Global Food Processing Equipment Market

Market Size in USD Billion

CAGR :

%

USD

61.90 Billion

USD

81.51 Billion

2024

2032

USD

61.90 Billion

USD

81.51 Billion

2024

2032

| 2025 –2032 | |

| USD 61.90 Billion | |

| USD 81.51 Billion | |

|

|

|

|

Food Processing Equipment Market Size

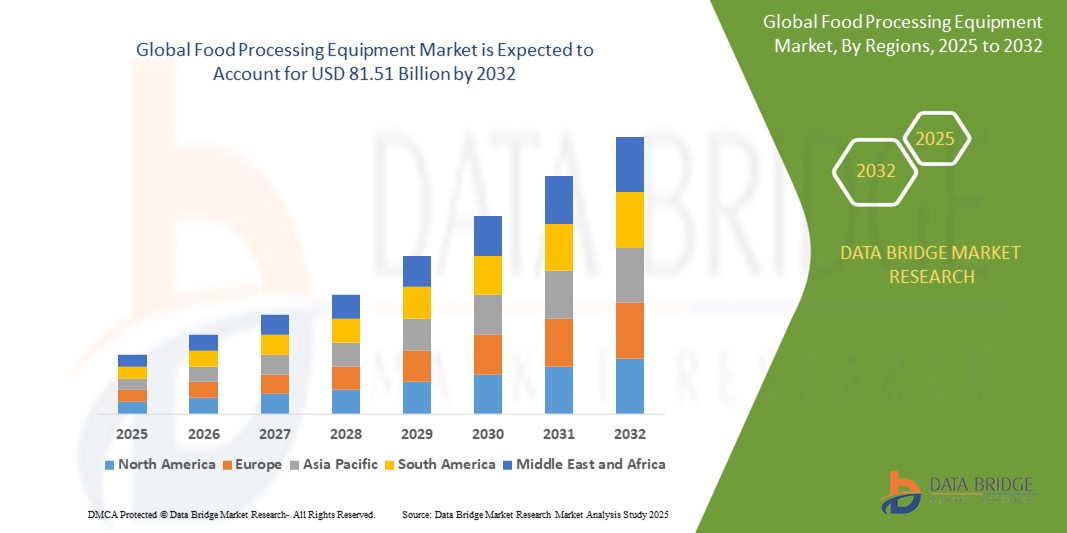

- The global food processing equipment market size was valued at USD 61.90 billion in 2024 and is expected to reach USD 81.51 billion by 2032, at a CAGR of 3.50% during the forecast period

- The market growth is largely fuelled by the rising consumer demand for processed and convenience foods due to changing lifestyles and increasing disposable incomes, the growing need for efficient and hygienic food processing methods, the adoption of advanced technologies such as automation and AI in food processing, and the expanding global trade of processed foods.

- Furthermore, stringent food safety and quality regulations worldwide are compelling food manufacturers to invest in modern processing equipment to ensure compliance and maintain product integrity.

Food Processing Equipment Market Analysis

- The food processing equipment market is currently experiencing a phase of continuous technological advancement with a strong emphasis on automation to enhance efficiency and reduce labor costs

- Manufacturers are increasingly focusing on developing equipment that meets stringent food safety and hygiene standards, along with solutions that offer greater flexibility and customization for diverse food production needs

- North America dominated the food processing equipment market with the largest revenue share of 38.6% in 2024, driven by a strong presence of food manufacturing companies and increasing demand for processed and packaged foods

- The Asia-Pacific region is expected to witness the highest growth rate in the global food processing equipment market, driven by rapid industrialization, increasing urban population, rising disposable incomes, and growing demand for packaged and convenience food across emerging economies such as China, India, and Southeast Asian countries

- The meat poultry & seafood segment accounted for the largest market revenue share in 2024, driven by the increasing global consumption of protein-rich diets and the necessity for hygienic and efficient processing systems

Report Scope and Food Processing Equipment Market Segmentation

|

Attributes |

Food Processing Equipment Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Food Processing Equipment Market Trends

“Increased Adoption of Automation and Robotics”

- The food processing sector is increasingly integrating robotic arms for tasks such as sorting and packaging to boost throughput and maintain hygiene standards

- Automated guided vehicles (AGVs) and autonomous mobile robots (AMRs) are becoming commonplace in food processing facilities for material handling and transportation

- The implementation of automated cleaning and sanitation systems is gaining traction to ensure food safety and compliance with stringent regulations

- Data analytics and IoT (Internet of Things) are being integrated with automated food processing equipment to enable real-time monitoring and predictive maintenance

- Collaborative robots (cobots) are being deployed in food processing environments to work alongside human employees on tasks requiring both precision and flexibility

Food Processing Equipment Market Dynamics

Driver

“Demand For Processed and Packaged Food Products”

