Global Fraud Detection And Prevention Market

Market Size in USD Billion

CAGR :

%

USD

33.63 Billion

USD

125.13 Billion

2024

2032

USD

33.63 Billion

USD

125.13 Billion

2024

2032

| 2025 –2032 | |

| USD 33.63 Billion | |

| USD 125.13 Billion | |

|

|

|

|

Fraud Detection and Prevention Market Size

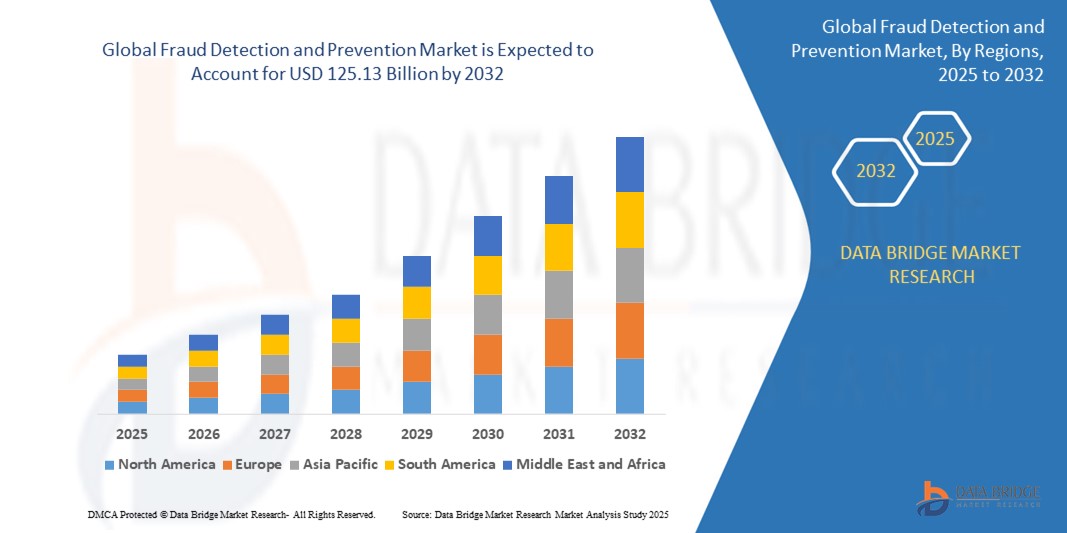

- The global fraud detection and prevention market size was valued at USD 33.63 billion in 2024 and is expected to reach USD 125.13 billion by 2032, at a CAGR of 17.85% during the forecast period

- The market growth is largely fueled by the increasing adoption of digital payment methods and the rise in online transactions across various sectors, leading to increased digitalization in both residential and commercial settings

- Furthermore, rising consumer and business demand for secure digital environments and the need to combat increasingly sophisticated fraudulent activities are establishing fraud detection and prevention solutions as critical tools. These converging factors are accelerating the uptake of fraud detection and prevention solutions, thereby significantly boosting the industry's growth

Fraud Detection and Prevention Market Analysis

- Fraud Detection and Prevention solutions, offering advanced technological capabilities to identify, monitor, and prevent fraudulent activities across various digital and physical channels, are increasingly essential components of modern business and organizational operations in both commercial and governmental settings due to their enhanced ability to mitigate financial losses, protect sensitive data, and ensure regulatory compliance

- The escalating demand for fraud detection and prevention solutions is primarily fueled by the rising sophistication of cyberattacks and scams, the rapid increase in online and mobile transactions, and the growing need for organizations to comply with stringent regulatory requirements related to fraud prevention and risk management

- North America held the largest revenue share of 38.97% in the global fraud detection and prevention market in 2024, driven by a significant need for advanced security measures across various industries

- Asia-Pacific is expected to be the fastest growing region in the fraud detection and prevention market during the forecast period due to rapid expansion of digital economies, the increasing adoption of online payment platforms, and a growing awareness of fraud risks across countries such as China, India, and Japan

- The solutions segment held a significant market revenue share of 63.21% in 2025, driven by the fundamental need for tools and platforms to detect and prevent fraudulent activities. Organizations prioritize implementing these technological solutions as a primary defense mechanism

Report Scope and Fraud Detection and Prevention Market Segmentation

|

Attributes |

Fraud Detection and Prevention Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Fraud Detection and Prevention Market Trends

