Global Foodservice Disposables Market

Market Size in USD Billion

CAGR :

%

USD

91.81 Billion

USD

201.15 Billion

2024

2032

USD

91.81 Billion

USD

201.15 Billion

2024

2032

| 2025 –2032 | |

| USD 91.81 Billion | |

| USD 201.15 Billion | |

|

|

|

|

Foodservice Disposables Market Size

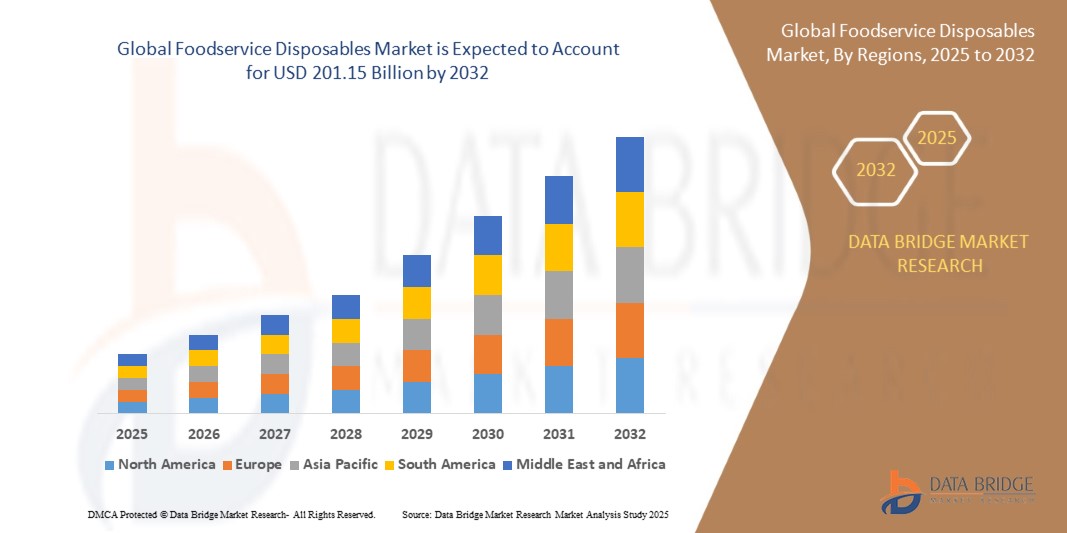

- The global foodservice disposables market was valued at USD 91.81 billion in 2024 and is expected to reach USD 201.15 billion by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 10.30%, primarily driven by the growing demand for hygienic, convenient, and eco-friendly disposable products

- This growth is driven by factors such as the rapid expansion of the foodservice industry, rising urbanization and on-the-go lifestyles, and increasing regulations and consumer preference for sustainable and biodegradable packaging solutions

Foodservice Disposables Market Analysis

- Foodservice disposables are essential components in the food and beverage industry, encompassing a wide range of single-use products such as plates, cups, cutlery, trays, napkins, and packaging items. These products are crucial for maintaining hygiene, facilitating takeout and delivery services, and enhancing customer convenience across foodservice operations

- The demand for foodservice disposables is significantly driven by the rise in quick-service restaurants (QSRs), growing online food delivery platforms, and heightened awareness of sanitation and food safety. Moreover, eco-conscious consumer behavior is influencing the surge in demand for biodegradable and compostable disposables

- The Asia-Pacific region stands out as one of the dominant regions for foodservice disposables, supported by rapid urbanization, rising disposable incomes, and expanding fast-food chains in countries like China and India

- For instance, the increasing penetration of global food delivery giants such as Uber Eats and Swiggy, along with domestic chains, has driven up consumption of disposable packaging products in urban centers across the region

- Globally, food packaging disposables rank as the most in-demand segment within the market, followed by single-use tableware. Their usage is not only essential for takeaway and delivery services but also plays a crucial role in promoting brand identity and ensuring regulatory compliance in food handling and waste management

Report Scope and Foodservice Disposables Market Segmentation

|

Attributes |

Foodservice Disposables Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Foodservice Disposables Market Trends

