Global Food Halal Ingredients Market

Market Size in USD Billion

CAGR :

%

USD

66.23 Billion

USD

105.97 Billion

2025

2033

USD

66.23 Billion

USD

105.97 Billion

2025

2033

| 2026 –2033 | |

| USD 66.23 Billion | |

| USD 105.97 Billion | |

|

|

|

|

Food Halal Ingredients Market Size

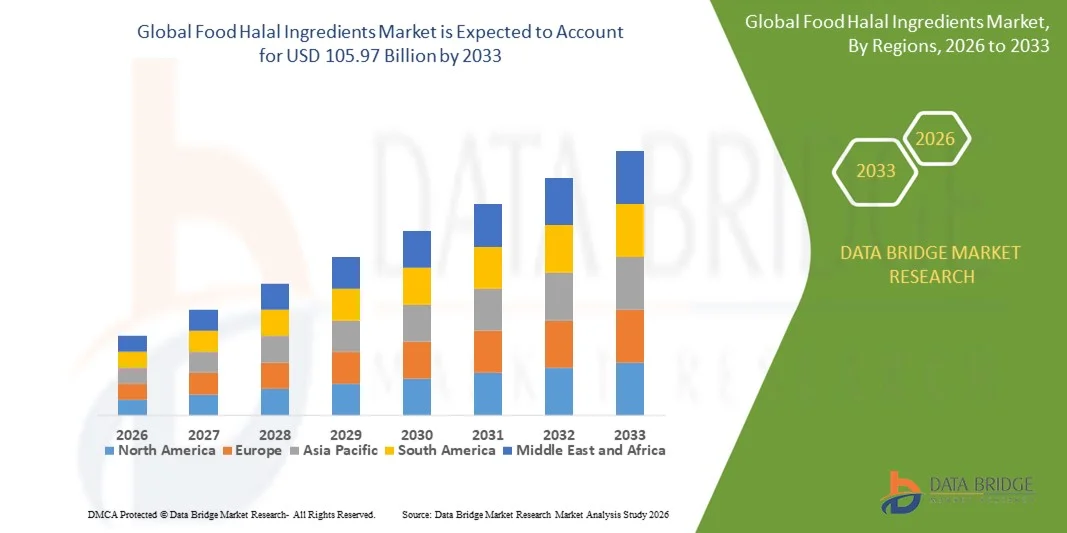

- The global food halal ingredients market size was valued at USD 66.23 billion in 2025 and is expected to reach USD 105.97 billion by 2033, at a CAGR of 6.05% during the forecast period

- The market growth is largely driven by the rising global Muslim population and increasing awareness of halal-certified food consumption, which is encouraging food manufacturers to adopt halal-compliant ingredients across processed and packaged food categories

- Furthermore, growing demand for transparency, food safety, and clean-label ingredients among both Muslim and non-Muslim consumers is positioning halal ingredients as a trusted standard for quality and ethical food production, thereby accelerating market expansion

Food Halal Ingredients Market Analysis

- Food halal ingredients are raw materials and additives that comply with Islamic dietary laws and are used in the production of halal-certified food and beverage products, ensuring compliance, safety, and quality across the supply chain

- The increasing demand for halal ingredients is primarily fueled by the expansion of the global food processing industry, rising consumption of convenience and ready-to-eat foods, and growing acceptance of halal-certified products in mainstream retail and foodservice channels

- Asia-Pacific dominated the food halal ingredients market with a share of 49% in 2025, due to rising consumption of halal-certified foods, expanding food and beverage manufacturing, and strong demand for convenience and bakery products

- North America is expected to be the fastest growing region in the food halal ingredients market during the forecast period due to rising demand for halal-certified convenience foods, bakery, and beverage products among diverse consumer groups

- Bakery products segment dominated the market with a market share of 27.2% in 2025, due to the increasing consumption of halal-certified breads, pastries, and snacks. Halal ingredients such as enzymes, emulsifiers, and flavors play a crucial role in enhancing product quality, texture, and taste, making them essential in commercial and retail bakery operations. Consumers increasingly prefer ready-to-eat and freshly baked halal products, contributing to strong market demand

