Global Food Grade Curcumin Market

Market Size in USD Billion

CAGR :

%

USD

6.73 Billion

USD

15.96 Billion

2024

2032

USD

6.73 Billion

USD

15.96 Billion

2024

2032

| 2025 –2032 | |

| USD 6.73 Billion | |

| USD 15.96 Billion | |

|

|

|

|

Food Grade Curcumin Market Size

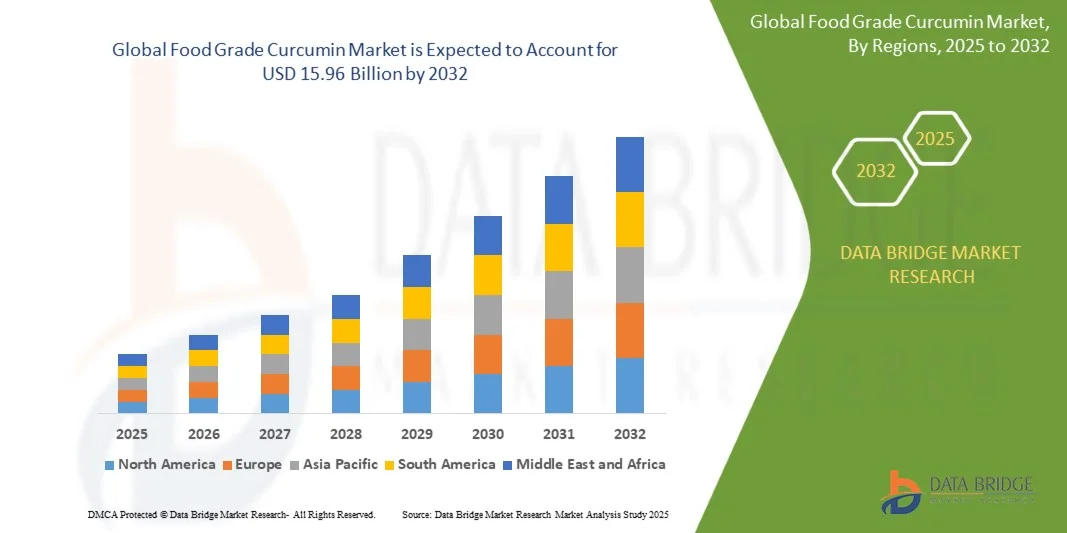

- The global food grade curcumin market size was valued at USD 6.73 billion in 2024 and is expected to reach USD 15.96 billion by 2032, at a CAGR of 11.40% during the forecast period

- The market growth is largely fueled by the increasing demand for natural food colorants and functional ingredients across processed foods and beverages, driven by rising consumer awareness of clean-label, organic, and health-promoting products

- Furthermore, growing preference for fortified and functional foods, combined with regulatory encouragement for natural additives, is establishing food grade curcumin as a key ingredient in bakery, dairy, snack, and beverage applications. These converging factors are accelerating the adoption of curcumin in industrial and retail food products, thereby significantly boosting the industry's growth

Food Grade Curcumin Market Analysis

- Food grade curcumin, a natural extract of turmeric, is increasingly adopted in food and beverage applications due to its coloring, antioxidant, and health-promoting properties, making it a vital component in functional and fortified foods

- The escalating demand for food grade curcumin is primarily fueled by rising health consciousness among consumers, stricter regulations on synthetic food colorants, and growing popularity of natural and clean-label ingredients in both developed and emerging markets

- North America dominated the food grade curcumin market with a share of 51.3% in 2024, due to the increasing demand for natural food colorants and health-promoting ingredients in processed foods and beverages

- Asia-Pacific is expected to be the fastest growing region in the food grade curcumin market during the forecast period due to rising urbanization, increasing disposable incomes, and the popularity of functional foods in countries such as India, China, and Japan

- Equal to 98.0 percent segment dominated the market with a market share of 63% in 2024, due to its superior purity, higher bioavailability, and consistent coloring strength, which are critical for maintaining quality in food products. Manufacturers and food processors prefer this type for standardized formulations, ensuring uniform taste, color, and health benefits across large-scale production. The segment also benefits from strong regulatory compliance in various regions, making it the preferred choice for premium food and beverage applications. Its compatibility with multiple food matrices and stability under processing conditions further enhances demand

Report Scope and Food Grade Curcumin Market Segmentation

|

Attributes |

Food Grade Curcumin Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Food Grade Curcumin Market Trends

“Growing Preference for Clean-Label and Natural Ingredients”

- The food grade curcumin market is witnessing notable expansion driven by the increasing consumer preference for clean-label and naturally derived food ingredients. As awareness about health and wellness grows, there is a pronounced shift away from synthetic additives toward plant-based compounds such as curcumin, known for its antioxidant and anti-inflammatory properties

