Global Forage Analysis Market

Market Size in USD Billion

CAGR :

%

USD

1.17 Billion

USD

1.81 Billion

2024

2032

USD

1.17 Billion

USD

1.81 Billion

2024

2032

| 2025 –2032 | |

| USD 1.17 Billion | |

| USD 1.81 Billion | |

|

|

|

|

Forage Analysis Market Size

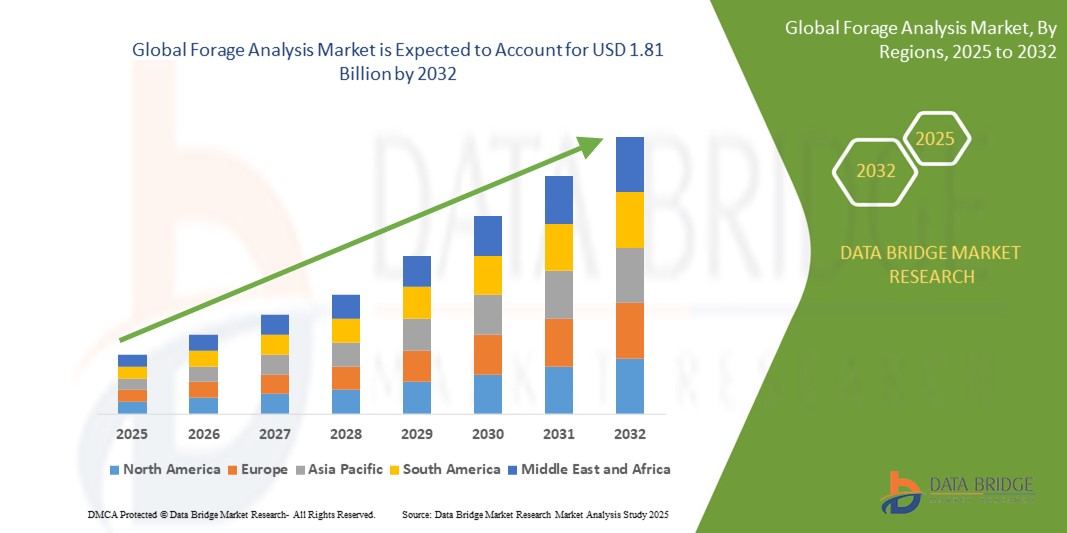

- The global forage analysis market size was valued at USD 1.17 billion in 2024 and is expected to reach USD 1.81 billion by 2032, at a CAGR of 5.60% during the forecast period

- The market growth is largely fueled by the growing demand for high-quality forages and the mandatory analysis of feed quality, leading to increased digitalization in agricultural settings

- Furthermore, the increasing need for accurate nutrient monitoring and safety in livestock cultivation is establishing forage analysis as a crucial tool for optimizing animal nutrition and ensuring livestock health, thereby significantly boosting the industry's growth

Forage Analysis Market Analysis

- Forage Analysis, offering crucial insights into the nutritional content and quality of animal feed, are increasingly vital components of modern livestock farming and feed management systems in both individual farms and large agricultural operations due to their enhanced accuracy in assessing feed value, remote data access capabilities, and seamless integration with farm management software and feeding technologies

- The escalating demand for forage analysis is primarily fueled by the growing adoption of precision livestock farming techniques, increasing awareness among producers about the importance of optimal animal nutrition for productivity and health, and a rising preference for data-driven decision-making in feed management

- North America is expected to dominate the forage analysis market with the largest revenue share, characterized by advanced agricultural practices, a large livestock population, and a strong presence of key analytical service providers and technology companies

- Asia-Pacific is expected to be the fastest-growing region in the forage analysis market during the forecast period due to increasing livestock populations, rising demand for animal protein, and the adoption of modern agricultural practices across countries such as China and India

- Nutrients segment is expected to dominate the forage analysis market in 2024, driven by the increasing focus on optimizing animal nutrition for improved productivity and health. Accurate nutrient profiling is essential for formulating balanced rations and enhancing livestock performance, which makes this segment a critical component of modern forage management

