Global Food Fibers Market

Market Size in USD Billion

CAGR :

%

USD

3.23 Billion

USD

4.55 Billion

2024

2032

USD

3.23 Billion

USD

4.55 Billion

2024

2032

| 2025 –2032 | |

| USD 3.23 Billion | |

| USD 4.55 Billion | |

|

|

|

|

Food Fibers Market Size

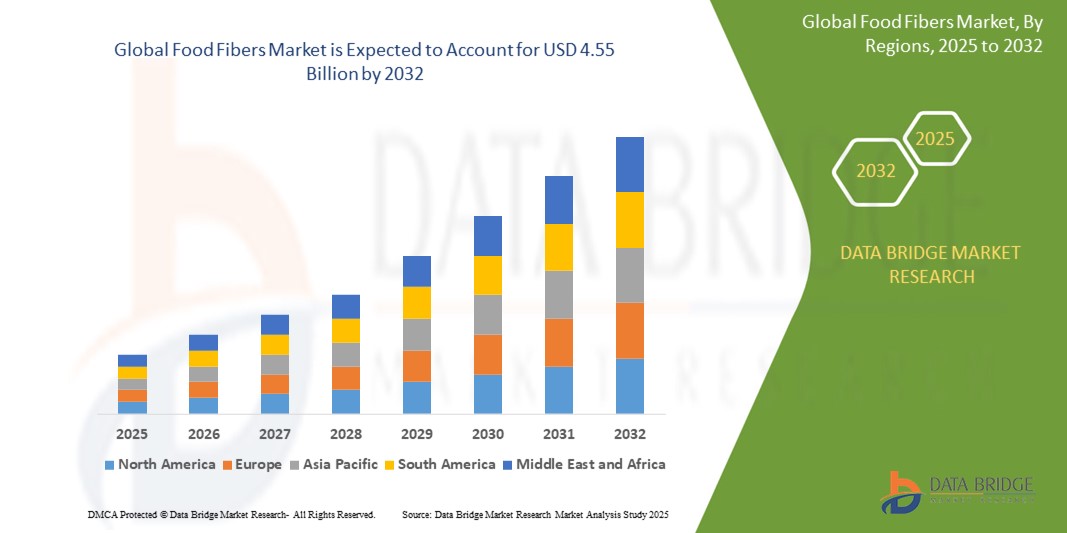

- The global food fibers market size was valued at USD 3.23 billion in 2024 and is expected to reach USD 4.55 billion by 2032, at a CAGR of 4.40% during the forecast period

- The market growth is largely fueled by increasing consumer awareness of the health benefits of dietary fibers, driving demand for fiber-enriched food and beverage products across various segments

- Furthermore, advancements in extraction and processing technologies, along with the rising trend of clean-label and functional foods, are enabling manufacturers to incorporate diverse soluble and insoluble fibers into a wide range of applications. These converging factors are accelerating the adoption of food fibers, thereby significantly boosting the industry's growth

Food Fibers Market Analysis

- Food fibers, comprising both soluble and insoluble dietary components, are increasingly vital ingredients in modern food formulations due to their proven benefits in digestive health, cholesterol reduction, glycemic control, and overall wellness, making them essential in functional, fortified, and clean-label product development across food and beverage sectors

- The escalating demand for food fibers is primarily fueled by rising health consciousness among consumers, growing prevalence of lifestyle-related disorders, and increased incorporation of fibers in bakery, dairy, beverages, and convenience foods to enhance nutritional value and meet evolving dietary preferences

- Asia-Pacific dominated the food fibers market with a share of 40.5% in 2024, due to rapid urbanization, increasing health consciousness, and growing demand for functional and fortified food products across emerging economies

- North America is expected to be the fastest growing region in the food fibers market during the forecast period due to rising consumer demand for digestive health products and functional foods incorporating both soluble and insoluble fibers

- Soluble fibers segment dominated the food fibers market with a market share of 63.7% in 2024, due to rising consumer awareness of digestive health and the increasing use of soluble fibers in functional foods and beverages. Soluble fibers such as inulin, pectin, and beta-glucan are widely recognized for their benefits in regulating blood sugar, lowering cholesterol, and promoting gut microbiota health

Report Scope and Food Fibers Market Segmentation

|

Attributes |

Food Fibers Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Food Fibers Market Trends

