Global Forestry And Logging Market

Market Size in USD Billion

CAGR :

%

USD

342.54 Billion

USD

634.02 Billion

2024

2032

USD

342.54 Billion

USD

634.02 Billion

2024

2032

| 2025 –2032 | |

| USD 342.54 Billion | |

| USD 634.02 Billion | |

|

|

|

|

Forestry and Logging Market Size

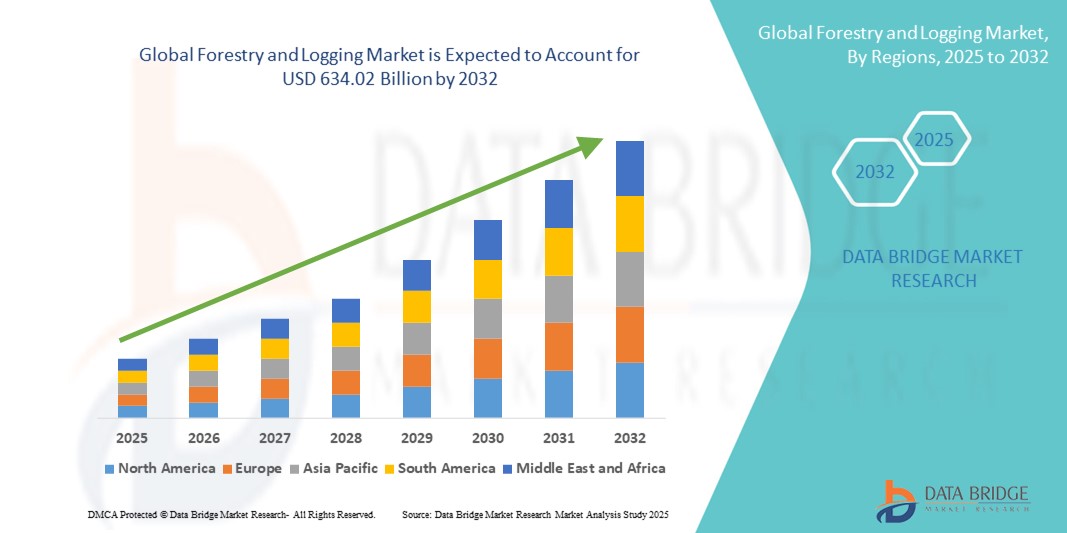

- The global forestry and logging market size was valued at USD 342.54 billion in 2024 and is expected to reach USD 634.02 billion by 2032, at a CAGR of 8% during the forecast period

- The market growth is largely fueled by the increasing demand for timber and wood-based products across construction, furniture, paper, and energy industries, supported by rapid urbanization, infrastructure development, and rising population in both emerging and developed economies

- Furthermore, advancements in mechanized harvesting, GIS-based forest mapping, and sustainable forest management practices are enhancing operational efficiency and resource utilization, thereby accelerating the adoption of modern logging methods and significantly boosting the industry's growth

Forestry and Logging Market Analysis

- Forestry and logging involve the management, harvesting, and processing of forest resources, supplying raw materials such as timber, pulpwood, and non-timber forest products to various end-use industries. This sector plays a crucial role in supporting construction, packaging, bioenergy, and furniture manufacturing

- The escalating demand for responsibly sourced wood, coupled with growing emphasis on sustainable forest practices and government reforestation initiatives, is driving investment in advanced forestry technologies and boosting the global expansion of commercial logging activities

- Asia-Pacific dominated the forestry and logging market with a share of 32.3% in 2024, due to extensive forest resources, rapid industrialization, and high demand for timber in construction, paper, and biomass energy sectors across emerging economies

- North America is expected to be the fastest growing region in the forestry and logging market during the forecast period due to strong domestic timber demand, export-oriented logging activities, and increasing adoption of precision forestry techniques

- Logging segment dominated the market with a market share of 61.9% in 2024, due to its critical role in supplying raw timber to construction, paper, and furniture industries. Logging operations remain the backbone of the forestry sector, driven by steady global demand for wood-based products and the increasing utilization of mechanized equipment, which boosts productivity and safety. The growth of engineered wood products and the resurgence of wooden architecture in sustainable construction practices further sustain demand for large-scale logging operations

Report Scope and Forestry and Logging Market Segmentation

|

Attributes |

Forestry and Logging Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Forestry and Logging Market Trends

“Rising Focus on Sustainable Forest Management”

- The forestry and logging market is advancing rapidly with a growing emphasis on sustainable forest management practices aimed at balancing economic growth with environmental preservation and biodiversity conservation

- For instance, companies such as Weyerhaeuser and Stora Enso actively obtain certification from organizations such as FSC (Forest Stewardship Council) and PEFC (Programme for the Endorsement of Forest Certification) to demonstrate commitment to sustainable logging and forest stewardship

