Global Food Packaging Barrier Film Market

Market Size in USD Billion

CAGR :

%

USD

7.49 Billion

USD

11.41 Billion

2024

2032

USD

7.49 Billion

USD

11.41 Billion

2024

2032

| 2025 –2032 | |

| USD 7.49 Billion | |

| USD 11.41 Billion | |

|

|

|

|

Food Packaging Barrier Film Market Size

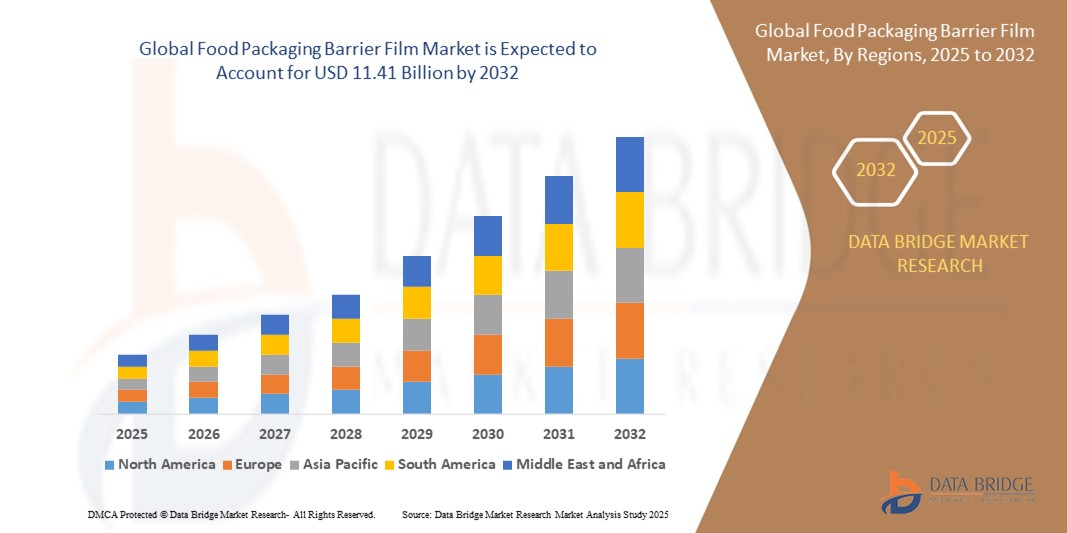

- The global food packaging barrier film market size was valued at USD 7.49 billion in 2024 and is expected to reach USD 11.41 billion by 2032, at a CAGR of 5.40% during the forecast period

- The market growth is largely fuelled by the increasing demand for extended shelf-life products, rising consumption of packaged and convenience foods, and growing awareness of food safety and quality

- Enhanced properties of barrier films, such as resistance to oxygen, moisture, and UV light, are driving adoption across the food and beverage industry, supporting efficient packaging solutions and reducing food wastage

Food Packaging Barrier Film Market Analysis

- Rising consumer preference for packaged foods and ready-to-eat meals is encouraging manufacturers to adopt high-performance barrier films that preserve freshness and nutritional quality

- Regulatory frameworks and food safety standards in developed and emerging markets are accelerating the use of advanced barrier films, ensuring compliance and reducing contamination risks

- North America dominated the food packaging barrier film market with the largest revenue share of 38.5% in 2024, driven by increasing demand for packaged and convenience foods, stringent food safety regulations, and advanced retail infrastructure

- Asia-Pacific region is expected to witness the highest growth rate in the global food packaging barrier film market, driven by rising demand for convenient and ready-to-eat foods, increasing investments in modern packaging technologies, and supportive government initiatives for the food processing industry

- The metalized barrier films segment held the largest market revenue share in 2024, driven by their superior ability to protect packaged food from oxygen, moisture, and light. These films are widely adopted in processed and ready-to-eat food packaging, providing enhanced shelf life and ensuring product safety throughout the supply chain

Report Scope and Food Packaging Barrier Film Market Segmentation

|

Attributes |

Food Packaging Barrier Film Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Food Packaging Barrier Film Market Trends

Increasing Demand For Shelf-Life Extension And Food Safety

• The rising demand for packaged and convenience foods is transforming the food packaging barrier film market by driving the need for films that preserve freshness and prevent contamination. Advanced barrier films help maintain product quality, reduce spoilage, and extend shelf life, directly impacting retailer and consumer satisfaction. In addition, growing e-commerce in food delivery and online grocery shopping is further boosting demand for reliable packaging solutions that ensure product integrity

