Global Food Drink Packaging Market

Market Size in USD Billion

CAGR :

%

USD

566.52 Billion

USD

799.49 Billion

2024

2032

USD

566.52 Billion

USD

799.49 Billion

2024

2032

| 2025 –2032 | |

| USD 566.52 Billion | |

| USD 799.49 Billion | |

|

|

|

|

Food Drink Packaging Market Size

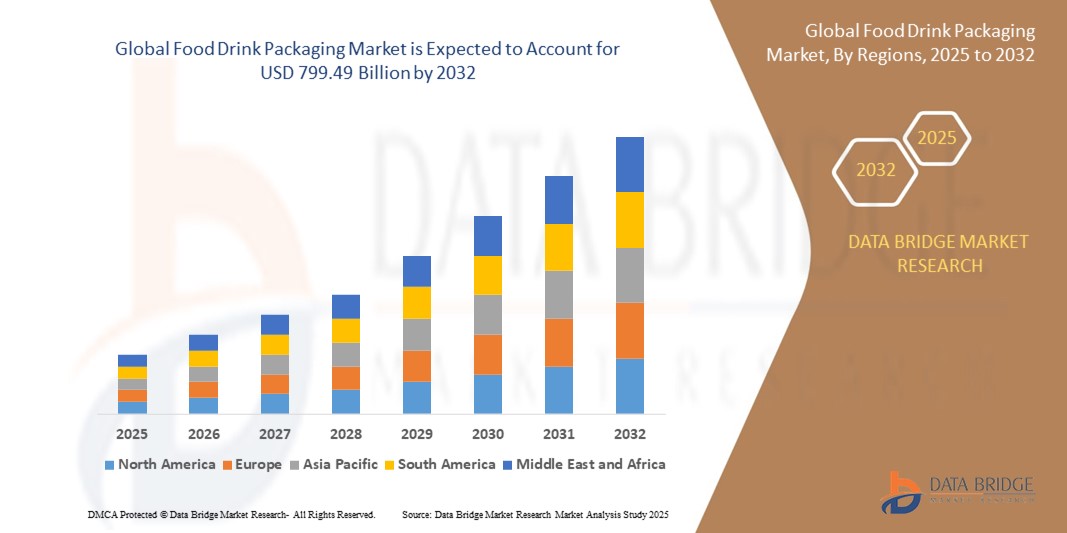

- The global food drink packaging market size was valued at USD 566.52 billion in 2024 and is expected to reach USD 799.49 billion by 2032, at a CAGR of 4.40% during the forecast period

- The market growth is largely fueled by consumers are increasingly becoming environmentally conscious, prompting food and beverage companies to adopt sustainable packaging options such as biodegradable plastics, compostable materials, and recyclable paperboard

- This trend has created a need for packaging that not only preserves freshness and extends shelf life but is also portable, lightweight, and user-friendly. Innovations in resealable, single-serve, and microwave-safe packaging formats are helping food and beverage brands meet evolving consumer expectations

Food Drink Packaging Market Analysis

- The market's expansion is significantly influenced by the increasing demand for sustainable and eco-friendly packaging solutions as consumers are actively seeking products that align with their values regarding environmental responsibility and long-term impact on the planet

- This shift is driven by heightened environmental awareness among consumers and regulatory pressures to reduce plastic waste which has encouraged manufacturers to adopt recyclable, biodegradable, or compostable packaging materials while also improving brand image and meeting evolving packaging standards

- Asia-Pacific dominates the food drink packaging market with the largest revenue share of 40.05% in 2024, driven by widespread adoption of advanced packaging technologies that enhance product safety and shelf life. companies in the region are increasingly investing in smart packaging solutions such as modified atmosphere packaging and active packaging to meet consumer demands and reduce food waste.

- North America is expected to be the fastest growing region in the Food Drink Packaging market during the forecast period due to increasing urbanization and rising disposable incomes

- The plastics segment dominates the largest market revenue share of approximately 68%, driven by its lightweight nature, cost-effectiveness, and versatility in design and color customization. Plastics offer excellent barrier properties and are highly compatible with different mascara formulas, making them the preferred choice for manufacturers and consumers alike

Report Scope and Food Drink Packaging Market Segmentation

|

Attributes |

Food Drink Packaging Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Food Drink Packaging Market Trends

“Rising Shift Toward Eco-Friendly Food Packaging”

- The market is steadily leaning toward biodegradable and compostable packaging materials as sustainability becomes a core priority in packaging decisions

- Plant-based materials such as cornstarch, sugarcane fiber, and mushroom roots are being explored as alternatives to traditional plastic packaging

- Brands are also experimenting with edible packaging formats, which eliminate waste and appeal to eco-conscious consumers

- Biodegradable adhesives and inks are being developed to ensure the entire package, not just the main material, meets compostable standards

- Smart features such as freshness indicators are being combined with eco-friendly designs to enhance functionality without harming the environment

