Global Food Industry Pulsed Electric Field Pef Systems Market

Market Size in USD Million

CAGR :

%

USD

660.84 Million

USD

3,693.80 Million

2025

2033

USD

660.84 Million

USD

3,693.80 Million

2025

2033

| 2026 –2033 | |

| USD 660.84 Million | |

| USD 3,693.80 Million | |

|

|

|

|

Food Industry Pulsed Electric Field (PEF) Systems Market Size

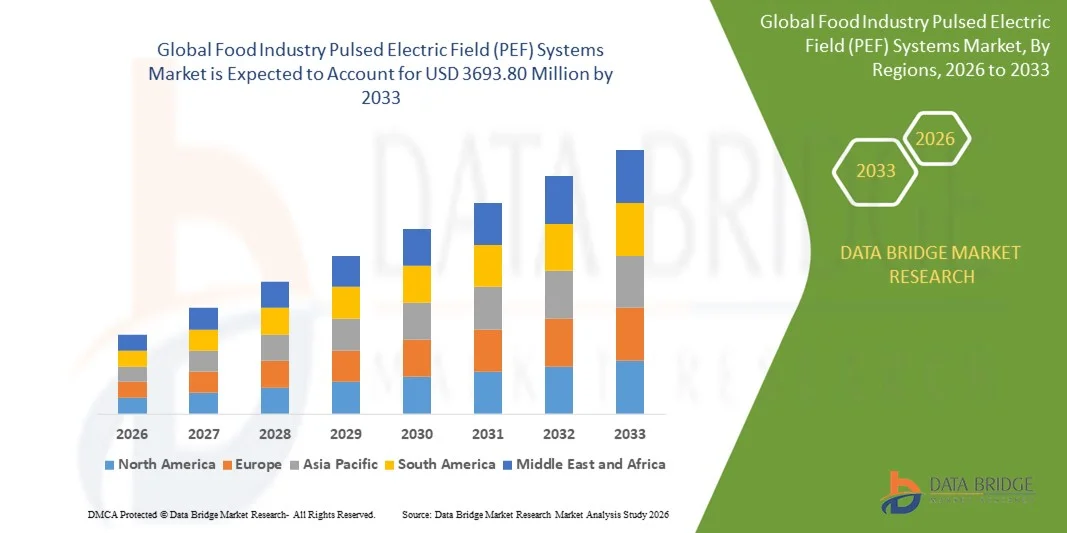

- The global food industry pulsed electric field (PEF) systems market size was valued at USD 660.84 million in 2025 and is expected to reach USD 3693.80 million by 2033, at a CAGR of 24.0% during the forecast period

- The market growth is primarily driven by the increasing adoption of non-thermal food processing technologies and the rising emphasis on retaining nutritional value, freshness, and clean-label attributes in processed foods, prompting manufacturers to integrate advanced PEF systems into production lines

- Furthermore, the growing demand for energy-efficient, high-quality, and minimally processed food products is positioning PEF technology as a preferred solution for microbial reduction and shelf-life extension, resulting in accelerated deployment across beverage, dairy, fruit, and plant-based food segments, thereby strengthening overall market expansion

Food Industry Pulsed Electric Field (PEF) Systems Market Analysis

- Pulsed Electric Field systems, enabling controlled electroporation for microbial inactivation and structural modification, are becoming essential in modern food processing as manufacturers seek to enhance product quality, improve processing efficiency, and preserve natural characteristics without thermal degradation

- The rising interest in sustainable and innovative food processing methods, supported by advancements in PEF equipment design and increasing regulatory acceptance, is fueling strong adoption across global food producers, reinforcing PEF systems as a transformative technology shaping the next phase of food processing modernization

- North America dominated the food industry pulsed electric field (PEF) systems market in 2025, due to the rising demand for advanced non-thermal food processing technologies and the shift toward cleaner-label products in the region

- Asia-Pacific is expected to be the fastest growing region in the food industry pulsed electric field (PEF) systems market during the forecast period due to accelerating urbanization, rising demand for high-quality packaged foods, and the expansion of advanced processing facilities in countries such as China, Japan, and India