- Technological integrations such as drone-based monitoring, AI-driven data analytics, and remote sensing are increasingly used to optimize harvesting schedules, reduce waste, and protect ecosystems

- Reforestation and afforestation initiatives are being supported globally through government incentives and private sector investments, promoting carbon sequestration and long-term resource sustainability

- The rising demand for wood pellets and biomass as renewable energy sources is driving expansion in the bioenergy segment within forestry, influencing harvesting patterns and resource allocation

- Digital transformation in forest management, including blockchain-based supply chain tracking, is improving transparency and combating illegal logging while ensuring compliance with increasingly strict environmental regulations

Forestry and Logging Market Dynamics

Driver

“Growing Demand for Wood Products”

- Increasing urbanization, construction activity, and consumer demand for wooden furniture, paper products, and packaging materials are propelling the growth of the forestry and logging market

- For instance, the Natural Resources Institute reported that Finland used over 75 million cubic meters of round wood in 2023, while the FAO projects a 37% increase in wood product consumption by 2050, reflecting global trends toward wood in construction and manufacturing

- The rising popularity of wood-based sustainable building solutions, which offer carbon footprint advantages compared to concrete and steel, further supports demand from residential and commercial sectors

- Growth in cruise ship construction, packaging, tissue, and paper industries—especially in developing regions—is expanding end-use markets for processed timber and wood fibers

- Advancements in automated forestry management, including robotics and AI-assisted harvesting machinery, are enabling higher productivity and cost efficiency, encouraging expansion into new markets

Restraint/Challenge

“Regulatory Constraints on Forestry and Logging”

- Stringent environmental regulations, policies on deforestation reduction, and land-use restrictions are imposing challenges on forestry and logging operations, increasing compliance costs and limiting operational flexibility

- For instance, operations in regions with strict governmental oversight, such as parts of the European Union or Canada, face rigorous audits and certification requirements by agencies enforcing sustainable forest management and logging permits

- Illegal logging and deforestation concerns increase pressure on companies to enhance traceability and adopt eco-friendly practices, sometimes slowing down harvest cycles and increasing costs

- Geopolitical tensions and trade restrictions can affect timber supply chains and export-import regulations, complicating market access for producers and buyers alike

- Climate change impacts—such as increased forest fires, pest outbreaks, and extreme weather events—pose risks that trigger regulatory scrutiny and necessitate adaptive management practices that may constrain short-term logging activities

Forestry and Logging Market Scope

The market is segmented on the basis of type and application.

- By Type

On the basis of type, the forestry and logging market is segmented into logging, timber tract operations, forest nurseries, and gathering of forest products. The logging segment dominated the largest market revenue share of 61.9% in 2024, owing to its critical role in supplying raw timber to construction, paper, and furniture industries. Logging operations remain the backbone of the forestry sector, driven by steady global demand for wood-based products and the increasing utilization of mechanized equipment, which boosts productivity and safety. The growth of engineered wood products and the resurgence of wooden architecture in sustainable construction practices further sustain demand for large-scale logging operations.

Forest nurseries and the gathering of forest products segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by the rising importance of biodiversity conservation, afforestation efforts, and the commercialization of non-timber forest products (NTFPs) such as resins, herbs, and medicinal plants. This segment is gaining traction due to growing awareness of forest resource sustainability and its critical role in climate resilience and rural employment generation.

- By Application

On the basis of application, the forestry and logging market is segmented into construction, industrial goods, and others. The construction segment held the largest market revenue share in 2024, driven by consistent global infrastructure development and the increasing use of wood as a renewable construction material. Timber's role in green building practices, especially cross-laminated timber and modular wood-based structures, is boosting demand from residential and commercial construction projects. Its advantages in reducing carbon footprint and ease of prefabrication further solidify its presence in modern architectural applications.

The industrial goods segment is anticipated to register the fastest growth rate from 2025 to 2032, supported by rising wood demand in manufacturing sectors such as pulp and paper, packaging, and biomass energy. The surge in eco-friendly and biodegradable material use is driving wood product consumption in industrial applications, while increasing investments in bioenergy and wood pellet plants are creating new revenue streams in the forestry value chain.

Forestry and Logging Market Regional Analysis

- Asia-Pacific dominated the forestry and logging market with the largest revenue share of 32.3% in 2024, driven by extensive forest resources, rapid industrialization, and high demand for timber in construction, paper, and biomass energy sectors across emerging economies

- The region’s expanding population, fast-growing infrastructure sector, and increasing export-oriented logging activities are key contributors to market growth

- Furthermore, government-backed afforestation programs, adoption of mechanized logging, and rising global demand for Asian hardwoods are accelerating the development of forestry and logging operations in countries such as China, India, and Indonesia

Japan Forestry and Logging Market Insight

The Japan market is growing steadily due to active forest management policies and increased demand for domestic timber under the country’s wood self-sufficiency goals. Initiatives promoting local wood use in housing and public infrastructure, along with investment in sustainable forest regeneration and thinning practices, are supporting long-term market development. Technological innovation in logging equipment and forest monitoring also contributes to efficiency and environmental compliance.

