Global Fortified Edible Oil Market

Market Size in USD Billion

CAGR :

%

USD

13.19 Billion

USD

17.64 Billion

2025

2033

USD

13.19 Billion

USD

17.64 Billion

2025

2033

| 2026 –2033 | |

| USD 13.19 Billion | |

| USD 17.64 Billion | |

|

|

|

|

Fortified Edible Oils Market Size

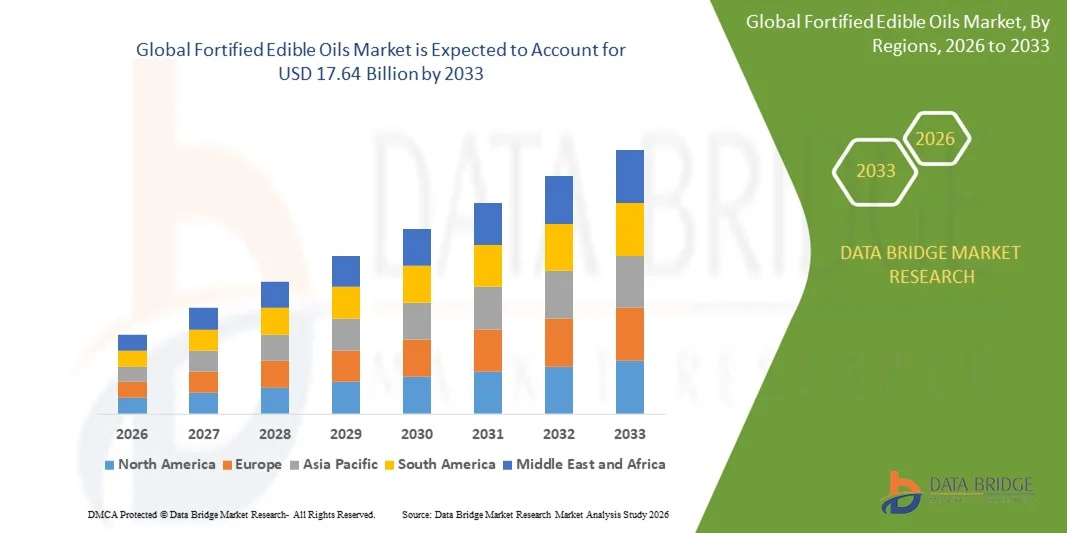

- The global fortified edible oils market size was valued at USD 13.19 billion in 2025 and is expected to reach USD 17.64 billion by 2033, at a CAGR of 3.70% during the forecast period

- The market growth is largely fuelled by the rising awareness of nutritional deficiencies and increasing consumer preference for health-enhancing food products

- Growing demand for fortified oils in processed and packaged foods, along with government initiatives to combat malnutrition, is further driving market expansion

Fortified Edible Oils Market Analysis

- The market is witnessing increasing adoption of fortified edible oils among health-conscious consumers and food manufacturers, focusing on vitamins A, D, and E enrichment

- Rising popularity of functional foods and fortified ingredients in bakery, confectionery, and ready-to-eat products is enhancing demand

- North America dominated the global fortified edible oils market with the largest revenue share of over 40% in 2025, driven by increasing health consciousness, consumer preference for nutrient‑enriched products, and well‑established fortification regulations

- Asia-Pacific region is expected to witness the highest growth rate in the global fortified edible oils market, driven by rapid urbanization, rising awareness of nutritional benefits, and expansion of modern retail and distribution networks

- The palm oil segment held the largest market revenue share in 2025, driven by its widespread usage in household and commercial cooking, affordability, and strong availability across both developed and emerging markets. Palm oil’s versatility in food processing and packaged products further supports its dominance

Report Scope and Fortified Edible Oils Market Segmentation

|

Attributes |

Fortified Edible Oils Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Fortified Edible Oils Market Trends

