Global Food Ingredient Market

Market Size in USD Billion

CAGR :

%

USD

6.43 Billion

USD

9.80 Billion

2024

2032

USD

6.43 Billion

USD

9.80 Billion

2024

2032

| 2025 –2032 | |

| USD 6.43 Billion | |

| USD 9.80 Billion | |

|

|

|

|

Food Ingredients (Acidulants) Market Size

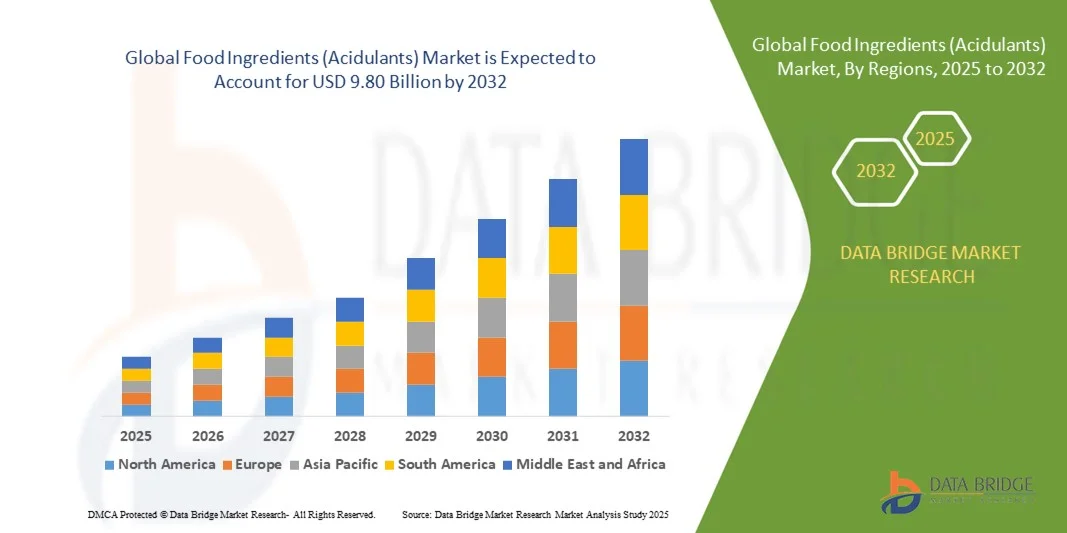

- The global food ingredients (acidulants) market size was valued at USD 6.43 billion in 2024 and is expected to reach USD 9.80 billion by 2032, at a CAGR of 5.4% during the forecast period

- The market growth is largely fueled by the increasing demand for processed and convenience foods, coupled with rising adoption of acidulants for pH control, flavor enhancement, and preservation across food and beverage applications. Growing consumer preference for clean-label and natural ingredients is further propelling the use of organic and fermentation-based acidulants in product formulations

- Furthermore, advancements in food processing technologies, rising investments in sustainable production, and the growing role of acidulants in extending product shelf life are strengthening market expansion. These factors collectively contribute to the accelerated growth of the acidulants industry, positioning it as a key segment within the global food ingredients market

Food Ingredients (Acidulants) Market Analysis

- Food Ingredients (Acidulants), essential for maintaining taste balance, product stability, and food safety, play a crucial role in beverage, bakery, dairy, and confectionery manufacturing. Their ability to enhance acidity, preserve freshness, and regulate pH makes them indispensable in modern food processing and formulation

- The growing demand for functional and fortified foods, increasing awareness of natural preservatives, and continued innovation in bio-based acidulant production are major factors driving the market forward. These developments underscore acidulants’ expanding relevance in ensuring quality, flavor consistency, and longevity across a wide range of food and beverage products

- Asia-Pacific dominated the food ingredients (acidulants) market with a share of 34.53% in 2024, due to expanding food and beverage manufacturing, increasing demand for processed and convenience foods, and a strong presence of key acidulant producers

- North America is expected to be the fastest growing region in the food ingredients (acidulants) market during the forecast period due to increasing consumption of processed foods, beverages, and dairy product