• Growing consumer preference for ready-to-eat and processed food products is accelerating the adoption of multilayer barrier films that protect against oxygen, moisture, and UV exposure. These films ensure product integrity during transportation and storage, supporting global food supply chains. Moreover, manufacturers are leveraging innovative film structures to reduce material usage without compromising performance, aligning with sustainability goals

• Innovations in sustainable and biodegradable barrier films are making these solutions more attractive, allowing manufacturers to meet both regulatory requirements and consumer expectations for environmentally friendly packaging. New eco-friendly materials also enhance brand perception and support corporate sustainability initiatives. Development of compostable and recyclable films is expected to open new market opportunities in environmentally conscious regions

• For instance, in 2023, several packaged food companies in Europe adopted multilayer barrier films with enhanced oxygen and moisture resistance, resulting in extended shelf life and reduced product waste. Companies reported improved consumer satisfaction and lower return rates, demonstrating the commercial impact of advanced barrier technologies

• While extended shelf life and food safety are key drivers, market growth depends on continued product innovation, cost optimization, and alignment with evolving sustainability regulations. The integration of smart packaging technologies, such as oxygen and temperature indicators, is also expected to enhance market adoption and product monitoring

Food Packaging Barrier Film Market Dynamics

Driver

Rising Consumption Of Packaged And Processed Foods Globally

• Increasing urbanization, changing lifestyles, and demand for convenient meal solutions are fueling the growth of packaged and processed foods, which directly drives the demand for high-performance barrier films. These films ensure product freshness and quality while reducing spoilage-related losses. Furthermore, rising demand for frozen, chilled, and ready-to-eat meals globally is creating consistent growth opportunities for barrier film manufacturers

• Regulatory frameworks and stringent food safety standards in developed and emerging markets are encouraging manufacturers to adopt advanced barrier films that protect against contamination and meet compliance requirements. The adoption of global standards such as ISO 22000 and HACCP drives manufacturers to prioritize high-barrier, contamination-resistant packaging solutions

• Growing awareness among consumers about food quality, freshness, and nutritional content is pushing brands to use barrier films that maintain product integrity during storage and transportation. Consumer demand for minimally processed foods packaged safely and attractively is also influencing packaging innovation and marketing strategies

• For instance, in 2022, major snack food and dairy companies in North America implemented high-barrier multilayer films to reduce oxygen permeability and enhance product shelf life, boosting consumer trust and brand loyalty. The adoption also helped companies reduce waste and logistic costs while enhancing sustainability profiles

• While the rise in packaged food consumption is driving market demand, scalability, innovation in biodegradable films, and cost management remain crucial for sustainable growth. Partnerships between film producers and food brands are increasingly fostering innovation and efficiency in the supply chain

Restraint/Challenge

High Production Costs And Environmental Concerns

• The high cost of producing multilayer and advanced barrier films, especially those incorporating biodegradable or bio-based polymers, limits adoption among cost-sensitive food manufacturers, particularly in emerging markets. Smaller manufacturers often face challenges in balancing performance with affordability, slowing market penetration

• Environmental concerns regarding plastic waste and recyclability of traditional barrier films are challenging market expansion. Inadequate recycling infrastructure in many regions restricts the widespread adoption of eco-friendly alternatives. In addition, consumer demand for sustainable packaging is pushing brands to shift toward higher-cost materials, creating pressure on profit margins

• Fluctuating raw material prices, particularly for polymers such as PET, PE, and EVOH, create cost instability and affect overall profitability for manufacturers and end-users. Supply chain disruptions and geopolitical factors can exacerbate price volatility, affecting long-term planning and adoption of advanced films

• For instance, in 2023, Southeast Asian packaging companies reported reduced adoption of high-barrier films due to volatile polymer prices and limited recycling facilities, slowing the shift toward sustainable packaging solutions. This affected production schedules and led to selective adoption of eco-friendly alternatives only for premium products

• While technological advancements and sustainability initiatives continue to evolve, addressing cost efficiency, recyclability, and regulatory compliance is essential for long-term market growth. The development of hybrid films, cost-effective biodegradable polymers, and improved recycling systems is expected to mitigate some of these challenges in the near future

Food Packaging Barrier Film Market Scope

The market is segmented on the basis of type, material, layers, and distribution channel.

