Global Food Essence Market

Market Size in USD Billion

CAGR :

%

USD

16.75 Billion

USD

23.82 Billion

2024

2032

USD

16.75 Billion

USD

23.82 Billion

2024

2032

| 2025 –2032 | |

| USD 16.75 Billion | |

| USD 23.82 Billion | |

|

|

|

|

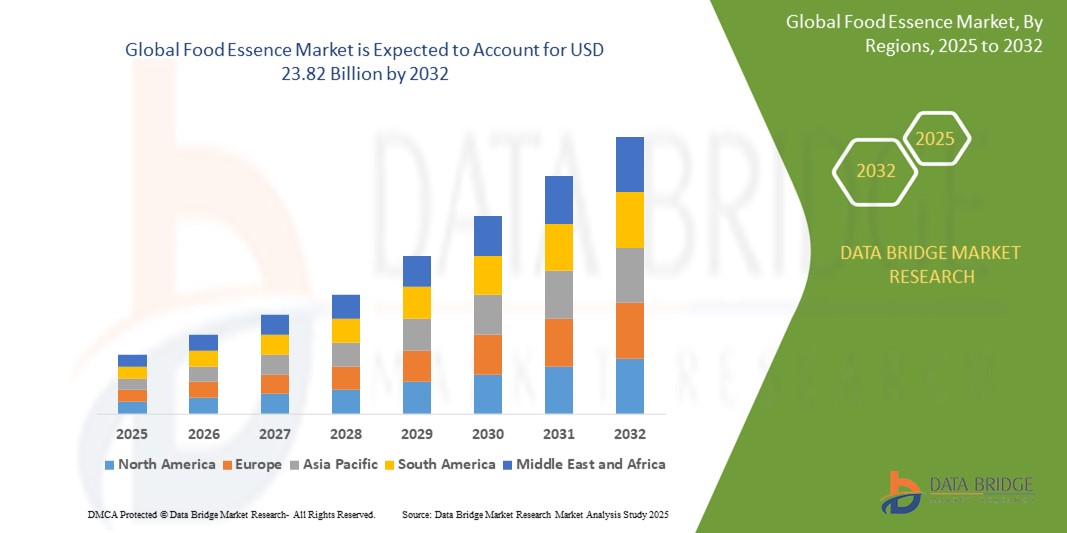

What is the Global Food Essence Market Size and Growth Rate?

- The global food essence market size was valued at USD 16.75 billion in 2024 and is expected to reach USD 23.82 billion by 2032, at a CAGR of 4.50% during the forecast period

- The application of flavors in the food industry is essential for product development and consumer satisfaction. Flavors are used to enhance the taste, aroma, and sensory experience of food products across numerous categories

- Food essence market play a crucial role in creating signature flavors for various food and beverage items, ranging from bakery goods, confectionery, and beverages to savory dishes and dairy product

What are the Major Takeaways of Food Essence Market?

- Technological advancements encompass various areas such as flavor extraction, encapsulation, and delivery systems. Improved extraction techniques enable the efficient extraction of flavors from natural sources, preserving their authenticity and quality. Encapsulation technologies enhance the stability and shelf life of food essences, ensuring their longevity and efficacy in food products

- North America dominated the food essence market with the largest revenue share of 37.8% in 2024, driven by rising demand for natural food ingredients, increasing health consciousness, and growing popularity of clean-label products

- Asia Pacific food essence market is projected to grow at the fastest CAGR of 23.9% during the forecast period from 2025 to 2032, driven by rising urbanization, increasing disposable incomes, and expanding food and beverage sectors across countries such as China, India, Japan, and Southeast Asian nations

- The Fruit Essence segment dominated the food essence market with the largest market revenue share of 62.4% in 2024, driven by the widespread use of fruit-based essences in beverages, confectionery, dairy products, and bakery items

Report Scope and Food Essence Market Segmentation

|

Attributes |

Food Essence Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Food Essence Market?

