Global Fork Sensor Market

Market Size in USD Million

CAGR :

%

USD

572.11 Million

USD

1,090.72 Million

2024

2032

USD

572.11 Million

USD

1,090.72 Million

2024

2032

| 2025 –2032 | |

| USD 572.11 Million | |

| USD 1,090.72 Million | |

|

|

|

|

Fork Sensor Market Size

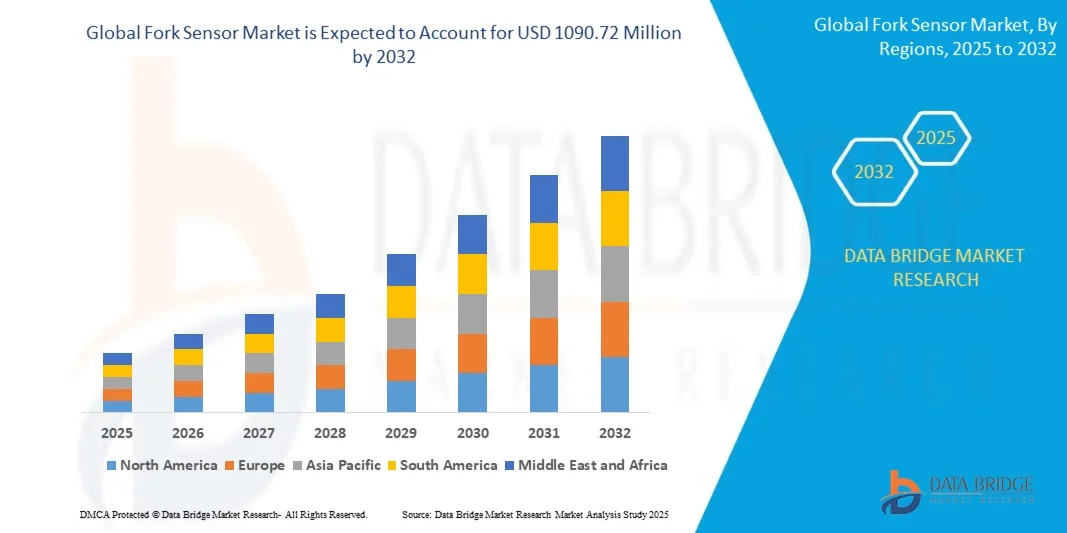

- The global fork sensor market size was valued at USD 572.11 million in 2024 and is expected to reach USD 1090.72 million by 2032, at a CAGR of 8.40% during the forecast period

- The market growth is largely fueled by the increasing adoption of automation and smart manufacturing technologies across industries, leading to enhanced operational efficiency, precision, and real-time monitoring in production lines, packaging, and labeling processes

- Furthermore, rising demand for high-accuracy, reliable, and versatile detection solutions is establishing fork sensors as a critical component in industrial automation, environmental monitoring, and smart manufacturing setups. These converging factors are accelerating the adoption of fork sensor solutions, thereby significantly boosting the market’s growth

Fork Sensor Market Analysis

- Fork sensors are precision devices used to detect object presence, count products, and monitor alignment in industrial and packaging applications. These sensors integrate with automation systems, enhancing production accuracy, reducing errors, and supporting real-time monitoring for diverse sectors including manufacturing, packaging, labeling, and environmental applications

- The escalating demand for fork sensors is primarily fueled by the growing need for smart factory solutions, Industry 4.0 implementations, and automated quality control processes, along with the push for energy-efficient, compact, and highly reliable sensing technologies

- North America dominated the fork sensor market in 2024, due to high adoption of automation and smart manufacturing technologies across industries

- Asia-Pacific is expected to be the fastest growing region in the fork sensor market during the forecast period due to rapid industrialization, expansion of manufacturing hubs, and adoption of automation technologies in countries such as China, Japan, and India

- PNP-NO segment dominated the market with a market share of 53.1% in 2024, due to its simplicity, reliability, and suitability for a wide range of industrial applications. PNP-NO fork sensors are widely used in automation processes where signal activation occurs when an object is detected, making them ideal for counting, positioning, and conveyor applications. The segment also benefits from ease of wiring, compatibility with standard industrial controllers, and widespread acceptance across manufacturing and packaging industries. Enhanced durability and stable performance in harsh conditions further strengthen its market position

Report Scope and Fork Sensor Market Segmentation

|

Attributes |

Fork Sensor Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Fork Sensor Market Trends

“Growth of Smart Factories and Industry 4.0 Adoption”

- The fork sensor market is growing rapidly due to the increasing adoption of smart factories and Industry 4.0 initiatives, where precise object detection and reliable automation systems are critical for operational efficiency. Fork sensors are extensively used for tasks such as label detection, part counting, and edge guiding in automated production lines, enabling accuracy and speed in industrial processes