- For instance, Arjuna Natural Pvt. Ltd. and Sabinsa Corporation have expanded their product lines to include food grade curcumin extracts formulated specifically for beverages, dairy, and bakery applications. These companies focus on standardization, purity, and safety to meet the rising industry demand for natural formulations

- The clean-label movement is encouraging food manufacturers to replace artificial colorants with natural pigments, and curcumin derived from turmeric serves this need effectively. Its appealing yellow hue and functional health benefits make it a dual-purpose ingredient—offering both aesthetic enhancement and nutritional value

- In addition, consumers are increasingly seeking transparency regarding ingredient sourcing and processing methods. As a result, companies are reformulating food products and launching naturally colored alternatives containing traceable and sustainably produced curcumin extracts

- The expansion of organic and plant-based product portfolios by major food brands is further supporting demand for curcumin as a versatile component. Its application in beverages, sauces, snacks, and confectionery reflects the broader trend toward functional and naturally enriched diets

- The rising inclination toward natural ingredient adoption, driven by health-conscious consumers and industry reformulations, will continue to strengthen the market position of food grade curcumin in the evolving clean-label food sector. This transition is expected to enhance long-term sustainability and consumer trust across the global food and beverage industry

Food Grade Curcumin Market Dynamics

Driver

“Rising Demand for Functional Foods and Natural Colorants”

- The growing integration of functional ingredients into daily diets is propelling demand for food grade curcumin across a wide variety of applications. Curcumin offers multiple nutritional benefits, making it suitable for use in fortified and value-added foods

- For instance, companies such as DSM-Firmenich AG and Naturex (Givaudan) are introducing curcumin-infused formulations aimed at improving food aesthetics and nutritional properties. These products cater to the increasing demand for functional bakery goods, dairy items, and ready-to-drink beverages in global markets

- The rising popularity of functional foods enriched with bioactive compounds is encouraging food brands to invest in ingredients that provide both visual appeal and health support. Curcumin, with its bioavailability-improving technologies, is becoming a preferred choice among manufacturers targeting health-focused consumers

- Growing awareness regarding the health benefits of curcumin in managing inflammation and oxidative stress is further supporting its inclusion in premium food segments. This has led to a rise in partnerships between ingredient suppliers and food brands for co-developing fortified product lines

- As consumers seek cleaner and nutritionally beneficial alternatives, curcumin’s dual role as a natural pigment and health-promoting ingredient ensures strong demand momentum in the functional food sector. This shift will remain central to market expansion over the forecast period

Restraint/Challenge

“Supply Fluctuations and High Production Costs”

- The food grade curcumin market faces considerable challenges due to irregular supply of turmeric root and the high costs associated with curcumin extraction and standardization processes. Variability in raw material availability and climatic factors affecting turmeric cultivation contribute to unpredictable price swings

- For instance, fluctuations in turmeric production across major growing regions in India and Southeast Asia often lead to inconsistencies in global supply chains. Leading producers such as Synthite Industries and Arjuna Natural must manage these risks through strategic sourcing and long-term supplier partnerships

- High costs involved in solvent extraction, purification, and customization of curcumin formulations make product pricing less competitive compared to synthetic alternatives. Smaller manufacturers often encounter difficulties in achieving economies of scale while maintaining quality standards

- The complexity of ensuring uniform bioavailability and food-grade compliance adds to the production burden, requiring continuous investment in advanced extraction technologies and laboratory testing. These processes increase operational costs for suppliers aiming to meet strict food safety regulations

- Addressing supply chain vulnerabilities and optimizing production efficiency will be essential for market growth. Collaborative efforts between agricultural producers, curcumin processors, and food manufacturers are key to achieving cost stability and ensuring consistent availability of high-quality food grade curcumin for global applications

Food Grade Curcumin Market Scope

The market is segmented on the basis of type, application, and channel.

• By Type

On the basis of type, the food grade curcumin market is segmented into Equal to 98.0 Percent and Less than 98.0 Percent. The Equal to 98.0 Percent segment dominated the market with the largest market revenue share of 63% in 2024, driven by its superior purity, higher bioavailability, and consistent coloring strength, which are critical for maintaining quality in food products. Manufacturers and food processors prefer this type for standardized formulations, ensuring uniform taste, color, and health benefits across large-scale production. The segment also benefits from strong regulatory compliance in various regions, making it the preferred choice for premium food and beverage applications. Its compatibility with multiple food matrices and stability under processing conditions further enhances demand.

