Global Fosthiazate Market

Market Size in USD Million

CAGR :

%

USD

120.29 Million

USD

184.61 Million

2024

2032

USD

120.29 Million

USD

184.61 Million

2024

2032

| 2025 –2032 | |

| USD 120.29 Million | |

| USD 184.61 Million | |

|

|

|

|

Fosthiazate Market Size

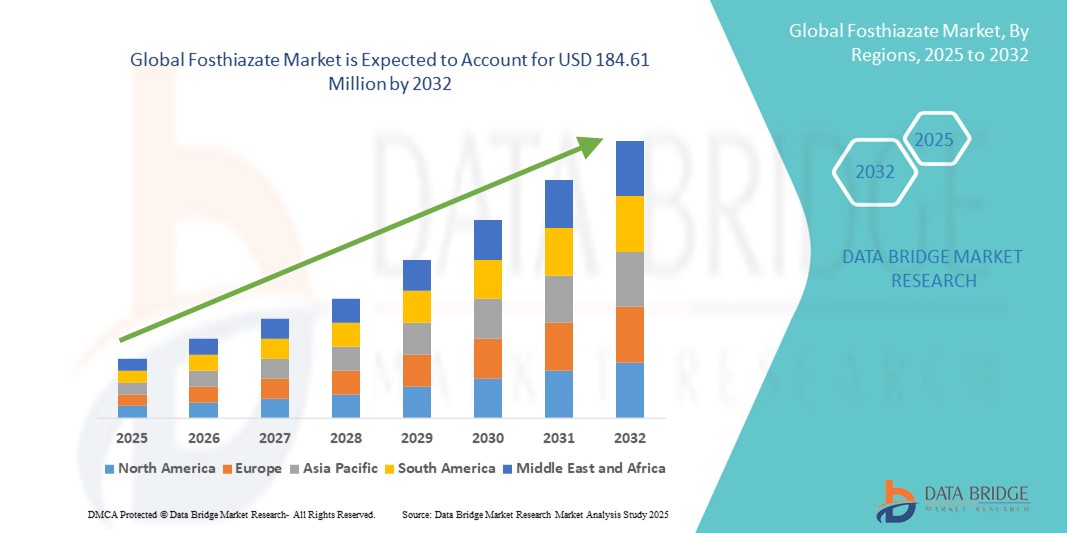

- The global fosthiazate market size was valued at USD 120.29 million in 2024 and is expected to reach USD 184.61 million by 2032, at a CAGR of 5.5% during the forecast period

- The market growth is primarily driven by the increasing demand for high-yield agricultural practices, growing awareness of crop protection solutions, and advancements in pesticide formulations

- Rising concerns over soil-borne pests and nematodes, coupled with the need for sustainable agricultural solutions, are accelerating the adoption of fosthiazate as an effective nematicide and insecticide across various applications

Fosthiazate Market Analysis

- Fosthiazate, a highly effective organophosphate nematicide and insecticide, is widely used in agricultural settings to control soil-dwelling pests and nematodes, enhancing crop yield and quality

- The demand for fosthiazate is fueled by the global push for food security, increasing agricultural productivity, and the rising adoption of integrated pest management (IPM) practices

- Asia-Pacific dominated the fosthiazate market with the largest revenue share of 42.5% in 2024, driven by extensive agricultural activities, large-scale crop production, and favorable government policies supporting pest control solutions in countries such as China and India

- North America is expected to be the fastest-growing region in the fosthiazate market during the forecast period due to increasing adoption of advanced agricultural technologies and growing awareness of sustainable pest control methods

- The Purity: ≥90% segment dominated the largest market revenue share of 85% in 2024, driven by its higher efficacy in controlling nematodes and soil-dwelling pests, making it the preferred choice for precision agriculture in developed regions

Report Scope and Fosthiazate Market Segmentation

|

Attributes |

Fosthiazate Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Fosthiazate Market Trends

“Increasing Adoption of Precision Agriculture and Integrated Pest Management (IPM)”

- The global fosthiazate market is experiencing a notable trend toward the integration of precision agriculture technologies and Integrated Pest Management (IPM) strategies

- These approaches leverage advanced data analytics and monitoring tools to optimize the application of fosthiazate, ensuring targeted and efficient pest control while minimizing environmental impact

- Precision agriculture enables farmers to use fosthiazate more effectively by analyzing soil conditions, pest prevalence, and crop health, allowing for precise dosing and application timing

- For instances, companies are developing platforms that integrate fosthiazate with IoT-enabled sensors to monitor nematode activity and soil conditions in real time, optimizing pest control for crops such as vegetables and medicinal herbs

- This trend enhances the efficacy of fosthiazate, making it more appealing to farmers aiming to improve crop yields and adopt sustainable farming practices

