasingly rely on deaeration to maintain flavor, purity, and long shelf life. Adoption is further supported by widespread use of automated processing lines and stringent consumer expectations for freshness and consistency.

Asia-Pacific Food Deaerators Market Insight

The Asia-Pacific food deaerators market is poised to grow at the fastest CAGR of 24% during 2026–2033, driven by rising urbanization, expanding beverage production capacities, and increasing disposable incomes in China, Japan, India, and Southeast Asia. Demand for packaged juices, functional drinks, dairy beverages, and flavored drinks is rapidly increasing, encouraging manufacturers to invest in modern deaeration technology. Government initiatives supporting industrial automation and food processing modernization are further accelerating regional adoption. As APAC becomes a major manufacturing hub for beverage processing equipment, the affordability and availability of advanced deaerators continue to improve.

Japan Food Deaerators Market Insight

The Japan food deaerators market is gaining momentum due to the country’s strong focus on quality, hygiene, and technologically sophisticated manufacturing processes. Growing demand for premium beverages such as high-purity juices, dairy-based drinks, teas, and nutritional beverages is driving adoption. The integration of deaeration systems with IoT-enabled monitoring and automated control is expanding across processing facilities. Additionally, Japan’s aging population is increasing demand for fortified and functional drinks, further supporting the use of advanced deaeration technology to maintain flavor integrity and product safety.

China Food Deaerators Market Insight

The China food deaerators market accounted for the largest market revenue share in Asia-Pacific in 2025, supported by rapid urbanization, increased consumption of packaged beverages, and strong domestic manufacturing capabilities. China is one of the world’s largest markets for juice, dairy drinks, and functional beverages, all of which require efficient oxygen removal for stability and shelf life extension. The nation’s push toward smart factories and automation, along with the availability of competitively priced, locally produced deaeration equipment, is driving adoption across both large-scale beverage plants and emerging regional producers.

Global Food Deaerators for Beverages Application Market Share

The Food Deaerators for Beverages Application industry is primarily led by well-established companies, including:

• GEA Group (Germany)

• SPX FLOW (U.S.)

• Tetra Pak (Sweden)

• Alfa Laval (Sweden)

• JBT Corporation (U.S.)

• Bucher Unipektin (Switzerland)

• Krones AG (Germany)

• CFT Group (Italy)

• Fenco Food Machinery (Italy)

• Feldmeier Equipment (U.S.)

• Pentair (U.S.)

• HRS Heat Exchangers (U.K.)

• Aroma Tech (France)

• Marel (Iceland)

• Statco-DSI (U.S.)

• Andritz (Austria)

• Ishigaki Co. Ltd. (Japan)

• SEPPE (China)

• Shanghai Precise Packaging Machinery (China)

• SPX Seital (Italy)

What are the Recent Developments in Global Food Deaerators for Beverages Application Market?

- In April 2024, GEA Group, a global leader in food and beverage processing technologies, launched an upgraded high-efficiency spray deaeration system designed to enhance oxygen removal in fruit juices, dairy beverages, and functional drinks. This development reflects GEA’s commitment to providing advanced, energy-efficient solutions tailored to the evolving needs of modern beverage manufacturers. By leveraging its engineering expertise and innovative technology portfolio, GEA is strengthening its position in the rapidly expanding Global Food Deaerators for Beverages Application Market.

- In March 2024, SPX FLOW introduced its next-generation tray deaerator system engineered for improved operational flexibility and reduced energy consumption. Designed specifically for medium and large-scale beverage facilities, the new system enhances product consistency and shelf-life stability across juice, sports drink, and non-carbonated beverage applications. This advancement underscores SPX FLOW’s dedication to delivering high-performance processing equipment that supports the growing demand for premium-quality beverages.

- In March 2024, Tetra Pak implemented an advanced deaeration module as part of a turnkey beverage processing line for a major Asia-Pacific juice manufacturer. The system integrates real-time oxygen monitoring and automated control technology to improve product quality and reduce oxidation-related losses. This deployment highlights Tetra Pak’s continued investment in smart, sustainable processing solutions and its crucial role in helping beverage producers meet rising quality standards and consumer expectations.

- In February 2024, Alfa Laval announced a strategic collaboration with a leading European dairy producer to supply cutting-edge cold water deaeration units aimed at improving flavor retention and minimizing foaming during production. The partnership enhances production efficiency and aligns with the industry’s shift toward high-purity, oxygen-free dairy beverages. Alfa Laval’s initiative reinforces its commitment to innovation and operational excellence within the global beverage processing sector.

- In January 2024, JBT Corporation unveiled its newly developed aroma and flavor retention deaerator at the International Production & Processing Expo (IPPE) 2024. Equipped with advanced vacuum control and heat-optimized design, the system is engineered to preserve delicate aromas in premium juices and botanical beverages. This innovation highlights JBT’s focus on delivering specialized processing technologies that enhance beverage quality, offering producers improved control while maintaining product integrity and sensory appeal.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Food Deaerators For Beverages Application Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Food Deaerators For Beverages Application Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Food Deaerators For Beverages Application Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.