Global Fortified Rice Market

Market Size in USD Billion

CAGR :

%

USD

38.35 Billion

USD

63.47 Billion

2025

2033

USD

38.35 Billion

USD

63.47 Billion

2025

2033

| 2026 –2033 | |

| USD 38.35 Billion | |

| USD 63.47 Billion | |

|

|

|

|

Fortified Rice Market Size

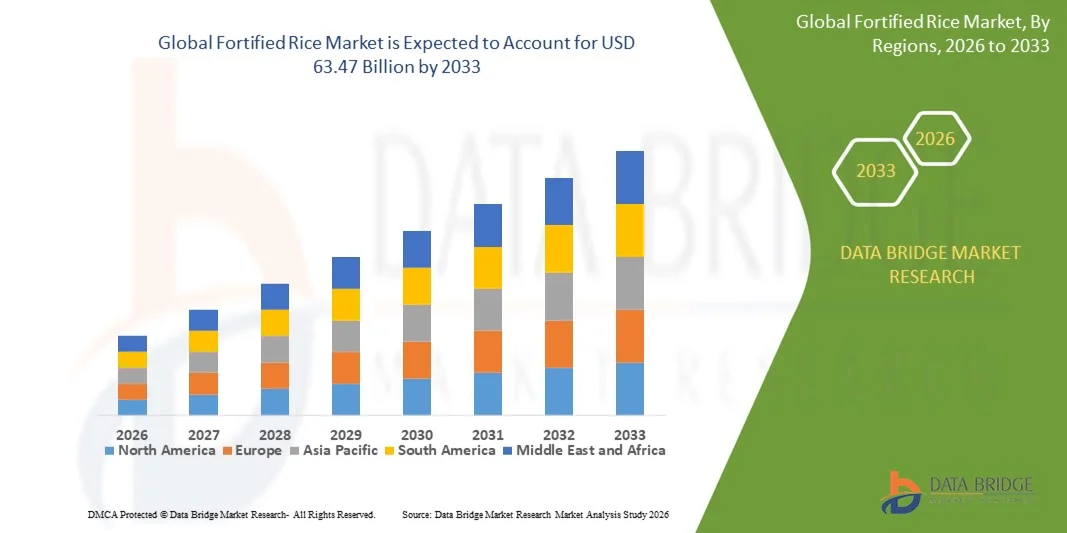

- The global fortified rice market size was valued at USD 38.35 billion in 2025 and is expected to reach USD 63.47 billion by 2033, at a CAGR of 6.5% during the forecast period

- The market growth is largely fueled by increasing government mandates and public nutrition programs aimed at addressing widespread micronutrient deficiencies, particularly anemia and malnutrition, across both developing and emerging economies

- Furthermore, rising awareness of preventive nutrition, growing emphasis on food security, and expanding collaboration between governments, NGOs, and food processors are accelerating large-scale adoption of fortified rice, thereby significantly boosting overall market growth

Fortified Rice Market Analysis

- Fortified rice, enhanced with essential vitamins and minerals, is increasingly recognized as a critical staple intervention for improving population-level nutrition due to its affordability, scalability, and seamless integration into existing rice consumption patterns across residential and institutional settings

- The escalating demand for fortified rice is primarily driven by nationwide fortification policies, rising health consciousness among consumers, and growing reliance on fortified staples within public distribution systems and welfare schemes

- Asia-Pacific dominated the fortified rice market with a share of 58.46% in 2025, due to large-scale government nutrition programs, high prevalence of micronutrient deficiencies, and widespread rice consumption as a staple food

- North America is expected to be the fastest growing region in the fortified rice market during the forecast period due to rising demand for functional foods and increasing awareness of micronutrient deficiencies

- Vitamins segment dominated the market with a market share of 56.5% in 2025, due to widespread government-led fortification programs focusing on vitamin A, B-complex, and folic acid to address large-scale micronutrient deficiencies. Vitamins are widely preferred due to their proven role in reducing anemia, improving immunity, and supporting child and maternal health outcomes. Their ease of blending with rice kernels and stability during cooking further strengthens adoption across public distribution systems. Strong policy backing and inclusion in national nutrition schemes continue to reinforce the dominance of vitamin-fortified rice

Report Scope and Fortified Rice Market Segmentation

|

Attributes |

Fortified Rice Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Fortified Rice Market Trends