Report Scope and Forage Analysis Market Segmentation

|

Attributes |

Forage Analysis Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Forage Analysis Market Trends

“Increasing Adoption of Advanced Analytical Technologies and Data Integration”

- A significant and accelerating trend in the global forage analysis market is the deepening integration of advanced analytical technologies such as Near-Infrared Spectroscopy (NIRS) and the use of sophisticated data analytics platforms, including those powered by Artificial Intelligence (AI). This fusion of technologies is significantly enhancing the speed, accuracy, and depth of forage analysis

- For instance, NIRS technology allows for rapid analysis of forage samples, providing quick insights into key nutritional components such as protein, fiber, and moisture content, often in a fraction of the time compared to traditional wet chemistry methods. Similarly, AI algorithms are being employed to process large datasets of forage analysis results to identify trends, optimize feeding strategies, and predict animal performance

- AI integration in forage analysis enables features such as predictive modeling of nutrient availability, identification of potential imbalances in feed, and the formulation of optimized feed rations tailored to specific animal needs and production goals. Furthermore, the integration of analysis results with cloud-based farm management systems offers users the ease of accessing and utilizing this information remotely through digital platforms

- The seamless integration of forage analysis data with other farm data, such as animal health records, milk production figures, or weight gain metrics, facilitates a more holistic and data-driven approach to livestock management. Through a unified interface, users can correlate feed quality with animal performance, enabling them to make more informed decisions regarding forage selection, storage, and supplementation

- This trend towards more advanced, data-driven, and interconnected analysis systems is fundamentally reshaping how livestock producers approach feed management and animal nutrition. Consequently, companies are developing user-friendly, technologically advanced forage analysis solutions that integrate seamlessly with other farm technologies and provide actionable insights to optimize production efficiency and animal health

- The demand for forage analysis services that offer enhanced accuracy, speed, and integration with digital farm management tools is growing rapidly across both small and large-scale livestock operations, as producers increasingly prioritize efficiency, cost-effectiveness, and maximizing the nutritional value of their forage resources

Forage Analysis Market Dynamics

Driver

“Growing Emphasis on High-Quality Livestock Products and Optimized Animal Nutrition”

- The increasing global demand for high-quality livestock products, such as meat, dairy, and eggs, coupled with a greater understanding of the critical role of optimized animal nutrition in achieving production goals and animal health, is a significant driver for the heightened demand for forage analysis

- For instance, consumers are increasingly demanding products from animals that are fed nutritious and balanced diets, leading producers to focus on the quality of their animal feed, where forage plays a crucial role. This emphasis on quality necessitates accurate and comprehensive forage analysis to ensure nutritional requirements are met

- As livestock producers strive to enhance the productivity, health, and overall welfare of their animals, precise knowledge of forage composition becomes essential for formulating balanced feed rations that maximize performance and minimize health issues. Forage Analysis provides this crucial information, enabling producers to make informed decisions about feed supplementation and management

- Furthermore, the growing awareness of the environmental impact of livestock farming is driving the need for efficient feed utilization. Optimized nutrition through informed forage analysis can help reduce feed wastage and improve the overall efficiency of animal production, contributing to more sustainable farming practices

- The increasing focus on reducing the use of antibiotics in animal agriculture is also driving the demand for high-quality forage. Well-nourished animals are generally healthier and less susceptible to diseases, reducing the need for medical interventions. Forage Analysis helps ensure animals receive the nutrients they need to maintain strong immune systems

Restraint/Challenge

“Variability in Forage Composition and Need for Standardized Testing Methods”

- A key challenge hindering the broader adoption and consistent interpretation of forage analysis results is the inherent variability in forage composition due to numerous factors such as plant species, growth stage, soil conditions, harvesting methods, and storage practices. This variability can make it difficult to compare results across different samples and regions

- For instance, the nutrient content of the same grass species can vary significantly depending on the time of year it was harvested or the soil it was grown in. This variability necessitates frequent and comprehensive analysis to accurately assess the nutritional value of forage being fed to livestock