Report Scope and Food Halal Ingredients Market Segmentation

|

Attributes |

Food Halal Ingredients Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Food Halal Ingredients Market Trends

Rising Demand for Halal-Certified Convenience and Processed Food Ingredients

- A key trend in the food halal ingredients market is the rising demand for halal-certified ingredients used in convenience and processed food products, driven by changing consumer lifestyles and increasing preference for ready-to-eat and packaged foods that align with halal dietary principles. This trend is strengthening the role of halal ingredients as essential inputs across bakery, confectionery, meat processing, dairy alternatives, and savory food segments

- For instance, companies such as Nestlé have significantly expanded the use of halal-certified ingredients across their processed food and ready-meal product lines, supported by halal certification from recognized bodies such as JAKIM and MUIS. This enables the company to cater to Muslim consumers while ensuring compliance with stringent halal sourcing and processing requirements

- The growing penetration of halal-certified ingredients in frozen foods, instant meals, and snacks is reshaping product development strategies among food manufacturers. This is driven by rising urbanization and the need for convenient food solutions that maintain religious compliance alongside taste and quality expectations

- Food manufacturers are increasingly integrating halal-certified emulsifiers, flavorings, stabilizers, and enzymes to ensure end-to-end halal integrity across processed food formulations. This trend is strengthening supplier demand for transparent sourcing, traceability, and verified production processes

- The expansion of halal-certified convenience foods in non-Muslim majority regions is also supporting market growth, as halal products gain wider acceptance due to their perceived quality, safety, and ethical production standards. This is increasing the global relevance of halal ingredients beyond traditional markets

- The sustained rise in demand for halal-certified processed food ingredients is reinforcing long-term market expansion, positioning halal ingredients as critical enablers of compliance, consumer trust, and scalability in the global food processing industry

Food Halal Ingredients Market Dynamics

Driver

Growth in Global Halal Food Consumption and Certification Adoption

- The steady growth in global halal food consumption is a major driver for the food halal ingredients market, supported by increasing Muslim population, rising disposable incomes, and greater awareness of halal dietary requirements. This growth is pushing food manufacturers to adopt halal-certified ingredients to access broader consumer bases and international markets

- For instance, organizations such as the Halal Development Corporation Berhad (HDC) and certification bodies such as JAKIM play a critical role in driving halal certification adoption among ingredient suppliers and food producers. Their certification frameworks enable companies to ensure ingredient compliance and expand exports to halal-sensitive markets

- The increasing emphasis on halal certification among multinational food companies is driving consistent demand for certified ingredients across meat derivatives, gelatin, enzymes, and food additives. Certification adoption helps manufacturers reduce market entry barriers and enhance brand credibility in halal-compliant regions

- Government-led initiatives and trade agreements supporting halal food ecosystems are further accelerating certification uptake across ingredient supply chains. This is encouraging standardization and improving market accessibility for certified ingredient producers

- The growing preference for certified halal products among younger consumers and health-conscious buyers is reinforcing long-term consumption growth. This sustained rise in halal food demand continues to strengthen ingredient-level adoption and supports overall market expansion

Restraint/Challenge

Complex and Fragmented Halal Certification Standards Across Regions

- The food halal ingredients market faces challenges due to the complexity and fragmentation of halal certification standards across different countries and regions, which creates compliance difficulties for global ingredient suppliers. Variations in interpretation, documentation requirements, and audit procedures increase operational burden for manufacturers

- For instance, differences between certification bodies such as JAKIM in Malaysia, MUIS in Singapore, and the Halal Food Authority in the U.K. often require ingredient suppliers to undergo multiple audits and certification processes. This increases time-to-market and raises certification-related costs

- Managing multiple halal standards complicates supply chain coordination, particularly for ingredients sourced from diverse geographic locations. Manufacturers must maintain strict segregation, traceability, and documentation to meet varying regulatory expectations

- The lack of universal harmonization in halal certification limits scalability for small and mid-sized ingredient producers seeking global market access. This creates entry barriers and restricts participation in international halal food supply chains

- These fragmented certification frameworks continue to challenge market growth by increasing compliance complexity and cost pressures. Addressing standard alignment and mutual recognition remains critical for improving efficiency and sustaining long-term expansion of the food halal ingredients market

Food Halal Ingredients Market Scope

The market is segmented on the basis of ingredient type and application.

