Global Fortified Dairy Products Market

Market Size in USD Billion

CAGR :

%

USD

95.83 Billion

USD

142.13 Billion

2025

2033

USD

95.83 Billion

USD

142.13 Billion

2025

2033

| 2026 –2033 | |

| USD 95.83 Billion | |

| USD 142.13 Billion | |

|

|

|

|

What is the Global Fortified Dairy Products Market Size and Growth Rate?

- The global fortified dairy products market size was valued at USD 95.83 billion in 2025 and is expected to reach USD 142.13 billion by 2033, at a CAGR of 5.05% during the forecast period

- Increasing health benefits associated with the consumption of fortified milk and milk products is a vital factor escalating the market growth, also rise in consumption of dairy products across the globe, rising spending power of consumers along with changing preferences towards the health food habits among consumers, increase in purchasing power of middle-class population along with increased concerns regarding fitness in developing countries of this region such as India and China

What are the Major Takeaways of Fortified Dairy Products Market?

- Rising technological advancements in the food and beverages industry are influencing the fortified dairy products are the major factors among others driving the fortified dairy products market briskly

- Moreover, rising research and development activities and increasing modernization in the new products offered in the market will further create new opportunities for the fortified dairy products market

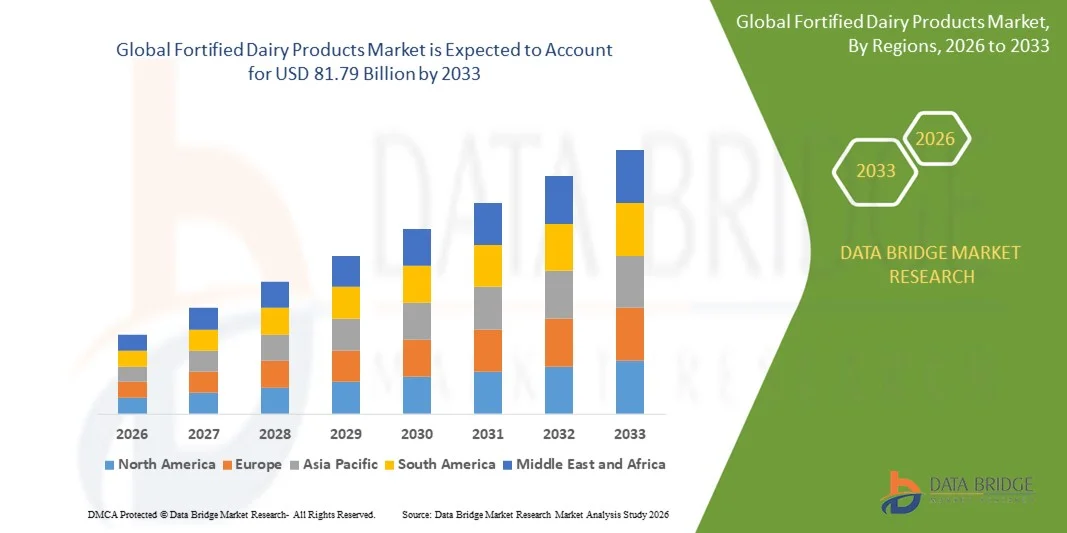

- North America dominated the fortified dairy products market with the largest revenue share of 40.6% in 2025, driven by high consumer awareness regarding nutritional deficiencies, rising health-consciousness, and strong retail infrastructure for fortified food products

- The Asia-Pacific region is projected to witness the fastest growth rate of 9.74% during 2026–2033, driven by rapid urbanization, rising disposable incomes, and increasing awareness about nutritional deficiencies

- The milk segment dominated the market with the largest revenue share of 47.9% in 2025, owing to its widespread consumption, affordability, and versatility as a nutrient delivery medium

Report Scope and Fortified Dairy Products Market Segmentation

|

Attributes |

Fortified Dairy Products Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Fortified Dairy Products Market?

Growing Emphasis on Nutrient-Enriched, Health-Driven Fortified Dairy Solutions

- The fortified dairy products market is experiencing a pronounced shift toward health and wellness, driven by increasing awareness of nutrient deficiencies and the demand for functional foods that provide more than basic nutrition

- For instance, more dairy producers are launching variants of milk, yogurt and cheese fortified with vitamins A, D, B-complex, minerals such as calcium and iron, and probiotics to cater to immunocompromised, child, pregnant and senior consumer segments.

- Consumers’ growing preference for functional, clean-label, and age-specific dairy snacks is propelling producers to innovate in formulations (e.g., low-lactose fortified milk for kids, high-calcium blends for seniors) and packaging formats

- Manufacturers are integrating micro-encapsulation technologies, precision fortification, and plant-based nutrient delivery systems to enhance nutrient bioavailability and meet regulatory/health claims.