- Citric acid segment dominated the market with a market share of 62.5% in 2024, due to its widespread use across beverages, processed foods, and confectionery. Its multifunctional role as a pH regulator, flavor enhancer, and preservative makes it highly versatile for industrial applications. The market growth is further supported by the increasing demand for natural and clean-label ingredients, as citric acid is often derived from natural sources, appealing to health-conscious consumers. Manufacturers also favor citric acid due to its cost-effectiveness and compatibility with various food formulations, driving sustained demand across multiple end-use sectors

Report Scope and Food Ingredients (Acidulants) Market Segmentation

|

Attributes |

Food Ingredients (Acidulants) Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Food Ingredients (Acidulants) Market Trends

Growing Shift Toward Natural and Bio-Based Acidulants

- The global food ingredients (acidulants) market is experiencing a notable transition from synthetic to natural and bio-based acidulants. This change is primarily driven by increasing consumer awareness of health, wellness, and clean-label preferences that emphasize transparency and sustainability in food production. Manufacturers are progressively reformulating their ingredients to meet the rising demand for naturally sourced acidulants derived from plant or fermentation-based origins

- For instance, Cargill, Incorporated has expanded its portfolio of fermentation-derived citric and lactic acids that cater to food and beverage manufacturers seeking naturally sourced alternatives. The company’s investment in bio-based production aligns with the global shift toward sustainable ingredient sourcing and reduced dependence on petrochemical-based acids

- Natural acidulants such as citric, malic, and tartaric acids are gaining prominence in beverages, sauces, and confectionery applications due to their superior flavor-enhancing characteristics and consumer acceptance. Their compatibility with clean-label product strategies makes them an essential component for brands targeting health-conscious and environmentally aware consumers

- In addition, increasing demand for organic and minimally processed foods has encouraged ingredient manufacturers to enhance the purity and traceability of bio-based acidulants. Advanced biotechnological processes, such as microbial fermentation and enzymatic production, are supporting large-scale manufacturing of sustainable acidulant variants without compromising functionality or sensory quality

- The shift also reflects tightening regulations on chemically synthesized additives, with several regions encouraging the use of renewable, biodegradable inputs in food manufacturing. As consumers become more environmentally aware, they are showing greater preference for products made using naturally derived ingredients emphasizing green production technologies and low-carbon sourcing

- This growing emphasis on renewable and eco-friendly inputs is expected to redefine product development across the global food and beverage industry. Through the adoption of bio-based acidulants, manufacturers are achieving dual objectives of consumer satisfaction and regulatory compliance, ensuring long-term market growth aligned with broader sustainability commitments

Food Ingredients (Acidulants) Market Dynamics

Driver

Rising Demand for Processed and Convenience Foods

- The increasing global consumption of processed and convenience foods is a major driver accelerating the growth of the acidulants market. These additives play a crucial role in enhancing flavor, improving shelf life, and ensuring microbial stability in ready-to-eat and packaged food categories consumed by urban and time-conscious populations

- For instance, Tate & Lyle PLC has expanded its application of citric acid and glucono-delta-lactone (GDL) across bakery and beverage segments to cater to the fast-growing demand for convenient food solutions. The company is focusing on providing functional acidulants that balance taste and safety, demonstrating how ingredient suppliers are contributing to the expansion of processed food manufacturing

- Acidulants are essential in improving product stability and maintaining pH balance, which is critical in processed foods such as dressings, sauces, dairy alternatives, and carbonated beverages. Their technological versatility enables consistent texture and freshness during extended shelf life while retaining palate appeal across mass-market food offerings

- In addition, the rising number of working professionals and changing lifestyles worldwide are increasing dependence on easy-to-prepare and grab-and-go food formats. The integration of acidulants ensures product uniformity, reducing spoilage and supporting longer distribution timelines in both domestic and international markets

- Food producers are continuously innovating formulations incorporating multifunctional acidulants to optimize preservation and sensory quality. As convenience food categories evolve to include more natural and healthier options, acidulants will remain a critical ingredient segment supporting safety, taste, and sustainability requirements across diverse applications

Restraint/Challenge

Fluctuating Raw Material Prices

- Volatility in the prices of raw materials used in acidulant production, such as molasses, corn, and sugarcane derivatives, poses significant challenges for ingredient manufacturers. Since these agricultural feedstocks are also linked to food and biofuel production, market fluctuations directly impact acidulant cost structures and pricing stability across supply chains