- Liquid food segment dominated the market with a market share of 50.40% in 2025, due to strong adoption across juice, dairy beverages, liquid eggs, and plant-based drinks where continuous-flow PEF systems offer efficient microbial reduction and quality preservation. Liquid products benefit significantly from uniform electric field exposure, which enhances safety, extends shelf life, and maintains freshness without heat-induced degradation. Preference for natural, additive-free beverages has accelerated the integration of PEF in high-volume processing lines, reinforcing its dominance

Report Scope and Food Industry Pulsed Electric Field (PEF) Systems Market Segmentation

|

Attributes |

Food Industry Pulsed Electric Field (PEF) Systems Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Food Industry Pulsed Electric Field (PEF) Systems Market Trends

Growing Shift Toward Non-Thermal Clean-Label Processing

- A major trend in the Food Industry Pulsed Electric Field (PEF) Systems market is the increasing transition toward non-thermal processing solutions that help preserve natural nutrients, flavor, and freshness in food products. This shift is driven by rising consumer preference for clean-label and minimally processed foods, pushing manufacturers to adopt advanced PEF systems that deliver high-quality output without heat-induced degradation

- For instance, Elea GmbH and Pulsemaster provide industrial-scale PEF systems that enable efficient microbial reduction and improved product texture across fruits, vegetables, and beverages. These systems help processors meet clean-label expectations while enhancing shelf life and reducing energy consumption

- The adoption of PEF is rising across beverage, dairy, and plant-based sectors as manufacturers seek technologies that maintain product integrity while improving operational efficiency. This is positioning PEF as a key enabler of modern food processing lines focused on nutrition retention and sustainable production

- Food processors are also integrating PEF to optimize extraction yields in applications such as juices, oils, and bioactive compounds, supporting improved profitability and resource efficiency. This expanding application scope is strengthening the relevance of PEF in value-added food production

- The trend is further supported by increasing R&D investments aimed at enhancing electroporation precision and scaling continuous-flow PEF systems for large industrial operations. These innovations are encouraging broader adoption across global food manufacturers

- As the market moves toward healthier and cleaner food alternatives, PEF systems are emerging as essential technologies for processors seeking to deliver premium-quality products while meeting evolving consumer demand

Food Industry Pulsed Electric Field (PEF) Systems Market Dynamics

Driver

Rising Demand for Nutrient-Retaining Processed Foods

- The growing consumer emphasis on healthier, fresher, and nutrient-rich processed foods is driving strong demand for advanced PEF systems that enable microbial inactivation without damaging nutritional properties. Manufacturers are increasingly shifting from traditional thermal methods to PEF due to its capability to maintain natural color, flavor, and vitamins while extending shelf life

- For instance, Tetra Pak and Döhler are integrating PEF-based solutions into processing lines to support production of high-quality juices and liquid foods with improved freshness and reduced thermal impact. These solutions align with consumer expectations for minimally processed products that retain natural characteristics

- The expansion of plant-based, functional, and premium beverage segments is further elevating the need for gentle processing technologies such as PEF. This rising demand is reinforcing PEF as a preferred solution for producers seeking to balance food safety with enhanced product quality

- Growing health awareness is also accelerating the adoption of nutrient-preserving methods, prompting food processors to invest in PEF systems that align with clean-label and low-additive formulations

- The industry’s shift toward sustainable and energy-efficient processes is strengthening the driver, as PEF requires significantly less energy than conventional high-temperature treatment methods. This is boosting market confidence and encouraging large-scale deployment across global facilities

Restraint/Challenge

High Cost of PEF Equipment and Integration

- The Food Industry PEF Systems market continues to face challenges arising from the high cost of industrial PEF equipment and the complexity of integrating it into existing processing lines. These systems require sophisticated power electronics, specialized chambers, and precise control mechanisms, contributing to elevated capital expenditure for manufacturers

