Global Foodservice Equipment Market

Market Size in USD Billion

CAGR :

%

USD

40.64 Billion

USD

60.05 Billion

2024

2032

USD

40.64 Billion

USD

60.05 Billion

2024

2032

| 2025 –2032 | |

| USD 40.64 Billion | |

| USD 60.05 Billion | |

|

|

|

|

Foodservice Equipment Market Size

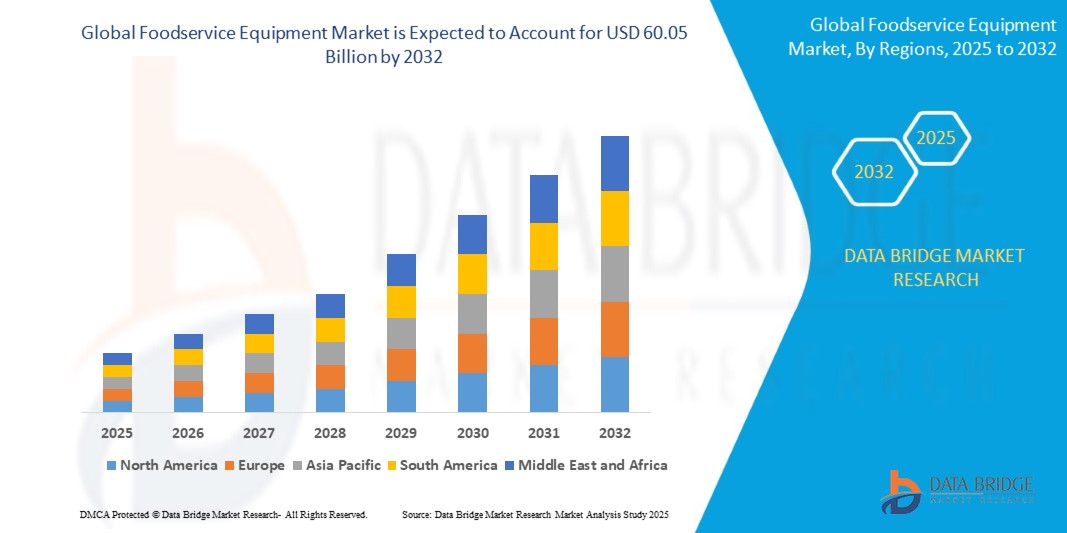

- The global foodservice equipment market size was valued at USD 40.64 billion in 2024 and is expected to reach USD 60.05 billion by 2032, at a CAGR of 5.00% during the forecast period

- The market growth is largely fueled by the rapid expansion of the foodservice industry, supported by rising consumer demand for quick service, automation, and consistency in food quality across commercial kitchens and institutional facilities

- Furthermore, increasing adoption of energy-efficient, space-saving, and technologically advanced equipment is transforming kitchen operations, enabling foodservice providers to improve productivity, reduce waste, and meet evolving regulatory and hygiene standards, thereby significantly boosting the industry's growth

Foodservice Equipment Market Analysis

- Foodservice equipment includes cooking, preparation, refrigeration, storage, and washing appliances used in commercial kitchens to ensure efficient, safe, and consistent food production and service. These tools are critical for operations in restaurants, hotels, hospitals, and institutional kitchens

- The escalating demand for foodservice equipment is driven by the rising number of food outlets, growth in the tourism and hospitality sectors, and the increasing preference for sustainable and high-p

- Asia-Pacific dominated the foodservice equipment market with a share of 37.4% in 2024, due to rapid urbanization, expanding hospitality infrastructure, and growing investments in commercial kitchens across emerging economies

- North America is expected to be the fastest growing region in the foodservice equipment market during the forecast period due to technological advancements, growing demand for automation, and the shift toward energy-efficient equipment

- Offline segment dominated the market with a market share of 69.3% in 2024, due to strong reliance on physical showrooms and dealer networks that allow buyers to assess equipment quality, installation feasibility, and after-sales services in person. Offline channels are particularly favored by institutional buyers and restaurant chains that require bulk procurement, onsite demonstrations, and customized solutions. The established trust and support infrastructure offered by brick-and-mortar dealers continues to make offline the dominant channel