- For instance, SICK AG offers advanced fork sensors designed for packaging, labeling, and material handling applications in smart factories, enabling higher productivity in automated lines. Similarly, Banner Engineering provides fork sensors with advanced optics and digital features to support Industry 4.0-enabled facilities across diverse manufacturing environments

- Smart manufacturing demands greater connectivity, and fork sensors integrated with digital communication protocols enhance factory automation by supporting real-time monitoring and data transfer. This level of integration allows seamless interaction between sensors, machines, and centralized control systems

- The ability of fork sensors to detect transparent, reflective, or small objects with precision makes them indispensable in industries such as pharmaceuticals, electronics, and food and beverages, where reliable quality control and throughput efficiency are critical objectives

- As industries adopt Industry 4.0 principles, smart sensors such as fork sensors contribute to predictive maintenance, error reduction, and advanced analytics. Their integration ensures alignment with long-term digital transformation goals aimed at improving efficiency and minimizing downtime

- The growth of fork sensors in smart factory applications reflects a broader shift toward connected, automated, and intelligent production facilities. By enabling accuracy, reliability, and enhanced productivity, fork sensors are establishing themselves as foundational components in industrial automation ecosystems worldwide

Fork Sensor Market Dynamics

Driver

“Rising Need for Precise and Reliable Object Detection”

- The increasing demand for reliable detection technologies in automated manufacturing and logistics processes is a key driver of the fork sensor market. As production lines become faster and more complex, industries are turning to fork sensors for accurate detection of products, labels, and packaging materials

- For instance, KEYENCE Corporation has introduced high-precision fork sensors that enhance automated detection accuracy in packaging and logistics facilities. Companies such as OMRON offer advanced fork sensors that support reliable material handling and product positioning in industrial production environments

- Fork sensors excel in providing dependable detection capabilities even under challenging conditions involving transparent films, reflective surfaces, or variable sizes. Their design ensures stability and consistency in environments where faulty detections could disrupt operations or reduce efficiency

- Industries such as pharmaceuticals, semiconductors, and consumer goods rely on fork sensors to maintain output accuracy and support regulatory compliance. Their role in ensuring high standards of quality control reinforces their importance in modern automated systems

- The growing reliance on precise detection across production facilities emphasizes fork sensors as indispensable tools for ensuring error-free industrial processes. Their consistent performance makes them critical to safeguarding product quality, operational uptime, and customer satisfaction across sectors

Restraint/Challenge

“High Cost and Integration Complexity”

- The relatively high cost of advanced fork sensors presents a restraint for their adoption, particularly in small and mid-scale manufacturing plants. As these sensors often incorporate advanced optics, digital communication capabilities, and durable housing, initial equipment costs can constrain investment for cost-sensitive industries

- For instance, premium fork sensors supplied by SICK AG and KEYENCE come at higher prices that reflect their advanced detection capabilities but discourage widespread adoption among budget-conscious enterprises. The expense of deploying multiple sensors across production lines amplifies the challenge of affordability

- Integration complexity adds another barrier, as fork sensors must align with diverse automation platforms and machine configurations. Ensuring compatibility with existing infrastructure, programmable logic controllers (PLCs), and other automation components increases setup time and requires skilled technical expertise

- Industries with legacy equipment may find the transition especially difficult, as integrating fork sensors into older systems can demand significant customization or additional hardware, which raises overall costs and complexity

- Addressing these concerns will require manufacturers to develop modular, cost-effective solutions and simplify integration with standardized protocols. Lowering cost barriers and reducing technical complexity will be vital for supporting mass adoption of fork sensors in smart factories and Industry 4.0 environments

Fork Sensor Market Scope

The market is segmented on the basis of type, end-user, and product.

• By Type

On the basis of type, the fork sensor market is segmented into optical, vibrating tuning, and ultrasonic. The optical segment dominated the largest market revenue share in 2024, driven by its high precision, reliability, and ease of integration across diverse industrial applications. Optical fork sensors are widely preferred for their ability to detect objects with varying colors, shapes, and sizes, making them suitable for automated production lines and packaging systems. The segment also benefits from strong demand due to its low maintenance requirements and compatibility with both standard and smart manufacturing setups. In addition, advancements in compact and durable optical sensor designs have enhanced their adoption across small- and large-scale operations.

The vibrating tuning type is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by increasing adoption in manufacturing environments requiring high sensitivity and rapid response times. Vibrating tuning fork sensors are particularly valued for detecting transparent or irregular objects, where optical sensors may face limitations. Their robustness in harsh industrial conditions, resistance to dust and liquids, and precise actuation make them ideal for modern automated systems. The growing trend of smart factories and Industry 4.0 implementations further drives the demand for these highly responsive sensor types.

