Global Fortified Snacks Market

Market Size in USD Billion

CAGR :

%

USD

77.43 Billion

USD

139.14 Billion

2025

2033

USD

77.43 Billion

USD

139.14 Billion

2025

2033

| 2026 –2033 | |

| USD 77.43 Billion | |

| USD 139.14 Billion | |

|

|

|

|

Fortified Snacks Market Size

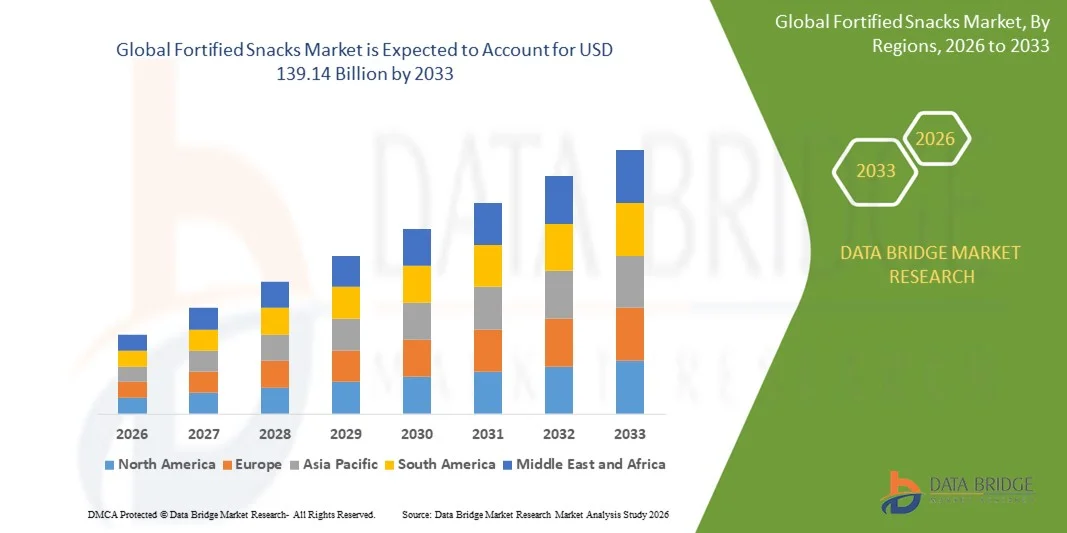

- The global fortified snacks market size was valued at USD 77.43 billion in 2025 and is expected to reach USD 139.14 billion by 2033, at a CAGR of 7.60% during the forecast period

- The fortified snacks market growth is largely fueled by rising health consciousness, increasing awareness of micronutrient deficiencies, and the growing shift toward convenient nutrition-focused snacking options across both developed and emerging regions

- Furthermore, the rapid expansion of fortified product portfolios by leading food manufacturers and rising consumer preference for nutrient-dense, ready-to-eat snack formats are accelerating product adoption. These converging factors are strengthening the demand for fortified snacks and significantly boosting overall market expansion

Fortified Snacks Market Analysis

- Fortified snacks, enriched with vitamins, minerals, proteins, or other essential nutrients, are becoming an integral part of modern dietary patterns as consumers prioritize convenience paired with measurable health benefits. Their rising adoption across all age groups reflects the increasing shift toward functional foods that support immunity, energy, and overall wellness

- The growing demand for fortified snacks is primarily driven by expanding preventive nutrition trends, rising penetration of fortified bakery, dairy, and cereal-based snack formats, and increasing manufacturer investments in nutrient enhancement technologies. This shifting preference toward healthier snacking continues to propel strong and sustained growth in the fortified snacks market

- Asia-Pacific dominated the fortified snacks market with a share of over 43% in 2025, due to strong demand for nutrient-enriched packaged foods, rising health awareness, and widespread adoption of fortified ready-to-eat products across emerging economies

- North America is expected to be the fastest growing region in the fortified snacks market during the forecast period due to increasing demand for functional and clean-label snacks, strong adoption of fortified high-protein and micronutrient-rich snack formats, and rising investment in innovative snack fortification technologies

- Vitamins segment dominated the market with a market share of 47% in 2025, due to widespread use of vitamin A, B-complex, D, and E fortification in snacks targeted at boosting immunity and addressing micronutrient deficiencies. Vitamin-fortified snacks are preferred by both manufacturers and consumers due to their proven health benefits, ease of incorporation, and strong alignment with clean-label and wellness-oriented consumption trends. Expanding awareness of preventive nutrition further fuels the dominance of this segment

Report Scope and Fortified Snacks Market Segmentation

|

Attributes |

Fortified Snacks Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Fortified Snacks Market Trends