Rising Consumer Preference for Nutritionally Enhanced Edible Oils

- The growing consumer focus on health and nutrition is transforming the edible oils market by driving demand for fortified oils enriched with vitamins A, D, E, and other micronutrients. This trend is particularly strong among health-conscious and urban populations seeking functional food products, resulting in increased consumption and market expansion. Consumers are now actively seeking oils that not only serve culinary purposes but also support overall well-being, further strengthening the fortified oils segment

- Rising awareness of nutritional deficiencies, especially in developing countries, is accelerating the adoption of fortified edible oils in household and commercial cooking. Government nutrition programs, school feeding initiatives, and NGO-led campaigns are further supporting consumer education and product uptake. This has encouraged food manufacturers to integrate fortified oils in processed and packaged food offerings, broadening market reach

- The affordability and accessibility of fortified oils in packaged formats are making them attractive for daily consumption, enabling widespread adoption without significantly altering dietary habits. Consumers benefit from enhanced nutritional intake while maintaining convenience in cooking and food preparation. Retail expansion, including supermarkets, convenience stores, and online channels, is also making fortified oils increasingly available to a larger consumer base

- For instance, in 2023, several packaged food companies in India and Nigeria reported higher sales of fortified cooking oils after introducing vitamin-enriched variants targeted at urban and semi-urban households. This resulted in increased consumer awareness, stronger brand loyalty, and greater penetration of fortified oils into mainstream diets

- While fortified edible oils are gaining traction globally, continued innovation, effective marketing, and regulatory compliance are essential to sustain growth and ensure consistent consumer trust. Companies are investing in product differentiation, packaging improvements, and collaborations with health organizations to reinforce the perceived value and nutritional benefits of their offerings

Fortified Edible Oils Market Dynamics

Driver

Increasing Health Awareness and Government Initiatives to Combat Nutritional Deficiencies

- Rising prevalence of vitamin and mineral deficiencies is pushing governments and health organizations to promote fortified edible oils as a cost-effective solution to malnutrition. This has boosted adoption among households, food manufacturers, and institutional buyers. The push from public health authorities is also encouraging private companies to invest in fortified product portfolios, strengthening the overall market ecosystem

- Consumers are increasingly aware of the health benefits of micronutrient-enriched oils, driving higher demand in both developed and emerging economies. Urban populations are particularly inclined toward fortified products as part of a balanced diet. Growing media campaigns, influencer endorsements, and nutrition awareness programs are further supporting positive consumer perception

- Regulatory support, public health campaigns, and mandatory fortification programs in countries such as India, Nigeria, and Brazil are strengthening market infrastructure and encouraging widespread usage. These policies ensure consistent product standards, enhance consumer confidence, and create long-term growth opportunities for manufacturers and distributors

- For instance, in 2022, Nigeria implemented mandatory fortification of edible oils with vitamin A, resulting in higher procurement by manufacturers and increased consumer adoption. The initiative also helped local companies expand production, improve supply chains, and strengthen partnerships with retailers and food service providers

- While health awareness and government policies are driving the market, there is still a need to ensure consistent quality, proper labeling, and consumer education to sustain long-term growth. Continuous monitoring, technological upgrades, and transparent communication of nutritional benefits remain critical to maintain market momentum

Restraint/Challenge

High Cost of Fortification Technology and Limited Consumer Awareness in Rural Areas

- The high cost of fortification technology and specialized equipment for enriching oils makes it challenging for small-scale producers to participate in the market. This limits the availability of fortified oils in certain regions and increases dependency on larger manufacturers. Consequently, price-sensitive consumers in rural areas often continue using traditional oils without enrichment

- In many rural areas, limited awareness of the benefits of fortified oils and low purchasing power reduce adoption rates. Consumers often continue using traditional cooking oils without nutritional enhancements. Lack of targeted marketing campaigns and low engagement with local communities further restrict demand in these regions

- Supply chain inefficiencies, including storage, transportation, and distribution challenges, further restrict market penetration in remote locations. This results in inconsistent availability and higher prices for fortified oils. Seasonal supply fluctuations, inadequate cold storage, and fragmented logistics networks exacerbate the accessibility issue