Report Scope and Foodservice Equipment Market Segmentation

|

Attributes |

Foodservice Equipment Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Foodservice Equipment Market Trends

“Rise of Smart Kitchen Technologies”

- The foodservice equipment market is being transformed by the increasing adoption of smart kitchen technologies that integrate AI, IoT, and automation to enhance operational efficiency, reduce waste, and improve customer experience. These technologies enable predictive cooking, real-time monitoring, and remote control of kitchen appliances

- For instance, companies such as Powerhouse Dynamics provide IoT platforms such as Open Kitchen, enabling restaurants to monitor equipment performance across multiple locations, optimize energy use, and proactively schedule maintenance to reduce downtime. Supy offers AI-powered inventory and procurement systems that streamline operations and reduce waste for foodservice operators

- Smart ovens that automatically adjust cooking parameters, voice-controlled dishwashers and hobs, and WiFi-enabled refrigerators tracking inventory are becoming common in both commercial and residential kitchens

- Innovations in ambient intelligence, gesture controls, and proactive kitchen ecosystems are making kitchens more intuitive and user-friendly, contributing to safer and faster food preparation workflows

- Integration with sustainable technologies and energy-efficient equipment aligns with growing environmental concerns and cost-saving goals

- The combination of automation and connectivity advances is driving the digital transformation of the foodservice industry in 2025 and beyond

Foodservice Equipment Market Dynamics

Driver

“Increasing Demand for Efficient Foodservice Equipment”

- Rising demand for equipment that improves kitchen workflow efficiency, reduces cooking times, and lowers energy consumption is a major market driver. Efficiency gains directly translate to cost savings and better service outcomes

- For instance, commercial kitchen operators using AI-integrated smart ovens and multipurpose combo units from companies such as Rational AG and Hestan Culinary are able to significantly reduce food prep time and energy use while improving consistency

- Cloud-connected equipment enables centralized management of multiple outlets, benefiting chains and franchises with scalable solutions

- The surge in quick-service restaurants and food delivery services further fuels demand for reliable, high-performance, and easy-to-maintain kitchen equipment

- Energy-efficient appliances certified by ENERGY STAR® and multifunctional, modular designs that optimize limited kitchen space are gaining traction. Continuous innovation focused on user-friendly interfaces and automation enhances staff productivity and reduces human error

Restraint/Challenge

“Supply Chain Disruptions”

- Persistent global supply chain challenges, including raw material shortages, transportation delays, and geopolitical tensions, pose significant obstacles to timely production and delivery of foodservice equipment

- For instance, manufacturers such as Middleby Corporation and Ali Group have reported delays and increased costs due to shortages of electronic components and steel, which have impacted order fulfillment and profit margins

- Elevated shipping costs and tariff fluctuations add to price volatility and operational complexity for suppliers and buyers alike

- Smaller operators are disproportionately affected due to reduced negotiating power and limited ability to stockpile inventory

- Supply chain bottlenecks may delay new kitchen installations or equipment upgrades, restraining market growth in some regions. Companies are investing in diversified sourcing, nearshoring, and enhanced logistics planning to mitigate these challenges but uncertainty remains a key risk factor

Foodservice Equipment Market Scope

The market is segmented on the basis of product, end-user, and sales channel.

• By Product

On the basis of product, the foodservice equipment market is segmented into kitchen purpose equipment, food and beverage preparation equipment, refrigeration equipment, washing equipment, food holding and storing equipment, and others. The kitchen purpose equipment segment dominated the largest market revenue share of 41.1% in 2024, driven by the essential role it plays in streamlining cooking operations across both commercial and institutional foodservice settings. High demand for multifunctional and energy-efficient cooking appliances, such as ovens, grills, and fryers, is propelling the growth of this segment. Technological innovations that enhance automation, reduce cooking time, and maintain food consistency are also boosting adoption across a wide range of foodservice formats.