Rising Demand for Nutrient-Dense Convenience Snacks

- The primary trend in the fortified snacks market is the rapid consumer shift towards products that offer both convenience and enhanced nutritional value, moving away from merely indulgent snacking. This is fueled by increasingly busy lifestyles globally, where consumers require quick, on-the-go options that contribute positively to their daily micronutrient and macronutrient intake

- For instance, KIND Snacks, a prominent player, consistently launches snack bars fortified with high levels of protein and fiber, in addition to using whole ingredients such as nuts and seeds. The company leverages this fortification to position its products as a genuinely healthy alternative to traditional candy or energy bars

- A significant movement is the broadening spectrum of fortifying ingredients, extending well beyond basic vitamins and minerals to include functional components such as probiotics, prebiotics, and adaptogens. These specialized inclusions cater to consumers seeking snacks that offer targeted health benefits, such as improved gut health or stress reduction

- There is a growing consumer preference for snacks that support specific dietary regimes such as high-protein, ketogenic, or gluten-free, with fortification being a key differentiator in these niches. Manufacturers are responding by fortifying products such as savory chips, cookies, and trail mixes with plant-based protein or essential fatty acids to meet these precise demands

- The market is observing a trend of clean-label and transparency in fortification, as consumers are becoming more discerning about the origin and type of nutrients added to their food. This requires manufacturers to use naturally derived fortifying agents such as extracts from fruits and vegetables, and to clearly communicate the source of these nutrients on their packaging

- Ultimately, the confluence of increased health awareness and the need for quick, accessible food solutions is establishing fortified snacks as a mainstream category within the broader food industry. This sustained demand is driving continuous product innovation across various formats, including bars, chips, and extruded products, all designed to deliver targeted nutrition in a convenient and appealing package

Fortified Snacks Market Dynamics

Driver

Increasing Focus on Preventive Nutrition and Micronutrient Intake

- The escalating consumer focus on preventive healthcare and the proactive management of individual health is a powerful driver for the fortified snacks market. Consumers are consciously seeking food products that can help bridge nutritional gaps, such as deficiencies in Vitamin D, Vitamin B12, or Iron, recognizing the role of these nutrients in boosting immunity and overall well-being

- For instance, the Kellogg Company, through brands such as Special K, strategically fortifies its snack offerings with essential vitamins, including Folic Acid and Iron, directly targeting the micronutrient deficiencies prevalent among specific consumer demographics such as women and adolescents. Such focused fortification drives consumption by transforming a snack from an indulgence into a perceived health necessity

- Government and non-governmental initiatives promoting food fortification as a public health strategy also play a crucial role in expanding the market by raising consumer awareness and standardizing the practice. These campaigns often normalize the consumption of fortified products and increase the general acceptance of such snacks as part of a balanced diet

- The growing understanding of the macro-level benefits of protein and fiber in diet, especially for sustained energy and satiety, is encouraging a strong preference for snacks fortified with these macronutrients. This desire for higher-value calories is leading consumers to opt for fortified options such as protein bars or fiber-rich nut mixes instead of conventional, low-nutrient snacks

- The fundamental shift in dietary habits, where traditional meal structures are often replaced by frequent, smaller snack-based eating occasions, transforms snacks into vital delivery vehicles for essential nutrients. This lifestyle change positions fortified snacks perfectly to capitalize on the desire to maintain nutritional quality throughout a demanding daily schedule

Restraint/Challenge

High Production Costs Associated with Fortification Processes

- The primary challenge facing the fortified snacks market is the substantially high cost associated with the procurement of premium-grade fortifying agents, as well as the specialized production processes required for their stable incorporation into the snack matrix. Ingredients such as microencapsulated vitamins, high-quality whey protein isolates, or organic botanicals often carry a premium price tag compared to standard ingredients

- For instance, companies face pressure to invest heavily in sophisticated technologies such as microencapsulation to protect sensitive nutrients such as Omega-3 fatty acids from degradation due to heat or light during the manufacturing and storage processes. This necessary investment, which adds significant cost to the production line, can make the final fortified snack product less price-competitive than its conventional, unfortified counterparts

- Regulatory complexities and varying standards across different geographies pose a significant challenge for companies looking to operate on a global scale. Navigating the specific fortification mandates, permissible nutrient levels, and labeling requirements in multiple countries necessitates costly compliance efforts and often requires distinct product reformulations for each region

- A persistent issue involves the potential negative impact of fortification on the sensory profile of the snack, particularly its taste and texture. High concentrations of certain fortifying nutrients, such as mineral salts or specific vitamins, can introduce off-flavors or alter the mouthfeel, requiring substantial and expensive research and development to mask or mitigate these unwanted effects

- Ultimately, these factors—namely the high cost of specialized ingredients, complex technological requirements, and the need for extensive R&D to ensure sensory acceptance—contribute to a higher final price point for the consumer, thereby acting as a barrier to mass-market adoption of fortified snacks, especially in price-sensitive developing economies

Fortified Snacks Market Scope

The market is segmented on the basis of technology, raw material, micronutrients, and distribution channel.