- The rising focus on sustainable dairy practices, including reduced waste, regenerative agriculture and eco-packaging, also supports brand positioning of fortified dairy as premium yet responsible

- As consumer health consciousness and demand for personalized nutrition accelerate, the adoption of nutrient-rich, age-segmented, and functionally fortifed dairy products will remain a key market driver globally

What are the Key Drivers of Fortified Dairy Products Market?

- Rising prevalence of micronutrient deficiencies and chronic health issues (e.g., bone health, immunity, anemia) is a major driver; dairy offers an effective vehicle for enrichment

- Government policies and public-health campaigns promoting food fortification and nutritional labelling are supporting market uptake in both developed and emerging regions.

- Growing consumer demand for functional foods, including age-specific and lifestyle-oriented dairy variants (children, adults, seniors) is encouraging innovation and diversification.

- Expansion of modern retail, e-commerce, and urbanisation are improving availability and visibility of fortified dairy products, especially in emerging markets

- Technological advancements in nutrient delivery (micro-encapsulation, plant-based nutrients) and formulation are improving product appeal, stability and price-value equation

Which Factor is Challenging the Growth of the Fortified Dairy Products Market?

- High production and fortification costs (specialty ingredients, quality control, stability testing) increase product price and limit accessibility in value-sensitive markets

- Sensory and stability challenges of added nutrients (e.g., off-flavours, degradation under heat/light) hinder repeat purchase and product formulation

- Regulatory complexity and varying fortification standards across geographies create compliance burden and slow global rollout

- Consumer scepticism about “over-processed” fortified foods and preference for whole/clean-label options may limit adoption among certain segments.

- Competition from plant-based alternatives and non-dairy nutrition options pose substitution threats, especially among younger or lactose-intolerant consumers

How is the Fortified Dairy Products Market Segmented?

The market is segmented on the basis of product type, processing method type, age, micronutrient type and distribution channel.

- By Product Type

On the basis of product type, the fortified dairy products market is segmented into milk, yogurt, cheese, and others. The milk segment dominated the market with the largest revenue share of 47.9% in 2025, owing to its widespread consumption, affordability, and versatility as a nutrient delivery medium. Fortified milk enriched with vitamins A, D, and calcium continues to be the most accessible and effective option for addressing micronutrient deficiencies, particularly in developing economies. Increasing government-backed nutrition programs and consumer awareness about fortified milk’s health benefits are further boosting segment demand.

The yogurt segment is projected to register the fastest CAGR from 2026 to 2033, driven by rising popularity of probiotic-rich, fortified yogurts among health-conscious consumers. Innovation in flavors, textures, and low-fat formulations is expanding yogurt’s appeal as both a functional and convenient dairy snack globally.

- By Processing Method Type

On the basis of processing method type, the fortified dairy products market is categorized into ultra-heat treatment (UHT), pasteurization, spray drying, and heating. The UHT segment dominated the market with the largest revenue share of 42.3% in 2025, owing to its superior ability to extend shelf life while maintaining nutrient stability. UHT processing is increasingly adopted for fortified milk and cream-based beverages that require long-term storage without refrigeration. Moreover, its cost-effectiveness and suitability for large-scale distribution make it the preferred choice in emerging economies.

The spray drying segment is expected to grow at the fastest CAGR from 2026 to 2033, driven by the rising production of fortified milk powders, infant formulas, and nutritional supplements. This method ensures enhanced solubility and nutrient retention, catering to the expanding demand for shelf-stable and portable fortified dairy products.

- By Age

On the basis of age, the fortified dairy products market is segmented into kids, elderly, and others. The kids segment dominated the market with the largest revenue share of 49.1% in 2025, fueled by increasing awareness about childhood nutrition and the role of fortified dairy in supporting growth and immunity. Manufacturers are developing dairy products enriched with calcium, vitamin D, and omega-3 fatty acids specifically designed for children’s dietary needs. Government school milk programs and pediatric nutrition campaigns are further enhancing consumption levels in this segment.

The elderly segment is anticipated to register the fastest CAGR from 2026 to 2033, driven by growing concerns about bone health, muscle strength, and immunity among aging populations. Fortified yogurts and milk beverages containing probiotics, vitamin B12, and calcium are gaining traction as essential dietary supplements for seniors worldwide.

- By Micronutrient Type

On the basis of micronutrient type, the fortified dairy products market is segmented into vitamins, minerals, and others. The vitamins segment dominated the market with the largest revenue share of 53.6% in 2025, attributed to the increasing prevalence of vitamin deficiencies and consumer preference for vitamin-enriched dairy products such as milk and yogurt. Fortification with vitamins A, D, and B-complex is being widely adopted to enhance immunity and overall health, especially in regions with low sun exposure and poor dietary diversity.

