Global Food Salt Market

Market Size in USD Billion

CAGR :

%

USD

35.02 Billion

USD

43.68 Billion

2024

2032

USD

35.02 Billion

USD

43.68 Billion

2024

2032

| 2025 –2032 | |

| USD 35.02 Billion | |

| USD 43.68 Billion | |

|

|

|

|

Food Salt Market Size

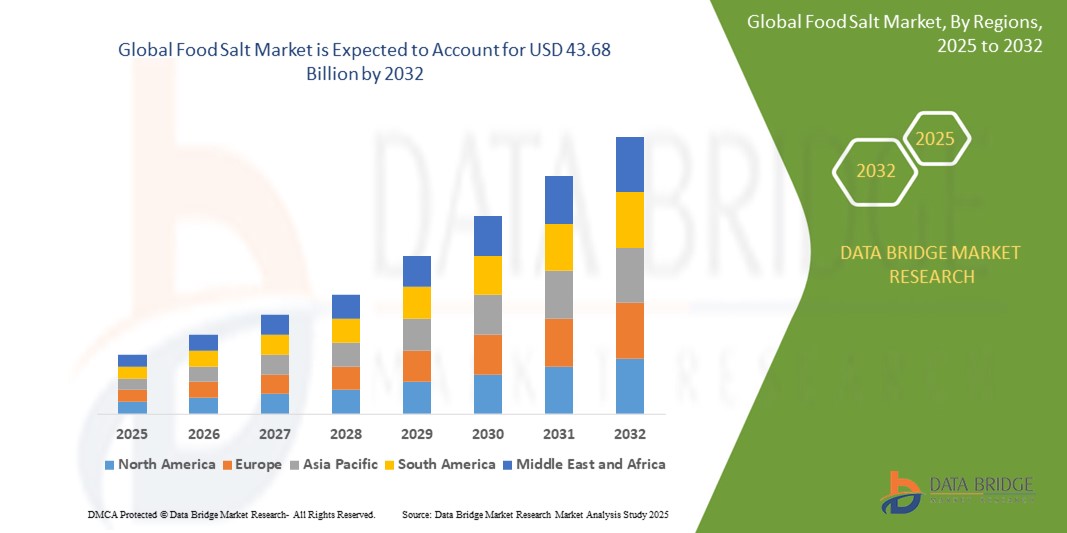

- The global food salt market size was valued at USD 35.02 billion in 2024 and is expected to reach USD 43.68 billion by 2032, at a CAGR of 2.80% during the forecast period

- The market growth is largely fuelled by the increasing demand for processed and packaged food products, rising global population, and heightened awareness regarding mineral-rich dietary intake

- In addition, the growing use of specialty salts such as sea salt, Himalayan pink salt, and low-sodium alternatives in culinary applications and health-conscious diets is further propelling market expansion across both developed and emerging regions

Food Salt Market Analysis

- The food salt market continues to witness steady expansion driven by increasing consumption across households and the food service industry, with a growing focus on product purity and traceability enhancing consumer confidence

- Rising popularity of gourmet cooking and demand for premium food experiences have led to a surge in specialty salt products, reshaping purchasing patterns and influencing brand innovation strategies

- Asia-Pacific dominated the food salt market with the largest revenue share of 41.3% in 2024, owing to high consumption of processed and preserved foods, coupled with large-scale agricultural and industrial applications

- The North America region is expected to witness the highest growth rate in the global food salt market, driven by increasing demand for processed and packaged foods, rising health awareness, and a growing trend toward specialty and low-sodium salts

- The rock salt segment held the largest market revenue share of 45% in 2024, driven by widespread use across multiple industrial and commercial applications such as de-icing, chemical processing, and water treatment. Its cost-effectiveness, abundant availability, and minimal processing requirements make it a preferred choice in large-scale operations. In regions with cold climates, the use of rock salt for road de-icing significantly boosts its demand during winter months

Report Scope and Food Salt Market Segmentation

|

Attributes |

Food Salt Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Food Salt Market Trends

“Growing Demand for Specialty and Gourmet Salts”

- Consumers are increasingly shifting toward specialty and gourmet salts due to their perceived health benefits, unique flavors, and visual appeal

- Products such as Himalayan pink salt and black lava salt are gaining popularity in both home kitchens and upscale restaurants, driven by trends in natural and artisanal food ingredients

- Culinary professionals and food enthusiasts are incorporating gourmet salts to enhance taste and presentation, with brands introducing innovative blends infused with herbs, spices, and smoked flavors

- The rising influence of food bloggers and cooking shows has also spotlighted premium salts as essential ingredients

- For instance, Himalayan pink salt being promoted in wellness-based recipes and sea salt used in handcrafted snacks

- Retailers and e-commerce platforms are expanding their specialty salt offerings, supported by instances such as gourmet salt gift sets in supermarkets and exclusive product lines on organic food websites

Food Salt Market Dynamics

Driver

“Rising Consumption of Processed and Packaged Foods”

