Global Food Mixing Equipment Market

Market Size in USD Billion

CAGR :

%

USD

37.79 Billion

USD

53.75 Billion

2024

2032

USD

37.79 Billion

USD

53.75 Billion

2024

2032

| 2025 –2032 | |

| USD 37.79 Billion | |

| USD 53.75 Billion | |

|

|

|

|

Food Mixing Equipment Market Size

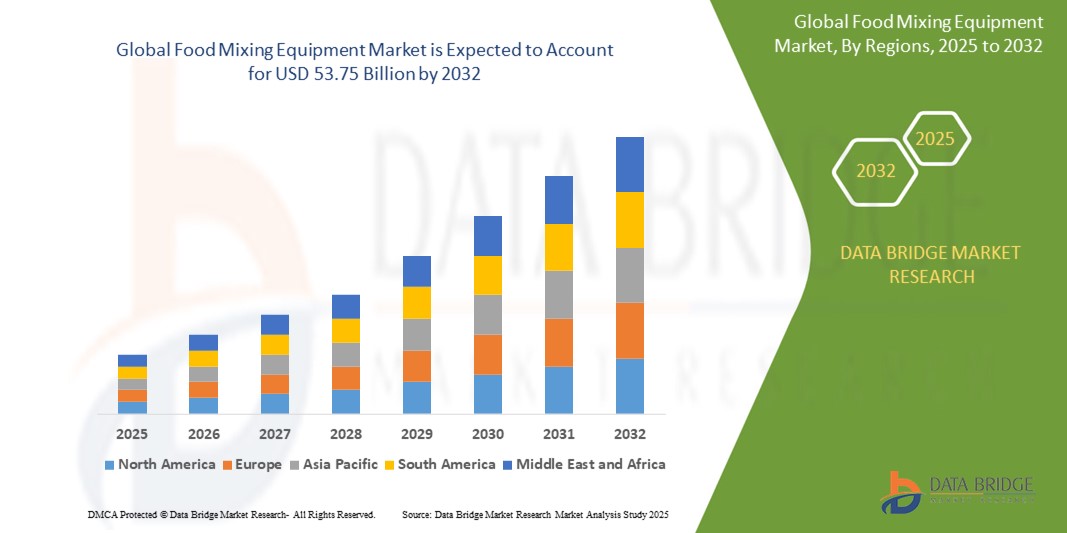

- The global food mixing equipment market size was valued at USD 37.79 billion in 2024 and is expected to reach USD 53.75 billion by 2032, at a CAGR of 4.50% during the forecast period

- The market growth is largely fuelled by the rising demand for processed and ready-to-eat food products, advancements in automation and mixing technologies, and increasing investments in food manufacturing infrastructure across emerging economies

- In addition, the surge in demand for customized mixing solutions across bakery, dairy, confectionery, and beverage segments is further contributing to the expansion of the global food mixing equipment market

Food Mixing Equipment Market Analysis

- The food mixing equipment market is experiencing steady growth due to the rising global population, changing dietary preferences, and the growing popularity of convenience foods that require efficient and high-capacity mixing solutions

- The increasing adoption of industrial automation and hygienic design standards in food processing facilities is boosting the demand for technologically advanced mixing systems that enhance productivity and ensure compliance with food safety regulations

- North America dominated the food mixing equipment market with the largest revenue share in 2024, driven by the strong presence of food processing industries, increasing demand for processed and convenience foods, and high levels of automation in food manufacturing

- Asia-Pacific region is expected to witness the highest growth rate in the global food mixing equipment market, driven by rapid urbanization, rising consumption of processed and convenience foods, and increasing investments in food manufacturing infrastructure across countries such as China, India, and Japan

- The ribbon blender segment dominated the market with the largest market revenue share in 2024, driven by its widespread use in the bakery and confectionery industries for mixing powders, granules, and dry ingredients with high efficiency. Its versatile design allows for homogeneous mixing and easy discharge, which appeals to both large-scale and small-scale food manufacturers. In addition, ribbon blenders are known for their low maintenance requirements and suitability for continuous processing operations

Report Scope and Food Mixing Equipment Market Segmentation

|

Attributes |

Food Mixing Equipment Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

• Integration Of IoT and Automation in Mixing Equipment • Rising Demand for Customizable and Energy-Efficient Mixing Solutions |

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Food Mixing Equipment Market Trends

“Rising Adoption of Automation and Smart Mixing Technologies”

- Food mixing equipment manufacturers are increasingly integrating IoT, sensors, and AI-driven systems to automate blending processes and ensure consistency in large-scale production

- Automated mixers allow for real-time data tracking, predictive maintenance, and recipe programming, reducing labor dependency and human error

- Smart mixers are designed to meet strict hygiene standards through features such as automated cleaning-in-place (CIP) systems

