Global Food Probiotics Market

Market Size in USD Billion

CAGR :

%

USD

106.67 Billion

USD

179.22 Billion

2025

2033

USD

106.67 Billion

USD

179.22 Billion

2025

2033

| 2026 –2033 | |

| USD 106.67 Billion | |

| USD 179.22 Billion | |

|

|

|

|

Food Probiotics Market Size

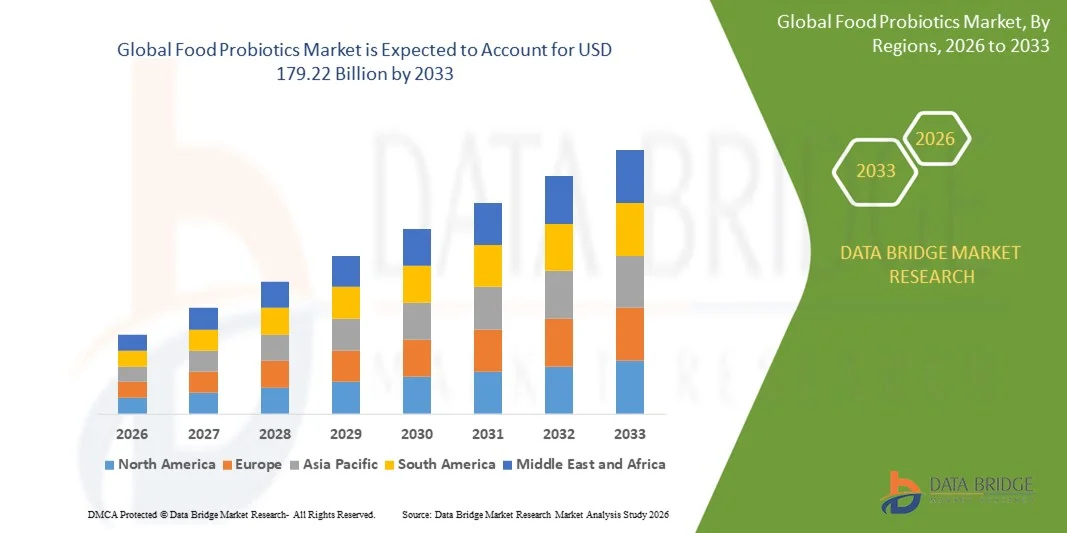

- The global food probiotics market size was valued at USD 106.67 billion in 2025 and is expected to reach USD 179.22 billion by 2033, at a CAGR of 6.70% during the forecast period

- The market growth is largely fueled by rising consumer awareness of gut health, immunity, and overall wellness, driving increased adoption of functional foods, beverages, and dietary supplements enriched with probiotics

- Furthermore, growing demand for natural, clean-label, and strain-specific probiotic products is establishing probiotics as a mainstream health and nutrition solution. These converging factors are accelerating the uptake of probiotic-enriched foods and supplements, thereby significantly boosting the industry's growth

Food Probiotics Market Analysis

- Food probiotics, comprising live bacteria and yeast strains, are increasingly integrated into functional foods, beverages, and dietary supplements due to their scientifically proven benefits for digestion, immunity, and metabolic health

- The escalating demand for probiotics is primarily fueled by rising health consciousness, increasing prevalence of digestive and lifestyle-related disorders, and consumer preference for preventive healthcare through diet and nutrition

- Asia-Pacific dominated the food probiotics market with a share of 39% in 2025, due to rising health awareness, rapid urbanization, increasing disposable income, and strong demand for functional foods and dietary supplements

- North America is expected to be the fastest growing region in the food probiotics market during the forecast period due to rising health consciousness, expanding functional food and dietary supplement markets, and increasing demand for immunity-boosting products

- Bacteria segment dominated the market with a market share of 62.9% in 2025, due to its extensive use in functional foods, beverages, and dietary supplements. Bacterial probiotics such as Lactobacillus and Bifidobacterium are widely recognized for their scientifically proven health benefits, including gut health support, immunity enhancement, and digestive regulation. Consumer trust in bacterial probiotics, coupled with strong regulatory approvals and established supply chains, further reinforces their market dominance. The segment also benefits from ongoing research and product innovations focused on improving stability, efficacy, and strain-specific functionalities