- IPM strategies incorporate fosthiazate as part of a broader pest control framework, combining biological, cultural, and chemical methods to reduce reliance on broad-spectrum pesticides

Fosthiazate Market Dynamics

Driver

“Growing Demand for High-Yield Crops and Sustainable Agriculture”

- The rising global demand for high-yield crops, driven by population growth and shrinking arable land, is a key driver for the fosthiazate market

- Fosthiazate, a nematicide effective against root-knot nematodes and soil-dwelling pests, enhances crop productivity for vegetables, fruits, and medicinal herbs, meeting the needs of farmers under pressure to increase output

- Supportive government policies promoting sustainable agriculture and reduced chemical pesticide use are boosting fosthiazate adoption, particularly in regions such as Asia-Pacific, which dominates the market with a 51% share

- Advancements in agricultural technology, such as improved formulation techniques for fosthiazate, enable more efficient and eco-friendly pest control, further driving market growth

- The increasing popularity of organic and residue-free crops is also encouraging the use of fosthiazate in IPM systems, as it aligns with sustainable pest management goals

Restraint/Challenge

“High Production Costs and Regulatory Restrictions”

- The high cost of producing and applying fosthiazate, particularly for high-purity (≥90%) formulations, poses a significant barrier to adoption, especially in cost-sensitive emerging markets

- The complexity of integrating fosthiazate into existing agricultural practices, including the need for specialized equipment and training, adds to the overall expense

- Regulatory challenges, such as stringent government regulations on pesticide use and varying compliance requirements across countries, complicate market operations for manufacturers and distributors

- Concerns over environmental impact and residue levels in crops treated with fosthiazate, particularly in regions with strict regulations such as Europe, can limit market expansion

- These factors may deter adoption in regions where cost sensitivity is high or where awareness of environmental and regulatory issues is prominent, potentially slowing market growth

Fosthiazate market Scope

The market is segmented on the basis of purity level and application.

- By Purity Level

On the basis of purity level, the Global Fosthiazate Market is segmented into Purity: ≥90% and Purity: <90%. The Purity: ≥90% segment dominated the largest market revenue share of 85% in 2024, driven by its higher efficacy in controlling nematodes and soil-dwelling pests, making it the preferred choice for precision agriculture in developed regions. Its superior performance ensures effective pest management, particularly for high-value crops such as vegetables and medicinal herbs.

The Purity: <90% segment is expected to witness the fastest growth rate from 2025 to 2032, driven by its cost-effectiveness and suitability for lower-input agricultural operations, particularly in emerging economies. This segment appeals to farmers with limited budgets, requiring higher application rates but offering affordability for widespread use in diverse agricultural settings.

- By Application

On the basis of application, the global fosthiazate market is segmented into Vegetables, Flowers, Fruits, Medicinal Herbs, and Others. The Vegetables segment is expected to dominate the market revenue share, driven by the significant economic impact of nematode infestations on vegetable crops and the critical need for effective pest control to secure yields and quality.

The Flowers and Fruits segments are anticipated to witness robust growth from 2025 to 2032. This growth is fueled by increasing consumer demand for aesthetically pleasing flowers and high-quality fruits, both of which are highly susceptible to nematode damage. Fosthiazate plays a crucial role in protecting these high-value crops, ensuring their marketability.

Fosthiazate Market Regional Analysis

- Asia-Pacific dominated the fosthiazate market with the largest revenue share of 42.5% in 2024, driven by extensive agricultural activities, large-scale crop production, and favorable government policies supporting pest control solutions in countries such as China and India

- Farmers prioritize fosthiazate for its efficacy in controlling nematodes and soil-dwelling insects, enhancing crop yield and quality, particularly in regions with intensive farming practices

- Growth is supported by advancements in pesticide formulations, including high-purity fosthiazate (≥90%), and rising adoption in both large-scale and small-scale agricultural operations

Japan Fosthiazate Market Insight

Japan’s fosthiazate market is expected to witness significant growth due to strong farmer preference for high-purity fosthiazate (≥90%) that enhances crop yield and soil health. The presence of major agricultural producers and the integration of fosthiazate in modern farming practices accelerate market penetration. Rising interest in sustainable pest control solutions for vegetables and fruits also contributes to growth.

China Fosthiazate Market Insight

China holds the largest share of the Asia-Pacific fosthiazate market, propelled by rapid urbanization, rising agricultural output, and increasing demand for effective pest control solutions. The country’s growing agricultural sector and focus on food security support the adoption of fosthiazate, particularly for vegetables and medicinal herbs. Strong domestic manufacturing capabilities and competitive pricing enhance market accessibility.