“Growing Sophistication of Cyberattacks and Data Breaches”

- A prominent and accelerating trend in the global fraud detection and prevention market is the continuous increase in the sophistication and volume of cyberattacks and data breaches. Fraudsters are constantly developing new and more advanced methods to bypass traditional security measures

- For instance, Companies such as Proofpoint offer solutions that use AI to analyze email content and sender behavior to identify and block such sophisticated phishing attempts

- Similarly, the increasing frequency of ransomware attacks targeting businesses requires proactive fraud prevention measures; companies such as CrowdStrike provide threat intelligence and endpoint protection platforms designed to prevent and mitigate these attacks

- The integration of advanced analytics, including AI and machine learning, is a key trend in combating these evolving threats, enabling organizations to identify subtle patterns and anomalies indicative of fraudulent activity

- Furthermore, there's a growing trend towards adopting proactive and predictive fraud detection strategies rather than reactive approaches. The use of threat intelligence and data sharing platforms is also becoming more common to stay ahead of emerging fraud trends and patterns

- This trend towards increasingly sophisticated and diverse cyber threats is fundamentally reshaping the demand for advanced fraud detection and prevention solutions. Consequently, companies are investing heavily in developing and deploying solutions that can adapt to and counteract these evolving threats

- The need for robust and adaptive fraud detection and prevention systems is rapidly growing across various industries to mitigate the significant financial and reputational risks associated with cyberattacks and data breaches

Fraud Detection and Prevention Market Dynamics

Driver

“Increasing Adoption of Digital Payment Methods and Online Transactions”

- The rapidly increasing adoption of digital payment methods and the surge in online transactions across various industries is a significant driver for the heightened demand for fraud detection and prevention solutions

- For instance, with the widespread use of mobile payment apps such as PayPal and Venmo, the risk of unauthorized transactions and account takeovers has increased. These companies invest heavily in fraud detection technologies to monitor transactions in real-time and identify suspicious activities

- Similarly, the booming e-commerce sector sees companies such as Shopify integrating various fraud prevention tools to protect their merchants and customers from fraudulent purchases and chargebacks

- As consumers increasingly embrace the convenience of online and digital transactions, the risk of fraud, including payment fraud, identity theft, and unauthorized access, has also amplified. This surge in digital activities is compelling businesses and financial institutions to invest in advanced fraud detection and prevention systems to ensure secure transaction environments and maintain customer trust

- The need to comply with regulations governing digital transactions and data security further reinforces this driver. The convenience and accessibility of online services, while beneficial, necessitate strong fraud prevention mechanisms, thereby propelling the growth of the market

Restraint/Challenge

“Difficulty in Balancing Security with User Experience and Privacy Concerns”

- A significant challenge in the fraud detection and prevention market is the difficulty in striking a balance between implementing robust security measures and ensuring a seamless and positive user experience, while also addressing growing privacy concerns

- The collection and analysis of user data for fraud detection purposes raise concerns about privacy violations and the potential misuse of personal information

- Addressing this challenge requires careful calibration of fraud detection algorithms to minimize false positives and a transparent approach to data collection and usage that respects user privacy

- Companies need to invest in sophisticated technologies and strategies that can accurately identify fraudulent activities without unduly impacting legitimate users or compromising their privacy. Balancing the need for strong security with the desire for a frictionless user experience and adherence to privacy regulations remains a key hurdle for the widespread adoption and effectiveness of fraud detection and prevention solutions

- Overcoming this challenge is crucial for building consumer trust and ensuring the long-term success of fraud prevention initiatives

Fraud Detection and Prevention Market Scope

The market is segmented on the basis of component, solution, application area, deployment mode, organization size, and vertical.

- By Component

On the basis of component, the fraud detection and prevention market is segmented into solutions and services. The solutions segment held a significant market revenue share of 63.21% in 2025, driven by the fundamental need for tools and platforms to detect and prevent fraudulent activities. Organizations prioritize implementing these technological solutions as a primary defense mechanism.

The services segment is anticipated to witness robust growth from 2025 to 2032, fueled by the increasing complexity of fraud schemes and the demand for expert guidance in implementing and managing fraud prevention strategies. Businesses often require specialized services for consultation, integration, and ongoing support.