- For instance, a food tech company recently introduced food trays made entirely from agricultural waste and natural polymers, offering a durable and fully compostable solution for packaging fresh produce

- In conclusion, this growing focus on biodegradable solutions signals a long-term transformation in how food and beverage products are packaged, aligning with consumer values and shaping the future of the packaging industry

Food Drink Packaging Market Dynamics

Driver

“Rising Demand for Convenience and Ready-to-Eat Foods”

- Growing consumer preference for convenience and ready-to-eat food products is driving demand for packaging that preserves freshness, ensures portability, and extends shelf life such as resealable pouches and microwave-safe containers

- Busy lifestyles and time constraints are fueling the need for easy-to-access and minimal preparation packaging, supporting takeaway and home delivery models that rely on durable, tamper-evident containers

- Packaging innovations such as single-serve packs and easy-open cans enhance user experience and food safety, making them popular among both consumers and food service providers

- For instance, companies such as Nestlé and PepsiCo have expanded their range of resealable and portion-controlled packaging in recent years to cater to on-the-go consumption trends

- Manufacturers are investing in packaging materials that balance functionality with sustainability and aesthetics to meet evolving consumer expectations and regulatory guidelines

- In conclusion, the widespread adoption of convenience-focused packaging is significantly contributing to the consistent growth of the global food and drink packaging market, highlighting its importance in the industry’s future development

Restraint/Challenge

“High Cost of Advanced Packaging Technologies”

- High costs of advanced and sustainable packaging technologies limit widespread adoption despite their benefits such as biodegradable films and antimicrobial coatings

- Specialized materials, research and development, and new production infrastructure investments significantly increase operational expenses for manufacturers

- Small and medium-sized enterprises often face prohibitive costs transitioning from conventional packaging to eco-friendly alternatives due to limited capital and scale

- Compliance with evolving packaging regulations and certifications adds complexity and further financial burden on manufacturers trying to innovate

- For instance, many startups and mid-sized companies report delays in adopting sustainable packaging because of fluctuating material costs and lack of affordable supply chains

- In price-sensitive markets, balancing innovation with affordability remains challenging, creating a gap between environmental goals and commercial viability

- In conclusion, this financial barrier slows the overall market transformation, particularly for companies operating with tight margins or in highly competitive sectors

Food Drink Packaging Market Scope

The global food and drink packaging market is segmented on the basis of material, technology, equipment, and application.

• By Material

On the basis of material, the food and drink packaging market is segmented into metal, glass and wood, paper and paperboard, plastics, and others. The plastics segment dominates the largest market revenue share of approximately 60% in 2024, driven by its versatility, cost-effectiveness, and excellent barrier properties that help preserve food freshness and extend shelf life. Plastics also offer design flexibility and lightweight benefits, making them preferred for various packaging formats.

The paper and paperboard segment is anticipated to witness the fastest growth rate of around 11% from 2025 to 2032, fueled by increasing environmental concerns and consumer demand for sustainable and recyclable packaging alternatives. Innovations in coated and laminated paperboard improve durability and barrier performance, making it more competitive with plastics.

• By Technology

On the basis of technology, the food and drink packaging market is segmented into controlled, active, intelligent, aseptic, biodegradable, and others. The controlled technology segment held the largest market revenue share in 2024, owing to its effectiveness in maintaining food quality by regulating gas composition within the package, thus extending freshness and shelf life.

The biodegradable technology segment is expected to witness the fastest CAGR from 2025 to 2032, propelled by rising regulatory mandates and consumer preference for eco-friendly packaging. Biodegradable materials such as polylactic acid and starch-based polymers are increasingly adopted for packaging fresh and convenience foods.

• By Equipment

On the basis of equipment, the food and drink packaging market is segmented into form-fill-seal, filling and dosing, cartooning, case packaging, wrapping and bundling, labelling and coding, inspecting, detecting, and check weighing machines, and others. The form-fill-seal equipment segment dominated the market, accounting for the largest revenue share due to its efficiency in packaging liquids, powders, and solids with speed and minimal waste.

The labelling and coding segment is expected to witness the fastest growth rate from 2025 to 2032, driven by growing demand for product traceability, branding, and compliance with food safety regulations. Advanced labelling technologies enable high-quality printing and serialization for supply chain transparency.

• By Application

On the basis of application, the food and drink packaging market is segmented into dairy and dairy products, bakery products, confectionery products, poultry, seafood and meat products, convenience foods, fruits and vegetables, and others. The convenience foods segment accounted for the largest market revenue share in 2024, driven by rising consumer demand for ready-to-eat and on-the-go meal options requiring safe, portable, and durable packaging.

The fruits and vegetables segment is expected to witness the fastest CAGR from 2025 to 2032, fueled by increasing consumption of fresh produce and innovations in breathable and biodegradable packaging that enhance shelf life and reduce spoilage.