- The rising global population necessitates large-scale food production to meet the nutritional demands of an increasing number of consumers

- For instance, in countries with rapidly growing populations, there is a heightened demand for high-capacity grain processing equipment to ensure sufficient food supply

- The demand for processed and packaged foods is escalating due to evolving lifestyles and increasing disposable incomes, particularly in urban and developing regions

- Urbanization and changing lifestyles have led to a greater reliance on convenient food options, further driving the need for advanced food processing equipment

- Food manufacturers are compelled to invest in sophisticated machinery capable of handling large volumes of raw materials while ensuring consistent product quality and adhering to strict hygiene and safety standards

- The globalization of food trade requires advanced processing and packaging technologies to facilitate the safe and efficient distribution of food products across geographical boundaries

Restraint/Challenge

“Substantial Initial Investment Cost Associated with Acquiring and Implementing Advanced Processing Technologies”

- The substantial initial investment cost for advanced food processing equipment, especially machinery incorporating automation and robotics, poses a significant financial hurdle

- For instance, a small meat processing company might find the upfront cost of automated cutting and packaging systems too high

- Modern food processing equipment with sophisticated control systems often requires significant capital expenditure, creating a barrier to entry for many

- This high cost is a considerable challenge for small and medium-sized enterprises (SMEs) in the food processing sector with limited financial resources

- Implementing complex machinery necessitates additional investments in areas such as infrastructure upgrades, specialized personnel training, and ongoing maintenance and technical support

- The perceived risk and uncertainties surrounding market demand and the return on investment can further deter businesses from adopting cutting-edge, yet expensive, food processing technologies

Food Processing Equipment Market Scope

The market is segmented on the basis of equipment type, automation type, and industry.

- By Equipment Type

On the basis of equipment type, the food processing equipment market is segmented into cooling and freezing equipment, cooking and heating equipment, fillers, sealers, mixers, grinders and mills, cutters and slicers, drying and dehydration equipment, peelers, separators, and others. The cooling and freezing equipment segment dominated the market with the largest market revenue share in 2024, driven by rising demand for frozen food and the need for preserving perishable products throughout extended supply chains. This equipment ensures food safety and quality, making it essential in both large-scale production and storage facilities.

The mixers segment is expected to witness the fastest growth rate from 2025 to 2032, owing to its critical role in blending ingredients across various food categories. Mixers support batch consistency and efficiency, and advancements in hygienic design and automation are further enhancing their adoption in modern food processing facilities.

- By Automation Type

On the basis of automation type, the food processing equipment market is segmented into automatic, semi-automatic, and manual. The automatic segment held the largest market revenue share in 2024, propelled by growing demand for high-efficiency, labor-saving equipment that ensures consistent product quality. Automation minimizes human error, enhances throughput, and reduces operational costs, making it increasingly popular across large-scale food manufacturers.

The semi-automatic segment is expected to witness the fastest growth rate from 2025 to 2032, supported by its flexibility in small and medium enterprises (SMEs). It offers a balance between cost-efficiency and manual control, especially valuable for customized processing needs or niche food products.

- By Industry

On the basis of industry, the food processing equipment market is segmented into meat poultry & seafood, dairy products, bakery, processed fruit & vegetable, confectionery, grain mill products, and others. The meat poultry & seafood segment accounted for the largest market revenue share in 2024, driven by the increasing global consumption of protein-rich diets and the necessity for hygienic and efficient processing systems. The complexity of meat processing also demands specialized equipment for cutting, grinding, cooking, and packaging.

The processed fruit & vegetable segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by rising demand for convenience foods and growing health awareness. Consumers increasingly seek ready-to-eat, nutrient-retaining processed products, which drives innovation and investment in advanced processing equipment for this segment.

Food Processing Equipment Market Regional Analysis

- North America dominated the food processing equipment market with the largest revenue share of 38.6% in 2024, driven by a strong presence of food manufacturing companies and increasing demand for processed and packaged foods

- The region benefits from advanced manufacturing infrastructure, high consumer spending on convenience food, and the adoption of automation and hygiene-compliant equipment in food facilities

- Continuous technological advancements and stringent food safety regulations support market growth, with manufacturers investing in efficient, automated solutions to enhance productivity and product quality

U.S. Food Processing Equipment Market Insight

The U.S. food processing equipment market captured the largest revenue share of 80.4% in 2024 within North America, supported by large-scale food production, technological innovation, and rising demand for clean-label and ready-to-eat food products. The need for advanced equipment that supports food safety, energy efficiency, and automation is a key driver. Furthermore, the growing trend of plant-based and organic food processing is fueling the adoption of versatile, high-performance equipment across the U.S. market.

Europe Food Processing Equipment Market Insight

The Europe food processing equipment market is expected to witness the fastest growth rate from 2025 to 2032, driven by a mature food and beverage industry and strict EU food safety and hygiene regulations. The shift toward sustainable and energy-efficient processing systems is a major factor encouraging the adoption of modern equipment. Rising demand for processed dairy, bakery, and confectionery products further supports regional market expansion, particularly in countries with high export potential.