- For instance, companies such as Diversified Technologies, Inc. and ScandiNova Systems AB develop high-performance pulsed power systems, which involve advanced engineering and high-grade components that significantly increase production and installation costs. This limits adoption among small and medium-sized processors

- Integrating PEF technology into established facilities often requires modifications to workflow, safety systems, and plant layouts, further adding to operational expenditures. These integration challenges can extend installation timelines and delay return on investment

- The need for skilled operators and technical expertise increases training and maintenance costs, creating additional barriers for manufacturers with limited technological resources

- Despite its long-term efficiency and quality benefits, the high upfront cost remains a significant restraint, particularly in emerging markets where price sensitivity is higher. This continues to challenge widespread adoption across the global food industry

Food Industry Pulsed Electric Field (PEF) Systems Market Scope

The market is segmented on the basis of type and application.

- By Type

On the basis of type, the Food Industry Pulsed Electric Field (PEF) Systems market is segmented into 10–30 kV/cm and 30–50 kV/cm. The 10–30 kV/cm segment dominated the market in 2025 due to its broad suitability for mainstream food processing operations such as microbial inactivation and shelf-life extension across juice, dairy, and vegetable products. This range is widely preferred by food manufacturers because it offers an effective balance between energy efficiency and processing intensity, enabling high-throughput production without excessive operational costs. Its compatibility with existing production lines and reduced thermal impact on food quality strengthens its adoption among mid-scale and large-scale processors. Increasing demand for minimally processed and nutrient-rich packaged foods continues to reinforce its leadership position in the market.

The 30–50 kV/cm segment is expected to witness the fastest growth rate from 2026 to 2033, driven by rising interest in advanced PEF applications that require higher field strengths such as enhancing extraction efficiency, improving mass transfer, and tenderizing meat structures. This segment is gaining traction among premium product manufacturers who aim to differentiate offerings through superior texture, enhanced nutrient retention, and improved processing performance. High-intensity PEF systems are increasingly adopted in R&D-focused facilities and innovative processing plants seeking greater flexibility for specialized food categories. Growing investment in high-performance nonthermal technologies supports the rapid expansion of this segment.

- By Application

On the basis of application, the Food Industry PEF Systems market is segmented into solid food and liquid food. The liquid food segment dominated the market with the largest share of 50.40% in 2025 due to strong adoption across juice, dairy beverages, liquid eggs, and plant-based drinks where continuous-flow PEF systems offer efficient microbial reduction and quality preservation. Liquid products benefit significantly from uniform electric field exposure, which enhances safety, extends shelf life, and maintains freshness without heat-induced degradation. Preference for natural, additive-free beverages has accelerated the integration of PEF in high-volume processing lines, reinforcing its dominance.

The solid food segment is anticipated to register the fastest growth from 2026 to 2033, supported by increasing implementation of PEF for applications such as potato processing, meat tenderization, vegetable softening, and improving drying and freezing efficiency. Manufacturers are using PEF to optimize cutting, slicing, and texture uniformity in solid foods, reducing energy consumption in downstream thermal processes. Demand from frozen food producers and snack manufacturers is rising as PEF enables better product quality, improved processing yield, and enhanced operational efficiency. Growing interest in nonthermal structuring technologies is creating strong momentum for this segment’s expansion.

Food Industry Pulsed Electric Field (PEF) Systems Market Regional Analysis

- North America dominated the food industry pulsed electric field (PEF) systems market with the largest revenue share in 2025, driven by the rising demand for advanced non-thermal food processing technologies and the shift toward cleaner-label products in the region

- Food manufacturers increasingly prefer PEF systems due to their ability to enhance shelf-life, preserve nutrients, and reduce thermal damage in juices, beverages, dairy products, and plant-based foods

- The adoption is further supported by strong technological innovation, well-established food processing infrastructure, and growing investment in sustainable processing solutions, positioning PEF systems as a key technology for scaling premium-quality food production

U.S. Food Industry Pulsed Electric Field (PEF) Systems Market Insight

The U.S. food industry pulsed electric field (PEF) systems market captured the largest revenue share within North America in 2025, driven by the rapid adoption of food processing automation and the rising inclination toward non-thermal preservation methods. Producers increasingly prioritize maintaining nutritional integrity and natural flavor while improving production efficiency. The expanding demand for minimally processed foods, combined with strong R&D investments from equipment manufacturers, is accelerating market growth. In addition, the emphasis on sustainable processing, reduced energy usage, and the development of advanced PEF-enabled production lines continues to strengthen the U.S. market outlook.