Food Drink Packaging Market Regional Analysis

- Asia-Pacific dominates the food drink packaging market with the largest revenue share of 40.05% in 2024, driven by widespread adoption of advanced packaging technologies that enhance product safety and shelf life. companies in the region are increasingly investing in smart packaging solutions such as modified atmosphere packaging and active packaging to meet consumer demands and reduce food waste

- The region benefits from strong demand for sustainable and recyclable packaging solutions fueled by increasing consumer awareness and regulatory pressure. Environmental regulations and growing focus on reducing plastic pollution are encouraging manufacturers to develop eco-friendly materials and circular packaging systems

- Rapid growth in e-commerce and home delivery services is further boosting the need for innovative, convenient packaging formats that ensure product integrity during transit. As more consumers opt for online grocery shopping, companies are adopting durable, tamper-evident, and easy-to-handle packaging to maintain freshness and enhance user experience.

U.S. Food and Drink Packaging Market Insight

The U.S. food and drink packaging market captured the largest revenue share of 78% in North America in 2024, driven by strong consumer demand for convenience and sustainability. Increasing preference for eco-friendly packaging materials and innovative formats that extend product shelf life is reshaping the market. Rising adoption of smart packaging solutions that provide real-time freshness monitoring and tamper evidence further fuels market growth. Moreover, the expanding retail and e-commerce sectors are accelerating demand for versatile and secure packaging designs suited for online delivery.

Europe Food and Drink Packaging Market Insight

The Europe food and drink packaging market is projected to grow steadily throughout the forecast period, supported by strict regulatory frameworks targeting reduction in plastic waste and carbon footprint. Growing consumer awareness around environmental impact encourages the use of recyclable and biodegradable packaging materials. The surge in demand for convenient, on-the-go food packaging formats and increasing urbanization are also key contributors. Both new product launches and packaging redesigns to meet sustainability goals are shaping the competitive landscape in Europe.

U.K. Food and Drink Packaging Market Insight

The U.K. food and drink packaging market is anticipated to expand at a healthy rate during the forecast period, fueled by growing consumer focus on health, safety, and sustainability. Stringent packaging regulations and commitments to reduce single-use plastics boost the adoption of innovative, eco-conscious packaging solutions. The rise of online grocery shopping and meal kit delivery services is increasing demand for protective, tamper-evident, and resealable packaging formats. The U.K. market benefits from well-established packaging supply chains and strong innovation hubs.

Germany Food and Drink Packaging Market Insight

Germany’s food and drink packaging market is expected to experience significant growth, driven by high consumer demand for sustainable packaging and advanced preservation technologies. Investments in biodegradable and compostable materials, as well as intelligent packaging systems that track product freshness, support the market’s expansion. Germany’s focus on circular economy principles and stringent waste management policies fosters innovation in recyclable packaging solutions. Demand from the organic food segment and rising e-commerce penetration also positively influence the market.

Asia-Pacific Food and Drink Packaging Market Insight

The Asia-Pacific food and drink packaging market is poised to grow at the fastest CAGR of around 22% from 2025 to 2032, driven by rapid urbanization, rising disposable incomes, and increasing health awareness. Countries such as China, India, Japan, and South Korea are witnessing strong adoption of convenient and sustainable packaging solutions. Government initiatives promoting sustainable packaging and investments in packaging machinery further boost market growth. The region’s expanding processed and convenience foods sector is a major driver of packaging demand.

Japan Food and Drink Packaging Market Insight

Japan’s food and drink packaging market is gaining traction due to the country’s emphasis on food safety, quality, and sustainability. The aging population and busy urban lifestyle drive demand for ready-to-eat meals and innovative packaging that enhances convenience and extends shelf life. Japan’s advanced technology ecosystem supports the development of smart packaging features such as freshness indicators and anti-counterfeit solutions. Packaging manufacturers are focusing on lightweight and eco-friendly designs aligned with consumer preferences.

China Food and Drink Packaging Market Insight

China accounted for the largest market revenue share in Asia-Pacific in 2024, propelled by rapid urbanization, a growing middle class, and rising demand for packaged convenience foods. The country is a major hub for both production and consumption of innovative food packaging materials and technologies. Efforts to reduce plastic waste and increase recycling rates are driving growth in biodegradable and recyclable packaging segments. Strong domestic manufacturing capabilities and government policies encouraging sustainable packaging solutions continue to support market expansion.

Food Drink Packaging Market Share

The food drink packaging industry is primarily led by well-established companies, including:

- Amcor plc (Australia)

- Ball Corporation (U.S.)

- Crown (U.S.)

- WestRock Company (U.S.)

- Sealed Air (U.S.)

- Silgan Holdings Inc. (U.S.)

- Tetra Pak International S.A. (Switzerland)

- Toyo Seikan Group Holdings, Ltd. (Japan)

- Parksons Packaging Ltd. (India)

- Cellpack AG Packaging (Switzerland)

- CLONDALKIN GROUP (Netherlands)

- Constantia Flexibles (Austria)

- Huhtamaki (Finland)

- Mondi (U.K.)

- Sonoco Products Company (U.S.)

