Global Fragrance Oil Market

Market Size in USD Billion

CAGR :

%

USD

8.50 Billion

USD

11.90 Billion

2024

2032

USD

8.50 Billion

USD

11.90 Billion

2024

2032

| 2025 –2032 | |

| USD 8.50 Billion | |

| USD 11.90 Billion | |

|

|

|

|

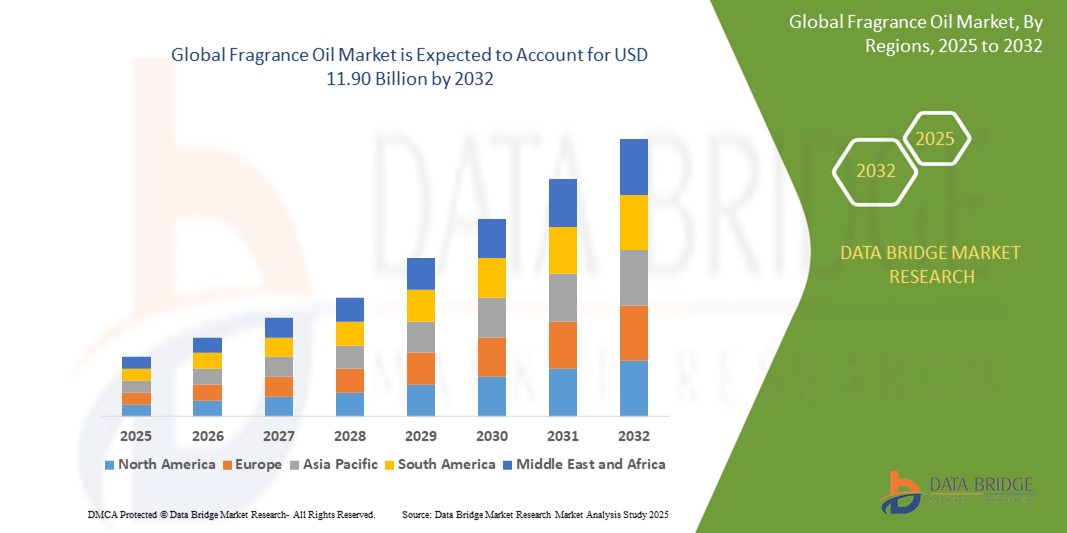

What is the Global Fragrance Oil Market Size and Growth Rate?

- The global fragrance oil market size was valued at USD 8.50 billion in 2024 and is expected to reach USD 11.90 billion by 2032, at a CAGR of 4.30% during the forecast period

- The fragrance oil market is experiencing robust growth due to rising disposable incomes and evolving consumer lifestyles. As consumers gain more purchasing power, there is an increasing appetite for high-quality and luxury fragrance products. This trend is particularly evident in premium segments where consumers are willing to invest in sophisticated and exclusive fragrances that reflect their style and status

- In addition, changing lifestyles, including greater emphasis on self-care and personal grooming, are further fueling the demand for diverse and high-end fragrance offerings. This growing consumer interest is a key driver behind the market’s expansion, as brands strive to meet the evolving preferences of a more affluent and discerning customer base

What are the Major Takeaways of Fragrance Oil Market?

- The fragrance oil industry is benefiting significantly from technological innovations that enhance production techniques and product offerings. Advances in extraction methods, such as cold pressing and steam distillation, have improved the quality and consistency of fragrance oils. Furthermore, innovations in fragrance blending technologies allow for more complex and unique scent profiles, catering to diverse consumer preferences. These technological advancements elevate the overall quality of fragrance products and enable manufacturers to create novel and appealing fragrances that drive consumer interest and fragrance oil market growth

- North America dominated the fragrance oil market with the largest revenue share of 36.47% in 2024, driven by rising demand for premium scented products and wellness-oriented formulations across personal care and home care applications

- Asia-Pacific fragrance oil market is projected to grow at the fastest CAGR of 11.78% from 2025 to 2032, driven by rising middle-class income, urbanization, and shifting preferences toward luxury home and personal care items

- The Synthetic category dominated the market with the largest revenue share of 61.4% in 2024, due to its cost-effectiveness, consistent aroma profile, and widespread usage in mass-market products such as soaps, candles, and household cleaners

Report Scope and Fragrance Oil Market Segmentation

|

Attributes |

Fragrance Oil Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Fragrance Oil Market?