“Rising Shift Toward Sustainable and Eco-Friendly Products”

- One prominent trend in the global foodservice disposables market is the rising shift toward sustainable and eco-friendly product alternatives

- Businesses and consumers alike are increasingly opting for biodegradable, compostable, and recyclable disposables to reduce plastic waste and meet environmental regulations

- For instance, many restaurant chains and food delivery platforms have started replacing traditional plastic containers and utensils with plant-based or paper-based alternatives to align with green initiatives and improve brand perception

- The development of compostable bioplastics, molded fiber products, and reusable single-use hybrids is gaining traction, especially in regions with stringent environmental policies such as Europe and North America

- This trend is reshaping product portfolios and manufacturing practices across the industry, driving innovation and influencing procurement decisions as both regulatory compliance and consumer demand push for greater sustainability in foodservice packaging

Foodservice Disposables Market Dynamics

Driver

“Growing Demand Due to the Expansion of Food Delivery and Takeaway Services”

- The rapid expansion of food delivery and takeaway services is significantly contributing to the increased demand for foodservice disposables across the globe

- As consumer lifestyles become more fast-paced, there is a growing preference for convenience foods, which has led to a surge in online food ordering and takeaway options, particularly in urban areas

- Single-use disposables such as containers, cups, cutlery, and packaging play a crucial role in maintaining food safety, hygiene, and quality during transport, making them indispensable for the foodservice ecosystem

- In addition, the rise of cloud kitchens and third-party delivery platforms like Uber Eats, DoorDash, and Deliveroo has further amplified the consumption of disposables as these business models rely heavily on packaging to serve customers without traditional dine-in setups

- As more consumers prioritize convenience and contactless food options, the need for reliable and efficient disposable solutions continues to grow, driving innovation in design, materials, and branding of these products

For instance,

- In February 2024, Huhtamaki, a leading global provider of sustainable packaging solutions, announced a €30 million investment in a new manufacturing unit in Malaysia focused entirely on sustainable foodservice packaging to meet the increasing demand from growing food delivery and QSR sectors in Asia

- These ongoing market dynamics and real-world initiatives are reinforcing the essential role of foodservice disposables in meeting modern food consumption habits, thereby acting as a key growth driver for the global market

Opportunity

“Sustainability Innovations Creating New Growth Avenues”

- The global shift toward sustainability is unlocking significant opportunities in the foodservice disposables market, particularly through the development and adoption of eco-friendly, biodegradable, and compostable materials

- Companies are investing in R&D and launching innovative packaging solutions that meet both environmental regulations and growing consumer demand for sustainable alternatives

- These innovations include plant-based plastics, molded fiber packaging, and reusable single-use hybrids, enabling businesses to reduce their carbon footprint while maintaining operational efficiency

For instance,

- In January 2023, PepsiCo partnered with Pulpex to pilot a paper-based bottle prototype for food and beverage packaging, paving the way for future use in single-use foodservice applications

- These real-world developments not only align with global climate goals but also provide foodservice businesses with an opportunity to enhance brand value, gain consumer trust, and expand into environmentally conscious market

- As governments enforce stricter packaging regulations and consumers increasingly prefer eco-conscious brands, the demand for sustainable foodservice disposables is expected to rise sharply—making this a critical growth opportunity for market players worldwide

Restraint/Challenge

“Environmental Regulations and Waste Management Challenges”

- Increasing environmental regulations and growing concerns over plastic pollution present a significant challenge to the global foodservice disposables market

- Many countries and regions are implementing strict bans or limitations on single-use plastics, creating compliance hurdles for manufacturers and foodservice businesses that rely on conventional disposable products

- In addition, the lack of adequate waste management infrastructure, particularly in developing regions, makes it difficult to process and recycle disposables efficiently—even when labeled as compostable or recyclable

For instance,

- In April 2023, India's Central Pollution Control Board (CPCB) reported non-compliance issues among several manufacturers following the nationwide ban on select single-use plastic items, leading to operational disruptions and added compliance costs for both local and global brands operating in the region