- By Ingredient Type

On the basis of ingredient type, the Food Halal Ingredients market is segmented into flavors, hydrocolloids, starches, sweeteners, acidulants, emulsifiers, enzymes, colors, protein, antioxidants, preservatives, and others. The flavors segment dominated the largest market revenue share in 2025, driven by the increasing consumer demand for diverse taste experiences in halal-certified food products. Flavors are widely used across beverages, confectionery, and convenience foods to enhance sensory appeal while maintaining compliance with halal regulations. Manufacturers are increasingly focusing on natural and clean-label flavors to cater to health-conscious consumers, further reinforcing the demand for this segment.

The enzymes segment is anticipated to witness the fastest growth rate from 2026 to 2033, fueled by their expanding application in bakery, dairy, and meat processing for improving texture, shelf life, and digestibility. For instance, companies such as Novozymes are innovating halal-certified enzyme solutions to meet functional and dietary requirements. Enzymes provide cost-effective solutions for process efficiency, and their growing acceptance in industrial food processing is driving market expansion. In addition, regulatory approvals and advancements in enzyme technology are encouraging broader adoption across the halal food supply chain.

- By Application

On the basis of application, the Food Halal Ingredients market is segmented into convenience food products, bakery products, beverage products, meat & poultry products, confectionery products, and others. The bakery products segment dominated the largest market revenue share of 27.2% in 2025, driven by the increasing consumption of halal-certified breads, pastries, and snacks. Halal ingredients such as enzymes, emulsifiers, and flavors play a crucial role in enhancing product quality, texture, and taste, making them essential in commercial and retail bakery operations. Consumers increasingly prefer ready-to-eat and freshly baked halal products, contributing to strong market demand.

The beverage products segment is expected to witness the fastest CAGR from 2026 to 2033, fueled by rising demand for halal-certified juices, dairy-based drinks, and functional beverages. For instance, companies such as FrieslandCampina have introduced halal-certified dairy and plant-based beverages to cater to the growing market. Halal beverage formulations focus on clean labeling, natural ingredients, and functional benefits, attracting health-conscious and ethically driven consumers. In addition, the expansion of modern retail channels and e-commerce platforms is facilitating easy access and adoption of halal beverages globally.

Food Halal Ingredients Market Regional Analysis

- Asia-Pacific dominated the food halal ingredients market with the largest revenue share of 49% in 2025, driven by rising consumption of halal-certified foods, expanding food and beverage manufacturing, and strong demand for convenience and bakery products

- The region’s cost-effective production capabilities, growing food processing infrastructure, and increasing adoption of halal standards across both domestic and export markets are accelerating market growth

- The availability of skilled labor, supportive government regulations for halal certification, and rising urbanization in developing economies are contributing to increased consumption of halal ingredients across multiple food categories

China Food Halal Ingredients Market Insight

China held the largest share in the Asia-Pacific Food Halal Ingredients market in 2025, owing to its position as a leading food manufacturing hub and increasing exports of halal-certified products. The country’s strong industrial base, government support for food safety and halal certification, and investments in modern processing technologies are major growth drivers. Rising consumer awareness of halal dietary requirements and demand for convenience and bakery products are further fueling market expansion.

India Food Halal Ingredients Market Insight

India is witnessing the fastest growth in the Asia-Pacific region, driven by a rapidly expanding food processing sector, increasing domestic consumption of halal foods, and growing exports of processed halal products. Initiatives to enhance food quality standards and promote halal certification, along with rising urban population and disposable income, are strengthening demand for halal ingredients. In addition, investments in cold chain infrastructure and modern bakery and beverage processing facilities are contributing to robust market growth.

Europe Food Halal Ingredients Market Insight

The Europe Food Halal Ingredients market is expanding steadily, supported by rising demand for halal-certified convenience foods, bakery, and beverage products. Stringent food safety and labeling regulations, focus on quality and certification, and increasing multicultural population are driving market adoption. Investments in specialty food manufacturing and R&D for halal-compliant formulations are further boosting growth in the region.