China Forestry and Logging Market Insight

China held the largest share in the Asia-Pacific forestry and logging market in 2024, fueled by massive domestic consumption of timber, strong demand for wood products in construction and manufacturing, and government initiatives to boost forestry productivity. The country’s afforestation and forest protection programs are balancing economic development with sustainability, while investment in mechanized harvesting and timber processing boosts efficiency and scale.

Europe Forestry and Logging Market Insight

The Europe forestry and logging market is projected to grow at a notable CAGR over the forecast period, driven by sustainable forest management practices and strong demand for certified timber in construction and biomass energy. The region benefits from well-regulated forest policies, advanced harvesting technologies, and the integration of circular economy principles, especially in Scandinavian and Central European countries.

U.K. Forestry and Logging Market Insight

The U.K. market is expected to expand steadily, supported by increased demand for homegrown timber in construction and landscaping, as well as government-led tree planting and woodland expansion programs. A growing emphasis on sustainable sourcing and biodiversity preservation is fostering investment in modern forest management and ecosystem services, making the sector more resilient and efficient.

Germany Forestry and Logging Market Insight

Germany’s forestry and logging market is positioned for significant growth, underpinned by a long-standing commitment to sustainable forestry and a mature timber industry. High demand for sawnwood, wood pellets, and engineered wood products, along with stringent forest stewardship standards, drives market expansion. Technological adoption and forest digitalization are further improving yield, traceability, and environmental compliance.

North America Forestry and Logging Market Insight

North America is projected to register the fastest CAGR from 2025 to 2032, supported by strong domestic timber demand, export-oriented logging activities, and increasing adoption of precision forestry techniques. Rising use of wood in green construction and energy production, coupled with reforestation policies and wildfire risk mitigation efforts, is boosting industry growth in both the U.S. and Canada.

U.S. Forestry and Logging Market Insight

The U.S. market captured the largest revenue share in North America in 2024, driven by expansive forest resources, growing demand for wood-based construction materials, and robust logging infrastructure. Supportive policies for sustainable forest use, increasing adoption of automated harvesting equipment, and growing export demand for U.S. timber and wood products are reinforcing the sector’s growth trajectory.

Forestry and Logging Market Share

The forestry and logging industry is primarily led by well-established companies, including:

- Weyerhaeuser Company (U.S.)

- Rayonier Inc. (U.S.)

- Forestry Corporation (Australia)

- China Jilin Forest Industry Group Co., Ltd. (China)

- Tilhill Forestry (U.K.)

- XINHUANET (China)

- Oji Holdings Corporation (Japan)

- EGGER (Austria)

- James Jones & Sons Limited (U.K.)

- Metsähallitus’s Metsa (Finland)

Latest Developments in Global Forestry and Logging Market

- In July 2023, Trimble introduced LIMS PRO, a new cloud-hosted iteration of its Log Inventory and Management System (LIMS), tailored for managing raw material procurement in sawmills. This cloud-based log settlement solution aims to enhance operational transparency for mills, enabling small- and medium-sized forest product companies to achieve productivity and growth benefits previously accessible only to larger enterprises

- In July 2021, EOS Data Analytics (EOSDA) launched EOSDA Forest Monitoring, a satellite-powered software aimed at transforming forest management practices. By providing landowners, logging companies, and research institutions with real-time AI-driven monitoring capabilities, the solution is expected to enhance decision-making, improve sustainability, and drive digital transformation in the global forestry and logging market

- In February 2021, West Fraser Timber Co. Ltd. and Norbord Inc. announced the successful completion of their merger. West Fraser acquired all outstanding common shares of Norbord as per the agreed terms, where Norbord shareholders received 0.675 shares of West Fraser for each Norbord share held

- In July 2020, Kobelco Europe introduced a logging specification variant of its SK140SRLC-7 excavator, designed to meet the specific demands of logging operations. This expansion in equipment offering supports the mechanization trend in the forestry sector and strengthens Kobelco’s position in the European logging machinery market

- In 2020, Rayonier Inc. finalized a $554 million USD merger agreement with Pope Resources to significantly expand its Pacific Northwest timberland and real estate holdings. This strategic move bolstered Rayonier’s market share in the U.S. forestry sector and enhanced its long-term growth potential through increased land assets and resource control

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.