“Growing Demand for Natural and Clean Label Ingredients”

- A significant and accelerating trend in the global food essence market is the rising demand for natural, plant-based, and clean label food essences, driven by growing consumer health consciousness and increasing scrutiny over artificial additives

- Consumers are seeking authentic flavors derived from botanical extracts, fruits, herbs, and spices, encouraging manufacturers to develop essences free from synthetic chemicals, preservatives, and artificial colors. For instance, in 2024, Döhler GmbH expanded its natural flavors portfolio using plant-based technologies to meet this clean-label demand

- The market is witnessing innovation through bio-based extraction methods, including CO₂ extraction and cold-pressed techniques, which preserve flavor integrity while aligning with eco-conscious practices

- Furthermore, demand for functional food essences that offer added health benefits such as immunity support, mood enhancement, or digestive health is reshaping product development pipelines across the food, beverage, and nutraceutical industries

- This clean label trend is particularly dominant across North America and Europe, where regulatory pressures and consumer preferences are accelerating the shift toward transparent, natural ingredient formulations, positioning food essences as essential to flavor innovation

What are the Key Drivers of Food Essence Market?

- The increasing consumer preference for flavorful, healthier food and beverage options, alongside the booming functional food and natural ingredients industries, is a significant driver for the food essence market's growth

- For instance, in March 2025, The Green Labs LLC announced the expansion of its organic food essence range, catering to the growing demand for natural, sustainably sourced ingredients in global food production

- In addition, the surge in the plant-based and vegan food sectors is fueling the adoption of natural food essences as manufacturers seek to enhance flavor profiles without compromising health standards

- The evolving beverage industry, particularly in segments such as flavored water, health drinks, and RTD teas, is propelling demand for innovative, botanical-based essences

- Moreover, the rising disposable incomes in emerging markets, coupled with growing urbanization and changing dietary habits, are supporting the integration of premium, high-quality food essences into everyday food products

Which Factor is challenging the Growth of the Food Essence Market?

- The fluctuating availability and pricing of natural raw materials, including fruits, herbs, and spices, pose a significant challenge to the scalability and profitability of the food essence market

- For instance, climate change impacts, supply chain disruptions, and agricultural constraints have led to increased volatility in the supply of key botanical ingredients, affecting production costs and pricing stability

- In addition, stringent regulatory frameworks regarding food safety, allergen declarations, and labeling standards, particularly in the U.S. and E.U., create compliance complexities for food essence manufacturers

- Some natural food essences also face technical challenges, such as flavor degradation during high-heat processing, requiring advanced formulation techniques to maintain stability and sensory quality

- Lastly, while demand for natural food essences is high, the premium pricing compared to synthetic alternatives may limit adoption among price-sensitive consumers, especially in cost-driven markets. Overcoming these challenges through sustainable sourcing, technological innovation, and cost-efficient production will be critical for long-term market expansion

How is the Food Essence Market Segmented?

The market is segmented on the basis of source, application, form, distribution channel, and end-user.

- By Source

On the basis of source, the food essence market is segmented into Vegetable Essence and Fruit Essence. The Fruit Essence segment dominated the food essence market with the largest market revenue share of 62.4% in 2024, driven by the widespread use of fruit-based essences in beverages, confectionery, dairy products, and bakery items. The growing consumer preference for natural fruit flavors, coupled with the demand for clean-label and health-oriented products, fuels the dominance of fruit essences across global markets.

The Vegetable Essence segment is expected to witness the fastest CAGR from 2025 to 2032, owing to rising demand for plant-based ingredients and natural flavor enhancers in soups, sauces, and savory products. The increasing adoption of vegetarian and vegan lifestyles is further accelerating the demand for vegetable essences, particularly in health-focused and specialty food sectors.

- By Application

On the basis of application, the food essence market is segmented into Fruit and Vegetable. The Fruit segment accounted for the largest market revenue share in 2024, supported by the extensive use of fruit essences in a wide variety of food and beverage products, including juices, smoothies, flavored water, and confectionery. The appeal of fruity flavors, combined with their association with freshness and health benefits, continues to drive the segment's growth.

The Vegetable segment is projected to grow at the fastest CAGR from 2025 to 2032, supported by the increasing incorporation of vegetable-based flavors in soups, sauces, health supplements, and ready-to-eat meals, catering to consumers' demand for savory, wholesome, and nutritious product options.