The minerals segment is projected to record the fastest CAGR from 2026 to 2033, driven by the rising demand for calcium- and iron-fortified dairy products aimed at addressing anemia and osteoporosis. Continuous innovation in mineral stabilization and absorption technologies is further promoting the inclusion of minerals in functional dairy formulations.

- By Distribution Channel

On the basis of distribution channel, the fortified dairy products market is segmented into hypermarkets and supermarkets, conventional stores, online, and others. The hypermarkets and supermarkets segment dominated the market with the largest revenue share of 46.2% in 2025, owing to the wide availability of diverse fortified dairy brands, attractive promotional strategies, and enhanced product visibility. Consumers prefer these outlets for their convenience, product variety, and assurance of authenticity, especially in urban centers.

The online channel is anticipated to witness the fastest CAGR from 2026 to 2033, supported by the rapid growth of e-commerce platforms, digital grocery apps, and direct-to-consumer (D2C) delivery models. The increasing consumer shift toward home delivery and subscription-based dairy services is driving the expansion of online fortified dairy sales globally.

Which Region Holds the Largest Share of the Fortified Dairy Products Market?

- North America dominated the fortified dairy products market with the largest revenue share of 40.6% in 2025, driven by high consumer awareness regarding nutritional deficiencies, rising health-consciousness, and strong retail infrastructure for fortified food products. The region’s demand is supported by large-scale dairy consumption, widespread vitamin D fortification programs, and proactive government initiatives promoting nutritional wellness

- The region benefits from robust regulatory frameworks such as those set by the U.S. Food and Drug Administration (FDA) and Health Canada, which mandate fortification standards for essential micronutrients in dairy. These policies ensure consistent quality and consumer trust in fortified dairy offerings

- Continuous innovations in product formulation, including low-fat and lactose-free fortified variants, are further enhancing North America’s leadership in the global fortified dairy products market

U.S. Fortified Dairy Products Market Insight

The U.S. held the largest share in the North America Fortified Dairy Products market in 2025, primarily due to high per-capita dairy consumption and increasing adoption of functional food trends. Government-supported vitamin fortification programs, such as milk enriched with vitamin D and calcium, continue to boost market growth. Major players such as Danone and General Mills Inc. are investing in product innovation, launching fortified yogurts, cheeses, and milk alternatives to cater to diverse dietary needs. In addition, the growing prevalence of lifestyle-related health conditions, such as osteoporosis and vitamin D deficiency, has encouraged consumers to opt for fortified options, ensuring steady market expansion.

Canada Fortified Dairy Products Market Insight

Canada remains a major contributor within North America, supported by strict fortification mandates and increasing consumer preference for nutrient-enriched dairy products. The country’s Canadian Food Inspection Agency (CFIA) regulations require fortification of certain dairy categories, promoting widespread market adoption. Rising demand for organic and clean-label fortified products, coupled with the popularity of functional dairy beverages, is enhancing the country’s growth prospects. Canadian dairy producers such as Arla Foods amba and Saputo Inc. are emphasizing sustainability and micronutrient fortification to align with national health initiatives. Growing awareness about vitamin D deficiency due to limited sunlight exposure further strengthens Canada’s fortified dairy segment.

Asia-Pacific Fortified Dairy Products Market Insight

The Asia-Pacific region is projected to witness the fastest growth rate of 9.74% during 2026–2033, driven by rapid urbanization, rising disposable incomes, and increasing awareness about nutritional deficiencies. Expanding middle-class populations in China, India, Japan, and South Korea are contributing to higher consumption of nutrient-enriched dairy products. Governments across the region are actively supporting fortification programs to address malnutrition, such as India’s “Food Fortification Resource Centre” initiative. Global players including Nestlé and FrieslandCampina are expanding production facilities and local partnerships to meet regional demand. The combination of cost-effective manufacturing, evolving dietary habits, and growing retail penetration positions Asia-Pacific as a vital growth hub for fortified dairy products worldwide.

China Fortified Dairy Products Market Insight

China is emerging as a key player in the Asia-Pacific fortified dairy products market, supported by a strong domestic dairy industry and rising consumer focus on nutrition and immunity. The government’s promotion of fortified milk and yogurt under national health programs is accelerating adoption. Domestic brands such as Bright Dairy & Food Co. and China Modern Dairy Holdings Ltd. are investing in research and product innovation to meet the rising demand for calcium- and vitamin-enriched dairy. In addition, the increasing penetration of fortified infant and elderly nutrition products is propelling market expansion. China’s strategic emphasis on food security and fortified nutrition continues to strengthen its dominance in the region.