“Rise of Customized and AI-Enhanced Scent Solutions”

- A key trend shaping the global fragrance oil market is the integration of artificial intelligence (AI) and machine learning to deliver personalized scent profiles and enhanced formulation efficiency. AI-powered systems are now able to analyze user preferences, ambient environments, and seasonal factors to create tailored fragrance experiences for consumers and businesses

- For instance, Givaudan launched its AI-based fragrance creation tool “Carto,” which assists perfumers in blending complex scent profiles faster while optimizing ingredient use. The tool leverages deep learning from thousands of fragrance combinations to enhance creativity and accuracy in product development

- AI is also being used in consumer-facing applications, such as smart diffusers that automatically adjust scent intensity and blend ratios based on usage patterns, mood detection, or connected smart home ecosystems. These innovations offer hyper-personalization, aligning with consumers' growing expectations for intelligent and interactive products

- In addition, AI enables predictive analytics to forecast trends, helping fragrance brands rapidly develop and launch market-relevant oils with reduced time-to-market. Brands are leveraging data insights from social media, reviews, and customer feedback to fine-tune olfactory profiles

- Companies such as Royal Aroma and Bell Flavors & Fragrances are increasingly investing in AI-backed R&D platforms to stay competitive in the dynamic market of customized home and personal care products

- The fusion of AI personalization, digital interfaces, and sustainable formulations is redefining the future of fragrance oils, aligning product innovation with evolving consumer behavior and wellness preferences

What are the Key Drivers of Fragrance Oil Market?

- Rising demand for aromatherapy and wellness solutions, along with the booming personal care and home fragrance segments, is a significant driver of growth for the fragrance oil market. Consumers increasingly associate scents with emotional balance, sleep quality, and stress relief, fueling demand for high-quality essential and fragrance oils

- For instance, in February 2024, VEDAOILS introduced a new therapeutic-grade fragrance oil line formulated for both wellness and cosmetic use, aimed at tapping into the growing holistic lifestyle movement

- The market is also being propelled by the increased use of fragrance oils in candles, soaps, air fresheners, diffusers, and cosmetics. These sectors benefit from consumers seeking non-toxic, phthalate-free, and cruelty-free fragrance solutions

- In addition, the rise in e-commerce channels and DIY culture has enabled smaller brands and artisans to access premium fragrance oils for customized product development

- Shifting consumer focus toward sustainable and ethically sourced ingredients has also encouraged global manufacturers to adopt green chemistry practices, further boosting demand in both mature and emerging markets

Which Factor is challenging the Growth of the Fragrance Oil Market?

- One of the major challenges facing the fragrance oil market is the lack of standardization and potential health concerns around synthetic ingredients. Some synthetic fragrance oils contain allergens or chemicals that may cause skin irritation or respiratory discomfort, leading to increased regulatory scrutiny

- For instance, the European Chemicals Agency (ECHA) has tightened its regulations on certain ingredients commonly found in fragrance oils, prompting brands to reformulate or reclassify their products to comply with safety standards

- Consumer mistrust in labels such as “natural” or “organic,” when loosely regulated, can also hinder market growth. Misinformation about ingredients and rising awareness around endocrine-disrupting chemicals has led to demand for full transparency

- In addition, supply chain disruptions and price volatility of natural raw materials such as sandalwood, rose, or oud oil due to environmental, geopolitical, or harvesting issues continue to pose a cost and availability challenge for manufacturers

- To overcome these hurdles, market leaders are investing in green science innovations, clearer ingredient labeling, and biotechnology-based fragrance synthesis to ensure both safety and sustainability ensuring long-term consumer trust and compliance with evolving global standards

How is the Fragrance Oil Market Segmented?

The market is segmented on the basis of category, fragrance type, and application.

- By Category

On the basis of category, the fragrance oil market is segmented into Natural and Synthetic fragrance types. The Synthetic category dominated the market with the largest revenue share of 61.4% in 2024, due to its cost-effectiveness, consistent aroma profile, and widespread usage in mass-market products such as soaps, candles, and household cleaners. Manufacturers favor synthetic oils for their stable supply chain and scalability in industrial applications.