- By Type

On the basis of type, the food packaging barrier film market is segmented into metalized barrier films, transparent barrier films, and white barrier films. The metalized barrier films segment held the largest market revenue share in 2024, driven by their superior ability to protect packaged food from oxygen, moisture, and light. These films are widely adopted in processed and ready-to-eat food packaging, providing enhanced shelf life and ensuring product safety throughout the supply chain.

The transparent barrier films segment is expected to witness the fastest growth rate from 2025 to 2032, driven by rising consumer preference for visually appealing packaging that allows product visibility while maintaining adequate protection. Transparent films are particularly favored in retail and premium packaged foods for showcasing product quality, promoting brand trust, and enhancing purchase decisions.

- By Material

On the basis of material, the market is segmented into polyethylene terephthalate (PET), polyethylene (PE), polypropylene (PP), polyamides (PA), ethylene vinyl alcohol (EVOH), linear low-density polyethylene (LLDPE), and others. PET films held the largest market revenue share in 2024, owing to their excellent barrier properties, mechanical strength, and compatibility with multilayer structures. PET-based films are commonly used in snacks, dairy, and frozen food packaging, ensuring product integrity over extended storage periods.

The EVOH segment is expected to witness the fastest growth rate from 2025 to 2032, attributed to its superior oxygen barrier properties and increasing adoption in multilayer films. EVOH enhances the shelf life of perishable products such as meat, cheese, and ready-to-eat meals, meeting the growing demand for food safety and reduced spoilage.

- By Layers

On the basis of layers, the market is segmented into multiple layers and single layers. The multiple layers segment dominated the market in 2024 due to its ability to combine various materials and achieve enhanced barrier performance, mechanical strength, and heat resistance. Multilayer films are widely preferred for packaging highly perishable and sensitive food products, ensuring longer shelf life and better consumer acceptance.

The single layer segment is expected to witness the fastest growth rate from 2025 to 2032, driven by its cost-effectiveness, ease of processing, and increasing adoption in flexible packaging applications. Single layer films are particularly used in low-cost packaging solutions where moderate barrier protection is sufficient, supporting the growth of packaged foods in emerging markets.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into supermarkets/hypermarkets, specialty stores, e-commerce, and others. Supermarkets and hypermarkets held the largest revenue share in 2024, owing to the high penetration of packaged foods and the preference for branded products with enhanced shelf life. These channels facilitate large-volume sales of barrier film-packaged products and ensure wide consumer reach.

The e-commerce segment is expected to witness the fastest growth rate from 2025 to 2032, driven by the growth of online grocery and food delivery platforms. E-commerce adoption increases demand for packaged products with extended shelf life and robust packaging solutions to withstand transportation and storage, promoting the use of high-performance barrier films.

Food Packaging Barrier Film Market Regional Analysis

• North America dominated the food packaging barrier film market with the largest revenue share of 38.5% in 2024, driven by increasing demand for packaged and convenience foods, stringent food safety regulations, and advanced retail infrastructure

• Manufacturers and food processors in the region highly value high-performance barrier films for extending product shelf life, preserving freshness, and minimizing spoilage across various food categories

• This widespread adoption is further supported by well-established cold-chain logistics, technologically advanced packaging solutions, and growing consumer awareness about food quality and safety, establishing barrier films as a preferred solution for food packaging

U.S. Food Packaging Barrier Film Market Insight

The U.S. food packaging barrier film market captured the largest revenue share in North America in 2024, fueled by the rising consumption of packaged and processed foods and the expanding trend of convenience-oriented lifestyles. Companies are increasingly adopting multilayer and high-barrier films to preserve freshness, prevent contamination, and comply with stringent FDA and USDA regulations. The growing preference for sustainable packaging solutions, coupled with innovations in biodegradable and recyclable films, further drives market growth. In addition, the integration of smart and active packaging technologies enhances product shelf life, boosting adoption across retail and foodservice channels.

Europe Food Packaging Barrier Film Market Insight

The Europe food packaging barrier film market is expected to witness the fastest growth rate from 2025 to 2032, primarily driven by strict food safety regulations, increasing demand for processed and ready-to-eat foods, and growing consumer awareness of product quality. European manufacturers are increasingly adopting multilayer films with superior oxygen and moisture barriers to meet regulatory standards and extend shelf life. The region is witnessing robust growth across dairy, bakery, meat, and snack segments, with sustainable and recyclable films gaining traction among environmentally conscious consumers.