- The trend aligns with the rising adoption of Industry 4.0 and smart factories in food processing across both developed and emerging markets

- For instance, Bühler Group’s advanced digital mixers offer predictive analytics and self-cleaning functions that optimize energy use and minimize downtime

Food Mixing Equipment Market Dynamics

Driver

“Growing Demand for Processed and Convenience Food Products”

- The rising consumption of ready-to-eat meals, frozen items, and packaged snacks is driving the need for efficient food mixing solutions

- Consumers' fast-paced lifestyles and urbanization are encouraging food manufacturers to scale up production using high-performance mixers

- Uniform mixing of ingredients is critical in ensuring quality, taste, and regulatory compliance in processed food production

- Sectors such as bakery, dairy, and confectionery are witnessing increased demand, pushing investments in modern mixing technology

- For instance, in 2024, SPX FLOW introduced sanitary mixers designed to streamline batch processing and reduce contamination risks in packaged food manufacturing

Restraint/Challenge

“High Initial Investment and Maintenance Costs”

- Advanced food mixing equipment with automation capabilities requires substantial upfront capital, posing a barrier for small to mid-sized processors

- Maintenance, staff training, and energy costs add to the operational burden, affecting total cost of ownership

- Equipment breakdown or downtime during repairs can delay production and impact supply chain efficiency

- Limited access to financing options in emerging economies can slow technology adoption and modernization

- For instance, a dairy processor in Southeast Asia faced supply delays due to an unexpected breakdown of its high-speed mixer, highlighting the risk and cost challenges of advanced machinery

Food Mixing Equipment Market Scope

The food mixing equipment market is segmented on the basis of type, automation type, and application.

• By Type

On the basis of type, the food mixing equipment market is segmented into tumbler blender, ribbon blender, paddle mixer, agitator, emulsifiers, homogenizers, and heavy duty mixers. The ribbon blender segment dominated the market with the largest market revenue share in 2024, driven by its widespread use in the bakery and confectionery industries for mixing powders, granules, and dry ingredients with high efficiency. Its versatile design allows for homogeneous mixing and easy discharge, which appeals to both large-scale and small-scale food manufacturers. In addition, ribbon blenders are known for their low maintenance requirements and suitability for continuous processing operations.

The homogenizers segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by the rising demand for smooth, uniform textures in dairy products and beverages. Homogenizers are increasingly being adopted in milk and juice processing facilities to improve shelf life, product stability, and taste consistency. Their ability to reduce particle sizes and eliminate separation is crucial in meeting quality standards in modern food processing.

• By Automation Type

On the basis of automation type, the food mixing equipment market is segmented into automatic and semi-automatic. The automatic segment accounted for the largest revenue share in 2024, attributed to the growing demand for labor-saving, high-output machinery that ensures consistent product quality. Food manufacturers are investing in automated mixers to streamline production, enhance hygiene, and reduce human intervention, especially in high-throughput environments.

The semi-automatic segment is expected to witness the fastest growth rate from 2025 to 2032, primarily driven by its cost-effectiveness and flexibility for small and medium-sized enterprises (SMEs). Semi-automatic equipment provides better control over mixing parameters, making it suitable for customized or small-batch production in artisanal or specialty food processing setups.

• By Application

On the basis of application, the food mixing equipment market is segmented into bakery and confectionery products, meat and poultry products, dairy products, beverages, and others. The bakery and confectionery products segment held the largest market share in 2024, driven by high consumer demand for cakes, biscuits, and chocolates that require uniform mixing of multiple ingredients. Efficient mixing equipment ensures consistent texture, flavor, and appearance, which are critical in baked goods.

The dairy products segment is expected to witness the fastest growth rate from 2025 to 2032, owing to the increased consumption of yogurt, cheese, and milk-based drinks. The rising preference for value-added dairy products and nutritional offerings is pushing manufacturers to adopt high-performance mixers capable of handling both viscous and delicate dairy formulations with minimal product degradation.

Food Mixing Equipment Market Regional Analysis

- North America dominated the food mixing equipment market with the largest revenue share in 2024, driven by the strong presence of food processing industries, increasing demand for processed and convenience foods, and high levels of automation in food manufacturing

- The region benefits from significant investments in food innovation and advanced mixing technologies, ensuring efficiency and consistency in large-scale production

- Stringent food safety regulations and a growing inclination toward hygienic food handling systems continue to support the adoption of modern mixing equipment in both commercial and industrial kitchens

U.S. Food Mixing Equipment Market Insight

The U.S. food mixing equipment market captured the largest revenue share within North America in 2024, fueled by robust demand across bakery, dairy, and meat processing sectors. Key players are actively introducing high-performance, energy-efficient mixing solutions tailored for large-scale operations. In addition, consumer preference for clean-label, ready-to-eat products is prompting manufacturers to invest in high-capacity, automated mixers that meet both output and regulatory standards. These trends are reinforcing the U.S. market’s leadership in technological innovation and adoption.