- For instance, ADM (Archer Daniels Midland Company) has reported varying input costs for carbohydrate-based raw materials due to unpredictable agricultural yields and global trade disruptions. Such cost variations influence operational margins, compelling manufacturers to adopt flexible sourcing and hedging strategies to mitigate procurement risks

- Supply chain interruptions triggered by extreme weather events, geopolitical tensions, and transportation constraints often lead to unpredictable raw material availability. This instability affects manufacturing costs and also disrupts consistent product quality, posing major challenges for producers operating on tight margin structures

- In addition, the rising demand for bio-based acids has intensified competition for raw inputs derived from corn and sugar, further heightening cost pressures. Price sensitivity in emerging markets also limits manufacturers from fully passing these increased costs onto end consumers, thereby affecting profitability

- As market dependence on agricultural raw materials continues, stabilizing pricing and ensuring sustainable sourcing will be essential for long-term business resilience. Expansion of vertically integrated supply chains, adoption of alternative biotechnological feedstocks, and strategic partnerships with growers are expected to reduce exposure to raw material volatility and secure steady growth for acidulant producers

Food Ingredients (Acidulants) Market Scope

The market is segmented on the basis of type, form, function, distribution channel, and end-user.

- By Type

On the basis of type, the acidulants market is segmented into citric acid, lactic acid, acetic acid, fumaric acid, tartaric acid, malic acid, gluconic acid, phosphoric acid and salts, succinic acid, sodium citrate, potassium citrate, tannic acid, formic acid, and others. The citric acid segment dominated the market with the largest revenue share of 62.5% in 2024, owing to its widespread use across beverages, processed foods, and confectionery. Its multifunctional role as a pH regulator, flavor enhancer, and preservative makes it highly versatile for industrial applications. The market growth is further supported by the increasing demand for natural and clean-label ingredients, as citric acid is often derived from natural sources, appealing to health-conscious consumers. Manufacturers also favor citric acid due to its cost-effectiveness and compatibility with various food formulations, driving sustained demand across multiple end-use sectors.

The lactic acid segment is anticipated to witness the fastest growth rate from 2025 to 2032, driven by rising adoption in dairy, bakery, and probiotic products. Lactic acid’s ability to enhance flavor while extending shelf life makes it highly sought after in both processed and fermented foods. In addition, its growing applications in clean-label and organic products, along with increasing consumer awareness about gut health and functional foods, are fueling market expansion. Manufacturers are also exploring innovative uses of lactic acid in beverage acidification and natural preservative formulations, supporting rapid segment growth.

- By Form

On the basis of form, the acidulants market is segmented into dry and liquid. The dry form segment dominated the market in 2024 due to its longer shelf life, ease of transport, and versatility in manufacturing processes. Dry acidulants are widely used in powdered beverage mixes, confectionery, and bakery products, where precise dosing and stability are critical. The preference for dry acidulants is further strengthened by their cost-efficiency, minimal storage requirements, and lower risk of microbial contamination compared to liquid counterparts, making them a preferred choice for large-scale industrial applications.

The liquid form segment is expected to witness the fastest growth rate from 2025 to 2032, driven by increasing demand in ready-to-drink beverages, sauces, and liquid food formulations. Liquid acidulants offer ease of blending, rapid dissolution, and consistent flavor profiles, making them ideal for modern food processing practices. The segment also benefits from growing adoption in automated and high-volume production lines where efficiency and process control are key considerations, supporting robust market expansion.

- By Function

On the basis of function, the acidulants market is segmented into pH control, acidic flavor enhancer, preservatives, and others. The acidic flavor enhancer segment dominated the market in 2024, driven by the growing consumer preference for tangy and naturally flavored food and beverage products. Acidulants in this segment contribute to taste enhancement and also improve product stability and shelf life. The increasing trend toward natural and clean-label ingredients further reinforces demand, as many flavor-enhancing acidulants are derived from natural sources such as fruits and fermentation processes. Manufacturers also leverage acidulants to maintain consistent flavor profiles across batches, ensuring consumer satisfaction.

The pH control segment is projected to witness the fastest growth rate from 2025 to 2032, fueled by its critical role in food safety, processing efficiency, and functional food applications. pH regulation helps maintain texture, prevent microbial growth, and optimize enzymatic reactions in processed foods, dairy, and bakery items. Rising regulatory emphasis on food safety and quality standards, along with increasing applications in functional and fortified foods, are driving accelerated adoption of acidulants for pH control.

