Global Form Fill Seal Equipment Market

Market Size in USD Billion

CAGR :

%

USD

22.05 Billion

USD

35.43 Billion

2024

2032

USD

22.05 Billion

USD

35.43 Billion

2024

2032

| 2025 –2032 | |

| USD 22.05 Billion | |

| USD 35.43 Billion | |

|

|

|

|

Form-Fill-Seal Equipment Market Size

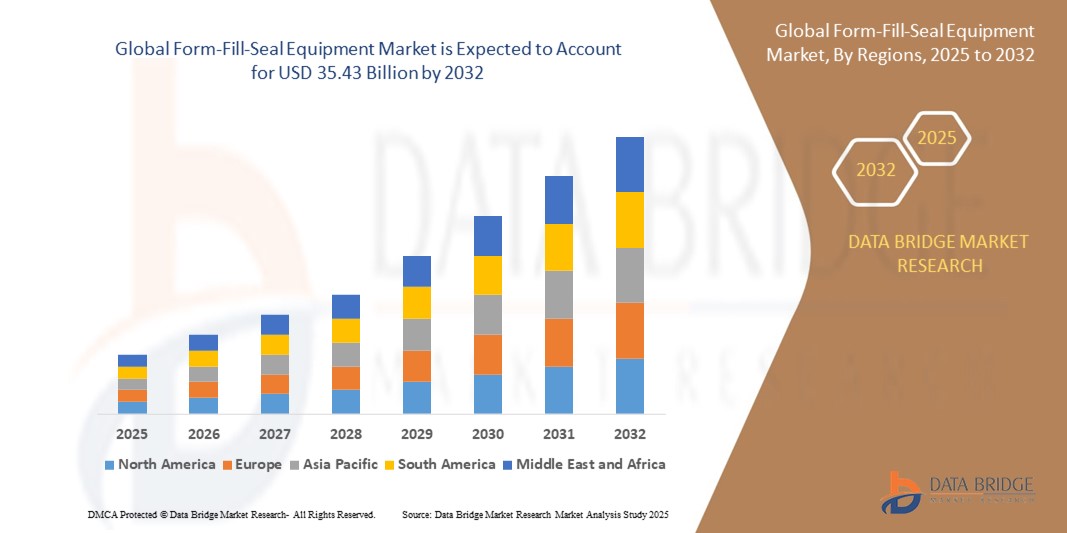

- The global Form-Fill-Seal Equipment market size was valued at USD 22.05 billion in 2024 and is expected to reach USD 35.43 billion by 2032, at a CAGR of 6.11% during the forecast period

- The market growth is largely fueled by the escalating demand for efficient and cost-effective packaging solutions across diverse industries, including food and beverage, pharmaceuticals, and chemicals

- Furthermore, increasing adoption of automation in manufacturing processes and the rising need for extended product shelf life through advanced packaging technologies. These converging factors are accelerating the uptake of Form-Fill-Seal Equipment solutions, thereby significantly boosting the industry's growth

Form-Fill-Seal Equipment Market Analysis

- Form-Fill-Seal (FFS) equipment plays a crucial role in modern packaging processes across various industries by automating the formation, filling, and sealing of packages. This technology enhances efficiency, reduces labor costs, and minimizes contamination, making it an indispensable part of the supply chain for numerous products.

- The escalating demand for FFS equipment is primarily driven by the increasing need for efficient and cost-effective packaging solutions in sectors such as food and beverage, pharmaceuticals, personal care, and chemicals. The rise of e-commerce and the growing preference for packaged and ready-to-eat products further fuel this demand, as FFS machines can handle large volumes with speed and precision. Additionally, stringent hygiene and safety regulations, particularly in the food and pharmaceutical industries, necessitate advanced packaging solutions that FFS equipment provides

- Asia-Pacific holds a share of 37.88% in the global FFS equipment market. Factors contributing to this include the presence of well-established manufacturing industries, high adoption rates of automation technologies, and stringent packaging standards. The region's focus on technological advancements and efficient production processes makes it a key market for FFS equipment. The United States, with its large consumer market and robust industrial base, contributes significantly to the North American market share.

- North America is anticipated to be the fastest-growing region in the FFS equipment market during the forecast period. This growth is attributed to rapid industrialization, increasing urbanization, rising disposable incomes, and the expansion of the manufacturing sector in countries like China and India. While specific revenue share for 2025 for Asia-Pacific isn't available in the same way as the North America smart lock example, the region's burgeoning manufacturing activities and growing demand for packaged goods position it for significant expansion in the FFS equipment market

- Vertical Form-Fill-Seal (VFFS) Equipment segment is expected to dominate the Form-Fill-Seal Equipment market with a market share of 64.51% in 2025, driven by its highly versatile and generally more cost-effective for a wide range of applications.