“Increasing Focus on Gut Health”

- A significant and accelerating trend in the global food fibers market is the growing consumer focus on gut health and the role of dietary fibers in supporting digestive wellness. This shift is driven by a broader awareness of the gut microbiome’s influence on immunity, metabolism, and mental health, prompting consumers to seek foods enriched with both soluble and insoluble fibers

- For instance, companies such as BENEO and Cargill are expanding their portfolio of inulin and chicory root fibers known for their prebiotic effects that foster beneficial gut bacteria. Similarly, Tate & Lyle offers soluble corn fibers designed to improve digestive health while maintaining product texture and taste

- Prebiotic fibers are being increasingly added to dairy, bakery, and beverage products to deliver digestive benefits without altering flavor profiles. For instance, Ingredion Incorporated is innovating with multifunctional fiber ingredients that aid in bowel regularity and nutrient absorption while supporting clean-label formulations

- The integration of gut health-focused fibers in daily diets is supported by ongoing clinical research, growing demand for natural solutions to digestive disorders, and the rising popularity of wellness-centric foods. Brands are also promoting fiber-rich formulations that address constipation, bloating, and general gastrointestinal discomfort, making gut health a mainstream product attribute

- This trend is reshaping product development across the food industry, encouraging manufacturers to prioritize functional fibers that enhance nutrition and also appeal to consumers seeking holistic health benefits. Consequently, companies such as DuPont Nutrition & Biosciences are investing in gut-health solutions combining fiber blends with probiotics to meet evolving consumer demands

- The demand for gut health-promoting food fibers is growing rapidly across multiple applications, as consumers increasingly prioritize preventative health, natural ingredients, and personalized nutrition in their daily diets

Food Fibers Market Dynamics

Driver

“Increasing Incidence of Digestive Disorders”

- The increasing incidence of digestive disorders such as constipation, irritable bowel syndrome (IBS), and inflammatory bowel diseases is a significant driver for the heightened demand for food fibers

- For instance, in March 2024, Tate & Lyle launched a new range of prebiotic soluble fibers designed to address gut health and alleviate symptoms of digestive discomfort, supporting its strategy to expand functional ingredient offerings in response to rising health concerns. Such initiatives by major players are expected to drive the food fibers market growth in the forecast period

- As consumers become more aware of the link between dietary habits and digestive health, they are actively seeking foods fortified with functional fibers to manage or prevent gastrointestinal issues. Soluble fibers help regulate bowel movements and nourish beneficial gut bacteria, while insoluble fibers aid in overall digestive tract function

- Furthermore, rising healthcare costs and a growing preference for preventive wellness are encouraging consumers to adopt high-fiber diets as a natural and cost-effective solution to digestive ailments. Manufacturers are responding by incorporating food fibers into an expanding range of bakery, dairy, and RTE products to meet this demand

- The convenience of consuming fiber through everyday foods, the rising popularity of clean-label and plant-based nutrition, and product innovation targeting digestive support are key factors propelling the adoption of food fibers across global markets. The expansion of fiber-rich product lines by companies such as BENEO, Ingredion, and Cargill further contributes to market growth

Restraint/Challenge

“High Cost of Fiber Extraction”

- The high cost of fiber extraction from plant-based raw materials poses a significant challenge to broader market penetration in the food fibers industry. Extraction processes often require advanced technologies, specialized equipment, and substantial energy input, making it difficult for manufacturers to produce high-purity fiber ingredients at a competitive cost

- For instance, sourcing and isolating functional fibers such as inulin from chicory root or pectin from citrus peels involves multiple stages of filtration, enzymatic treatment, and drying—processes that significantly raise production expenses and limit scalability for small and medium-sized manufacturers

- Addressing these cost challenges through technological innovation, optimization of extraction efficiency, and valorization of agricultural by-products is crucial for market expansion. Companies such as Ingredion and DuPont are actively investing in R&D to develop cost-effective fiber extraction techniques and multifunctional fiber blends that maintain nutritional value while reducing processing costs

- In addition, the relatively high price of premium fiber ingredients compared to conventional thickeners or bulking agents can be a barrier to adoption for price-sensitive manufacturers, particularly in developing markets or budget food segments. While bulk fibers such as wheat bran remain affordable, specialty fibers offering enhanced health benefits are often cost-prohibitive for mainstream use

- Overcoming these challenges through sustainable sourcing strategies, investment in lower-cost processing technologies, and consumer education on the health benefits of dietary fibers will be essential to drive long-term market growth

Food Fibers Market Scope

The market is segmented on the basis of type and application.

