Global Food Stabilizers Market

Market Size in USD Billion

CAGR :

%

USD

7.50 Billion

USD

10.20 Billion

2024

2032

USD

7.50 Billion

USD

10.20 Billion

2024

2032

| 2025 –2032 | |

| USD 7.50 Billion | |

| USD 10.20 Billion | |

|

|

|

|

Food Stabilizers Market Size

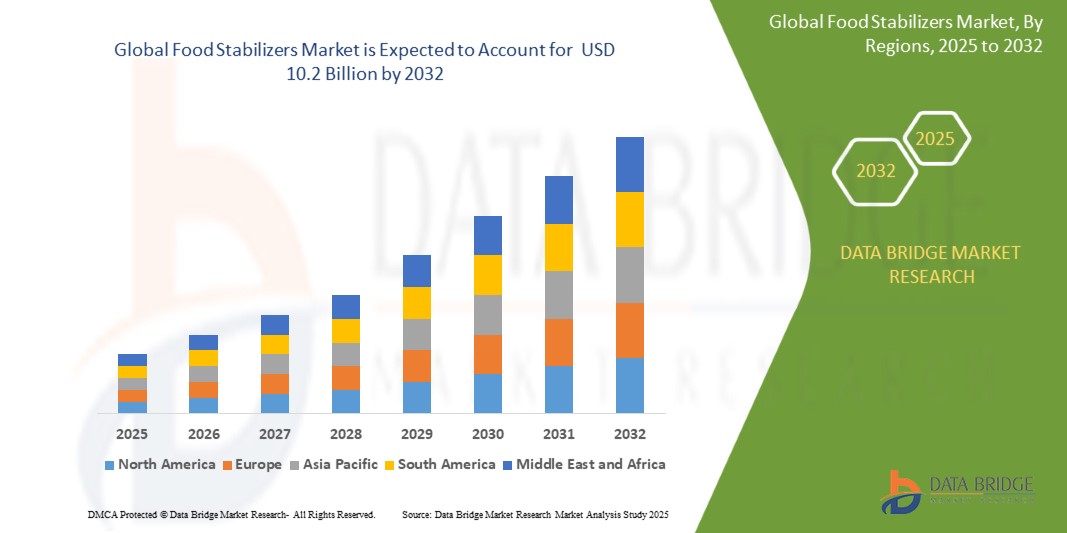

- The Global Food Stabilizers Market size was valued at USD 7.5 billion in 2024 and is expected to reach USD 10.2 billion by 2032, at a CAGR of 4.20% during the forecast period

- This growth is driven by factors such as the increasing demand for processed and convenience foods, growing awareness of food quality, and the expanding food and beverage industry globally.

- Rising demand for clean-label and natural additives is further fueling the market, as consumers increasingly seek transparency in ingredients and healthier food options without compromising texture or stability.

Food Stabilizers Market Analysis

- Food stabilizers are additives used to maintain the uniform dispersion of ingredients, improve texture, and extend shelf life in food products by preventing separation or degradation.

- These stabilizers help retain the physical and chemical stability of food and beverage products by preventing crystallization, sedimentation, and textural changes during processing and storage.

- Asia-Pacific is expected to dominate the Global Food Stabilizers Market with a market share of 35%, driven by rapid urbanization, rising disposable incomes, and growing demand for processed and convenience foods.

- North America is projected to be the fastest growing region with a CAGR of 5.1% during the forecast period due to increasing consumer demand for clean-label and functional food products.

- Pectin dominates the food stabilizers market, holding a 32% market share, primarily due to its natural origin, clean-label appeal, and widespread use in jams, jellies, dairy, and beverages. Its high compatibility with fruit-based applications and consumer preference for plant-derived stabilizers solidify its position across food and beverage industries globally.

Report Scope and Food Stabilizers Market Segmentation

|

Attributes |

Food Stabilizers Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Food Stabilizers Market Trends

“Shift Towards Clean-Label and Natural Food Stabilizers”

- Traditional food stabilizers often include synthetic additives, which are increasingly scrutinized by health-conscious consumers seeking transparency and minimal processing in their food products.

- In response, regulatory agencies and industry standards are promoting the use of clean-label ingredients, encouraging manufacturers to replace artificial stabilizers with natural alternatives.

For Instance,

- The European Food Safety Authority (EFSA) has tightened evaluations on food additives, prompting reformulations across the food industry.

- Manufacturers are developing plant-based, non-GMO, and allergen-free stabilizers such as agar, pectin, and guar gum to meet evolving consumer preferences.

- Food producers in sectors like dairy, beverages, and bakery are increasingly adopting these natural stabilizers to align with clean-label trends and build brand trust.

- Growing consumer awareness about health, wellness, and ingredient sourcing is accelerating the demand for food products with recognizable and natural stabilizing agents.