• By End-User

On the basis of end-user, the fork sensor market is segmented into packaging, manufacturing, labeling, and others. The manufacturing segment dominated the largest market revenue share in 2024, owing to extensive utilization of fork sensors in assembly lines, quality control, and automation processes. Fork sensors play a critical role in detecting object presence, counting products, and ensuring operational efficiency, which is vital in automotive, electronics, and consumer goods manufacturing. The segment benefits from continuous modernization of manufacturing plants, increased automation adoption, and the need to maintain high accuracy and productivity standards. Furthermore, the integration of sensors with industrial IoT platforms enhances real-time monitoring, predictive maintenance, and operational efficiency.

The packaging segment is expected to witness the fastest CAGR from 2025 to 2032, driven by the growing demand for automated packaging solutions across food, beverage, and pharmaceutical industries. Fork sensors in packaging applications enable accurate product detection, sorting, and alignment, reducing errors and improving throughput. Rising demand for high-speed, automated packaging lines and regulatory compliance in labeling and packaging quality further fuels adoption. The ease of integrating these sensors into existing packaging machinery and their role in minimizing production downtime also contributes to their growing popularity.

• By Product

On the basis of product, the fork sensor market is segmented into PNP-NO and PNP-NC. The PNP-NO (Normally Open) segment dominated the largest market revenue share of 53.1% in 2024, owing to its simplicity, reliability, and suitability for a wide range of industrial applications. PNP-NO fork sensors are widely used in automation processes where signal activation occurs when an object is detected, making them ideal for counting, positioning, and conveyor applications. The segment also benefits from ease of wiring, compatibility with standard industrial controllers, and widespread acceptance across manufacturing and packaging industries. Enhanced durability and stable performance in harsh conditions further strengthen its market position.

The PNP-NC (Normally Closed) segment is anticipated to witness the fastest growth rate from 2025 to 2032, driven by increased demand for fail-safe and continuous monitoring systems in critical industrial operations. PNP-NC fork sensors are preferred in applications where uninterrupted signal is crucial and immediate detection of object absence is required. Their adoption is further supported by growing automation in sensitive production lines, safety-critical environments, and the need to reduce downtime. Rising awareness of advanced sensor technology in precision-driven industries also contributes to their accelerated growth.

Fork Sensor Market Regional Analysis

- North America dominated the fork sensor market with the largest revenue share in 2024, driven by high adoption of automation and smart manufacturing technologies across industries

- Manufacturers in the region highly value the precision, reliability, and efficiency offered by fork sensors in production lines, packaging, and quality control

- The widespread adoption is further supported by advanced industrial infrastructure, high investment in automation, and the increasing preference for IoT-enabled and Industry 4.0-compliant solutions, establishing fork sensors as a critical component in modern manufacturing processes

U.S. Fork Sensor Market Insight

The U.S. fork sensor market captured the largest revenue share in North America in 2024, fueled by the rapid adoption of automated production lines and growing emphasis on operational efficiency. Industries such as automotive, electronics, and consumer goods rely heavily on fork sensors for precise object detection, counting, and alignment. The integration of these sensors with smart factory systems and predictive maintenance solutions is further accelerating market growth. In addition, government initiatives supporting automation and technological modernization in manufacturing are contributing to the market’s expansion.

Europe Fork Sensor Market Insight

The Europe fork sensor market is projected to expand at a steady CAGR during the forecast period, driven by the increasing focus on automation, quality control, and smart manufacturing. Countries such as Germany, France, and Italy are witnessing rising demand due to stringent industrial standards and the need for efficient production processes. European manufacturers are adopting fork sensors to improve productivity and reduce errors in packaging, labeling, and assembly lines. The integration of sensors with IoT-enabled systems for real-time monitoring and analytics is further supporting growth.

U.K. Fork Sensor Market Insight

The U.K. fork sensor market is expected to grow at a notable CAGR, driven by the adoption of automation in packaging, manufacturing, and labeling sectors. Companies are prioritizing efficiency, precision, and reliability, and fork sensors are increasingly integrated into smart production lines. The country’s focus on Industry 4.0 technologies and growing investment in industrial automation are key factors fueling adoption. In addition, the U.K.’s strong manufacturing base and demand for advanced quality control solutions are supporting market expansion.

Germany Fork Sensor Market Insight

The Germany fork sensor market is anticipated to expand at a significant CAGR, fueled by the country’s advanced industrial ecosystem and emphasis on precision manufacturing. German manufacturers increasingly adopt fork sensors for packaging, labeling, and assembly processes to enhance operational efficiency and maintain stringent quality standards. Rising automation initiatives, integration of sensors with smart factory solutions, and the push for Industry 4.0 compliance are driving market growth.

