Global Freeze Dried Pet Food Market

Market Size in USD Billion

CAGR :

%

USD

18.44 Billion

USD

26.42 Billion

2024

2032

USD

18.44 Billion

USD

26.42 Billion

2024

2032

| 2025 –2032 | |

| USD 18.44 Billion | |

| USD 26.42 Billion | |

|

|

|

|

What is the Global Freeze-Dried Pet Food Market Size and Growth Rate?

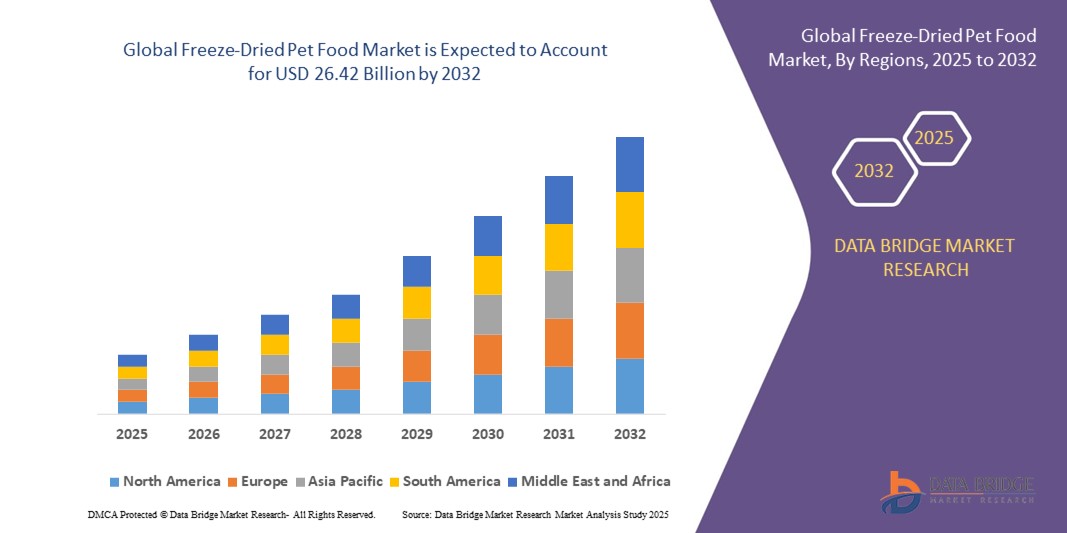

- The global freeze-dried pet food market size was valued at USD 18.44 billion in 2024 and is expected to reach USD 26.42 billion by 2032, at a CAGR of4.60% during the forecast period

- The essential factors contributing to the growth of the global freeze-dried pet food market include the increasing pet humanization trends, growing consumer demand for natural and premium pet food options, rising awareness of pet health and nutrition, advancements in freeze-dry technology, and expanding distribution channels. These factors collectively contribute to the market's growth by catering to evolving consumer preferences and pet care trends

What are the Major Takeaways of Freeze-Dried Pet Food Market?

- The growing trend of pet humanization, where pets are increasingly considered members of the family, is a significant driver in the freeze-dried pet food market. Pet owners are willing to spend more on premium pet food options that resemble human-grade food in terms of quality, ingredients, and production processes

- Freeze-dried pet food aligns well with this trend as it offers high-quality, minimally processed, and convenient feeding options that appeal to pet owners seeking the best for their furry companions. As the humanization trend continues to rise globally, the demand for freeze-dried pet food is expected to grow proportionally

- North America dominated the freeze-dried pet food market with the largest revenue share of 44.78% in 2024, driven by strong consumer awareness of premium nutrition, high pet ownership rates, and the willingness of pet parents to spend on high-quality diets

- Asia-Pacific freeze-dried pet food market is poised to grow at the fastest CAGR of 7.12% during 2025 to 2032, driven by rising pet adoption, growing disposable incomes, and increasing awareness of pet health and nutrition in countries such as China, Japan, and India

- The chicken segment dominated the freeze-dried pet food market with the largest market revenue share of 38.5% in 2024, owing to its high digestibility, affordability, and widespread acceptance among both dogs and cats

Report Scope and Freeze-Dried Pet Food Market Segmentation

|

Attributes |

Freeze-Dried Pet Food Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Freeze-Dried Pet Food Market?