- By Solution

On the basis of solution, the fraud detection and prevention market is segmented into fraud analytics, authentication, and governance, risk, and compliance. The fraud analytics segment probably held a substantial market revenue share in 2025, driven by the critical need to analyze large datasets and identify patterns indicative of fraudulent behavior. Organizations heavily invest in these analytical tools to proactively detect and mitigate risks.

The authentication segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by the escalating sophistication of cyber threats and the growing emphasis on secure identity verification across various platforms and transactions. Enhanced authentication methods are becoming increasingly crucial for preventing unauthorized access and fraud.

- By Application Area

On the basis of application area, the fraud detection and prevention market is segmented into identity theft, payment fraud, money laundering, and others. The payment fraud segment likely accounted for the largest market revenue share in 2025, driven by the high volume and value of transactions occurring through various payment channels, making it a primary target for fraudulent activities.

The money laundering segment is anticipated to witness significant growth from 2025 to 2032, fueled by increasing regulatory scrutiny and the need for sophisticated technologies to detect and prevent the flow of illicit funds across the financial system. The growing focus on anti-money laundering compliance is driving the adoption of advanced solutions.

- By Deployment Mode

On the basis of deployment mode, the fraud detection and prevention market is segmented into on-premises and cloud. The on-premises segment likely held a considerable market revenue share in 2025, attributed to established IT infrastructures and data security concerns among some organizations, particularly in highly regulated industries.

The cloud segment is expected to witness the fastest CAGR from 2025 to 2032, driven by its scalability, flexibility, cost-effectiveness, and ease of deployment, making it an increasingly attractive option for organizations of all sizes to implement and manage their fraud prevention measures.

- By Organization Size

On the basis of organization size, the fraud detection and prevention market is segmented into small and medium-sized enterprises (SMEs) and large enterprises. Large enterprises probably commanded the largest market revenue share in 2025, owing to their greater resources and the higher stakes associated with potential fraud losses due to their larger scale of operations.

The SME segment is anticipated to experience rapid growth from 2025 to 2032, fueled by the increasing availability of cost-effective and user-friendly fraud detection and prevention solutions tailored to their specific needs, as well as a growing awareness of the risks they face.

- By Vertical

On the basis of vertical, the fraud detection and prevention market is segmented into banking, financial services and insurance (BFSI), retail, telecommunication, government/public sector, healthcare, real estate, energy and power, manufacturing, and others. The BFSI sector likely held the largest market revenue share in 2025, driven by the highly regulated nature of the industry and the significant financial risks associated with fraud in banking, insurance, and financial transactions.

The retail sector is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by the increasing volume of online transactions and the growing need to combat various forms of retail fraud, including e-commerce fraud, returns fraud, and payment fraud.

Fraud Detection and Prevention Market Regional Analysis

- North America held the largest revenue share of 38.97% in the global fraud detection and prevention market in 2024, driven by a significant need for advanced security measures across various industries

- The region's high internet penetration and the increasing volume of digital transactions contribute to the demand for sophisticated fraud detection and prevention solutions

- The U.S. is a major contributor to the North American market, with a strong emphasis on adopting cutting-edge technologies to combat evolving fraud threats

U.S. Fraud Detection and Prevention Market Insight

The U.S. fraud detection and prevention market, a significant contributor to the North American region in 2025, is driven by the widespread adoption of digital transactions and the increasing sophistication of online fraud. Consumers and businesses are prioritizing the implementation of advanced fraud detection and prevention solutions to safeguard against financial losses and data breaches. The growing preference for online shopping, digital banking, and mobile payments, coupled with stringent regulatory requirements in sectors such as finance and healthcare, is propelling the demand for robust fraud management systems and services across the U.S.

Europe Fraud Detection and Prevention Market Insight

The European fraud detection and prevention market is projected to experience substantial growth throughout the forecast period, primarily fueled by stringent regulatory frameworks such as PSD2 and GDPR, which mandate enhanced security measures for financial transactions and data protection. The escalating need to combat rising instances of online fraud, identity theft, and payment fraud across various industries, including banking, e-commerce, and insurance, is driving the adoption of innovative fraud detection and prevention technologies. Increased urbanization and the growing volume of digital interactions are further contributing to the market's expansion across residential, commercial, and government sectors in Europe.