Latest Developments in Global Food Drink Packaging Market

- In October 2023, CPMC Holdings Limited unveiled plans to construct a new beverage can plant in Hungary, forming a joint venture with ORG to establish Europe's second China-owned facility. The two-piece beverage can plant signifies a significant expansion in the beverage cans market, enhancing production capacity in Europe

- In March 2023, SIG enabled Casalasco Società Agricola to introduce its food products in aseptic carton packs featuring full-barrier packaging materials, ensuring product freshness and quality preservation

- In January 2023, Cascades launched eco-friendly packaging tailored for fresh fruits and vegetables, introducing closed baskets made from recycled and recyclable corrugated cardboard, catering specifically to the produce sector

- In May 2022, UFlexIndia launched FLEXCOAT AQUABAN Coating for Corrugation Boxes, a water-repellent solution for kraft paper used in corrugated boxes. This FDA-compliant coating preserves box integrity during transit and adverse weather conditions, particularly benefiting perishable goods

- In April 2022, Zomato initiated '100% Plastic Neutral Deliveries' in April 2022, aiming to deliver over ten crore orders in sustainable packaging within three years. Collaborations with government initiatives, social enterprises, and startups will drive innovation in restaurant industry packaging solutions

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL FOOD AND DRINK PACKAGING MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL FOOD AND DRINK PACKAGING MARKET SIZE

2.3 VENDOR POSITIONING GRID

2.4 MARKETS COVERED

2.5 GEOGRAPHIC SCOPE

2.6 YEARS CONSIDERED FOR THE STUDY

2.7 RESEARCH METHODOLOGY

2.8 TECHNOLOGY LIFE LINE CURVE

2.9 MULTIVARIATE MODELLING

2.1 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.11 DBMR MARKET POSITION GRID

