Global Food Deaerators Market

Market Size in USD Million

CAGR :

%

USD

348.00 Million

USD

603.09 Million

2024

2032

USD

348.00 Million

USD

603.09 Million

2024

2032

| 2025 –2032 | |

| USD 348.00 Million | |

| USD 603.09 Million | |

|

|

|

|

Food deaerators Market Size

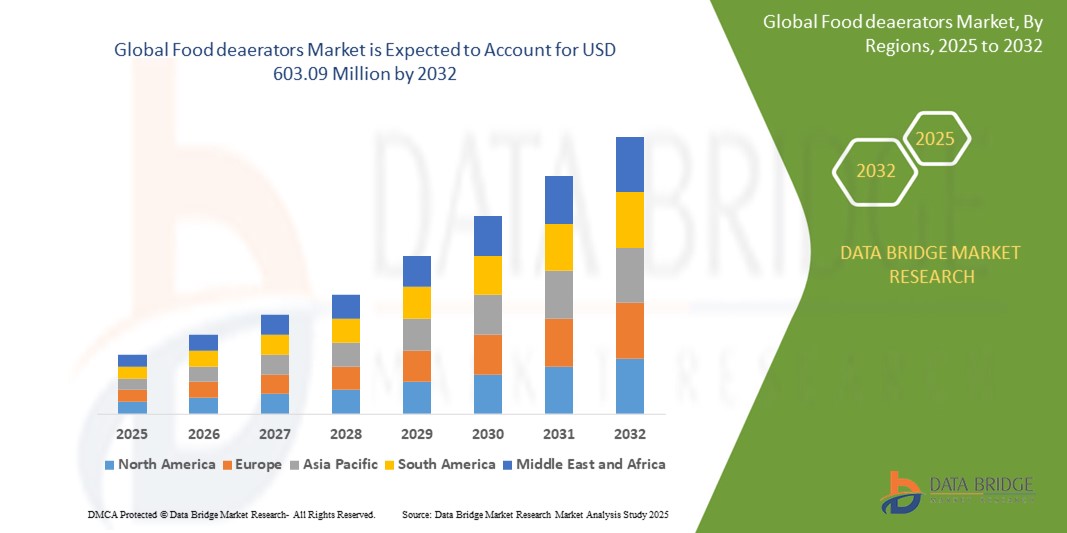

- The Global Food Deaerators Market size was valued at USD 348.00 Million in 2024 and is expected to reach USD 603.09 Million by 2032, at a CAGR of6.3% during the forecast period

- This growth is driven by factors such as increase in demand for processed food across the globe

Food deaerators Market Analysis

- Food Deaerators are the type of devices that are used for the elimination of any oxygen and other dissolved gases and air from food and beverages, so that the fermentation and spoilage of food and beverages can be deferred for a period of time

- The major growing factor towards food deaerators market is the significant growth in the increasing food and beverage industry has boosted demand for food deaerators to lessen side-effects of high levels of dissolved oxygen in foods and beverages

- North America is expected to dominate the food deaerators market due to advanced food processing infrastructure, high consumption of packaged beverages, and strong regulatory standards for food quality

- Asia-Pacific is expected to be the fastest growing region in the food deaerators market during the forecast period due to rapid industrialization of food and beverage processing and rising consumption of packaged drinks

- The vacuum type segment is expected to dominate the market with a market share of 42.6% due to its effectiveness in removing dissolved oxygen, which is crucial for maintaining the quality and shelf life of sensitive food and beverages like juices and dairy products.

Report Scope and Food deaerators Market Segmentation

|

Attributes |

Food deaerators Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Food deaerators Market Trends

“Integration of Vacuum Technology for Enhanced Product Stability”

- One prominent trend in the Food Deaerators market is the integration of advanced vacuum and spray-type deaeration systems to improve the shelf life and stability of liquid food products.

- Manufacturers are increasingly investing in automated systems that allow precise control of dissolved oxygen levels, which is critical in maintaining color, flavor, and nutrient integrity—especially in juices, dairy-based drinks, and sauces

- For instance, GEA Group has introduced vacuum deaerators equipped with inline oxygen measurement and digital control to ensure consistent product quality.

- The shift toward high-speed, hygienic, and energy-efficient deaeration systems is also contributing to their adoption in large-scale beverage and dairy production facilities

Food deaerators Market Dynamics

Driver

“Rising Consumption of Functional and Packaged Beverages”

- The global surge in consumption of packaged beverages—including functional drinks, flavored water, and RTD (ready-to-drink) teas—has significantly increased the demand for deaerators in beverage manufacturing lines.

- These beverages require precise oxygen removal to prevent oxidation, ensure microbiological safety, and maintain sensory characteristics

For instance,

- According to the International Food & Beverage Alliance (2023), functional beverages saw a significant year-over-year growth globally, driving the demand for advanced food processing equipment.

- Consequently, food deaerators play a critical role in ensuring product consistency, leading to higher adoption among manufacturers focused on premium quality beverage offerings

Opportunity

“Expansion of Clean Label and Non-Thermal Processing Applications”

- The growing consumer preference for clean label products with minimal preservatives has spurred demand for non-thermal processing methods such as vacuum deaeration.