Food Stabilizers Market Dynamics

Driver

“Growing Demand for Processed and Convenience Foods”

- Increasing urbanization, dual-income households, and hectic lifestyles are fueling the global preference for ready-to-eat, processed, and long-shelf-life food products, particularly in rapidly developing economies and metropolitan cities across Asia-Pacific and Latin America.

- Food stabilizers are crucial in large-scale food production as they maintain emulsification, preserve uniformity, prevent ingredient separation, and retain appealing texture during storage and transportation cycles.

- With the rapid expansion of organized retail, online grocery platforms, and cold chains, the demand for processed foods is growing, thereby driving the use of stabilizers that can sustain food quality under diverse temperature and handling conditions.

- Rising disposable income and increasing awareness of premium, high-quality food products have prompted manufacturers to develop innovative, attractive, and shelf-stable food offerings that rely heavily on effective stabilizers.

- The surge in health-conscious consumers is also boosting demand for fortified foods, where stabilizers are required to maintain the integrity and stability of nutrients, textures, and flavors in fortified functional food formulations.

For instance,

- India's frozen food giant ITC Ltd. integrated guar gum into its ready-to-eat biryani line to improve rice consistency and shelf life. The move significantly enhanced consumer satisfaction, reduced product returns, and supported longer distribution cycles through e-commerce and exports—highlighting stabilizers' role in quality assurance and operational efficiency.

Restraint/Challenge

“Stringent Regulations on Food Additives and Labeling”

- Food safety authorities such as the FDA (U.S.), EFSA (Europe), and FSSAI (India) impose strict evaluation criteria and dosage limits for food stabilizers to ensure consumer safety, demanding exhaustive product testing and compliance documentation.

- International food manufacturers often face challenges when adapting their stabilizer formulations to suit distinct regulatory frameworks, labeling norms, and additive lists in multiple countries, complicating global market access and compliance timelines.

- With growing consumer demand for transparency, food companies are pressured to transition from synthetic to natural stabilizers—like pectin, agar, or xanthan gum—which may increase production costs and affect product texture or performance consistency.

- Developing and validating stabilizer alternatives that meet clean-label and organic certifications, while also adhering to shelf-life and functional performance expectations, significantly extends product development cycles and raises R&D investment burdens.

- Non-compliance with regional additive standards can lead to delayed product launches, penalties, product recalls, or withdrawal from shelves, severely affecting a company’s brand image, consumer trust, and financial outcomes in competitive markets.

Food Stabilizers Market Scope

The market is segmented on the basis of type, function, application, source and food categories.

- By type

On the basis of type, the food stabilizers market is segmented into pectin, gelatin, carrageenan, xanthan gum and guar gum. In 2025, Pectin dominates the food stabilizers market, holding a 32% market share, primarily due to its natural origin, clean-label appeal, and widespread use in jams, jellies, dairy, and beverages. Its high compatibility with fruit-based applications and consumer preference for plant-derived stabilizers solidify its position across food and beverage industries globally.

Xanthan gum is the fastest-growing segment with a projected CAGR of 5.8%, driven by increasing demand for gluten-free, vegan, and low-calorie foods. It offers excellent thickening and stabilizing properties across sauces, dressings, and plant-based formulations, meeting evolving dietary trends and enhancing texture in processed food products across multiple regions.

- By function

On the basis of function, the food stabilizers market is segmented into stability, texture, moisture retention and others. Others have been further segmented into egg replacement, mouthfeel and synthesis control. Texture leads due to its critical role in enhancing mouthfeel and consistency, especially in dairy, bakery, and confectionery, making it essential for product appeal and consumer satisfaction.

Moisture retention is growing fastest, driven by demand in bakery and meat products where maintaining freshness, preventing drying, and extending shelf life are key for both quality and customer preference.

- By application

On the basis of application, the food stabilizers market is segmented into bakery, confectionery, dairy product, sauce and dressing, beverage, convenience food and meat & poultry product. Dairy products dominate due to widespread stabilizer use in yogurt, cheese, and ice cream, ensuring texture, preventing separation, and improving shelf life across traditional and plant-based dairy sectors.

Convenience food is growing fastest due to urbanization and demand for ready-to-eat meals. Stabilizers help maintain consistency, stability, and appearance during storage, reheating, and distribution.

- By source

On the basis of source, the food stabilizers market is segmented into plant, seaweed, microbial, animal and synthetic. Plant-based sources dominate due to rising demand for clean-label, natural ingredients like guar gum and pectin, preferred by consumers seeking healthy, vegetarian, and environmentally friendly food solutions.

Microbial sources are the fastest growing, driven by sustainability and popularity of ingredients like xanthan gum in vegan and gluten-free products across dressings, sauces, and beverages.

- By food categories

On the basis of food categories, the food stabilizers market is segmented into dairy products, confectionary, meat and poultry, sauces and dressing, bakery and ready to eat food. Bakery dominates as stabilizers are crucial in improving dough texture, extending freshness, and maintaining structure in widely consumed products like bread, cakes, and pastries.