India Fortified Dairy Products Market Insight

India is witnessing robust growth in the Fortified Dairy Products market, driven by government-led nutrition initiatives such as “POSHAN Abhiyaan” and fortification guidelines by the Food Safety and Standards Authority of India (FSSAI). The growing middle-class population and rising demand for healthy, value-added dairy products are key factors driving expansion. Domestic players such as GCMMF (Amul) and Sarthak Exports are offering milk and yogurt fortified with vitamin A, D, and calcium to combat nutritional deficiencies. The country’s strong agricultural base, combined with an expanding organized dairy sector, provides a favorable environment for fortified dairy growth. Increasing awareness about child and maternal nutrition is also reinforcing market adoption in India.

Europe Fortified Dairy Products Market Insight

The Europe fortified dairy products market is expanding steadily, supported by strong regulatory backing, health-oriented consumer behavior, and growing innovation in dairy fortification. Countries such as Germany, France, and the U.K. are leading the shift toward fortified and functional dairy foods that align with the European Food Safety Authority (EFSA) standards. Rising demand for lactose-free, probiotic, and plant-based fortified alternatives is reshaping the regional market. Furthermore, increasing attention toward addressing vitamin D and calcium deficiencies, especially among elderly populations, is boosting demand. The region’s focus on sustainability and organic dairy fortification supports its position as a high-value market for fortified dairy innovations.

Germany Fortified Dairy Products Market Insight

Germany dominates the European fortified dairy products market due to its strong dairy processing infrastructure and commitment to nutritional fortification. German consumers are showing heightened interest in dairy products that promote bone and digestive health, such as fortified yogurts and milk drinks. Key market players are leveraging advancements in bioavailability and clean-label fortification techniques to meet evolving health and sustainability expectations. The nation’s alignment with EU fortification standards and investment in functional food research continues to make Germany a hub for fortified dairy innovation.

U.K. Fortified Dairy Products Market Insight

The U.K. market is experiencing solid growth, propelled by consumer demand for fortified dairy that supports immune and bone health. Post-Brexit regulatory flexibility allows local producers to innovate rapidly, introducing vitamin D–fortified milk, calcium-rich cheese, and probiotic yogurts. Increased public health campaigns addressing nutrient deficiencies and the expansion of fortified dairy options in supermarkets are key market drivers. Brands are focusing on premium, clean-label, and sustainable fortified dairy products to attract health-conscious consumers. The U.K.’s dynamic retail landscape and evolving nutritional policies are expected to sustain long-term market growth.

Which are the Top Companies in Fortified Dairy Products Market?

The fortified dairy products industry is primarily led by well-established companies, including:

- Arla Foods amba (Denmark)

- Danone (France)

- General Mills Inc. (U.S.)

- Dairy Farmers of America, Inc. (U.S.)

- Ace International LLP (India)

- SANCOR COOPERATIVAS UNIDAS LIMITADA (Argentina)

- FrieslandCampina (Netherlands)

- Guangming Dairy Dezhou Co. Ltd. (China)

- The Kraft Heinz Company (U.S.)

- Sarthak Exports (India)

- BASF SE (Germany)

- Fonterra Co-operative Group Limited (New Zealand)

- China Modern Dairy Holdings Ltd. (China)

- Bright Dairy & Food Co. (China)

- GCMMF (India)

- Nestlé (Switzerland)

What are the Recent Developments in Global Fortified Dairy Products Market?

- In January 2025, General Mills, Inc. finalized the sale of its yogurt business in Canada to Sodiaal, which includes the transfer of Canada-based operations of Yoplait and Liberté brands, along with a manufacturing facility in Saint-Hyacinthe, Québec. The company also revealed plans to divest its U.S. yogurt business to LACTALIS, pending regulatory approvals. This strategic move allows General Mills to streamline its portfolio and focus on core growth segments across key markets

- In November 2024, LACTALIS announced an investment of USD 55 million to enhance production capacity at its Tulare facility in the U.S., aimed at increasing the volume of Président Feta Cheese manufactured in the country. This investment reinforces LACTALIS’s commitment to expanding its footprint and meeting the rising demand for premium cheese products in the U.S. market

- In September 2024, Müller Group entered a collaboration with MyProtein to launch a new product range featuring high-protein yogurts and desserts, including low-fat puddings and low-fat mousses in vanilla, chocolate, and salted caramel flavors. This partnership aims to capitalize on the growing health and fitness trend by offering consumers nutritious, protein-enriched dairy options

- In July 2024, Yili Group, a leading Chinese dairy company, partnered with Xampla, a University of Cambridge spin-off, to implement microencapsulation technology that enhances the nutritional content and stability of heat-treated dairy beverages. This innovation underscores Yili’s focus on advancing product quality and maintaining leadership in sustainable dairy innovation

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Fortified Dairy Products Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Fortified Dairy Products Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Fortified Dairy Products Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.