Expanding Government-Led Mandatory Rice Fortification Programs

- A significant trend in the fortified rice market is the expansion of government-led mandatory fortification programs aimed at addressing large-scale micronutrient deficiencies and improving public health outcomes. These programs are strengthening the role of fortified rice as a core nutritional intervention, particularly in regions where rice is a primary staple food and malnutrition levels remain high

- For instance, the Government of India has mandated fortified rice distribution through the Public Distribution System, Mid-Day Meal Scheme, and Integrated Child Development Services, creating sustained demand for fortified rice kernels supplied by companies such as LT Foods and VSR Foods. This initiative has accelerated large-scale adoption and standardized fortified rice consumption across multiple population segments

- Several developing economies are aligning national food security strategies with global nutrition goals set by organizations such as the World Food Programme and UNICEF. This alignment is reinforcing fortified rice as a long-term solution for addressing anemia and vitamin deficiencies at a population level

- The trend is also encouraging modernization within rice milling and processing facilities to meet fortification standards and quality benchmarks. Manufacturers are increasingly investing in technology upgrades to comply with regulatory requirements and ensure consistent nutrient delivery

- Public-private partnerships are expanding as governments collaborate with rice millers, technology providers, and NGOs to scale fortified rice production efficiently. These collaborations are improving supply chain reliability and enhancing market penetration

- The continued expansion of mandatory fortification initiatives is positioning fortified rice as an essential component of national nutrition frameworks. This trend is reinforcing steady market growth and long-term demand visibility across both public and institutional channels

Fortified Rice Market Dynamics

Driver

Rising Prevalence of Micronutrient Deficiencies and Malnutrition

- The rising prevalence of micronutrient deficiencies and malnutrition is a key driver fueling growth in the fortified rice market, as governments and health organizations seek scalable and cost-effective nutritional interventions. Fortified rice offers an efficient method to deliver essential vitamins and minerals through daily diets without requiring major changes in consumption behavior

- For instance, the World Food Programme actively supports fortified rice distribution across Asia and Africa to combat iron-deficiency anemia and vitamin deficiencies, collaborating with local rice millers and suppliers. These programs are increasing institutional demand and driving consistent procurement volumes

- High rates of anemia among women and children in countries such as India and Bangladesh are accelerating policy focus on fortified staples rather than supplements alone. This shift is strengthening reliance on fortified rice as a preventive nutrition tool

- Healthcare authorities are increasingly recognizing fortified rice as a sustainable solution for improving long-term health indicators, particularly in low-income and food-insecure populations. This recognition is translating into sustained funding and regulatory support

- The persistent burden of micronutrient deficiencies is therefore acting as a strong structural driver, ensuring steady expansion of the fortified rice market over the forecast period

Restraint/Challenge

High Implementation and Compliance Costs for Small Rice Millers

- The fortified rice market faces challenges due to the high implementation and compliance costs associated with fortification requirements, particularly for small and medium-sized rice millers. Fortification demands investments in extrusion equipment, blending systems, quality testing, and regulatory compliance, which can strain limited financial resources

- For instance, small-scale rice millers in India have faced difficulties upgrading facilities to meet fortified rice standards set by the Food Safety and Standards Authority of India, leading to slower adoption among unorganized players. These cost barriers can limit participation and create supply-side disparities

- Maintaining consistent micronutrient levels requires regular monitoring, skilled technical personnel, and adherence to strict quality protocols. These operational demands increase overhead costs and complexity for smaller producers

- The challenge is further compounded by fluctuating input costs and limited access to financing for equipment upgrades. Small millers often struggle to balance compliance with profitability under competitive pricing pressures

- As a result, market consolidation is gradually increasing, with larger organized players better positioned to absorb compliance costs. This challenge continues to restrict uniform adoption across the supply chain and places pressure on policymakers to provide financial and technical support mechanisms

Fortified Rice Market Scope

The market is segmented on the basis of micronutrient, technology, end users, and distribution channel.

- By Micronutrient

On the basis of micronutrient, the fortified rice market is segmented into minerals, vitamins, and others. The vitamins segment dominated the market with the largest revenue share of 56.5% in 2025, driven by widespread government-led fortification programs focusing on vitamin A, B-complex, and folic acid to address large-scale micronutrient deficiencies. Vitamins are widely preferred due to their proven role in reducing anemia, improving immunity, and supporting child and maternal health outcomes. Their ease of blending with rice kernels and stability during cooking further strengthens adoption across public distribution systems. Strong policy backing and inclusion in national nutrition schemes continue to reinforce the dominance of vitamin-fortified rice.