- Another significant challenge is the lack of complete standardization in forage testing methods across different laboratories and regions. While certain standard procedures exist, variations in analytical techniques and reporting formats can lead to inconsistencies in results, making it challenging for producers to compare data from different sources and make informed decisions about their feed management practices

- Addressing the variability in forage composition requires producers to adopt consistent sampling techniques and understand the factors that can influence nutrient content. Furthermore, efforts to enhance the standardization of forage testing methods across the industry are crucial for improving the reliability and comparability of analysis results

- While advanced technologies such as NIRS offer rapid and cost-effective analysis, their accuracy can sometimes be affected by the calibration models used, which may need to be specific to certain forage types and geographical regions. Continuous research and development are needed to refine these technologies and ensure their accuracy across a wider range of forage samples and environmental conditions

Forage Analysis Market Scope

The market is segmented on the basis of target, forage type, livestock, and method.

• By Target

On the basis of target, the forage analysis market is segmented into Nutrients, Dry Matter, Mycotoxin, and Others. The Nutrients segment held the largest market revenue share in 2024, driven by the increasing focus on optimizing animal nutrition for improved productivity and health. Accurate nutrient profiling is essential for formulating balanced rations and enhancing livestock performance, which makes this segment a critical component of modern forage management.

The Mycotoxin segment is projected to witness the fastest CAGR from 2025 to 2032, as concerns over feed safety and contamination risks drive demand for precise detection methods. Rising awareness among farmers and regulatory bodies about the impact of mycotoxins on animal health is fueling adoption.

• By Livestock

On the basis of livestock, the forage analysis market is segmented into Cattle, Equine, and Sheep. The Cattle segment accounted for the largest market share in 2024, attributed to the high global demand for dairy and beef products, which necessitates effective nutritional management. Accurate forage analysis helps dairy and beef producers enhance milk yield, meat quality, and overall herd health.

The Equine segment is expected to experience the fastest growth rate from 2025 to 2032, driven by growing investments in equine health and performance monitoring, particularly in developed countries where horse breeding and racing are prominent industries.

• By Forage Type

On the basis of forage type, the market is segmented into Ration, Hay, and Silage. The Silage segment held the largest revenue share in 2024, owing to its widespread use in high-efficiency cattle farming. Silage requires consistent monitoring of fermentation quality and nutrient preservation, boosting demand for reliable analysis solutions.

The Ration segment is expected to witness the fastest growth through 2032, as customized rations become more common in precision feeding strategies to improve efficiency and reduce waste.

• By Method

On the basis of method, the forage analysis market is segmented into Chemical Method, Physical Method, Wet Chemistry, and NIRs. The Wet Chemistry method held the largest revenue share in 2024, due to its established accuracy and widespread use in laboratories for detailed nutrient profiling.

The NIRs (Near-Infrared Spectroscopy) segment is expected to grow at the fastest pace from 2025 to 2032, owing to its rapid, non-destructive nature and suitability for on-site analysis. The increasing push for real-time and cost-effective testing in both small and large-scale farms supports NIRs adoption across regions.

Forage Analysis Market Regional Analysis

- North America dominates the forage analysis market with the largest revenue share in 2024, driven by a growing demand for efficient livestock feeding and increased awareness of the nutritional value of forage

- Consumers (farmers and ranchers) in the region highly value the convenience, advanced analytical features, and seamless integration offered by Forage Analysis with other farm management practices

- This widespread adoption is further supported by high disposable incomes in the agricultural sector and a technologically inclined farming community

U.S. Forage Analysis Market Insight

The U.S. forage analysis market captured the largest revenue share within North America in 2024, fueled by the swift uptake of advanced agricultural technologies and the expanding trend of precision livestock farming. Producers are increasingly prioritizing the optimization of animal nutrition through intelligent forage analysis systems. The growing preference for on-farm testing solutions and integration with farm management software is propelling the forage analysis industry.

Europe Forage Analysis Market Insight

The European forage analysis market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by stringent regulations related to animal feed quality and the escalating need for enhanced efficiency in livestock production. The increase in farm sizes and the demand for accurate feed information is fostering the adoption of forage analysis. European consumers (farmers) are also drawn to the convenience and cost-effectiveness these services offer.