- By Technology

On the basis of technology, the fortified snacks market is segmented into drying, extrusion, coating and encapsulation, and others. The drying segment dominated the market in 2025 due to its suitability for retaining nutrient stability and extending shelf life, which is essential for fortified fruit-based and cereal-based snacks. Manufacturers prefer drying technologies because they allow gentle moisture removal while maintaining the potency of added micronutrients, ensuring high consumer acceptance. The cost-effectiveness and scalability of drying techniques further support their strong adoption among large-scale processors supplying both domestic and export markets.

The extrusion segment is expected to witness the fastest growth rate from 2026 to 2033 due to its increasing use in producing fortified cereal puffs, protein snacks, and grain-based extrudates. Extrusion enables precise control over nutrient incorporation, making it ideal for developing high-fiber, high-protein, and micronutrient-rich snack formats targeted at health-conscious consumers. Its versatility in shaping and texturizing products drives rapid adoption among manufacturers introducing innovative fortified snack varieties to meet evolving dietary preferences.

- By Raw Material

On the basis of raw material, the fortified snacks market is segmented into flours, salt, milk, oil, and sugar. The flours segment dominated the market in 2025 due to its extensive use in producing baked, extruded, and fried fortified snacks across global regions. Flour-based matrices support uniform dispersion of micronutrients, making them ideal for developing energy-dense nutrient-enriched snacks consumed by both children and adults. Strong consumption of grain-based foods and rising demand for healthier flour blends, such as multigrain and protein-rich options, further strengthened its market share.

The milk segment is expected to witness the fastest growth rate from 2026 to 2033 due to rising consumer preference for dairy-based fortified snacks rich in calcium, proteins, and essential vitamins. Milk serves as a superior raw material for developing nutrient-dense bars, puffs, and ready-to-eat snacks that appeal to health-driven and functional-food consumers. Growing adoption of milk powders and whey derivatives in fortified formulations supports rapid innovation in this category, accelerating its future demand.

- By Micronutrients

On the basis of micronutrients, the fortified snacks market is segmented into vitamins, minerals, and others. The vitamins segment dominated the market with the largest share of 47% in 2025 owing to widespread use of vitamin A, B-complex, D, and E fortification in snacks targeted at boosting immunity and addressing micronutrient deficiencies. Vitamin-fortified snacks are preferred by both manufacturers and consumers due to their proven health benefits, ease of incorporation, and strong alignment with clean-label and wellness-oriented consumption trends. Expanding awareness of preventive nutrition further fuels the dominance of this segment.

The minerals segment is anticipated to experience the fastest CAGR from 2026 to 2033 driven by the rising inclusion of iron, zinc, calcium, and magnesium in snacks designed for children, pregnant women, and working-age populations. Mineral fortification supports targeted health outcomes such as bone strength, cognitive development, and anemia reduction, making it increasingly important for functional snack innovations. Improving fortification technologies that reduce mineral taste interactions also enhance consumer acceptance, accelerating segment growth.

- By Distribution Channel

On the basis of distribution channel, the fortified snacks market is segmented into modern trade, online sales, neighbourhood stores, and others. The modern trade segment dominated the market in 2025 due to its broad product visibility, strong merchandising support, and consumer preference for curated health and wellness aisles. Supermarkets and hypermarkets play a major role in promoting fortified snack brands by offering product comparisons, promotions, and bundled health-oriented assortments, driving high-volume sales. Growing retail penetration across urban regions further supports segment leadership.

The online sales segment is projected to record the fastest growth from 2026 to 2033 due to rising digital adoption, convenience-driven shopping, and rapid expansion of health-focused e-commerce platforms. Online channels enable easy access to a wide variety of fortified snacks, subscription-based healthy snack packs, and personalized recommendations, which appeal strongly to busy urban consumers. Increasing influencer-led awareness and digital marketing accelerates product discovery, contributing to robust segment growth.

Fortified Snacks Market Regional Analysis

- Asia-Pacific dominated the fortified snacks market with the largest revenue share of over 43% in 2025, driven by strong demand for nutrient-enriched packaged foods, rising health awareness, and widespread adoption of fortified ready-to-eat products across emerging economies

- The region’s expanding food processing sector and increasing penetration of global nutrition brands are strengthening market performance

- Growing consumption of value-added snacks among young and urban populations continues to accelerate fortified snacks adoption in Asia-Pacific

China Fortified Snacks Market Insight

China held the largest share of the Asia-Pacific fortified snacks market in 2025 due to its extensive packaged food consumption base, rapid expansion of fortified dairy and cereal snack categories, and strong manufacturing capacity. The country’s growing focus on preventive nutrition, government support for micronutrient enrichment, and rising demand for premium fortified snacks reinforce China’s leadership in the region.