U.K. Food Processing Equipment Market Insight

The U.K. food processing equipment market is expected to witness the fastest growth rate from 2025 to 2032, owing to increased investments in food innovation, automation, and facility modernization. The demand for healthier food options, including low-sugar and plant-based alternatives, is pushing food producers to adopt more adaptable and precise equipment. Moreover, post-Brexit regulatory adjustments are prompting companies to upgrade their processing systems to meet both domestic and international quality standards.

Germany Food Processing Equipment Market Insight

The Germany food processing equipment market is expected to witness the fastest growth rate from 2025 to 2032, driven by the country's strong engineering base, focus on food quality, and growing demand for sustainable processing technologies. German manufacturers are at the forefront of integrating Industry 4.0 capabilities, such as AI, robotics, and IoT, into food processing systems. The emphasis on reducing food waste and energy consumption is also contributing to the adoption of advanced, eco-friendly equipment.

Asia-Pacific Food Processing Equipment Market Insight

The Asia-Pacific food processing equipment market is expected to witness the fastest growth rate from 2025 to 2032, driven by rapid urbanization, rising disposable incomes, and expanding middle-class populations in countries such as China, India, and Southeast Asian nations. Government initiatives to improve food safety, infrastructure development, and the emergence of food manufacturing hubs are significantly boosting market growth. The region’s growing appetite for processed, packaged, and convenience foods further accelerates equipment demand.

Japan Food Processing Equipment Market Insight

The Japan food processing equipment market is expected to witness the fastest growth rate from 2025 to 2032, fueled by the nation’s preference for automation, compact machinery, and hygienic processing standards. The aging population and shrinking workforce are pushing manufacturers to invest in labor-saving technologies and high-efficiency equipment. Japan’s strong tradition of packaged and convenience food consumption, combined with its reputation for quality and innovation, supports continued growth in the food processing equipment sector.

China Food Processing Equipment Market Insight

The China food processing equipment market is expected to witness the fastest growth rate from 2025 to 2032, driven by the country’s expanding food manufacturing sector and increasing consumer demand for processed and packaged foods. Rapid urbanization, rising disposable incomes, and evolving dietary preferences are contributing to the surge in demand for modern food processing solutions. In addition, government policies encouraging food safety, technological innovation, and automation are fostering the adoption of advanced equipment. Domestic and international manufacturers are investing heavily in China’s market to meet the growing need for efficient, high-capacity, and compliant processing systems across industries such as meat, dairy, bakery, and beverages.

Food Processing Equipment Market Share

The Food Processing Equipment industry is primarily led by well-established companies, including:

- JBT (U.S.)

- ALFA LAVAL (Sweden)

- Marel (Iceland)

- The Middleby Corporation (U.S.)

- Bühler AG (Switzerland)

- GEA Group Aktiengesellschaft (Germany)

- SPX FLOW (U.S.)

- Tetra Pak Group (Switzerland)

- Bigtem Makine A.S. (Turkey)

- TNA Australia Pty Limited (Australia)

- Schaaf Technologie GmbH (Germany)

- ANKO FOOD MACHINE CO., LTD. (Taiwan)

- Bettcher Industries, Inc. (U.S.)

- Baker Perkins (U.K.)

- Heat and Control, Inc. (U.S.)

- Key Technology (U.S.)

- Provisur Technologies, Inc. (U.S.)

- PROXES GMBH (Germany)

- FME Food Machinery Europe Sp. z o.o (Poland)

- Alto-Shaam, Inc. (U.S.)

Latest Developments in Global Food Processing Equipment Market

- In May 2024, Tetra Pak Group unveiled its ‘Factory Sustainable Solutions’ offering, a new comprehensive approach for factory optimization. This initiative aims to enhance energy, water, and cleaning-in-place (CIP) processes across Food and Beverage (F&B) production facilities. It provides producers with a customized blend of advanced technologies and superior plant integration capabilities, helping them achieve their sustainability targets by boosting energy and resource efficiency, ultimately reducing operational costs. This strengthens Tetra Pak's overall sustainability portfolio

- In January 2024, Tetra Pak Group announced a strategic collaboration with Absolicon, a Swedish solar thermal company. This partnership aims to provide a standardized solution for industrial equipment powered by renewable thermal energy (heat). They will integrate scalable solar thermal modules with existing and new UHT lines, offering various decarbonization options, including significant reductions in greenhouse gas emissions tailored to customer requirements. This collaboration supports Tetra Pak in achieving its sustainability targets, enhancing operational efficiency, and maintaining a competitive advantage in the market

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Food Processing Equipment Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Food Processing Equipment Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Food Processing Equipment Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.