The food and beverage preparation equipment segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by the rising trend of specialty beverages and customizable menu offerings. Increasing demand for blenders, coffee machines, and dough mixers in cafes, bakeries, and fast-food chains is driving growth. In addition, the growing preference for freshly prepared and visually appealing food and drink items is prompting establishments to invest in advanced preparation equipment to improve output quality and efficiency.

• By End-User

On the basis of end-user, the foodservice equipment market is segmented into full service restaurant (FSR), quick service restaurant (QSR), institutional, and others. The full service restaurant (FSR) segment accounted for the largest market share in 2024, supported by consistent demand for robust and versatile equipment to manage a wide variety of cooking styles and high-volume service. FSRs typically require a broad range of high-performance equipment, including refrigeration units, preparation tools, and cleaning systems, to maintain food quality and regulatory compliance. The segment also benefits from investments in ambiance-enhancing open kitchens and modern back-of-house setups.

The quick service restaurant (QSR) segment is projected to witness the fastest CAGR from 2025 to 2032, driven by rapid global expansion of fast-food chains and the need for compact, efficient, and easy-to-maintain equipment. QSRs prioritize high-throughput cooking and quick turnaround times, encouraging the adoption of automated and pre-programmed devices. Moreover, the surge in delivery and takeaway formats has created demand for equipment that can efficiently support order customization, speed, and hygiene compliance.

• By Sales Channel

On the basis of sales channel, the foodservice equipment market is segmented into online and offline. The offline segment held the largest market share of 69.3% in 2024, driven by strong reliance on physical showrooms and dealer networks that allow buyers to assess equipment quality, installation feasibility, and after-sales services in person. Offline channels are particularly favored by institutional buyers and restaurant chains that require bulk procurement, onsite demonstrations, and customized solutions. The established trust and support infrastructure offered by brick-and-mortar dealers continues to make offline the dominant channel.

The online segment is expected to grow at the fastest pace from 2025 to 2032, driven by increasing digitalization of B2B transactions and the convenience of browsing, comparing, and ordering equipment from centralized platforms. Online marketplaces and manufacturer websites are gaining traction due to transparent pricing, wide product variety, and detailed technical specifications. In addition, smaller foodservice operators and startups are increasingly turning to online platforms for cost-effective procurement and rapid delivery options.

Foodservice Equipment Market Regional Analysis

- Asia-Pacific dominated the foodservice equipment market with the largest revenue share of 37.4% in 2024, driven by rapid urbanization, expanding hospitality infrastructure, and growing investments in commercial kitchens across emerging economies

- The region’s rising disposable income, increasing penetration of organized foodservice outlets, and evolving consumer food preferences are fueling the demand for modern, efficient kitchen equipment

- Government initiatives promoting tourism, coupled with the rise of cloud kitchens and quick service restaurants, are further boosting equipment adoption across developing markets such as India and Southeast Asia

Japan Foodservice Equipment Market Insight

The Japan market is expanding due to the high demand for space-saving, energy-efficient kitchen equipment suited to compact urban kitchens. The country’s aging population and preference for automation are encouraging adoption of advanced cooking and preparation systems. Japanese manufacturers continue to lead in innovations offering durability, hygiene, and compliance with local energy standards.

China Foodservice Equipment Market Insight

The China foodservice equipment market held the largest share in Asia-Pacific in 2024, supported by the country’s growing middle class, increased dining-out culture, and surge in quick service restaurants. Rising health awareness and demand for standardized food preparation have prompted investment in modern kitchen technologies. Both domestic and international brands are expanding production and distribution to meet local demand.

Latin America Foodservice Equipment Market Insight

The Latin America foodservice equipment market is projected to grow at a notable CAGR over the forecast period, driven by increasing urbanization, modernization of the foodservice sector, and rising adoption of western-style dining formats. Countries such as Brazil and Mexico are witnessing significant growth in the hospitality and tourism industries, which is creating strong demand for commercial-grade foodservice appliances.