- By Form

On the basis of form, the food essence market is segmented into Powder and Liquid. The Liquid segment held the largest market revenue share in 2024, driven by its easy solubility, strong flavor concentration, and broad applications in beverages, dairy, and sauces. Liquid essences offer convenience in blending with both food and drink formulations, making them highly favored by manufacturers.

The Powder segment is anticipated to record the fastest CAGR from 2025 to 2032, owing to its longer shelf life, convenient handling, and increasing use in dry food mixes, instant beverages, and bakery applications. The stability and ease of transport of powdered essences further enhance their market appeal.

- By Distribution Channel

On the basis of distribution channel, the food essence market is segmented into B2B and B2C. The B2B segment dominated the Food Essence market with the largest market revenue share of 74.9% in 2024, attributed to the high-volume demand from food and beverage manufacturers, fragrance companies, and pharmaceutical producers. The extensive use of essences as ingredients in large-scale production drives B2B segment growth.

The B2C segment is projected to grow at the fastest CAGR from 2025 to 2032, driven by rising consumer awareness of DIY food preparations, homemade cosmetics, and natural wellness products, with essences becoming increasingly available through retail stores and online platforms.

- By End-User

On the basis of end-user, the food essence market is segmented into Food and Beverages, Fragrance Industry, Cosmetics, and Pharmaceuticals. The Food and Beverages segment held the largest market revenue share in 2024, supported by the widespread use of essences to enhance flavors and aromas in diverse food categories, including beverages, bakery, dairy, and confectionery. Consumer demand for natural, clean-label flavors significantly contributes to this segment's dominance.

The Pharmaceuticals segment is expected to witness the fastest CAGR from 2025 to 2032, driven by the increasing use of food essences in medicinal syrups, oral care products, and wellness supplements, where flavor masking and sensory enhancement are critical for consumer acceptance.

Which Region Holds the Largest Share of the Food Essence Market?

- North America dominated the food essence market with the largest revenue share of 37.8% in 2024, driven by rising demand for natural food ingredients, increasing health consciousness, and growing popularity of clean-label products

- Consumers in the region highly value food essences for enhancing flavors in beverages, bakery, dairy, and confectionery products, while preferring plant-based, organic, and non-artificial options

- The region’s leadership is supported by a mature food and beverage sector, widespread availability of premium essence products, and strong investments in flavor innovation by major market players, establishing food essences as a key ingredient across multiple food categories

U.S. Food Essence Market Insight

The U.S. food essence market accounted for the largest revenue share within North America in 2024, fueled by strong demand from the food, beverage, and nutraceutical sectors. The country's focus on product differentiation through unique flavors, coupled with increasing consumer preference for natural and clean-label ingredients, is boosting food essence consumption. The growth of health-focused beverages, flavored water, and plant-based alternatives further drives the demand for fruit and vegetable essences across the U.S. market.

Europe Food Essence Market Insight

The Europe food essence market is expected to witness steady growth throughout the forecast period, supported by stringent regulations promoting natural ingredients, coupled with growing demand for premium and organic food products. The shift towards health-conscious consumption, along with innovation in flavor formulations for bakery, dairy, and beverages, drives food essence adoption. The region is experiencing notable growth in clean-label and plant-based product categories, with Food Essences becoming an essential component in product development across both established and emerging food brands.

U.K. Food Essence Market Insight

The U.K. food essence market is poised to grow at a significant CAGR during the forecast period, driven by strong consumer preference for authentic, natural flavors and clean-label products. The flourishing food and beverage sector, combined with rising health awareness, supports the increased use of food essences, particularly in flavored beverages, snacks, and health supplements. In addition, the trend of premiumization and demand for exotic fruit flavors continue to create growth opportunities for Food Essence suppliers in the U.K.

Germany Food Essence Market Insight

The Germany food essence market is expected to expand at a substantial CAGR during the forecast period, fueled by increasing demand for natural food ingredients, product innovation, and sustainability-focused consumption patterns. Germany’s strong emphasis on organic, vegan, and eco-friendly products creates a favorable environment for food essence adoption, particularly in the beverage, dairy, and bakery industries. Local manufacturers are also investing in advanced processing technologies to enhance flavor authenticity and shelf life of essence products.