Europe Food Industry Pulsed Electric Field (PEF) Systems Market Insight

The Europe food industry pulsed electric field (PEF) systems market is projected to grow at a substantial CAGR during the forecast period, driven by strict food safety regulations and the expanding interest in innovative processing technologies that retain natural product quality. The rising demand for premium juices, functional beverages, and nutrient-rich processed foods fosters the adoption of PEF technology across food manufacturers. European consumers also show strong interest in clean-label and minimally processed foods, reinforcing the region’s shift toward non-thermal processing. The market is witnessing growing integration of PEF systems across dairy, fruit processing, and ready-to-eat product applications.

U.K. Food Industry Pulsed Electric Field (PEF) Systems Market Insight

The U.K. food industry pulsed electric field (PEF) systems market is expected to grow at a noteworthy CAGR, supported by the country’s expanding focus on sustainable food processing and the surge in demand for nutrient-preserved packaged foods. Manufacturers are adopting PEF systems to enhance product quality while reducing thermal stress and energy consumption. The rising consumer awareness of healthier and fresher food options, along with the growing acceptance of advanced preservation techniques, is strengthening market adoption in both beverage and convenience food segments.

Germany Food Industry Pulsed Electric Field (PEF) Systems Market Insight

The Germany food industry pulsed electric field (PEF) systems market is set to expand at a considerable CAGR, fueled by the country's strong engineering expertise, advanced food processing infrastructure, and emphasis on sustainable production technologies. Rising awareness regarding nutrient retention, flavor preservation, and efficient microbial inactivation supports robust adoption across juice processing, dairy, and plant-based food industries. The country’s commitment to high-quality manufacturing standards and increased investment in automated processing systems further enhances the integration of PEF technology in commercial-scale food production.

Asia-Pacific Food Industry Pulsed Electric Field (PEF) Systems Market Insight

The Asia-Pacific food industry pulsed electric field (PEF) systems market is projected to grow at the fastest CAGR from 2026 to 2033, driven by accelerating urbanization, rising demand for high-quality packaged foods, and the expansion of advanced processing facilities in countries such as China, Japan, and India. Increasing consumer demand for safe, fresh, and minimally processed food products is promoting the adoption of non-thermal processing technologies. The region’s emergence as a manufacturing and processing hub, alongside supportive government initiatives for food technology modernization, is expanding the accessibility of PEF systems to both large-scale processors and emerging food brands.

Japan Food Industry Pulsed Electric Field (PEF) Systems Market Insight

The Japan food industry pulsed electric field (PEF) systems market is witnessing strong momentum due to the country’s technological leadership, rapid growth in premium food categories, and the preference for fresh-tasting packaged products. The adoption of PEF systems is increasing across juice processing, ready-to-drink beverages, and functional food segments. Integration with IoT-enabled production lines and the growing interest in efficient microbial inactivation methods are supporting market development. The country’s aging population also strengthens demand for nutrient-rich, safely processed foods, further encouraging the use of PEF technology.

China Food Industry Pulsed Electric Field (PEF) Systems Market Insight

The China food industry pulsed electric field (PEF) systems market accounted for the largest revenue share in Asia-Pacific in 2025, supported by the expansion of food manufacturing, rapid modernization of processing facilities, and the rising consumption of packaged beverages and processed fruits. China’s growing middle-class population and strong interest in high-quality, safe food products drive the adoption of advanced processing technologies. The increasing presence of domestic equipment suppliers, widespread integration of non-thermal systems in beverage companies, and strong government support for food technology innovation are key contributors to the country’s growing PEF Systems market.