Rising Demand for Premium, Natural, and Functional Nutrition

- A significant and accelerating trend in the global freeze-dried pet food market is the growing preference for premium, natural, and functional pet nutrition. Pet owners are increasingly treating pets as family members, driving demand for high-quality, minimally processed food

- For instance, Stella & Chewy’s Freeze-Dried Raw Meals highlight complete and balanced nutrition with natural proteins, catering to pet parents seeking human-grade food quality. Similarly, Champion Petfoods’ ORIJEN and ACANA brands emphasize biologically appropriate diets using regional ingredients

- Freeze-dried pet foods retain nutrients, flavor, and texture compared to traditional kibbles, making them attractive for pet parents concerned about pet health, digestion, and immunity. The rising interest in functional ingredients such as probiotics, omega-3 fatty acids, and joint-support supplements is further strengthening this trend

- The integration of grain-free, organic, and novel protein options (duck, venison, fish) enhances product appeal to health-conscious and allergy-prone pets. This creates broader choice for consumers while pushing brands to differentiate in a competitive space

- Companies such as Primal Pet Foods are expanding their freeze-dried portfolios with limited-ingredient diets and functional blends, targeting digestive health and weight management

- The demand for premium, health-focused freeze-dried pet foods is rapidly growing across both developed and emerging markets, as consumers increasingly prioritize nutrition, convenience, and wellness for their pets

What are the Key Drivers of Freeze-Dried Pet Food Market?

- The rising trend of pet humanization and willingness of owners to spend more on high-quality nutrition is a major growth driver for freeze-dried pet food

- For instance, in March 2024, Nestlé Purina announced expanded investments in premium pet food production facilities in the U.S., reflecting surging demand for natural and freeze-dried product lines

- Increasing concerns around pet health, digestion, and allergies are boosting the demand for minimally processed, high-protein, and grain-free diets. Freeze-dried food offers enhanced palatability, shelf stability, and easy rehydration, making it attractive to busy pet owners

- The convenience factor—lightweight, portable, and long-lasting shelf life—is driving adoption among both urban consumers and travelers seeking premium nutrition without refrigeration

- Growth in online pet food retailing and subscription models is expanding accessibility of freeze-dried options, with companies leveraging direct-to-consumer platforms. The trend towards organic and sustainable sourcing is further fueling adoption in premium segments

- The premium positioning, transparency in labeling, and veterinary endorsements are also playing a vital role in building trust and driving purchase decisions across the residential pet parent market

Which Factor is Challenging the Growth of the Freeze-Dried Pet Food Market?

- The high cost of freeze-dried pet food compared to traditional kibbles and canned food remains a significant barrier to mass adoption, especially in price-sensitive regions

- For instance, premium freeze-dried brands such as K9 Natural or Vital Essentials are priced substantially higher than conventional dry food, limiting uptake among middle-income consumers.

- Concerns around nutritional balance and feeding guidance sometimes create hesitation among new buyers unfamiliar with rehydration methods or portion control

- Supply chain issues and reliance on high-quality meat proteins make production cost-intensive and vulnerable to raw material price fluctuations

- While e-commerce is expanding reach, limited retail penetration in developing regions constrains availability, especially outside major urban markets

- Overcoming these challenges through cost optimization, consumer education, and smaller pack sizes will be essential to make freeze-dried pet food more accessible and appealing to a wider customer base

How is the Freeze-Dried Pet Food Market Segmented?

The market is segmented on the basis of food type, process, grain type, pet type, nature, and distribution channel.

- By Food Type

On the basis of food type, the freeze-dried pet food market is segmented into chicken, fish, duck, beef, pig, and others. The chicken segment dominated the freeze-dried pet food market with the largest market revenue share of 38.5% in 2024, owing to its high digestibility, affordability, and widespread acceptance among both dogs and cats. Chicken-based freeze-dried meals are also preferred due to their protein-rich and low-fat profile, making them suitable for various breeds and life stages.

The fish segment is anticipated to witness the fastest growth rate of 20.6% from 2025 to 2032, driven by the increasing demand for novel proteins, hypoallergenic diets, and omega-3-rich formulas supporting skin and coat health. Rising awareness of alternative proteins for pets with chicken allergies also supports this segment’s rapid adoption.