The minerals segment is expected to witness the fastest growth from 2026 to 2033, supported by rising emphasis on iron and zinc fortification to combat iron-deficiency anemia. Increasing clinical evidence linking mineral fortification with improved cognitive and physical development is accelerating uptake. Food processors are investing in advanced formulations to improve bioavailability without altering taste or appearance. Growing awareness among urban consumers and nutrition-focused organizations is also driving rapid expansion of mineral-fortified rice.

- By Technology

On the basis of technology, the fortified rice market is segmented into drying, extrusion, coating technology and encapsulation, and others. The extrusion segment dominated the market in 2025, owing to its ability to uniformly incorporate multiple micronutrients while maintaining rice-like texture and appearance. Extrusion technology offers high nutrient retention and consistency, making it the preferred choice for large-scale fortification initiatives. Its compatibility with mass production and cost efficiency supports extensive adoption by government suppliers and large food manufacturers. The technology’s proven performance across diverse cooking conditions further strengthens its leading position.

The coating technology and encapsulation segment is projected to grow at the fastest rate during the forecast period, driven by advancements in microencapsulation that enhance nutrient stability and shelf life. This technology minimizes nutrient loss during washing and cooking, addressing a key consumer concern. Increasing demand for premium fortified rice with higher efficacy is encouraging manufacturers to adopt coating-based solutions. Continuous innovation in encapsulation materials is expected to accelerate this segment’s growth.

- By End Users

On the basis of end users, the fortified rice market is segmented into commercial and residential. The commercial segment accounted for the largest market share in 2025, supported by bulk procurement from governments, schools, hospitals, and welfare institutions. Public food distribution systems and mid-day meal programs rely heavily on fortified rice to improve nutritional intake at scale. Commercial buyers prioritize standardized quality, regulatory compliance, and cost efficiency, which favors large-volume fortified rice supply. Long-term supply contracts and institutional demand continue to sustain this segment’s dominance.

The residential segment is anticipated to register the fastest growth from 2026 to 2033, driven by rising consumer awareness of hidden hunger and preventive nutrition. Urban households are increasingly opting for fortified staples as part of daily diets to improve overall health outcomes. Improved packaging, branding, and availability through modern retail channels are enhancing household adoption. Growing health consciousness and willingness to pay for nutritional benefits are accelerating residential demand.

- By Distribution Channel

On the basis of distribution channel, the fortified rice market is segmented into convenience stores, modern trade, drug store, departmental stores, online stores, and others. The modern trade segment dominated the market in 2025, driven by strong presence of supermarkets and hypermarkets offering a wide range of fortified rice brands. These outlets provide better product visibility, quality assurance, and consumer education through labeling and in-store promotions. Established supply chains and partnerships with leading food manufacturers further support high sales volumes. Consumers’ trust in organized retail continues to reinforce this channel’s leadership.

The online stores segment is expected to witness the fastest growth over the forecast period, supported by rapid digitalization and changing purchasing behavior. E-commerce platforms offer convenience, subscription models, and access to niche fortified rice variants. Detailed product information and nutritional transparency are influencing informed buying decisions. Expanding internet penetration and growth of direct-to-consumer strategies are accelerating online channel adoption.

Fortified Rice Market Regional Analysis

- Asia-Pacific dominated the fortified rice market with the largest revenue share of 58.46% in 2025, driven by large-scale government nutrition programs, high prevalence of micronutrient deficiencies, and widespread rice consumption as a staple food

- The region’s strong public distribution systems, increasing investments in food fortification infrastructure, and collaboration with international nutrition agencies are accelerating market penetration

- Rising population, supportive regulatory frameworks, and growing focus on food security across developing economies are contributing to sustained demand for fortified rice

China Fortified Rice Market Insight

China held the largest share in the Asia-Pacific fortified rice market in 2025, supported by its extensive food processing industry and strong government emphasis on improving population-level nutrition. National policies promoting fortified staples, combined with large-scale production capabilities, are driving adoption. Continuous investments in food quality standards and technology upgrades further support market growth.