Report Scope and Form-Fill-Seal Equipment Market Segmentation

|

Attributes |

Form-Fill-Seal Equipment Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Form-Fill-Seal Equipment Market Trends

“Increased Focus on Automation and Efficiency”

- A significant and accelerating trend in the global Form-Fill-Seal Equipment market is the increasing focus on advanced automation and the pursuit of greater operational efficiency. This is driven by manufacturers across various industries seeking to reduce labor costs, enhance production speeds, minimize material waste, and improve overall equipment effectiveness (OEE).

- For instance, modern FFS machines are being equipped with sophisticated robotic arms for automated product feeding and discharge, advanced sensor technologies for precise material handling and defect detection, and programmable logic controllers (PLCs) for seamless and synchronized operation. This automation not only boosts throughput but also ensures consistent packaging quality.

- The integration of advanced automation in FFS equipment enables features such as automatic film splicing to reduce downtime, self-diagnostic systems for proactive maintenance alerts, and recipe management for quick changeovers between different product or packaging formats. Furthermore, data analytics capabilities are being incorporated to monitor machine performance in real-time, providing insights for optimization and predictive maintenance scheduling.

- The seamless integration of FFS equipment with other automated systems within a manufacturing facility, such as upstream filling lines and downstream palletizing robots, facilitates a more streamlined and integrated production process. This interconnectedness allows for better coordination, reduced manual intervention, and improved overall supply chain efficiency.

- This trend towards more automated, data-driven, and efficient packaging solutions is fundamentally reshaping the expectations of end-users in the food, beverage, pharmaceutical, and other industries. Consequently, companies are investing in developing FFS equipment with higher levels of automation, enhanced control systems, and features that maximize uptime and minimize operational costs.

- The demand for FFS equipment that offers advanced automation and efficiency-enhancing features is growing rapidly across both established and emerging markets, as manufacturers increasingly prioritize operational excellence and seek to gain a competitive edge through optimized packaging processes.

Form-Fill-Seal Equipment Market Dynamics

Driver

“Surging Demand for Efficient and Cost-Effective Packaging Solutions”

- The escalating need for efficient and cost-effective packaging solutions across a multitude of industries, including food and beverage, pharmaceuticals, chemicals, and personal care, serves as a significant driver for the heightened demand for Form-Fill-Seal (FFS) Equipment.

- For instance, in March 2025, a major food processing company in India invested in high-speed vertical FFS machines to automate the packaging of snack foods, aiming to reduce labor costs and increase production output to meet growing consumer demand. Such investments by end-user industries are expected to propel the Form-Fill-Seal Equipment market growth during the forecast period.

- As businesses strive to optimize their production processes and reduce operational expenses, FFS equipment offers a compelling solution by automating the entire packaging process – forming the package, filling it with the product, and sealing it – in a continuous operation. This significantly reduces the need for manual labor, minimizes the risk of contamination, and enhances overall production efficiency.

- Furthermore, the increasing emphasis on product safety, extended shelf life, and attractive packaging to capture consumer attention is making advanced packaging technologies, enabled by FFS equipment, an indispensable part of the manufacturing process. The ability of FFS machines to handle various packaging materials and formats provides manufacturers with the flexibility to meet diverse product requirements and market trends.

- The rising demand for packaged and ready-to-eat products, fueled by changing lifestyles and urbanization, particularly in rapidly growing economies like India and other parts of Asia-Pacific, is further propelling the adoption of FFS equipment. The convenience of pre-packaged goods and the need for efficient packaging solutions for large-scale production are key factors driving market growth in both domestic and international markets. The increasing focus on minimizing packaging waste and the adoption of sustainable packaging materials are also influencing the demand for FFS equipment capable of handling these requirements.

Restraint/Challenge

“High Initial Investment and Complexity of Integration”

- The relatively high initial investment required for advanced Form-Fill-Seal (FFS) equipment, coupled with the complexity of integrating these sophisticated machines into existing production lines, can pose a significant restraint on broader market adoption, particularly for small and medium-sized enterprises (SMEs).

- For instance, the cost of a fully automated, high-speed FFS line with advanced features like servo controls and sophisticated sealing mechanisms can be substantial, representing a significant capital expenditure for many manufacturers, especially those in price-sensitive markets or with limited financial resources.

- Furthermore, the integration of new FFS equipment often necessitates modifications to existing infrastructure, including material handling systems, control networks, and even facility layouts. This integration process can be complex, time-consuming, and may require specialized technical expertise, adding to the overall cost and potentially causing production disruptions.