Europe Food Mixing Equipment Market Insight

The Europe food mixing equipment market is expected to witness the fastest growth rate from 2025 to 2032, driven by growing demand for sustainable and automated processing solutions. The region's established food production sector, coupled with increasing consumption of premium and functional food products, supports the use of efficient mixing equipment. Manufacturers are incorporating eco-friendly features and smart sensors to meet regulatory and environmental standards. Growing adoption in bakery and dairy applications remains a key contributor to market growth.

U.K. Food Mixing Equipment Market Insight

The U.K. food mixing equipment market is expected to witness the fastest growth rate from 2025 to 2032, driven by a thriving bakery and snack food sector, and increasing adoption of digitalization in food processing. Small and medium enterprises are embracing semi-automated mixers to improve product quality and consistency. In addition, rising demand for plant-based food alternatives and functional beverages is supporting equipment innovation and modernization in the country’s food manufacturing infrastructure.

Germany Food Mixing Equipment Market Insight

The Germany is expected to dominate the Europe food mixing equipment market, supported by its well-established machinery industry and strong presence of premium food producers. Emphasis on energy efficiency, precision, and hygiene has spurred demand for advanced mixing systems across dairy, confectionery, and meat sectors. The integration of automation and IoT technologies in mixers is gaining traction, driven by the need for consistency and compliance with stringent food safety standards.

Asia-Pacific Food Mixing Equipment Market Insight

The Asia-Pacific food mixing equipment market is expected to witness the fastest growth rate from 2025 to 2032, driven by expanding food processing sectors in countries such as China, India, and Japan. Rising disposable incomes, urbanization, and a growing appetite for packaged and ready-to-eat foods are accelerating the demand for high-performance mixing systems. Government support for food manufacturing infrastructure and the growth of regional equipment manufacturers further contribute to market expansion.

Japan Food Mixing Equipment Market Insight

The Japan food mixing equipment market is expected to witness the fastest growth rate from 2025 to 2032, due to the country’s focus on precision manufacturing and quality assurance. Increasing demand for functional foods and nutrient-enriched beverages is encouraging food manufacturers to adopt versatile, automated mixing systems. Technological integration, including temperature and viscosity controls, supports the development of innovative food products while maintaining compliance with strict regulatory standards.

China Food Mixing Equipment Market Insight

The China accounted for the largest market share in the Asia-Pacific food mixing equipment market in 2024, propelled by rapid industrialization of the food sector, rising middle-class population, and growing consumption of bakery, dairy, and meat-based products. Local and international manufacturers are expanding their operations to meet demand for efficient, high-output mixers. China’s strategic focus on modernizing food production infrastructure and enhancing export capacity is further driving market growth.

Food Mixing Equipment Market Share

The food mixing equipment industry is primarily led by well-established companies, including:

- Marel (Iceland)

- GEA Group Aktiengesellschaft (Germany)

- Bühler (Switzerland)

- JBT (U.S.)

- The Middleby Corporation (U.S.)

- Heat and Control, Inc. (U.S.)

- ALFA LAVAL (Sweden)

- TNA Australia Pty Limited (Australia)

- SPX FLOW, Inc. (U.S.)

- Bigtem Makine A.S. (Turkey)

- Krones AG (Germany)

- Bettcher Industries, Inc. (U.S.)

- ANKO FOOD MACHINE CO., LTD. (Taiwan)

- Baader Global SE (Germany)

Latest Developments in Global Food Mixing Equipment Market

- In February 2023, Middleby Corporation completed the acquisition of Flavor Burst to strengthen its beverage group. This strategic move brings advanced flavor injection technology into Middleby’s portfolio, enhancing its ability to deliver customized beverage solutions and bolstering its leadership in foodservice innovation

- In February 2023, Middleby acquired Escher Mixers, a prominent provider of automated dough handling and mixing systems for bakeries. This acquisition expands Middleby’s capabilities in bakery production, enabling the company to offer more efficient and integrated solutions, thereby strengthening its position in the commercial baking sector

- In October 2021, GEA launched the Xtru Twin 140 extruder, marking a significant addition to its high-capacity equipment lineup. Designed for producing snack pellets, breakfast cereals, and pet food, the machine supports large-scale output exceeding 3 tonnes per hour for pellets and 10 tonnes per hour for pet food, boosting productivity and market competitiveness

- In June 2021, SPX FLOW introduced the APV Pilot 4T Homogenizer, a compact unit aimed at facilitating recipe development for food and beverage manufacturers. By enabling the efficient creation of emulsions from immiscible liquids, the device supports innovation and accelerates product testing, positively impacting time-to-market and formulation flexibility

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Food Mixing Equipment Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Food Mixing Equipment Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Food Mixing Equipment Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.