The Less than 98.0 Percent segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by cost-effectiveness and adoption in budget-friendly food and snack products. This type appeals to small- and medium-sized manufacturers seeking functional coloring and mild health benefits without the premium price. Rising interest in fortified foods and nutraceuticals also supports its adoption. The ease of incorporation into various products such as snacks, baked goods, and beverages drives market expansion. In addition, ongoing innovations to improve its stability and bioavailability are expected to boost growth.

• By Application

On the basis of application, the food grade curcumin market is segmented into Baked Goods, Snack Foods, Dairy Products, and Other. The Snack Foods segment dominated the market with the largest revenue share in 2024, driven by the growing consumer demand for colorful, health-enhanced snacks with natural ingredients. Curcumin is widely used as a natural colorant and antioxidant in snacks, providing both visual appeal and added nutritional value. Rising awareness regarding functional foods and the inclusion of curcumin for its anti-inflammatory and antioxidant properties further drives its adoption. The segment also benefits from diverse product formulations, enabling manufacturers to innovate flavors, textures, and packaging.

The Dairy Products segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by increasing use in fortified yogurts, cheeses, and beverages. For instance, companies such as Amul and Danone are incorporating curcumin into dairy formulations to enhance health benefits and differentiate products. Growing demand for plant-based and functional dairy products in health-conscious markets supports this trend. The segment’s expansion is aided by advancements in microencapsulation and solubility techniques, improving curcumin’s stability in liquid and semi-solid dairy matrices.

• By Channel

On the basis of channel, the food grade curcumin market is segmented into Direct Sales and Distributor. The Direct Sales segment dominated the market with the largest revenue share in 2024, driven by manufacturers’ preference for direct procurement to maintain quality control, traceability, and consistent supply. Large-scale food and beverage companies often rely on direct sourcing to ensure compliance with stringent food safety and quality standards. Direct sales channels also provide opportunities for customization, bulk ordering, and long-term contracts, which are highly valued in industrial applications.

The Distributor segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by the increasing number of small- and medium-sized manufacturers and startups that depend on intermediaries for timely and flexible supply. For instance, companies such as Arjuna Natural and Synthite utilize distributor networks to expand reach in regional and international markets. Distributors also facilitate access to multiple product types and grades, simplifying procurement for manufacturers with varied requirements. The growth is further supported by e-commerce and B2B platforms enabling seamless ordering and logistics management.

Food Grade Curcumin Market Regional Analysis

- North America dominated the food grade curcumin market with the largest revenue share of 51.3% in 2024, driven by the increasing demand for natural food colorants and health-promoting ingredients in processed foods and beverages

- Consumers in the region highly value high-purity curcumin for its consistent coloring strength, functional benefits, and regulatory compliance in food applications

- This widespread adoption is further supported by high consumer awareness of clean-label and fortified food products, a technologically advanced food processing industry, and the growing preference for natural additives, establishing food grade curcumin as a preferred solution across both industrial and retail food applications

U.S. Food Grade Curcumin Market Insight

The U.S. food grade curcumin market captured the largest revenue share in 2024 within North America, fueled by the increasing trend of functional foods and beverages. Consumers are prioritizing ingredients that provide natural color, antioxidant properties, and health benefits, particularly in bakery, snack, and dairy products. Rising demand for clean-label, organic, and nutraceutical products, coupled with the presence of leading curcumin manufacturers, is further driving market expansion.

Europe Food Grade Curcumin Market Insight

The Europe food grade curcumin market is projected to grow at a substantial CAGR during the forecast period, primarily driven by the rising demand for natural food additives and fortified products. Stringent food safety and labeling regulations encourage the adoption of high-quality curcumin, while consumers are drawn to its health-promoting properties and natural coloring benefits. Growth is seen across bakery, snack, dairy, and beverage applications, with curcumin increasingly incorporated in both premium and mainstream products.

U.K. Food Grade Curcumin Market Insight

The U.K. food grade curcumin market is expected to grow at a noteworthy CAGR during the forecast period, driven by the clean-label and functional foods trend and consumer preference for natural, health-enhancing ingredients. Strong food processing capabilities, robust retail and e-commerce channels, and product differentiation strategies in bakery, dairy, and snack segments are supporting the market expansion.

Germany Food Grade Curcumin Market Insight

The Germany food grade curcumin market is anticipated to expand at a considerable CAGR during the forecast period, fueled by health-conscious consumer behavior and demand for natural additives. Emphasis on food quality, sustainability, and innovation promotes the use of high-purity curcumin in processed foods, while its application in baked goods, dairy products, and snacks continues to grow. Manufacturers prioritize stable, high-quality curcumin to comply with regulatory standards and ensure consistent product performance.