2.12 MARKET APPLICATION COVERAGE GRID

2.13 DBMR MARKET CHALLENGE MATRIX

2.14 IMPORT AND EXPORT DATA

2.15 SECONDARY SOURCES

2.16 GLOBAL FOOD AND DRINK PACKAGING MARKET : RESEARCH SNAPSHOT

2.17 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

5.1 VALUE CHAIN ANALYSIS

5.2 SUPPLY CHAIN ANALYSIS

5.3 IMPORT-EXPORT ANALYSIS

5.4 PORTER’S FIVE FORCES ANALYSIS

5.4.1 BARGAINING POWER OF SUPPLIERS

5.4.2 BARGAINING POWER OF BUYERS/CONSUMERS

5.4.3 THREAT OF NEW ENTRANTS

5.4.4 THREAT OF SUBSTITUTE PRODUCTS

5.4.5 INTENSITY OF COMPETITIVE RIVALRY

5.5 RAW MATERIAL SOURCING ANALYSIS

5.6 OVERVIEW OF TECHNOLOGICAL INNOVATIONS

5.7 INDUSTRY TRENDS AND FUTURE PERSPECTIVE

5.8 GROWTH STRATEGIES ADOPTED BY KEY MARKET PLAYERS

5.9 FACTORS INFLUENCING PURCHASING DECISION OF END-USERS

6 IMPACT OF ECONOMIC SLOW DOWN ON MARKET

6.1 IMPACT ON PRICE

6.2 IMPACT ON SUPPLY CHAIN

6.3 IMPACT ON SHIPMENT

6.4 IMPACT ON COMPANY’S STRATEGIC DECISIONS

7 REGULATORY FRAMEWORK AND GUIDELINES

8 PRICING INDEX (PRICE AT B2B END & PRICES AT FOB)

9 PRODUCTION CAPACITY OF KEY MANUFACTURERES

10 BRAND OUTLOOK

10.1 COMPARATIVE BRAND ANALYSIS

10.2 PRODUCT VS BRAND OVERVIEW

11 GLOBAL FOOD AND DRINK PACKAGING MARKET, BY PRODUCT TYPE, 2022-2031, (USD MILLION) (MILLION UNITS)

11.1 OVERVIEW

11.2 POUCHES

11.2.1 POUCHES, BY TYPE

11.2.1.1. STAND UP POUCHES

11.2.1.2. GUSSETED POUCHES (SIDE GUSSET AND BOTTOM GUSSET)

11.2.1.3. PILLOW POUCHES

11.2.1.4. 3 SIDE SEAL POUCHES

11.2.1.5. OTHERS

11.2.2 POUCHES, BY APPLICATION

11.2.2.1. PLAIN MILK (WHITE MILK)

11.2.2.2. FLAVOURED MILK

11.2.2.3. RTD SMOOTHIES

11.2.2.4. RTD TEAS

11.2.2.5. DRINKABLE YOGURT

11.2.2.6. BUTTERMILK

11.2.2.7. RTD SHAKES

11.2.2.8. RTD COFFEE

11.2.2.9. OTHERS

11.3 TETRA PACKS

11.3.1 TETRA PACKS, BY APPLICATION

11.3.1.1. PLAIN MILK (WHITE MILK)

11.3.1.2. FLAVOURED MILK

11.3.1.3. RTD SMOOTHIES

11.3.1.4. RTD TEAS

11.3.1.5. DRINKABLE YOGURT

11.3.1.6. BUTTERMILK

11.3.1.7. RTD SHAKES

11.3.1.8. RTD COFFEE

11.3.1.9. OTHERS

11.4 BOTTLES

11.4.1 BOTTLES, BY APPLICATION

11.4.1.1. PLAIN MILK (WHITE MILK)

11.4.1.2. FLAVOURED MILK

11.4.1.3. RTD SMOOTHIES

11.4.1.4. RTD TEAS

11.4.1.5. DRINKABLE YOGURT

11.4.1.6. BUTTERMILK

11.4.1.7. RTD SHAKES

11.4.1.8. RTD COFFEE

11.4.1.9. OTHERS

11.5 CANS

11.5.1 CANS, BY APPLICATION

11.5.1.1. PLAIN MILK (WHITE MILK)

11.5.1.2. FLAVOURED MILK

11.5.1.3. RTD SMOOTHIES

11.5.1.4. RTD TEAS

11.5.1.5. DRINKABLE YOGURT

11.5.1.6. BUTTERMILK

11.5.1.7. RTD SHAKES

11.5.1.8. RTD COFFEE

11.5.1.9. OTHERS

11.6 CONVERTED ROLL STOCK

11.7 GUSSETED BOX

11.8 CORRUGATED BOX

11.9 OTHERS (IF ANY)

12 GLOBAL FOOD AND DRINK PACKAGING MARKET, BY PRODUCT CATEGORY, 2022-2031, (USD MILLION)

12.1 OVERVIEW

12.2 RIGID PACKAGING

12.3 FLEXIBLE PACKAGING

13 GLOBAL FOOD AND DRINK PACKAGING MARKET, BY MATERIAL, 2022-2031, (USD MILLION)

13.1 OVERVIEW

13.2 GLASS

13.3 PAPER AND PAPERBOARD

13.4 PLASTIC

13.5 METAL

13.6 OTHERS

14 GLOBAL FOOD AND DRINK PACKAGING MARKET, BY APPLICATION, 2022-2031, (USD MILLION)

14.1 OVERVIEW

14.2 FOOD

14.2.1 DAIRY PRODUCTS

14.2.1.1. MILK

14.2.1.2. YOGURT

14.2.1.3. CHEESE

14.2.1.4. CLARIFIED BUTTER

14.2.1.5. COTTAGE CHEESE

14.2.1.6. OTHERS

14.2.2 POULTRY PRODUCTS

14.2.2.1. CHICKEN

14.2.2.2. TURKEY

14.2.2.3. OTHERS