- By Distribution Channel

On the basis of distribution channel, the acidulants market is segmented into B2B and B2C. The B2B segment dominated the market in 2024 due to high demand from food manufacturers, beverage producers, and large-scale processors who require bulk acidulant procurement for industrial applications. B2B channels enable efficient supply chain management, cost advantages, and long-term contracts, making them a preferred mode for commercial buyers. Manufacturers also focus on strategic partnerships with B2B clients to ensure consistent product quality and availability, supporting sustained revenue generation.

The B2C segment is expected to witness the fastest growth rate from 2025 to 2032, driven by increasing consumer awareness of home cooking, DIY food preparation, and functional ingredients. Growing online retail penetration and easy access to specialty acidulants for household use are supporting segment expansion. In addition, health-conscious consumers are seeking convenient solutions for flavor enhancement and natural preservation in homemade products, further boosting demand in the B2C channel.

- By End-User

On the basis of end-user, the acidulants market is segmented into the food processing sector, food service sector, and household/retail. The food processing sector dominated the market in 2024, driven by large-scale production of beverages, dairy, bakery, and processed foods requiring consistent acidulant performance. This sector benefits from economies of scale, stringent quality standards, and the ability to integrate acidulants across multiple product lines, fueling significant revenue contribution. Growing demand for processed and packaged foods globally further reinforces the dominance of this segment.

The food service sector is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by increasing restaurant chains, cafes, and catering services adopting acidulants for flavor enhancement, preservation, and pH control. The expansion of fast-food culture and on-demand food delivery services is driving higher acidulant usage in sauces, dressings, and ready-to-eat meals. In addition, food service operators are increasingly leveraging acidulants to maintain consistency, shelf life, and taste quality, supporting accelerated segment growth.

Food Ingredients (Acidulants) Market Regional Analysis

- Asia-Pacific dominated the food ingredients (acidulants) market with the largest revenue share of 34.53% in 2024, driven by expanding food and beverage manufacturing, increasing demand for processed and convenience foods, and a strong presence of key acidulant producers

- The region’s cost-effective production facilities, rising investments in food processing technologies, and growing exports of food ingredients are accelerating market expansion

- The availability of skilled labor, supportive government policies, and rapid urbanization across developing economies are contributing to increased consumption of acidulants in both industrial and retail sectors

China Food Ingredients (Acidulants) Market Insight

China held the largest share in the Asia-Pacific acidulants market in 2024, owing to its position as a leading producer of citric acid, lactic acid, and other key acidulants. The country’s well-established food processing sector, favorable government initiatives supporting ingredient manufacturing, and extensive export capabilities are major growth drivers. Demand is also bolstered by rising consumption of processed foods, beverages, and confectionery products both domestically and internationally.

India Food Ingredients (Acidulants) Market Insight

India is witnessing the fastest growth in the Asia-Pacific region, fueled by rapid expansion of the packaged foods and beverage industry, rising urban population, and increasing adoption of acidulants in dairy and bakery applications. Government programs promoting “Make in India” and self-reliance in food processing ingredients are strengthening the market. In addition, growing exports of processed foods and expanding R&D capabilities in food technology are contributing to robust market growth.

Europe Food Ingredients (Acidulants) Market Insight

The Europe acidulants market is expanding steadily, supported by high demand for clean-label and natural ingredients, stringent food safety regulations, and growing investments in specialty food production. The region emphasizes quality, sustainability, and innovative food formulations, particularly in beverages, dairy, and confectionery sectors. Increasing use of acidulants in functional foods and pH-controlled applications is further enhancing market growth.

Germany Food Ingredients (Acidulants) Market Insight

Germany’s acidulants market is driven by its leadership in processed food manufacturing, strong R&D capabilities, and adoption of high-quality ingredients. The country’s well-established food science ecosystem and partnerships between academia and industry foster innovation in natural and specialty acidulants. Demand is particularly strong in bakery, dairy, and beverage applications, along with functional and fortified foods.