Report Scope and Food Probiotics Market Segmentation

|

Attributes |

Food Probiotics Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Food Probiotics Market Trends

Rising Demand for Functional and Gut-Health-Focused Foods

- The growing preference for functional foods that support digestive health is a major trend driving the food probiotics market. Consumers are increasingly turning to probiotic-enriched products to improve gut balance, immunity, and overall wellness, fueled by a broader shift toward preventive and natural health solutions

- For instance, Danone S.A. and Nestlé S.A. have expanded their probiotic product lines across segments such as yogurts, fortified beverages, and infant nutrition formulas. Danone’s Activia brand, rich in Bifidobacterium cultures, and Nestlé’s probiotic-enriched infant cereal range demonstrate how leading players are mainstreaming probiotics as key components of daily diets

- Rising awareness of the gut microbiome’s link to immunity and metabolic functions is significantly influencing consumer purchasing behavior. Increasing clinical research validating the role of specific probiotic strains such as Lactobacillus and Bifidobacterium in supporting digestive and immune health has supported the category’s expansion across functional food formulations

- The integration of probiotics into diverse food categories such as dairy alternatives, snacks, and beverages is broadening the consumer base. The introduction of plant-based probiotic products and non-dairy fortified options caters to lactose-intolerant and vegan consumers, promoting inclusivity and innovation in product development

- In addition, the convergence of nutraceuticals and convenience food consumption is driving new delivery forms such as ready-to-drink probiotic beverages, probiotic powders, and on-the-go shots. These formats cater to modern consumer lifestyles that prioritize convenience without compromising nutritional value

- The accelerated focus on functional and gut-health-centered foods emphasizes the industry’s transition toward scientifically backed, health-oriented offerings. As consumers increasingly associate probiotics with holistic wellness, their incorporation into everyday food products is set to become a defining feature of modern dietary habits globally

Food Probiotics Market Dynamics

Driver

Increasing Health Awareness and Preventive Healthcare Adoption

- The rising health consciousness among consumers coupled with the shift toward preventive healthcare practices is a primary driver for the food probiotics market. Consumers are actively seeking dietary solutions that can strengthen immunity, enhance digestion, and reduce dependency on pharmacological interventions

- For instance, Yakult Honsha Co., Ltd. has capitalized on rising awareness by promoting its daily probiotic drinks as a simple preventive health measure that improves gut microbiota balance. Similarly, Chr. Hansen Holdings A/S is investing in strain-focused research to develop targeted probiotic formulations that support specific health outcomes such as immunity and metabolic function

- Growing awareness of chronic lifestyle diseases has reinforced interest in maintaining gut health through diet-based interventions. Probiotic foods provide a natural, sustainable method for improving gut biodiversity, supporting nutrient absorption, and enhancing long-term wellness across all age groups

- In addition, national health campaigns and educational programs emphasizing the importance of balanced diets and functional nutrition have increased acceptance of probiotics in both developed and emerging economies. This has encouraged manufacturers to innovate and expand availability through fortified everyday foods and dietary supplements

- Sustained global interest in preventive healthcare and holistic well-being continues to propel probiotic food demand. As consumers increasingly prioritize natural nutrition over synthetic supplements, probiotics are set to remain central to modern functional food portfolios and dietary recommendations worldwide

Restraint/Challenge

Stability and Shelf-Life Limitations of Probiotic Strains

- The limited stability and short shelf life of probiotic microorganisms remain a major challenge in the food probiotics market. Probiotic strains are highly sensitive to environmental factors such as temperature, oxygen, and moisture, which can significantly reduce their viability during processing, storage, and distribution

- For instance, companies such as Kerry Group and DuPont Nutrition & Biosciences have reported ongoing R&D efforts to improve the survivability of live bacteria during food processing. Technologies such as microencapsulation and freeze-drying are being increasingly adopted to extend shelf life and ensure probiotic efficacy in different food matrices