- By Process

On the basis of process, the freeze-dried pet food market is segmented into 100% freeze-dried, freeze-dried, and partly freeze-dried. The 100% freeze-dried segment held the largest market revenue share of 46.2% in 2024, supported by strong consumer preference for minimally processed, nutrient-dense, and preservative-free diets. This category appeals to premium buyers seeking raw nutrition in a shelf-stable format.

The partly freeze-dried segment is expected to witness the fastest CAGR from 2025 to 2032, as hybrid products balance affordability and nutrition while catering to middle-income consumers transitioning from traditional kibble to raw diets.

- By Grain Type

On the basis of grain type, the freeze-dried pet food market is segmented into whole grain and grain-free. The grain-free segment dominated with a 57.4% share in 2024, reflecting consumer demand for biologically appropriate, high-protein diets that mimic ancestral feeding habits of pets. The segment’s growth is also linked to concerns over digestive health and food allergies.

The whole-grain segment is anticipated to grow at the fastest CAGR from 2025 to 2032, as balanced grain-inclusive diets regain popularity due to affordability and a focus on gut health.

- By Pet Type

On the basis of pet type, the freeze-dried pet food market is segmented into dog and cat. The dog segment accounted for the largest market revenue share of 63.1% in 2024, driven by the higher global dog ownership rates and the strong adoption of premium nutrition by dog owners.

The cat segment is projected to expand at the fastest CAGR from 2025 to 2032, fueled by the rising trend of cat ownership in urban households and the growing demand for protein-dense, palatable freeze-dried formulas for felines.

- By Nature

On the basis of nature, the freeze-dried pet food market is segmented into organic and conventional. The conventional segment dominated the market with a 68.9% revenue share in 2024, as it remains more affordable and widely available across offline and online platforms.

The organic segment is expected to register the fastest growth rate from 2025 to 2032, driven by rising awareness of natural, chemical-free ingredients and the willingness of premium buyers to spend on ethically sourced products.

- By Distribution Channel

On the basis of distribution channel, the freeze-dried pet food market is segmented into offline and online. The offline segment accounted for the largest market share of 61.7% in 2024, supported by strong retail presence in supermarkets, pet specialty stores, and veterinary clinics where trust and product trial drive sales.

The online segment is expected to witness the fastest CAGR from 2025 to 2032, driven by the growing popularity of e-commerce, subscription models, and direct-to-consumer strategies offering convenience and wider product choices.

Which Region Holds the Largest Share of the Freeze-Dried Pet Food Market?

- North America dominated the freeze-dried pet food market with the largest revenue share of 44.78% in 2024, driven by strong consumer awareness of premium nutrition, high pet ownership rates, and the willingness of pet parents to spend on high-quality diets

- Consumers in the region highly value the convenience, nutritional integrity, and premium positioning of freeze-dried pet food compared to traditional kibble and canned options

- This widespread adoption is further supported by high disposable incomes, established retail and online distribution networks, and growing demand for raw, grain-free, and functional diets, positioning North America as the global leader in freeze-dried pet food consumption

U.S. Freeze-Dried Pet Food Market Insight

U.S. freeze-dried pet food market captured the largest revenue share in 2024 within North America, fueled by a surge in pet humanization and premiumization trends. Consumers are increasingly prioritizing nutritionally dense, minimally processed foods that mirror human-grade quality. The expansion of direct-to-consumer channels, subscription models, and veterinary endorsements has further boosted adoption. Moreover, the introduction of functional freeze-dried meals fortified with probiotics, omega fatty acids, and joint-care supplements continues to propel the U.S. market forward.

Europe Freeze-Dried Pet Food Market Insight

Europe freeze-dried pet food market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by rising pet ownership in urban households and growing awareness of raw, natural diets. The demand for organic, sustainable, and regionally sourced ingredients is accelerating adoption across the continent. The region is also witnessing significant growth in premium cat food sales, as European consumers are highly inclined toward grain-free and high-protein formulations. Freeze-dried products are increasingly being adopted in both established and emerging pet food markets across Europe.

U.K. Freeze-Dried Pet Food Market Insight

U.K. freeze-dried pet food market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by the trend of treating pets as family members and preference for premium diets. Rising concerns about pet allergies and digestive health are pushing demand for novel protein-based freeze-dried meals, including duck and fish formulations. The U.K.’s well-developed e-commerce sector and pet specialty retail infrastructure provide strong growth support, while younger pet owners are fueling demand for innovative and sustainable nutrition options.

