Global Food Humectants Market

Market Size in USD Billion

CAGR :

%

USD

3.27 Billion

USD

4.78 Billion

2024

2032

USD

3.27 Billion

USD

4.78 Billion

2024

2032

| 2025 –2032 | |

| USD 3.27 Billion | |

| USD 4.78 Billion | |

|

|

|

|

Food Humectants Market Size

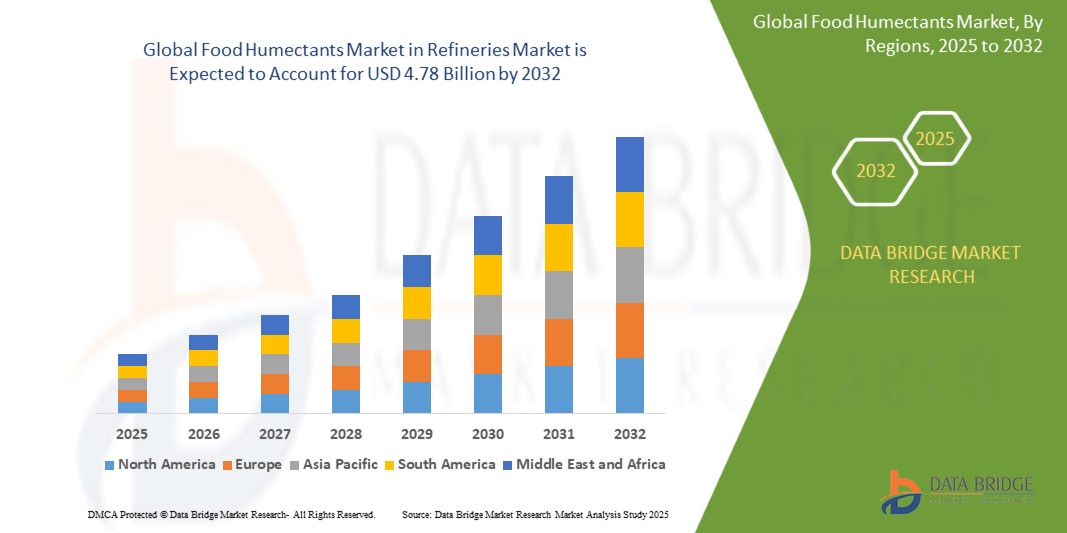

- The global Food Humectants market size was valued at USD 3.27 billion in 2024 and is projected to reach USD 4.78 billion by 2032, growing at a CAGR of 5.0% during the forecast period.

- Growth is fueled by rising demand for shelf-life extension in processed foods, increasing consumption of low-sugar and sugar-free food & beverage products, and a strong shift towards clean-label, plant-derived ingredients globally.

Food Humectants Market Analysis

- Food humectants are ingredients used to attract and retain moisture in food, enhancing texture, mouthfeel, and shelf stability. Their application is vital in bakery, confectionery, dairy, and beverage products where moisture retention directly impacts product quality.

- Market expansion is propelled by higher consumption of processed and functional foods, especially in urban centers with busy lifestyles and preference for convenience.

- Sugar Alcohols, particularly sorbitol, lead the market due to widespread use in sugar-free and diet foods. However, glycerol is expected to exhibit the highest growth rate as demand surges for natural and plant-based alternatives.

- The Asia-Pacific region holds the largest market share at 33.2%, supported by dynamic food processing industries and rising disposable incomes in China, India, and Southeast Asia.

- North America and Europe remain key markets for natural humectants, influenced by regulatory requirements and strong demand for clean-label products in bakery and dairy applications.

- The bakery & confectionery application segment dominates by value, driven by the need for freshness, softness, and sugar-reduction in baked goods and sweets. The beverages segment is anticipated to grow at the fastest pace, as humectants find increasing use in functional, low-sugar, and nutrition-focused drinks.