The Natural category is expected to witness the fastest CAGR from 2025 to 2032, driven by rising consumer preference for clean-label, plant-based, and eco-friendly ingredients in personal care and wellness products. Growing awareness of potential health risks associated with synthetics also bolsters natural fragrance oil demand.

- By Fragrance Type

On the basis of fragrance type, the market is segmented into a wide variety including Lemon, Peppermint, Rosemary, Eucalyptus, Frankincense, Burning Leaves, BBW Type, Adobe Sage, Almond Extract, Amber Romance, Amish Harvest, Apple Blossom, Apple Butter Caramel, Apple Sage, Autumn Lodge, Avobath, Azure Sand, Baby Powder, Bamboo and Lotus, Bamboo, Bayberry, Be Enchanted, Rose, Beehive Brittle, Bergamot, Lavender, Black Amber, Black Lace, Black Pepper, Black Raspberry, Vanilla, Blackberry & Magnolia, Autumn Woods, Cannabis, Chardonnay, Sandalwood, Strawberry, Chocolate, Frangipani, Honey and Milk, Saffron, Orchid Flower, Mix Fruit Fragrance, Jasmine, and Others. The Lavender fragrance held the largest revenue share of 8.7% in 2024, favored for its calming, floral scent widely used in personal care, aromatherapy, and household products. Its versatility across segments and longstanding association with relaxation has fueled high consumer demand.

The Sandalwood fragrance is projected to register the fastest growth between 2025 and 2032, driven by its rising popularity in fine fragrances and skincare, especially in premium and natural product lines.

- By Application

On the basis of application, the fragrance oil market is segmented into Personal Care and Cosmetics, Household Care, Fine Fragrances, Aromatherapy, Food and Beverages, and Others. The Personal Care and Cosmetics segment dominated the market with the largest revenue share of 34.9% in 2024, fueled by the high demand for fragranced skincare, haircare, and body care products. Custom-scented product offerings and the clean beauty trend further enhance the use of fragrance oils in this category.

The Aromatherapy segment is expected to witness the fastest CAGR from 2025 to 2032, driven by growing mental wellness awareness and the adoption of essential oils for stress relief, sleep enhancement, and holistic therapy.

Which Region Holds the Largest Share of the Fragrance Oil Market?

- North America dominated the fragrance oil market with the largest revenue share of 36.47% in 2024, driven by rising demand for premium scented products and wellness-oriented formulations across personal care and home care applications

- Consumers in the region are increasingly favoring clean-label and natural ingredients, leading to a surge in the use of essential oil-based fragrance oils in skincare, aromatherapy, and candles

- The presence of well-established brands, high disposable income, and growing interest in customized and artisan fragrances are further accelerating market growth in both the U.S. and Canada

U.S. Fragrance Oil Market Insight

The U.S. fragrance oil market captured the largest revenue share of 81% within North America in 2024, fueled by a strong preference for personalized wellness products and niche home fragrances. Demand is particularly high in applications such as diffusers, cosmetics, and scented cleaning products. The rise of the DIY beauty trend and increasing adoption of organic and plant-derived fragrance oils continue to shape the U.S. market. In addition, e-commerce growth and influencer-driven marketing are enhancing consumer access and brand engagement.

Europe Fragrance Oil Market Insight

The Europe fragrance oil market is projected to grow at a robust CAGR throughout the forecast period, supported by sustainability trends, clean beauty standards, and regulatory support for natural ingredients. Growing consumer awareness about synthetic chemicals in fragrances is driving the shift toward eco-friendly and allergen-free fragrance oils. Europe also benefits from a strong luxury fragrance heritage, with rising interest in artisan perfumery, wellness products, and high-end scented candles across countries such as France, Germany, and Italy.

U.K. Fragrance Oil Market Insight

The U.K. fragrance oil market is anticipated to expand at a notable CAGR, propelled by the increasing use of fragrance oils in home ambiance and personal wellness routines. The market is witnessing rising popularity of soy-based candles, reed diffusers, and bath oils containing bespoke scents. Strong retail infrastructure and the proliferation of vegan, cruelty-free fragrance brands are encouraging consumers to switch from synthetic to natural oils, supporting overall market expansion.