- The increasing global demand for processed and packaged foods is significantly driving the food salt market, as food salt is essential for preserving and flavoring these products

- As urban lifestyles accelerate, consumers opt for ready‑to‑eat meals, frozen foods, snacks, canned goods, and baked items, all dependent on salt to extend shelf life and enhance taste

- Salt contributes to improving flavor, texture, and visual appeal in processed foods, making it indispensable in food manufacturing

- Developing economies such as India see a surge in packaged and fast‑food consumption, with brands such as Haldiram’s and McDonald’s reaching or exceeding local sodium thresholds, Haldiram’s chips contain over four times the allowable sodium limit, while Maggi noodles have nearly six times the limit

- Fast‑food chains worldwide rely heavily on salt for consistency, a survey by World Action on Salt and Health found that children's meals at McDonald’s, KFC, Burger King, and Subway contained more salt than recommended, the saltiest KFC meal had nearly six grams of salt, surpassing adult daily limits

Restraint/Challenge

“Health Concerns Associated with High Sodium Intake”

- The growing awareness of the health risks associated with high sodium intake, such as hypertension, heart disease, and stroke are a significant challenge for the food salt market

- Health organizations and medical professionals are promoting reduced salt consumption, particularly in processed and packaged foods, leading to widespread consumer behaviour changes

- Food manufacturers are being pressured to reformulate their products with lower sodium content, a task that is both technically complex and cost-intensive due to challenges in maintaining taste and texture

- Regulatory bodies across several countries have implemented sodium reduction targets and mandatory front-of-pack labelling, creating compliance burdens for producer

- For instance, the U.K. government set voluntary salt reduction targets across 28 food categories, which many major brands are working to meet

- Public campaigns are actively influencing consumers to reduce salt intake, with instances such as the U.S. Food and Drug Administration launching a national sodium reduction initiative urging food producers to cut sodium across packaged and restaurant foods

Food Salt Market Scope

The market is segmented on the basis of type, source, and application.

- By Type

On the basis of type, the food salt market is segmented into gourmet salt, rock salt, salt in brine, vacuum pan salt, solar salt, and others. The rock salt segment held the largest market revenue share of 45% in 2024, driven by widespread use across multiple industrial and commercial applications such as de-icing, chemical processing, and water treatment. Its cost-effectiveness, abundant availability, and minimal processing requirements make it a preferred choice in large-scale operations. In regions with cold climates, the use of rock salt for road de-icing significantly boosts its demand during winter months.

The gourmet salt segment is expected to witness the fastest growth rate from 2025 to 2032, propelled by growing consumer interest in premium and exotic ingredients. The rising use of gourmet salts such as fleur de sel and smoked salt in fine dining and home cooking has increased demand across foodservice and retail channels. Their unique flavor profiles and visual appeal continue to drive innovation in product offerings.

- By Source

On the basis of source, the market is segmented into brine and salt mines. The salt mines segment held the dominant market share of 65% in 2024 owing to the demand for minimally processed natural salts. With growing consumer preference for authentic, mineral-rich products, salt mined from geological deposits such as rock salt is gaining popularity in the culinary and wellness sectors.

The brine segment is expected to witness the fastest growth rate from 2025 to 2032, supported by its cost-effective production, scalability, and application in bulk food processing. Brine-derived salt is commonly used in the production of refined table salt and various industrial-grade salts, making it essential to the supply chain.

- By Application

On the basis of application, the food salt market is segmented into chemical processing, de-icing, water treatment, oil and gas, agriculture, flavoring agent, confectionery, bakery, meat and poultry, seafood, sauces and savouries, and others. The flavoring agent segment accounted for the largest market revenue share in 2024, attributed to salt’s vital role in enhancing taste and preserving a wide variety of food products. Its use is especially prominent in ready-to-eat meals, snacks, and canned goods across both retail and foodservice sectors.

The bakery segment is expected to witness the fastest growth rate from 2025 to 2032, driven by increasing demand for baked goods in emerging economies and the need for salt to control fermentation and strengthen dough. As artisanal and packaged bakery products expand globally, salt remains a critical ingredient in maintaining texture, taste, and shelf life.

Food Salt Market Regional Analysis

- Asia-Pacific dominated the food salt market with the largest revenue share of 41.3% in 2024, owing to high consumption of processed and preserved foods, coupled with large-scale agricultural and industrial applications

- The region’s robust food processing sector, especially in countries such as China, India, and Indonesia, continues to drive demand for various types of food salt including rock salt and vacuum pan salt

- In addition, increasing population, rising disposable incomes, and government support for food security and preservation techniques are reinforcing the need for stable and cost-effective salt supply in both food manufacturing and seasoning applications

China Food Salt Market Insight

The China food salt market accounted for the largest revenue share within Asia-Pacific in 2024, attributed to strong domestic production capacity and rising demand from both food processing and consumer retail segments. China’s massive processed food sector, along with government efforts to modernize agricultural practices, drives the consumption of food-grade and industrial salt. Moreover, the presence of major salt producers and wide availability of raw materials bolster supply chain efficiency and price competitiveness.