- Maintaining viable cell counts in probiotic-enriched products requires precise environmental control and specialized packaging. Inadequate conditions during transportation or retail storage can compromise product quality and limit health benefits, thus affecting brand credibility and consumer trust

- In addition, regulatory frameworks in many regions require specific viable cell counts for labeling a product as probiotic. Meeting these standards adds manufacturing complexity and increases production costs, particularly for small-scale producers lacking advanced stabilization technologies

- Overcoming stability-related obstacles through technological innovation, improved formulation methods, and controlled storage environments remains essential for sustained market growth. The success of future probiotic food offerings will depend on scalable preservation techniques that maintain microbial efficacy throughout the product’s intended shelf life

Food Probiotics Market Scope

The market is segmented on the basis of ingredient, form, application, distribution channel, and end user.

- By Ingredient

On the basis of ingredient, the food probiotics market is segmented into bacteria and yeast. The bacteria segment dominated the market with the largest market revenue share of 62.9% in 2025, driven by its extensive use in functional foods, beverages, and dietary supplements. Bacterial probiotics such as Lactobacillus and Bifidobacterium are widely recognized for their scientifically proven health benefits, including gut health support, immunity enhancement, and digestive regulation. Consumer trust in bacterial probiotics, coupled with strong regulatory approvals and established supply chains, further reinforces their market dominance. The segment also benefits from ongoing research and product innovations focused on improving stability, efficacy, and strain-specific functionalities.

The yeast segment is anticipated to witness the fastest growth rate from 2026 to 2033, fueled by rising consumer awareness about novel probiotics and demand for gut-friendly dietary alternatives. Yeast-based probiotics, such as Saccharomyces boulardii, are increasingly incorporated into beverages and functional food products due to their digestive benefits and resistance to antibiotics. Their application in vegan and plant-based formulations is expanding rapidly, further driving market adoption. Manufacturers are exploring yeast strains for enhanced health benefits, broadening their use in human and animal nutrition.

- By Form

On the basis of form, the food probiotics market is segmented into liquid and dry. The dry segment dominated the market with the largest revenue share in 2025, owing to its longer shelf life, ease of incorporation into powders, capsules, and functional foods, and stability during storage and transport. Dry probiotics are preferred by manufacturers for precise dosing, compatibility with fortification processes, and versatility across multiple product categories. Consumer preference for convenient and shelf-stable supplements reinforces the dominance of the dry form, particularly in dietary supplements and fortified food products.

The liquid segment is projected to witness the fastest growth rate from 2026 to 2033, driven by increasing demand for ready-to-drink probiotic beverages and fermented drinks. Liquid probiotics offer faster absorption and live cell delivery, making them popular among health-conscious consumers seeking immediate benefits. Innovations in packaging, refrigeration, and flavoring are boosting the adoption of liquid probiotic products across functional beverages, smoothies, and dairy alternatives.

- By Application

On the basis of application, the food probiotics market is segmented into functional food and beverages, dietary supplements, and feed. The functional food and beverages segment dominated the market with the largest revenue share in 2025, driven by rising consumer demand for gut health and immunity-boosting products incorporated into daily diets. Products such as yogurt, kefir, and fortified beverages provide convenient avenues for probiotic consumption while offering nutritional value. The segment benefits from strong product innovation, strategic brand positioning, and growing awareness campaigns highlighting digestive and overall health benefits. Consumer inclination towards preventive healthcare and wellness lifestyles further fuels the dominance of this segment.

The dietary supplements segment is expected to witness the fastest growth rate from 2026 to 2033, fueled by increased health consciousness, rising fitness trends, and growing interest in personalized nutrition. Supplements allow consumers to achieve targeted probiotic intake with precise dosages and strain-specific formulations. For instance, companies such as Culturelle and Garden of Life have expanded their offerings of capsule- and powder-based probiotic supplements, catering to adults, children, and seniors seeking digestive support.