14.2.3 SEAFOOD

14.2.4 BAKERY AND CONFECTIONERY

14.2.4.1. BREADS AND ROLLS

14.2.4.2. COOKIES AND BISCUITS

14.2.4.3. CAKES AND DESSERTS

14.2.4.4. OTHERS

14.2.5 SNACKS

14.2.5.1. CHIPS

14.2.5.2. PEANUTS

14.2.5.3. POPCORNS

14.2.5.4. OTHERS

14.2.6 OTHERS

14.3 BEVERAGES

14.3.1 ALCOHOLIC BEVERAGES

14.3.2 ALCOHOLIC BEVERGES, BY TYPE

14.3.2.1. BEER

14.3.2.1.1. BEER, BY TYPE

14.3.2.1.1.1 ALE BEER

14.3.2.1.1.1.1. ALE, BY TYPE

A. BLOND ALE

B. BROWN ALE

C. PALE ALE

D. SOUR ALE

14.3.2.1.1.2 LAGER BEER

14.3.2.1.1.3 STOUT BEER

14.3.2.1.1.4 PORTER BEER

14.3.2.1.1.5 WHEAT BEER

14.3.2.1.1.6 PILSNER

14.3.2.1.1.7 OTHERS

14.3.2.2. WINE

14.3.2.2.1. WINE, BY TYPE

14.3.2.2.1.1 RED WINE

14.3.2.2.1.1.1. RED WINE, BY TYPE

A. FULL-BODIED RED WINES

B. MEDIUM-BODIED RED WINES

C. LIGHT-BODIED RED WINES

14.3.2.2.1.2 WHITE WINE

14.3.2.2.1.3 DESSERT WINE

14.3.2.2.1.3.1. LIGHTLY SWEET DESSERT WIN

14.3.2.2.1.3.2. RICHLY SWEET DESSERT WINE

14.3.2.2.1.3.3. WINE

14.3.2.2.1.4 ROSE WINE

14.3.2.2.1.5 OTHERS

14.3.2.2.2. WINE, BY CATEGORY

14.3.2.2.2.1 STILL WINE

14.3.2.2.2.2 SPARKLING WINE

14.3.2.3. WHISKEY

14.3.2.3.1. WHISKEY, BY TYPE

14.3.2.3.1.1 RYE WHISKEY

14.3.2.3.1.2 RYE MALT WHISKEY

14.3.2.3.1.3 MALT WHISKEY

14.3.2.3.1.4 WHEAT WHISLEY

14.3.2.3.1.5 CORN WHISKEY

14.3.2.3.1.6 OTHERS

14.3.2.4. RUM

14.3.2.4.1. RUM, BY TYPE

14.3.2.4.1.1 WHITE RUM

14.3.2.4.1.2 DARK RUM

14.3.2.5. VODKA

14.3.2.6. TEQUILA

14.3.2.6.1. TEQUILA, BY TYPE

14.3.2.6.1.1 TEQUILA BLANCO

14.3.2.6.1.2 TEQUILA JOVEN

14.3.2.6.1.3 TEQUILA REPOSADO

14.3.2.6.1.4 OTHERS

14.3.2.7. GIN

14.3.2.8. BOTTLED COCKTAIL

14.3.2.8.1. BOTTLED COCKTAIL, BY ALCOHOL BY VOLUME % (ABV %)

14.3.2.8.1.1 3% ABV

14.3.2.8.1.2 5% ABV

14.3.2.8.1.3 6% BV

14.3.2.8.1.4 7% ABV

14.3.2.8.1.5 8% ABV

14.3.2.8.1.6 OTHERS

14.3.2.9. MALT-BASED DRINKS

14.3.2.10. OTHERS (IF ANY)

14.3.3 NON-ALCOHOLIC BEVERAGES

14.3.3.1. NON-ALCOHOLIC BEVERGES, BY TYPE

14.3.3.1.1. RTD TEA

14.3.3.1.1.1 RTD TEA, BY TYPE

14.3.3.1.1.1.1. GREEN TEA

14.3.3.1.1.1.2. BLACK TEA

14.3.3.1.1.1.3. MATCHA

14.3.3.1.1.1.4. HERBAL TEA

14.3.3.1.1.1.5. FERMENTED TEA

14.3.3.1.1.1.6. OTHERS

14.3.3.1.2. RTD COFFEE

14.3.3.1.3. JUICE BASED BEVERAGES

14.3.3.1.4. CARBONATED BEVERAGES

14.3.3.1.4.1 DIET DRINKS

14.3.3.1.4.2 FRUIT FLAVORED CARBONATES

14.3.3.1.4.3 OTHERS

14.3.3.1.5. SPORTS & ENERGY BEVERAGE

14.3.3.1.5.1 SPORTS BEVERAGE, BY TYPE

14.3.3.1.5.1.1. ISOTONIC

14.3.3.1.5.1.2. HYPERTONIC

14.3.3.1.5.1.3. HYPOTONIC

14.3.3.1.5.2 ENERGY BEVERAGE, BY TYPE

14.3.3.1.5.2.1. ENERGY DRIN BEVERAGE K, BY TYPE

A. STILL

B. CARBONATED

14.3.3.1.6. CBD INFUSED RTD BEVERGES

14.3.3.1.7. PLANT-BASED MILK BEVERAGES

14.3.3.1.7.1 PLANT-BASED MILK, BY TYPE

14.3.3.1.7.1.1. SOY

14.3.3.1.7.1.2. ALMOND

14.3.3.1.7.1.3. CASHEW

14.3.3.1.7.1.4. COCONUT

14.3.3.1.7.1.5. PEA

14.3.3.1.7.1.6. OATS

14.3.3.1.7.1.7. OTHERS

14.3.3.1.8. WHEY PROTEIN BEVERAGES

14.3.3.1.9. PROTEIN SHAKES

14.3.3.1.10. OTHERS

15 GLOBAL FOOD AND DRINK PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2022-2031, (USD MILLION)

15.1 OVERVIEW

15.2 DIRECT

15.3 INDIRECT

16 GLOBAL FOOD AND DRINK PACKAGING MARKET, BY GEOGRAPHY, 2022-2031 (USD MILLION)

Global FOOD AND DRINK PACKAGINGMarket, (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