- By Type

On the basis of type, the food fibers market is segmented into soluble fibers and insoluble fibers. The soluble fibers is further sub-segmented into inulin, pectin, beta-glucan, corn fibers, and others. The insoluble fibers further sub-segmented into cellulose, hemicellulose, chitin & chitosan, lignin, oat bran, wheat fiber, and others. The soluble fibers segment held the largest market revenue share 63.7% in 2024, driven by rising consumer awareness of digestive health and the increasing use of soluble fibers in functional foods and beverages. Soluble fibers such as inulin, pectin, and beta-glucan are widely recognized for their benefits in regulating blood sugar, lowering cholesterol, and promoting gut microbiota health. The segment also benefits from its integration into low-calorie and sugar-replacement formulations, making it a popular choice among health-conscious consumers and manufacturers focused on clean-label product development.

The insoluble fibers segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by increasing demand for high-fiber dietary products aimed at improving bowel health and supporting weight management. Insoluble fibers, including cellulose and hemicellulose, are being extensively incorporated into whole grain bakery products and plant-based meat alternatives, enhancing texture while promoting satiety. The expanding vegan population and growing preference for minimally processed natural ingredients further support the adoption of insoluble fibers in diverse food formulations.

- By Application

On the basis of application, the food fibers market is segmented into bakery and confectionery, dairy, meat, poultry, seafood, RTE products, beverages, and others. The bakery and confectionery segment dominated the largest market revenue share in 2024, supported by high inclusion rates of both soluble and insoluble fibers in bread, cereals, snacks, and dessert items. With consumers increasingly seeking high-fiber, low-sugar alternatives, manufacturers are integrating dietary fibers to enhance nutritional profiles while preserving taste and texture. The segment also benefits from the growing trend of fiber-enriched functional bakery products targeting heart and digestive health.

The beverages segment is projected to register the fastest CAGR from 2025 to 2032, driven by the rising popularity of fiber-fortified drinks including juices, smoothies, dairy-based beverages, and plant-based milks. The convenience of liquid intake combined with the functional health claims associated with fiber fortification contributes to growing demand. Innovations in soluble fiber ingredients that maintain clarity, taste, and mouthfeel are enabling manufacturers to meet consumer preferences for health-oriented and ready-to-drink solutions, especially in wellness and sports nutrition categories.

Food Fibers Market Regional Analysis

- Asia-Pacific dominated the food fibers market with the largest revenue share of 40.5% in 2024, driven by rapid urbanization, increasing health consciousness, and growing demand for functional and fortified food products across emerging economies

- The region’s expanding middle class, rising disposable incomes, and preference for high-fiber diets to combat lifestyle diseases are major contributors to market growth

- In addition, supportive government initiatives promoting nutrition awareness and investments in agricultural fiber extraction technologies are accelerating adoption of food fibers in both domestic food manufacturing and export sectors

Japan Food Fibers Market Insight

Japan market is expanding due to rising demand for dietary fiber-enriched bakery and confectionery products amid an aging population focused on digestive health. Japanese consumers prefer clean-label, natural ingredients, and food fibers meet these needs effectively. Local manufacturers are investing in advanced fiber processing technologies and innovative product formulations targeting health-conscious consumers.

China Food Fibers Market Insight

China food fibers market held the largest share in Asia-Pacific in 2024, supported by its status as a global food processing hub and high domestic demand for fiber-enriched bakery, dairy, and beverages. Government programs aimed at improving public health and increasing fiber intake are driving demand. Chinese companies are increasingly focusing on sustainable sourcing and novel fiber ingredients to cater to both local and export markets.

Europe Food Fibers Market Insight

The Europe food fibers market is projected to grow at a significant CAGR over the forecast period, fueled by strong consumer demand for clean-label, high-fiber foods and regulatory focus on nutritional labeling. The region leads in innovation for fiber-enriched functional foods and beverages, supported by well-established food safety standards. Increasing popularity of plant-based diets and digestive health products is further boosting market penetration across Western and Northern Europe.