- For instance, in 2023, several small towns in West Africa reported minimal sales of vitamin-enriched oils due to low awareness and limited distribution networks. Local distributors often face challenges in reaching remote consumers, while smaller retailers are reluctant to stock fortified variants due to uncertain demand

- While technological advances continue to improve production efficiency, addressing cost and awareness gaps is crucial. Market stakeholders must focus on scalable fortification solutions, consumer education campaigns, and improved rural distribution to unlock long-term growth potential. Partnerships with NGOs, government programs, and community-based initiatives can further expand market reach and encourage adoption

Fortified Edible Oils Market Scope

The market is segmented on the basis of type, micronutrient, and distribution channel.

- By Type

On the basis of type, the fortified edible oils market is segmented into Palm Oil, Soybean Oil, Sunflower Oil, Olive Oil, Corn Oil, Canola Oil, Rice Bran Oil, and Others. The palm oil segment held the largest market revenue share in 2025, driven by its widespread usage in household and commercial cooking, affordability, and strong availability across both developed and emerging markets. Palm oil’s versatility in food processing and packaged products further supports its dominance.

The soybean oil segment is expected to witness the fastest growth rate from 2026 to 2033, driven by its high nutritional value, increasing fortification with vitamins A, D, and E, and growing consumer preference for healthier cooking oils. Soybean oil is particularly popular among urban health-conscious consumers and food manufacturers focusing on fortified products.

- By Micronutrient

On the basis of micronutrient, the market is segmented into Vitamin A, Vitamin D, Vitamin E, and Others. The Vitamin A segment held the largest market revenue share in 2025, owing to mandatory fortification programs in several countries and high awareness of its benefits in combating vitamin A deficiency. Vitamin A-enriched oils are widely adopted in both household cooking and commercial food production.

The Vitamin E segment is expected to register the fastest growth from 2026 to 2033, driven by increasing consumer focus on antioxidant properties, cardiovascular health benefits, and rising incorporation into functional and fortified foods. Growing demand in health-conscious populations is fueling this trend.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into Hypermarkets/Supermarkets, B2B, E-Commerce, Specialty Retail, and Others. Hypermarkets and supermarkets dominated the market in 2025 due to their extensive reach, availability of multiple brands, and ability to provide packaged fortified oils with clear labeling. These channels are preferred by urban households for convenience and product variety.

E-commerce is expected to witness the fastest growth rate from 2026 to 2033, driven by increasing internet penetration, smartphone adoption, and the convenience of home delivery. Online platforms also provide opportunities for smaller and niche fortified oil brands to reach wider consumer bases efficiently.

Fortified Edible Oils Market Regional Analysis

- North America dominated the global fortified edible oils market with the largest revenue share of over 40% in 2025, driven by increasing health consciousness, consumer preference for nutrient‑enriched products, and well‑established fortification regulations

- Consumers in the region are increasingly seeking fortified edible oils that provide added vitamins and minerals, such as A, D, and E, to support overall nutrition and address micronutrient deficiencies

- High disposable incomes, advanced retail infrastructure, and awareness of functional foods further support the widespread adoption of fortified edible oils across households and institutional buyers

U.S. Fortified Edible Oils Market Insight

The U.S. fortified edible oils market captured the largest revenue share within North America in 2025, fueled by rising consumer awareness of health benefits, adoption of functional nutrition, and strong retail penetration. Consumers are increasingly incorporating fortified oils into daily diets, and innovative product offerings are encouraging continued market growth. Voluntary fortification practices, along with preventive health trends, are driving demand across both mainstream and premium segments.

Europe Fortified Edible Oils Market Insight

The Europe fortified edible oils market is expected to witness strong growth from 2026 to 2033, supported by regulatory emphasis on fortification and increasing consumer demand for healthier cooking oils. Consumers in the region prefer products that enhance nutritional intake while ensuring quality and sustainability. Market expansion is observed across traditional, organic, and specialty retail channels, with fortified oils being adopted in both households and institutional use.