Brazil Foodservice Equipment Market Insight

The Brazil market is anticipated to grow steadily, fueled by rapid expansion of fast-food chains and increasing investment in institutional catering, such as schools and hospitals. Government efforts to improve energy efficiency in commercial kitchens and a growing preference for hygienic and high-performance equipment are supporting market growth.

Mexico Foodservice Equipment Market Insight

The Mexico foodservice equipment market is expected to witness considerable expansion, backed by the growth of full-service restaurants and the rising popularity of convenience food outlets. Trade agreements and increased foreign investment in the hospitality sector are facilitating the entry of global equipment brands. Upgrades in refrigeration and food preparation units, especially in urban centers, are driving sales.

North America Foodservice Equipment Market Insight

North America is projected to grow at the fastest CAGR from 2025 to 2032, driven by technological advancements, growing demand for automation, and the shift toward energy-efficient equipment. The region is witnessing strong growth in QSRs, cloud kitchens, and meal delivery services, all of which require compact, high-throughput kitchen solutions. Emphasis on sustainability and food safety compliance is also driving modernization of kitchen infrastructure.

U.S. Foodservice Equipment Market Insight

The U.S. foodservice equipment market captured the largest revenue share in 2024 within North America, supported by a well-established foodservice industry and high adoption of advanced equipment across fast-food and institutional segments. Increasing focus on equipment that reduces labor dependency and supports digital integration is boosting demand. Moreover, rising consumer preference for fresh, made-to-order meals is encouraging restaurants to invest in precision cooking and preparation equipment.

Foodservice Equipment Market Share

The foodservice equipment industry is primarily led by well-established companies, including:

- Ali Group Worldwide (U.S.)

- Dover Corporation (U.S.)

- Duke Manufacturing (U.S.)

- Haier Inc. (China)

- ITW Food Equipment Group (U.S.)

- The Middleby Corporation (U.S.)

- SMEG S.p.A. (Italy)

- The Vollrath Company, LLC (U.S.)

- Parth Kitchen Equipments (India)

- Berjaya Steel Product Sdn. Bhd. (Malaysia)

- Shreemanek (India)

- Bharti Refrigeration Works (India)

Latest Developments in Global Foodservice Equipment Market

- In March 2024, Parts Town introduced PartPredictor, the first AI-powered tool of its kind in the commercial foodservice sector, aimed at streamlining equipment repairs. By analyzing data from millions of technician repairs, the tool helps service companies accurately identify the most commonly required parts for specific equipment issues. This innovation is expected to significantly enhance operational efficiency, reduce equipment downtime, and improve service responsiveness, thereby positively impacting the foodservice equipment market by driving demand for intelligent repair solutions

- In July 2023, Hoshizaki America expanded its sales team with three new manufacturers' representative groups: Gabriel Group in the Midwest, Preferred Source in Northern Texas, and Elevate Foodservice Group in the Northeast. These groups will represent Hoshizaki's refrigeration lines in their respective territories, aiming to strengthen market presence and customer support

- In February 2023, The Middleby Corporation acquired Dublin-based Marco Beverage Systems, known for energy-efficient beverage dispensing solutions. This acquisition enhances Middleby's portfolio in cold brew dispense, coffee brewers, and water dispensers. It aligns with Middleby's strategy to broaden product offerings in commercial foodservice equipment through innovative technology and expanded capabilities

- In February 2023, Vollrath Company revamped its countertop equipment line to enhance performance, functionality, and user-friendliness. Updates include improvements to hot food merchandisers, fryers, and gas equipment such as charbroilers, hot plates, and griddles. Visual design enhancements were also made to these models, reflecting Vollrath's commitment to meeting customer needs with updated and efficient equipment solutions

- In January 2023, Rancilio Group announced that its Rancilio Specialty RS1 achieved Premium Certification from the Italian Espresso Institute (IEI). This certification recognizes the RS1's advanced features, including a multi-boiler system and Advanced Temperature Profiling technology. The machine underwent rigorous testing for extraction temperature consistency, pre-infusion quality, and steam production, reaffirming its status as a top-tier espresso machine

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Foodservice Equipment Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Foodservice Equipment Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Foodservice Equipment Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.