Which Region is the Fastest Growing Region in the Food Essence Market?

Asia Pacific food essence market is projected to grow at the fastest CAGR of 23.9% during the forecast period from 2025 to 2032, driven by rising urbanization, increasing disposable incomes, and expanding food and beverage sectors across countries such as China, India, Japan, and Southeast Asian nations. The region's booming middle class and growing preference for convenient, flavored food and beverage products are key growth drivers. Furthermore, government initiatives promoting food innovation and the region’s emergence as a manufacturing hub for Food Essences are enhancing affordability and accessibility for a wide consumer base.

Japan Food Essence Market Insight

The Japan food essence market is witnessing accelerated growth due to the country's rich culinary culture, technological innovation, and demand for authentic, high-quality flavors. The market is driven by the rising consumption of health-oriented food and beverages, growing popularity of natural ingredients, and integration of Food Essences into functional products, including fortified drinks and health supplements. Japan's aging population also contributes to demand for easily consumable, flavorful health-focused offerings.

China Food Essence Market Insight

The China food essence market accounted for the largest revenue share in Asia Pacific in 2024, driven by rapid urbanization, a growing middle-class population, and increasing health awareness. China is witnessing substantial demand for fruit and vegetable essences across dairy, beverages, snacks, and functional foods. The push towards healthier lifestyles, along with strong domestic production capabilities and the government's support for food innovation, continues to propel the Food Essence market in China.

Which are the Top Companies in Food Essence Market?

The food essence industry is primarily led by well-established companies, including:

- Amrut International (India)

- L.liladhar And Co. (India)

- Synergy Flavors (U.S.)

- Döhler GmbH (Germany)

- Lotioncrafter (U.S.)

- Northwest Naturals (U.S.)

- Centritherm (Australia)

- Ingredion Inc. (U.S.)

- SEMPIO FOODS COMPANY (South Korea)

- Kanegrade (India)

- Firmenich SA (Switzerland)

- The Green Labs LLC. (U.S.)

- Flavor Producers, LLC. (U.S.)

- citromax (U.S.)

- Beijing Heronsbill Food Material Co.,Ltd (China)

- Y&R International (Wuhu) Industrial Limited (China)

What are the Recent Developments in Global Food Essence Market?

- In October 2024, Synergy Flavors introduced a new range of ‘heat and fire’ flavors to cater to the growing consumer demand for bold and intense taste experiences. This innovative product line includes a variety of natural flavors and pastes that enable food manufacturers to enhance and customize their product offerings across ready meals, plant-based meats, and baked goods. This move is expected to strengthen Synergy’s position in the global food flavors market

- In October 2024, Givaudan Taste & Wellbeing initiated construction of its new production facility in Cikarang, Indonesia, as part of its strategic expansion in Southeast Asia. The facility, spanning 24,000 square meters within a total land area of 50,000 square meters, will manufacture savory, sweet, snack powders, and infant nutrition products with an investment of USD 58.31 million. This expansion reinforces Givaudan's commitment to meeting the region’s growing demand for flavor solutions

- In September 2024, T. Hasegawa USA, Inc. completed the acquisition of Abelei Flavors, Inc. to expand its flavor portfolio and strengthen operations in North America. The acquisition aligns with T. Hasegawa's growth strategy to broaden its flavor offerings and leverage Abelei’s established customer base and technical expertise. This step is expected to enhance the company’s service capabilities across the region

- In January 2024, Brookside Flavors and Ingredients (BFI) announced the successful acquisition of Sterling Food Flavorings, LLC, a company known for its expertise in flavoring systems for the food and beverage sector. This acquisition allows BFI to capitalize on Sterling’s market presence and technical strengths to drive growth and meet evolving industry demands. The move reinforces BFI’s position as a comprehensive flavor solution provider

- In March 2023, International Flavors and Fragrances (IFF) entered a strategic distribution partnership for FermaSure XL in Brazil’s sugar and alcohol markets. This collaboration supports IFF’s efforts to expand its biosciences portfolio and strengthen its footprint in South America. The partnership is expected to accelerate IFF's market presence in Brazil’s food and beverage sector

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Food Essence Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Food Essence Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Food Essence Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.