Report Scope and Food Humectants Market Segmentation

|

Attributes |

Food Humectants Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Food Humectants Market Trends

Rising Shift Towards Natural and Clean-Label Solutions

- The global Food Humectants market is witnessing a significant trend toward natural, clean-label, and plant-based humectant solutions. This shift is driven by heightened consumer awareness of food ingredients, tighter regulatory scrutiny on synthetic additives, and increasing demand for transparency across the food supply chain.

- Food manufacturers are investing in natural polyols, vegetable-derived glycerin, and low-calorie alternatives to replace synthetic humectants. The bakery, confectionery, and snack sectors lead the adoption, as consumers increasingly seek products free from artificial additives and with sustained freshness.

- Manufacturers are developing next-generation humectants from renewable sources to meet clean-label claims, enhance shelf-life, and support healthier product positioning. The emphasis is also on sustainable sourcing and eco-friendly production processes, with an added focus on recyclable and biodegradable packaging for humectant-laden products.

Food Humectants Market Dynamics

Driver

Increasing Demand for Processed and Functional Foods

- Global growth in processed and convenience foods is a major driver of the Food Humectants market.

- Busy lifestyles, urbanization, and a rising working population are leading to higher consumption of packaged foods that require advanced moisture management to maintain quality and sensory appeal.

- Humectants play a pivotal role in extending shelf-life, retaining softness, and preventing staling or crystallization. The boom in functional and fortified foods, including high-protein snacks and nutritional bars, is further boosting the use of specialized humectants for texture stability.

Restraint/Challenge

Regulatory and Cost Pressures for Novel and Natural Humectants

- Cost pressures and evolving regulatory frameworks are key challenges in the market.

- The move toward novel, plant-based, and low-calorie humectants often results in higher production costs due to the sourcing of specialty raw materials and the complexity of clean-label formulation.

- Regulatory standards for food additives also differ widely across regions, necessitating costly reformulations and approvals for global manufacturers. Price-sensitive markets and smaller food producers may find it difficult to balance the benefits of high-performance, natural humectants against cost constraints.

Food Humectants Market Scope

The market is segmented on the basis of type, source, application

· By Type

Sugar Alcohols (Sorbitol, Xylitol, Mannitol), Glycerol, Propylene Glycol, Polydextrose, Glycols, Alpha Hydroxy Acids, Others. The Sugar Alcohols segment leads with the largest revenue share due to widespread use in sugar-reduced and sugar-free products—especially bakery, confectionery, and beverages. However, Glycerol is anticipated to experience the highest CAGR, given rising adoption in clean-label and natural foods.

· By Source

Natural and Synthetic. The Natural segment is dominating, reflecting the industry’s shift toward plant-based and eco-friendly ingredients. Demand for synthetic sources is declining, though they remain popular for their cost-effectiveness and consistent performance.

· By Application

Bakery & Confectionery, Dairy Products, Beverages, Meat, Poultry & Seafood, Oral & Personal Care, Others. The Bakery & Confectionery segment holds the largest share, attributed to the constant need for moisture retention, freshness, and desirable texture in baked goods and confections. The Beverages segment is projected to grow at the highest CAGR due to humectants’ role in low-sugar and functional drinks.

Food Humectants Market Regional Analysis

- North America dominates the global market with a 35.18% share in 2025, driven by demand from the pharmaceutical, food, and chemical sectors for automated, hygienic processing. Advanced infrastructure, Industry 4.0 adoption, and strict FDA/EPA norms fuel innovation and market leadership.

- The region’s strong manufacturing infrastructure supports the seamless integration of advanced Food Humectants, ensuring consistency, productivity, and compliance with stringent hygiene protocols across food and industrial processing units.

- Widespread adoption of Industry 4.0 technologies, such as IoT-enabled sensors and AI-based automation, enhances system control, predictive maintenance, and performance monitoring, improving starch recovery efficiency and operational decision-making.

U.S. Food Humectants Market Insight

The U.S. represents the largest Food Humectants market in North America, anchored by its highly developed processed food, bakery, confectionery, and beverage sectors. Consumer demand for sugar-reduced, clean-label, and plant-based products is driving adoption of natural humectants—including polyols and vegetable-derived glycerol. Regulatory clarity and a strong health trend encourage innovations in humectants for freshly baked goods and functional beverages.