16.1 NORTH AMERICA

16.1.1 U.S.

16.1.2 CANADA

16.1.3 MEXICO

16.2 EUROPE

16.2.1 GERMANY

16.2.2 U.K.

16.2.3 ITALY

16.2.4 FRANCE

16.2.5 SPAIN

16.2.6 SWITZERLAND

16.2.7 RUSSIA

16.2.8 TURKEY

16.2.9 BELGIUM

16.2.10 NETHERLANDS

16.2.11 SWITZERLAND

16.2.12 DENMARK

16.2.13 NORWAY

16.2.14 FINLAND

16.2.15 SWEDEN

16.2.16 REST OF EUROPE

16.3 ASIA-PACIFIC

16.3.1 JAPAN

16.3.2 CHINA

16.3.3 SOUTH KOREA

16.3.4 INDIA

16.3.5 SINGAPORE

16.3.6 THAILAND

16.3.7 INDONESIA

16.3.8 MALAYSIA

16.3.9 PHILIPPINES

16.3.10 AUSTRALIA

16.3.11 NEW ZEALAND

16.3.12 HONG KONG

16.3.13 TAIWAN

16.3.14 REST OF ASIA-PACIFIC

16.4 SOUTH AMERICA

16.4.1 BRAZIL

16.4.2 ARGENTINA

16.4.3 REST OF SOUTH AMERICA

16.5 MIDDLE EAST AND AFRICA

16.5.1 SOUTH AFRICA

16.5.2 EGYPT

16.5.3 SAUDI ARABIA

16.5.4 UNITED ARAB EMIRATES

16.5.5 ISRAEL

16.5.6 BAHRAIN

16.5.7 KUWAIT

16.5.8 OMAN

16.5.9 QATAR

16.5.10 REST OF MIDDLE EAST AND AFRICA

17 GLOBAL FOOD AND DRINK PACKAGING MARKET, COMPANY LANDSCAPE

17.1 COMPANY SHARE ANALYSIS: GLOBAL

17.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

17.3 COMPANY SHARE ANALYSIS: EUROPE

17.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

17.5 MERGERS & ACQUISITIONS

17.6 NEW PRODUCT DEVELOPMENT & APPROVALS

17.7 EXPANSIONS

17.8 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

18 SWOT ANALYSIS

19 GLOBAL FOOD AND DRINK PACKAGING MARKET – COMPANY PROFILE

19.1 AMCOR PLC

19.1.1 COMPANY SNAPSHOT

19.1.2 PRODUCT PORTFOLIO

19.1.3 PRODUCTION CAPACITY OVERVIEW

19.1.4 SWOT ANALYSIS

19.1.5 REVENUE ANALYSIS

19.1.6 RECENT UPDATES

19.2 BALL CORPORATION

19.2.1 COMPANY SNAPSHOT

19.2.2 PRODUCT PORTFOLIO

19.2.3 PRODUCTION CAPACITY OVERVIEW

19.2.4 SWOT ANALYSIS

19.2.5 REVENUE ANALYSIS

19.2.6 RECENT UPDATES

19.3 BERRY GLOBAL INC

19.3.1 COMPANY SNAPSHOT

19.3.2 PRODUCT PORTFOLIO

19.3.3 PRODUCTION CAPACITY OVERVIEW

19.3.4 SWOT ANALYSIS

19.3.5 REVENUE ANALYSIS

19.3.6 RECENT UPDATES

19.4 TETRA PAK

19.4.1 COMPANY SNAPSHOT

19.4.2 PRODUCT PORTFOLIO

19.4.3 PRODUCTION CAPACITY OVERVIEW

19.4.4 SWOT ANALYSIS

19.4.5 REVENUE ANALYSIS

19.4.6 RECENT UPDATES

19.5 INTERNATIONAL PAPER

19.5.1 COMPANY SNAPSHOT

19.5.2 PRODUCT PORTFOLIO

19.5.3 PRODUCTION CAPACITY OVERVIEW

19.5.4 SWOT ANALYSIS

19.5.5 REVENUE ANALYSIS

19.5.6 RECENT UPDATES

19.6 WESTROCK COMPANY

19.6.1 COMPANY SNAPSHOT

19.6.2 PRODUCT PORTFOLIO

19.6.3 PRODUCTION CAPACITY OVERVIEW

19.6.4 SWOT ANALYSIS

19.6.5 REVENUE ANALYSIS

19.6.6 RECENT UPDATES

19.7 MONDI

19.7.1 COMPANY SNAPSHOT

19.7.2 PRODUCT PORTFOLIO

19.7.3 PRODUCTION CAPACITY OVERVIEW

19.7.4 SWOT ANALYSIS

19.7.5 REVENUE ANALYSIS

19.7.6 RECENT UPDATES

19.8 NAMPAK LTD

19.8.1 COMPANY SNAPSHOT

19.8.2 PRODUCT PORTFOLIO

19.8.3 PRODUCTION CAPACITY OVERVIEW

19.8.4 SWOT ANALYSIS

19.8.5 REVENUE ANALYSIS

19.8.6 RECENT UPDATES

19.9 ARDAGH GROUP

19.9.1 COMPANY SNAPSHOT

19.9.2 PRODUCT PORTFOLIO

19.9.3 PRODUCTION CAPACITY OVERVIEW

19.9.4 SWOT ANALYSIS

19.9.5 REVENUE ANALYSIS

19.9.6 RECENT UPDATES

19.1 PACTIV EVERGREEN INC.

19.10.1 COMPANY SNAPSHOT

19.10.2 PRODUCT PORTFOLIO