- While the long-term benefits of FFS equipment, such as increased efficiency and reduced operating costs, can outweigh the initial investment, the upfront capital outlay can be a significant barrier to entry, especially for companies with tight budgets or uncertain market conditions. The perceived complexity of operating and maintaining advanced FFS machinery can also deter some potential adopters who may lack the necessary technical skills in their workforce.

- Although more cost-effective and user-friendly FFS solutions are becoming available, particularly for entry-level applications, the advanced features and high-speed capabilities often come with a premium price tag. This can limit the adoption of state-of-the-art FFS technology primarily to larger corporations with greater financial capacity and established engineering teams.

- Overcoming these challenges through the development of more affordable and standardized FFS equipment, offering comprehensive training and support for integration and maintenance, and clearly demonstrating the long-term return on investment will be crucial for wider market penetration across diverse scales of manufacturing operations.

Form-Fill-Seal Equipment Market Scope

The market is segmented on the basis of machine, product, and end-user.

- By Type

On the basis of machine, the Form-Fill-Seal Equipment market is segmented into Vertical Form-Fill-Seal Equipment and Horizontal Form-Fill-Seal Equipment. The Vertical Form-Fill-Seal (VFFS) Equipment segment held the largest market revenue share in 2025. This dominance is driven by the versatility and cost-effectiveness of VFFS machines in packaging a wide array of products, particularly in the food and beverage industry. Their ability to handle various pouch styles and high-speed operation for products like snacks, powders, and liquids contribute significantly to their market leadership.

The Horizontal Form-Fill-Seal (HFFS) Equipment segment is anticipated to witness a steady growth rate from 2025 to 2032, fueled by its suitability for packaging larger or irregularly shaped items, as well as its increasing adoption in industries like pharmaceuticals and baked goods where specific packaging formats like flow wraps and blister packs are common. Advancements in HFFS technology offering greater flexibility and faster changeover times are also contributing to its growth.

- By Product

On the basis of product type, the Form-Fill-Seal Equipment market is segmented into Bags and Pouches, Cartons, Cups, Bottles, Sachets, and Trays. The Bags and Pouches segment held the largest market revenue share in 2025. This is attributed to the widespread use of pouches and bags across various industries for packaging food, beverages, personal care items, and more, due to their flexibility, cost-effectiveness, and convenience for consumers. The increasing demand for stand-up pouches and other innovative pouch formats further supports this segment's dominance.

The Bottles segment is expected to witness a significant CAGR from 2025 to 2032, driven by the increasing demand for liquid packaging in industries like beverages, pharmaceuticals, and household chemicals. Advancements in FFS technology allowing for efficient and high-speed filling and sealing of bottles, coupled with the growing preference for plastic and other convenient bottle formats, are fueling this growth.

- By End-User

On the basis of end-user, the Form-Fill-Seal Equipment market is segmented into Food and Beverages, Pharmaceutical, and Personal Care. The Food and Beverages segment held the largest market revenue share in 2025. This is due to the high volume of packaged food and beverage products consumed globally, requiring efficient and high-speed FFS solutions for a wide range of product types, from snacks and confectionery to liquids and frozen foods. The stringent hygiene and shelf-life requirements in this sector also necessitate advanced FFS technologies.

The Pharmaceutical segment is anticipated to witness the fastest CAGR from 2025 to 2032, driven by the increasing demand for unit-dose packaging, blister packs, and other specialized packaging formats to ensure patient safety and compliance. The growing pharmaceutical industry, coupled with stringent regulations regarding drug packaging, is fueling the adoption of advanced and precise FFS equipment in this sector.

Form-Fill-Seal Equipment Market Regional Analysis

- Asia-Pacific dominated the global FFS equipment market with the largest revenue share of 37.88% in 2024, driven by rapid urbanization, industrialization, and increasing demand for packaged food and beverages.

- The region's growth is further propelled by innovations in automation and packaging technology, improving production efficiency.

- Precedence Research

- Countries like China, Japan, and India are leading this growth due to technological advancements and rising disposable incomes.

China Form-Fill-Seal Equipment Market Insight

China accounted for the largest market revenue share in Asia-Pacific in 2025, attributed to its expanding middle class, rapid urbanization, and high rates of technological adoption. The country's push towards smart cities and the availability of affordable FFS equipment options, alongside strong domestic manufacturers, are key growth drivers.

Japan Form-Fill-Seal Equipment Market Insight

Japan's FFS equipment market is gaining momentum due to its high-tech culture, rapid urbanization, and demand for convenience. The integration of FFS equipment with other IoT devices, such as home security cameras and lighting systems, is fueling growth.

North America Form-Fill-Seal Equipment Market Insight

North America is expected to grow at a CAGR of 5.4% over the studied period, driven by the booming beverage and food industry. The rising consumer preferences for ready-to-eat products and convenient food are impelling market players to invest in innovative packaging solutions.