Canada Food Humectants Market Insight

Canada’s Food Humectants market is growing steadily, supported by rising demand for premium, functional foods and clean-label bakery products. Expansion in frozen and dairy sectors, along with consumer preference for healthier reformulated goods, are fueling the use of humectants for improved shelf-life and texture. Canadian manufacturers are focusing on incorporating natural and low-calorie humectant solutions, with government initiatives backing food innovation and product reformulation.

Europe Food Humectants Market Insight

Europe remains a mature and regulated market for Food Humectants, driven by strong consumer demand for natural ingredients, clean labels, and sustainable sourcing. Countries like Germany, France, and the U.K. prioritize plant-based humectants for bakery, confectionery, dairy, and beverages. Regulatory constraints and environmental standards also push manufacturers towards eco-friendly, multifunctional humectant formulations.

U.K. Food Humectants Market Insight

The U.K. is experiencing robust growth, propelled by strong bakery, dairy, and confectionery sectors. Local focus on freshness and extended shelf-life, along with a cultural emphasis on premium and artisanal food products, encourages use of humectants—especially those derived naturally. French manufacturers are reformulating products to reduce synthetic additives and support clean-label claims, boosting demand for natural humectants.

Germany Food Humectants Market Insight

Germany is a leader due to its advanced food processing sector and preference for high-quality, fresh baked goods and sweets. Widespread adoption of natural polyols and plant-derived glycerol is seen in the bakery and dairy sectors. Technical innovation and stringent quality standards make Germany a key market for suppliers of advanced humectant solutions.

Asia Pacific Food Humectants Market Insight

The Asia-Pacific region is forecast as the fastest-growing global market, fueled by rapid urbanization, expanding middle-class, and rising consumption of packaged and convenience foods. China and India, in particular, drive strong growth in bakery, dairy, beverage, and snack segments, with local manufacturers investing in plant-based humectants to meet evolving dietary preferences and regulatory requirements.

China Food Humectants Market Insight

China holds the largest market share in Asia-Pacific, thanks to its massive food manufacturing capacity and surging demand for shelf-stable, fresh-tasting convenience foods. Major players are increasing the supply of sugar alcohols and natural humectants for bakery and snack applications. Government policies promoting food safety, clean labeling, and ingredient transparency further support market penetration and reformulation efforts among local brands.

India Food Humectants Market Insight

India is set for rapid expansion, led by the growing urban middle-class and increased demand for convenience foods, bakery products, and low-sugar beverages. The presence of global and domestic food processors is accelerating use of natural humectants for shelf-life and sensory improvements. Regulatory encouragement and health trends are prompting reformulation to favor plant-based, clean-label humectants.

Food Humectants Market Share

The Food Humectants Market is primarily led by well-established companies, including:

- Cargill Inc. (U.S.)

- ADM (U.S.)

- Roquette Frères (France)

- Ingredion Incorporated (U.S.)

- Dow (U.S.)

- BASF (Germany)

- Brenntag AG (Germany)

- Palsgaard A/S (Denmark)

- Tate & Lyle PLC (U.K.)

- Barentz (Netherlands)

- Ashland Global Holdings (U.S.)

- Wilmar International Limited (Singapore)

- CP Kelco (U.S.)

- Foodchem International Corporation (China)

Latest Developments in Global Food Humectants Market

- In March 2025, Cargill introduced a new line of naturally derived polyol humectants tailored for sugar-reduced bakery and dairy products, supporting global clean-label and plant-based trends.

- In February 2025, Roquette launched an expanded plant-based humectant portfolio for confectionery and beverage applications, focusing on improved texture and shelf-life performance.

- In November 2024, Ingredion unveiled a range of multifunctional humectant solutions compatible with protein-fortified and high-fiber foods, addressing demand for healthier snacking.

- In July 2024, BASF invested in sustainable humectant manufacturing technologies in Germany, increasing the availability of eco-friendly, food-grade glycols for beverage and oral care applications.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Food Humectants Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Food Humectants Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Food Humectants Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.