U.K. Forage Analysis Market Insight

The U.K. forage analysis market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by the escalating trend of precision agriculture and a desire for heightened efficiency and productivity in livestock farming. In addition, concerns regarding animal health and welfare are encouraging the adoption of comprehensive forage analysis solutions. The UK’s embrace of modern farming techniques is expected to continue to stimulate market growth.

Germany Forage Analysis Market Insight

The German forage analysis market is expected to expand at a considerable CAGR during the forecast period, fueled by increasing awareness of animal nutrition and the demand for technologically advanced, sustainable farming solutions. Germany’s well-developed agricultural sector promotes the adoption of forage analysis, particularly in dairy and meat production. The integration of Forage Analysis with farm management software and automated feeding systems is also becoming increasingly prevalent.

Asia-Pacific Forage Analysis Market Insight

The Asia-Pacific forage analysis market is poised to grow at the fastest CAGR of over 24% in 2024, driven by increasing livestock populations, rising incomes of farmers, and technological advancements in agricultural practices in countries such as China, Japan, and India. The region's growing inclination towards modern farming techniques is driving the adoption of forage analysis. Furthermore, the affordability and accessibility of Forage Analysis services are expanding.

Japan Forage Analysis Market Insight

The Japan forage analysis market is gaining momentum due to the country’s high-tech culture, rapid urbanization impacting land availability for grazing, and demand for efficient livestock farming. The Japanese market places a significant emphasis on the quality and safety of agricultural products, and the adoption of forage analysis is driven by the increasing focus on optimizing animal nutrition. The integration of forage analysis with other farm management technologies is fueling growth.

China Forage Analysis Market Insight

The China forage analysis market accounted for the largest market revenue share in Asia Pacific in 2024, attributed to the country's expanding middle class driving demand for animal protein, rapid urbanization reducing grazing land, and high rates of technological adoption in the agricultural sector. China stands as one of the largest markets for livestock, and forage analysis services are becoming increasingly popular in large-scale farming operations and feed production facilities.

Forage Analysis Market Share

The forage analysis industry is primarily led by well-established companies, including:

- SGS Société Générale de Surveillance SA (Switzerland)

- Eurofins Scientific (Luxembourg)

- Cargill, Incorporated (U.S.)

- CVAS, Inc. (U.S.)

- HILL LAB (New Zealand)

- ServiTech, Inc. (U.S.)

- MASSEY FEEDS (U.K.)

- Dairyland Laboratories, Inc. (U.S.)

- Dairy One (U.S.)

- Bruker (U.S.)

- AgroDyne Inc. (U.S.)

- Cawood Scientific Limited (U.K.)

Latest Developments in Global Forage Analysis Market

- In March 2023, Barenbrug announced its acquisition of Watson Group, a U.K.-based seed specialist, in a strategic move to strengthen its foothold in the U.K. grass-seed market and support ongoing expansion efforts. This acquisition is expected to significantly enhance Barenbrug's market share and regional growth potential

- In March 2023, DLF unveiled a new seed processing and storage facility in New Zealand, aimed at boosting its operational efficiency and increasing its seed storage capabilities. This investment demonstrates DLF’s long-term commitment to serving the growing demand in New Zealand’s agricultural industry

- In September 2021, Si-Ware Systems Inc., the company behind NeoSpectra FT-NIR spectrometer solutions, announced a collaboration with Dairyland Laboratories, Inc., a leading agricultural feed and forage testing provider with a global client base. This partnership aims to advance precision agriculture through enhanced material analysis technologies

- In September 2020, Forage Analysis Inc. introduced the Forage Analyzer Plus, featuring upgraded capabilities to meet the evolving demands of the forage analysis market. This launch marked a significant step forward in providing users with more accurate and efficient testing solutions

- In July 2020, Forage Analysis Inc. launched the Forage Analyzer Pro, an advanced addition to its product lineup that offers comprehensive analytical functions for forage testing. This product strengthened the company’s portfolio and addressed the growing need for detailed forage analysis in agriculture

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.