Food Industry Pulsed Electric Field (PEF) Systems Market Share

The food industry pulsed electric field (PEF) systems industry is primarily led by well-established companies, including:

- Diversified Technologies, Inc. (U.S.)

- Elea GmbH (Germany)

- Heat and Control, Inc. (U.S.)

- Pulsemaster (Netherlands)

- ScandiNova Systems AB (Sweden)

- EnergyPulse Systems, Lda (Portugal)

- CoolWave Processing B.V. (Netherlands)

- Stalam S.p.A. (Italy)

- Tetra Pak International S.A. (Switzerland)

- Döhler GmbH (Germany)

- Peftec BV (Netherlands)

- Bosch Packaging Technology (Germany)

- GEA Group AG (Germany)

Latest Developments in Global Food Industry Pulsed Electric Field (PEF) Systems Market

- In May 2025, Chirag Exports secured USD 15 million in funding to establish a new PEF-based food processing plant in India, marking one of the region’s largest commercial investments in non-thermal processing technologies. The new plant is expected to significantly increase production efficiency while improving product quality across juices, beverages, and fruit-based items. This milestone is poised to accelerate the adoption of PEF systems across South Asia, as other manufacturers are such as to follow similar modernization paths to strengthen export capabilities and meet rising demand for minimally processed foods in global markets. The investment also demonstrates growing regional confidence in PEF as a viable alternative to conventional thermal methods, supporting long-term market expansion

- In May 2025, the European Food Safety Authority (EFSA) officially approved PEF technology as an authorized processing method for multiple food categories, clearing a major regulatory hurdle for widespread adoption across Europe. This approval is expected to reshape the competitive landscape by enabling food and beverage manufacturers to integrate PEF into mainstream production lines without regulatory restrictions. The decision enhances industry confidence, encourages capital investments in advanced PEF equipment, and supports the growth of clean-label, nutrient-retaining food with extended shelf life. As major European processors begin integrating PEF into large-scale operations, equipment demand is projected to increase sharply, positioning Europe as a major growth hub for the PEF systems market

- In March 2024, Döhler entered a strategic partnership with Peftec to integrate PEF-based capabilities into its global portfolio of natural ingredients and food solutions. This partnership enables Döhler to provide food and beverage companies with enhanced processing options that preserve color, nutrition, and freshness while reducing reliance on heat-based systems. By leveraging Döhler’s global distribution network and Peftec’s specialized PEF expertise, the collaboration is expected to accelerate commercial adoption of PEF systems in multiple regions. It also strengthens industry awareness of non-thermal processing benefits, leading to broader market penetration across beverages, fruit preparations, and plant-based products

- In January 2024, Tetra Pak launched its advanced Pulsed Electric Field (PEF) technology for juice and liquid food applications, introducing a highly efficient non-thermal alternative for microbial reduction and shelf-life extension. This innovation allows food manufacturers to retain natural taste, color, and nutrients while improving safety and reducing energy consumption. The launch represents a major technological advancement from a global processing leader, triggering renewed interest among large beverage players to adopt PEF systems. Tetra Pak’s influence and established customer base are expected to accelerate PEF market expansion by encouraging rapid integration into industrial-scale liquid food processing lines

- In November 2023, Elea Technology expanded its industrial-scale manufacturing facility dedicated to PEF systems, responding to rising worldwide demand from the beverage, fruit processing, and snack industries. The expansion enhances the company’s production capacity, shortens system delivery times, and enables support for higher-volume, multi-line installations. This development strengthens global supply availability and makes advanced PEF systems more accessible for both large and emerging food processors. By increasing its manufacturing footprint, Elea is positioned to support rapid global scaling of PEF technology, contributing substantially to market growth over the coming years

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Food Industry Pulsed Electric Field Pef Systems Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Food Industry Pulsed Electric Field Pef Systems Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Food Industry Pulsed Electric Field Pef Systems Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.