Germany Fragrance Oil Market Insight

The Germany fragrance oil market is expected to experience solid growth, driven by the country’s focus on natural ingredients, sustainable sourcing, and certified organic personal care products. Germany’s consumers are highly conscious of ingredient transparency, boosting demand for essential oil-based fragrances in skin, aromatherapy, and cleaning applications. The wellness and spa culture in Germany also contributes to a steady demand for therapeutic fragrance oils in massage and relaxation products.

Which Region is the Fastest Growing in the Fragrance Oil Market?

Asia-Pacific fragrance oil market is projected to grow at the fastest CAGR of 11.78% from 2025 to 2032, driven by rising middle-class income, urbanization, and shifting preferences toward luxury home and personal care items. Demand for fragrance oils is surging in skincare, incense sticks, and aroma diffusers, with countries such as China, India, and Japan leading consumption. The region’s strong manufacturing base and affordability of raw materials further support scalability and wider market penetration.

Japan Fragrance Oil Market Insight

The Japan fragrance oil market is expanding steadily due to the country's emphasis on minimalism, cleanliness, and sensory well-being. Fragrance oils are widely adopted in products such as humidifiers, air fresheners, skincare, and functional cosmetics. Japanese consumers value subtle, calming scents, especially those derived from natural sources such as cherry blossom, yuzu, and hinoki. The rising aging population is also influencing demand for therapeutic and mood-enhancing oils integrated into daily routines.

China Fragrance Oil Market Insight

The China fragrance oil market held the largest revenue share in Asia-Pacific in 2024, driven by a rapidly growing middle class, high digital engagement, and demand for aesthetic home and beauty products. With the boom in smart retail, e-commerce, and influencer-driven trends, fragrance oils are now common in cosmetics, personal care, and household applications. The country’s push for “Made in China” premium products and support for local manufacturers is fueling innovation in scent profiles, packaging, and affordability.

Which are the Top Companies in Fragrance Oil Market?

The fragrance oil industry is primarily led by well-established companies, including:

- Royal Aroma (U.S.)

- Bell Flavors & Fragrances (U.S.)

- CREATIVE FLAVOURS & FRAGRANCES S.P.A. (Italy)

- Escentscia (Belgium)

- Chemarome (France)

- Craftiful Fragrance Oils (U.K.)

- Schreiber Essences GmbH & Co.KG (Germany)

- Moksha Lifestyle (India)

- Aromaaz International (India)

- DOOP Fragrance Co. (U.S.)

- Candle Chemistry (U.S.)

- Givaudan (Switzerland)

- VEDAOILS (India)

- Fragrance Innovation Australia (Australia)

- Guangzhou Yahe Biotechnology Co., Ltd. (China)

- BMV Fragrances Pvt. Ltd. (India)

- Bickford Flavors (U.S.)

- Synthodor Company (U.S.)

- Natural Sourcing, LLC (U.S.)

- Rimports (U.S.)

- Nature's Flavors, Inc. (U.S.)

- LDG International (U.S.)

What are the Recent Developments in Global Fragrance Oil Market?

- In October 2023, Praan Naturals launched a new collection of Plant-Based Fragrance Oils (INCI, Fragrance), developed using essential oils, absolutes, botanical extracts, and natural aromatic isolates. These oils are tailored for clean beauty, home fragrance, personal care, and soap-making applications, offering a cost-efficient and synthetic-free fragrance alternative. This initiative reflects the brand’s commitment to natural and sustainable formulations

- In January 2023, VedaOils unveiled its 2023 fragrance oil collection featuring more than 15 Essential Oil Blends made from natural aromatic sources. These blends are intended for both personal use and integration into scented consumer products. This launch highlights VedaOils’ focus on natural wellness and multipurpose aromatic solutions

- In November 2022, Coty Inc. introduced Chloé Rose Naturelle Intense, its first refillable fragrance offering. The company emphasized that its refillable bottles demonstrated reduced environmental impact across all PLCA indicators. This marks Coty’s strategic move towards sustainability and eco-conscious product design

- In July 2022, Chanel SA released Gabrielle Chanel Essence Twist & Spray and Gabrielle Chanel Eau de Parfum SA. While the Twist & Spray is available in limited domestic and travel retail markets, the Eau de Parfum is offered exclusively online. This launch showcases Chanel’s shift toward selective and digital-first fragrance retailing

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Fragrance Oil Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Fragrance Oil Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Fragrance Oil Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.