Germany Food Halal Ingredients Market Insight

Germany’s halal ingredients market is driven by its strong food processing industry, growing multicultural consumer base, and increasing demand for bakery and convenience products. The country has well-established supply chains and partnerships between manufacturers and certification bodies, facilitating the adoption of halal ingredients. Demand is particularly strong in bakery and beverage applications, with companies focusing on product quality and compliance.

U.K. Food Halal Ingredients Market Insight

The U.K. market is supported by a mature food and beverage industry, growing multicultural population, and increasing preference for halal-certified products. Focus on quality standards, R&D in product formulation, and investments in modern processing units are enhancing the adoption of halal ingredients. The rising popularity of ready-to-eat and packaged foods is further supporting market growth.

North America Food Halal Ingredients Market Insight

North America is projected to grow at the fastest CAGR from 2026 to 2033, driven by rising demand for halal-certified convenience foods, bakery, and beverage products among diverse consumer groups. Increasing awareness of halal dietary requirements, growth in food service and retail sectors, and investments in halal-certified processing facilities are boosting market expansion. In addition, collaborations between manufacturers and certification agencies are supporting broader adoption of halal ingredients.

U.S. Food Halal Ingredients Market Insight

The U.S. accounted for the largest share in the North America market in 2025, underpinned by a strong food manufacturing industry, high consumer demand for halal-certified products, and increasing imports of halal ingredients. The country’s focus on quality, compliance with halal standards, and investments in modern processing infrastructure are encouraging market growth. Presence of key halal-certified food manufacturers and a well-established distribution network further solidify the U.S.’s leading position in the region.

Food Halal Ingredients Market Share

The food halal ingredients industry is primarily led by well-established companies, including:

- BASF SE (Germany)

- Cargill, Incorporated (U.S.)

- Solvay (Belgium)

- Unilever Food Solutions (Netherlands)

- Tesco plc (U.K.)

- SAAF International (U.K.)

- Koninklijke DSM N.V. (Netherlands)

- ADM (U.S.)

- Kerry Group plc (Ireland)

- Barentz International BV (Netherlands)

- PureCircle (Malaysia)

- Nestlé S.A. (Switzerland)

- Givaudan SA (Switzerland)

- Symrise AG (Germany)

- Ajinomoto Co., Inc. (Japan)

- Ingredion Incorporated (U.S.)

Latest Developments in Global Food Halal Ingredients Market

- In November 2024, Al Islami Foods launched its extensive range of processed halal food products in Qatar, significantly strengthening its footprint in the GCC convenience food segment. This launch expands consumer access to premium, hand-slaughtered halal products and supports rising demand for ready-to-cook solutions among busy urban households. The move also reinforces Al Islami’s position as a regional leader while intensifying competition in the halal processed food market across the Middle East

- In October 2024, Tanmiah Food Company entered strategic partnerships with Griffith Foods and Poulta Inc. to advance halal product innovation and ingredient development in Saudi Arabia. This collaboration enhances the availability of halal-certified seasonings, coatings, and functional ingredients, supporting local food manufacturers in improving product quality and scalability. The initiative contributes to strengthening the regional halal food ecosystem and reducing reliance on imports

- In July 2024, GoodLife Foods completed the acquisition of Pure Ingredients, expanding its halal frozen food and ingredient portfolio in Europe. This acquisition improves GoodLife’s production capacity and enables broader distribution of halal-certified products across retail and foodservice channels. The move supports growing consumer demand for convenient halal foods and reinforces Europe’s role as a key growth market

- In March 2024, Isla Délice Group finalized the acquisition of German halal brand Gürkan, enhancing its presence in the European halal meat segment. This development allows Isla Délice to expand its premium product offerings and strengthen supply chain efficiency across key EU markets. The acquisition supports consolidation in the halal food sector and improves access to certified products for a growing multicultural consumer base

- In January 2024, Cargill expanded its halal-compliant protein and ingredient capabilities through the acquisition of HalalCure, strengthening its position in the global halal ingredients market. This move enables Cargill to offer a wider range of halal-certified functional proteins and inputs to food manufacturers. It also supports large-scale adoption of halal ingredients across processed food, meat, and alternative protein applications

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Food Halal Ingredients Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Food Halal Ingredients Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Food Halal Ingredients Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.