U.K. Food Fibers Market Insight

The U.K. market is expected to grow steadily during the forecast period, driven by growing consumer awareness about dietary fiber benefits and increasing availability of fiber-fortified bakery and RTE products. Public health campaigns promoting fiber intake and government support for functional food innovation are encouraging brands to develop fiber-enriched formulations. Rising vegan and vegetarian populations also contribute to market expansion.

Germany Food Fibers Market Insight

The Germany food fibers market is poised for considerable growth, supported by a strong focus on preventive healthcare and high consumer demand for natural, minimally processed foods. Germany’s food industry is innovating with diverse fiber sources such as oat bran and wheat fiber to meet clean-label trends. The country’s advanced food processing infrastructure and regulatory emphasis on nutritional quality underpin the sector’s robust outlook.

North America Food Fibers Market Insight

North America market is projected to grow at the fastest CAGR from 2025 to 2032, driven by rising consumer demand for digestive health products and functional foods incorporating both soluble and insoluble fibers. Increasing prevalence of lifestyle diseases and growing interest in plant-based nutrition are key growth factors. Innovations in fiber ingredient technology and strong regulatory frameworks promoting fiber labeling and health claims further accelerate market adoption.

U.S. Food Fibers Market Insight

U.S. food fibers market captured the largest revenue share in 2024 within North America, supported by the high consumption of fiber-enriched bakery, dairy, and beverage products. The retail and foodservice sectors are increasingly incorporating dietary fibers to cater to health-conscious consumers. In addition, rising consumer preference for clean-label, organic, and non-GMO products is accelerating the use of novel fiber ingredients and fiber blends that enhance product functionality and nutritional value.

Food Fibers Market Share

The food fibers industry is primarily led by well-established companies, including:

- Cargill, Incorporated (U.S.)

- Tate & Lyle (U.K.)

- ADM (U.S.)

- Roquette Frères (France)

- SunOpta (Canada)

- Nexira (France)

- Grain Processing Corporation (U.S.)

- Kerry Group plc. (Ireland)

- J. RETTENMAIER & SÖHNE GmbH + Co. KG (Germany)

- DuPont (U.S.)

- BENEO (Germany)

- Lonza (Switzerland)

- AdvoCare (U.S.)

- Foodchem International Corporation (China)

- CreaFill Fibers Corporation (U.S.)

- Fibersol (U.S.)

What are the Recent Developments in Global Food Fibers Market?

- In July 2024, Ingredion Incorporated introduced the VERSAFIBE dietary fiber series, a new line of low cost-in-use fibers designed to support manufacturers in fiber fortification and calorie reduction. This launch is expected to significantly impact the food fibers market by addressing one of its major challenges—high production costs. By offering a cost-effective solution without compromising on product quality or sensory attributes, Ingredion is likely to enhance fiber inclusion in mainstream food categories such as pastas, baked goods, and extruded products, thereby broadening the market’s commercial appeal and adoption rate across cost-sensitive regions

- In January 2023, Fiberstar, Inc. launched its Citri-Fi® 400 series, a new line of organic citrus fibers developed in response to growing demand for clean-label, sustainable, and health-oriented food ingredients. This innovation is anticipated to strengthen the market position of natural fibers by aligning with key industry trends such as sustainability, organic product development, and hydrocolloid alternatives amid supply chain disruptions. By offering functional, organic fiber solutions, Fiberstar is contributing to the expansion of the premium segment of the food fibers market, especially in applications where natural origin and environmental credentials influence consumer purchase decisions

- In September 2022, Cargill announced plans to commercially launch a soluble corn fiber ingredient within the next year. This ingredient, which contains at least 804.4% fiber when dry, allows for high fiber content claims on product labels. Besides serving as a bulking agent, the soluble corn fiber is low in calories and minimally impacts the texture and color of food products

- In April 2022, Tate & Lyle acquired Quantum Hi-Tech (Guangdong) Biological, a China-based prebiotic manufacturer, for USD 237 Billion. This acquisition supports Tate & Lyle's strategy to focus on growth in the food and beverage sector and enhances its presence in the rapidly expanding global dietary fiber market

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Food Fibers Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Food Fibers Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Food Fibers Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.