Ready-to-eat food is the fastest growing segment due to busy lifestyles, requiring stabilizers to ensure quality, stability, and shelf life in processed meals and packaged foods.

Food Stabilizers Market Regional Analysis

- Asia-Pacific is expected to dominate the Global Food Stabilizers Market with a market share of 35%, driven by rapid urbanization, rising disposable incomes, and growing demand for processed and convenience foods.

- Rapid urbanization and changing lifestyles, leading to increased consumption of packaged and convenience foods that heavily rely on food stabilizers for shelf life and quality retention.

- Rising disposable incomes and expanding middle-class populations in countries like China and India boost demand for premium, processed food products, accelerating the adoption of natural and synthetic food stabilizers across diverse applications.

China Food Stabilizers Market Insight

China leads Asia-Pacific with a 38% revenue share in 2025, driven by the expanding processed food industry, large-scale dairy and beverage production, and consumer preference for clean-label and plant-based stabilizers.

India Food Stabilizers Market Insight

India is projected to record the highest CAGR of 6.9%, fueled by rapid urbanization, rising demand for convenience foods, growing health awareness, and government initiatives to boost domestic food processing infrastructure.

Europe Food Stabilizers Market Insight

Europe’s market is shaped by strict clean-label regulations, high demand for natural stabilizers, and strong presence of dairy, bakery, and meat processing industries—particularly in Germany, France, and the Netherlands.

U.K. Food Stabilizers Market Insight

The U.K. market is driven by growing demand for plant-based and vegan-friendly stabilizers, innovation in low-fat food formulations, and an advanced food manufacturing sector emphasizing transparency and ingredient functionality.

Germany Food Stabilizers Market Insight

Germany leads Europe in stabilizer innovation, driven by strong R&D, high usage in bakery and dairy segments, and consumer demand for sustainable, high-performance texturizers and moisture retention agents.

North America Food Stabilizers Market Insight

North America is projected to be the fastest growing region with a CAGR of 5.1% during the forecast period due to increasing consumer demand for clean-label and functional food products.

U.S. Food Stabilizers Market Insight

In 2025, the U.S. accounts for 35% of the North American market, driven by innovation in stabilizer blends, health-conscious consumers, and high consumption of dairy, bakery, and convenience food products.

Food Stabilizers Market Share

The Food Stabilizers industry is primarily led by well-established companies, including:

- Cargill Incorporated (U.S.)

- DuPont (U.S.)

- Tate & Lyle (U.K.)

- Kerry Inc. (Ireland)

- CP Kelco U.S., Inc. (U.S.)

- Palsgaard (Denmark)

- Ashland (U.S.)

- ADM (Archer Daniels Midland Company) (U.S.)

- BASF SE (Germany)

- Ingredion Incorporated (U.S.)

- Hydrosol GmbH & Co. KG (Germany)

- Glanbia plc (Ireland)

- Advanced Food Systems Inc. (U.S.)

- Nexira (France)

- Chemelco (Netherlands)

- Associated British Foods plc (U.K.)

- DSM (Netherlands)

- Celanese Corporation (U.S.)

- Chr. Hansen Holding A/S (Denmark)

- JEY’S F.I. Inc. (South Korea)

Latest Developments in Global Food Stabilizers Market

- In March 2024, Cargill launched a new line of eco-friendly, plant-based food stabilizers made from citrus peels and legumes. Designed for clean-label applications, the stabilizers enhance shelf life and texture in dairy alternatives, beverages, and sauces, supporting both sustainability and natural ingredient trends in processed food markets.

- In June 2024, DuPont Nutrition & Biosciences expanded its European innovation center to accelerate the development of advanced stabilizer technologies. The facility focuses on natural texture and moisture-retention ingredients, targeting the growing demand for functional, clean-label solutions in dairy, bakery, and plant-based food segments across European markets.

- In October 2024, Kerry Group completed the acquisition of Biobake, a European supplier of bakery ingredients. The move boosts Kerry’s functional stabilizer offerings for gluten-free and plant-based bakery products, responding to rising consumer interest in texture-enhancing, moisture-preserving, and natural food additive formulations.

- In January 2025, Ingredion introduced a new stabilizer solution combining pea protein with hydrocolloids to improve the structure and mouthfeel of plant-based dairy and meat products. This allergen-free innovation supports vegan labeling and meets growing consumer demand for high-performance, plant-based functional ingredients in processed foods.

- In February 2025, CP Kelco announced a strategic partnership with a U.S.-based biotech company to co-develop advanced xanthan gum solutions. The collaboration targets low-dosage, high-efficiency formulations for beverages, sauces, and dressings, addressing cost reduction and sustainability concerns in food stabilizer applications.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Food Stabilizers Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Food Stabilizers Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Food Stabilizers Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.