- By Distribution Channel

On the basis of distribution channel, the food probiotics market is segmented into hypermarkets/supermarkets, pharmacies/drugstores, specialty stores, and online. The hypermarkets/supermarkets segment dominated the market with the largest revenue share in 2025, driven by the availability of a wide variety of probiotic products and the convenience of bulk shopping. These retail outlets attract health-conscious consumers seeking functional foods, beverages, and supplements under one roof. Strategic promotions, in-store product sampling, and visibility of trusted brands further strengthen the dominance of hypermarkets and supermarkets in probiotic distribution.

The online segment is anticipated to witness the fastest growth rate from 2026 to 2033, fueled by increasing e-commerce penetration, home delivery services, and consumer preference for convenience. Online platforms offer easy access to niche probiotic products, detailed product information, and subscription-based purchase models. Companies such as iHerb and Amazon have expanded their probiotic listings, enabling customers to explore a wider range of strains, formulations, and brands, accelerating the adoption of online sales channels.

- By End User

On the basis of end user, the food probiotics market is segmented into human and animal. The human segment dominated the market with the largest revenue share in 2025, driven by rising awareness of gut health, immunity, and overall wellness among all age groups. Consumers increasingly incorporate probiotics into their daily diets through functional foods, beverages, and dietary supplements. Strong marketing campaigns, clinical studies demonstrating benefits, and the expanding availability of ready-to-consume products reinforce the dominance of human end users.

The animal segment is projected to witness the fastest growth rate from 2026 to 2033, fueled by the increasing use of probiotics in animal feed for livestock and pets to enhance gut health, immunity, and nutrient absorption. For instance, companies such as DSM and Chr. Hansen are developing strain-specific probiotics for poultry, cattle, and pets, which improve feed efficiency and reduce reliance on antibiotics. Growing demand for organic and natural animal products is further supporting the adoption of probiotics in the animal nutrition segment

Food Probiotics Market Regional Analysis

- Asia-Pacific dominated the food probiotics market with the largest revenue share of 39% in 2025, driven by rising health awareness, rapid urbanization, increasing disposable income, and strong demand for functional foods and dietary supplements

- The region’s expanding retail and e-commerce infrastructure, rising middle-class population, and growing adoption of immunity-boosting and gut-friendly products are accelerating market expansion

- The availability of advanced manufacturing facilities, favorable government initiatives promoting nutrition and wellness, and increasing R&D in probiotic strains are contributing to higher consumption of food probiotics across human and animal applications

China Food Probiotics Market Insight

China held the largest share in the Asia-Pacific food probiotics market in 2025, owing to its strong dairy and functional beverage industry, rising health awareness, and growing investments in probiotic product development. The country’s large population, urbanization, and increasing disposable income are driving higher consumption of probiotic-enriched foods and dietary supplements. In addition, ongoing research in novel probiotic strains and regulatory support for functional food innovations are bolstering market growth.

India Food Probiotics Market Insight

India is witnessing the fastest growth in the Asia-Pacific region, fueled by expanding functional food consumption, rising awareness of gut health, and increasing adoption of dietary supplements. Government initiatives promoting nutrition and health, combined with growing investments in dairy and beverage industries, are strengthening demand. Rising e-commerce penetration and brand expansions by companies such as Yakult and Danone are contributing to rapid market growth.

Europe Food Probiotics Market Insight

The Europe food probiotics market is expanding steadily, supported by high consumer awareness of digestive health, strong demand for functional foods, and stringent food safety regulations. The region emphasizes high-quality probiotic formulations and sustainable production practices, particularly in dairy and beverages. Continuous innovation, clinical validation of probiotic strains, and government initiatives promoting preventive healthcare are enhancing market adoption.

Germany Food Probiotics Market Insight

Germany’s food probiotics market is driven by advanced functional food manufacturing, strong research infrastructure, and high consumer preference for gut health and wellness products. The country’s established supply chain networks and focus on clinical efficacy of probiotics foster market growth. Demand is particularly strong for dairy-based probiotics, supplements, and fortified beverages, with innovation in strain-specific formulations gaining traction.

U.K. Food Probiotics Market Insight

The U.K. market is supported by growing awareness of digestive and immune health, rising functional food consumption, and expansion of dietary supplement offerings. Increasing collaboration between food manufacturers and academic institutions for probiotic research, along with regulatory emphasis on product safety and efficacy, strengthens the market. The U.K.’s mature retail and online distribution channels also facilitate broad consumer access.