Japan Food Salt Market Insight

The Japan food salt market is expected to witness the fastest growth rate from 2025 to 2032, driven by a strong preference for high-quality and low-sodium salt products. Traditional Japanese cuisine relies heavily on salt-based seasonings such as miso, soy sauce, and pickled products, sustaining consistent demand. Additionally, the market is seeing growth in gourmet and specialty salts, including sea salt and flavored variants, aligned with consumer interest in culinary diversity and health-conscious choices.

North America Food Salt Market Insight

The North America food salt market is expected to witness the fastest growth rate from 2025 to 2032, driven by the established processed food industry and demand for clean-label, specialty, and gourmet salts. Despite regulatory efforts to reduce sodium consumption, food salt remains critical in flavoring, preservation, and textural improvement in a wide range of food categories including meats, bakery products, and snacks.

U.S. Food Salt Market Insight

The U.S. food salt market held the largest revenue share in North America in 2024, supported by high consumption of fast foods and processed items. Consumer demand for premium culinary experiences has also led to rising interest in Himalayan pink salt, sea salt, and flavored salt varieties. Furthermore, ongoing product innovation and robust distribution networks through supermarkets and online channels help maintain a strong market footprint.

Europe Food Salt Market Insight

The Europe food salt market is expected to witness the fastest growth rate from 2025 to 2032, supported by the region’s stringent food safety regulations and increasing use of food-grade salt in meat processing and bakery applications. Shifting consumer preferences toward health-conscious diets are creating opportunities for low-sodium and mineral-enhanced salt products. Key markets including Germany, France, and the U.K. are focusing on sustainable sourcing and advanced packaging.

Germany Food Salt Market Insight

The Germany food salt market is expected to witness the fastest growth rate from 2025 to 2032, driven by demand from the organic and gourmet food segments. German consumers are showing greater interest in regionally produced, sustainable, and minimally processed salt products. Additionally, the country’s advanced food manufacturing capabilities and growing focus on clean-label products further support market development.

U.K. Food Salt Market Insight

The U.K. food salt market is expected to witness the fastest growth rate from 2025 to 2032, supported by the increasing popularity of artisanal, organic, and reduced-sodium salt products. Rising health awareness and regulatory efforts to curb sodium intake are encouraging food manufacturers to reformulate products using mineral-rich or alternative salt types. The demand for gourmet salts, such as sea salt and Himalayan pink salt, is also rising among premium culinary brands and home chefs, contributing to market diversification.

Food Salt Market Share

The Food Salt industry is primarily led by well-established companies, including:

- Alaska Pure Sea Salt Company (U.S.)

- Maldon Crystal Salt Company Ltd. (U.K.)

- Morton Salt, Inc. (U.S.)

- Cargill, Incorporated (U.S.)

- Krishna Engineering Works (India)

- Padmavati Salt (India)

- Nahta Salt & Chemicals Pvt Ltd (India)

- Amagansett Sea Salt LLC (U.S.)

- CK Life Sciences Int'l. (Holdings) Inc. (Hong Kong)

- Infosa (Spain)

- Kalahari Pristine Salt Worx (South Africa)

- Murray River Salt (Australia)

- SAN FRANCISCO SALT CO (U.S.)

- BASF SE (Germany)

- Atisale Spa (Italy)

- Akzo Nobel N.V. (Netherlands)

- CIECH S.A. (Poland)

- Hoosier Hill Farm (U.S.)

- MITSUI & CO., LTD. (Japan)

- INEOS (U.K.)

Latest Developments in Global Food Salt Market

- In May 2023, Cargill entered into a strategic collaboration with CIECH Group to expand its specialty and evaporated food salt solutions across Europe. This development aims to diversify Cargill’s product offerings tailored for food manufacturers and strengthen its market presence in the region. The move positions Cargill to meet the rising demand for specialty salts in food processing, reinforcing its innovation-driven leadership in the European salt market

- In December 2022, CIECH Soda Polska signed a long-term supply agreement with Inowrocław Salt Mines "Solino" to secure a consistent brine supply. This initiative enhances production stability and operational efficiency for CIECH, ensuring uninterrupted output. The agreement supports CIECH’s role as a major player in the European salt market through reliable sourcing and sustainable growth

- In April 2022, Tata Salt launched Tata Salt Immuno in India, a zinc-fortified edible salt designed to support immune health. This product innovation addresses increasing consumer focus on health and nutrition, going beyond basic iodization. The launch strengthens Tata’s product portfolio and highlights a growing trend toward functional salt in the Indian market

- In May 2021, Tanteo Tequila introduced flavored margarita salts to complement its tequila offerings, targeting the premium cocktail segment. These salts enhance taste profiles and provide a customizable drinking experience, aligning with the evolving preferences in the beverage industry. The launch showcases the expansion of salt applications into lifestyle and niche markets, creating new growth avenues beyond traditional food use

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Food Salt Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Food Salt Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Food Salt Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.