U.K. Food Packaging Barrier Film Market Insight

The U.K. food packaging barrier film market is expected to witness the fastest growth rate from 2025 to 2032, supported by rising demand for packaged and convenience foods and heightened food safety awareness. Increasing adoption of high-barrier films for perishable products such as meat, dairy, and ready-to-eat meals is driving market expansion. Moreover, the UK’s focus on sustainable and recyclable packaging materials, alongside strong retail and e-commerce infrastructure, encourages food manufacturers to implement advanced barrier film solutions.

Germany Food Packaging Barrier Film Market Insight

The Germany food packaging barrier film market is expected to witness the fastest growth rate from 2025 to 2032, driven by stringent food quality and safety standards, high consumption of processed foods, and growing demand for innovative packaging solutions. German manufacturers emphasize multilayer and metalized films to enhance shelf life, minimize waste, and meet export quality requirements. The adoption of eco-friendly and recyclable films is also increasing, supported by government regulations and sustainability initiatives across the country.

Asia-Pacific Food Packaging Barrier Film Market Insight

The Asia-Pacific food packaging barrier film market is expected to witness the fastest growth rate from 2025 to 2032, driven by rising urbanization, expanding retail and foodservice sectors, and increasing demand for packaged and processed foods in countries such as China, India, and Japan. Rapid growth in cold-chain logistics, coupled with technological advancements in barrier film manufacturing, is improving product shelf life and food safety. The region is also witnessing strong adoption of biodegradable and recyclable films as sustainability awareness rises among manufacturers and consumers.

Japan Food Packaging Barrier Film Market Insight

The Japan food packaging barrier film market is expected to witness the fastest growth rate from 2025 to 2032 due to the country’s high consumption of packaged and convenience foods, technological advancement in packaging, and strong regulatory framework for food safety. Japanese manufacturers are increasingly implementing multilayer and transparent barrier films to maintain product freshness and reduce spoilage. In addition, growing consumer preference for eco-friendly and recyclable packaging supports innovations in sustainable barrier films across the food industry.

China Food Packaging Barrier Film Market Insight

The China food packaging barrier film market accounted for the largest revenue share in the Asia-Pacific region in 2024, attributed to the country’s expanding processed and packaged food industry, rapid urbanization, and rising consumer awareness about food safety. Manufacturers are adopting advanced multilayer, metalized, and transparent films to enhance shelf life and maintain product quality during transportation and storage. The government’s push toward modernized food packaging standards and sustainable solutions further fuels the market’s expansion across retail, e-commerce, and foodservice channels.

Food Packaging Barrier Film Market Share

The Food Packaging Barrier Film industry is primarily led by well-established companies, including:

- Amcor plc (Switzerland)

- Mondi Group (U.K.)

- Huhtamaki Oyj (Finland)

- Sealed Air Corporation (U.S.)

- Jindal Poly Films Limited (India)

- Toppan Inc. (Japan)

- Kureha Corporation (Japan)

- HPM Global, Inc. (South Korea)

- Flair Flexible Packaging Corporation (U.S.)

- Constantia Flexibles (Austria)

- MULTIVAC Inc. (Germany)

- DuPont (U.S.)

- Wihuri Group (Finland)

- Bernhardt Packaging & Process (France)

- Borealis AG (Austria)

- Uflex Limited (India)

Latest Developments in Global Food Packaging Barrier Film Market

- In September 2023, Mondi launched a new recyclable paper-based packaging in collaboration with Veetee for the UK food market. This development aims to enhance sustainability in food packaging by offering eco-friendly alternatives while ensuring effective protection of food products. The innovative solution aligns with increasing consumer demand for environmentally responsible packaging, promoting brand loyalty and supporting broader sustainability goals in the food industry

- In April 2021, Amcor plc introduced recyclable pharmaceutical blister packaging designed to improve sustainability in the healthcare sector. This advancement enables efficient recycling while maintaining high standards of product protection and regulatory compliance. By reducing plastic waste and supporting eco-conscious initiatives, the packaging solution positively impacts the market by encouraging wider adoption of sustainable materials across pharmaceutical applications

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Food Packaging Barrier Film Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Food Packaging Barrier Film Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Food Packaging Barrier Film Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.