Asia-Pacific Fork Sensor Market Insight

The Asia-Pacific fork sensor market is poised to grow at the fastest CAGR during 2025–2032, driven by rapid industrialization, expansion of manufacturing hubs, and adoption of automation technologies in countries such as China, Japan, and India. The region’s increasing focus on smart factories and precision-driven production is fueling demand for fork sensors across packaging, manufacturing, and labeling sectors. In addition, favorable government policies promoting automation and digitalization, coupled with the presence of cost-effective sensor manufacturing, are expanding accessibility to a broader industrial base.

Japan Fork Sensor Market Insight

The Japan fork sensor market is gaining traction due to the country’s advanced manufacturing technologies, high automation adoption, and emphasis on operational precision. Industries are leveraging fork sensors for real-time detection, counting, and alignment in production and packaging lines. The integration of sensors with IoT and smart factory solutions further accelerates adoption. Moreover, Japan’s focus on reducing labor dependency and enhancing manufacturing efficiency is driving the market.

China Fork Sensor Market Insight

The China fork sensor market accounted for the largest revenue share in Asia-Pacific in 2024, supported by the country’s extensive manufacturing base, rapid industrialization, and high adoption of automated production technologies. Fork sensors are widely deployed in packaging, manufacturing, and labeling operations to improve efficiency, accuracy, and throughput. The expansion of smart factories, government incentives for industrial automation, and the presence of domestic sensor manufacturers providing cost-effective solutions are key factors propelling market growth.

Fork Sensor Market Share

The fork sensor industry is primarily led by well-established companies, including:

- M.D.Micro Detectors S.p.A. (Italy)

- SICK AG (Germany)

- Pepperl+Fuchs (Germany)

- Baumer (Switzerland)

- Rockwell Automation, Inc. (U.S.)

- SensoPart Industriesensorik GmbH (Germany)

- Leuze electronic bv (Germany)

- Datalogic S.p.A. (Italy)

- Balluff GmbH (Germany)

- Telco Sensors (Denmark)

Latest Developments in Fork Sensor Market

- In April 2025, Fraunhofer IPMS contributed its expertise in miniaturized sensor structures for the development of edge-AI-enabled insect monitoring systems. This innovation demonstrates the expanding versatility of fork sensors beyond traditional industrial applications into environmental monitoring and precision agriculture. By enabling real-time data processing at the sensor level, these systems allow faster detection, analysis, and response, improving operational efficiency and effectiveness in pest management. The development also highlights the role of advanced fork sensor technology in supporting sustainable practices and smart monitoring solutions, opening new growth avenues in environmental and agricultural sectors

- In April 2025, Fraunhofer IPMS developed a compact ISFET-based pH sensor control system with ultra-low power consumption, ideal for portable applications in water analysis, healthcare diagnostics, and environmental monitoring. This advancement enhances the adoption of fork sensors in industries where continuous, on-site measurement is critical, reducing dependency on laboratory testing and enabling rapid decision-making. The integration of such energy-efficient and portable systems allows industries and research organizations to implement high-accuracy monitoring in remote or mobile setups, driving the demand for versatile and robust fork sensor solutions

- In October 2024, Fraunhofer IPMS unveiled advanced evaluation kits for spatial light modulators, incorporating tilting or piston micro mirrors as actuators. These kits improve the precision and responsiveness of light modulation, which is critical in applications such as lithography, medical imaging, astronomy, and quantum computing. The development underscores the growing demand for high-precision fork sensors capable of supporting intricate and high-tech industrial processes. As industries increasingly require sensors with high accuracy, fast response times, and reliability, such innovations drive both adoption and ongoing research into next-generation fork sensor technologies

- In February 2022, Elliptic Labs announced that its AI-powered virtual proximity sensor, INNER BEAUTY, would be implemented in Redmi K50 Gaming smartphones. By replacing traditional hardware proximity sensors, this forked detection system eliminates sourcing constraints and reduces manufacturing costs. Its integration in widely used consumer electronics accelerates awareness of AI-enabled fork sensors and demonstrates the potential for software-driven solutions in mobile and smart devices. This move is expanding the market for virtual or AI-based fork sensors, particularly in applications where miniaturization, cost efficiency, and flexibility are critical

- In April 2021, the Fraunhofer Institute for Photonic Microsystems (IPMS) introduced multipurpose, compact, energy-efficient, and eco-friendly sensor systems. These systems support broader adoption of fork sensors across industrial automation, packaging, labeling, and environmental monitoring by offering high reliability with reduced power consumption and minimal environmental impact. The compact and versatile nature of these sensors allows seamless integration into production lines and monitoring systems, enabling industries to enhance efficiency, maintain accuracy, and adopt sustainable practices. The development reflects the market’s shift toward energy-efficient, multifunctional, and environmentally conscious sensor solutions

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Fork Sensor Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Fork Sensor Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Fork Sensor Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.