Germany Freeze-Dried Pet Food Market Insight

Germany freeze-dried pet food market is expected to expand at a considerable CAGR during the forecast period, fueled by increasing awareness of pet wellness, sustainability, and eco-friendly nutrition. German consumers place high importance on organic certification, clean labeling, and functional nutrition, which aligns with the growth of freeze-dried offerings. The country’s strong distribution networks and emphasis on premium product innovation are also driving adoption, particularly in urban households and veterinary-recommended diets.

Which Region is the Fastest Growing in the Freeze-Dried Pet Food Market?

Asia-Pacific freeze-dried pet food market is poised to grow at the fastest CAGR of 7.12% during 2025 to 2032, driven by rising pet adoption, growing disposable incomes, and increasing awareness of pet health and nutrition in countries such as China, Japan, and India. The region’s rapid shift toward premiumization, expansion of e-commerce, and increasing number of nuclear families with companion animals are accelerating market growth. Furthermore, the presence of local manufacturers and the growing affordability of freeze-dried options are broadening accessibility across middle-income households.

Japan Freeze-Dried Pet Food Market Insight

Japan freeze-dried pet food market is gaining momentum due to the country’s high pet longevity rates, demand for premium care, and advanced retail structure. Japanese consumers emphasize convenience, portion-controlled meals, and functional nutrition, fueling demand for freeze-dried products that support senior pet health, joint care, and digestive wellness. Moreover, the country’s aging pet owner population favors easy-to-store and easy-to-serve freeze-dried formats, further driving adoption.

China Freeze-Dried Pet Food Market Insight

China freeze-dried pet food market accounted for the largest market revenue share in Asia-Pacific in 2024, supported by a rapidly growing middle class, rising disposable incomes, and an expanding pet population. China has become one of the largest pet food markets globally, with freeze-dried dog and cat meals gaining strong traction due to their premium positioning. The government’s support for domestic manufacturing and pet nutrition standards, combined with the rise of e-commerce giants such as JD.com and Alibaba, is making freeze-dried pet food more widely accessible across both Tier 1 and Tier 2 cities.

Which are the Top Companies in Freeze-Dried Pet Food Market?

The freeze-dried pet food industry is primarily led by well-established companies, including:

- Stella & Chewy's, LLC (U.S.)

- Vital Essentials (U.S.)

- Champion Petfoods (Canada)

- K9 Natural (New Zealand)

- Nature’s Variety (U.S.)

- Steve's Real Food (U.S.)

- Primal Pet Foods (U.S.)

- TruPet (U.S.)

- Wisconsin Freeze Dried (U.S.)

- Stewart Pet Food (U.S.)

- Bravo (U.S.)

What are the Recent Developments in Global Freeze-Dried Pet Food Market?

- In February 2024, Petsource by Scoular completed a USD 75 million expansion in Nebraska, adding extra capacity to serve existing clients while attracting new ones seeking freeze-dried production facilities. This development is expected to triple the company’s production capacity, strengthening its position in the freeze-dried pet food market

- In January 2024, Kelly and Co’s received the prestigious “Brand of the Year” award for 2023-2024 at an event in Vienna, following its earlier recognition as “Freeze-Dried Product of the Year” at an event in the U.S. in 2023. These accolades further reinforce the brand’s reputation as an industry leader in the freeze-dried pet food segment

- In November 2023, Shepherd Boy Farms introduced a new range of freeze-dried diets for dogs, featuring raw formulations made with organic produce and high-quality protein in various flavors. This launch broadens the company’s product portfolio and caters to the rising demand for natural and nutritious pet food options

- In June 2023, 360 Pet Nutrition rolled out its Freeze-Dried Raw Complete Meal for Adult Dogs in a Chicken Formula, created using 16 ounces of premium chicken and vegetables. This product aims to support canine muscle strength, bone health, and overall well-being through a nutrient-dense diet

- In April 2023, CULT Food Science Corp. unveiled its premium pet nutrition brand, Noochies, introducing the world’s first freeze-dried, high-protein cultured pet food for cats and dogs. This innovation marks a milestone in sustainable pet nutrition, focusing on enhanced immunity, digestion, and overall pet health

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.