Asia-Pacific Food Grade Curcumin Market Insight

The Asia-Pacific food grade curcumin market is poised to grow at the fastest CAGR from 2025 to 2032, driven by rising urbanization, increasing disposable incomes, and the popularity of functional foods in countries such as India, China, and Japan. Traditional turmeric usage, government initiatives promoting nutraceuticals, and APAC’s position as a major curcumin manufacturing hub are boosting adoption, while affordability and accessibility are expanding its reach. The trend toward fortified and clean-label products is further propelling growth across industrial and retail sectors.

Japan Food Grade Curcumin Market Insight

The Japan food grade curcumin market is gaining momentum due to high consumer awareness of functional foods, preference for natural colorants, and an expanding nutraceutical industry. Curcumin adoption is rising in beverages, dairy products, and snacks, and the country’s aging population is encouraging demand for products with health benefits such as anti-inflammatory and antioxidant properties.

China Food Grade Curcumin Market Insight

The China food grade curcumin market accounted for the largest revenue share in Asia-Pacific in 2024, driven by rapid urbanization, an expanding middle class, and a strong food processing sector. Curcumin is increasingly used in snacks, bakery, and dairy applications, supported by government initiatives promoting health and nutrition and the presence of competitive domestic manufacturers. The growing trend of fortified and clean-label products is further fueling market adoption across industrial and retail segments.

Food Grade Curcumin Market Share

The food grade curcumin industry is primarily led by well-established companies, including:

- Bioprex Labs (India)

- Synthite Industries Ltd. (India)

- BioThrive Sciences (U.S.)

- Konark Herbals (India)

- Arjuna Natural Pvt Ltd (India)

- SV AGROFOOD (India)

- Star Hi Herbs Pvt Ltd. (India)

- NOW Foods (U.S.)

- Phyto Life Sciences P. Ltd. (India)

- Herboveda (India)

- Sabinsa (U.S.)

- Shaanxi Jiahe Phytochem Co., Ltd. (China)

- The Green Labs LLC (U.S.)

- Wacker Chemie AG (Germany)

- Hindustan Mint & Agro Products Pvt. Ltd. (India)

- Naturite Agro Products Ltd. (India)

- ARJUNA NATURAL LTD (India)

- BioMax Security (India)

Latest Developments in Global Food Grade Curcumin Market

- In August 2025, the food grade curcumin market experienced a notable price surge of 8–9% due to tighter regulations on artificial food dyes in the U.S. and reduced turmeric feedstock yields from heavy monsoons in India. This supply-side constraint is driving food manufacturers to increasingly adopt natural colorants, particularly high-purity curcumin, as a reliable alternative. The regulatory push against synthetic dyes, combined with scarcity of raw materials, is likely to accelerate the incorporation of curcumin in processed foods, beverages, and bakery products, creating opportunities for suppliers to expand production and strengthen market presence

- In April 2025, Theracurmin won the Grand Prize at the Korea Luxury Brand Awards for its high-absorption curcumin format. This achievement highlights the growing consumer and industry recognition of premium, bioavailable curcumin products. It is expected to boost confidence among food and beverage manufacturers to include high-performance curcumin in functional foods, fortified snacks, and beverages. The award also emphasizes the market trend toward scientifically advanced formulations that offer enhanced health benefits, thereby expanding the appeal of curcumin in high-end and health-focused product segments

- In March 2025, a breakthrough in protein-stabilized curcumin emulsions was published, showing significantly improved solubility and bioavailability in liquid and semi-solid food applications. This innovation addresses one of the major challenges of curcumin incorporation—its poor water solubility—and enables broader application across beverages, dairy products, sauces, and nutritional drinks. By enhancing stability and performance, manufacturers can develop functional and fortified foods with consistent quality, driving wider adoption of curcumin as both a natural colorant and health-promoting ingredient in the market

- In January 2025, Arjuna Natural Extracts Ltd announced that its turmeric-extract manufacturing plant in Coimbatore became fully solar-powered. This sustainability initiative strengthens the clean-label and eco-friendly positioning of food grade curcumin, meeting the rising consumer demand for environmentally responsible ingredients. Manufacturers can leverage this development to market their products as sustainably sourced, aligning with growing trends of green production, corporate social responsibility, and eco-conscious branding, which in turn is expected to enhance market penetration and consumer loyalty

- In May 2024, Indena S.p.A. and Synthite Industries Ltd formed a strategic partnership to co-develop high-purity curcumin extracts and phytosome formulations. This collaboration is significant as it combines technological expertise to create high-performance curcumin suitable for functional foods, beverages, and fortified products. By focusing on improved absorption and efficacy, the partnership supports manufacturers in differentiating products in an increasingly competitive market, fostering innovation, and expanding the overall adoption of food grade curcumin in both domestic and international markets

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Food Grade Curcumin Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Food Grade Curcumin Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Food Grade Curcumin Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.