U.S. Fosthiazate Market Insight

The U.S. fosthiazate market is expected to witness significant growth, fueled by strong demand in the agricultural sector and growing awareness of integrated pest management (IPM) benefits. The trend towards sustainable farming and increasing regulations promoting safer pesticide standards further boost market expansion. The use of fosthiazate in high-value crops such as vegetables and medicinal herbs complements its adoption in both commercial and specialty agriculture.

Europe Fosthiazate Market Insight

The Europe fosthiazate market is expected to witness significant growth, supported by regulatory emphasis on sustainable agriculture and crop protection. Farmers seek high-purity fosthiazate (≥90%) to ensure effective nematode control while meeting environmental standards. Growth is prominent in both large-scale farming and specialized applications, with countries such as Germany and France showing significant uptake due to rising concerns about crop losses and soil health.

U.K. Fosthiazate Market Insight

The U.K. market for fosthiazate is expected to witness robust growth, driven by demand for enhanced crop productivity and pest control in diverse agricultural settings. Increased interest in high-quality crop yields and rising awareness of fosthiazate’s benefits in controlling soil pests encourage adoption. Evolving regulations on pesticide use influence farmer choices, balancing efficacy with compliance for applications in vegetables and medicinal herbs.

Germany Fosthiazate Market Insight

Germany is expected to witness strong growth in the fosthiazate market, attributed to its advanced agricultural sector and high farmer focus on crop protection and sustainability. German farmers prefer high-purity fosthiazate (≥90%) to reduce pest-related crop losses and enhance soil health. The integration of fosthiazate in precision agriculture and its use in high-value crops such as fruits and vegetables supports sustained market growth.

Fosthiazate Market Share

The fosthiazate industry is primarily led by well-established companies, including:

- FMC Corporation (U.S.)

- SinoHarvest (China)

- Sumitomo Chemical Co., Ltd. (Japan)

- ADAMA India Private Limited (India)

- BASF SE (Germany)

- DuPont (U.S.)

- Dow (U.S.)

- AMVAC Chemical Corporation (U.S.)

- UPL (India)

- Marrone Bio Innovations (U.S.)

- Nissan Chemical Corporation (Japan)

- Bayer AG (Germany)

- ChemChina (China)

- Corteva (U.S.)

- Nufarm US (Australia)

- Syngenta (Switzerland)

- Valent BioSciences LLC (U.S.)

What are the Recent Developments in Global Fosthiazate Market?

- In October 2024, ISK entered a research and development partnership with a prominent agricultural research institute to create next-generation fosthiazate formulations featuring enhanced biodegradability. This initiative reflects a shared commitment to environmental stewardship and supports the global shift toward sustainable farming practices. The collaboration focuses on reducing the ecological footprint of nematicides by improving degradation profiles, soil compatibility, and targeted efficacy. These advancements aim to deliver safer, more responsible pest control solutions for vegetable crops, aligning with evolving regulatory standards and farmer expectations

- In August 2024, Veyong, a prominent manufacturer in the fosthiazate market, formed a strategic partnership with a global distributor to expand the reach of its nematicide products across North America and Europe. This collaboration aims to streamline supply chains, improve distribution efficiency, and meet the growing demand for root-knot nematode control solutions in high-value crop production. By leveraging the distributor’s international network and Veyong’s technical expertise, the partnership supports sustainable agriculture and enhances product accessibility in key markets

- In June 2024, Hebei Sannong Agricultural Chemical completed a merger with a regional agrochemical firm in China, aiming to boost its production capacity and market reach for fosthiazate-based crop protection products. This strategic consolidation is designed to reinforce Hebei Sannong’s position in the Asia-Pacific agricultural market, where demand for effective nematicides and sustainable pest control solutions is growing rapidly. By combining resources, technologies, and distribution networks, the merged entity is expected to accelerate innovation, improve supply chain efficiency, and better serve farmers across the region

- In March 2024, ISK launched a new high-purity fosthiazate formulation (≥90%), targeting improved control of root-knot nematodes in vegetable crops. This advanced product delivers enhanced stability, bioavailability, and environmental safety, aligning with the rising demand for sustainable agricultural practices. By optimizing release kinetics and minimizing leaching, the formulation supports efficient pest management while reducing ecological impact. It reflects ISK’s commitment to innovation in nematicide development, offering growers a reliable solution for protecting high-value crops under evolving regulatory and environmental conditions

- In June 2023, a study published in Sustainable Chemistry and Pharmacy explored the preparation and performance of fosthiazate/expanded perlite sustained-release pesticides, aiming to enhance efficiency and reduce environmental harm. Researchers developed a formulation using expanded perlite (EP) as a carrier and fosthiazate (FOS) as the active ingredient, coated with modified soybean oil and polyisocyanate. The study demonstrated improved drug loading, controlled release behavior, and pH-responsive kinetics, with better stability at pH 5 than pH 7. These findings support the development of eco-friendly pesticide delivery systems that minimize leaching and maximize field efficacy

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.