India Fortified Rice Market Insight

India is witnessing the fastest growth in the Asia-Pacific region, fueled by nationwide fortification mandates under public distribution and mid-day meal schemes. Government initiatives targeting anemia and malnutrition, along with partnerships with private rice millers, are significantly boosting demand. Increasing awareness of nutritional security and expanding rural outreach programs are strengthening market expansion.

Europe Fortified Rice Market Insight

The Europe fortified rice market is expanding steadily, supported by rising consumer awareness of preventive nutrition and increasing demand for functional food products. The region’s strong regulatory focus on food safety, labeling, and quality standards is encouraging adoption of fortified staples. Growth is further supported by demand from health-conscious and aging populations.

Germany Fortified Rice Market Insight

Germany’s fortified rice market is driven by its well-developed food and beverage industry and strong emphasis on nutritional innovation. The country’s focus on research-backed fortification, clean-label products, and compliance with stringent food regulations supports consistent demand. Fortified rice is gaining traction within health-oriented retail and institutional food segments.

U.K. Fortified Rice Market Insight

The U.K. market is supported by increasing adoption of fortified and functional foods, along with government and non-government initiatives addressing nutritional gaps. Growing consumer preference for health-enhancing staples and strong presence of organized retail are aiding market development. The emphasis on transparency and nutritional labeling further supports fortified rice uptake.

North America Fortified Rice Market Insight

North America is projected to grow at the fastest CAGR from 2026 to 2033, driven by rising demand for functional foods and increasing awareness of micronutrient deficiencies. Strong purchasing power, evolving dietary habits, and expansion of fortified food offerings are key growth drivers. The region’s focus on preventive healthcare and wellness-oriented diets is accelerating adoption.

U.S. Fortified Rice Market Insight

The U.S. accounted for the largest share in the North America market in 2025, underpinned by high consumer awareness, advanced food processing capabilities, and strong distribution networks. Demand is supported by the growing popularity of fortified and enriched food products across retail and institutional channels. Ongoing innovation and emphasis on nutritional enhancement continue to reinforce the U.S.’s leading position.

Fortified Rice Market Share

The fortified rice industry is primarily led by well-established companies, including:

- Dalberg Group (Switzerland)

- Bunge Limited (U.S.)

- Cargill, Incorporated (U.S.)

- VSR Foods (India)

- DSM (Netherlands)

- LT Foods (India)

- EstracoKft (Hungary)

- The Rice ’n Spice International Ltd (U.K.)

- East End Foods Ltd (U.K.)

- FOODS GROUP LIMITED (India)

- Mars, Incorporated (U.S.)

- Goalzy (U.K.)

- JVS Foods Pvt Ltd (India)

- Loften India Private Limited (India)

- BASF SE (Germany)

- Christy Friedgram Industry (India)

Latest Developments in Global Fortified Rice Market

- In June 2025, Jindal Rice Mills strengthened competition in the fortified rice market by launching its new consumer brand Nourifyme, offering fortified rice variants including Basmati along with fortified wheat flour, while Anand Agro Industries simultaneously introduced White Spoon Fortified Basmati Rice. These launches signal a clear shift toward branded, value-added fortified staples, expanding consumer access beyond government channels and intensifying brand-led differentiation in the market

- In April 2025, Shyamatara Rice Mills expanded its product portfolio with the launch of Bengal Crown Fortified Rice, targeting nutritional improvement across West Bengal. This development reinforces the role of regional rice millers in supporting public health objectives while increasing localized penetration of fortified rice in high-consumption markets

- In November 2024, ACI Foods Limited, under its ACI Pure brand, introduced Bangladesh’s first fortified rice, marking a major milestone for the country’s food fortification landscape. This launch is accelerating market formalization, encouraging regulatory support, and setting a benchmark for other food processors in emerging South Asian markets

- In January 2024, the Government of India accelerated nationwide adoption by scaling up mandatory fortified rice distribution across public distribution systems, mid-day meal schemes, and integrated child development services. This policy-driven rollout significantly expanded volume demand, ensured long-term market stability, and positioned India as a key growth engine for the global fortified rice market

- In September 2023, Bühler Group partnered with multiple Asian rice millers to deploy advanced extrusion technology for fortified rice kernel production. This development improved production efficiency, nutrient retention, and scalability, enabling manufacturers to meet rising regulatory and institutional demand while enhancing overall market capacity

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Fortified Rice Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Fortified Rice Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Fortified Rice Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.