U.S. Form-Fill-Seal Equipment Market Insight

The U.S. led the North American market owing to advancements in sustainable packaging materials and the presence of major market players. Consumers are increasingly prioritizing the enhancement of home security through intelligent, keyless entry systems, further propelling the FFS equipment industry.

Europe Form-Fill-Seal Equipment Market Insight

Europe accounted for 27.3% of the global FFS equipment market in 2024, driven by the growing trend of convenience packaging and the increasing demand for flexible packaging solutions. The presence of leading manufacturers, such as Syntegon Technology GmbH, Bosch Packaging Technology, and IMA S.p.A., further supports the growth of the European market.

U.K. Form-Fill-Seal Equipment Market Insight

The U.K. market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by the escalating trend of home automation and a desire for heightened security and convenience. Concerns regarding burglary and safety are encouraging both homeowners and businesses to choose keyless entry solutions, stimulating market growth.

Germany Form-Fill-Seal Equipment Market Insight

Germany's market is expected to expand at a considerable CAGR during the forecast period, fueled by increasing awareness of digital security and the demand for technologically advanced, eco-conscious solutions. The integration of FFS equipment with home automation systems is becoming increasingly prevalent, aligning with local consumer expectations.

Form-Fill-Seal Equipment Market Share

The Form-Fill-Seal Equipment industry is primarily led by well-established companies, including:

- Robert Bosch GmbH (Germany)

- Italian Trade Agency (Italy)

- I.M.A. Industria Macchine Automatiche S.p.A. (Italy)

- HAVER & BOECKER OHG (Germany)

- ProMach (U.S.)

- ARPAC LLC (U.S.)

- Mespack (Spain)

- ACG (India)

- PMMI Media Group (U.S.)

- Aagard (U.S.)

- Herrmann Ultrasonics (U.S.)

- Matrix Packaging Machinery, LLC (U.S.)

- Busch Machinery, Inc. (U.S.)

- Rovema (Germany)

- Ossid, LLC (U.S.)

- Fres-co System USA, Inc. (U.S.)

- Packaging Center USA (U.S.)

- Precision Automation Company, Inc. (U.S.)

- Willems Baling Equipment (Netherlands)

- Gainsborough Engineering Company (U.K.)

Latest Developments in Global Form-Fill-Seal Equipment Market

- On November 18, 2024, IMA Life — a division of the IMA Group specializing in aseptic pharmaceutical processing — announced a strategic partnership with RheaVita, a pioneer in continuous freeze-drying technology for biopharmaceuticals. The collaboration includes a financial investment by IMA Life and is focused on advancing and commercializing RheaVita’s innovative freeze-drying solutions, which consolidate all traditional steps into a single, streamlined production line. This cutting-edge technology is particularly well-suited for high-value, low-volume products such as gene and RNA therapies, monoclonal antibodies, and vaccines

- In November 2024, IMA Life — one of the three pharmaceutical divisions of the IMA Group and a global leader in advanced aseptic processing and production technologies — revealed a strategic partnership with RheaVita, a frontrunner in continuous freeze-drying technology for biopharmaceuticals. The collaboration includes a financial investment in RheaVita, reinforcing IMA Life’s commitment to innovation in pharmaceutical manufacturing

- In September 2024, Syntegon unveiled the PMX 4001 vertical bagger, a compact solution tailored for packaging ground coffee and whole beans. The machine accommodates both conventional and recyclable packaging materials while ensuring high product protection and a reduced footprint. Equipped with integrated aroma-preserving degassing valves made from mono-materials, the PMX 4001 underscores Syntegon’s commitment to advancing sustainable packaging technologies

- In September 2024, Syntegon — a leading provider of processing and packaging technology — announced its participation in FACHPACK 2024, held in Nuremberg, Germany, from September 24–26. At booth 1-257 in Hall 1, the company showcased a suite of sustainable packaging innovations, including the SVX Agile vertical form-fill-seal machine, the Kliklok ACE glueless carton erector, and the Pack 403 horizontal flow-wrapper with the paper-ON-form forming shoulder. These solutions are designed to support food manufacturers in transitioning to eco-friendly packaging processes in alignment with the forthcoming EU Packaging and Packaging Waste Regulation (PPWR), set to take effect in 2030

- In August 2024, Syntegon announced its participation in this year’s FACHPACK, set to take place in Nuremberg, Germany, from September 24 to 26. At booth 1-257 in Hall 1, the company will showcase its latest machine and software solutions, designed to help food manufacturers transition to more sustainable packaging processes. Syntegon plans to highlight its "future-proof" packaging material innovations aimed at supporting eco-friendly production

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Form Fill Seal Equipment Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Form Fill Seal Equipment Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Form Fill Seal Equipment Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.