- These methods help maintain product integrity without relying on heat-based pasteurization, offering a cleaner formulation path for beverages, soups, and plant-based milks

For instance,

- A leading U.S. organic juice brand adopted low-oxygen processing using spray deaerators to extend shelf life naturally while meeting clean label requirements.

- This trend presents opportunities for equipment manufacturers to design systems compatible with high-viscosity and natural ingredient formulations, especially in the organic and wellness product segments.

Restraint/Challenge

“High Initial Investment and Customization Requirements”

- Food deaerators often require significant upfront capital expenditure and complex integration into existing processing lines, especially in small and mid-sized production facilities.

- The equipment needs to be customized based on viscosity, flow rate, and product formulation—adding to lead times and installation costs

For instance,

- A fruit concentrate processor in Asia reported delays in scaling operations due to the need for specialized deaerators compatible with pulp-heavy formulations

- These financial and operational barriers may limit adoption in emerging markets or among artisanal producers lacking the resources for industrial-grade equipment

Food deaerators Market Scope

The market is segmented on the basis of type, function, and application.

|

Segmentation |

Sub-Segmentation |

|

By Type |

|

|

By Function |

|

|

By Application |

|

In 2025, the vacuum type segment is projected to dominate the market with a largest share in type segment

The vacuum type segment is expected to dominate the food deaerators market with the largest share of 42.6% in 2025 due to its effectiveness in removing dissolved oxygen, which is crucial for maintaining the quality and shelf life of sensitive food and beverages like juices and dairy products. It ensures minimal oxidation and preserves flavor and color.

The spray-type segment is expected to account for the highest CAGR during the forecast period in type market

In 2025, the spray-type segment is expected to account for the highest CAGR in the market due to its superior efficiency in removing dissolved gases from heat-sensitive liquids like juices and dairy beverages. Its ability to support continuous processing and clean label formulations drives adoption.

Food deaerators Market Regional Analysis

“North America Holds the Largest Share in the Food deaerators Market”

-

North America dominates the food deaerators market with a share of 35.13%, driven by advanced food processing infrastructure, high consumption of packaged beverages, and strong regulatory standards for food quality

- The U.S. accounts for the largest share due to its large-scale beverage manufacturing industry and early adoption of vacuum and spray-type deaeration systems

- In addition, the region's growing demand for clean-label and functional drinks supports continuous investments in high-efficiency food processing technologies, reinforcing North America's leadership in the global market

“Asia-Pacific is Projected to Register the Highest CAGR in the Food deaerators Market”

- Asia-Pacific region is expected to experience the fastest growth in the food deaerators market, fuelled by rapid industrialization of food and beverage processing and rising consumption of packaged drinks

- China leads in the market due to growing demand for RTD beverages, dairy products, and functional drinks, prompting investment in advanced food processing infrastructure

- Among these, India is projected to register the highest CAGR due to its expanding middle class, urbanization, and government support for food manufacturing under initiatives like "Make in India."

Food deaerators Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- GEA Group Aktiengesellschaft (Germany)

- JBT (U.S.)

- ALFA LAVAL (Sweden)

- STORK (Netherlands)

- Indeck Power Equipment Company (U.S.)

- Pentair plc. (U.K.)

- Sterling Deaerator Company (U.S.)

- SPX FLOW (U.S.)

- THE CORNELL MACHINE COMPANY (U.S.)

- The Fulton Companies (U.S.)

- Jaygo Incorporated (U.S.)

- Permix Tec Co., Ltd. (China)

- Spirax Sarco Limited (U.K.)

- PARKER BOILER (U.S.)

- Shakumbhari Engineering Works (India)

- Centec USA (U.S.)

- EnviroSep, Inc (U.S.)

- Mepaco (U.S.)

- Wenzhou Leno Machinery Co., Ltd. (China)

- TECHNIBLEND (U.S.)

Latest Developments in Global Food Deaerators Market

-

In October, 2022, GEA inaugurated a cutting-edge food processing and packaging technology center in Frisco, Texas. Situated near Dallas, the 15,000-square-foot facility houses over 40 pieces of GEA equipment used for food production.

- In October, 2022, Alfa Laval entered into a global partnership with Spirax Sarco, a prominent provider of steam and thermal energy solutions across multiple industries. Under the agreement, Alfa Laval will serve as Spirax Sarco’s preferred supplier of plate heat exchangers for customers in Europe, Asia, and the Americas over the next three years.

- In October, 2020, Stork expanded its operations in the United Kingdom by opening a new office in Grimsby. To reinforce its presence in North East and East England and support existing regional contracts, the company invested significantly in a new facility in North Lincolnshire. This addition complements Stork’s growing footprint and enables it to serve the entire region more effectively.

- In 2020, GEA Group AG acquired Hilge, a German manufacturer of hygienic pumps, to enhance its product portfolio for the food and beverage sector.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Food Deaerators Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Food Deaerators Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Food Deaerators Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.