U.K. Fraud Detection and Prevention Market Insight

The U.K. fraud detection and prevention market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by the country's well-developed financial services sector and the high volume of online transactions. Growing concerns over cybercrime, payment fraud, and other fraudulent activities are encouraging both businesses and consumers to invest in advanced fraud detection and prevention solutions. The U.K.'s robust e-commerce infrastructure and the increasing adoption of digital payment methods are expected to continue stimulating the growth of this market.

Germany Fraud Detection and Prevention Market Insight

The German fraud detection and prevention market is expected to expand at a considerable CAGR during the forecast period, fueled by increasing awareness of digital security risks and a strong demand for technologically advanced solutions to protect against financial fraud and data breaches. Germany’s strong emphasis on data privacy and security, coupled with the growing adoption of online services and digital payment systems, promotes the adoption of sophisticated fraud detection and prevention technologies across various sectors, including finance, retail, and manufacturing.

Asia-Pacific Fraud Detection and Prevention Market Insight

The Asia-Pacific fraud detection and prevention market is expected to grow at the fastest CAGR in 2025, driven by the rapid expansion of digital economies, the increasing adoption of online payment platforms, and a growing awareness of fraud risks across countries such as China, India, and Japan. The region's burgeoning e-commerce sector and the increasing use of mobile wallets and digital financial services are creating a significant demand for robust fraud detection and prevention solutions to protect both businesses and consumers from evolving fraud tactics.

Japan Fraud Detection and Prevention Market Insight

The Japan fraud detection and prevention market is gaining momentum due to the country’s increasing adoption of digital transactions and a heightened focus on security within its advanced technological ecosystem. The Japanese market places a significant emphasis on trust and security in financial transactions, and the adoption of sophisticated Fraud Detection and Prevention systems is driven by the need to combat emerging online fraud threats associated with the growth of e-commerce and digital payments.

China Fraud Detection and Prevention Market Insight

The China fraud detection and prevention market accounted for the largest market revenue share in Asia Pacific in 2025, attributed to the country's massive online population, the rapid growth of its e-commerce market, and the widespread adoption of mobile payment systems. The sheer volume of digital transactions and the increasing sophistication of online fraud are driving a significant demand for advanced fraud detection and prevention technologies across various sectors, including e-commerce, finance, and telecommunications, making China a pivotal market in the global fraud prevention landscape.

Fraud Detection and Prevention Market Share

The Fraud Detection and Prevention industry is primarily led by well-established companies, including:

- InterGuard (U.S.)

- Software GmbH (Germany)

- NCR Voyix Corporation (U.S.)

- Capgemini (France)

- DXC Technology Company (U.S.)

- LexisNexis (U.S.)

- Splunk LLC (U.S.)

- Microsoft (U.S.)

- Bloombase (China)

- Broadcom (U.S.)

- Intel Corporation (U.S.)

- Amazon Web Services Inc. (U.S.)

- Check Point Software Technologies Ltd. (Israel)

- Cisco Systems Inc. (U.S.)

- F-Secure (Finland)

Latest Developments in Global Fraud Detection and Prevention Market

- In December 2023, Experian entered into a strategic partnership with NeuroID to bolster its fraud prevention capabilities. The collaboration is designed to combat fraud attacks, curb identity theft, and defend against AI-driven bot threats. By integrating their technologies, both firms aim to deliver more robust security for consumers and businesses, enhancing fraud detection efficiency

- In October 2023, Oscilar launched the industry’s first generative AI-powered fraud prevention platform. This groundbreaking solution is capable of autonomously detecting fraud patterns, conducting root cause analysis, and providing real-time risk insights. Through this innovation, Oscilar seeks to transform how businesses identify and mitigate fraud

- In May 2023, Experian rolled out Experian's Hunter, a fraud prevention platform specifically tailored for fintech companies in the U.S. Building upon its well-established fraud detection infrastructure, this solution enhances protection for both consumers and enterprises by leveraging extensive data analytics to address modern fraud threats

- In September 2022, Experian introduced Experian Fraud Score, a versatile fraud detection tool developed to help organizations detect fraudulent behavior across the transaction and customer lifecycle. By delivering actionable insights at key decision points, the solution empowers businesses to strengthen their fraud defense strategies

- In June 2022, Advanced Fraud Solutions (AFS) collaborated with Fiserv to provide advanced fraud detection for financial institutions. The partnership allows clients to evaluate risk-based fund availability and make better-informed decisions. By incorporating AFS’s tools, Fiserv enhances its ability to detect and prevent fraudulent credits before they are processed

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.