U.K. Fortified Edible Oils Market Insight

The U.K. fortified edible oils market is expected to grow steadily from 2026 to 2033, driven by rising awareness of nutrition and preventive health care. Consumers are increasingly opting for fortified cooking oils to address micronutrient deficiencies and support healthy lifestyles. Well‑developed retail and e‑commerce infrastructure further facilitates market adoption and product accessibility.

Germany Fortified Edible Oils Market Insight

The Germany fortified edible oils market is projected to witness significant growth from 2026 to 2033, fueled by heightened interest in nutritionally enhanced food products and strict food safety standards. Innovative fortified oil offerings that align with health and wellness trends are gaining popularity. Adoption is supported by high consumer awareness regarding healthy dietary practices and preference for preventive nutrition.

Asia-Pacific Fortified Edible Oils Market Insight

The Asia-Pacific fortified edible oils market is expected to witness the fastest growth rate from 2026 to 2033, driven by rising health awareness, government-mandated fortification programs, and increasing disposable incomes in countries such as India and China. Prevalence of micronutrient deficiencies, rapid urbanization, and expanding distribution networks are further accelerating market adoption across households and commercial segments.

Japan Fortified Edible Oils Market Insight

The Japan fortified edible oils market is expected to record strong growth from 2026 to 2033 due to high focus on health and nutrition, urbanization, and preference for functional foods. Consumers emphasize dietary quality and convenience, driving adoption of fortified oils that integrate easily into everyday cooking. The aging population further supports demand for products with enhanced nutritional benefits.

China Fortified Edible Oils Market Insight

The China fortified edible oils market accounted for the largest revenue share in Asia-Pacific in 2025, driven by rising middle-class incomes, increasing health awareness, and government initiatives promoting food fortification. Growing preference for fortified oils as part of a healthy diet, along with expanding retail and e-commerce channels, is boosting market growth across residential and commercial sectors.

Fortified Edible Oils Market Share

The Fortified Edible Oils industry is primarily led by well-established companies, including:

- Bunge Limited (U.S.)

- ADM (U.S.)

- Cargill, Incorporated (U.S.)

- Conagra Brands, Inc (U.S.)

- BORGES INTERNATIONAL GROUP, S.L (Spain)

- Allanasons Pvt Ltd (India)

- Liberty (South Africa)

- King Rice Oil Group (India)

- Samarth Oil (India)

- Adani Group (India)

- Lam Soon Group (Malaysia)

- Tata Trusts (India)

- BASF SE (Germany)

- Aveno NV (Belgium)

- Adams Group (U.K.)

- Marico (India)

- COFCO International (China)

- Emami Agrotech Ltd. (India)

- Fytel (India)

Latest Developments in Global Fortified Edible Oils Market

- In July 2025, India Gate Foods launched a new product, India Gate Uplife Gut Pro Oil, as part of its Uplife wellness range. The cooking oil is fortified with Pro Digest, containing natural antioxidants and anti-inflammatory properties to aid digestion. This launch was based on consumer research and functional benefits to differentiate the brand. The product is expected to strengthen India Gate’s position in the fortified oil segment and attract health-conscious consumers

- In December 2023, EC Organic Products Ltd, a subsidiary of East Coast Group, introduced ECORGANIC, an organic fortified sunflower oil in Bangladesh. The oil is enriched with vitamins E, A, and phytosterols and is available in 1-litre, 3-litre, and 5-litre PET bottles, as well as 5-litre tin cans. This launch enhances the company’s presence in the organic and fortified oils market, catering to nutrition-focused consumers

- In December 2023, Fly Ace Corporation launched Jolly Prito King Vegetable Oil in the Philippines. Fortified with Vitamin A, the product is available in 900ml and 1.8L stand-up pouches and 16kg tin cans, complying with safety and quality standards. This development aims to expand Fly Ace’s market share in the fortified edible oils segment while promoting improved nutritional intake among consumers

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Fortified Edible Oil Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Fortified Edible Oil Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Fortified Edible Oil Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.