- These regulatory pressures and infrastructural gaps create complexity for manufacturers aiming to scale production of sustainable alternatives, while also limiting smaller foodservice operators from making a seamless transition

Foodservice Disposables Market Scope

The market is segmented on the basis product, raw material, distribution channel, application, end user, and packaging type.

|

Segmentation |

Sub-Segmentation |

|

By Product |

|

|

By Raw Material |

|

|

By Distribution Channel |

|

|

By Application |

|

|

By End-User |

|

|

By Packaging Type

|

|

Foodservice Disposables Market Regional Analysis

“North America is the Dominant Region in the Foodservice Disposables Market”

- North America leads the global foodservice disposables market, driven by the region’s extensive foodservice industry, high consumer demand for convenience, and strong presence of quick service restaurants (QSRs) and delivery-based business models

- The U.S. accounts for the largest share, owing to the widespread culture of takeaway and home delivery, high penetration of food delivery apps, and increasing demand for sustainable packaging solutions

- Well-established food chains such as McDonald’s, Starbucks, Yum! Brands, and Chipotle continually invest in disposable innovations that enhance branding, portability, and food safety

- Government regulations promoting eco-friendly materials and a rising shift toward recyclable and compostable products also contribute to the transformation and expansion of the market

“Asia-Pacific is Projected to Register the Highest Growth Rate”

- The Asia-Pacific region is poised to witness the highest growth rate in the global foodservice disposables market, driven by the booming food delivery economy, growing urban population, and rapid expansion of organized foodservice chains

- Countries such as China, India, Indonesia, and Vietnam are becoming major contributors due to increasing disposable income, lifestyle changes, and the rising preference for convenience-driven, on-the-go meals

- With the surge in food delivery platforms such as Meituan, Zomato, Swiggy, and GrabFood, the demand for disposable packaging materials—including containers, cutlery, and cups—has risen exponentially

- Local governments are simultaneously introducing eco-friendly policies, prompting innovation in sustainable packaging solutions while encouraging foreign investments in regional production facilities

Foodservice Disposables Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Graphic Packaging International, LLC (U.S.)

- Sonoco Products Company (U.S.)

- Sealed Air(U.S.)

- WestRock Company(U.S.)

- Berry Global Inc(U.S.)

- Huhtamaki (Finland)

- Cascades inc. (Canada)

- Amcor plc (Switzerland)

- Airlite Plastics (U.S.)

- Twin Rivers Paper Company (U.S.)

- Seda Group, Inc. (Italy)

- Fabri-Kal(U.S.)

- Dart Container Corporation (U.S.)

- Anchor Packaging Inc (U.S.)

- Placon(U.S.)

- Novolex (U.S.)

- Hoffmaster Group, Inc (U.S.)

- DandW Fine Pack (U.S.)

- Menasha Packaging Company, LLC(U.S.)

- Inteplast Group (U.S.)

Latest Developments in Global Foodservice Disposables Market

- In April 2024, the global biodegradable foodservice disposables market was reported to have reached USD 7.7 billion in 2023 and is projected to grow to USD 12.3 billion by 2032. This surge is driven by increasing global restrictions on single-use plastics and a rising consumer shift toward eco-friendly alternatives such as plant-based containers and bagasse products

- In October 2024, it was reported that the European foodservice disposables market is expected to reach USD 27 billion by 2034. This projected growth is largely supported by the U.K.’s strong contribution, driven by the rapid expansion of the commercial food sector and increasing use of hygienic packaging solutions in quick-service restaurants (QSRs)

- In January 2022, Amcor, a global leader in packaging solutions, launched AmFiber, a sustainable paper-based packaging designed to replace conventional plastics in foodservice applications. The innovation offers high-performance and recyclable alternatives, supporting the industry’s move toward eco-friendly materials

- In August 2023, Huhtamaki, a leading Finnish packaging company, expanded its sustainable product portfolio by introducing fiber-based lids and cutlery. These new offerings are both recyclable and compostable, specifically designed to serve the needs of quick-service restaurants worldwide, reinforcing the company’s commitment to eco-friendly innovation

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Foodservice Disposables Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Foodservice Disposables Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Foodservice Disposables Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.