19.10.3 PRODUCTION CAPACITY OVERVIEW

19.10.4 SWOT ANALYSIS

19.10.5 REVENUE ANALYSIS

19.10.6 RECENT UPDATES

19.11 INDUSTRIAL DEVELOPMENT COMPANY SAL

19.11.1 COMPANY SNAPSHOT

19.11.2 PRODUCT PORTFOLIO

19.11.3 PRODUCTION CAPACITY OVERVIEW

19.11.4 SWOT ANALYSIS

19.11.5 REVENUE ANALYSIS

19.11.6 RECENT UPDATES

19.12 ELOPAK

19.12.1 COMPANY SNAPSHOT

19.12.2 PRODUCT PORTFOLIO

19.12.3 PRODUCTION CAPACITY OVERVIEW

19.12.4 SWOT ANALYSIS

19.12.5 REVENUE ANALYSIS

19.12.6 RECENT UPDATES

19.13 CLONDALKIN GROUP

19.13.1 COMPANY SNAPSHOT

19.13.2 PRODUCT PORTFOLIO

19.13.3 PRODUCTION CAPACITY OVERVIEW

19.13.4 SWOT ANALYSIS

19.13.5 REVENUE ANALYSIS

19.13.6 RECENT UPDATES

19.14 CKS PACKAGING, INC

19.14.1 COMPANY SNAPSHOT

19.14.2 PRODUCT PORTFOLIO

19.14.3 PRODUCTION CAPACITY OVERVIEW

19.14.4 SWOT ANALYSIS

19.14.5 REVENUE ANALYSIS

19.14.6 RECENT UPDATES

19.15 COVERIS

19.15.1 COMPANY SNAPSHOT

19.15.2 PRODUCT PORTFOLIO

19.15.3 PRODUCTION CAPACITY OVERVIEW

19.15.4 SWOT ANALYSIS

19.15.5 REVENUE ANALYSIS

19.15.6 RECENT UPDATES

19.16 GRAHAM PACKAGING COMPANY

19.16.1 COMPANY SNAPSHOT

19.16.2 PRODUCT PORTFOLIO

19.16.3 PRODUCTION CAPACITY OVERVIEW

19.16.4 SWOT ANALYSIS

19.16.5 REVENUE ANALYSIS

19.16.6 RECENT UPDATES

19.17 CROWN

19.17.1 COMPANY SNAPSHOT

19.17.2 PRODUCT PORTFOLIO

19.17.3 PRODUCTION CAPACITY OVERVIEW

19.17.4 SWOT ANALYSIS

19.17.5 REVENUE ANALYSIS

19.17.6 RECENT UPDATES

19.18 APTARGROUP, INC

19.18.1 COMPANY SNAPSHOT

19.18.2 PRODUCT PORTFOLIO

19.18.3 PRODUCTION CAPACITY OVERVIEW

19.18.4 SWOT ANALYSIS

19.18.5 REVENUE ANALYSIS

19.18.6 RECENT UPDATES

19.19 REFRESCO GROUP

19.19.1 COMPANY SNAPSHOT

19.19.2 PRODUCT PORTFOLIO

19.19.3 PRODUCTION CAPACITY OVERVIEW

19.19.4 SWOT ANALYSIS

19.19.5 REVENUE ANALYSIS

19.19.6 RECENT UPDATES

19.2 PACIFIC CAN CHINA HOLDINGS LIMITED

19.20.1 COMPANY SNAPSHOT

19.20.2 PRODUCT PORTFOLIO

19.20.3 PRODUCTION CAPACITY OVERVIEW

19.20.4 SWOT ANALYSIS

19.20.5 REVENUE ANALYSIS

19.20.6 RECENT UPDATES

19.21 TOKO SEIKAN GROUP HOLDING

19.21.1 COMPANY SNAPSHOT

19.21.2 PRODUCT PORTFOLIO

19.21.3 PRODUCTION CAPACITY OVERVIEW

19.21.4 SWOT ANALYSIS

19.21.5 REVENUE ANALYSIS

19.21.6 RECENT UPDATES

19.22 STORA ENSO

19.22.1 COMPANY SNAPSHOT

19.22.2 PRODUCT PORTFOLIO

19.22.3 PRODUCTION CAPACITY OVERVIEW

19.22.4 SWOT ANALYSIS

19.22.5 REVENUE ANALYSIS

19.22.6 RECENT UPDATES

19.23 SONOCO PRODUCTS COMPANY

19.23.1 COMPANY SNAPSHOT

19.23.2 PRODUCT PORTFOLIO

19.23.3 PRODUCTION CAPACITY OVERVIEW

19.23.4 SWOT ANALYSIS

19.23.5 REVENUE ANALYSIS

19.23.6 RECENT UPDATES

19.24 CAN-PACK S.A

19.24.1 COMPANY SNAPSHOT

19.24.2 PRODUCT PORTFOLIO

19.24.3 PRODUCTION CAPACITY OVERVIEW

19.24.4 SWOT ANALYSIS

19.24.5 REVENUE ANALYSIS

19.24.6 RECENT UPDATES

20 CONCLUSION

21 QUESTIONNAIRE

22 RELATED REPORTS

23 ABOUT DATA BRIDGE MARKET RESEARCH

Global Food Drink Packaging Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Food Drink Packaging Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Food Drink Packaging Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.