India Fortified Snacks Market Insight

India is witnessing the fastest growth in the Asia-Pacific region, driven by rising awareness of micronutrient deficiency, growing urban consumption of healthy packaged snacks, and expanding domestic production capabilities. Increasing investments by food manufacturers in vitamin- and mineral-fortified snack lines, along with government emphasis on nutrition programs, further accelerate India’s market growth.

Europe Fortified Snacks Market Insight

Europe is expanding steadily in the fortified snacks market, supported by high consumer preference for clean-label and functional foods, strong innovation in nutrient-rich snack formulations, and widespread adoption of fortified bakery and cereal snacks. The region’s advanced food processing infrastructure and focus on health-centric products continue to strengthen market growth across major European economies.

Germany Fortified Snacks Market Insight

Germany’s fortified snacks market benefits from high demand for functional, vitamin-enriched snacks, strong consumer inclination toward premium nutrition products, and extensive R&D activity among domestic food manufacturers. The country’s focus on healthy snacking habits, robust retail distribution, and innovation in fortified cereal, dairy, and protein snacks reinforces Germany’s role as a key market in Europe.

U.K. Fortified Snacks Market Insight

The U.K. market is supported by rising consumer preference for nutrient-fortified snack bars, high-fiber biscuits, and enriched ready-to-eat snacks, along with a strong retail ecosystem promoting functional food brands. Continuous development of fortified plant-based snack innovations and rising health-focused purchasing trends help strengthen the U.K.’s market position.

North America Fortified Snacks Market Insight

North America is projected to grow at the fastest CAGR from 2026 to 2033 due to increasing demand for functional and clean-label snacks, strong adoption of fortified high-protein and micronutrient-rich snack formats, and rising investment in innovative snack fortification technologies. The region’s focus on preventive health and widespread acceptance of premium healthy snacks support rapid market expansion.

U.S. Fortified Snacks Market Insight

The U.S. accounted for the largest share of the North America fortified snacks market in 2025, driven by strong consumer demand for healthier snacking alternatives, extensive presence of leading fortified snack manufacturers, and continuous innovation in nutrient-dense snack formulations. Growing consumption of fortified bars, functional chips, protein snacks, and enriched baked products further strengthens the U.S. position as the largest market in the region.

Fortified Snacks Market Share

The fortified snacks industry is primarily led by well-established companies, including:

- Unilever (U.K.)

- Dairy Farmers of America, Inc. (U.S.)

- General Mills Inc. (U.S.)

- The Kraft Heinz Company (U.S.)

- Kellogg's Company (U.S.)

- DSM (Netherlands)

- Meiji Holdings Co., Ltd. (Japan)

- Glanbia plc (Ireland)

- Fortified Foods (U.S.)

- Christy Friedgram Industry (India)

- Indopol Group of Companies (India)

- Nestlé (Switzerland)

Latest Developments in Global Fortified Snacks Market

- In October 2025, Glanbia Nutritionals launched its dedicated Health & Nutrition division, strengthening the fortified snacks market by providing manufacturers with expanded access to advanced nutrient premixes, flavor systems, and functional ingredient technologies. This development enhances the capability of snack producers to formulate high-quality fortified products, supports faster innovation cycles, and drives market growth across premium functional snacks

- In August 2025, Kellogg’s expanded its U.K. snacking portfolio with the introduction of fortified “Oaties” cereal bars enriched with B vitamins and iron, directly boosting the fortified snacks market through the entry of widely recognized and trusted branded products. This launch broadened consumer uptake of fortified snacks by linking nutritional benefits with mainstream convenience formats, encouraging competing brands to accelerate their fortified product development strategies

- In March 2025, Innophos launched its LEVAIR Fortify ingredient technology designed to improve texture in protein-fortified snack bars, significantly impacting the fortified snacks market by enabling manufacturers to increase protein content without compromising softness or quality. This innovation strengthened the performance nutrition segment and encouraged further growth in high-protein fortified snacks targeted at fitness-oriented consumers

- In January 2025, a fortified oat-based snack pillow was launched in the U.K. by a better-for-you bakery manufacturer, enriched with B vitamins and iron, contributing to the expansion of the fortified snacks market by increasing accessibility to nutrient-enhanced everyday snack formats. This launch helped elevate consumer interest in simple, wholegrain-based fortified products and expanded the presence of fortified snacks on retail shelves

- In 2024, Sanku (in collaboration with Millers for Nutrition) established a micronutrient premix blending facility in Tanzania, positively influencing the fortified snacks market by providing affordable nutrient premixes to regional food processors. This development accelerated fortification adoption across East Africa, enabling local manufacturers to produce fortified grain snacks and cereal products more cost-effectively and promoting broader market penetration in emerging regions

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Fortified Snacks Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Fortified Snacks Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Fortified Snacks Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.