North America Food Probiotics Market Insight

North America is projected to grow at the fastest CAGR from 2026 to 2033, driven by rising health consciousness, expanding functional food and dietary supplement markets, and increasing demand for immunity-boosting products. Research in microbiome science, growing interest in personalized nutrition, and advancements in probiotic delivery technologies are accelerating market adoption.

U.S. Food Probiotics Market Insight

The U.S. accounted for the largest share in the North America market in 2025, underpinned by strong consumer awareness of digestive health, established dietary supplement and functional food industries, and significant investment in R&D. The country’s focus on innovation, clinical validation of probiotic strains, and a mature distribution network are supporting the leading market position. Key players such as Danone, Yakult, and Nestlé have expanded product offerings, further solidifying the U.S.’s dominance in the region.

Food Probiotics Market Share

The food probiotics industry is primarily led by well-established companies, including:

- Arla Foods Ingredients Group P/S (Denmark)

- BioGaia AB (Sweden)

- Chr. Hansen Holding A/S (Denmark)

- Danone S.A. (France)

- Deerland Probiotics & Enzymes, Inc (U.S.)

- DuPont (U.S.)

- General Mills Inc. (U.S.)

- Lallemand Inc. (Canada)

- ADM (Archer Daniels Midland Company) (U.S.)

- Lifeway Foods, Inc. (U.S.)

- Mother Dairy Fruit & Vegetable Pvt. Ltd. (India)

- Glac Biotech Co., Ltd. (South Korea)

- Nestlé (Switzerland)

- DSM (Royal DSM N.V.) (Netherlands)

- Exden (U.S.)

- Yakult Honsha Co., Ltd. (Japan)

- Attune Foods (U.S.)

- Kerry Inc. (Ireland)

- Morinaga Milk Industry Co., Ltd. (Japan)

- Kemin Industries, Inc. (U.S.)

Latest Developments in Global Food Probiotics Market

- In July 2025, Bioma Probiotics launched a triple-action synbiotic supplement that combines prebiotics, probiotics, and postbiotics to support digestion, immunity, and overall gut health. The innovative formulation addresses growing consumer demand for holistic gut-health solutions, offering enhanced functional benefits compared to single-strain products. This development underscores Bioma Probiotics’ commitment to advancing premium wellness solutions and expanding the functional food segment

- In June 2025, Novonesis completed its €1.5 billion acquisition of DSM-Firmenich’s stake in the Feed Enzyme Alliance, consolidating its position in the global animal nutrition market. The acquisition enables integrated enzyme and probiotic solutions, improving efficiency and product offerings for livestock nutrition. This strategic move emphasizes Novonesis’ commitment to expanding its footprint in the functional feed additives sector and driving market growth

- In May 2025, Evonik introduced its poultry probiotic Ecobiol® in mainland China at the China Feed Industry Expo, designed to improve gut health and productivity in poultry. The product provides a sustainable alternative to antibiotics and enhances feed efficiency, aligning with rising demand for natural animal nutrition solutions. This launch highlights Evonik’s focus on innovative feed additives that support the growing probiotic market in Asia-Pacific

- In February 2025, Novonesis initially reached an agreement to acquire DSM-Firmenich’s share of the Feed Enzyme Alliance, aiming to strengthen its global presence in animal probiotics and enzymes. The consolidation allows for better standardization, distribution, and innovation in feed solutions, supporting increased adoption of probiotic-based animal nutrition products. This development demonstrates Novonesis’ long-term strategy to lead in the growing animal probiotics market

- In September 2023, Danone launched the “Partner for Growth” program in collaboration with Chr. Hansen, co-developing dairy and plant-based probiotic products to expand functional food offerings. The partnership leverages Chr. Hansen’s probiotic expertise and Danone’s global distribution to create science-backed, culture-rich products. This initiative reflects Danone’s commitment to innovation in the probiotics sector and to meeting increasing consumer demand for gut-health-focused functional foods

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Food Probiotics Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Food Probiotics Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Food Probiotics Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.