U.K. Food Ingredients (Acidulants) Market Insight

The U.K. market is supported by a mature food and beverage industry, rising focus on clean-label and natural ingredients, and increasing demand for processed and convenience foods. With growing investment in R&D and collaboration between ingredient suppliers and food manufacturers, the U.K. continues to adopt innovative acidulants for flavor enhancement, pH control, and preservation in industrial and retail applications.

North America Food Ingredients (Acidulants) Market Insight

North America is projected to grow at the fastest CAGR from 2025 to 2032, driven by increasing consumption of processed foods, beverages, and dairy products. Rising consumer awareness about natural and functional ingredients, combined with innovations in acidulant formulations, is boosting demand. In addition, growing reshoring of food ingredient manufacturing and strategic partnerships between food processors and ingredient suppliers are supporting market expansion.

U.S. Food Ingredients (Acidulants) Market Insight

The U.S. accounted for the largest share in the North America market in 2024, underpinned by its strong food processing sector, advanced R&D infrastructure, and significant investment in specialty ingredients. Rising demand for processed, ready-to-eat, and fortified foods, along with focus on product safety, clean-label compliance, and sustainable sourcing, is encouraging adoption of high-quality acidulants. Presence of major players and mature distribution networks further solidify the U.S.'s leading position in the region.

Food Ingredients (Acidulants) Market Share

The food ingredients (acidulants) industry is primarily led by well-established companies, including:

- Cargill, Incorporated (U.S.)

- Brenntag SE (Germany)

- Tate & Lyle (U.K.)

- ADM (U.S.)

- Jungbunzlauer Suisse AG (Switzerland)

- Corbion (Netherlands)

- Bartek Ingredients Inc. (Canada)

- INDUSTRIAL TECNICA PECUARIA, S.A. (Spain)

- DIARYCHEM (India)

- Weifang Ensign Industry Co., Ltd (China)

- FBC Industries (U.S.)

- Chemvera Specialty Chemicals Pvt. Ltd. (India)

- Direct Food Ingredients Ltd (U.K.)

- Richest Group (China)

- Suntran.cn (China)

- Foodchem International Corporation (China)

- Arshine Pharmaceutical Co. (China)

- Hawkins Watts Limited (New Zealand)

- Arihant Chemicals (India)

- Innova Corporate (India)

Latest Developments in Global Food Ingredients (Acidulants) Market

- In July 2025, Chemrich Global expanded its international chemical operations by consolidating its U.S. and Indian facilities, focusing on AI-integrated quality control and custom manufacturing for food and pharmaceutical sectors. This strategic move enhanced production efficiency and strengthened the company’s global supply chain, thereby improving the consistency and quality of acidulant products and boosting its market competitiveness

- In March 2024, Jungbunzlauer acquired Alliance Gums & Industries (AGI), integrating it as an independent subsidiary within its group. This acquisition expanded Jungbunzlauer’s product portfolio to include complementary texture, stabilizer, and acidulant solutions, enabling cross-selling opportunities in the food ingredients sector. The move strengthened the company’s presence in both acidulants and functional ingredient markets globally

- In March 2023, Univar Solutions LLC announced its acquisition by Apollo Funds under a definitive merger agreement valuing the company at about USD 8.1 billion, which included a minority investment from the Abu Dhabi Investment Authority’s wholly owned subsidiary. This transaction provided Univar with increased capital resources, operational flexibility, and strategic support to enhance its chemical and food ingredient distribution network, positively impacting its acidulants business

- In November 2021, Tate & Lyle built a new biomass boiler at its Santa Rosa, Brazil plant, where acidulants are produced, aiming to reduce greenhouse gas emissions, improve efficiency, and lower water usage. This sustainability-focused investment improved environmental performance and reduced operational costs, enhancing the company’s production efficiency and market reputation in eco-friendly acidulant manufacturing

- In July 2021, Tate & Lyle agreed to sell a controlling stake in a new company, NewCo, to KPS Capital Partners, LP, resulting in each holding 50% ownership. The deal included Tate & Lyle’s Primary Products business in North America and Latin America, along with acidulant plants in Santa Rosa, Brazil, and Dayton, Ohio & Duluth, Minnesota. This restructuring optimized business focus and operational specialization, allowing stronger strategic alignment and investment in the acidulants segment

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Food Ingredient Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Food Ingredient Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Food Ingredient Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.